有本港代理行代理表示,受高息環境及股市波動影響,第3季工廈舖買賣登記量跌穿千宗大關,按季跌逾20%,9月份全港共錄275宗登記,較8月減少19%,再次跌穿300宗水平,為年內第三低月份;月內買賣總值錄40.84億,按月微升2%,主因逾億元高價登記逆市上升,刺激金額創近4個月最多。

9月僅錄275宗登記

按工商舖三個物業類別劃分,工廈9月登記量下跌26%,跌幅最大且跑輸大市,按宗數計則仍是登記最多,佔整體比例達49.8%,惟按月減少5.1個百分點。9月全月工廈共錄137宗買賣,按月挫26%。

商廈谷底反彈,逆市上升,總結9月共錄55宗,按月上升10%,造就商廈登記自4月起連跌4個月及之後橫行2個月後終見回升,並創近3個月最多。9月份錄7.83億元,近3個月最多。

工廈宗數佔整體49.8%

店舖按月跌近20%,登記佔比達30.2%,9月份店舖買賣登記由8月的103宗回落至83宗,按月跌20宗或19%,為年內第4少的月份。9月份店舖買賣登記金額相應減少,按月跌14%,錄17.17億元,為之前連升兩月後再度回軟,大買賣包括悅興地產羅守耀及其太太鄧嘉玲,以約3億元購銅鑼灣銀座式商廈基座部分。

(星島日報)

市建九龍城項目收31份意向 大中小財團紛參與 估值25億至28億

市建局九龍城啟德道/沙浦道發展項目,昨日截收發展意向,合共接獲31份意向書,包括長實、新地、恒基、信和、華懋、鷹君、中國海外、英皇國際、富豪酒店及資本策略等,符合市場預期。項目預期可提供約810個住宅單位,最新市場估值約25.7億至28.3億,每方呎樓面估值約5000至5500元。

英皇國際物業經理蔡宏基表示,項目靜中帶旺,而且鄰近港鐵站,同時集團在同區亦有其他發展項目。他又說,今日政府發表的《施政報告》,預期會有「減辣」等措施,相信短期內會刺激樓市交投。

英皇蔡宏基:項目鄰近港鐵站

有測量師表示,項目連接啟德的地下購物街,是將來與九龍城之間的主要行人通道。但項目要提供300個公眾車場,再加上項目本身要求的車位,將增加建築成本。而且早前批出的政府地其餘標價遠低於中標價,因此調低項目估值約10%。最新市場估值約25.7億至28.3億,每方呎樓面估值介乎約5000至5500元。

高息下料發展商出價審慎

另一測量師表示,鄰近啟德地皮以低價批出,而且在高息環境下,建築成本及持貨成本增加,相信屆時推出招標時,發展商出價會審慎。

上述項目位於啟德道及沙浦道,鄰近富豪東方酒店,項目地盤面積約5.71萬方呎,可建總樓面約51.41萬方呎,預計可提供約810個住宅單位。另外,市建局會在項目撥出約8611方呎樓面,以提供一間幼兒中心予社區使用。

項目是將九龍城舊區與啟德發展區連接的重要節點,因此該局將重新規劃及重整道路網絡等,以興建一個面積約10764方呎的分層地下廣場,當中設有各類零售店舖,並連接一條新建的行人隧道至啟德發展區的地下購物街。

與此同時,項目亦會興建一個地庫停車場,提供約300個公眾停車位,期望能解決區內車位不足、減少違例泊車的問題。

市建局九龍城啟德道/沙浦道發展項目,合共接獲31份意向書,符合市場預期,但業界指在高息環境下,建築及持貨成本增加,相信正式招標時,發展商出價會審慎。

(星島日報)

