50大甲廈首三季錄131宗買賣

有代理行數據顯示,今年首三季五十大指標甲廈合共錄得131宗買賣,較去年同期的51宗增1.6倍,成交樓面涉56.25萬方呎,按年升2.1倍。

按年升1.6倍

該行指出,今年首三季的成交量集中於九龍,期內共錄得78宗,佔整體約6成,其次為港島的27宗及新界的26宗。若以大廈劃分,沙田石門京瑞廣場共錄14宗,屬表現最好的大廈,其次為葵涌新都會廣場及中環中心,期內均各錄得12宗買賣成交。九龍區的成交較為分散,最多為尖東新文華中心的11宗及觀塘寧晉中心的7宗。

該行代理表示,本地疫情緩和,加上受惠去年低基數效應,令到今年首三季的指標甲廈交投大幅反彈。不過,近期的指標甲廈買賣成交有放緩的迹象,主要因為早前股市表現波動,加上近期多個甲廈新項目推出拆售,包括觀塘道368號、長沙灣荔枝角道888號,以及快將推出的黃竹坑宏基匯等,吸去部分市場購買力,令到二手指標甲廈交投略為放緩,但整體而言商廈市場氣氛仍然平穩。

該行另一代理指出,港島核心區甲廈成交量持續偏低,因為上述地區甲廈涉及銀碼較大,在商廈市況尚未復甦下,投資者偏向審慎,不欲斥巨資入市,反觀九龍及新界等地區甲廈銀碼較細,較易吸引新晉投資者入市,因而令到港島與新界九龍交投呈現兩極化。

(星島日報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多寧晉中心寫字樓出售樓盤資訊請參閱:寧晉中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

今年暫錄24宗大手工廈成交 基金主導市場 屯門荃灣葵涌成目標

今年工廈交投熾熱,根據本報統計,今年以來市場暫錄24宗大手工廈買賣,較去年同期僅6宗,上升3倍,涉資高達171億,更是急升3.3倍。當中,外資基金主導市場,並以屯門、葵涌及荃灣為目標,頻購入全幢及大手工廈。

今年以來,市場暫錄24宗逾億元工廈買賣,除了有14宗全幢買賣,更不乏分散業權的大手成交,數目共10宗,最新一宗為SilkRoad Property Partners購入屯門恒威工業中心C座約九成業權,作價11.6億,根據土地註冊記錄,該廈地廠及多層全層樓面以9.46億成交,還有,該廈約187個車位以逾2.14億易手,業內人士指出,大廈樓面及車位分別登記,方便會計上安排,買家日後或不排除拆售車位。

上述該宗交易,論金額之高,於今年以來工廈排行榜,位踞第五位,至於最大宗買賣為,施羅德資本房地產與Bentall Green Oak買入荃灣有線電視大樓及One Midtown一籃子貨,排行第二位的為,東亞紗廠工業大廈全幢,由華潤物流以22.4億承接。

金額171億急升3.3倍

今年以來,大手工廈買賣以屯門、葵涌及荃灣最多,基金主導大市,數目共有6家,施羅德、嘉民亞洲基金、SilkRoad Property Partners、安祖高頓基金、黑石基金及ESR都相繼出手,可見他們看好工廈前景。

當中,ESR購入葵涌光輝凍倉,作價18億,安祖高頓基金斥14.35億,購入葵涌佳寶集團中心全幢。嘉民亞洲基金更先後購入位處觀塘、九龍灣及葵涌的物流中心及一籃子工廈,悉數為分散業權,合共涉資13.2億。

地產界人士表示,散業權工廈依然有價有市,基金打算在重新打造後,為物業增值,從而收取可觀回報,日後或轉售。

全幢及散業權皆受捧

代理表示,受惠於活化工廈2.0及標準金額先導計畫,全幢工廈交投明顯活躍,近月開始陸續有工廈在標準金額先導計畫下完成補地價,在比傳統補地價需時更短,大大降低補地價金額的不確定性下,將有助工廈加快活化,同時提升工廈物業的吸引力,有助支持工廈交投。此外,本港經濟逐漸復甦,但由於香港恢復全面通關仍未見明朗化,相信工廈租售價將保持平穩發展。

(星島日報)

淺水灣地估值逾八億

近年政府全方面覓地,大幅增加房屋供應漸見成效,其中,南區淺水灣南灣道住宅地皮將於新一季推出,據業內人士指出,該項目屬市場罕有豪宅地皮供應,料掀大中小財團競逐,市場估值逾8億至14億,每呎樓面地價4萬至7.5萬。

罕有豪宅地皮供應

南區淺水灣南灣道地皮,地盤面積約為21097方呎,估計可建樓面約為18988方呎。有測量師指出,該住宅地皮位處南灣道上的一幅斜坡地,可步行往沙灘地皮,坐享開揚海景,屬市場罕有供應,加上項目投資金額不算高,故對大中小型發展商均具吸引力,預期估值約12.3億至14.2億,每呎樓面地價約6.5萬至7.5萬。

另一測量師稱,豪宅市場近期有價有市,料各大發展商對該地皮以積極態度競投,料每呎地價約4.1萬,市場估值約8億。

測量師表示,該項目位處傳統豪宅地段,屬市場罕有供應,料項目備受各大發展商垂青,尤其於區內具豪宅發展經驗的發展商參與意會較高,料以興建低密度洋房作主導,每呎地價約5萬,市場估值約9.5億。

(星島日報)

Secondary market hit by policy wait

Secondary-market transactions over the long weekend fell to a second record low in the past six months ahead of the policy address announcement on Wednesday.

Property agency reported a 50 percent drop in the number of transactions among its top 10 housing estates.

Only four deals were struck in Ap Lei Chau's South Horizons, Quarry Bay's Kornhill and Tin Shui Wai's Kingswood Villas. A total of 11 deals were done over the National Day weekend starting Friday.

A wait-and-see attitude prevailed among secondary home buyers over the right time to enter the market with stronger indications of the government's housing policies on Wednesday casting uncertainty over the market, agent said.

A stark contrast to the dull secondary market was the primary-market frenzy.

Koko Reserve in Lam Tin saw inquiries from families planning to move from east Hong Kong Island and east Kowloon, and investors after the opening of show flats Saturday, said developer Wheelock.

The first batch of the low-rise Koko Reserve, the second phase of the Koko Hills development, will be sold via tenders from October 10 to December 31.

The round includes 24 three-to-four-bedroom flats with sellable areas of 776 to 1,171 square feet, and three penthouses with sellable areas of 1,755 to 1,992 sq ft and a rooftop.

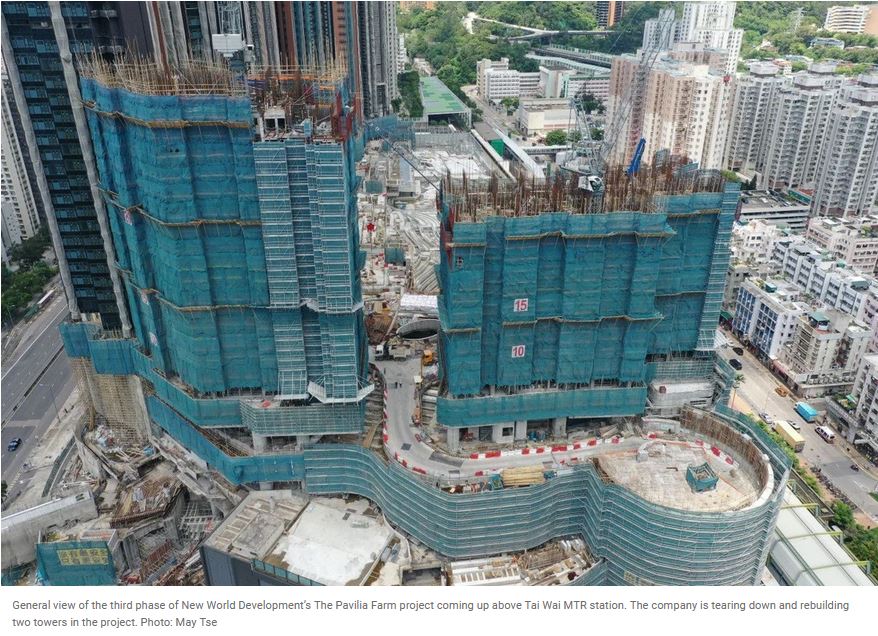

That came as another two deals worth HK$32.9 million were terminated at the to-be-rebuilt Pavilia Farm III atop the MTR's (0066) Tai Wai Station.

A total of 53 deal terminations was reported as of yesterday at the New World Development (0017) project, 6 percent of the total number of flats sold.

In the secondary market, La Cite Noble in Tseung Kwan O saw the first-ever loss in three years. A 643-sq-ft flat with three bedrooms was sold after HK$1.3 million was shaved off the price. It was sold for HK$10.2 million, 12 percent lower than the HK$11.55 million paid in 2018.

In the commercial market, the number of deals at top 50 grade-A offices saw a 160 percent jump to 131 in the past three quarters, data from property agency showed.

US Federal Reserve vice chair Richard Clarida traded between US$1 million (HK$7.8 million) and US$5 million out of a bond fund into stock funds one day before chairman Jerome Powell issued a statement indicating potential policy action due to the worsening of the pandemic, Bloomberg News reported.

Clarida's trades were described in his 2020 financial disclosures, showing the shifting of funds out of a Pimco bond fund on February 27, 2020, and buying the Pimco StocksPlus Fund and the iShares MSCI USA Min Vol Factor exchange-traded fund in similar dollar ranges, on the same day.

The next day, Powell released a statement that said coronavirus "poses evolving risks to economic activity." He added that the Fed was "closely monitoring developments and their implications for the economic outlook."

"Vice chair Clarida's financial disclosure for 2020 shows transactions that represent a preplanned rebalancing to his accounts, similar to a rebalancing he did and reported in April 2019," a Fed spokesman said.

The Bloomberg report comes as two other Fed officials came under scrutiny for investment trades they made last year and announced their retirements on Monday.

Meanwhile, the International Monetary Fund's executive board will intensify its probe of managing director Kristalina Georgieva this week by separately interviewing her and investigators who said she pressured World Bank staff to alter data to favor China, insiders said.

The board will question lawyers from the WilmerHale firm today about their World Bank investigation report, three insiders said. The report alleged that Georgieva, as the bank's CEO in 2017, applied undue pressure on staff to alter data in the flagship "Doing Business" report to benefit China.

Georgieva, who has strongly denied the accusations, will appear before the board tomorrow, the day she is to deliver a virtual speech about the IMF and World Bank annual meetings October 11-17, two of the sources said.

The interviews could prove pivotal in either building or eroding IMF shareholder support for Georgieva.

(The Standard)核心區甲廈頻錄市價承租

隨着本港經濟表現逐步回穩,帶動甲廈租賃交投向好,核心區甲廈頻錄市價承租,其中,金鐘海富中心以每方呎約40元租出,此外,尖沙嘴星光行亦以每方呎30元承租,均屬市價水平。

海富中心每呎約40元租

市場消息指出,金鐘海富中心二座低層08室,面積1328方呎,呎租約40.5元,月租約53784元,屬貼市價水平。據土地註冊處資料顯示,原業主於1993年以約2643萬購入,註冊董事為陳姓人士。

據代理行資料顯示,該甲廈近期承租為1期中層03A室,面積2210方呎,於上月以每方呎39元租出,月租約86910元。

尖沙嘴區內指標甲廈星光行亦錄承租個案,市場消息指出,該甲廈高層單位,面積約824方呎,以每方呎約30元租出,月租約2.5萬。

另一方面,商廈市場亦頻錄買賣個案,市場消息指出,銅鑼灣拔萃商業大廈中層C室,面積380方呎,以約468萬成交,呎價約12316元;此外,灣仔金豐商業大廈中層,面積約1330方呎,以約1049.3萬售出,呎價約7890元。

(星島日報)

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多星光行寫字樓出租樓盤資訊請參閱:星光行寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

長沙灣甲廈三層12億成交 新世界沽售 呎價1.75萬創新高

疫情持續平穩,帶動甲廈交投轉活,市場再錄大手成交。由新世界發展長沙灣荔枝角道888號高層三層樓面以約12億易手,每呎造價約1.75萬,創該項目新高;消息指,買家為大型中資銀行,料購入作自用用途。

甲級商廈再錄大手成交,由新世界發展的荔枝角道888號高層三全層單位,每層樓面介乎2.08萬方呎至2.46萬方呎,合共總樓面約6.8萬方呎,作價約12億售出,平均呎價約1.75萬,創該項目呎價新高。

涉總樓面約6.8萬呎

據市場知情人士透露,上述樓面為該廈29至31樓,為最高三層樓面,屬優質單位,故以破頂價售出,買家為大型中資銀行。

大型中資銀行購入

據發展商指出,荔枝角道888號為1幢樓高28層甲級商廈,自去年底開售,首輪30個單位1小時內全數售罄。

項目至今已累售近七成樓面,套現逾54億;至於客源包括金融機構、高等院校、醫生或其他專業服務,亦有專業投資者。

項目每層約2.4萬呎

新世界早於2017年先後在區內投得3幅商業用地,總可建樓面面積約190萬平方呎。荔枝角道888號甲級商廈,間隔靈活,標準樓層全層建築面積約2.4萬方呎,預計2022年4月落成。

累售近七成樓面

另外,該項目早前成交,買家身分亦逐步曝光。

據土地註冊處資料顯示,18樓全層於上月初以逾3.3億售出,買家以公司名義Modern Elite (Hong Kong) Limited,註冊董事為朱達慈、馮子堯及莫國豪,為協興建築高層人士。

據資料顯示,新創建早前公布,以13.67億向母公司新世界購入荔枝角道888號樓花商廈、位於項目的18至21樓,總樓面96744方呎,呎價約1.41萬。

套現逾54億

新創建當時表示,收購可以為集團提供一個較具吸引力資本增值的物業投資機會,而且租務優惠要約將於未來提供穩定的租金收入。

事實上,長沙灣區內近年商廈發展迅速,早前市場亦頻錄商廈重建申請,資料顯示,長沙灣利豐大廈申請重建為1幢樓高27層的商廈,涉及總樓面約28.77萬方呎。

至於,毗鄰的香港紗廠工業大廈一期及二期,連同萬利中心,則重建為兩幢商廈,涉及總樓面逾107萬方呎。

(星島日報)

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

外資基金斥逾11億購屯門工廈九成業權

受活化政策帶動,令工廈項目備受追捧,市場再錄大手成交。新加坡基金SilkRoad Property Partners以約11.6億購入屯門恒威工業中心約九成業權,包括地廠、多層全層樓面及一籃子車位。

涉逾180個車位

據土地註冊處顯示,屯門恒威工業中心C座大部分業權,包括地廠及多層全層樓面,在本月初以逾9.46億成交,買家以公司名義Belfast Investments Limited登記,註冊董事為JOHN NICHOLAS KEARNS及FOO CHOY MARK KHOO等,為新加坡基金SilkRoad Property Partners相關人士。

樓面約31萬呎

此外,該基金亦購入該工廈車位。據土地註冊處資料顯示,恒威工業中心一籃子車位於本月初以逾2.14億成交,買家以公司名義Belfast Investments Limited登記。據從事工廈買賣的代理指出,上述一籃子車位涉約187個,以易手價計,每個車位售價約114萬。

據代理指出,上述易手物業佔該廈約九成業權,涉及樓面約31.7萬方呎。

事實上,該外資基金早前於本港頻頻入市,資料顯示,粉嶺安全街10號至12號堅達中心,全幢樓高6層,總樓面97750方呎,於今年初以3.21億連租約售出,呎價約3284元,購入作經營物流業務。

(星島日報)

教協連沽旺角物業 全由百本醫護接貨涉2.3億

教協本月11日正式通過解散後,先後沽出旺角好望角大廈及中僑商業大廈,共3層物業,據土地註冊處顯示,中僑商業大廈的買家為合富國際有限公司,公司董事為雷燕萍 (LUI, YIN PING),為百本醫護 (2293) 高層。

資料顯示,百本醫議在本月初公布,以1.75億元向教協購入旺角好望角大廈8樓及9樓兩層樓面,作為主要業務辦公室、設立醫護人員考核中心等,連同中僑商業大廈,即先後斥資2.3億元購入旺角商廈共3層。

(明報)

New World Development sold three floors of Cheung Sha Wan building at near HK$1.2b

New World Development recorded yet another big-ticket transaction at its Grade A commercial building at 888 Lai Chi Kok Road in Cheung Sha Wan.

