逾亿元工商铺录49宗 交投按年跌43%

息口当未见顶,工商铺物业成交急挫,有本港代理行表示,今年逾亿元大手买卖暂仅49宗,按年回落43%,成交总额近300亿元。其中近40%资金来自中资,金额比去年增加逾40%,趁机吸纳优质物业,可见「北水」支撑大市。

近4成资金属中资

该行数据显示,截至今年8月中为止,逾亿元大手买卖暂录49宗,比去年同期减少43%,金额299.1亿元,比去年同期减少20.3%。当中,「北水」今年以来净买入达118.3亿元,比去年同期增加约42.1%,外资买入涉资约65.8亿元,按年下跌21.9%。

金额299亿按年减20%

该行认为,高息环境下借贷成本高企,整体大手成交减少,投资者及企业保持审慎态度,预测今年全年亿元成交只有约75宗,涉资约430亿元。不过,内地利率下调,相信将会令「北水」佔本港投资市场相当的比重。

料北水继续流入市场

该行代理补充,内地于今年实施较宽鬆的货币政策,以刺激经济,内地利率的下调,或促使投资者及存户重新配置其资金至一些可提供较高回报率的地方如香港,「北水」有望重新流入本港,相信中资佔本港投资市场的比重将会回升。

(星岛日报)

THE AUSTINE PLACE铺 2.2亿放售减价3成

通关后零售復甦不似预期,工商铺业主面对现实减价,其中兴胜创建 (00896) 持有的佐敦官涌街 THE AUSTINE PLACE 基座地铺以2.2亿元放售,相较3月份大幅劈价1亿元或逾3成。

涉地下及1楼12270呎 同时放租

据一名本港代理表示,官涌街38号 THE AUSTINE PLACE 地下及1楼放租售,单位建筑面积12,270平方呎,其中地下面积约4,880平方呎。业主意向售价2.2亿元,呎价约1.8万元,意向租金为75万元,呎租约61元。

据资料显示,兴胜创建曾经在今年3月以3.2亿元放售上述铺位,相隔半年时间,大幅劈价1亿元或31%。

陈圣泽家族 1.8亿放工厦铺位

另外,恒和珠宝集团创办人陈圣泽家族持有的一批工厦及楼上铺放售,估计合共市值近1.8亿元。一间外资代理行指,呎价略低于市价。

当中有线电视大厦30楼一篮子物业,总面积约2.1万平方呎,可个别单位独立洽购,意向呎价约4,300至4,500元。若果以最高呎价4,500元计算,即整批单位最高意向价约9,400多万元。

至于另一批的楼上铺位于豪景商业大厦1至3楼,合共面积约6,858平方呎,意向呎价约1万至1.2万元,以最高呎价1.2万元计算,即意向价最多约8,230万元。原业主陈圣泽在2018年以1.06亿元购入该批楼上铺,单是现时叫价已经帐面蚀逾2成或约2,370万元。

(经济日报)

Typhoon hurts home deals

Secondary market transactions remained subdued over the weekend as Typhoon Saola battered Hong Kong.

A property agency reported just three transactions in 10 major housing estates over the weekend, mirroring the previous weekend's figures and extending its streak of 18 consecutive weeks with single-digit transactions.

The real estate agency stated that due to Typhoon Saola, most of the scheduled property viewings for the weekend were canceled. Even though the typhoon gradually moved away on Saturday afternoon, citizens were occupied with post-typhoon activities.

Furthermore, given the current lack of positive news in the real estate market, potential buyers remained hesitant to enter the market. Consequently, only properties with lower price points saw any notable activity.

Another property agency also recorded only three deals in the 10 major housing estates over the weekend, one less compared to the previous weekend. It also marked the 18th consecutive weekend with single-digit deals for the real estate company.

In Tin Shui Wai, the owners of a 546-square-foot three-bedroom flat at Kingswood Villas sold the flat at HK$4.2 million, a price usually reserved for a two-bedroom home in the area.

The owners were adamant about selling the apartment prior to the typhoon's arrival, consequently reducing the asking price three times within the week from HK$4.7 million. This resulted in a loss of HK$980,000 compared to the original purchase price of HK$5.18 million in 2018.

(The Standard)英皇珠宝50万租海防道铺 高疫市8成

高峰期租金曾见230万 尖沙咀吉铺渐减

近期珠宝店加快于尖沙咀核心一綫段扩充,信置 (00083) 旗下海防道地下铺位,面积2,000平方呎,以近50万元租出,较3年前疫情租金升8成。新租客为英皇鐘錶珠宝 (00887),料作珠宝销售。

市场消息指出,尖沙咀海防道51及52号地下A、B、C1、C2及D号铺,面积约2,060平方呎,以每月约50万元租出,呎租约242元。该铺位处海防道及乐道交界,铺位门面阔,加上附近人流旺,为当地段优质铺位。该铺由信置持有,楼上为集团旗下服务式住宅 The Camphora。

消息指,新租客为英皇鐘錶珠宝,而是次租用铺位,料主力作珠宝销售。事实上,早在去年通关前,集团亦租用旺角弥敦道好望角大厦地下B铺,如今通关半年多,旅客重临,集团即重啟扩充计划。

翻查资料,该铺十多年来数度更换租客,2010年前专营手袋买卖的米兰站曾以100万元租用该铺,其后零售高峰期,太子珠宝鐘錶以高达230万元抢租铺位,呎租逾千元。

通关后 尖沙咀租务加快

数年前,零售开始回落,莎莎化粧品以每月约80万元承租铺位,其后遇上疫情,租客迁出,铺位亦交吉一段时间。2020年尾,米兰站趁铺租大跌,以每月28.3万租用铺位3年。按目前最新铺租计算,较旧租升近8成,惟与高峰期相比,仍下跌约8成。

通关后尖沙咀商铺租务加快,特别近一个多月,尖沙咀两大核心地段广东道及海防道连录租务,当中涉及金行、鐘錶珠宝重新扩充。如广东道新港中心地下至2楼,以每月约200万元租出,面积合共约10,140平方呎,呎租约200元,新租客为内地金行「老铺黄金」,该品牌主力打造高级黄金及珠宝,于尖沙咀海港城设分店,如今趁租金回调,于新港中心大手租多层铺作旗舰店之用。

另外,大鸿辉旗下海防道46号铺位,面积约1,000平方呎,以约40万元租出,新租客为内地鐘錶店。此外,尖沙咀弥敦道美丽都大厦地下G12号连1、2楼11号铺,面积约1,650平方呎,以每月约30万元租出,新租客为福泰珠宝。

事实上,经过多宗租务落实后,广东道、海防道及弥敦道3大核心地段,吉铺明显减少。

(经济日报)

更多新港中心写字楼出租楼盘资讯请参阅:新港中心写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

中环商厦全层意向价4480万

有本港代理行表示,中环砵典乍街10号25楼全层,楼面面积约1828方呎,意向价约4480万元,呎价约2.4万元,物业以连租约形式出售,目前月租约7.5万元,租客为投资公司,租期至明年5月届满。

该行指出,砵典乍街10号主要租户为教育及医疗等专业行业,以租用全层单位为主,出租率长期逾九成;买家则大多为用家及作长线收租的投资者。

(信报)

更多砵典乍街10号写字楼出售楼盘资讯请参阅:砵典乍街10号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

Hong Kong’s empty retail space falls to 3-year low, though sector recovery is hobbled as more tourists leave than enter

Retailers have been opening new shops and expanding, bringing the city’s empty commercial space down to 9 per cent in the second quarter

‘Travel outflow of locals is greater than the inflow of tourists, which could diminish local consumption power,’ property agent said

Retailers have been opening new shops and expanding in Hong Kong, bringing the city’s empty commercial space to a three-year low of 9 per cent in the second quarter, according to the latest report by an international property agency.

However, the recovery of the sector after three disastrous years of sales diminished by the Covid-19 pandemic faces a challenge: while the number of visitors – particularly mainland Chinese – to Hong Kong has been increasing, more Hongkongers have been travelling outside the city, shifting their purchasing power elsewhere, the property agency said.

“We have seen that following the border reopening, the travel outflow of locals is greater than the inflow of tourists to Hong Kong, which could diminish some local consumption power,” an agent said.

“As a result, the retail market during the long holidays such as Labour Day and the Buddha’s Birthday holiday periods was not as active as the market has hoped-for.”

A V-shaped recovery or a sharp upswing in the retail property market is unlikely, the report said.

The retail segment was one of the hardest hit in Hong Kong after the unprecedented social unrest of 2019 was immediately followed by the coronavirus pandemic.

The anti-government protests four years ago, which at times turned violent, had put mainland Chinese visitors off coming to Hong Kong. When the pandemic came along, forcing the closure of borders, tourists all but vanished from the city.

During boom times, mainland visitors were a major driver of tourism in Hong Kong.

Many of them came for the shopping, often returning home laden with luxury goods.

In 2018, before the unrest took hold, Chinese tourists in the city grew 14.8 per cent to 51 million, driving total visitor arrivals to a record 65.1 million, according to government data. Retail sales that year rose 8.8 per cent to HK$485.2 billion (US$61.85 billion).

In the first half of this year, retail sales rose 20.7 per cent, but they remain 15 per cent lower than the equivalent period of 2019, before the protests began, according to another property agency in a separate report. The improvement was largely thanks to the 12.9 million visitors that came to the city in that period, a massive increase from 76,000 a year earlier. Almost 80 per cent of the visitors were mainland Chinese.

Still, the number of tourists was a long way shy of the 34.8 million who came in the first half of 2019.

Almost 29 million Hong Kong residents, meanwhile, headed abroad for holidays in the period.

“As leisure travel shows no sign of waning, the widening inbound-outbound gap may impede the retail market recovery in the remainder of the year,” another agency said in a separate report, published on August 29.

Despite the somewhat clouded outlook for the retail sector, some notable transactions were recorded in the first seven months of 2023.

French luxury fashion house Chanel leased 18,000 square feet of space at Jardine’s Bazaar in Causeway Bay. In Central, The Macallan, a Scottish whisky brand, opened its first global flagship store on the second and third floors of the Hing Wai Building, occupying 8,519 square feet and paying a reported monthly rent of about HK$600,000.

The agency said a pharmacy had recently taken an 818 square-foot ground floor unit at 45 Haiphong Road in Tsim Sha Tsui. It leased the space for HK$300,000 per month, an increase of nearly 70 per cent in rent compared to the previous contract.

(South China Morning Post)

For more information of Office for Lease at Hing Wai Building please visit: Office for Lease at Hing Wai Building

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central祥祺陈红天山顶傲璇 银主4.2亿沽

成交价低估值近4成 呎价约8.1万

优质豪宅银主盘获垂青,内地祥祺集团陈红天山顶傲璇自用单位,早前沦为银主盘。消息称,单位新近以4.2亿元成交,呎价约8.1万元,低估值近4成。

较早前,银主委託测量师行,标售山顶司徒拔道53号傲璇 (OPUS HONG KONG) 5楼单位连同两个车位。物业将按现状并以非交吉形式出售,并于上月初截标。市场人士透露,项目最终以约4.2亿元成交。

物业实用面积约为5,154平方呎,属5房4套间隔,按4.2亿元成交价计,呎价约8.1万元。据悉,是次属发展商2012年一手推出并沽清后,项目首度录二手成交。

翻查资料,傲璇由太古地产发展,设有12个单位,面积为4,819至5,444平方呎,并于2012年正式推售,其中一伙呎价高见9.6万元。2015年项目最后一伙以5.096亿元售出,呎价93,608元,整项目共套现逾50亿元。祥祺集团陈红天2015年以3.87亿元,向太古地产 (01972) 购入该单位,以单位实用面积5,154平方呎计算,成交实用呎价75,087元。若按购入价计,物业8年升值8.5%。

据了解,陈红天购入单位后自住,而直至本年初,不少内房人士陷财困,而陈红天旗下物业,先后被接管。上述傲璇进行招标时,物业估值为6.8亿元,若按现时成交价计,低市值约38%。

歌赋山道15号超豪宅 正放售

除了傲璇单位外,陈红天持有山顶超级豪宅歌赋山道15号,同样早前沦为银主盘,银主继较早前委託代理出售。按早前上载项目楼书,洋房实用面积18,078平方呎,採6房连套房加书房及家庭客房设计,另连花园、天台、室内亦备有升降机通往各层。该洋房由陈红天于2016年以21亿元购入,当时成交呎价22.8万元,一度创亚洲洋房呎租新高。

另一项贵重物业,为红磡祥祺中心全幢商厦,物业总楼面面积合共约28万平方呎,现为永明金融香港总部,陈红天于2016年向会德丰地产,以约45亿元购入 One Harbour Gate 东座作总部,并易名为祥祺中心。

(经济日报)

更多祥祺中心写字楼出租楼盘资讯请参阅:祥祺中心写字楼出租

更多红磡区甲级写字楼出租楼盘资讯请参阅:红磡区甲级写字楼出租

Tycoon Chen Hongtian’s seized US$86.7 million Frank Gehry-designed Hong Kong flat sells at 38% discount

Chen bought the 5,154 sq ft flat in the Frank Gehry-designed Opus Hong Kong development for HK$387 million (US$49 million) in 2015

The property was one of three assets seized by creditors earlier this year amid what Chen’s company termed a ‘short-term cash flow disruption’

Receivers for a HK$680 million (US$86.7 million) Mid-Levels flat have sold the property – seized from Chinese tycoon Chen Hongtian for unpaid loans – at a steep discount to the market price.

The 5,154 sq ft flat in Opus Hong Kong, sold at around HK$420 million, 38 per cent below its market valuation, according to sources familiar with the transaction. Details on the buyer have not been disclosed.

Chen and his wife, Chen Yao Li Ni, bought the fifth-floor flat at 53 Stubbs Road for HK$387 million in September 2015, according to official records. In February, the flat was seized by Bank of Communications, which extended a mortgage in August 2019.

The property was one of at least three assets seized by lenders in Hong Kong as of late March from Chen, whose Cheung Kei Group owns offices, hotels and finance firms.

The receivers put the flat up for sale by tender in May, and the tender closed on August 8, according to Savills, which had been appointed the sole agent for the deal.

Chen did not respond to a request for comment.