莎莎60萬 租中環德己立街舖

較早前大鴻輝旗下中環德己立街舖位,以60萬元租出,據悉新租客為莎莎化粧品。

中環德己立街2至12號業豐大廈地下A、B舖連地庫,面積約8,380平方呎,位置在蘭桂坊一帶,舖位交吉近1年後,以每月約60萬元租出,呎租約72元。據了解,新租客為莎莎,而該品牌早於多年前,亦曾租用該廈舖位。

自從通關後,莎莎亦重啟擴充,於核心零售區稍為加分店,包括以80萬元,租用尖沙咀廣東道舖位,以及斥70萬,租旺角文華 MPM 商場地下G3號舖,如今在核心區中環增加分店,迎旅客生意。

該舖原由 Cotton On 時裝租用多年,3年多前曾以約85萬元續租,去年約滿品牌決定轉租皇后大道中商廈兩層作旗艦店。按最新月租計,租金下跌約3成。

北角渣華道舖 8550萬沽

此外,據資料顯示,北角渣華道96至106號 (98號) 地下1、2、3號舖等,以8,550萬元易手,舖位面積約4,435平方呎,呎價約2萬餘元,新買家為投資者彭貴有,物業分別由點心店及屈臣氏租用,月租合共逾28萬元,回報率達4厘。

(經濟日報)

火炭具改建潛力 發展商紛進駐

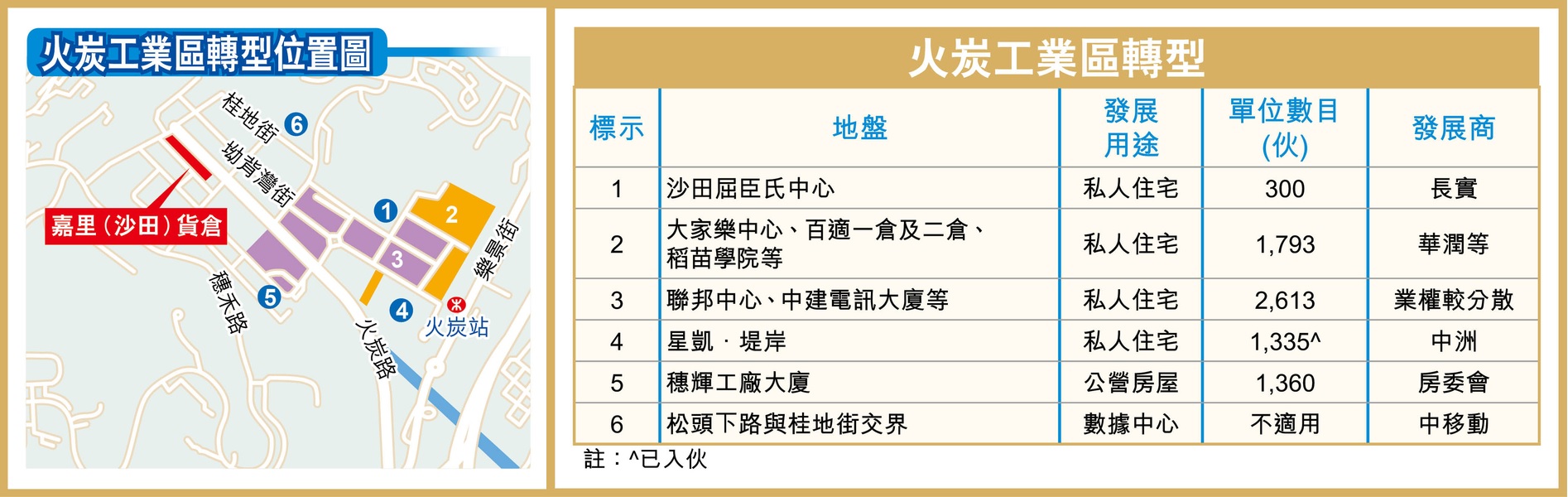

火炭近年積極由舊工業區轉型為住宅,當中最大規模的改劃屬2021年長實 (01113) 遞交的住宅重建申請,預計該區日後會新增至少逾6,000伙公、私營房屋供應。

火炭工業區佔地約30公頃,位於港鐵火炭站西北面,區內共有約45幢工廈,平均樓齡逾30年以上,一半樓齡介乎約15至30多年,但因區內近8成工廈屬於分散業權,重建轉型的困難增加,但是私人發展商亦積極參與轉型,當中長實於2021年亦已就火炭工業區東部20幢工廈,向城規會申請由「工業」用途改劃為「住宅 (戊類)」等用途,以重建大型屋苑,提供約4,706伙。