A financial institution, showing signs of robust interest, recently paid close to HK$1.2 billion for three floors of space for self-use, with an average price of about HK$17,500 per sq ft, setting a new record for per-square-foot price for the development.

A total of 70 percent of GFA sold at over HK$5.4 billion, paving way for West Kowloon's new core business district.

The newly sold floor space is on the higher-level floors, covering three full floors, each with an area ranging from 20,800 to 24,600 sq ft and a total floor area of nearly 68,000 sq ft.

888 Lai Chi Kok Road in Cheung Sha Wan is a 28-storey Grade A commercial building. It went on sale at the end of last year. The first batch of 30 units were all sold out within an hour.

So far, nearly 70 percent of the gross floor area of project has been sold, bringing in more than HK$5.4 billion, and establishing it as a highly sought-after development. Buyers include financial institutions, universities, medical practices and other professional services, as well as professional investors such as family offices.

The Cheung Sha Wan district has witnessed remarkable changes in recent years. Boasting complete transportation infrastructure and ancillary facilities, its convenient location and access include a half-hour drive to Hong Kong International Airport and the Shenzhen Bay Highway Bridge, promising great potential for transforming the area into a new core business district in West Kowloon.

As early as 2017, New World successively acquired three lots of commercial land in the district, with a total buildable floor area of approximately 1.9 million sq ft. The Grade A commercial building at 888 Lai Chi Kok Road has flexible spacing options and a standard full-floor building area of about 24,000 sq ft. It is expected to be completed in April 2022.

(The Standard)

For more information of Office for Sale at 888 Lai Chi Kok Road please visit: Office for Sale at 888 Lai Chi Kok Road

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan

New World submits proposal to demolish and rebuild part of The Pavilia Farm project hit by construction defects

Company is awaiting approval from the Buildings Department to demolish and rebuild towers one and eight of the third phase of the project in Tai Wai, says Adrian Cheng

New World posts a nearly 6 per cent increase in full-year underlying profit to HK$6.98 billion

New World Development has submitted a proposal to demolish and rebuild part of The Pavilia Farm project that has been marred by construction defects, a top executive said on Thursday after the developer posted a full-year underlying profit increase of nearly 6 per cent.

The Hong Kong-listed developer also said that it was striving to help the government solve the city’s housing shortage problems.

The company has submitted a proposal to the Buildings Department to demolish and rebuild towers one and eight of the third phase of the development of its bestselling project in Tai Wai, said Adrian Cheng Chi-kong, executive vice-chairman and chief executive.

“After approval of the formal time to start work, an independent third-party team will monitor the process of demolition and rebuild,” Cheng said.

In early July, New World sent shock waves through the industry after it said it would tear down and rebuild two of the seven tower blocks under construction at the project above Tai Wai MTR station in the New Territories. The company said that this would set back the delivery schedule of phase three by nine months to March 2024. It also came up with compensation options and subsidies for affected buyers.

As of June 30, a total of 3,028 units in the project were sold, realising nearly HK$37.4 billion (US$4.8 billion) in sales proceeds, according to a filing to the Hong Kong stock exchange.

So far, 48 buyers have cancelled deals, or about 5 per cent in phase 3 of the project, with the compensation totalling around HK$829 million, according to the Post’s calculations, based on data from the Register of Transactions.

Cheng disclosed that New World had submitted a plan for the Land Sharing Pilot Scheme to the government for preliminary review. The land sharing scheme will be used to enhance the development potential of private land currently constrained by inadequate infrastructure.

New World, which has donated four land parcels to four NGOs for building some 2,000 units of transitional housing, is discussing plans to donate two to three more parcels of land for the project, Cheng said.

Cheng also said that New World had not received any instruction from Beijing on alleviating the city’s housing problem. Earlier this month Reuters reported that Chinese officials had told Hong Kong’s powerful tycoons that they should help solve the city’s housing shortage.

New World’s contracted sales in Hong Kong amounted to about HK$42.4 billion, more than double its target of HK$20 billion for the financial year ended June.

New World’s full-year underlying profit, which excludes changes in the valuation of properties, rose 5.9 per cent from a year ago to HK$6.98 billion. Net profit rose 6.9 per cent to HK$1.17 billion.

New World proposed a final dividend of HK$1.5 per share, 1.4 per cent higher compared with last year.

Separately, New World said that it sold three floors of a grade A commercial building under construction at 888 Lai Chi Kok Road in Cheung Sha Wan to a financial institution for nearly HK$1.2 billion. The building is expected to be ready in April next year.

(South China Morning Post)

For more information of Office for Sale at 888 Lai Chi Kok Road please visit: Office for Sale at 888 Lai Chi Kok Road

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan麥當勞38萬 租旺角文華商場舖

1樓3千呎每呎約127元 跌幅約4成

隨着疫情逐漸緩和,加上政府昨天派發第二批消費券,帶動民生消費穩定,令餐廳租舖相對活躍。消息指,麥當勞以約38萬租用旺角文華商場1樓3,000呎舖位,該複式舖曾先後由Gap及卓悅等租用,租金跌約4成。

市場消息指,旺角砵蘭街錄租務成交,涉及文華商場1樓,面積約3,000平方呎,以每月約38萬元租出,呎租約127元。該商場位於地標商場朗豪坊對面,亦鄰近港鐵站出口,人流相對暢旺。

朗豪坊舖約滿 搬移省成本

據了解,新租客為連鎖快餐店麥當勞,該餐廳原租用對面朗豪坊商場,如今租約期滿,搬至對面1樓商舖,可節省租金開支。

翻查資料,該舖位過往多年曾由不同租客承接,2011年商舖租務高峰期,美國休閒服連鎖店Gap,租用旺角文華商場多層,合共2.3萬平方呎舖位,月租高見300萬元。

上手租客 160萬租兩層

其後零售轉弱,品牌於2015年遷出,舖位空置接近9個月,業主重新把舖位拆細放租,並獲卓悅化粧品以約160萬元租用地下及1樓,約逾8,000平方呎樓面,呎租約200餘元,其後卓悅再遷出,業主遂再分拆出租,如今租出1樓3,000呎舖位,按呎租計,租金跌幅約4成,現時地下舖位仍在待租。

本港疫情緩和,社交距離措施有所放寬,加上政府派發消費劵,昨天便派發第二批消費券,直接帶動食肆生意,加上租金下跌,餐廳進駐核心區一、二綫地段個案有所增加。以旺角區為例,早前西洋菜南街2W至2Y地下,面積約2,000餘平方呎地舖,獲冰室以28.2萬元租用,早前開業。該舖曾由屈臣氏租用,在零售高峰期時,月租達60萬元,現租金跌逾半。

中信銀行35萬 租軒尼詩道舖

另外,銅鑼灣軒尼詩道525號逸園中心1及2樓,每層面積約3,000平方呎,合共約6,000平方呎,以每月約35萬元租出。據了解,新租客為中信銀行,該銀行現租用同區地舖,是次轉租可節省租金開支。

(經濟日報)

更多朗豪坊寫字樓出租樓盤資訊請參閱:朗豪坊寫字樓出租

更多旺角區甲級寫字樓出租樓盤資訊請參閱:旺角區甲級寫字樓出租

Hong Kong’s home buying sentiment upbeat as Nan Fung sells over 80 per cent of units at LP10 project in Lohas Park

Nan Fung Group and MTR Corporation sold 150 of the 179 flats at the LP10 project at Lohas Park in Tseung Kwan O on Friday

Sales of newly completed homes in the city reached 1,700 units in September, 40 per cent higher compared with August, property agency data shows

Hong Kong’s homebuyers piled into the property market on the National Day holiday, snapping up more than 80 per cent of the flats on offer, encouraged by an improving local economy.

Market observers said buyers were rushing into the market to get ahead of rising prices and potentially higher mortgage rates, as the Hong Kong Monetary Authority was likely to raise interest rates in lockstep with the US Federal Reserve’s tapering measures, which may come sooner than anticipated.

Nan Fung Group and MTR Corporation sold 150 of the 179 flats at the LP10 project at Lohas Park in Tseung Kwan O on Friday, after receiving more than 645 registrations of interest, or some 3.5 bids for each flat, according to sales agents.

“ The sentiment in the housing market now is robust because the city’s economy is recovering,” agent said. Many buyers, who were waiting on the sidelines last year, were entering the market, fearing that they may not able to afford homes if prices continue to rise, the agent added.

Hong Kong’s unemployment rate fell in August to its lowest level since the coronavirus pandemic began, with the economy buoyed by the government’s multibillion-dollar e-voucher scheme. The latest official figures show that the city’s jobless rate dropped to 4.7 per cent for the three-month period ending in August, the lowest since early 2020.

Hong Kong’s lived-in home prices hovered near a historical high in August after breaking a record in July that stood for nearly two years.

LP10, the 10th phase of a massive development at Lohas Park, comprises 893 flats in total, with the first batch launched in January.

The fourth batch released for sale on Friday included two and four-bedroom units ranging from 634 square feet to 1,523 sq ft.

The units were priced from HK$9.5 million (US$1.21 million) to HK$22.5 million, with the average price ranging from HK$15,032 per square foot to HK$19,559 per square foot.

“Earlier only those that were priced cheaper were in demand, but now even those homes tagged above HK$10 million are snapped quickly,” agent said. “It means people are very confident of the housing market.”

Last month Reuters reported that Chinese officials had told major Hong Kong developers that they should use their resources and influence to champion state interests. They were also reportedly asked to help solve Hong Kong’s chronic housing shortage, which has previously been blamed on land hoarding by the developers.

The Real Estate Developers Association has, however, denied coming under pressure from Beijing to solve the city’s housing woes. The association did stress that its members, which include Sun Hung Kai Properties, Henderson Land Development and CK Asset Holdings, were continuing to support the Hong Kong government in boosting housing supply and improving living standards.

“Even if the government is going to boost the supply of land and homes, the city won’t see a bunch of extra homes until five years later and it cannot ease the runaway home price immediately ,” the agent said.

Separately, sales of newly completed homes in the city reached 1,700 units in September, 40 per cent higher compared with August and the best since May when sales reached 2,200, according to a property agency.

The property agency expects sales of up to 2,500 new homes in October.

(South China Morning Post)

甲廈第三季247買賣 按季跌31%

第三季甲廈買賣回落,統計指,今年第三季錄247宗買賣,按季跌31%。

代理表示,今年第三季暫錄得約247宗寫字樓買賣個案,涉及總成交金額約79.71億元,對比上一季分別下跌約31%及55%。不過若扣除第二季的九龍灣國際展貿中心全幢約105億元交易,該季總成交金額約73.55億元,今季金額對比上一季度略見回升;而按2020年比較則見明顯改善,第三季成交宗數及金額較去年同期分別遞增約39%及93%。租賃市場走勢相對穩定,第三季暫有約1,704宗及1.58億元,與第二季數字相若。

該代理續表示,港島甲廈空置率未有明顯改善,中環區8月份甲廈空置率錄得約7.29%,不論對比去年同期或今年初數字都為高;金鐘8月份甲廈空置率則為8.79%。

8月中環甲廈空置率7.29%

該代理預測,第四季寫字樓市場整體表現視乎通關情況而定,若維持目前狀況,商廈市場氣氛會維持偏弱,料第四季買賣成交量會保持平穩約300宗,成交金額則會維持約150億元水平。而寫字樓租金就因空置情況未能明顯改善而持續受壓,預計第四季租金會下跌約5%,成交宗數則在1,500宗左右。

(經濟日報)

更多九龍灣國際展貿中心寫字樓出租樓盤資訊請參閱:九龍灣國際展貿中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

商廈8月量升價跌 錄118登記

8月份商廈買賣放緩,有代理行統計指,8月商廈買賣登記錄118宗。

該行代理表示,股市走下坡加上內地打擊多個行業板塊,本港商廈買家有轉趨審慎的傾向。根據土地註冊處數據,2021年8月份全港共錄118宗商廈買賣登記 (數字主要反映2至4星期前商廈市場實際市況),較7月份的117宗微升1宗,為連續6個月在逾百宗的高水平窄幅徘徊,反映過去半年商廈市道走勢平穩。

不過,8月份出現量升值跌的情況,主因是7月份曾有1宗涉資24億元的全幢巨額登記拉升基數所致,故導致8月份商廈買賣登記金額大幅回落36%,只錄約27.09億元。至於,8月份最矚目的單一登記項目為中環中心25樓全層,涉及合約金額逾6.74億元;其次為銅鑼灣耀華街39號全幢,涉及登記金額達3.6億元。

尖沙咀佐敦區最活躍

按物業價格劃分,在7個價格組別當中,錄得4升3跌。在升幅者中,以5,000萬至1億元以內組別的2倍升幅最顯著,月內登記量由前月的3宗升至上月9宗;而2,000萬至5,000萬元以內組別亦升18%,錄得13宗登記;至於登記量最活躍的是介乎200萬至1,000萬元以內的兩個組別,月內分別錄得37宗及34宗,按月分別跌3%及升3%,表現相對平穩;惟1億元或以上的大額登記則大減33%至只得2宗。

至於以地區劃分,在該行觀察的11個分區當中,共有5區的登記量按月有所上升。當中以九龍灣區及沙田區的1.33倍升幅最顯著,兩者均由前月只有3宗增至上月的7宗。此外,尖沙咀/佐敦區錄得25宗登記,按月升92%,並成為8月份登記量最活躍的觀察區;而北角/炮台山區的登記量亦按月升75%,錄得7宗買賣。至於逆市錄的跌幅較顯著的地區是西營盤/堅尼地城區,由7月的9宗跌至8月的「零登記」,成為表現最差的觀察區。