The three seized properties – the Opus flat, a 9,212 sq ft house at 15 Gough Hill Road on The Peak and One HarbourGate East Tower – were mortgaged with banks for about HK$6 billion, but are valued at about HK$10 billion, according to Chen.

In an interview with the Post in June 2016, Chen said he bought 15 Gough Hill Road for a then record price of HK$2.1 billion because the Opus flat was “too tiny”.

Chen’s company blamed the seizures on “ short-term cash-flow disruption” and said in May that it would offload equity in some overseas assets to overcome the cash crunch.

The One HarbourGate tower and the 15 Gough Hill Road home, have also been put on the market for tender sale by receivers, according to an international property agency.

Developed by Swire Properties on a site long possessed by the company as a home for its executives, the Opus project is acclaimed architect Frank Gehry’s only residential project in Asia. The building twists to give each of its 12 flats a unique floor plan, and is only a nine-minute drive away from the Central business district.

The flat Chen owned, which occupies the entire fifth floor, has five bedrooms, including four with their own bathrooms, a study, a living room, a dining room and a kitchen. It has an open-plan design and a ceiling height of more than four metres, according to the agency.

(South China Morning Post)企业续省成本 中环空置率料升

环球经济前景仍有忧虑,有外资代理行认为,企业仍非常审慎,不少选择搬迁至非核心区,以节省开支。

该行每月商厦租金走势报告指,各区甲厦租金稳定,中环超甲厦呎租现报119.5元,按月跌0.4%,整体中环甲厦呎租跌0.6%。至于其他多区包括金鐘、上环、鰂鱼涌等,升跌幅不足1%。

家乐福搬至港岛东

租务成交方面,消息指,鰂鱼涌英皇道633号商厦录租务,涉及物业28楼全层,以及26楼A室,面积约1.5万平方呎,以每平方呎约25元租出。据悉,新租客为国际连锁超市家乐福,料作内地市场业务之用。该集团目前办公室位于九龙湾一号九龙,估计呎租同约20餘元,估计是次搬迁,有见港岛东租金下跌,故提升级数至港岛区。英皇道633号位于区内主要商业地段,附近亦有全新及翻新的甲厦项目,据了解,目前物业仍有数层楼面待租。

至于东九龙方面,大手租务较多,包括观塘全新甲厦 The Millennity 1座27至29楼,合共3层楼面约4.5万平方呎,获日资机构FUJIFILM租用。该集团目前租用太古湾道12号 (前称太古城中心四座) 商厦,是次新租 The Millennity 3层料作搬迁,既可节省租金开支,亦提升办公室级数。

另外,东九龙不乏扩充个案,如九龙湾德福广场恒生中心录得租务成交,涉及物业中层2层,每层面积约2.6万平方呎,合共约5.2万平方呎租出,据估计,平均呎租约25元。新租客为港铁,而该集团总部亦设于该项目,即德福广场港铁总部大楼,相信是次租用2层恒生中心作扩充。

该行料九龙租金 年尾见底回升

该行指,在过去一个月,企业节省成本的趋势更明显,当中包括缩减写字楼的规模或搬迁到非核心区。与此同时,企业依然重视写字楼的质素。一些对成本敏感度较低的租户利用租金低迷的机会,以相近的预算进行写字楼升级。大部分写字楼租赁交易涉及约3,000至4,000平方呎的中小型写字楼。该行料,在实惠的租金支持下,湾仔、铜锣湾和鰂鱼涌的写字楼空间逐渐填满。与非核心区相比,预计中环的空置率在短期内可能向上,因企业搬迁到非核心区和缩减规模以节省成本。

东九龙方面,该行指,九龙区写字楼交易和规模增加证明了市场气氛略有改善。九龙东和尖沙咀主导写字楼分区的主要租务成交,因为新建写字楼和具竞争力的租金继续受租户的关注。上月,制造业、航运业和物流业的公司是主要的写字楼需求驱动力,优化规模和提高质素是写字楼搬迁的原因。

后市上,该行预计九龙区写字楼的租金将在年底前见底,甚至租金将有轻微增长,市场悲观情绪将有所缓解。

(经济日报)

更多英皇道633号写字楼出租楼盘资讯请参阅:英皇道633号写字楼出租

更多北角区甲级写字楼出租楼盘资讯请参阅:北角区甲级写字楼出租

更多一号九龙写字楼出租楼盘资讯请参阅:一号九龙写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

7月50宗商厦买卖 近5个月最少

据一间本港代理行统计,7月份仅录50宗商厦买卖,按月跌3成。

金额按月跌1成

该行代理表示,面对股市低迷加上息口仍未见顶,商厦投资买卖相对淡静,近月屡创低位,料后市持续整固。综合土地註册处数据,2023年7月份全港共录50宗商厦买卖登记 (数字主要反映2至4星期前商厦市场实际市况),较6月份的71宗大跌21宗或3成,已连跌4个月,为近5个月最少,且属年内第3低水平。至于8月份至今登记仍然缓慢,料全月仍低位窄幅徘徊。

7月份商厦买卖登记出现量值齐跌的情况,当中登记金额连跌2月,按月再减11%,创下自今年3月以来的5个月新低,仅录得7.3亿元,当中主要是受1,000万至5,000万元以内的中高价商厦买卖登记出现较大跌幅所拖累。

(经济日报)

佐敦银主商厦1.38亿售 捷成许丽莲等承接

投资市场淡静,价格低企的银主盘受捧,佐敦柯士甸路28号全幢商厦银主盘,早前以1.38亿易手,新买家曝光,市场消息透露,由捷成饮料啤酒部董事许丽莲及相关人士购入物业。

知情人士指,该物业新买家 Alvanada Riviera Ltd,向银行购入物业,该公司董事包括许丽莲,为捷成饮料有限公司啤酒部董事,惟未知她私人购入,或代集团购入。

平均呎价7698元

该物业为银主盘,造价更较12年前购入价低出约35%,该厦地下至3楼为商铺,总面积约5462方呎,4至18楼则为写字楼,面积合共约12465方呎,另天台面积约1570方呎,平均呎价7698元 (不计天台),新买家拥物业命名权,预计全幢市值月租约50万,料回报逾4.3厘。

该厦业主于2012年8月以2.12亿购入,2020年曾以4.6亿放售,直至2022年3月,沦为银主盘,由银行接手放售,最新成交价较当年购入价低约35%。

成交价较购入价低35%

上述物业发展商为科达地产,早于1988年起进行购併,1995年统一业权后重建,并于2010年以1.21亿易手;然后,接手的买家于2年多后,再以2.12亿沽货。

(星岛日报)

中环德辅道中巨铺3.7亿易手 翠华李远康沽货23年升值5.4倍

铺市录1宗罕见大买卖,翠华控股大股东兼主席李远康沽售中环德辅道中一个巨铺,曾是翠华旗舰店,作价3.7亿易手,持货23年赚逾3亿,据悉,新买家为港人投资者,以买物业形式购入物业。

正当内地救市,放宽房产政策,铺市亦随即反弹,昨日,市场消息指,中环德辅道中84至86号章记大厦地下及地库,以3.7亿易手,由于现时息口高,该项目若要取得约4厘回报,月租势必破120万,业界对该成交深感讶异,不过,有代理证实该宗交易,惟详情不能透露。本报致电李远康,惟直至截稿时未获回覆。

代理行证实交易

知情人士则透露,上述铺位作价3.7亿,以卖物业易手,买家为港人投资者,需支付相等于铺价4.25%的釐印费,涉资1572.5万,看中该巨铺属中环区罕有,面积大用途多,银行、零售及食肆皆适宜。该巨铺地下面积约3163方呎,地库面积约4200方呎,合共7363方呎,以成交价计算,平均呎价约5万。

港人投资者「买物业」

李远康早于2000年以约5780万购入该铺位,并由翠华餐厅租用多年,从2018年4月1至2021年3月31日止的3个财政年度,翠华每年以1328.1万租用该铺,即月租约110.7万,今番沽售,持货23年,李远康帐面劲赚逾3.1亿,升值逾5.4倍。

今年以来,铺位虽然屡录成交,不过以中价物业为主导,成交价逾亿并不多,近期较瞩目为盛滙商铺基金购入北角英皇道165至175号公主大厦地下一篮子地铺,建筑面积6535方呎及1楼建筑面积6440方呎,总面积约12975方呎,作价约2.13亿易手,呎价约1.6万。原业主为资深投资者杨奋彬。

中环德辅道中章记大厦巨铺易手,买家为港人投资者,以「买物业」形式,需支付釐印费1572.5万。

(星岛日报)

财团斥12亿收购渣甸山松圃

正当市场人士以为,收楼市场停顿,市场却录1宗瞩目的收购,位于渣甸山的松圃,属传统豪宅地段,录财团垂青,以约12亿收购物业。

松圃位于卫信道8至12号,于1965年1月落成,楼高只有3层,共提供18个单位,面积由1216方呎至1547方呎,由于伙数少,以用家主导,过去数年皆录「0」成交。单位成交价由5958.4万至7580.3万,涉资约12亿。

成交价5958万至7580万

业界人士指,松圃位置极优越,且佔地面积规模大,逾8000方呎,属豪宅地段罕有供应,旺市极难收购,由于近期市况回落,财团善用银弹政策,诱使业主卖楼,平均呎价约5万元,容易于豪宅地段选择心仪的单位,代理于去年才展开收购,财团以 MIGHTY GRAND ENTERPRISES LTD 名义购入物业,惟未知背后买家身份。

近期收楼市场相对淡静,发展商集中为项目「埋尾」,强拍申请及强拍,上述的收购令人耳目一新,不过,业内人士指,未来的收购只集中于优质项目。近期,市场最瞩目的大型强拍,为恒基及太古地产合作收购的鰂鱼涌英皇道及滨海街一系列旧楼,月初获土地审裁处批出强拍令,底价高达63.1亿,创本港有史以来金额最高的强拍底价纪录,最新落实于9月19日举行公开拍卖。

(星岛日报)

Special home loans offered to attract overseas talent

Sino Land (0083) will offer special mortgages for workers who have come to Hong Kong via the city's various talent schemes and are looking to buy a home.

Sales of unsold flats at One Soho in Mong Kok - jointly developed by Sino Land, Chuang's Consortium (0367) and the Urban Renewal Authority - will be relaunched as early as this month, with the developer offering special plans for prospective buyers who have come under the various talent and professional schemes.

A new price list could be unveiled around the middle of the month.

Sino Land says 191 flats have so far been sold at One Soho for a total HK$1.36 billion and at an average price of HK$23,800 per square foot.

The developer's offer came as the overnight Hong Kong Interbank offered rate surged by 1.38 percentage points to the highest in nearly a month at 3.9 percent. However, the one-month Hibor, which is linked to the mortgage rate, fell by about 3 basis points to 3.6858 percent.

In the secondary market, a flat with a car-parking space at Bel-Air in Po Fu Lam sold for HK$70.5 million, 10 percent lower than what it cost five years ago.

The 1,985-sq-ft flat originally had an asking price of HK$82 million but was eventually sold for HK$70.5 million, 10 percent lower than the transaction price of HK$78.5 million paid by the seller in 2018.

With the property market remaining weak, the number of real estate agents continues to decline.

Data from the Estate Agents Authority shows that as of the end of August, the licensed agent count stood at 40,430, marking a monthly decrease of 183 agents.

This decline has persisted for five consecutive months, resulting in a cumulative loss of 644 agents, marking the lowest point in over two-and-a-half years since November 2020.

(The Standard)商厦租户调查 仅26%将扩充

外资代理行:预期高空置困境 短期难改善

通关后甲厦租务气氛有改善,布外资代理行进行香港写字楼租户调查,访问300多间公司,超过一半表示维持现有楼面,仅约两成多将扩充。该行认为,由于环球经济前景不明,企业审慎,写字楼租务上以控制成本为主,预期商厦高空置困境短期难以改善,现时本港甲厦空置率约15%。

该行近日进行香港写字楼租户调查报告,调查共徵求了321位写字楼租户对未来前景的展望,以了解企业对办公空间的需求。调查于本年6月底至8月初进行,企业对復甦的信心和情绪正在逐渐改善,约41%的受访者对未来3年内的行业前景持乐观态度。

53%租户 将维持现时楼面

租用办公室楼面上,整体上53%租户表示将维持现时办公室楼面,而26%表示会扩充,而21%则表示将进行收缩。当中以资讯科技行业最进取,5成受访机构表示有意扩充,而银行、保险等亦有35%表示计划扩充。

该行代理表示,今年在通关初期,3月份机构查询及睇楼非常活跃,租务上亦加快,惟近月市况转弱。该代理分析,目前主要影响市场,为环球经济前景忧虑、息口偏高等因素,令机构扩充步伐减慢,反而疫情期间在家工作,并非主要缩减办公室主因。该代理表示,今年机构仍会以控制成本为主,逾半计划留在现有办公室。

后市上,该行另一代理指出,现时本港甲厦空置率约15%,处偏高水平,而明年因供应极低,故可作缓冲。他表示,因租户选择多,故设备齐全的大厦,在租务市场上有优势。

(经济日报)

啟德3大商场 两年内相继落成

啟德今、明两年将有多个大型商业项目陆续落成,提供近430万平方呎商业楼面,当中南丰发展的 AIRSIDE 大型商场将率先在今个月试业,连写字楼部分,合共涉及逾190万平方呎楼面。

啟德区内商业项目属于起动九龙东第二个核心商业区部分组成,在2016年、2017年开始,政府便陆续推出区内商业用地,多个项目有望在未来2年陆续落成。

目前啟德区内仍以住宅发展为主,并以附属于私人屋苑的商场、商铺居多,现时仍缺乏大型商场,不过按照规划区内未来至少有3个大型商场,包括 AIRSIDE 的商场部分、啟德双子塔的啟德SOGO旗舰店,以及啟德体育园的室内及零售场馆。

AIRSIDE 70万呎购物商场 9.28试业

率先登场将会是南丰旗下 AIRSIDE,前身为发展商于2017年以约246亿元投得第1F区2号商业地,总投资额高达约320亿元,按照规划项目楼高47层,总楼面达约190万平方呎,提供32层高的甲级写字楼,逾10层的购物商场,前者涉约120万平方呎,而商场部分涉约70万平方呎。

