有本港代理行代理表示,受高息环境及股市波动影响,第3季工厦铺买卖登记量跌穿千宗大关,按季跌逾20%,9月份全港共录275宗登记,较8月减少19%,再次跌穿300宗水平,为年内第三低月份;月内买卖总值录40.84亿,按月微升2%,主因逾亿元高价登记逆市上升,刺激金额创近4个月最多。

9月仅录275宗登记

按工商铺三个物业类别划分,工厦9月登记量下跌26%,跌幅最大且跑输大市,按宗数计则仍是登记最多,佔整体比例达49.8%,惟按月减少5.1个百分点。9月全月工厦共录137宗买卖,按月挫26%。

商厦谷底反弹,逆市上升,总结9月共录55宗,按月上升10%,造就商厦登记自4月起连跌4个月及之后横行2个月后终见回升,并创近3个月最多。9月份录7.83亿元,近3个月最多。

工厦宗数佔整体49.8%

店铺按月跌近20%,登记佔比达30.2%,9月份店铺买卖登记由8月的103宗回落至83宗,按月跌20宗或19%,为年内第4少的月份。9月份店铺买卖登记金额相应减少,按月跌14%,录17.17亿元,为之前连升两月后再度回软,大买卖包括悦兴地产罗守耀及其太太邓嘉玲,以约3亿元购铜锣湾银座式商厦基座部分。

(星岛日报)

市建九龙城项目收31份意向 大中小财团纷参与 估值25亿至28亿

市建局九龙城啟德道/沙浦道发展项目,昨日截收发展意向,合共接获31份意向书,包括长实、新地、恒基、信和、华懋、鹰君、中国海外、英皇国际、富豪酒店及资本策略等,符合市场预期。项目预期可提供约810个住宅单位,最新市场估值约25.7亿至28.3亿,每方呎楼面估值约5000至5500元。

英皇国际物业经理蔡宏基表示,项目静中带旺,而且邻近港铁站,同时集团在同区亦有其他发展项目。他又说,今日政府发表的《施政报告》,预期会有「减辣」等措施,相信短期内会刺激楼市交投。

英皇蔡宏基:项目邻近港铁站

有测量师表示,项目连接啟德的地下购物街,是将来与九龙城之间的主要行人通道。但项目要提供300个公眾车场,再加上项目本身要求的车位,将增加建筑成本。而且早前批出的政府地其餘标价远低于中标价,因此调低项目估值约10%。最新市场估值约25.7亿至28.3亿,每方呎楼面估值介乎约5000至5500元。

高息下料发展商出价审慎

另一测量师表示,邻近啟德地皮以低价批出,而且在高息环境下,建筑成本及持货成本增加,相信届时推出招标时,发展商出价会审慎。

上述项目位于啟德道及沙浦道,邻近富豪东方酒店,项目地盘面积约5.71万方呎,可建总楼面约51.41万方呎,预计可提供约810个住宅单位。另外,市建局会在项目拨出约8611方呎楼面,以提供一间幼儿中心予社区使用。

项目是将九龙城旧区与啟德发展区连接的重要节点,因此该局将重新规划及重整道路网络等,以兴建一个面积约10764方呎的分层地下广场,当中设有各类零售店铺,并连接一条新建的行人隧道至啟德发展区的地下购物街。

与此同时,项目亦会兴建一个地库停车场,提供约300个公眾停车位,期望能解决区内车位不足、减少违例泊车的问题。

市建局九龙城啟德道/沙浦道发展项目,合共接获31份意向书,符合市场预期,但业界指在高息环境下,建筑及持货成本增加,相信正式招标时,发展商出价会审慎。

(星岛日报)

莎莎60万 租中环德己立街铺

较早前大鸿辉旗下中环德己立街铺位,以60万元租出,据悉新租客为莎莎化粧品。

中环德己立街2至12号业丰大厦地下A、B铺连地库,面积约8,380平方呎,位置在兰桂坊一带,铺位交吉近1年后,以每月约60万元租出,呎租约72元。据了解,新租客为莎莎,而该品牌早于多年前,亦曾租用该厦铺位。

自从通关后,莎莎亦重啟扩充,于核心零售区稍为加分店,包括以80万元,租用尖沙咀广东道铺位,以及斥70万,租旺角文华 MPM 商场地下G3号铺,如今在核心区中环增加分店,迎旅客生意。

该铺原由 Cotton On 时装租用多年,3年多前曾以约85万元续租,去年约满品牌决定转租皇后大道中商厦两层作旗舰店。按最新月租计,租金下跌约3成。

北角渣华道铺 8550万沽

此外,据资料显示,北角渣华道96至106号 (98号) 地下1、2、3号铺等,以8,550万元易手,铺位面积约4,435平方呎,呎价约2万餘元,新买家为投资者彭贵有,物业分别由点心店及屈臣氏租用,月租合共逾28万元,回报率达4厘。

(经济日报)