代理指出,過去一季,港股反覆偏軟,加上內地對多個行業予以整頓,窒礙投資氣氛,連帶本地商廈市道亦受影響。綜觀9月份截至26日,商廈買賣登記暫時只有約72宗,走勢反映買家入市轉趨緩慢,預料全月最終登記難以再破百宗,或回落逾兩成,至約90宗左右,屆時將創7個月新低,並為期內首度失守百宗水平。

(經濟日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

商廈前景好 市場連環大手成交

整體投資氣氛轉好,而商廈買賣亦增加,近日市場連環錄得大手商廈成交,入市包括用家及投資者,反映仍看好商廈前景。

近日商廈買賣市場稍轉好,其中以甲廈樓花最旺,不乏大額買賣。新世界 (00017) 旗下荔枝角道888號錄大手成交,項目最高3層,每層樓面介乎2.08萬至2.46萬平方呎,總樓面近6.8萬平方呎,以約12億元成交,呎價約1.75萬元,屬呎價新高。消息稱,新買家為一家中資銀行,以南洋商業銀行呼聲最高。

另外,較早前同系新創建 (00659) 以13.67億元,購入18樓至21樓共4層,總樓面96,744平方呎,呎價約14,130元。當中,新創建間接全資附屬公司富通保險佔19樓及20樓兩層,涉資6.79億元,總樓面47,712平方呎。

荔枝角道888號於去年尾發售,至今累售近7成樓面,套現逾54億元。買家方面,包括金融機構、高等院校、醫生或其他專業服務,亦有家族辦公室等專業投資者。

市況轉好,發展商趁勢推售商廈樓花,而億京旗下觀塘道368號上星期開售,並錄得大手成交,涉及項目極高層33、35及36樓,其中36樓為平台特色單位,3層合共以約4.5億元成交。據了解新買家為有「手套大王」之稱的葉建明。

項目設有7間商舖及29層寫字樓,地庫設有3層停車場,寫字樓建築面積由654至9,566平方呎。項目上星期先推出9層樓面,呎價約1.1萬元起,反應不俗。

灣仔莊士企業大廈多層 4億沽

至於乙廈市場上,亦錄大額買賣,灣仔莊士企業大廈多層樓面易手,當中涉及項目5至23樓其中18層樓面,其中16至24樓9層,屬酒店用途,提供500間房。項目總樓面約44,829平方呎,項目以4.145億元成交,呎價約9,257元。據了解,買家為投資者。翻查資料,波叔早於2014年以約3.6億元,向投資者紀寶購入灣仔莊士企業大廈15層樓面,其後再分階段購入3層,合共持有18層樓面,總涉資約4.32億元。如今家族以4.15億元沽出該批樓面,仍蝕約1,700萬元離場。

分析指,受疫情影響,整體商廈買賣去年至本年初交投淡靜,而今年中疫情緩和,投資氣氛改善,而相比起舖位及工廈,商廈交投仍相對少。由於不少商廈呎價回調,而甲廈新盤亦具一定吸引力,令用家及投資者漸留意,相信商廈成交可望持有改善。

(經濟日報)

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

廖偉麟睇好寫字樓 逾億入市九龍灣商廈

投資者觸覺向來敏銳,正八集團廖偉麟 (Jeffrey) 近日斥逾億元,低價購入九龍灣企業廣場三期單位,他謂看好通關後寫字樓反彈,持有單位至少升值逾3成。

高層1.6萬呎樓面 呎價8900

日前九龍灣企業廣場三期高層全層,面積約1.61萬平方呎,以約1.43億易手,呎價約8,900元,由廖偉麟承接。Jeffrey一直喜歡投資甲廈,惟少於東九龍入市,今次入市只因一個「平」字,「呎價不足9,000元,高峰期該廈呎價達1.5萬元以上,如今大幅回調值得入市。」他指,準備為單位裝修,待通關便有價有市,「通關後,內地資金傳統上投資寫字樓為主,而該層樓面享全海景,正合內地用家。我估計通關後,單位至少升值35至40%。」

近日股市波動,Jeffrey認為暫對工商舖買賣影響不算大,他料明年市況明顯反彈,「中港正商討通關,我估明年初有機會。現時我仍密切留意市場,今年仍有機會動用35億至5億元入市。」

(經濟日報)

更多企業廣場三期寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

尖東區商廈向來受用家歡迎,其中新文華中心,周邊配套齊全,大廈單位更望開揚景觀,以望噴水池景單位最受用家歡迎。

新文華中心在80年代初落成,設於尖東百周年紀念花園旁,屬於尖東區最多人流的地段,同時坐享港鐵站優勢,由紅磡、尖東及尖沙咀港鐵站步行至該廈,約10至15分鐘步程,加上鄰近紅隧交通交滙處,地理位置十分方便,方便上班人士出入。

每層樓面約1.99萬呎

大廈由A座及B座組成,物業樓高13層,辦公室樓層由3樓起,每層樓面約1.99萬平方呎,屬區內具規模商廈。物業開則呈正方形,間隔亦實用,大部分單位屬長形。以A座標準間隔為例,每層設有20個單位,位於每層四角的13、8、3、18室,擁多邊窗,視野相對開揚,惟單位近出入口設有小玄關位置。

景觀方面以A座較為優勝,其中向百周年紀念花園單位,景觀最為優質,主要分布於1至3、及18至20號單位,可望園景及噴水池景。另B座部分單位,可望紅隧及紅磡方向,感覺開揚。至於其他單位,主要望區內市景及樓景。

8月至今錄4宗成交

另外,大廈亦設有2層商場,舖位用戶以食肆為主,加上受新冠肺炎影響,不少新派食肆成功進駐,為上班一族提供更好的美食選擇。

成交方面,新文華中心為今年尖東買賣成交最多物業,8月至今錄4宗成交,其中8月份B座低層20室,面積約792平方呎,以約850萬元成交,呎價約10,732元。對上一宗買賣為9月,B座商層12室,面積約951平方呎,以約1,142萬元易手,呎價約1.2萬元。

(經濟日報)

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

鄧成波家族1.23億 沽欽州街舊樓

市場消息指,深水埗欽州街51至53號全幢,以約1.23億元成交。該項目為兩幢相連的樓宇,樓高4層,早於1932年落成,列入一級歷史建築的戰前舊樓。

據了解,項目由鄧成波家族持有,波叔早年收購項目,其中以3,830萬元購入深水埗欽州街51號,其後再購入53號全幢。早年項目獲批出圖則,可興建1座25層商住樓宇,總樓面面積約2.16萬平方呎。

(經濟日報)

共享工作間再現擴張 非核心商業區可望受惠

共享工作間於數年前開始在香港出現,並大規模擴張,至經濟逆轉始收縮,再經歷新冠疫情一役,自然被市場憂慮此市場會否進一步收縮。答案是:不會,反而再現新一浪的擴張潮。

過去大半年,多家共享工作間重拾擴張步伐,主要原因是市場對靈活工作空間的需求增加。始終疫症於全球仍未完全受控,經濟前景未明,不少企業對經營前景仍未感明朗,難以估計未來2至3年需要多少寫字樓樓面,加上,共享工作間均已裝修,附設辦公設施,企業毋須為租用辦公室承擔裝修費,因而傾向租用租期靈活的共享工作間。

中環上環出租率 超逾90%

據了解,近期中環、上環的共享工作間及商務中心的出租率均超過90%,有一家共享工作間去年於尖沙咀承租了5萬平方呎的樓面,開業9個月之後,出租率已高達95%,遂決定於近期承租額外2.5萬平方呎的樓面擴充。

與上一輪擴充潮不同的地方是,以往共享工作間只會考慮傳統核心商業區,現時則會考慮進駐其他非核心商業區,最重要的是區內是否有足夠人口及寫字樓供應。疫情雖然令遙距工作的概念廣獲接受,然而,香港居住空間狹小,難以長期在家工作,營運商看好市場對此類非核心商業區的共享工作間有需求。新近便有一家營運商租用沙田的寫字樓擴張。

另一趨勢是有別於以往以高價搶租,現時營運商與業主簽署富彈性的租約,個別業主願意採用利潤分紅模式,此合作模式對雙方均有利,因此新一浪的共享工作間擴充將較以往持久及穩健。目前共享工作間佔香港整體寫字樓樓面約不到2%,但倫敦及紐約等市場已分別高達7%和4%,共享工作間於香港將不乏發展潛力。

大業主為大廈增值 設共享間

值得注意的是,除了營運商外,大業主也陸續在寫字樓開設共享工作間,認為此舉能為租客提供多一項選擇,為大廈增值。現時不少租客因有短期項目,或因應疫情裝修辦公室配合新要求,需要額外的樓面,若物業能提供共享工作間,租客便不用遷離該廈,有助業主留住租客。

大業主開設共享工作間的趨勢料將持續。近期整體寫字樓市場租賃交投已轉趨活躍,核心區租金未必會如以往般優惠,營運商將積極在非核心商業區擴張,東九龍等商業區將會受惠,對出租率及租金均有支持。

(經濟日報)

中環巨鋪租期長達25年花旗銀行售後租回

花旗銀行早前以售後租回形式沽出中環畢打街巨鋪,作價7.1億,該租約條款終曝光,租約期長達25年,屬近年市場罕見的長年期租約。

據土地註冊處資料顯示,中環畢打街20號會德豐大廈地下A鋪及B鋪、地庫及外牆,於上月初以獲花旗銀行 (香港) 有限公司租用,租約期由今年9月9日起,為期10年,同時,租戶可續租5次,每次為期3年,換而之,租約期為梗約10年、另加15年生約,合共長達25年。

10年梗約 15年生約

然而,最新資料尚未顯示該鋪最新租金水平,據業內人士指出,上述鋪位為銀行契,故該鋪早前可以「理想價」7.1億易手,主要依靠售後租回形式作推售,料上址每月租金約150萬,以易手價計,租金回報約2.5厘。

早前以7.1億易手

資料顯示,該鋪建築面積約11924方呎,呎價約59543元,買家為資深投資者「台灣張」張彥緒,花旗銀行早於38年前進駐該鋪,及後於2002年10月以1.84億售出,當時帳面賺近億元,售後租回,惟隨後在2年後,即2004年12月以3.9億回購,至今持貨17年,今番帳面獲利3.2億。

(星島日報)

更多會德豐大廈寫字樓出租樓盤資訊請參閱:會德豐大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

BAKEHOUSE每月18萬租漢口道鋪

尖沙嘴漢口道一地鋪,以每月18萬租出,平均呎租129元,新租客為瑞士烘焙名店BAKEHOUSE,作「前鋪後工場」用途。

業主:簽六年長約

上址為漢口道44號漢威大廈地下B號鋪,屬於單邊鋪位,新租客簽下6年長約,由今年10月1日「起標月租」18萬,至最後一年加至31萬,該舖業主形容:「江山代有人才出,新租客BAKEHOUSE來自瑞士,擊中新一代消費模式,雖然每件餅賣50元至100元,卻成功打進年輕人市場,除了美味外,更着眼於打卡用途,拍拖時的分享!」

業主續說,欣賞新租客的魄力,大家惺惺相惜,這盤生意「前鋪後工場」,即場烘焙製作,絕非網上可取代的;新租客看中漢口道,認為此街道很有FEEL,雖然位處核心區,卻給人一種舒適的感覺;他為了支持新租客,亦將該鋪位電力三相60M提升至三相160M,適合新租客使用。

平均呎租129元

上述鋪位建築面積約1400方呎,汪敦敬於今年2月購入,作價8380萬,新租約由今年10月1日至2027年9月30日,現時起標每月18萬,並提供一個月免租期,由10月1日至10月31日,翌年10月加至每月20萬,第3及第4年月租25萬,第5及第6年分別為28萬及31萬,以此推算,現時回報2.6厘,5年後可望將回報提升至4.4厘。

(星島日報)

波斯富街鋪每呎439元減40% 銅鑼灣核心區租金重返15年前

銅鑼灣波斯富街地鋪獲珠寶行以9.5萬續租,較舊租金急挫約40%,呎租約439元,重返約15年前水平;據業內人士指出,中港兩地至今尚未通關,受遊客絕迹影響下,珠寶行等奢侈品承租力銳減,料核心區鋪位租金持續調整。

市場消息指出,銅鑼灣波斯富街77至83號地鋪,面積216方呎,以約9.5萬獲珠寶行續租,呎租約439.8元。據土地註冊處資料顯示,上址業主早於1984年以130萬購入,以溫姓人士持有,及後該鋪再錄數次買賣,惟料為內部轉讓,此外,資料亦顯示,該鋪上一段租約於2015年,當時租金16萬,故最新租金較舊租急挫約4成,此外,該鋪於2013年曾以26萬租出,故是次租金較高峰期回落約63%。

珠寶行每月9.5萬續約

有代理表示,上述租金重回約15年前水平;盛滙商舖基金創辦人李根興指出,受疫情等因素打擊,銅鑼灣一綫街道鋪位租金較高峰期回落約6至7成。故上述續租租金屬合理水平,環顧現時中港兩地至今尚未通關,於遊客絕迹下,單靠本地消費力實在難以支撐奢侈品市場,拖累珠寶行等奢侈品承租力銳減。

高峰期回落約63%

事實上,該街道早前已頻錄減租,資料顯示,銅鑼灣波斯富街57號地鋪,面積約758方呎,早前以約9.2萬獲花店承租,呎租約121元,據土地註冊處資料顯示,該鋪業主於1996年以3268萬購入,以公司名義FORTUNE ROAD DEVELOPMENT LIMITED登記,證冊董事為資深投資者、俊文珠寶創辦人陳俊文等人,同時,資料亦顯示,上述鋪位於2017年7月獲連眼鏡零售商以20.8萬承租,故租金較上手租金下跌56%,此外,該鋪於2010年租金為26萬,故最新租金較11年前更低,反映市況仍然疲弱。

據業內人士指出,雖然疫情回穩,對鋪位市場具一定支持作用,惟利好因素主要集中於飲食業,銅鑼灣波斯富街商戶以零售為主導,現時租金跌勢仍未結束,並較高峰期回落約3至4成,惟近期租金跌幅已明顯放緩,現時該街道吉鋪數目約10間。

(星島日報)

Sun Hung Kai backs development of green belt and wetland buffer zones

The government should make optimal use of green belt sites as 10 percent of such land can build 1.2 million public housing units, developer Sun Hung Kai Properties suggested.

It was among the six suggestions made by the developer on easing the city’s land and housing problem.

The property giant said Hong Kong does not have insufficient land, but the government should release those land from red tapes that are affecting the land and housing supply.

It therefore proposed the government to make good use of the green belt’s potential, and review the green belt areas, especially those owned by the government.