AIRSIDE 面积达70万平方呎的购物商场,将会在9月28日试业,据发展商早前披露,将包括约3.3万平方呎的大型戏院、逾万平方呎的艺文空间、日式生活品牌、40多间食肆等。同时,项目停车场共有850个车位,并全部配备电动车充电功能。

1E区2号地 9成楼面作零售

另外,由利福国际于2016年以约74亿元投得的啟德第1E区2号商业地,将发展为2幢楼高18至19层高的双子塔式商厦,有机会最快今年底落成,楼面面积合共逾109万平方呎。项目投资额达145亿元,9成楼面会成为零售,包括作为SOGO啟德旗舰店。

至于明年下旬则将会有啟德零售馆登场,项目由新世界 (00017) 旗下K11集团营运,主建筑共3座,每座最多有5层,设有超过70万呎零售及餐饮设施,提供逾200家店铺。

同时,新地 (00016) 旗下啟德第1F区1号住宅地王,已命名为「天璽‧天」,除了提供约1,500个住宅单位外,基座还设有一个面积约24万平方呎零售商场。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE 写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

南丰啟德 AIRSIDE 即将试业,项目除了大型商场,还提供120万平方呎的甲级写字楼,今年底前出租率料达5成,呎租约35至49元。

平均呎租35至49

AIRSIDE 设有32层的甲级写字楼,每层面积3.2万至5.3万平方呎,据南丰早前披露,已出租面积佔近40万平方呎,成交呎租为35至49元,除了南丰将会把总部陆续迁入外,主要租户还包括日资金融集团、法国赛博集团香港分公司及柯尼卡美能达商业系统租用。据南丰在今年中曾指出,预计在年底前可落实2至3宗租赁个案,出租率有望增至一半。

至于同区的承啟道商业项目,中电 (00002) 早在2021年12月时斥约33亿元向远东发展 (00035) 购入写字楼部分,涉及楼面约17.43万平方呎,平均呎价约1.94万元,日后将会成为啟德的新总部。

而利福国际持有的啟德双子塔项目,其中1座将会发展成SOGO啟德旗舰店,较高楼层用作自用办公室;另1座则主要为购物商场,拟引入不适合在百货公司经营的零售商,如单一主要零售商、戏院,另设医疗服务楼层。

(经济日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE 写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

Luxury and commercial property remain weak

Secondary sales of homes in prime residential districts of Hong Kong languished last month with only two deals reported at The Peak and the Southern Districts.

And a Causeway Bay shop was put up for sale at a potential loss despite the government's plans to boost the night economy.

A local property agency reported only two transactions - in The Peak and Southern Districts - in August, representing a significant month-on-month decline of about 67 percent.

The two deals were together worth around HK$99.5 million, also marking a substantial drop of 94 percent over the previous month's total.

But despite a downward trend, the agency said the potential for more transactions exists if sellers reduce prices.

The agency anticipates a modest uptick in transactions this month, as buyers may enter the market ahead of new measures expected in the upcoming policy address.

Meanwhile, the total value of sale and purchase agreements for residential homes in August declined by 11.8 percent year-on-year to HK$28.6 billion, according to the Land Registry.

However, on a monthly basis, the transaction value was 7.7 percent higher compared to the HK$26.6 billion recorded in July.

Also in the residential market, the reserve price for a foreclosed three-bedroom unit at Le Prime in Lohas Park was set at HK$6 million in an auction, nearly 30 percent lower than the market's valuation.

And in Tin Shui Wai, a 551-square-foot three-bedroom flat at Kingswood Villas changed hands for HK$4.78 million, or HK$8,675 per sq ft, another local agency said.

The price was about 16 percent lower than the asking price of HK$5.7 billion in July.

In the commercial property market, the Tang Shing-bor family recently listed a ground-floor shop on Lee Garden Road in Causeway Bay for sale, at a reduced price of HK$168 million.

If sold at the target price, the sellers would face an estimated loss of around HK$40 million, marking a nearly 20 percent drop from the HK$208 million purchase price six years ago.

In other news, most Hong Kong Interbank offered rates rose yesterday, with the one-week and one-month rates hitting the highest in nearly two weeks at 3.72 and 4.03 percent, respectively.

This came after the Hong Kong Monetary Authority injected HK$2 billion into the market through the discount window on Monday.

(The Standard)油塘项目建商厦规划署不反对 金宝李秀恒:总投资逾20亿 打造新地标

油塘湾「巨无霸」商住项目未来发展备受市场关注,其发展范围内由金宝集团持有的荣山工业大厦,去年向城规会申请重建1幢楼高29层的商厦,可建总楼面约54.4万方呎。最新获规划署原则上不反对,城规会将于明日举行会议审议时料会「开绿灯」通过。该公司指,涉及总投资逾20亿,以打造区内新地标。

规划署指,拟建商厦与邻近景观等并非不相容,项目申请的建筑物高度限制及地积比率并非不合理,故该署原则上不反对有关申请,而城规会将于明日举行会议审议时料会「开绿灯」通过。

城规会料「开绿灯」

金宝集团主席李秀恒回覆本报查询时指,该项目本来打算彻底翻新,改作商场、商厦及酒店综合项目,最新决定拆卸重建,原因是工厦贴近海傍,因应政府要求,将腾出20米作为海滨长廊,地盘面积将由现时约5万方呎,减至只有约4万方呎,工厦现时楼高60米,重建后楼高约130米,以打造区内新地标。

他又称,项目将重建商场、商厦及酒店综合项目,惟暂未决定3者比例,视乎市况而定,初步估计每方呎建筑费约4000元,总投资逾20亿。

他续说,由于项目位处综合发展区,未能享受工厦活化政策,另外,该项目早于2008年已向政府完成补地价程序,以作商业用途,当时每呎补价100元,涉及补价金额约5500多万。

可建总楼面逾54.4万呎

据城规会文件显示,荣山工业大厦位于油塘海旁地段第73及74号,现时属「综合发展区」地带,申请改划为「商业 (1)」地带及修订「商业」地带的《註释》;地盘面积约49514方呎,以地积比11倍发展,拟建1幢楼高29层、包括1层防火层,另有5层地库的商厦,涉及可建总楼面约544658方呎。

近年油塘区发展步伐加快,不少财团积极改划区内项目发展,最瞩目为恒基、新地及会德丰地产等六大发展商合作发展的油塘湾「巨无霸」商住项目,市场消息透露,政府早前第三度批出项目的补地价金额,平均每方呎楼面补价约6000元,涉及金额约245亿,但因金额过高,发展商拒绝接纳并提出上诉。

(星岛日报)

救世军购葵涌同珍工厦 一篮子物业作价1.22亿

工厦受追捧,再有用家出手,慈善机构救世军购入葵涌同珍工业大厦一篮子物业,作价1.22亿,6年间升值约67%。

金朝阳沽货 6年升值67%

金朝阳于今年5月放售葵涌同珍工业大厦一篮子物业,意向价约1.6亿,平均呎价约4315元,上月由慈善机构救世军以1.22亿承接,较意向价减3800万,平均呎价3290元。该物业位于昌荣路9至11号同珍工业大厦地下至3楼一篮子物业,建筑面积合共约37081方呎,连约出售,新买家 THE GENERAL OF THE SALVATION ARMY,即是慈善机构救世军。目前,救世军使用同珍工业大厦上述的部分楼面,作为办事处,今番由租客晋身业主。

金朝阳于2017年以7300万买入上述同珍工业大厦一篮子物业帐面赚约4900万,幅度67%。

工厦频录用家承接

近期工厦频录用家承接,其中,北角英皇道657至659号东祥工厂大厦,由大型出版商联合出版集团购入9楼A及B室,作价3800万,建筑面积约7980方呎,平均呎价约4762元。联合出版集团持有该厦4楼及7楼部分单位自用,是次增购9楼单位,料作为自用。原业主分别于1973年及1983年购入A室 (39万) 及B室 (15.73万),合共54.73万,帐面获利3745.27万,升值68.4倍。

(星岛日报)

Over a fifth of Hong Kong’s office tenants likely to reduce office space, with many relocating to mainland China and Singapore, study finds

More than a fifth of the respondents polled in Hong Kong said they would downsize their office space in the next two years and relocate elsewhere

Poll respondents cite cost cutting, shrinking business demand and work-from-home policy implementation as the reasons behind their choice

More than a fifth of office tenants in Hong Kong are likely to downsize their space in the next two years with some even looking to relocate to mainland China, Singapore and other parts of the world as they cut costs in a weak economic environment, according to a study released by an international property consultancy on Wednesday.

In a poll of 321 companies, the first since Hong Kong and mainland China scrapped all coronavirus pandemic curbs, 21 per cent or 69 of the respondents said they were likely to trim their operations, citing costs, shrinking business demand and further implementation of work-from-home policy as the top three reasons for their outlook.

“Some occupiers mentioned that their company’s capacity to relocate contributed to their decision,” the study by the property consultancy said. “Among all occupiers planning to downsize, 14 per cent cited relocating capacity to mainland China, 13 per cent to Singapore and 9 per cent to other parts of the world.”

“Businesses are motivated by optimising costs and adapting to changing market demands,” it added.

The poll was conducted from late June to early August and more than half the respondents were Hong Kong-based firms, 18 per cent from Europe and 11 per cent from other Asian cities.

Although 26 per cent of those polled said they would expand their office space and 53 per cent said they were likely to keep their current real estate requirements, the short-term outlook of those planning to leave could pile more pressure on a beleaguered property segment.

“While the majority of the occupiers intend to remain the same in terms of office size, the fact similar proportions of the respondents plan to expand or downsize reflects that the impact of the global economy on business operations and relocation needs vary across industries,” a property consultant said.

The vacancy rate in Hong Kong’s prime office space hit a record high of 15.1 per cent towards the end of August, according to the consultancy, beating the earlier peak of 13.1 per cent struck in September 2003.

Monthly office rental rates have declined 30.3 per cent to HK$54.70 (US$6.98) per square foot from the high struck in January 2019, when office vacancies were at a record low of 3.5 per cent, according to the consultancy.

More supply is scheduled to come on stream with about 3 million sq ft of new office space expected in the second half of the year, the consultancy said in a previous report.

Among the sectors, those in manufacturing, sourcing and trading, and shipping and logistics were the most pessimistic with about a third saying they were likely to reduce their office footprint.

Notably, the split in the real estate and construction sector between companies that said they would expand or reduce their office space was equal at 28 per cent, the study showed.

On the other hand, companies in the IT, banking, finance and insurance sectors were the most optimistic. About 56 per cent of those polled in the IT sector and 35 per cent in the banking, finance and insurance sectors said they were likely to add more office space.

“Respondents identified Hong Kong’s economic outlook (43 per cent) and a potential global recession (34 per cent) as the most important factors likely to impact their business over the next three years,” the study said. “Despite Hong Kong’s slower-than-expected recovery in the first half of 2023, business confidence is improving, with most respondents, especially those in banking and finance and professional services, optimistic about their business outlook over the three years, while 37 per cent of them believe their business will not change.”

The study recommended more flexibility from landlords such as shorter lease periods to adapt to the changing needs of their tenants.

“Supplementary incentives could include rent-free periods and contributions towards fit-out costs,” the consultancy said.

(South China Morning Post)

CWB store is rented for a song

A Causeway Bay store has been leased at rock-bottom rates last seen during the Covid pandemic.

The monthly rent of HK$180,000 is also 80 percent lower than peak rents seen at the same prime location.

The 1,325-square-foot rented store includes shops 1 and 2 on the ground floor of The Goldmark on Hennessy Road, near the Sogo department store.

The new tenant is a fashion shop, a real estate agent said. Though it is a short-term lease, the price is the same as the rent paid by a mask brand during the pandemic.

Lukfook Jewellery once paid as much as HK$3.5 million or HK$636 per sq ft to rent shops 1 to 7 at the building but the retailer vacated the premises during the pandemic. Thus, in terms of the price per sq ft, the new lease is about 80 percent lower than those peak levels.

In June, Chanel rented a shop at the adjacent at Capitol Centre for HK$3 million a month, or HK$158 per sq ft, which marked the largest commercial shop deal in Hong Kong in the past three years.

(The Standard)

Home completions dive 62pc

Private home completions slumped by 61.7 percent month-on-month in July to just 128 units, according to data from the Rating and Valuation Department.

It brings the total number of completions in the first seven months to 7,684 homes, which is about 38.5 percent of the government's full-year projection.

The downtrend was primarily due to the substantial inventory of unsold flats in new projects, prompting developers to slow the pace of completions in an effort to reduce unsold stock, a property agent said.

The agent noted that since March this year, monthly completions for new residential units have consistently remained in the low three-digit range, with May seeing a two-and-a-half-year low of just 86 units.

Furthermore, the scarcity of construction starts in 2020, totaling just 6,704 flats, has also contributed to the reduced number this year.

With only 7,684 homes built in the first seven months, the agent expects that it is unlikely that the annual target of 19,950 units will be reached.

The majority of the supply consists of small to medium-sized flats, with 4,352 units of 431 square feet or less completed this year, making up about 56.6 percent of the total supply.

In the primary market, Henderson Land (0012) posted the fourth price list for its Baker Circle Greenwich in Hung Hom, offering 28 flats at an average discounted price of around HK$19,038 per sq ft, the same as the third price list. Sales of these units start this Sunday.

In other news, a survey by an international property consultancy showed 56 percent of firms in the information technology sector expressed a strong interest in expanding their offices. Conversely, sectors such as manufacturing showed less interest in expansion, with 31 percent planning to downsize their offices.