火炭具改建潜力 发展商纷进驻

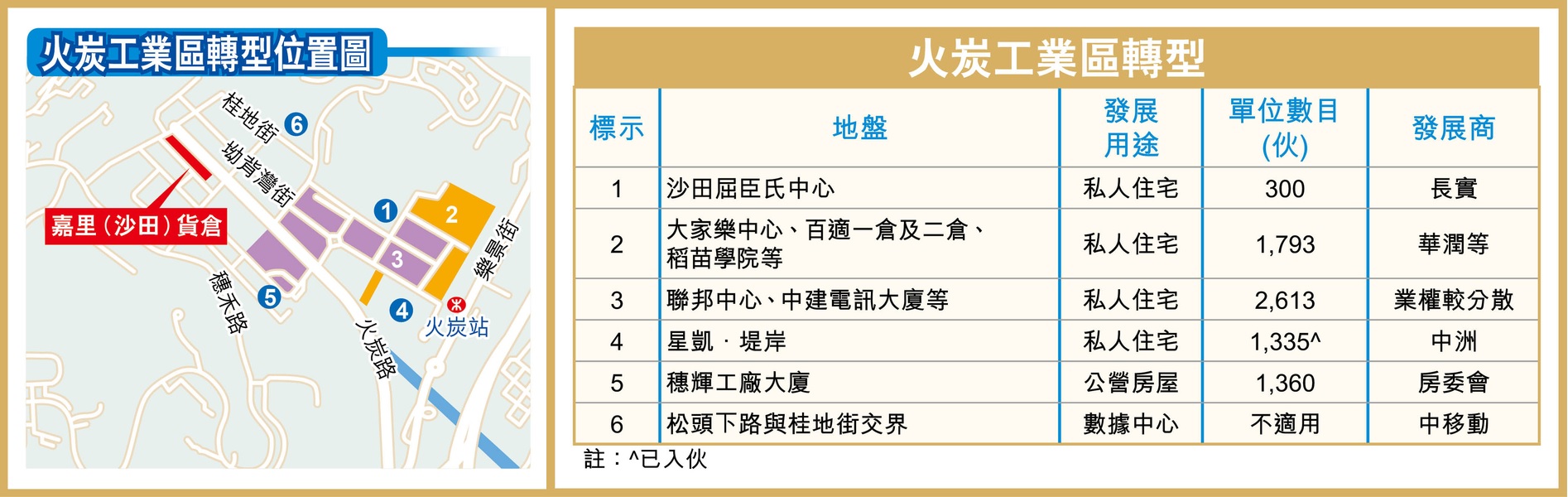

火炭近年积极由旧工业区转型为住宅,当中最大规模的改划属2021年长实 (01113) 递交的住宅重建申请,预计该区日后会新增至少逾6,000伙公、私营房屋供应。

火炭工业区佔地约30公顷,位于港铁火炭站西北面,区内共有约45幢工厦,平均楼龄逾30年以上,一半楼龄介乎约15至30多年,但因区内近8成工厦属于分散业权,重建转型的困难增加,但是私人发展商亦积极参与转型,当中长实于2021年亦已就火炭工业区东部20幢工厦,向城规会申请由「工业」用途改划为「住宅 (戊类)」等用途,以重建大型屋苑,提供约4,706伙。

长实申改用途 重建大型屋苑

根据当时的文件,项目将会分3期发展,涉及24幢住宅,当中第1期是长实旗下的沙田屈臣氏中心,将提供约300伙,预料2026年落成。而第2期则涉邻近火炭站的多幢工厦,包括大家乐中心、华润旗下沙田冷仓一仓、二仓、百适一仓、二仓,及稻苗学院等,提供约1,793伙,预计2028年落成。

至于中建电讯大厦及峯达工业大厦等共13幢工厦即属项目第3期,将提供约2,613伙。不过,鑑于前述的工厦现时的业权相当分散,普遍欠缺单一大业主主导重建,估计难在短期内落实重建。

值得留意的是,有发展商早前已经看中区内潜力,前身为火炭惠康仓的新盘星凯.堤岸,原由爪哇控股 (00251) 持有,其后中洲置业于2015年底以约11.2亿元向爪哇控股买入地皮,并于2017年完成补地价程序,涉及补地价金额约35.8亿元,每平方呎楼面地价约3,580元。

华润拥5厦 区内大地主之一

除外,华润物流近年频频买入香港的工厦,并于去年5月以约23.3亿元,购入位于火炭工业区内山尾街36至42号嘉里 (沙田) 货仓,以总楼面面积约404,374平方呎计,平均呎价约5,762元。

事实上,华润积极扩大区内势力,若计入百适一仓、百适二仓、沙田冷仓 (一仓) 及沙田冷仓 (二仓),华润系内持有的火炭工厦增加至5幢,可谓区内大地主之一。而华润创业早年曾就沙田冷仓 (一仓) 及百适一仓,向城规会重建为酒店及商场,提供约858间客房,但方案当年未获会方通过。

(经济日报)

Kowloon project draws 31 expressions of interest

The Urban Renewal Authority received 31 expressions of interest from developers, as the submission deadline for the Kai Tak Road / Sa Po Road development project in Kowloon City ended yesterday, but surveyors have cut their estimated price for the site.

The interested developers include Emperor International (0163), China Overseas Land and Investment (0688), Wheelock Properties, CSI Properties (0497), Chinachem and Regal Hotels.