“Some of those green belt areas can be repurposed to build subsidized housing including Starter Homes to help middle class families purchase a property,” it proposed.

The property giant also said releasing 10 percent of the green belt area already means 1,600 hectares of land.

Given the development density in recent new development areas, where 750 flats can be built per hectare, 1,600 hectares of land would mean 1.2 million public housing units, which would already mean 1.2 million in public housing flats, according to Sun Hung Kai.

“If the government releases 25 percent, or 4,000 hectares, of the green belt area, it already means increasing the area for residential use in Hong Kong by 50 percent,” it added.

The developer also said the government had not reviewed wetland conservation policies for over 20 years, and the government back then simply marked all land 500 meters from the wetland conservation areas as wetland buffer areas.

“The planning was very arbitrary, while the boundary for the wetland buffer areas in the Town Planning Board Guidelines and Environmental Impact Assessment Ordinance are different, which leads to much of the land being frozen,” it wrote.

Sun Hung Kai also said many fish ponds in the wetland conservation area and wetland buffer area have been infested with sewage, weeds and even invasive plants, making people question the ecological value of the areas.

Many ponds in the wetland buffer area were even filled with concrete and now became warehouses, and the environment there is getting worse as the areas were used for storage, it said.

The company hopes the government could fix the wetland planning guidelines as soon as possible to achieve a win-win situation of “conservation and development”.

(The Standard)

Bad news for Hong Kong tenants as rents predicted to chart record-high in coming months

Improving economic outlook and potential return of mainland Chinese students and job-market entrants could spur leasing demand

The Merton in Kennedy Town registered a 15.4 per cent jump in August, the most among 133 private housing estates compiled by property agency

Housing rents in Hong Kong are expected to recoup all the losses caused by the social unrest and the Covid-19 pandemic, with analysts predicting a record in the coming months as the economic outlook brightens.

Rents climbed for a sixth month in August for a cumulative gain of 4.7 per cent to 182.2, according to an index published by the Rating and Valuation Department. The index reached an all-time high of 200.1 in August 2019 before crashing in the subsequent nine months amid anti-government protests.

Hong Kong’s economy grew 7.5 per cent in the second quarter from a year earlier, and official reports since June showed retail sales jumped in July and August while the outlook for exports has improved over the past five quarters. The government is working to reopen the border with mainland China, although this may take more than four to five months, a government health adviser said.

“As the economy recovers, unemployment [rate] falls, rents are expected to rise,” property agent said. The agent expects that the record to be broken over the next six to 12 months. “What’s more, if the border really reopens [further], even more mainlanders will come.”

The border reopening could pave the way for the return of mainland Chinese students and new job-market entrants to Hong Kong, fanning demand for housing near universities, according to another property agency. Recent sales by homeowners have also displaced their tenants, pushing them into the market, it added.

The Merton in Kennedy Town, located near the Hong Kong University, saw the biggest rental increase among 133 private housing estates tracked by the property agency. It jumped 15.4 per cent in August to HK$49.54 per square foot, data compiled by the agency showed.

“More people are renting flats, while supply is not catching up to fulfil the demand,” agent said. “We have clearly told tenants that there are not many [listings]. The rent has to be more expensive.”

The agent echoed the view. Rents could increase by 5 per cent in the fourth quarter before charging past the old record over the next six to 12 months, the agent added.

One of the hottest areas is expected to be the southern side of Hong Kong Island, another agent said. There’s a premium for properties with ample built-up areas, coveted by people who are spending more time working from home.

One example is a 2,580 sq ft flat in Stanley Knoll, where an unrenovated unit is on the market for HK$150,000 (US$19,264) a month, some 25 per cent more than a year ago. Similarly, the asking price at Grosse Pointe Villa in Stanley has risen by a quarter to HK$130,000 over the same period.

“We expect rents to continue to rise 5 to 10 per cent over the next 12 months,” agent said. “Increases will be higher for those properties on the south side [of Hong Kong Island] with ample outdoor space as these properties tend to meet Covid lifestyle demand.”

(South China Morning Post)

甲廈空置樓面達900萬呎 歷來最多

新冠肺炎疫情雖緩和,但對商廈租務影響仍然嚴重。有外資代理行指,目前全港甲廈空置樓面900萬呎歷來最多,年內租金已跌約6.2%。該行料未來一年甲廈租金仍向下,跌約5%,調整期至少兩年。

該行數據指,第三季甲級寫字樓租賃量達130萬平方呎,與上一季度基持平,導致年初至今的總租賃量略低於340萬平方呎。第三季吸納量進一步收縮至負119,320平方呎,為連續第8個季度出現負吸納量,打破了房地產歷史上最長的下行周期記錄。

空置率方面,甲廈整體空置率再上升0.2個百分點至11%,將整體空置樓面推高至900萬平方呎的最新紀錄,當中以港島東的空置率躍升得最快,達8.5%,創16年新高。

該行代理認為,由於目前尚未通關,新需求仍較弱,若明年通關,中資機構來港可推動甲廈租務,該代理料未來一年租金料跌約5%。

甲廈租金調整期 至少兩年

另外,該代理指未來兩年為甲廈供應高峰期,有逾600萬平方呎,連同現有空置樓面,消化需時,估計甲廈租金調整期至少兩年。

商舖市場上,近期商舖租務有所改善,但第三季的核心區街舖空置率繼續上升,當中旺角的租賃壓力最大,空置率升2.9個百分點至18.9%。尖沙咀區的表現較為正面,空置率下降2.9個百分點至20.3%。

至於租金方面,第三季各區租金表現平穩,個別如中環區因租務多,租金更按季升1.6%。

該行另一代理指,租務需求大部分來自餐飲行業,其次是個人護理和化粧品,以及休閒服裝品牌,它們合共佔第三季租務的32%。後市上,該代理料核心區的空置率將會維持在高位一段時間,未來一年租金有望輕微回升約5%。

今年大手買賣 工廈佔38%

投資市場今年向好,代理指出,今年大手買賣中,涉及工廈成交佔約38%比例最高,反映工廈因呎價低、兼具價值提升機會,故獲基金及財團承接,該代理料今年第四季仍以工廈最值得看好。

(經濟日報)

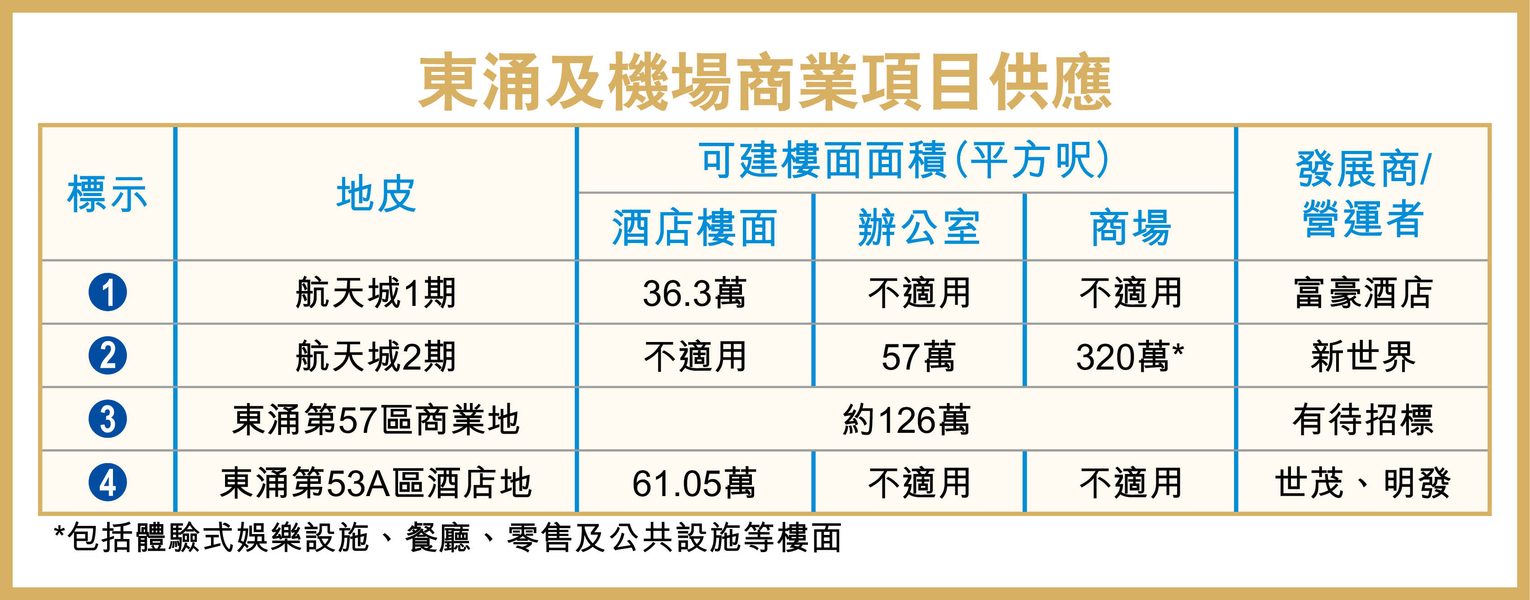

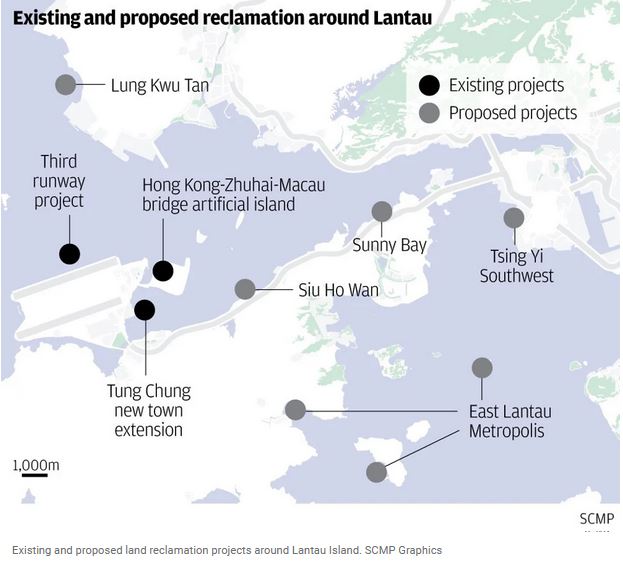

流標東涌商業地 重返今年賣地表

去年曾經流標的東涌商業地,滾存至本財政年度賣地表內,預計將為區內新增約126萬平方呎商業樓面,憧憬未來鄰近的港鐵東涌東站等配套落成,該帶有望成為東涌新商貿區。

提供126萬呎商業樓面

據發展局局長黃偉綸上周公布本財政年度第三季的《賣地計劃》時透露,希望視乎11月份中環海濱商業地的結果,再考慮推商業地招標,其中包括東涌新填海區的57區商業地。該地皮屬東涌市地段第45號,位於東涌迎東邨東面,亦是東涌新填海區首幅推出的私人發展用地,其地盤面積約13.3萬平方呎,目前坐落於「商業 (1)」地帶,以地積比率約9.5倍發展,預計提供約126萬平方呎商業樓面,並可興建樓高30至40層的商廈,可作酒店、辦公室及商場等用途。

東涌東站落成 料推動商貿發展

地皮的前方為東涌第100區的公營房屋用地,東面為未來港鐵東涌東站,交通相對方便。據最新文件透露,車站將於2023年動工,並可望於2029年竣工,但由於東涌填海計劃仍在進行,項目周邊仍然沙塵滾滾。

值得留意的是,由於疫情重創經濟,該地皮於去年10月截標,最終宣告流標,並由上一個財政年度的賣地表滾存至本年度賣地計劃內,當時地皮的市場估值約37.8億至56.7億元,每呎樓面地價約3,000至4,500元。

事實上,東涌新市鎮擴展區計劃分為東部及西部兩部分,當中東涌東的填海區,料提供多達918萬平方呎樓面面積,當中近6成,即約538萬平方呎樓面,將作辦公室用途。而於2014年由世茂集團 (00813) 及明發集團 (00846) 以約18.3億元投得東涌第53A區酒店地,該地皮可建樓面約61.05萬平方呎,每平方呎樓面地價約2,998元,並已經發展為東涌世茂喜來登酒店,及東涌世茂福朋喜來登酒店,共提供約1,200間客房。

另外,新世界 (00017) 早前亦投得赤鱲角機場的航天城項目第2期的營運權,並命名為「11 SKIES」,將可提供逾400萬平方呎的商業及娛樂設施樓面,項目於明年開始會分階段落成。據了解,項目總樓面達57萬平方呎,設3幢甲級寫字樓,而零售餐飲部分佔約266萬平方呎,將有逾800間商店進駐。

(經濟日報)

上月錄497宗工商鋪成交

有代理行資料顯示,9月份共錄約497宗工商鋪買賣成交,金額約119.54億;宗數按月微跌約9%,受大額成交帶動,金額則比8月份多出約26%。

該行代理表示,根據統計,9月份市場共錄得約497宗工商鋪買賣,比8月份略微減少約9%,不過按年表現持續造好,對比2020年9月增加約31%。成交宗數按月遞減,但受大額成交帶動下,按月金額則增長,9月錄得約119.54億,按月升26%,對比去年同期更大增約1.37倍。

代理:宗數按月微跌約9%

該代理續表示,9月內鋪市錄兩宗近兩年罕見核心區巨鋪買賣,同由資深投資者承接,包括「台灣張」張彥緒亦以約7.1億買入中環畢打街巨鋪,帶動9月成交金額錄約45.88億,按月多出約35%。

代理:工商鋪買賣按年倍升

另一代理行綜合土地註冊處資料顯示,工商鋪首三季註冊量共錄5418宗,較去年同期躍升1.2倍,金額則錄744.86億,按年升1.5倍,主因受今年大手成交熾熱所帶動。

9月份整體註冊宗數513宗,按月跌12.2%,金額錄76.97億,按月下跌33.4%。若按金額劃分,成交量最多的為500萬或以下物業。

代理表示,外資基金積極入市,工廈最受捧,尤其全幢工廈成交,該代理認為,疫情持續穩定,惟股市波動,全面通關未明朗化,預計成交量保持每月約500宗水平。

(星島日報)

麗新3.28億購窩打老道地盤

據土地註冊處資料,何文田窩打老道116號地盤,於上月以3.28億易手,買家為麗新發展,並以昊威有限公司 (WELLWAY LIMITED) 名義登記,公司董事包括麗新發展副主席周福安、麗新發展執行董事劉樹仁。

總投資10億 建精品豪宅

原業主於11年10月以1.56億購入,並以榮多有限公司 (MUCH GLORY LIMITED) 名義持有,公司董事包括裕泰興家族成員羅守弘、區碧華及趙成基,目前帳面獲利1.72億。上址早於1956年落成,現為4座樓高三層住宅,據悉,可建樓面約4.61萬方呎,每呎樓面地價約7115元。