(The Standard)法巴续租国际金融中心二期两层 每呎料130元 低5年前28%

本港写字楼租金大幅下调,核心商业区中环的租金跌至吸引水平,令部分企业放慢撤出中环的步伐。中环指标甲级商厦国际金融中心二期 (IFC 2),首批大型租户之一的法国巴黎银行 (BNP Paribas,下称法巴),现租用该厦4层,原打算明年租约到期时放弃其中3层,把有关部门搬迁至鰂鱼涌太古坊运作。据悉,法巴最终决定只减租一半楼面,并已续租其中两层共逾4.6万方呎楼面。

原拟四层弃其三 迁太古坊

法巴目前正租用国际金融中心二期60至63楼共4层作为香港总部,每层租用面积 (Lettable Area) 约23295方呎,合共约93180方呎,有关租约明年2月到期。今年初市场已有消息传出,法巴会在租约到期后,放弃续租大部分国际金融中心二期的楼面,把办公室搬迁到鰂鱼涌太古坊非核心商业区,以节省租金开支。

市场人士透露,大业主今年初曾把国际金融中心二期60、61及62楼3层推出市场放租,合共租用面积69885方呎楼面,意向呎租约160元,3层总月租逾1118万元,即每层月租约372.7万元。不过,近期60楼一层已经不在放租名单中。据悉,有关楼层并非成功预租,而是法巴决定续租60楼及63楼两层,合共约46590方呎,市场估计续租每月逾600万元,呎租约130元,租期4年。

根据资料显示,法巴早在2006年起,已经承租国际金融中心二期5层半楼面作为香港总部;2011年缩减至租用59至63楼共5层,合共总租用楼面达11.65万方呎。

法巴于2018年续租5层楼面至2024年2月,为期6年,月租高达2096.55万元,呎租达180元。不过,法巴突然在2021年初提早3年退租59楼全层,目前只留下4层,随着公司决定不续租61楼及62楼,明年法巴位于国际金融中心二期的香港总部只会餘下两层,较17年前减少逾一半规模,以法巴最新续租的呎租130元计算,较5年前大跌27.8%。

逾半商厦租户未来2年不扩充

自内地和本港通关后,由于环球经济不景,本港写字楼市道未见明显回勇,空置率不减之餘,租金亦反弹乏力。虽然市场普遍预期营商环境不会再变差,但重拾增长需时,因此企业对租用商厦持审慎态度。据一间外资代理行发布的香港写字楼租户调查研究报告,受访本港写字楼租户中,有超过一半企业表明未来两年不会就现时办公空间进行搬迁或扩充,只会保留现有的规模运作。

以国际金融中心二期为例,近期成交多为续租个案,如东莞银行现时租用的国际金融中心二期25楼4至11室,租用面积约11000方呎,在2021年以每月约154万元租用3年,呎租约140元,租约于明年1月到期。

据了解,东莞银行已续租上述楼面多3年,至2027年初,以市值呎租约120元计,涉及月租约132万元,料每月租金开支可减22万元,降幅约14.3%。

(信报)

更多国际金融中心写字楼出租楼盘资讯请参阅:国际金融中心写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

珠宝金行频进驻核心街道 租金高位跌70% 吸引「新品牌」首度插旗

今年开关以来,市面上率先回復回復过往药妆店林立情景,新一波则是珠宝金行「发力」,频抢租核心区最旺位置,有见租金高位跌70%,「新品牌」及「新面孔」首度在黄金地段插旗。

今次「主角」都尚未进场,名字陌生,因此更加令人期待,一家叫「老铺黄金」的内地过江龙首次抵港,成为焦点,一掷约150万承租「名店街」最当眼的单边巨铺,位处「珠宝段」的海防道单边,足见其野心及魄力。

「老铺黄金」成焦点

「老铺黄金」成立于2009年,以「古法金」招徠,以足金为底材镶嵌钻石,完全颠覆业界以K金为底材的做法。

该新港中心地下至2楼复式巨铺,前身英国奢侈品品牌Burberry旗舰店,高峰时月租高达650万,最新租金高位跌约70%。

海防道弥敦道皆受捧

海防道将一连开设两家珠宝品牌,大鸿辉旗下海防店46号地铺,疫市以来短租3年,近期刚以每月40万租出,新租客为首次攻港的内地鐘錶店,大鸿辉执行董事曹展康则强调,现阶段未能透露租客名称。

上址旧租客运动鞋店 SKECHERS 于2016年,以约74.2万进驻,近年不敌疫情肆虐,于2020年6月撤走,铺位短租予口罩店逾3年。

毗邻上址的海防道45号地铺,亦由法国首饰店 SATELLITE PARIS 港区代理进驻,月租40万,该代理曾在海港城设专柜,有见核心铺租大跌,首次进驻街铺,对后市投以信心一票,旧租客麦蛋糕,去年续约时月租17万,业主补偿让旧租各离场,反映通关前后,铺位租值发生巨变。

尖沙咀弥敦道美丽都大厦地下G12号连1、2楼,位处加拿分道单边,上手长租客谢瑞麟珠宝金行,疫情前撤出,该铺以每月约30万租出,租客福泰珠宝,向来于深水埗、荃湾等民生区经营,首次进驻核心街道。

(星岛日报)

更多新港中心写字楼出租楼盘资讯请参阅:新港中心写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

Secondary home deals rebound amid price cuts

Despite record rainfall last Friday, transactions in the secondary property market rebounded over the weekend thanks to more price reductions and fewer launches in the primary market.

A local property agency reported 13 deals at 10 major housing estates, up from three during the previous typhoon-hit weekend, to a 19-week high.

The agency said adverse weather over the previous weekend had affected real estate transactions but this weekend saw a release in buying power, as more owners lowered prices, enticing home buyers.

There are signs that prices have begun to stabilize and secondary transactions are expected to recover gradually, it said.

Meanwhile, another local agency saw weekend deals at 10 major housing estates rise to 14 from three the previous week to a 19-week high.

A three-bedroom flat at Taikoo Shing in Quarry Bay with an area of 689 square feet sold for under HK$10 million, after its price was reduced from HK$11.5 million in June to HK$9.9 million.

And in Tin Shui Wai, a three-bedroom flat at Kingswood Villas sold for HK$5.1 million or HK$8,100 per sq ft, marking a loss of HK$300,000 compared to its 2018 purchase price.

The Hongkong and Shanghai Banking Corporation was reportedly set to raise the H-plan mortgage rate cap by 0.5 percentage points to 4.125 percent on September 18. Other lenders are anticipated to follow suit, aiming to alleviate high borrowing costs.

A property agent expressed concerns that this might discourage potential buyers, worsening the overall market sentiment.

In the primary market, Henderson Land (0012) released 28 flats at Baker Circle Greenwich in Hung Hom yesterday, with the cheapest priced at HK$3.65 million, while Longfor (0960) will launch sales of four special flats at Upper RiverBank in Kai Tak today, three days later than originally planned, due to the heaviest rain on record last week.

CK Asset (1113) has added 10 more car-parking spaces to The Beaumont II in Tseung Kwan O with prices starting from HK$1.28 million, and five lots to Harbour Glory in North Point with the cheapest priced at HK$2.36 million.

This move followed a price reduction of up to 35 percent, which contributed to the developer's successful sales of 32 parking lots at both projects, generating a revenue of HK$52 million.

(The Standard)

Hong Kong luxury home market awaits return of affluent mainland Chinese buyers, as city’s talent scheme powers rentals

The city recorded 42 luxury home sales in the three months to June, down 37.3 per cent quarter on quarter, as high borrowing costs put off investors

The decline in Hong Kong luxury flat sales reflects the overall malaise in the city’s property market under the current high interest rate regime

Hong Kong’s luxury property market is still waiting for affluent mainland Chinese buyers to return, according to industry analysts, but the wait could take longer as high borrowing costs and economic uncertainty continue to weigh on investors’ appetite for the city’s high-end flats.

“We’ve had many inquiries from mainland Chinese investors, but they are still taking a wait-and-see attitude during the second quarter,” a property agent from an international agency said “Therefore, inquiry numbers were larger than transactions.”

The number of so-called super prime residential sales – covering transactions worth US$10 million and above – fell 17.6 per cent in the second quarter, down from their peak level in the fourth quarter of 2021, according to data from the agency. Total consideration for these deals in the same period dropped 28.6 per cent from the high reached in 2021’s December quarter.

The city recorded 42 luxury flat sales in the three months to June, which amounted to a total of HK$6.54 billion (US$834 million). That reflected a 37.3 per cent quarter-on-quarter tumble in the number of deals and a 15.6 per cent decline in total consideration.

In the first half of the year, 1,318 luxury flats were sold, at an average price of more than HK$20 million, according to data from another international property consultancy. That number was down from the previous high of 1,717 such transactions during the same period in 2019.

Luxury residential sales in the first six months of the year were concentrated at The Peak and Kowloon Tong, upmarket areas traditionally favoured by affluent property buyers, according to data from both agencies.

The decline in Hong Kong luxury flat sales reflects the overall malaise in the city’s property market, which has struggled amid high interest rates and a recent surge in unsold inventory from newly developed projects.

Hong Kong’s “prime” homes – defined by the first agency as the top 5 per cent of the residential market in terms of value – lost 1.5 per cent of their value for the year.

“We don’t see a lot of reasons that support a luxury residential sales market recovery in the short term,” the agent said. “The recovery will need to wait until the US starts cutting interest rates. So we expect sales in the market will slowly pick up in the second quarter of 2024.”

The city’s luxury residential market, which gained momentum in the first quarter after its borders reopened, has since been hampered by high borrowing costs owing to the US Federal Reserve’s aggressive interest rate hike strategy. The one-month Hong Kong Interbank Offered Rate, a measure of the interest banks charge each other to borrow money, surged to 5.29 per cent in July from 0.2 per cent in May, largely freezing buying activity.

The priciest luxury home transaction recorded in July was a 4,470 sq ft town house at Twenty Peak Road by V, which sold for HK$860 million, or HK$181,435 per square foot. A flat measuring 7,111 sq ft at 59 Mount Kellett Road on The Peak was bought in the same month for HK$900 million, or about HK$126,564 per square foot.

In Kowloon Tong’s 36 LaSalle Road, a 7,083 sq ft house sold for HK$255 million.

“We haven’t heard of an influx of mainland or foreign buyers in the housing market,” another agent said.

“Capital is allocated and parked in risk-free assets, such as time deposits, under the [current] high interest rate environment,” the agent said. “The wealthy mainland buyers or end users are cautious about the high borrowing costs.”

Still, there is some optimism that Hong Kong’s luxury home rental market has turned a corner and is set to rise on the back of the government’s Top Talent Pass Scheme.

“The Top Talent Pass Scheme attracted many mainland talents to work in Hong Kong,” and this group of professionals has also gradually bought or rented houses, driving a large amount of rental transactions on Hong Kong Island, a recent report from a local property agency said.

The Hong Kong government said in July that it received more than 100,000 applications to various talent schemes and approved over 60 per cent of them, nearly double the number targeted.

The city’s luxury home rental market edged up 3.2 per cent year-to-date in July, according to data from the international property agency.

“Demand from the rental market is rather robust and dynamic,” the agent said. The agent indicated that luxury flat tenants are from the mainland and returning expats.

“Although the numbers are not as many as those pre-Covid, we are now seeing tenants coming from Singapore and Dubai,” the agent said.

A three-bedroom, one-suite flat with an area of 1,032 sq ft in 80 Robinson Road at Mid-Levels West was rented to a mainland professional for HK$61,000 per month or HK$59 per square foot, according to another local agency’s report.

Also at Mid-Levels West, a 1,310 sq ft flat in Azure was leased in April for HK$85,000 a month in April, or about HK$65.3 per square foot, according to the agency.

Although Hong Kong’s talent scheme is expected to appeal to a number of mainland Chinese and foreign professionals to lease luxury flats in the city, the agent said they remains “cautiously optimistic” about the prospects of the luxury residential rental market.

(South China Morning Post)中环盈置大厦巨铺每月55万 丢空3年终租出租金较疫市前跌38%

核心区巨铺受追捧,中环盈置大厦一个复式巨铺,面积约6000方呎,自从运动用品旗舰店撤出,铺位在丢空3年后,终以每月55万租出,平均呎租93元,较3年前旧租金下跌38%。

上址为中环干诺道中41号盈置大厦地铺及1楼,建筑面积约5942方呎,铺面向干诺道中及域多利皇后街大单边。

平均呎租93元

市场消息透露,自从开关以来,业主以每月65万放租,近日成功租出,月租55万,较意向租金减10万,暂未知新租客所属行业,惟并非时装,亦不是饮食业。

租金较高峰期跌66%

该巨铺旧租客运动用品连锁店NIKE,10年前,NIKE将旗舰店由区内皇后大道中的万年大厦巨铺,搬迁至该盈置大厦巨铺,其时正值铺市高峰期,租金高企,该巨铺月租高达160万,及后于疫市前续租时,月租减至90万,2020年8月,NIKE敌不过疫市只好撤出,铺位亦一直丢空,业主亦大幅减价放租,曾一度叫价50万,在市况低迷时仍乏人问津。

直至今年通关后,该铺位开始受注目,业主亦将叫租提高至65万,今番终获承租,最新租金较当时跌38%,相对高峰期更下跌66%,却高于市况最低潮时的意向价。

近期区内巨铺承租,包括中环皇后大道中36号兴瑋大厦2及3楼,建筑面积共约8500方呎,由威士忌品牌麦卡伦以每月约50万承租,平均呎租约60元,在此设立旗舰店,上址位处中环核心地段,是皇后大道中通往兰桂坊必经之路,该品牌选址于此,可网罗中环上班一族、兰桂坊常客及旅客。

麦卡伦承租九龙湾国际交易中心单位多时,面积约1.2万方呎,市值呎租约20餘元,早前租用金鐘太古广场二座中层全层,面积约2万方呎,市值呎租约100元,现时由东九龙升级至核心区,开设旗舰店。

(星岛日报)

更多盈置大厦写字楼出租楼盘资讯请参阅:盈置大厦写字楼出租

更多万年大厦写字楼出租楼盘资讯请参阅:万年大厦写字楼出租

更多兴瑋大厦写字楼出租楼盘资讯请参阅:兴瑋大厦写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多太古广场写字楼出租楼盘资讯请参阅:太古广场写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

更多国际交易中心写字楼出租楼盘资讯请参阅:国际交易中心写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

工商铺录351宗註册 代理行:按月升18.2%

有本地代理行综合土地註册处资料显示,8月份工商铺註册量共录351宗,按月升约18.2%,金额录38.76亿,按月增约27.7%。当中工商铺三板块的註册宗数按月录全线上升,商铺註册量升幅最大,8月共录106宗登记,按月升约35.9%,其次为商厦板块,最新60宗註册,按月增约22.4%。工厦维持平稳,8月录185宗登记,按月升约8.8%。

中高价物业交投大增

若按金额划分,8月份註册量升幅最多的为价值5,000万以上至1亿物业,共录10宗註册,按月升150%。其次为价值2000万以上至5000万物业,最新录25宗,按月增约38.9%。中细价物业註册量维持平稳,500万或以下最新录189宗,按月升约8.0%。至于介乎500万以上至1000万物业,登记量则录72宗,按月升约26.3%。

8月份录4宗逾亿元註册成交,其中1宗为商厦,尖沙咀柯士甸路28号新港国际大厦全幢以1.38亿成交。商铺录3宗登记,包括鰂鱼涌英皇道983至987A号瑞士楼多个铺位、荃湾荃威花园1期地下及2楼商场部分,以及西营盘皇后大道西476至482号永兴楼地下多个铺位,作价分别2.49亿、1.7亿及1.15亿。

该行代理表示,虽然8月份工商铺註册量略见回升,但由于市场上欠缺新盘推售,加上经济仍未恢復到疫情前水平,相信短期内註册量将在目前水平徘徊。

(星岛日报)

西营盘旧楼批强拍底价2.54亿

市区住宅地皮供应有限,财团纷纷透过併购旧楼以增加土储。其中,西营盘时利楼获土地审裁处批出强拍令,底价2.54亿,较2021年申请强拍时的市场估值逾1.8亿,高出逾41%。

市场估值逾1.8亿

土地审裁处资料显示,位于西营盘荔安里1、3、5号,以及朝光街21、22、23、24号的时利楼,直至判决时,财团收购约82.857%业权,尚餘7个单位未收购,而餘下未收购的7个单位中,有4个由九建执行董事柯沛钧持有。

上述项目地盘面积约2977方呎,现址为1幢楼高7层的商住物业,地下及地库设有商铺,2楼至5楼为住宅部分,物业于1971年落成,楼龄52年。

事实上,市区地皮供应不足,特别是港岛区,因此发展商频向旧楼埋手,例如由恒基及太古地产合作收购的英皇道及滨海街一系列旧楼,早前获土地审裁处批出强拍令,底价高达63.1亿,创本港有史以来最高的强拍底价纪录,将于本月19日正式拍卖。

(星岛日报)

商厦租金倒退至哪一年?