長實申改用途 重建大型屋苑

根據當時的文件,項目將會分3期發展,涉及24幢住宅,當中第1期是長實旗下的沙田屈臣氏中心,將提供約300伙,預料2026年落成。而第2期則涉鄰近火炭站的多幢工廈,包括大家樂中心、華潤旗下沙田冷倉一倉、二倉、百適一倉、二倉,及稻苗學院等,提供約1,793伙,預計2028年落成。

至於中建電訊大廈及峯達工業大廈等共13幢工廈即屬項目第3期,將提供約2,613伙。不過,鑑於前述的工廈現時的業權相當分散,普遍欠缺單一大業主主導重建,估計難在短期內落實重建。

值得留意的是,有發展商早前已經看中區內潛力,前身為火炭惠康倉的新盤星凱.堤岸,原由爪哇控股 (00251) 持有,其後中洲置業於2015年底以約11.2億元向爪哇控股買入地皮,並於2017年完成補地價程序,涉及補地價金額約35.8億元,每平方呎樓面地價約3,580元。

華潤擁5廈 區內大地主之一

除外,華潤物流近年頻頻買入香港的工廈,並於去年5月以約23.3億元,購入位於火炭工業區內山尾街36至42號嘉里 (沙田) 貨倉,以總樓面面積約404,374平方呎計,平均呎價約5,762元。

事實上,華潤積極擴大區內勢力,若計入百適一倉、百適二倉、沙田冷倉 (一倉) 及沙田冷倉 (二倉),華潤系內持有的火炭工廈增加至5幢,可謂區內大地主之一。而華潤創業早年曾就沙田冷倉 (一倉) 及百適一倉,向城規會重建為酒店及商場,提供約858間客房,但方案當年未獲會方通過。

(經濟日報)

Kowloon project draws 31 expressions of interest

The Urban Renewal Authority received 31 expressions of interest from developers, as the submission deadline for the Kai Tak Road / Sa Po Road development project in Kowloon City ended yesterday, but surveyors have cut their estimated price for the site.

The interested developers include Emperor International (0163), China Overseas Land and Investment (0688), Wheelock Properties, CSI Properties (0497), Chinachem and Regal Hotels.

The land site encompasses 57,125 square feet, with a maximum allowable gross floor area of 514,121 sq ft, and it is estimated that about 810 residential homes can be built on the site.

A surveyor has lowered the consultancy's valuation of the site by 10 percent, to between HK$2.6 billion and HK$2.8 billion, with a per square foot estimate of about HK$5,000 to HK$5,500. The adjustment is primarily due to lower bid prices for land in the vicinity.

The surveyor also noted that factors like interest rate hikes, cost implications, and the market's anticipation of declining property prices are all causing developers to bid cautiously.

In the primary market, Sun Hung Kai Properties's (0016) University Hill in Tai Po released its sixth price list yesterday, providing 65 flats with an average discounted price of around HK$16,127 per sq ft, which is similar to the previous batch.

In Aberdeen, Emperor International's SouthSky project has unveiled two unfurnished units for public viewing.

The first price list is expected to be released shortly and sales of at least 50 flats are expected to start by the end of the month.

Out of the 10 major housing estates, seven have seen a decrease in home prices compared to the end of last year, with City One Shatin experiencing a significant drop of 13.5 percent per sq ft.