麗新發展執行董事潘銳民稱,項目連同補地價,總投資額約10億,將興建精品式豪宅,提供80至100伙,並主打面積500至600方呎的中型單位,另設3房戶,可望吸納家長客及換樓人士所需。他再指,是次成交價合理,地盤亦位於豪宅地段,校網亦理想。

項目原業主為羅守弘

此外,潘氏亦指出,集團將繼續透過多方面增加土儲,除政府土地及一鐵一局的項目外,亦會留意舊樓重建及私人地盤,新一份《施政報告》將於今日出台,可令市況更為明朗。

(星島日報)

葵涌中央工廈重建數據中心申請放寬20%地積比9.5倍增至11.4倍

疫情推動網絡連接需求上升,市場對數據中心需求大增。其中,萬國數據今年6月向鄧成波家族購入的葵涌中央工業大廈,新近向城規會提交新發展方案,申請放寬兩成地積比率,由9.5倍增至11.4倍以重建為一幢樓高20層的數據中心,涉及可建總樓面27.74萬方呎。

據城規會文件顯示,上述項目位於打磚坪街57至61號,現時屬「其他指定用途」註明「商貿」地帶,申請擬議略為放寬地積比率限制,以作准許的資訊科技及電訊業 (擬議數據中心發展)。

上址地盤面積約24337方呎,申請放寬地積比率約20%發展,由9.5倍增加至11.4倍,以重建為一幢樓高20層 (包括1層地庫) 的數據中心,涉及可建總樓面約277446方呎。

可建總樓面27.7萬呎

申請人指,擬議數據中心符合政府發展香港成為國際創新科技中心的政策;發展項目能與附近已核准的數據中心申請產生協同效應;亦為社區帶來規劃及設計增益。

萬國數據持有

資料顯示,連同上述申請該廈已於過去3年、第3度申請不同的方案的重建,其中,前業主資深投資者鄧成波家族,去年11月申請重建一幢樓高31層的酒店,以提供1196間客房並獲批准;惟鄧成波家族於今年6月以9億易手,帳面蝕讓1.8億,新買家為萬國數據創辦人黃偉 (HUANG WEI),最新計畫作數據中心發展。

另外,由均輝集團持有的觀塘均輝中心及禧年大廈,亦向城規會申請放寬地積比率及建築物高度限制,以合併發展,並重建一幢樓高30層的商廈,總樓面涉約14.4萬方呎。

據城規會文件顯示,上述項目位於觀塘大業街1號及偉業街111號,現時屬「其他指定用途」註明「商貿」地帶,申請擬議略為放寬地積比率及建築物高度限制,以作准許的辦公室、商店及服務行業和食肆用途。

觀塘均輝禧年合併重建

上址地盤面積約9978方呎,申請放寬地積比率約20%發展,由12倍增加至14.4倍,而建築物高度由主水平基準以上100米申請放寬至119.5米,即增加約19.5%,重建為一幢樓高30層 (包括1層平台花園及3層地庫) 的商廈,涉及可建總樓面約143689方呎。

申請人指出,擬議計畫提供多項規劃及設計增益,如提供多層綠化及設置平台花園等;擬議發展項目符合「其他指定用途」註明「商貿」地帶的規劃意向及能配合觀塘商貿區一帶轉型,亦符合大綱圖規定的相關準則。

資料顯示,禧年大廈原有興勝創建持有,去年11月獲批建一幢36層高的酒店,提供160間客房;其後均輝集團向興勝創建購入禧年大廈,最新合併地盤發展商廈。

(星島日報)

Grade A office occupancy drops for eight consecutive seasons

Total occupancy of Grade A offices contracted for eight consecutive seasons in the third quarter, breaking the record for the longest downward cycle in the history of Hong Kong real estate, property agency said.

The leasing volume of Grade A office space stayed flat at 1.3 million square feet in the third quarter, but the overall vacancy rate increased by another 0.2 percentage points to 11 percent, resulting in a new record high of 9 million square feet for the overall vacant floor space, the commercial real estate services company said.

The continued improvement in leasing momentum slowed down the rent decline in this quarter, which had fallen by 5.3 percent in the first half, while the decline in the third quarter was just 0.9 percent, the agency added.

Rents held stable for retail shops in the quarter as the market sentiment improved, but the vacancy rate of street shops in the core areas continued to rise.

Among them, the vacancy rate of Mong Kok jumped by 2.9 percentage points quarter-to-quarter to 18.9 percent. So far this year, street shop rents in Central, Causeway Bay and Mong Kok have all recorded increases, ranging from 0.7 percent to 3.2 percent, the agency stated.

(The Standard)

Bank rolls out green loans for Lam Tin flats

Bank of China (Hong Kong) (2388) will provide green mortgage loans for Wheelock Properties' Koko Reserve in Lam Tin which has received green building certification.

Buyers who successfully get the green mortgage loans will enjoy an additional HK$6,888 cash rebate, BOCHK said.

The lender joined hands with Sino Land (0083) to offer similar loans last month.

Koko Reserve, the second stage of the Koko Hills, will open sales on Sunday by tender, offering 28 three- and four-bedroom homes with areas starting at 700 square feet.

Koko Hills will also offer 100 flats for sale on the same day, of which 85 will be launched in the form of price lists.

Meanwhile, Centralcon Properties' The Arles in Fo Tan revealed its first price list of 268 homes at an average price of HK$18,888 per sq ft after discounts. The cheapest flat - a 33- sq-ft one-bedroom unit - costs HK$6.17 million after discounts, or HK$18,654 per sq ft.

The first batch of one- to three-bedroom flats range from 331sq ft to 945 sq ft. The project offers 1,335 homes, from studios to three-bedroom flats, with areas of 228 sq ft to 2,001 sq ft.

Also launching a new price list is Nan Fung Group's Lohas Park's phase 10 in Tseung Kwan O. The sixth price list offers 101 units ranging from 447 sq ft to 1,526 sq ft.

Together with the previous ones, a total of 183 homes will be put on market on Saturday.

This came as a property agency said that the net absorption of Grade A offices remained negative for eight consecutive seasons in the third quarter, breaking the record for the longest downward cycle in the history of Hong Kong real estate.

The leasing volume of Grade A office space stayed flat at 1.3 million square feet in the third quarter, but the overall vacancy rate increased by another 0.2 percentage points to 11 percent, resulting in a new record high of 9 million square feet for the overall vacant floor space, the commercial real estate services company said.

The luxury leasing market presented a mixed picture in this quarter, with rents on Hong Kong Island recording a rise of 1 percent, while Kowloon and the New Territories declined slightly by 0.1 percent and 0.8 percent, respectively, data from another property agency showed.

(The Standard)

Rare residential plot in Repulse Bay likely to draw strong bids from developers as outlook for luxury housing improves

Worth an estimated HK$900 million, the small plot is the first in Repulse Bay to come up for government tender in nine years

It has the potential to be developed into a handful of large luxury houses, say surveyors

A rare plot of residential land coming up for auction in Repulse Bay is likely to attract the interest of developers as the luxury housing market improves amid an easing of the coronavirus pandemic, according to market observers.

It is one of two parcels designated for low-density residential development to be sold in the Hong Kong government’s land sales programme in the three months to December, the other being in Tai Po.

“The residential plot in Repulse Bay would be the most sought after [of the two] by developers,” property agent said. “It is rare to see a residential site in Repulse Bay up for government tender.”

The site is small and likely to yield just a handful of large, luxury houses, surveyors said.

The last government land auction in Repulse Bay was in 2012 when Tai Cheung Holdings won a site near 110 Repulse Bay Road for HK$1.67 billion (US$210 million).

The Tai Po parcel, which is likely to yield about 200 flats, is valued at HK$1.4 to HK$1.8 billion, while the Repulse Bay site is worth around HK$900 million, according to another property agency. The homes built on the Tai Po plot may fetch HK$16,000 to HK$19,000 per square foot while those in Repulse Bay may go for HK$45,000 to HK$55,000 per sq ft.

The Tai Po parcel may attract five to eight tenders while the Repulse Bay one could see more than 10 developers bidding, surveyor said.

“After the pandemic has stabilised [locally] this year, the luxury housing market has gradually become active. The price of this land is not large in the luxury housing market,” surveyor said. “The price is likely to have an indicative effect on the luxury housing market in the Southern district.”

The plot covers an area of 21,097 square feet, with a gross floor area of about 18,987 square feet.

Another surveyor said that the site in Repulse Bay is “the most eye-catching [of the two]”.

The scale is small and can accommodate three to four houses, the surveyor said.

“As the project is located in a rare, traditional luxury residential section of Hong Kong Island, it has the potential to be built into super luxury houses,” another surveyor said.

The land, on South Bay Road, is surrounded by well-known developments such as Chinachem Group’s The Lily.

The exclusive Repulse Bay has counted many celebrities and tycoons among its residents through the years. They include actress Carol “Dodo” Cheng Yu-ling, singer Jacky Cheung, the late gaming magnate Stanley Ho and Cheng Yu-tung of New World Development.

One recent land transaction there was the private sale of 92 Repulse Bay Road in 2020. It went for HK$550 million to CSI Properties and Asia Standard International Group.

There were seven transactions involving lived-in homes in Repulse Bay in August, a relatively high number, compared to four a year earlier and zero in September of 2020 as the pandemic riled the market.

A house measuring 3,871 sq ft, with garden, sold for HK$438 million at Overbays of 71 Repulse Bay Road in July.

The Tai Po site is much larger, at 150,696 square feet, with an estimated gross land area of about 226,044 square feet.

Surveyor said that the neighbouring areas are mainly quiet, low-density residential developments such as Constellation Cove and Savanna Garden.

(South China Morning Post)九龍灣億京中心全層1.8億售

九龍灣億京中心錄全層買賣,涉資1.8億,平均呎價1.3萬,物業於4年間升值36%。

上址為,億京中心A座31樓全層連車位,以1.8億售出,建築面積約13851方呎計算,平均每呎約1.3萬。據土地註冊處資料顯示,上址原業主隆滙國際投資有限公司,於2017年購入全層,作價約1.32億,隆滙國際註冊董事為蘇姓人士,持貨4年後沽貨,帳面獲4800萬,物業升值36%。

平均呎價1.3萬

億京中心對上一宗成交為,B座32樓全層連車位,建築面積12678方呎,以約1.52億售出,平均呎價約1.2萬。原業主港新集團有限公司於2010年9月以7496.46萬元一手購入,帳面升值7703.54萬,幅度逾1倍。

光榮電業等購富騰工中

中洲火炭旗下新盤推售,區內工廈亦率先獲名人入市。土地註冊處資料顯示,坳背灣街富騰工業中心中層1室,面積2363方呎,上月以922萬售出,呎價約3902元,買家以名福有限公司登記,公司董事包括郭靜欣、郭靜怡及張躍翔,為光榮電業相關人士,郭靜欣為恒和珠寶主席陳聖澤媳婦、郭靜怡則是理文造紙主席李運強媳婦。

原業主於2012年以約565萬元購入,持貨9年,帳面獲利357萬,升幅約63%。

(星島日報)

更多億京中心寫字樓出售樓盤資訊請參閱:億京中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

星光行呎租23元低20%

疫情持續平穩,為工商鋪市場釋出正面訊息,惟甲廈租金仍彈升乏力,消息指,尖沙嘴星光行中層單位,於交吉近一年後,以每呎約23元租出,較租金低約20%,低市價約兩成。

交吉近一年租出

市場消息指出,尖沙嘴星光行高層低層21A室,面積858方呎,以每呎約23元租出,月租約19734元。據代理指出,上址早前獲財務公司以每呎29元租用,惟於去年底已遷出,故交吉至今近一年,租金亦下跌約20%,亦較市價低約兩成。

據代理資料顯示,該甲廈近期成交為高層25A至02室,面積824方呎,於上月以23896元租出,平均呎租約29元,較是次租金相差約20%。

據土地註冊處資料顯示,上址原業主於2013年以約1836.5萬購入,以公司名義耀裕有限公司(BRILLIANT LUCK LIMITED)持有,註冊董事為外籍人士,料租金回報可觀。

該甲廈近期較矚目成交為由日本玩具商TOMY持有的一籃子自用物業,於今年初作價約1.44億易手,每呎造價約1.5萬,該買家身分曝光,為資深投資者盧華,涉及單位為1207至1212、1214至1216及1216A室,總樓面約9621方呎,全為海景優質戶。

(星島日報)

更多星光行寫字樓出租樓盤資訊請參閱:星光行寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

觀塘茂興24%業權叫價1.6億

觀塘重建活化項目吸引,逐決定聯合放售位處區內核心街道的偉業街205號茂興工業大廈一籃子單位,涉及共約24%業權份數,叫價約1.6億。

平均呎價6485元

有代理表示,觀塘偉業街205號茂興工業大廈一籃子物業,主要集中於大廈低層,佔大廈23.95%業權,涉及總樓面面積約24672方呎,意向價約1.6億,平均呎價約6485元。該廈極具收購重建潛力,毗鄰的偉業街203號同得仕大廈,曾於去年初獲批放寬地積比率20%至14.4倍,將建成新式工廈。大廈對面即為新地發展的甲廈 One Harbour Square 及 Two Harbour Square。

該代理續稱,觀塘區內頻錄廠廈改規劃重建,令區內進一步變天。而該期錄得的業主聯合出售全幢工廈為高良工業大廈,由理想集團牽頭發展,早於2006年起逐步收購該廈業權,累計共持有約66.6%,繼而說服其他小業主一起出售,最終以約1.9億易手,理想集團在該項目上賣樓收益佔逾1.28億。

茂興工業大廈佔地10075方呎,樓高12層,現址總建築面積約104000方呎,重建地積地積比12倍。早於今年4月,該廈業主集89%業權放售,當時全幢意向價8億,該廈可重建樓面120900方呎,當時放售的樓面呎價約6617元,尚未計算額外20%地積比。

(星島日報)

更多One Harbour Square寫字樓出租樓盤資訊請參閱:One Harbour Square 寫字樓出租

更多Two Harbour Square寫字樓出租樓盤資訊請參閱:Two Harbour Square 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

活化工廈兩項措施延長至2024年

政府於2018年推出新一輪的活化工廈措施 (下稱活化工廈2.0),包括容許合資格工廈重建項目的地積比率,經過城規會准許後放寬兩成,以及豁免整體改裝工廈支付相關的地契豁免書費用。行政長官林鄭月娥昨天宣布,一併把兩項措施延長至2024年10月。

其中有關放寬發展密度的措施,適用於1987年前落成,位於主要市區或新市鎮,用地地帶屬於住宅以外的工廈,以重建作工業或商業樓宇;政府2018年公布時,初步表示措施為期3年,有關申請須在2018年10月10日起3年內向城規會提出申請,並要在申請獲批後補地價,意味該項原定本月到期的計劃,將延長3年。