差估署数据显示,今年7月整体商厦租金指数227点,大概回到2015年年中水平。

翻查差餉物业估价署数据,今年上半年继续有商厦楼面入伙,总数约有近48万平方呎楼面落成,其中超过43万平方呎是甲级商厦,而预计今年全年约有287万平方呎楼面落成,甲级佔270万平方呎。

商厦市况疲弱,几乎可以说是席捲全球,澳洲房地产委员会 (PCA) 8月发表最新研究数据,显示澳洲今年上半年的写字楼空置率升至90年代以来最高。由于新冠疫情以来在家工作情况普遍,加上经济放缓,对写字楼物业经营造成压力。

大多数大企业总部所在的大城市,空置率大部分都超过1成,悉尼为11.5%,墨尔本15%,珀斯15.9%。另外,有外资代理行报告显示,今年第二季加拿大全国写字楼空置率升至18.1%,高于第一季的17.7%,是自1994年第一季18.6%以来的最高水平。

如果要比空置率的高低,内地城市情况更严峻,另一外资代理行早前公布的数据显示,第二季度上海甲级写字楼净吸纳量录得33万平方呎,环同比分别下滑77.5%、59.9%。在净吸纳量大幅下跌的情况下,上海甲级写字楼整体空置率攀升至18.59%,环比上升1.28%。

北京今年第二季写字楼空置率升至18.3%,创下近13年新高,租金则倒退到2012年的水平。财经网引用三间外资代理行数据指,第二季度,北京写字楼的净吸纳量为负57万平方呎,租户不断流失。

作为北京高新科技企业集中地的中关村,写字楼空置率达到了16.9%,创了近10年高位,其平均租金跌幅更大,按季下跌了7.6%。有受访附近居民提到,在2020年前后,中关村附近的写字楼到晚上9时依旧灯火通明,叫车软件上排队都得20分鐘起跳。现在的晚上,几乎再没有整片亮起灯光的大楼。

各一綫城市的写字楼各面临着不同程度出租困境,上半年,上海、广州、深圳的甲级写字楼空置率分别升至18.6%、18%及24.5%。至于香港,据其中一间代理行的最新统计,整体甲厦空置率为15.7%,中环甲级商厦是9.9%,中环超甲级商厦是7.4%。官方数据差餉物业估价署数据,2022年整体空置14.4%,甲厦15.1%,乙厦15.1%,丙级是8.8%。至于上文提到北京商厦租金回到2012年,香港又如何?

7月租金指数 回到2015年中

同为差估署数字,今年7月整体商厦租金指数227点,大概回到2015年年中水平;甲级商厦的租金指数是227.8点,大概回落至2015年初的水平;乙级大概跌至2015年年中,丙级则回落至2017年上半年。

有关内地商厦报道,提到其中一间外代理代理为内地商厦作出比喻,「这就像疫情三年,办公楼市场生了一场病。本以为今年第二季度已经完全康復可以跑马拉松了,但走到小区门口发现身体还是不舒服,只能先回来。」香港同样是大病一场,调理需时!

(经济日报)

3,000 homes to hit market

Nearly 3,000 new homes are ready to hit the market after the Lands Department granted presale consents to four projects including Lohas Park phase 12A and 12B.

In August, a total of four presale consent agreements were approved, covering 2,998 units. This represents a decrease of 1,604 units or 34.9 percent from that of July when 4,602 units were approved.

Lohas Park Phase 12A and 12B, above the Lohas Park MTR station in Tseung Kwan O, are the result of a joint development between Wheelock Properties and MTR Corporation (0066). They will contribute a combined total of 1,335 residential units, with 650 units in Phase 12A and 685 units in Phase 12B.

In respect of the Subsidized Sales Flats Project at 21 On Yu Road, Kwun Tong, under the Hong Kong Housing Society, and the third tower of the eResidence, a Starter Homes Pilot Project for Hong Kong residents in To Kwa Wan under the Urban Renewal Authority, they both have obtained presale consents. These projects will offer 1,403 units and 260 units respectively.

The department also received last month applications regarding three projects including two by Early Light International, involving a total of 1,361 units.

Meanwhile, 18 units of The Harmonie, a project co-developed by Henderson Lands (0012) and the URA in Cheung Sha Wan will be put on the market next Tuesday for an average price of HK$17,470 a square foot after discounts. The sole three-bedroom apartment in this batch, of 769 sq ft in space, has seen its price drop from HK$15 million one and a half years ago to HK$11.3 million today.

In a separate development, a Taiwanese beverage maker has rented a 560-sq-ft shop at 33 Argyle Street in Mong Kok for HK$52,000 per month, or HK$93 per sq ft.

(The Standard)

Hong Kong wealthy families, funds among likely bidders in distress sale of defaulter Golden Wheel’s retail building in Tin Hau

Golden Wheel’s Tin Hau property is likely to sell for a price much lower than the original HK$1.25 billion demanded by its owner a year ago

The property is just one of the handful of assets seized by creditors as the owners have been unable to meet debt obligations

Hong Kong’s property market remains stressed with the potential distress sale of a retail building providing further evidence of the weak demand in the sector. The property which is located in Tin Hau is in creditor possession and is now likely to sell for a price much lower than the original HK$1.25 billion (US$160 million) that its owner, Golden Wheel Tiandi Holdings, was asking about a year ago, according to market sources.

The sale of the 25-story Golden Wheel Plaza on 68 Electric Road in a district known for its local cuisine and food stalls has drawn interest from “investors including funds and high-net-worth local families looking for a trophy asset”.

“All I can say is that this is a receivers’ sale of asset, so as long as the receivers accept an offer made, it will push through,” said the analyst. “The owner tried to sell the property a year ago but did not find any buyer for the asking price. But this time it is different.”

The property is just one of a handful of assets seized by creditors as the owners have been unable to meet their debt obligations.

China Evergrande Group’s Hong Kong headquarters building, a 27-story tower in Wan Chai, is yet to find a buyer. Creditors put the building on the market a year ago to recover their dues as the world’s most indebted developer struggled to restructure its US$300 billion liabilities.

In January, the former headquarters of embattled Goldin Financial Holdings was bought by PAG and Singapore-backed Mapletree Investment for a significant discount of HK$5.6 billion, according to PAG.

The site of the Golden Wheel Plaza building was bought for about HK$800 million and the construction cost of the building, which was completed in 2020, was about HK$200 million, according to a source.

Currently, the building, which has a gross floor area of 51,971 sq feet, is 60 per cent occupied with personal-care retailer Mannings and some food-and-beverage shops on the ground floor, the source said.

Rents paid by tenants on the ground floor are estimated to be as high as HK$120 per square foot, while those on the higher floors are estimated to be about HK$50 per square foot.

“The occupancy is a bit low but it is likely to improve once the building is managed better,” the source said.

A property agent said “the building has a lot of value. “It has good restaurants as tenants, including one that has a Michelin star, and it has a good sea view and is surrounded by more restaurants and hotels. It’s a destination area.”

An international property agency has been appointed by receivers to conduct the public sale by tender that is set to close on October 31 at noon.

The property is located close to the Tin Hau MTR Station and Victoria Park and not far from the bustling shopping district of Causeway Bay. The property includes a car park and is near a taxi rank.

“Investors may seize this opportunity to purchase the property while the global market is still in the recovery phase,” the agent said. “When the global economy fully rebounds, stable rental income and property appreciation can be expected.”

Debt-stricken Golden Wheel, the Nanjing-based developer of the property, reported a higher loss in the six months ended June. Its net loss widened by 44 per cent to 518.9 million yuan from 360 million yuan a year ago, and the company continues to battle with negative working capital as its current liabilities are far in excess of current assets.

The developer defaulted on a US$40 million loan in October last year, which triggered cross-defaults on its HK$304.135 million and 3.377 billion yuan loans.

Golden Wheel said it was taking steps to restructure its debts and raise funding.

(South China Morning Post)代理行:甲厦租金按月微升0.6%

有本港代理行发表的商厦报告指,8月份商厦註册宗数录59宗,按月升约20%,租售价持平,分散业权甲厦售价及租金分别按月微升0.4%及0.6%,惟乙厦售价跌幅达3.8%,中环区乙厦过去半年未录买卖。

上月50大指标甲厦仅录2宗买卖,其中为德林控股购入中环威灵顿街92号商厦的最高5层及冠名权,作价近3亿,反映家族办公室来港设立据点。

九龙东成焦点

九龙东甲厦录大手租务,日资银行 MUFG Bank 承租啟德 AIRSIDE 二层,涉及面积约9万方呎,呎租35元,为医管局主要部门租用啟汇 (Harbourside HQ) 达10万方呎的楼面,市场预料成交呎租为15元。该行代理认为,目前啟德新甲厦的租金水平对比传统核心区如中环、金鐘的平均租金较便宜,估计能吸引没有特定地域要求的政府办公室或国际企业后勤部门进驻,带动该区的商厦租务。

(星岛日报)

更多AIRSIDE写字楼出租楼盘资讯请参阅:AIRSIDE 写字楼出租

更多啟德区甲级写字楼出租楼盘资讯请参阅:啟德区甲级写字楼出租

更多啟汇写字楼出租楼盘资讯请参阅:啟汇写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

啟德「巨无霸」住宅地6财团角逐 大发展商主导业界:出价趋保守

啟德2A区2号及3号「巨无霸」住宅地,原定上周五截标,惟受世纪暴雨影响,延至昨日截标,共接获6份标书,除一眾「本地薑」外,亦有发展商以合组财团方式竞投。有入标发展商指,出价已考虑近期市况及地皮位置等因素。业界指,料出价倾向保守,但流标风险不大。综合市场估值约44.65亿至59.54亿,每方呎楼面估值约4500至6000元。

上述啟德住宅地昨中午12时正式截标,地政总署公布,合共接获6份标书,据现场所见及及综合市场消息,多间大型发展商均有入标,包括长实、新地、恒基、会德丰地产、南丰集团,而信和则伙拍中国海外、鹰君及华人置业合组财团入标竞投。

市场估值44至59亿

会德丰地产高级经理 (物业发展) 何伟锦表示,集团以独资方式入标,由于地皮位处市区,而且邻近港铁站,故有兴趣,并透露出价会考虑目前市况等因素,强调会计自己数。

新地回覆查询时表示,集团以独资方式入标竞投。

有测量师指,大型发展商都基本有入标,流标的机会转低,但相信出价仍属保守。

涉总楼面99万方呎

另一测量师说,入标财团均属本港龙头发展商,部分财团于邻近亦有项目,考虑到近期经济以至市况偏淡,相关出价会反映对后市的看法,包括未来美国联储局进一步上调息率压抑通涨的负面因素,料出价保守,但流标风险不大。

上述啟德2A区2号及3号合併招标住宅地,邻近港铁宋皇臺站,指定作非工业 (不包括仓库、酒店及加油站) 用途。地盘面积约14.53万方呎,涉及可建总楼面约99.23万方呎。综合市场估值约44.65亿至59.54亿,每方呎楼面估值约4500至6000元。

据卖地章程显示,中标财团需兴建多项设施,包括负责兴建长者邻舍中心、严重弱智人士宿舍、残疾人士地区支援中心、男童院等政府地方的楼面,上述政府设施总楼面可获豁免,有关费用将在上述政府配置转让给政府时由政府支付。另外,亦需负责地盘外东面一节范围修建一处公眾休憩用地,并及后交还于政府;负责兴建地下购物街、多段24小时开放的公眾通道及于地盘7处指定位置修筑接驳口以连接地盘与地下街、龙津石桥保育长廊及毗邻发展项目等。另外,发展局早前指地下街长约175米,佔整条啟德地下街11%。上述项目发展期长达7年,至2030年12月31日。

(星岛日报)

铜锣湾 OLIV 银座商厦配套完善

近年,市面上出现不少银座式商厦,位于铜锣湾的 OLIV 邻近大商场,加上交通便利,配套完善,吸引不少商户进驻。

OLIV 为银座式商厦,位处铜锣湾霎东街15至21号,为目前铜锣湾区鲜有较新簇的银座式商厦,楼高24层,採用一梯一伙设计,每层楼面面积约1,809至2,090平方呎不等,实用率约75%以上,商厦提供3部客用升降机,有助疏通人流,另每层设有两个洗手间,包括一个伤残人士洗手间。另附有大型户外广告位,楼底近5米高,内置楼梯连专用电梯贯通地下至3楼。