The recent price in City One Shatin is about HK$12,479 per sq ft, close to mid-2016 prices. At Kingswood Villas, it is around HK$8,459 per sq ft, back to early 2017 price levels.

UBS expects home prices in Hong Kong to decline by more than 10 percent next year due to the high debt risks faced by small and medium-sized developers and the anticipation of continued elevated interest rates.

An international property consultancy anticipates a maximum 5 percent decrease in luxury residential prices this year, with another 5 percent decline expected in 2024.

(The Standard)

Hong Kong’s moribund luxury property market unlikely to be resuscitated by chief executive’s policy speech

Hong Kong Chief Executive John Lee Ka-chiu’s policy speech is expected to unveil some rollback of the property cooling measures announced earlier

The transaction volume for residential properties valued at or above HK$20 million (US$2.56 million) has plummeted by 52 per cent in the third quarter

Hong Kong’s luxury home market, which has been dealt a triple whammy of lower economic activity in mainland China, elevated global interest rates and higher mortgage costs, is poised for disappointment at this week’s policy speech by the city’s chief executive.

Hong Kong Chief Executive John Lee Ka-chiu will deliver his second policy speech in the Legislative Council at 11am on Wednesday and the market anticipates some rollback of the property cooling measures announced earlier. The government gave strong hints about this loosening last month, when Financial Secretary Paul Chan Mo-po said the conditions that prompted the authorities to impose these measures more than a decade ago no longer prevailed.

“The government is expected to relax the cooling measures in the short term,” a property agent said. “However a partial or even full reduction in stamp duties is unlikely to bolster the luxury prices, but it will cushion the price fall and promote market activities.”

Despite sellers reducing their asking prices, the luxury housing market has yet to witness an influx of buyers. The transaction volume for residential properties valued at or above HK$20 million (US$2.56 million) has plummeted by 52 per cent in the third quarter. In the first nine months of 2023, the capital value of luxury properties fell by 0.3 per cent year-to-date, which erased all the gains made in the first half of 2023.

The difficult global economic environment and a discouraging outlook are set to pressure luxury home prices further, regardless of whether cooling measures are reversed at the upcoming policy address, another agent said.

The agent said that the weakening mainland’s economy, an interest rate hiking cycle that may be extended and higher mortgage rates will continue to exacerbate the luxury market.

Given current market conditions, the liquidity risk of luxury properties could become a major concern for non-local, high-net-worth individuals and hinder their relocation to the city, the consultancy said in its report.

“The government has been striving to attract family offices and investors back to Hong Kong, and this reduction [of stamp duties] could provide some direct incentives,” the agent said. “The government could also potentially benefit from increased stamp duty revenues and higher land premium from residential sites for luxury developments as the transaction volume of luxury properties improves.”

The luxury market has been flooded with new flats in recent months, with unsold inventory levels in completed projects at the highest level since 2007. This could put pressure on property values at a time when the investment environment continues to deteriorate.

“We anticipate a decline in luxury home prices of up to 5 per cent in 2023 and another 5 per cent in 2024 due to elevated interest rates, geopolitical uncertainties, and sizeable unsold stocks,” according to the consultancy.

The city’s home prices declined in September, after registering a 7 per cent increase in April, according to Raymond Cheng, managing director, head of China and HK property at CGS-CIMB Securities.

“We think the most impactful relaxation could be the waiver of the 26 per cent tax prepayment for non-locals, who we believe will have more incentives to buy residential property in Hong Kong once exempted.” he said.

Cheng estimated that there are more than 200,000 potential buyers in Hong Kong’s property market, most of whom are from mainland China, and even if 10 to 15 per cent of them end up buying, it would translate into total demand for 20,000 to 30,000 units, equivalent to about two years of new home sales units in Hong Kong.

“We retain our constructive view on the Hong Kong property market, as we think the supportive measures, if realised, should be able to stabilise the property market in Hong Kong,” Cheng added.

(South China Morning Post)