至於有關整幢改裝的措施,本來有效期為2019年4月2日起為期3年,意味原定2022年4月初截止,現延長約兩年半時間。

市場人士表示,過去兩年,政府推出活化工廈2.0政策的成效顯著,其中重建項目可以獲得20%額外地積比等措施,為業主提供誘因,把舊工廈重新發展為數據中心、冷凍倉,以及迷你倉等現代工業項目,有助可持續發展。

另有測量師亦支持政府延長活化工廈措施,預期可鼓勵更多業主參與活化工廈計劃,並配合現有「標準金額」補地價計劃,加快工廈重建。

全幢舊式工廈可重建受覬覦

有代理行指出,截至今年9月底,已有57宗放寬發展密度的規劃申請獲批,涉及樓面面積約1270萬方呎,相信政府延長活化工廈措施的話,將延續目前工廈投資的熾熱氣氛和活躍交投,料投資者將在市場上物色合適可重建的全幢舊式工廈,但由於此類全幢物業將買少見少,投資者或會從併購重建方向入手。

香港測量師學會認為,政府除延長前述兩項措施外,亦應檢視政策,適量放寬和簡化審批要求,例如彈性處理興建停車場和社區設施的要求,建立公開、透明的標準及指引,增加有關計劃的吸引力和協助工廈重建。

(信報)

新蒲崗匯達商業中心頂層 同步租售

東九龍近年火速變天,觀塘、九龍灣由工業轉型全新工商貿區,啟德發展區打造為新貴屋苑滙聚地,而位處兩區中間的新蒲崗亦因而備受關注,商貿氛圍與日俱增;新近有業主看準市況,將原先自用的匯達商中心頂層全層單位,調低叫價,以意向價約6,476.8萬元放售。

降價12% 冀吸引買家

代理指,位於新蒲崗雙喜街9號匯達商業中心28樓全層,面積約5,632平方呎,現以意向呎價約1.15萬元放售,叫價約6,476.8萬元。上址業主原以每平方呎約1.3萬元放盤,惟最近眼見工商舖交投氣氛暢旺,因而將意向價下調至約12%,冀吸引用家或投資者承接。該代理稱,28樓為匯達商業中心頂層單位,可眺望獅子山一帶的開揚景色,而單位備有分體式冷氣,使用上更具彈性。至於單位實用率亦不俗,少柱位、樓底高的設計,令單位的空間效能極盡發揮。

每呎叫租25元

而位置上,匯達商業中心靠近港鐵鑽石山站,屯馬綫全面通車下,令區內的交通配套更為完善,此外,單位亦同時招租中,意向呎租約25元,涉及總月租叫價約14.08萬元。事實上,新蒲崗區內商廈為數不多,成交亦只集中於匯達商業中心及萬迪廣場身上。而據資料顯示,同區大有街3號萬迪廣場9樓F、G及H室,合共面積約4,534平方呎,於今年年初以約5,942萬元易手,平均呎價約1.3萬元,而匯達商業中心高層單位,面積約5,632平方呎,今年亦以約6,195萬元沽出。

代理續稱,匯達商業中心大多單位均由業主自用,而是次推售的頂層全層單位,更屬市場罕有放盤,再者,隨着啟德區發展,新蒲崗亦受惠,並逐步轉型成商貿區,而活化工廈政策同時吸引區內業主、發展商進行重建或改裝,不少用家及投資者對區內發展前景信心十足,搶先落戶。而現正放售的匯達商業中心頂層戶,一梯一伙設計,單位質素不俗,而位置又比鄰港鐵鑽石山站出口,各方面條件極具競爭力,最重要業主又願意降低叫價,令放售項目的價錢更為貼市,預料可獲實力買家追捧。

(經濟日報)

Hong Kong property deals set to plunge in October amid fears Beijing is tightening its grip on the housing market

Chinese officials overseeing the city’s affairs told local developers to use their influence to champion state interests, according to a recent Reuters report

The number of properties changing hands in October is likely to plunge by more than 20 per cent on the month, say analysts

The number of property deals taking place in Hong Kong is set to slide for a third month in October as buyers await clarity on housing policy amid rumours that Beijing is muscling in to control the local market.

The overall number of transactions, including residential, commercial and industrial properties, as well as parking spaces, marked an eight-month low of 7,400 in September, down 6 per cent from the previous month, according to Land Registry data released on Tuesday.

The number of properties changing hands in October is likely to plunge by more than 20 per cent on the month, according to property agent.

“Buyers have generally waited for the final policy address in the term of Chief Executive [Carrie Lam Cheng Yuet-ngor on October 6], and will only make arrangements after the property market policies and measures become clear,” the agent said.

“The failure of property prices to rise sharply after breaking the record has made buyers become more cautious. In addition, the stock market has fallen a lot in the past quarter. It has been reported that the central government wanted to change the rules in the local property market.”

Hong Kong’s housing problem – tight supply underpinning sky-high prices – has raised red flags among Chinese officials overseeing the city’s affairs, with some of them telling local developers to use their resources and influence to champion state interests, according to a recent Reuters report.

For now, reports of arm-twisting by Beijing officials have been denied, according to the Real Estate Developers Association (Reda).

The biggest drop in transactions has been for non-residential properties, which sank 36.7 per cent to 1,048 in September.

A property agency expected that the overall number of transactions to test a 14-month low of 5,800 transactions in October. It would be the first time the number of deals has fallen below 6,000 since August 2020.

Another agency also believes the overall number of transactions could go as low as 6,000.

Lived-in home prices in Hong Kong retreated for the first time this year in August from an all-time high, after a slump in the equity market weakened buying sentiment.

But the agency remained optimistic about homebuying demand as the percentage of buyers originally from mainland China purchasing new homes in the first eight months of this year marked a four-year high of 13.2 per cent.

An immigration consultancy also noted strong demand among mainland Chinese buyers in a survey in late September.

Separately, another property agency priced the first batch of 268 flats at The Arles in Fo Tan on Tuesday. Prices start at HK$6.17 million (US$792,669) for a flat measuring 331 square feet. The average price per sq ft of the batch at HK$18,888 is about 5.6 per cent lower than the average for the first batch of The Pavilia Farm phase three in nearby Tai Wai launched in May at HK$19,999.

(South China Morning Post)中環中心連錄承租 每呎78元屬市價水平

隨疫情持續平穩,帶動甲廈租賃交投轉活,「小巴大王」馬亞木持有的中環中心錄連環承租,其中高層單位以每呎約78元租出,屬市價水平。

代理指出,上述為「小巴大王」馬亞木持有的中環中心高層07至11室,面積約10675方呎,以約83.265萬租出,平均呎租約78元,上址舊租每呎90元,故租金下跌約13%。

「小巴大王」馬亞木持有

另一個案為該甲廈中層08至12室,面積9897方呎,以59.38萬租出,平均呎租約60元。該代理指,上址亦由馬亞木持有,早前每呎租金為70元,故租金下跌約14%,上述兩宗租金均屬市價水平。

資料顯示,馬亞木於今年7月以6.93億沽出該甲廈26樓全層,以面積2.5萬方呎計,呎價約27720元,買家為紀惠集團。

較舊租跌13%至14%

有外資代理行指出,本港甲廈租金於今年第三季按季下跌約1.5%,較第二季的2.6%跌幅已見放緩,空置率則續升至9.3%,涉及樓面約580萬方呎,該行指出,中環跟其他地區的租金差距收窄,非核心地區的租金或會受壓,展望明年,料明年整體甲廈租金跌10%,中環區則下跌約5%。

該行代理指出,近期股市急跌,但首次公開招股申請仍然踴躍,成為了中環寫字樓市場背後兩股平衡力量。展望未來,各區之間的租金差距繼續收窄,經濟展望不明朗,加上供應量增加,或令非核心地區寫字樓的租金進一步受壓。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

西洋菜街鋪每呎200元跌60% 租金重返16年前 美容店取代鐘表行

受疫情等因素打擊,核心區鋪位租金跌勢未止,消息指,旺角西洋菜南街地鋪於交吉逾一年後,獲美容中心以18萬承租,取代鐘表行進駐,平均呎租約200元,租金急挫約6成,並重返16年前水平;據業內人士指出,現今核心區遊客絕迹,單靠本地消費難以支撐大市,拖累租金持續下滑。

上述為西洋菜南街69號地下及閣樓,面積約900方呎,閣樓約700方呎,交吉一年,市場消息透露,剛以約18萬獲美容中心承租,呎租約200元,該鋪舊租客THE SWATCH GROUP (HONG KONG) LIMITED,2013年以月租68萬進駐,2016年時續約時月租45萬,租約至今年8月,惟去年7月提早遷出,最新租金急挫約60%,較高峰期更回落約74%。

交吉一年始獲承租

據土地註冊處資料顯示,上址業主於2007年以約1.12億購入,以公司名義TOP RAINBOW LIMITED (高虹集團有限公司) 持有,註冊董事為莫姓人士,以最新租金計,回報僅1.9厘。

盛滙基金創辦人李根興評論指,西洋菜南街屬鋪市「重災區」,上址最新租金重返2005年、即約16年前水平,政治運動及疫情等負面因素重創鋪市,加上中港兩地未通關,遊客絕迹,傳統核心區單靠本地消費難以支撐大市,拖累租金急速下滑。

代理指出,旺角西洋菜南街現今吉鋪數量逾20間,部分丟空逾一年,現時以短租主導,租金普遍跌約75%,短租客包括手機用品、電子數碼產品口罩店及家庭用品等。

百年老店「老鳳祥」今年六月遷出的旺角亞皆老街與西洋菜南街交界「鋪王」,交吉兩個月後,獲樓上燕窩莊以短租形式承租,月租約30萬,較舊租跌約80%。

駱克道地鋪7150萬售

據土地註冊處資料顯示,灣仔駱克道468號鑽石大樓地鋪連閣樓,上月初以7150萬售出,買家CLAY THE RACCOON HOLDINGS COMPANY LIMITED,註冊董事為陳姓人士,原業主於1978年以80萬購入,持貨43年帳面獲利7070萬,物業期間升值約88.3倍。上址地鋪連閣樓總樓面約2000方呎,呎價約35750元。

(星島日報)

50大甲廈首3季 131買賣按年升1.6倍

今年第三季商廈勝去年,有代理行統計指,首三季錄131宗商廈買賣,按年升1.6倍。

該行數據顯示,今年首三季50大甲廈合共錄得131宗買賣,較去年同期的51宗大幅增加1.6倍,成交面積合共56.25萬平方呎,按年更大升2.1倍,反映今年的成交不乏大單位、大銀碼物業。

今年首三季的成交量集中於九龍,期內共錄得78宗,佔整體約6成,其次為港島的27宗及新界的26宗。若以大廈劃分,沙田石門京瑞廣場共錄14宗,屬表現最好的大廈,其次為葵涌新都會廣場及中環的中環中心,期內均各錄得12宗買賣成交。

九龍區的成交較為分散,最多為尖東新文華中心的11宗,及觀塘寧晉中心的7宗。

中環環球大廈3年未發市

統計指,多個傳統核心區甲廈交投慢熱,除了中環中心錄得較多買賣之外,其餘多座傳統指標甲廈成交量低迷,例如一向屬交投集中地的上環信德中心及金鐘力寶中心,今年以來分別只錄得1宗及3宗買賣,信德中心的成交量較去年同期還要少。此外,中環環球大廈及灣仔會展廣場辦公大樓等今年暫仍未錄得買賣,而環球大廈更已經連續39個月未錄得成交,相當於冰封超過3年。

代理表示,本地疫情緩和,加上受惠去年低基數效應,令到今年首三季的指標甲廈交投大幅反彈。不過,近期的指標甲廈買賣成交有放緩的迹象,主要因為早前股市表現波動,加上近期多個甲廈新項目推出拆售,包括觀塘觀塘道368號、長沙灣荔枝角道888號,以及快將推出的黃竹坑宏基匯等,吸去部分市場購買力,令到二手指標甲廈交投略為放緩,但整體而言商廈市場氣氛仍然平穩。

(經濟日報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多環球大廈寫字樓出售樓盤資訊請參閱:環球大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多會展廣場辦公大樓寫字樓出售樓盤資訊請參閱:會展廣場辦公大樓寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多寧晉中心寫字樓出售樓盤資訊請參閱:寧晉中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

市況持續向好 投資者趁機沽貨

疫情緩和下,投資市場向好,不少財團四出尋找物業投資,而持重貨的投資者趁機沽貨套現,稍作減磅。

投資市場平穩向好,舖位、全幢物業等承接力不俗,個別業主趁機加快沽貨。近月積極出貨的鄧成波家族,第二季連環沽貨涉逾百億元,近日再度推出數10億元物業放售,個別獲得承接,包括深水埗欽州街51至53號全幢,以約1.23億元成交。該項目為兩幢相連的樓宇,樓高4層,早於1932年落成,列入一級歷史建築的戰前舊樓。舖王波叔早年收購,其中以3,830萬元購入深水埗欽州街51號,其後再購入53號全幢。早年項目獲批出圖則,可興建1座25層高商住樓宇,總樓面面積約2.16萬平方呎。

鄧成波家族蝕讓沽禮頓道舖

另外,銅鑼灣禮頓道33至35號地下,面積約2,800平方呎,以約1.8億元成交,呎價約6.4萬元。據了解,舖位由中銀 (02388) 租用,較早前以每月56萬元續租。物業由舖王鄧成波家族持有,波叔於2017年斥2.15億元購入,家族成員較早前以約2.7億元放售,現減價逾3成沽貨。持貨4年轉手,蝕約3,500萬元離場。

商廈方面,灣仔莊士企業大廈多層樓面易手,當中涉及項目5至23樓其中18層樓面,其中16至24樓9層,屬酒店用途,提供500間房。項目總樓面約44,829平方呎,以4.15億元成交,呎價約9,257元,由投資者購入。波叔早於2014年,以約3.6億元,向投資者紀寶購入灣仔莊士企業大廈15層樓面,其後再分階段購入3層,合共持有18層樓面,總涉資約4.32億元。如今家族以4.15億元沽出該批樓面,仍蝕約1,700萬元離場。

至於工廈,該家族亦沽出觀塘開源道62號駱駝漆大廈第1座1樓全層,面積約14,795平方呎,涉約1億元,呎價約6,759元。鄧成波家族於2010年以約4,700萬元購入,持貨11年,帳面獲利約5,300萬元。

佳寶8500萬 售土瓜灣自用舖

另一沽貨較積極財團為佳寶,該集團頻頻沽舖,如最近以8,500萬售出土瓜灣靠背壟道自用舖位,持貨6年料實蝕約500萬元離場。物業面積約3,000平方呎,以租金20萬元計,料買家享回報約2.8厘。

此外,他早前亦沽出西灣河及屯門舖位,其中西灣河街129至133號利基大廈地下2號舖連閣樓,以1.22億元成交,舖位面積約8,400平方呎,現由百佳超市租用。佳寶於2012年以8,960萬元買入,持貨9年轉手,帳面獲利約3,240萬元。另外,集團以約8,200萬元,沽屯門鄉事會路112至140號雅都花園地下8號舖,面積約3,435平方呎。

分析指,由於整體投資市況向好,特別舖位租售價從低位反彈,吸引投資者重新留意入市。個別持重貨的投資者,因資金安排等原因,有需要沽貨套現,而趁現時市況理想,加快推售物業,獲一定承接力,預計投資者把握機會,續推售物業。

(經濟日報)

Presale applications rise to three-year high

Developers have applied for the presale consent for three projects that offer 2,966 units altogether, the most in three years, while more buyers rushed to buy homes in Yuen Long and Hung Shui Kiu.