用户包括高级餐饮医美

交通方面,由铜锣湾港铁站时代广场出口,步行至大厦只需数分鐘,同时距区内其他地标,如希慎广场、崇光百货、利舞臺等,步程约5分鐘即可到达。项目亦邻近铜锣湾地铁站,步程只需约5分鐘,附近亦设有的士及巴士站。

有代理表示,OLIV 多为业主自用或出租,出租率亦见理想,用户由高级餐饮、美容医美、健身、瑜伽纤体等行业组成,当中9楼 LashLab 为台湾美睫品牌进军香港的首间分店,引入睫毛嫁接技术,更同时设有美甲专区。

物业地铺至3楼及大型户外广告位,近日以约3亿元售出,该项目涉及面积约9,499平方呎,以成交价计算,折合呎价约31,580元,以现状形式购入。

买家为悦兴地产发展有限公司董事罗守耀及其牙医太太邓嘉玲。据了解,项目于高峰期时市值曾达约8亿元。而物业地铺至3楼曾获瑞士名錶品牌 Franck Muller 以约238万元承租。

(经济日报)

更多OLIV写字楼出售楼盘资讯请参阅:OLIV写字楼出售

更多铜锣湾区甲级写字楼出售楼盘资讯请参阅:铜锣湾区甲级写字楼出售

地下连1楼铺 意向月租70万

随着本港积极推行激活夜市经济,各界纷参与,期望爆发本港消费潜力,位于铜锣湾霎东街15号 OLIV 基座,更率先推出项目地下连1楼及户外广告位招租,意向月租为每月70万元。

有代理表示,目前招租中的 OLIV 地下至1楼及户外广告位,涉及总建筑面积约4,651平方呎,地下面积约2,235平方呎,1楼面积约2,416平方呎,叫租为每月约70万元。期望可吸引高档时尚品牌,高级餐饮食府,以至金融及保险等中外及内地企业进驻。

夜间经济料激活铺市

该代理指,项目门前可停车外,地利位置亦见优越,靠近全球最贵地段罗素街,更位处时代广场落客及上车区静中带旺,属城中名人必经之处。

而近期铜锣湾区铺位零售及餐饮气氛转好,已相继吸引多个知名餐饮及零售品牌进驻,随着政府积极推动夜间经济,有意强化本地及旅客消费,相信将会振兴本港铺位市道,预料铜锣湾区铺位租务及买卖市况将会全面復甦,在租务交投带动下,铺位买卖气氛亦将会随之起动。

(经济日报)

更多OLIV写字楼出租楼盘资讯请参阅:OLIV写字楼出租

更多时代广场写字楼出租楼盘资讯请参阅:时代广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

全新商厦设备理想,现湾仔金源集团大厦全层招租,意向呎租38元。

面积2014呎 意向呎租38

有代理称,近日有业主放租湾仔金源集团大厦全层单位,物业面积约2,014平方呎,业主意向月租7.6万元,平均呎租约38元。

该代理表示,该厦为全新多用途商厦,拥有特高楼底4.55米,以及楼层负重达5Kpa,适合各种不同行业的租客。另外,物业设有独立空调,可24小时运作,足以满足需长时间或不定时工作的公司的个别需要。他又指,该大厦位处湾仔旺段,步行至会展站或湾仔站仅数分鐘,附近食肆、酒店林立,更有多条巴士綫到达,交通便利。

(经济日报)

更多金源集团大厦写字楼出租楼盘资讯请参阅:金源集团大厦写字楼出租

更多湾仔区甲级写字楼出租楼盘资讯请参阅:湾仔区甲级写字楼出租

Major players enter fray for $6b Kai Tak site

A residential site in Kai Tak worth up to nearly HK$6 billion has drawn six bids from major local property developers when the tender closed yesterday, the Lands Department said.

CK Asset (1113), Sun Hung Kai Properties (0016), Henderson Land Development (0012), Wheelock Properties and Nan Fung Group were said to be among the bidders for the 13,499-square-meter site.

And a consortium formed by Sino Land (0083), Great Eagle (0041), Chinese Estates (0127), and state-owned China Overseas Land & Investment (0688) also reportedly submitted its bid.

The plot, Kai Tak Area 2A Site 2 and Site 3, will provide a supply of 1,325 flats totaling 92,185 sq m when completed.

Its market valuation ranges from HK$4.47 billion to HK$5.96 billion, or from HK$4,500 to HK$6,000 per sq ft.

That was even lower than the price of an adjacent site CK acquired last year. The developer purchased it for HK$6,138 per sq - the lowest in Kai Tak since May 2014 and 23 percent below the lower end of market expectation - in December, which was seen as a bargain at the time.

The purchaser of the new site is required to construct around 175 meters of the underground shopping street, which is around 11 percent of the total Kai Tak underground street by length, as well as six social welfare facilities of around 42,000 sq ft which is excluded from the total floor area of the site. The facilities include a neighborhood elderly center, day activity center, and hostel for the mentally handicapped.

The plot is near the Sung Wong Toi MTR Station, but the provisions of the underground street and government accommodations are expected to increase the construction cost and time to a certain extent, and thus be reflected in bids, a surveyor said.

Coupled with the sluggish property market, the surveyor expects the developers' bids to be conservative.

This came as data from the Inland Revenue Department showed Hong Kong's overall stamp duty revenues from property purchases nearly halved last month from July to the lowest since October at HK$295 million. The number of transactions involved, though, rose 3 percent to 201 in August.

Revenue from buyer's stamp duty, which applies to non-permanent resident and company purchases, slumped by 61 percent to HK$230.4 million, despite cases only down by just 5 percent to 54 in the month.

In the primary market, Road King Infrastructure (1098) said it may unveil the first price list of at least 139 units for its new project Mori in Tuen Mun this week, and the sales may take place within the month.

(The Standard)恒地 The Henderson 预租率已近半

瑞士制錶品牌爱彼 租全层1.2万呎

本港写字楼市场空置率仍高企,恒基地产 (00012) 旗下中环美利道商业项目 The Henderson 亦将于2023年底落成。恒地租务部副总经理梁碧茜表示,全港包括中环的写字楼市场自2020年开始需求减弱,空置率高,但恒地对项目仍有信心,目前 The Henderson 可出租楼层的出租率已升至近50%。

梁碧茜表示,继佳士德及私募基金凯雷后,The Henderson 亦获瑞士制錶品牌爱彼 (Audemars Piguet) 及国际画廊将会承租,其中爱彼将租用全层约1.2万平方呎楼面,作为其AP House及香港办公室之用。

明年中入伙 出租率料续升

她承认,中环空置率高企,但今年开关后,租客活动转活,他们对新项目有兴趣及需求,相信 The Henderson 于2024年中入伙时出租率会进一步提升,目前 The Henderson 签订的租金与中环其他甲级写字楼相若,属合理租金,但会因应租户需要楼面及需求,制定不同租约。

The Henderson 楼高36层,写字楼共有25层,楼面面积介乎1.2万至1.5万平方呎,设有空中花园及宴会厅。

梁碧茜指,The Henderson 全幢只会有20至30个租客,故最重要是拣选认同集团理念的合适租客,而租金一般会视乎市场供求及经济环境而定,但相信项目地理位置及设计优越,再配合可持续发展策略,会受租户欢迎。

「地标中的地标」 重ESG合作

恒地锐意将 The Henderson 打造为「地标中的地标」(An icon amongst icon),由扎哈.哈迪德建筑事务所设计,参考香港紫荆花的花蕾,使用逾4,000块玻璃,由超过1,000种不同弧度的玻璃拼砌出来,并针对地带的特点,围绕3个绿化带,包括遮打花园的绿化建筑、香港公园等。

梁碧茜指,早前本港经历打风及黑雨期间,项目的玻璃均无受损,亦无渗透,加强对建筑物的信心。

随社会对可持续发展关注度提高,The Henderson 推出由业主、租户及其员工三方共同参与的ESG合作伙伴计划,除每年会向租户提供ESG表现报告,包括能源、水、废物、碳排放四大领域,员工如达到ESG目标也可赚取HEND Coins换取免费咖啡等奖赏。

梁碧茜指项目无将绿色条款与租金掛钩,但与潜在租户开会时,他们重视物业能否配合其公司ESG目标,而且恒地着重业主及租客在ESG方面如何合作,如提供太阳能幕墙降温装置、迷你天气监测仪等。

(经济日报)

更多The Henderson写字楼出租楼盘资讯请参阅:The Henderson 写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

工商铺买卖录319宗 中原:按月升27%

有本港代理行资料显示,8月份共录约319宗工商铺买卖,按月升约27%,增幅归咎于7月份基数较低,当中近70%由造价1000万的成交组成。

该行认为,政府积极研究推出具体措施刺激经济,令投资者信心逐步回升,预测工商铺买卖平稳上扬。

1000万或以下买卖佔70%

该行代理表示,根据统计,8月份市场仅录约319宗工商铺买卖,总金额约44.88亿,对比7月份升约27%及20%,按年同期未见改善,分别较2022年同期少约6%及23%。

该代理续指,月内市况表现持续疲弱,佔69%即约220宗为造价1000万以下成交,当中七成来自工商物业,达157宗。观乎8月份成交宗数与其他月份相若,表面上,8月份成交走势有所回升,主要是7月份受暑假外游影响令基数低,7月份买卖仅录250宗。

商铺录80宗按月升37%

该代理续说,8月以商铺最受捧,宗数由7月约58宗,跳升约37%至约80宗,铜锣湾霎东街15号 OLIV 基座,包括商铺及1至3楼,成交价约3亿,新买家为罗守耀及其牙医太太邓嘉玲。

盛汇商铺基金以约2.13亿购入北角英皇道165至175号公主大厦地下一篮子地铺及1楼全层,呎价约17000元,原业主为投资者杨奋彬,其于2009年以约1.14亿购入上述物业,持货约14年帐面获利近1亿。

(星岛日报)

更多OLIV写字楼出售楼盘资讯请参阅:OLIV写字楼出售

更多铜锣湾区甲级写字楼出售楼盘资讯请参阅:铜锣湾区甲级写字楼出售

石门京瑞广场地铺1.17亿售 投资者承接料回报3.1厘

民生地段铺市受捧,沙田石门京瑞广场一个巨铺,近期录食肆租客承租兼易手,作价1.1745亿易手,买家为投资者,料回报约3.1厘;至于平均呎价3.1万,较一年前下跌逾10%。

石门安群街京瑞广场一期地下29号铺,由发展商亿京持有,面积约3767方呎,物业前身租客为政府,作为智能身份证换领中心,早前约满迁出后,旋即录毗邻食肆承租,月租30万,租客为物业毗邻的食肆冰室。

平均呎价3.1万

该物业亦以约1.1745亿沽出,平均呎价约31179元,市场消息指,新买家谢姓人士,名字为普通话拼音,料回报约3.1厘。

盛滙商铺基金创办人李根兴表示,G29号以及毗邻的G19号铺,建筑面积各约2434方呎,其中G19号铺于去年4月以8791.4万沽出,平均呎价36119元。

他续指,若以呎价作比较,新近成交的G29号铺,较去年成交价下跌13.6%。

食肆每月30万承租

京瑞广场由亿京发展,位于石门安群街1号及3号,于2016年落成,亿京于2011年两度购入地皮,安群街1号于11月以8.28亿投得,总楼面43万方呎,每呎楼面地价仅1926元,写字楼楼面16层,每层约1.6万方呎。

京瑞广场地铺去年录短炒,煌府婚宴专门店集团主席陈首铭于去年8月,购入沙田石门安群街3号京瑞广场第1期基座地下12号铺 (面积约1032方呎),作价4000万,持货1个月,以4380万沽出,帐面赚380万或幅度9.5%,该铺位由药房租用,月租约15万,新买家回报逾4厘。陈首铭早于多年前看好区内发展,2015年旗下煌府婚宴集团斥近2.5亿,买入京瑞广场二期3楼楼花全层,现时自用,共约5万方呎,物业2021年标售叫价高达5.48亿。

(星岛日报)

更多京瑞广场写字楼出售楼盘资讯请参阅:京瑞广场写字楼出售

更多石门区甲级写字楼出售楼盘资讯请参阅:石门区甲级写字楼出售

陈秉志1.55亿沽北角地厂

投资者陈秉志沽售北角七姊妹道地厂,市场消息透露,七姊妹道206及208号昌利大厦地厂及1楼,建筑面积各约7485方呎,分别以9500万及6000万易手,涉资合共1.55亿,平均呎价10354元,该物业接近港铁鰂鱼涌站,地厂亦已补价,不限于工业用途,现址租客包括快餐店及面包店等,以易手价计算,回报逾3厘。

料回报逾3厘

有代理称,火炭黄竹洋街15至21号华联工业中心特色地厂,建筑面积约588方呎,意向价438万,平均呎价约7449元,现连约放售,回报高近5厘,可即买即收租。

该代理表示,该地厂拥有3个出入口,楼底约21呎特高,可建阁楼,大增使用空间。

(星岛日报)

湾仔旧楼批强拍 底价1.361亿

港岛区地皮供应罕有,不少财团透过强拍增加土储,由财团去年申请强拍的湾仔秀华坊旧楼,最新获土地审裁处批出强拍令,底价为1.361亿,对比2022年5月申请时估值约5751万,高出7859万或1.4倍。

料可建总楼面1.6万方呎

据土地审裁处文件显示,上述获批强拍令的旧楼位于秀华坊18号,财团于2022年5月向该处提出强拍申请,当时已持有约83.33%业权,餘下1个单位未能成功收购。而申请人曾于2022年至2023年期间曾5度向小业主出价收购,由最初1865.2万,提升至今年2月的2100万,同年5月进一步提升至2300万,即加增约434.8万或23.3%,仍遭小业主拒绝。

恒基大角咀旧楼今强拍

属于999年期的「千年地契」,重建无用途限制,地盘面积约3358方呎,若以地积比5倍重建,料可建总楼面约16790方呎。

恒基併购的大角咀道177至191号旧楼,将于今日举行公开拍卖,拍卖底价为6.97亿。

(星岛日报)