The land site encompasses 57,125 square feet, with a maximum allowable gross floor area of 514,121 sq ft, and it is estimated that about 810 residential homes can be built on the site.

A surveyor has lowered the consultancy's valuation of the site by 10 percent, to between HK$2.6 billion and HK$2.8 billion, with a per square foot estimate of about HK$5,000 to HK$5,500. The adjustment is primarily due to lower bid prices for land in the vicinity.

The surveyor also noted that factors like interest rate hikes, cost implications, and the market's anticipation of declining property prices are all causing developers to bid cautiously.

In the primary market, Sun Hung Kai Properties's (0016) University Hill in Tai Po released its sixth price list yesterday, providing 65 flats with an average discounted price of around HK$16,127 per sq ft, which is similar to the previous batch.

In Aberdeen, Emperor International's SouthSky project has unveiled two unfurnished units for public viewing.

The first price list is expected to be released shortly and sales of at least 50 flats are expected to start by the end of the month.

Out of the 10 major housing estates, seven have seen a decrease in home prices compared to the end of last year, with City One Shatin experiencing a significant drop of 13.5 percent per sq ft.

The recent price in City One Shatin is about HK$12,479 per sq ft, close to mid-2016 prices. At Kingswood Villas, it is around HK$8,459 per sq ft, back to early 2017 price levels.

UBS expects home prices in Hong Kong to decline by more than 10 percent next year due to the high debt risks faced by small and medium-sized developers and the anticipation of continued elevated interest rates.

An international property consultancy anticipates a maximum 5 percent decrease in luxury residential prices this year, with another 5 percent decline expected in 2024.

(The Standard)

Hong Kong’s moribund luxury property market unlikely to be resuscitated by chief executive’s policy speech

Hong Kong Chief Executive John Lee Ka-chiu’s policy speech is expected to unveil some rollback of the property cooling measures announced earlier

The transaction volume for residential properties valued at or above HK$20 million (US$2.56 million) has plummeted by 52 per cent in the third quarter

Hong Kong’s luxury home market, which has been dealt a triple whammy of lower economic activity in mainland China, elevated global interest rates and higher mortgage costs, is poised for disappointment at this week’s policy speech by the city’s chief executive.

Hong Kong Chief Executive John Lee Ka-chiu will deliver his second policy speech in the Legislative Council at 11am on Wednesday and the market anticipates some rollback of the property cooling measures announced earlier. The government gave strong hints about this loosening last month, when Financial Secretary Paul Chan Mo-po said the conditions that prompted the authorities to impose these measures more than a decade ago no longer prevailed.

“The government is expected to relax the cooling measures in the short term,” a property agent said. “However a partial or even full reduction in stamp duties is unlikely to bolster the luxury prices, but it will cushion the price fall and promote market activities.”

Despite sellers reducing their asking prices, the luxury housing market has yet to witness an influx of buyers. The transaction volume for residential properties valued at or above HK$20 million (US$2.56 million) has plummeted by 52 per cent in the third quarter. In the first nine months of 2023, the capital value of luxury properties fell by 0.3 per cent year-to-date, which erased all the gains made in the first half of 2023.

The difficult global economic environment and a discouraging outlook are set to pressure luxury home prices further, regardless of whether cooling measures are reversed at the upcoming policy address, another agent said.

The agent said that the weakening mainland’s economy, an interest rate hiking cycle that may be extended and higher mortgage rates will continue to exacerbate the luxury market.

Given current market conditions, the liquidity risk of luxury properties could become a major concern for non-local, high-net-worth individuals and hinder their relocation to the city, the consultancy said in its report.

“The government has been striving to attract family offices and investors back to Hong Kong, and this reduction [of stamp duties] could provide some direct incentives,” the agent said. “The government could also potentially benefit from increased stamp duty revenues and higher land premium from residential sites for luxury developments as the transaction volume of luxury properties improves.”

The luxury market has been flooded with new flats in recent months, with unsold inventory levels in completed projects at the highest level since 2007. This could put pressure on property values at a time when the investment environment continues to deteriorate.

“We anticipate a decline in luxury home prices of up to 5 per cent in 2023 and another 5 per cent in 2024 due to elevated interest rates, geopolitical uncertainties, and sizeable unsold stocks,” according to the consultancy.

The city’s home prices declined in September, after registering a 7 per cent increase in April, according to Raymond Cheng, managing director, head of China and HK property at CGS-CIMB Securities.

“We think the most impactful relaxation could be the waiver of the 26 per cent tax prepayment for non-locals, who we believe will have more incentives to buy residential property in Hong Kong once exempted.” he said.

Cheng estimated that there are more than 200,000 potential buyers in Hong Kong’s property market, most of whom are from mainland China, and even if 10 to 15 per cent of them end up buying, it would translate into total demand for 20,000 to 30,000 units, equivalent to about two years of new home sales units in Hong Kong.

“We retain our constructive view on the Hong Kong property market, as we think the supportive measures, if realised, should be able to stabilise the property market in Hong Kong,” Cheng added.

(South China Morning Post)