Government data also showed that only 508 private homes were completed in August, down 53.7 percent month-on-month to a seven-month low.

Meanwhile, Noelle Kwok Hew-yin, the daughter of Thomas Kwok Ping-kwong, the former joint chairman of Sun Hung Kai Properties (0016), bought a 4,597-square-foot luxury home at 33 Island Road in Repulse Bay for HK$505 million.

The apartment includes a 2,600 -sq-ft garden and the per-square-foot price was HK$109,854, according the Land Registry.

Kwok's daughter paid a stamp duty of HK$21.5 million, or 4.25 percent of the property price, meaning the flat was her starter home. The seller was a company registered outside of Hong Kong named Linkful Shares, which enjoyed a paper gain of HK$205 million, or 68 percent after holding for 10 years.

Local media reported that the former owner was actually billionaire King Pak-fu, who ranked 165th on the Forbes Chinese Rich List in 2015 with a net worth of US$1.9 billion (HK$14.8 billion) at that time.

He was engaged in the IT business in the 1990s and then set foot in the mainland real estate market. In 2010, King moved to Hong Kong and successively took over three Hong Kong shell stock listed companies.

However, things changed in 2018 with many giant financial players like China Minsheng Investment Group and China Huarong Asset Management (2799) going into a series of debt crises, dragging King and his companies down along with them.

(The Standard)

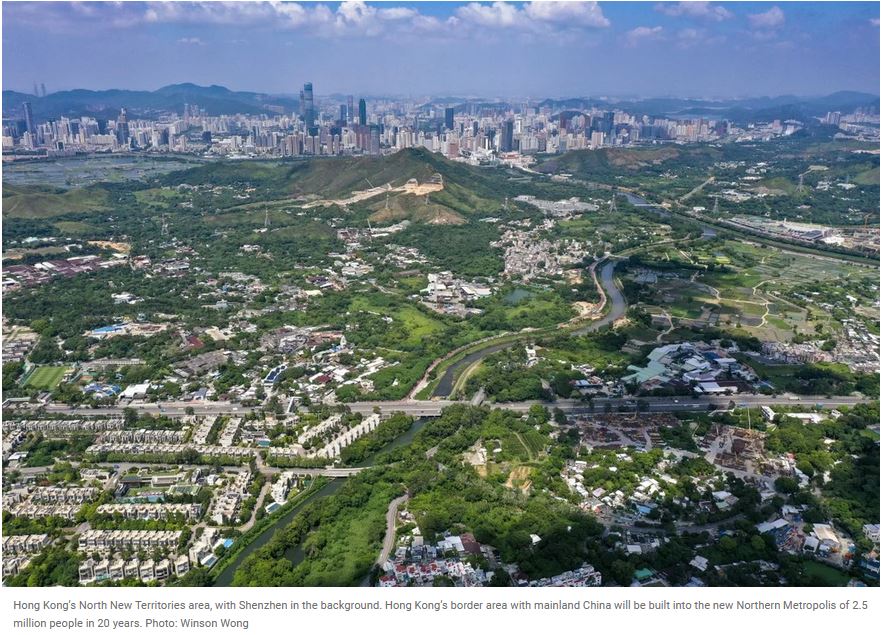

Hong Kong’s ‘big four’ developers stand to win big from government’s proposed Northern Metropolis

The metropolis covering 300 sq km of area includes 600 hectares of farmland, wetland and brownfield sites partly held by big developers

Sun Hung Kai Properties, CK Asset, Henderson Land and New World own a total of 106.3 million sq ft of farmland in designated hub: CGS-CIMB

Hong Kong developers sitting on massive holdings of farmland are expected to be the biggest winners of the government’s latest proposal to develop a new hub called Northern Metropolis.

While the plan covers an area of 300 sq km, the government will develop 600 hectares (1,480 acres) of land including farmland, wetland and brownfield sites, some of which is held by developers and private owners.

Sun Hung Kai Properties, CK Asset, Henderson Land and New World Development, the city’s top four by market value, together own a total of 106.3 million sq ft of farmland in the designated area, according to CGS-CIMB Securities.

“The four largest developers will stand to benefit the most among the local players from the new policies, due to their huge farmland reserves and extensive experience in developing farmland-converted mixed-use developments,” a brokerage report said.

While some of the farmland might be acquired under local laws by the government for public housing and infrastructure, developers will still have profit margins of about 20 to 30 per cent because of the extremely low cost of land, the broker said.

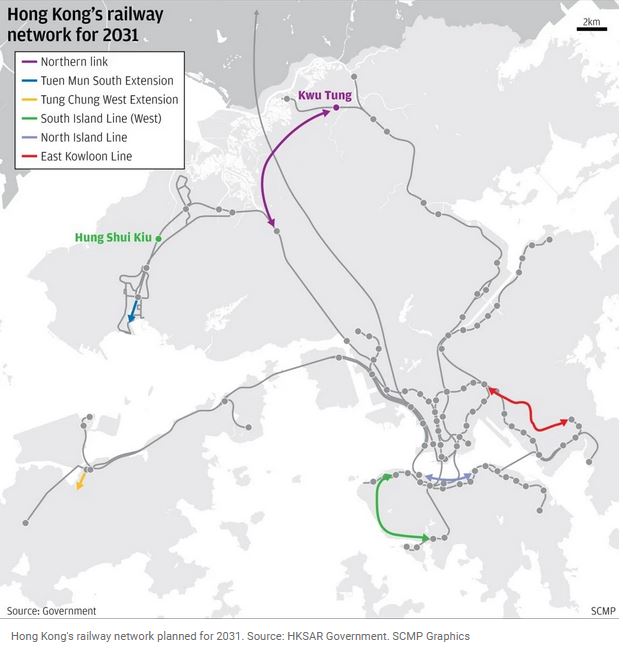

Chief Executive Carrie Lam Cheng Yuet-ngor on Wednesday said an innovation and technology corridor will serve as the engine of the Northern Metropolis. It will also include a new cross-border railway linking the city to the Qianhai economic zone in Shenzhen, and an extension of a local rail link that will stimulate development across Hong Kong’s rural hinterland.

Once the entire Northern Metropolis is fully developed, as many as 926,000 units, including the existing 390,000 flats in Yuen Long and North districts, will be available to accommodate 2.5 million people in 20 years, she said.

The metropolis will include existing new towns in Tin Shui Wai, Yuen Long, Fanling and Sheung Shui and their neighbouring rural areas, as well as six new development areas under planning or construction. They are Kwu Tung North/Fanling North, Hung Shui Kiu/Ha Tsuen, Yuen Long South, San Tin/Lok Mak Chau, Man Kam To and The New Territories North New Town.

Under this plan, CK Asset and Henderson Land could have their wetland sites around Mai Po acquired by the government, an analysis report said.

Henderson Land had the largest holding of farmland in Hong Kong at 44.6 million sq ft as of June, according to its interim report. It said about 100,000 sq ft in Kam Tin was resumed by the government in the first half for public use for which it received a payment of HK$80 million. Another 1.26 million sq ft in Fanling New Development Area and Kwu Tung New Development Area was taken by the government in 2019, for which it was paid HK$1.75 billion

Still, Henderson Land has more than 4 million sq ft of gross floor area in the Fanling and Kwu Tung new development areas, according to its interim report.

SHKP holds 31 million sq ft of farmland, making it the second largest holder, while New World Development and CK Asset own 17.9 million sq ft and 12.8 million sq ft, respectively.

The shares of the city’s property developers continued to rise for a second day following the announcement of the Northern Metropolis plan.

Henderson Land jumped 7 per cent, SHKP advanced 2.4 per cent, New World Development rose 3 per cent and CK Asset added 1.2 per cent on Thursday.

(South China Morning Post) NIKE租觀塘ITT 每呎32元涉逾5萬呎

東九龍甲廈租務相對較旺,消息指,運動服裝品牌NIKE租用觀塘ITT (國際貿易中心) 逾5萬平方呎樓面,呎租高見32元。該品牌原租用九龍灣商廈,是次搬遷屬提升級數,同時亦縮減樓面。

搬遷提升級數 縮減樓面

市場消息指,觀塘國際貿易中心錄得租務,涉及12樓全層,以及15樓部分樓面,合共約5.2萬平方呎,成交呎租約32元。近一年東九龍甲廈租金顯著下跌,普遍甲廈呎租徘徊20餘元,而是次錄得呎租逾30元,屬頗高水平。該廈為區內最具質素新商廈之一,故租金水平較高。

據了解,新租客為NIKE,該品牌於十年前租用九龍灣國際交易中心29、30及31樓,屬項目最頂3層,合共約7.8萬平方呎,租約即將到期。是次NIKE轉租ITT,既可提升寫字樓級數,同時亦縮減約3成樓面。事實上,不少運動服裝品牌把總部設於東九龍,如去年Adidas租觀塘海濱滙合共約7萬平方呎樓面,呎租約30元。

華潤擴充 租創紀之城2萬呎

同區其他租務方面,消息指,觀塘創紀之城一期全層,面積約2.1萬平方呎,呎租約25元。據悉,新租客華潤,集團本身已租用該廈單位,是次屬擴充。據了解,該層樓面原由渣打銀行使用,年初決定放棄部分樓層。

另消息稱,九龍灣企業廣場五期2座23樓全層,面積約1.7萬平方呎,獲一家會計師樓租用,呎租約23元。據悉,該機構原租用北角萬國寶通中心,搬遷可節省開支。另外,九龍灣恩浩國際中心高層樓D室,面積約約1,497平方呎,以約2.8萬元租出,呎租約19元。

(經濟日報)

更多國際貿易中心寫字樓出租樓盤資訊請參閱:國際貿易中心寫字樓出租

更多海濱匯寫字樓出租樓盤資訊請參閱:海濱匯寫字樓出租

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多國際交易中心寫字樓出租樓盤資訊請參閱:國際交易中心寫字樓出租

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多萬國寶通中心寫字樓出租樓盤資訊請參閱:萬國寶通中心寫字樓出租

更多北角區甲級寫字樓出租樓盤資訊請參閱:北角區甲級寫字樓出租

甲廈新供應來臨 租金難反彈

外資代理行:業主願降價 「去中環化」將放緩

疫情衝擊商業活動,甲廈需求急降,導致空置樓面創新高。有外資代理行認為,現時空置樓面多,加上未來兩年新供應達650萬平方呎,消化需時,相信未來兩年甲廈租金低位徘徊,難以反彈。

環球疫情最影響商務活動往來,外資及中資機構來港租寫字樓需求大降,導致甲廈淡靜。據該代理數字,第三季的甲廈租賃量達130萬平方呎,與上一季度基本持平,導致年初至今的總租務低於340萬平方呎,第三季吸納量進一步收縮至負119,320平方呎。連續第8個季度出現負吸納量,打破了歷來最長的下行周期記錄。

持續負吸納,令甲廈空置率升至11%,而空置樓面增至900萬平方呎,為歷來最多。該行代理指,香港長期平均每年約350萬至400萬呎空置面積為合理,現900萬呎即高出逾500萬呎,以每年平均吸納量170萬呎,正常需2至3年時間消化。但要留意,疫情下在家工作、工作模式改變,均令需求減少。

未來兩年 共650萬呎出台

現有空置樓面創新高,代理指未來兩年踏入供應高峰期,令情況雪上加霜,「2022至23年合共有650萬呎新供應出台,數字甚大,連同900萬呎未消化,合共約1,500多萬呎。按過往每年平均吸納量約170萬呎,而當時沒有揮之不去的疫情,現在也說不定明年疫情會否完結,前景不明朗下,估計吸納較慢。」

事實上,近期市場租務稍增加,令租金下降繼續放緩,由2021年初至今已下降5.3%,而第三季整體租金則下降0.9%。他預計,短期內租金有下行壓力,其後市況有望少少改善,但不代表其後即回升,料未來1至2年租金低位橫行為主。他料未來12個月,租金仍跌約5%。

封關下企業難來港開業,代理指,近年內地機構活躍來港開業,但相信即使重新通關,中資機構難以撑起整個租務市場,「內地公司以租幾千呎樓面作起步,要數量很大才可吸納如此多空置樓面。」至於外資及跨國企業,他認為擴充上會審慎,「近期新近租務多,惟搬遷為主,擴充甚少,搬遷甚至縮減樓面。跨國企業未來6至12個月,預計仍較為觀望,未必作大型擴充。」

東九龍中長綫 仍有吸引力

核心區中環向來是企業必搶之地,近期中區租務也有上升,如中環國際金融中心一期5.3萬平方呎樓面,獲內地金融機構中金公司租用,為今年最大手超甲廈租務成交,中金公司樓面擴充至12萬呎,成物業最大租戶。該代理指,中環空置率稍為穩定,認為大型機構仍有興趣。至於近年不少機構遷出中環,代理料因中區租金下跌,「去中環化」將放緩,「中環業主願降價,吸引租客續租。畢竟搬遷費仍涉及一定成本,當業主減價留客,搬遷節省租金開支幅度減少,故傾向續租。」代理指,中長綫非核心區如東九龍,仍有一定吸引力,「除了租金較便宜外,東九龍新商廈林立,質素上始終較為理想。疫情下很多機構重視寫字樓質素,如空調、通風、洗手間衞生等。」

(經濟日報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

金鐘統一中心意向呎租38元

疫情持續平穩,帶動甲廈租賃交投轉活,部分業主亦趁勢放租旗下物業,金鐘統一中心高層單位推出市場放租,意向呎租約38元。

代理表示,金鐘道95號統一中心高層A02室及A03室,單位面積分別約6952方呎及4382方呎,合共約11334方呎,業主意向租金分別約26萬及16萬,合共約43萬,呎租約38元。

享開揚維港景致

該代理指,物業以交吉形式放租,間隔方正實用,坐享開揚維港景致,屬該甲廈優質單位,統一中心盡享龐大地理優勢,物業毗鄰政府總部,以及雲集頂級購物及餐飲選擇的太古廣場,同時連接區內商廈遠東金融中心、力寶中心及海富中心等,享協同效益。

資料顯示,該甲廈近期矚目買賣為由宏安地產持有的高層全層以5.15億易手,呎價約2.5萬,料買家享租金回報約2.7厘。據了解,買家為許大絢及梁先杰。資料顯示,業主為宏安地產,於2016年以5.12億購入,持貨約5年帳面獲利約277.5萬。