雅丽阁全幢放售 估值5.5亿

港岛豪宅地有价有市,东半山大坑道333号雅丽阁全幢物业最新推出市场,市场预计物业市值约5.5亿元。

雅丽阁于1982年落成,为1幢楼高4层的豪宅,一梯两伙,共涉及8个住宅单位,面积介乎1,628至3,270平方呎,地下设有停车场。项目的地盘面积约6,471平方呎,最大可重建建筑面积约为13,857平方呎。物业将全座以现状出售,并可以公司股权转让方式进行买卖。

(经济日报)

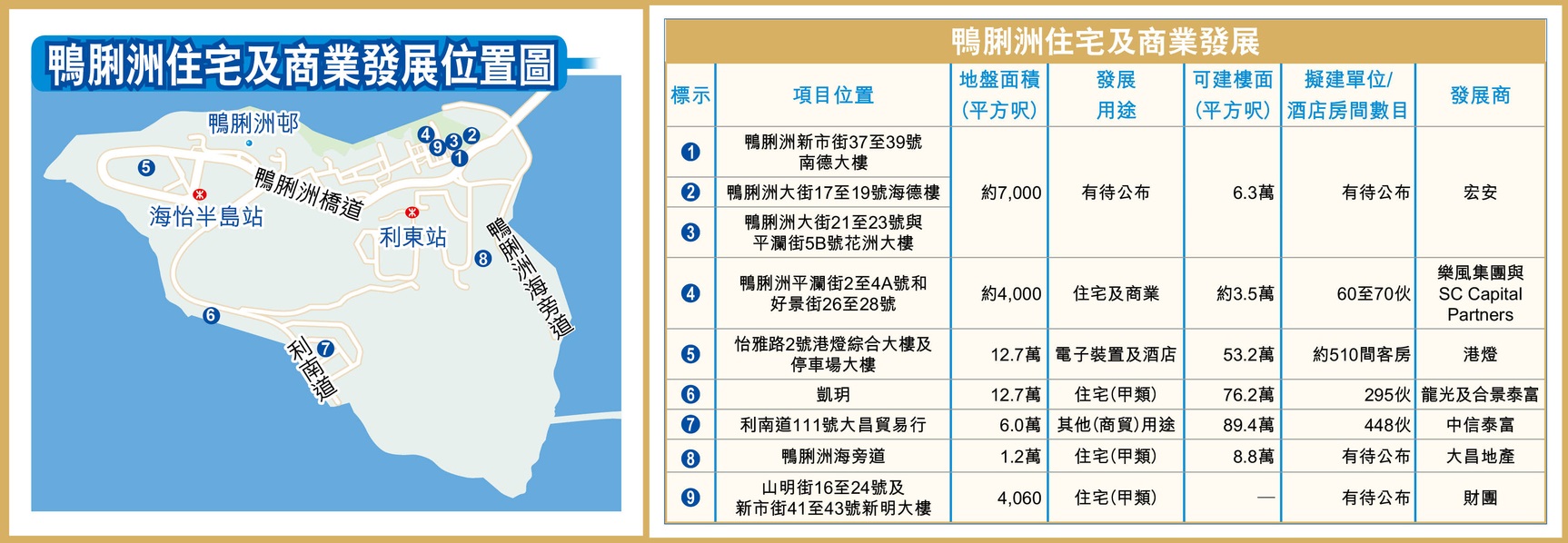

旧楼有价 鸭脷洲成发展商收购对象

港铁南港岛綫通车后,南区与传统市区的距离拉近,交通变得更为便利,释放发展潜力,因此鸭脷洲一带近年相继吸引中小型发展商在区内插旗。

鸭脷洲大街一带有不少旧楼林立,对于发展商而言为收购的机会。早年本地龙头发展商之一的恒地 (00012) 已看中区内潜力,收购该带的旧楼,并已发展为倚南及逸南。

新明大楼 年初申强拍

而位于鸭脷洲山明街16至24号及新市街41至43号新明大楼,今年年初亦已经向土地审裁处申请强拍。根据申请文件,项目早于1966年落成,现为1幢8层高的商住楼宇,地盘面积约4,060平方呎,是次强拍的申请人为威德胜有限公司 (Victory Super Limited),其公司董事包括郑慧仪 (CHENG, WAI YEE CONNIE) 等人,属新世界 (00017) 附属公司董事,故不排除背后申请财团为新世界。申请人现持有上述项目80%业权,项目的现况市值逾2.6亿元。

事实上,当港铁南港岛綫落成后,鸭脷洲的发展潜力进一步增加,吸引不少发展商积极在该区收购旧楼,当中以宏安 (01222) 最为积极。发展商于去年年初接连为区内旧楼申请强拍,包括位于鸭脷洲大街17至19号海德楼、鸭脷洲大街21至23号与平澜街5B号花洲大楼,及鸭脷洲新市街37至39号南德大楼。而发展商于今年年初亦已成功以约1.06亿元统一南德大楼的业权。

宏安3项目一併重建 增6.3万呎楼面

宏安曾透露将会为前述3个项目一併重建,共组成面积近7,000平方呎地盘,以地积比率9倍计,其可重建楼面约6.3万平方呎。

至于近年积极物色旧楼收购的乐风集团亦看準区内优势,伙新加坡房地产私募股权投资公司SC Capital Partners收购该带旧楼。发展商于今年3月成功以约1.57亿元统一鸭脷洲好景街26、28号及平澜街2号项目。该项目将连同比邻全数拥有的平澜街4至4A号项目合併发展,组成约4,000多平方呎的地盘,并计划以地积比率约9倍重建1座约20多层的项目,提供约60至70伙,主打1及2房户型,总投资额涉约8亿元,发展商当时预计项目会在3年内落成。

另外,由庄士中国 (00298) 发展的弦岸,前身为平澜街6至8号、及鸭脷洲大街26至32号旧楼,发展商于2019年斥资约4.55亿元收购项目,其地盘面积4,320平方呎,可重建总楼面约4万平方呎。项目将兴建1幢27层高的商住大厦,提供105伙,但值得留意的是,弦岸原计划于6月中展开首轮销售,惟最终销售突然遭煞停。

(经济日报)

Audemars Piguet to move into The Henderson

Henderson Land (0012) said its grade A office building The Henderson under construction in Central has recorded a 50 percent occupancy rate, with Audemars Piguet the latest tenant to sign up.

The Swiss watchmaker will take up a 12,000-square-foot floor at the tower which will include its office and an AP House store.

AP House stores are designed to feel like a home away from home for the manufacture's most valued clients.

Other major tenants to sign up include Christie's and Caryle.

Christie's will hold its auctions there instead of the Hong Kong Convention and Exhibition Centre, renting four floors with altogether about 50,000 sq ft. And private equity firm Carlyle will occupy 1.5 floors - about 20,000 sq ft.

The building is targeted to be completed by the end of this year, and the hope is to achieve 80 percent occupancy in 2024, according to Henderson Land Development deputy general manager for leasing Charlotte Leung Pik-sai.

Leung acknowledged the increasing supply of grade A offices but believes rental prices will be stabilized when economic activities resume to normal gradually.

The Henderson will sign a green memorandum of understanding with tenants. Some patented technologies have been applied to the green building including the solar responsive ventilator.

The Henderson is a 36-story building with 25 floors of office space, a sky garden and a glass roofed banquet hall.

(The Standard)

For more information of Office for Lease at The Henderson please visit: Office for Lease at The Henderson

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Ho Man Tin flat prices cut by 14pc as developers vie for sales

Local developers are rolling out offers to attract home buyers, including discounts of up to 14 percent for flats at Chinachem's In One in Ho Man Tin.

For the new project atop Ho Man Tin MTR Station, Chinachem said it will revise the price lists to offer home buyers discounts of as much as 14 percent with a new payment scheme.

Jointly developed by Chinachem and MTR Corporation (0066), In One still has 81 units for sale, with the cheapest unit of HK$7.99 million in this batch.

The project has sold 429 flats, or 80 percent of total units, cashing in HK$7.3 billion. The average price per square foot for the sold apartments is HK$28,300.

For the coming Mid-Autumn festival and national holiday, Chinachem plans to offer coupons at MTR malls to those who buy units at In One from September 16 to October 8. The highest award is HK$38,000 worth of coupons for the three-bedroom unit buyers.

Meanwhile, Chinachem said it will upload the prospectus of the redecorated project Victoria Coast in Pok Fu Lam as early as this week, to offer 118 units by tender.

CK Asset (1113) plans to hand out Mid-Autumn festival shopping coupons to new buyers at The Coast Line in Yau Tong.

Following successful contract signing, buyers will be awarded HK$88,000 worth of Fortress gift coupons, which will be applicable to home appliances, health and beauty products.

Furthermore, CKA will distribute a box of mooncakes to the viewers who visit the show flats in Tsim Sha Tsui for festival blessings.

On the other side, the primary market will see more new homes. Mori in Tuen Mun aims to release the first price list soon and will put at least 139 flats for sale in the first batch.

Co-developed by Road King Infrastructure (1098) and Shenzhen Investment (0604), Mori will provide 693 units in total, with sizes ranging from 291 to 3,419 square feet, according to the prospectus.

In other news, the Elegant Court on 333 Tai Hang Road is put for an en-bloc sale, with a market valuation of HK$550 million, according to the appointed agency.

A luxury house Casa Bella in Kowloon Tong has been put up for sale by tender, with a market valuation of HK$150 million, or HK$24,000 per sq ft, the appointed agency said.

Elsewhere in Wan Chai, the old building in Sau Wa Fong was approved by the Lands Tribunal to enter a compulsory auction, with a reserve price of HK$136 million.

(The Standard)信和财团53.5亿「低捞」啟德靚地

近期楼价持续回软,连地价亦级级跌,日前截标的啟德2A区2号及3号「巨无霸」住宅地终于顺利批出。由信和牵头财团以53.5亿力压5财团夺标,每方呎楼面地价约5392元,属市场估值范围之内,惟呎价创同区逾9年半新低纪录,同时对比去年12月同区另一幅批出住宅地低出约12%。

上述啟德住宅地于周一截标,当时吸引6间财团入标。地政总署昨日公布招标结果,由信和伙拍中国海外、鹰君及华人置业合组的财团,以53.5亿力压5财团夺标,每方呎楼面地价约5392元。其中,信和、鹰君及华人置业更是首次「插旗」啟德住宅地。

黄永光:对港前景充满信心

信和副主席黄永光表示,项目位置优越,配套完善,而且交通四通八达,为集团土地储备增添一幅上佳的地皮。他强调,集团对香港前景充满信心,全力支持。另外,集团非常高兴与伙伴中国海外、鹰君及华人置业投得上述用地。

黄永光续指,未来将兴建优质住宅项目,加上园境、绿色及智能家居设计,以及住客会所等设施,打造优质生活,贯彻可持续发展理念,建构更美好生活。

上述项目市场估值约44.65亿至59.54亿,每方呎估值约4500至6000元,批出地价属市场估值范围内。除中标的信和财团外,其餘入标财团包括长实、新地、恒基、会德丰地产、南丰集团。

呎价5392元创9年半新低

值得留意的是,是次呎价对比长实去年12月底以87.03亿投得的啟德2A区4号、5 (B) 号及10号合併地皮,每呎地价约6138元,低出约12%;若与2014年2月嘉华以29.388亿投得的啟德1I区2号地皮 (现已发展为嘉汇) 比较,当时每呎地价约5330元,意味是次地价重返9年半前水平。

有测量师表示,项目发展周期长,而且中标财团须兴建一系列社福及政府设施,再者在加息环境下,均影响发展商出价。

业界料落成呎价达1.8万

测量师预料,未来项目落成后呎价可售约1.7万至1.8万,形容地价属「进可攻、退可守」,即使未来数年楼市未有起色,相信项目仍会有合理利润。

另一测量师指出,楼价持续下跌,而且近年该区为新盘供应重镇,仍有不少项目尚待推出,再加上在息口高企环境下,均影响发展商出价,并趋向保守。虽然地价属市场预测范围,惟仍属低位水平。

(星岛日报)

恒基底价6.97亿夺大角咀旧楼

市区靚地新供应罕有,不少财团透过强拍途径增加土储;恒基近年积极扩展大角咀一带版图发展,昨日再下一城,成功以底价6.97亿投得大角咀道一列旧楼业权,未来将与毗邻项目合併发展,涉及可建总楼面约14万方呎,并主打上车盘,届时发展成利奥坊系列楼盘之一。

恒基併购多年的大角咀道177至191号,在7月底获土地审裁处批出强拍令,底价为6.97亿;项目于昨日举行公开拍卖,由手持「1号牌」的恒基执行董事黄浩明,在未有其他竞争对手下以底价投得,成功统一业权发展。

频扩区内版图

黄浩明拍卖会后透露,上述项目会连同毗邻项目合併发展,换言之整个项目涉及大角咀道 173号至199号,总地盘面积扩展至约1.57万,若以地积比率约9倍重建发展计,涉及可建总楼面约14万方呎,预料将兴建中小型单位,主打上车盘,届时将发展成利奥坊系列楼盘之一,据了解,该项目为利奥坊第7期。

上述毗邻的万安街24至30号,该公司早于2021年9月以底价约2.7亿成功统一业权,料将发展成利奥坊第6期;黄浩明指,由于上述大角咀道及万安街地盘中间有后巷相隔,牵涉政府用地,因而未能合併发展,故将会分2期发展,上述两个项目最快2至3年后推出市场销售楼花。

发展成利奥坊第7期

另外,油塘湾「巨无霸」项目早前第三度批出补地价金额,黄浩明透露,集团就该项目补地价上诉当中,补地价金额对比首次批出时为低,认为「个市跌得快过佢 (补地价金额)」,希望今年内可以成事。另外,粉岭北3个项目则採用传统补地价方式进行。

昨日举行强拍的项目,位于大角咀道177至191号,由4幢6层高旧楼组成,每幢楼宇设有两道公用楼梯,早于1957年落成入伙,至今约66年楼龄。项目地契条款限制该地段只可用作非工业用途。该项目地盘面积约8995方呎,现规划为「住宅 (甲类)」,涉及可建总楼面约8万方呎。交通方面,步行至港铁太子站约10分鐘,而沿着大角咀道设有多种公共交通工具如小巴及巴士等。

上述项目将连同毗邻项目合併发展,地盘面积扩展至约1.57万,可建总楼面约14万方呎,并主打上车盘,届时将发展成利奥坊第7期。

(星岛日报)

德辅道中作价3.7亿 利国伟家族等承接

翠华控股大股东兼主席李远康等人早前沽售中环德辅道中一个巨铺,作价3.7亿,新买家亦终于曝光,为恒生银行创办人之一利国伟家族及有关人士,以买物业形式购入物业。

23年升值5.4倍

中环德辅道中84至86号章记大厦地下及地库,以3.7亿易手,该项目若要取得约4厘回报,月租势必破120万,新买家为恒生银行创办人之一利国伟家族及有关人士,需付相等于铺价4.25%釐印费,涉资1572.5万,据了解,新买家看中该巨铺中环罕有,面积大,银行、零售及食肆皆适宜。该巨铺地下面积约3163方呎,地库面积约4200方呎,合共7363方呎,平均呎价约5万。利国伟家族亦于2020年4月,以2.86亿元买入中环永安集团大厦全层,平均呎价2.58万。

李远康早于2000年以约5780万购入该铺位,并由翠华餐厅租用多年,从2018年4月1至2021年3月31日3个财政年度,翠华每年以1328.1万租用,月租约110.7万,持货23年帐面赚逾3.1亿,升值逾5.4倍。

(星岛日报)

利福啟德双子汇明年分阶段开幕

利福国际旗下啟德旗舰项目「The Twins双子汇」,当中Tower I及Tower II分别于明年中旬及下旬开幕,利福国际执行董事刘今蟾表示,双子汇突破百货公司业务营运模式,两幢大楼外观相若,却具备截然不同特色,项目定位「Different Together一样不一样」,强调当中不同元素均和谐共存。

她补充,项目以独立与连繫概念,作为啟发灵感,融合最新崇光百货,提供多样化商品及服务,由奢侈品、美容及家居用品,以至首次登陆香港品牌,一应俱全,同时举办有趣活动,为顾客带来便利。

Tower I定位购物空间

其中,Tower I定位为购物空间,展现日式百货公司气质,而Tower II作为生活品味平台,象徵当代潮流,成就体验及自我发现机会,啟发无限可能。

Tower II作生活品味平台

利福国际于2016年11月,击败一眾大孖沙,以73.88亿投得啟德「商业地王」,用作拓展崇光百货零售业务。

(星岛日报)

金鐘力宝中心 高层呎租约35

消息指,金鐘力宝中心连录租务,其中2座高层05至08室,面积约3,224平方呎,以每月约11.2万元租出,呎租约35元,属略低于市价成交。

另同厦1座极高层06至07室,面积约2,165平方呎,成交呎租约48元。

(经济日报)

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

Hong Kong developer Sino Land wins Kai Tak land tender with a US$676 million bid, a nine year-low, beating a crowded field of rivals

Bids were also submitted by Sun Hung Kai Properties, CK Asset Holdings, Wheelock, Nan Fung Group and Henderson Land

Analysts say the winning price was on the ‘low side’ and within ‘adjusted’ market expectations

A consortium led by Sino Land won a Hong Kong land tender for a site at Kai Tak with a bid of HK$5.3 billion (US$676 million), the lowest in nine years, which some analysts said was a conservative price as the city’s economy could stagnate in the near term.

Bids were also submitted by Sun Hung Kai Properties, CK Asset Holdings, Wheelock Properties, Nan Fung Group and Henderson Land this Monday, the last day of the tender period. The parcels of land, with an aggregate area of 145,303 sq ft, are located in Kai Tak, the site of Hong Kong’s former international airport. They went on sale by public tender on July 28.

A surveyor said the HK$5,392 per square foot land price was close to market expectations, but was a nine-year low compared to other land prices in the same district.

Analysts said given the level of the winning bid, the developer could still sell the housing units when construction is completed at current prices, should the economic environment show no improvement and were the property market to remain sluggish.

“There’s enough cushion for the developers to sell their project at a good price,” a surveyor said. “As for government coffers, yes the government may have a deficit but it should not be confused with a negative cash flow.”

“The government also does not have to keep selling parcels of land at a cheap price - there is no urgency for them to do that should interest rates keep rising,” the surveyor added. “They may also choose to develop subsidised homes on these sites instead of selling them. That is a good long-term investment and a wise way for the government to use its capital.”

HSBC analysts said last month Sino Land’s share price could react positively, if the company can replenish more of its land bank to strengthen its medium-term earnings growth visibility, as there was a growing risk of moderating sales based on existing run rate due to lower residential land bank within the portfolio.

“We are delighted that our consortium won this urban site with underground connection to the MTR station,” Daryl Ng, Deputy Chairman of Sino Land told the Post. “This is an excellent addition to our land bank. We have full confidence in Hong Kong and China, and will fully support quality and sustainable developments.”

The successful grant of the site was not affected by the withdrawal in August of the first starter home site at Yau Kom Tau, Tsuen Wan, which showed that developers were still actively competing for land, experts said.

Another surveyor said bidding was expected to be muted given the current market environment and site location.

“The site has many constraints and that developers would have to undertake the construction of a number of government facilities and a basement retail area,” the surveyor said. “Due to the high interest rates and increased construction costs, the property market is much different from December last year when CK Asset made its bid in Kai Tak.”

The Kai Tak Area 2A Site 2 and 3, close to Sung Wong Toi MTR station, is located close to the residential site acquired by CK Asset and a temporary public housing project. It has a total permissible gross floor area (GFA) of about 992,000 sq ft.

Under the conditions of sale, the purchaser must build an underground shopping street and various pedestrian links to proposed public housing developments in the neighbourhood.

The successful bidder must also construct various government accommodation, including a neighbourhood elderly centre, a hostel for mentally handicapped persons, a day activity centre, a district support centre for persons with disabilities and a boys’ home.

“The land value has decreased significantly over the eight months due to high interest rates, high construction costs and growing unsold housing units from existing supply,” the surveyor added.

The first surveyor expects the site to be developed into small and medium-sized residential units, and the project to be sold at around $15,000 per square foot after taking into account construction costs and a reasonable profit margin.

“The award price is within ‘adjusted’ market expectations,” another surveyor said. “It is still on a low side.”

The surveyor expects land prices in Hong Kong to remain soft and said the decline in property prices could continue in the coming months.

Recent land tenders have received tepid responses from developers, as Hong Kong’s property market creaks under the weight of high unsold inventory and rising interest rates.

Last month, a land tender in Yau Kom Tau, Tsuen Wan, received just a single bid from Grand Ming Group Holdings. The government eventually rejected the bid as the “tendered premium did not meet the government’s reserve price for the site”, according to the Lands Department.

(South China Morning Post)

First prices for Tuen Mun flats coming today

Road King Infrastructure (1098) will unveil a first price list for Mori in Tuen Mun today, with at least 139 homes being offered.

The low-density project might commence a first round of sales as early as this month, says the developer, and show flats will be opened soon.

Road King said Mori has received many inquiries from potential buyers, including local families and mainland talent arriving.

Mori comprises four blocks and 16 houses, to provide 693 units in total.

Elsewhere, CK Asset (1113) will put the last house at El Futuro in Sha Tin up for sale on Monday after the transaction was given up by an intending buyer despite an expected loss of HK$2.55 million in deposits.

Meanwhile, The Arles in Fo Tan sold three out of 11 units yesterday morning, collecting over HK$46 million, according to builder Centralcon Properties.

And with more new projects coming, a property agency expects the primary market can record 600 deals this month.

That estimated figure would be the equivalent of just half of the 1,204 transactions last month.

But more local banks are set to raise their capped rate of mortgage plans, which might deter people from buying homes.

Standard Chartered Hong Kong and Citibank Hong Kong are said to be increasing the cap by 0.5 percentage points on Monday following such an adjustment by Hongkong and Shanghai Banking Corporation, Bank of China Hong Kong (2388) and Hang Seng Bank (0011).

The moves come with interbank borrowing costs remaining at high levels recently. The Hong Kong interbank offered rate rose across all maturities yesterday, with the mortgage-related, one-month rate up to 4.97 percent.

(The Standard)

Twin retail towers to rise up in Kai Tak

Sogo operator Lifestyle International will launch a flagship project called The Twins in Kai Tak as early as the middle of next year.

The two distinctive buildings will be located in Kowloon East with Tower I is set to open in mid-2024, followed by Tower II in the second half of 2024.

The project will offer 1.1 million square feet of retail space and host over 700 shops, including a Sogo department store.

Lifestyle executive director Lau Kam-shim said The Twins, as Kai Tak's largest lifestyle retail complex, signifies a major achievement for the group. "It enables us to expand beyond the department store model to creating a multi-functional platform that agilely caters to the evolving needs of the next generation customer."

(The Standard)尖东华懋广场录大手租赁 建华租全层商厦涉4万呎每呎约16元

商厦市况虽然低潮,整体空置率处新高,不过,市场却不乏大手租赁,华懋旗下尖东华懋广场录大手租赁,该厦全层写字楼单位,面积约4万方呎,以每呎约16元租出,月租约64万,新租客为建华集团及相关人士。

尖东麼地道77号华懋广场录大手租赁,市场消息透露,该厦8楼全层面积约4万方呎,由建华集团及相关人士承租,平均呎租约16元,月租约64万,旧租客为 Leader Light Ltd,呎租约22元,新租金跌27%。

华懋:不评论个别租赁

本报就上述租赁向华懋集团查询,发言人表示,对个别租赁不予置评,惟她强调,尖东华懋广场年初至今,租务交投畅顺,平均呎租比起去年有5至10%增幅,今年整体写字楼成交量亦上升20%。本报亦向建华集团查询,惟直至截稿前未获回覆。

近年经济环境未如理想,建华集团却频有动作,包括拓展迷你仓市场,进军冻仓市场,业务越做越大。

月租约64万

建华集团自2022年7月起,涉足迷你仓业务,开设24 STORAGE,整个迷你仓业务总投资高达5亿元,并不断扩展,近期斥资4720.1万,购入大埔太平工业中心3座9楼全层,建筑面积约13486方呎,平均呎价约3500元,料经营迷你仓。

该集团早前于葵涌亚洲货柜物流中心承租一个单位,B座9楼9016E至9021E,年期约10年,面积达3.8万方呎,打造「智能冷链物流」系统,投资额高达1亿元,旗下全新冷链物流公司TAHUHU (塔胡胡),研发一套自动化智能冷链物流系统,亦将为工厦业主,包括投资者、基金及财团改造工厦,装设智能物流系统,令物业变身冻仓。

建华集团业务包括新鲜食品、餐饮、街市活化及超市等,旗下坐拥约1000家据点,有「街市大王」之称。

(星岛日报)

更多华懋广场写字楼出租楼盘资讯请参阅:华懋广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租

星光行一篮子入场价1280万

由资深投资者卢华持有的尖沙咀星光行12楼一篮子单位放售,呎价逾14579元,入场价约1280万。

呎价逾14579元

有代理表示,上址为星光行12楼,面积由878方呎至2138方呎,于9月30日前购入,呎价约14579元,当中最相宜为1214室,面积约878方呎,意向价下调至约1280万,呎价约14579元;另一个可作相连单位为1210至11室,面积约2138方呎,叫价约3300万,资料显示,星光行正海景位单位最高呎价曾录得逾21000元,现时售价较高位回落30%至40%。

该厦较近期成交为18楼16及16A室,建筑面积共约2173方呎,于7月底以2950万沽出,呎价约13576元。

(星岛日报)

更多星光行写字楼出售楼盘资讯请参阅:星光行写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

息口高企 8月港岛指标甲厦零成交

8月份港岛区指标甲厦未有任何买卖,有代理行认为,因息口高企,影响投资意慾,而租务则相对平稳。

据该行十大指标甲厦买卖,上月全月仅录两宗买卖成交,而港岛区多幢物业均未有成交,极为淡静。所录得两宗成交,均来自尖沙咀星光行。内地企业以2,950万元,售出星光行中层两个单位,以面积2,173平方呎计,呎价约13,576元,原业主2017年约3,911.4万元购入,持货约6年,帐面蚀约961.4万元。

慈善组织790万 购星光行1伙

此外,慈善组织「点滴是生命」,以790.2万元购入星光行19楼16室,建筑面积约878平方呎,呎价约9,000元。原业主2005年以364.4万元购入,帐面获利425.8万元或1.2倍。资料显示,「点滴是生命」现时租用星光行19楼同层邻近单位作办公室。

至于较大手商厦买卖,来自二綫商厦,柴湾东贸广场中层全层,面积约7,758平方呎,以约4,809万元成交,呎价约6,200元,项目连同两车位成交。据悉,该层楼面由资深投资者罗守辉持有,他于2019年以约5,900万元购入单位,持货5年转手,蚀约1,091万元离场,幅度近2成。消息称,买家为该层楼面租客,现转租为买。整体上,8月份写字楼买卖成交宗数录得约37宗,按月增多约37%,按年更增加约42%。

指标甲厦买卖静,该行代理认为,由于息口持续高企,对投资者来说不算吸引,加上业主普遍未有大幅降价,导致买卖极为淡静。

统一中心极高层全层 呎租38元

租务方面则相对平稳,核心区金鐘录数宗租务成交,如统一中心录得全层租务,涉及34楼全层,面积约20,489平方呎,以每呎约38元租出,与旧租金相若。另力宝中心二座中层单位,面积约1万平方呎,成交呎租约42元,属市价水平。另同区海富中心二座单位,面积约3,363平方呎,以每呎约42元租出。

该代理分析,由于息口仍处高位,短期内变化不大,相信投资者仍审慎,而用家入市比例会提高,惟仍难推高成交量,预计持续淡静。租务上,代理指近期租务活动平稳,而租金同样见底,相信企业仍有兴趣升级办公室,料租务较理想。

(经济日报)

更多星光行写字楼出售楼盘资讯请参阅:星光行写字楼出售

更多尖沙咀区甲级写字楼出售楼盘资讯请参阅:尖沙咀区甲级写字楼出售

更多东贸广场写字楼出售楼盘资讯请参阅:东贸广场写字楼出售

更多柴湾区甲级写字楼出售楼盘资讯请参阅:柴湾区甲级写字楼出售

更多统一中心写字楼出租楼盘资讯请参阅:统一中心写字楼出租

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租