據大型代理行資料顯示,該甲廈對上一宗成交於今年3月錄得,為高層B室,面積10244方呎,以約2.15億售,呎價約2.1萬;另一成交為30樓F室,面積20489方呎,於2016年11月以約5.1億售,呎價約2.5萬。

(星島日報)

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多遠東金融中心寫字樓出租樓盤資訊請參閱:遠東金融中心寫字樓出租

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

西洋菜街鋪每呎167元跌60% 交吉逾一年獲承租鐘表店進駐

疫情持續,隨着鋪租急跌,核心區吉鋪陸續被「填上」,旺角西洋菜南街繼早前一個地鋪獲美容店進駐,毗鄰地鋪亦成功租出,新租客為鐘表店,月租約15萬,平均呎租約200元,較舊租金急挫約60%,並重返16年前水平。

上述為西洋菜南街67號地下,面積約900方呎,交吉逾一年,剛由鐘表店承租,市場消息透露,最新月租15萬,平均呎租約167元,該鋪舊租客為連鎖時裝店Wanko,2019年時續約時月租38萬,租約至今年首季,惟於去年中提早遷出,最新租金急挫約60%,較高峰期更回落約74%。

每月租金15萬

最新進駐的叫「鎣時計」,售賣時尚鐘表,價格大眾化,與主攻遊客的奢侈品鐘表並不同。該核心區鋪早年很搶手,去年中至今罕有丟空,早於十年前租客為雞仔嘜,直至2015年月租55萬,由威高國際以每月57萬搶租,由旗下Colourmix進駐,大做遊客生意,亦是該鋪位史以來最高租金。隨後好景不常,隨着市況回落,於2019年續租時,月租減至38萬,威高國際引入旗下的Wanko時裝,該品牌主攻本地客生意,直至去年中撤出。

據土地註冊處資料顯示,上址業主於2010年1月以約1.43億購入,以公司名義LEIGH HUNG SING LIMITED持有,以最新租金計算,回報不足2厘。

回報不足兩厘

上述為西洋菜南街69號地下及閣樓,面積約900方呎,閣樓約700方呎,交吉一年,市場消息透露,剛以約18萬獲美容中心承租,呎租約200元,該鋪舊租客THE SWATCH GROUP (HONG KONG) LIMITED,2013年以月租68萬進駐,2016年時續約時月租45萬,租約至今年8月,惟去年7月提早遷出,最新租金急挫約60%,較高峰期更回落約74%。

據土地註冊處資料顯示,上址業主於2007年以約1.12億購入,以公司名義TOP RAINBOW LIMITED (高虹集團有限公司) 持有,註冊董事為莫姓人士,以最新租金計,回報僅1.9厘。

(星島日報)

代理:工廈受惠「活化計畫」延期

自從工商鋪辣稅撤銷後,市場買賣增加,特首發表任內最後一份《施政報告》,將活化工廈2.0延長,進一步利好工廈,今年以來,市場共錄17幢工廈成交,包括屯門東亞紗廠工業大廈全幢,涉資高達22.4億,今年工廈成交數目,遠超於2020全年的約7宗,後市看高一綫。

有代理表示,活化工廈2.0計畫今年10月到期,《施政報告》落實延長兩項活化工廈政策至2024年10月,包括放寬工廈重建地積比率以及免收豁免整幢工廈改裝所產生的地契豁免書費用,令發展商及財團對大型工廈重建保持信心。事實上,今年首三季錄約17宗全幢工廈買賣,遠超2020全年的約7宗;投資者積極購入一籃子工廈,證明大型工廈項目投資價值受肯定。

今年暫錄17幢工廈成交

該代理續指,《施政報告》亦提出增強香港與內地的交通連繫,包括探討北環綫及東鐵綫延伸,預計有利物流業發展,工廈需求將持續穩健,其中預計新界西如上水、粉嶺、屯門及元朗的工廈、地皮以及倉地會備受大投資者追捧;繼而令新界可發展工業用地減少,投資者及財團有機會轉向葵荃區工廈尋寶。

另一代理表示,政府進一步擴大跨境人民幣資金雙向流通管道、考慮稅務寬減以吸引企業來港設辦公室等,對中資企業吸引力上漲,增加對核心區商廈需求,有助刺激價格。代理續指,研究降低強拍門檻有利工廈之外,港島區一帶乙丙級商廈亦會受惠,吸引發展商及財團收購。

乙丙商廈料成收購對象

代理表示,強拍門檻若降低,對鋪市有正面影響,加上以油麻地及旺角先行,隨着更多舊樓重建,鋪位減少,帶動價格上升。

(星島日報)

新藝工廈10%業權放售意向1.55億減價14%

小西灣新藝工業大廈一籃子貨,涉及大廈近10%業權,意向價1.55億,呎價約4019元,較早前放售價調低約14%,買家料回報約4厘水平。

總樓面3.85萬呎

代理表示,小西灣安業街3號新藝工業大廈共11個單位,分布於5、7、9及10樓,總樓面積約38566方呎,佔新藝工業大廈近一成業權,現以意向價約1.55億出售,平均呎價約4019元。

該代理稱,物業現已全數租出,租客以經營倉存行業為主,總月租收入約52萬,按此計算,回報高達4厘,極其適合投資者購入作中長綫投資。代理補充,項目曾於去年底推出市場放售,當時意向呎價約4685元,今次業主調低叫價約14%,以提升租金回報,增加物業競爭力及吸引力。

連約回報料四厘

據大型代理行資料顯示,該工廈近期頻錄租賃成交,其中,該項目高層A室,面積3220方呎,於今年5月以4萬租出,呎租約12元;另一承租個案為中層F室,面積3700方呎,於今年4月以3.8萬租出,呎租約10元。

代理補充,位處新藝工業大廈斜對面,新業街5號王子工業大廈於今年中錄得1宗逾億元成交,涉及樓層為5層全層、天台連車位,總成交額約1.597億元,據悉買家為迷你倉公司,證明小西灣一帶工業物業的投資及自用價值均受肯定。

新藝工業大廈周邊重建發展項目林立,最矚目的由太古地產及中華汽車共同持有柴灣道391號住宅項目,前中巴車廠原址,毗鄰新藝工業大廈,落成後該地段人流料大增。此外,毗鄰新藝工業大廈旁,由新地早年發展的數據中心iAdvantage租務暢旺。

(星島日報)

Sheung Shui flats snapped up amid Metropolis heat

Tai Hung Fai Enterprise's Sheung Shui low-priced residential project Artique sold out in 90 minutes flat yesterday, amid speculation over the government's Northern Metropolis development plan.

The 30-home project is considered to have the smallest floor plan available in the Northern district, with prices as low as parking spaces in private housing estates.

It consists of 24 studios and six one-bedroom flats with areas from 138 square feet to 259 sq ft. The discounted selling price ranged from HK$2.43 million to HK$5.12 million, and the average discounted price was HK$18,454 per sq ft.

Artique is Tai Hung Fai's second residential development project after the 2014-completed Kadoorie Lookout in Ho Man Tin. The six-story development was built on the site after bidding HK$131 million in 2017, with an average price per square foot of about HK$14,000. It was 32 percent higher than the market valuation of HK$10,700 and set a new high in Northern district at that time.

However, the market valuation of all the 30 flats in Artique was about HK$100 million, which was half of the estimated total investment amounting to nearly 200 million, the developer said.

Tai Hung Fai Enterprise was founded by billionaire businessman Edwin Leong Siu-hung. It has an extensive portfolio of retail shops, hotels, service departments, office and industrial buildings. Leong is the son of Henry Guthrie Leong, a renowned Jardine Matheson comprador back in the 20th century.

In Tseung Kwan O's Lohas Park, LP10 sold 44 flats yesterday, accounting for 27.8 percent of the 158 units offered in the latest round of sales.

Co-developed by Nan Fung Group and MTR Corporation (0066), the project has sold 722 units in the five rounds of sales so far, which account for more than 80 percent of the 893 flats provided in the development, and cashed in a total of HK$8.3 billion, said the developers.

In Fo Tan, the Arles, developed by mainland China's Centralcon Properties, released the second price list, which offered 134 units, including 33 one-bedroom units, 48 two-bedroom units and 53 three-bedroom units.

The discounted prices were from HK$6.39 million to HK$23.5 million.

Meanwhile, sluggish demand from buyers in the secondary market continued. One deal was recorded among a property agency’s top 10 housing estates over the weekend.

The figure fell 75 percent from the last weekend where Mei Foo Sun Chuen in Lai Chi Kok was the only housing estate with a successful transaction.

Property agency said that the adverse weather brought by typhoon Lionrock deterred buyers from viewing flats during the weekend, despite the clearer market sentiment after the Policy Address.

(The Standard)新文華中心三單位意向價1838萬起

代理表示,尖沙咀新文華中心3組單位,面積約1671至6715方呎,售價約1838萬元起;業主接受獨立或一併出售,同時亦接受以買賣公司股份形式進行交易。

入場單位為B座低層03室,面積約1671方呎,意向呎價約1.1萬元,涉及總額約1838萬元;單位現收月租約4.8萬元。

B座高層06至08室,面積約6715方呎,同樣以呎價約1.1萬元放售,總意向價約7386.5萬元;物業月租約20.6萬元。

另一個放售單位則位處A座中層18至20B室,面積約5250方呎,意向呎價約1.3萬元,意向價約6825萬元。

(信報)

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

Hong Kong homebuyers snap up all flats in ‘Northern Metropolis’ district in first weekend sales after Carrie Lam’s policy address

Developer Tai Hung Fai Group Holdings sells all 30 flats at Artique development in Sheung Shui, a district that is part of Lam’s proposed Northern Metropolis

Weekend property sales, usually held on Saturdays, were postponed this weekend after the city’s first typhoon signal No. 8 of the year

Hong Kong’s first weekend property sale after Chief Executive Carrie Lam Cheng Yuet-ngor’s policy address was mixed, as homebuyers snapped up all the flats in Sheung Shui, which is part of a new proposed “Northern Metropolis”, but were less enthusiastic about flats in Lohas Park from an earlier project.

Developer Tai Hung Fai Group Holdings had on Sunday evening sold all 30 flats at its six-storey Artique development in Sheung Shui, a district that is part of Lam’s proposed Northern Metropolis. The project received about 850 registrations of intent, or around 28 bids for each available flat, according to agents.

“The new Artique project in Sheung Shui has received a boost from Chief Executive Carrie Lam’s proposal, which has generated some excitement among prospective homebuyers in the area,” property agent.

Weekend property sales, usually held on Saturdays, were postponed this weekend after the city’s first typhoon signal No. 8 of the year was hoisted. All typhoon signal warnings were cancelled on Sunday, as Tropical Storm Lionrock moved away from the city.

Hong Kong’s border area with mainland China will be built into the new Northern Metropolis of 2.5 million people in 20 years, according to a blueprint laid down by Lam in her policy address on Wednesday. It will include a “Silicon Valley” that will closely interact with neighbouring Shenzhen.

Upon the full development of the metropolis, up to 926,000 flats, including the existing 390,000 homes in Yuen Long and North districts, will be available to house a population of about 2.5 million, Lam said.

The metropolis will include Tin Shui Wai, Yuen Long, Fanling and Sheung Shui, along with six new development areas under planning or construction.

It will also involve a new cross-border railway linking the city to the Qianhai economic zone in Shenzhen, and an extension of a local northern rail link that is expected to stimulate development across Hong Kong’s hinterland.

“The flats in Sheung Shui are very attractive to prospective homebuyers, as it is very difficult to find new flats for around HK$2 million (US$256,924),” agent said.

The flats range from 138 sq ft to 259 sq ft in size and cost between HK$2.42 million and HK$5.12 million after discounts of up to 12 per cent. Their average price is HK$18,454 per square foot, about 20 to 38 per cent higher than the secondary transaction prices of HK$13,320 to HK$15,340 per square foot in the area.

The strong sales in Sheung Shui came after the city’s development minister said that property developers could be required to build flats of at least 200 sq ft. Secretary for Development Michael Wong Wai-lun made the suggestion on Friday as he acknowledged cramped living spaces were a “pain point for society”. While he did not specify what the minimum size would be, he noted recent suggestions of setting the starting point at 200 sq ft or 210 sq ft for the private sector.

Wong also said that new public housing flats could be 10 or 20 per cent bigger than their current size – but only more than a decade later when land supply was more abundant.

Meanwhile, Nan Fung Group and MTR Corporation had sold 44 of the 183 flats on offer at the LP10 project at Lohas Park in Tseung Kwan O as of 8pm on Sunday, according to agents. These flats included leftover units from previous sales, agents said.

These flats ranged from two-bedroom units to four-bedroom flats, with sizes ranging from 447 sq ft to 1,526 sq ft and prices starting from HK$8.23 million.

The sales of the LP10 project on Sunday were in line with expectations, as there have already been multiple rounds of property launches at Lohas Park, agent added.

LP10, the 10th phase of a massive development at Lohas Park, comprises 893 flats in total, with the first batch launched in January this year.

The fresh batch of 101 flats at LP10 was priced at an average of HK$18,751 per square foot after a discount of as much as 20 per cent. The latest price was 7.5 per cent higher than the previous launch price of HK$17,436 per square foot last month.

(South China Morning Post)英皇兩屯門工廈分拆重建

由英皇國際持有的屯門新安街兩幢工廈,即寶泰工業大廈和山齡工業大廈,去年1月獲批合併重建,最新向城規會遞交新發展方案,申請將上述兩工廈分拆作單獨重建,可建總樓面維持22.8萬方呎。

據城規會文件顯示,兩幢工廈地盤面積同為1萬方呎,同步申請放寬兩成地積比,由9.5倍增加至11.4倍發展,並分別重建為一幢樓高23層 (包括兩層地庫) 的新式工廈,可建總樓面約113991方呎,即兩廈重建後合共可提供約227982方呎工業樓面。

馬頭角幸福大廈新近向城規會申請放寬建築物高度限制,項目面積約21938方呎,申請放寬高度限制,由主水平基准以上15米及45米放寬至主水平基准以上100米,以地積比約11.839倍發展,擬議發展包括1座23層建築及2層地庫停車場,總樓面約259720方呎。

南華冷房申增發展

此外,金朝陽早前向鄧成波家族購入的葵涌南華冷房工業大廈,新近向城規會略為放寬兩成地積比率限制,據城規會文件顯示,地盤面積約19134方呎,申請放寬兩成地積比率,由9.5倍增加至11.4倍發展,計畫興建一幢樓高27層 (包括2層地庫) 的新式工廈,可建總樓面約218129方呎。

觀塘振業工廠大廈,新近向城規會申請放寬地積比率及建築物高度限制,地盤面積約11053方呎,申請放寬地積比率約20%發展,由12倍增加至14.4倍,而建築物高度由主水平基準以上100米申請放寬至125.9米,即增加約25.9%,重建為一幢樓高28層 (包括1層空中花園/防火層,另有4層地庫) 的商廈,涉及可建總樓面約159168方呎。

(星島日報)

興迅廣場兩單位連租約放售

代理表示,長沙灣興迅廣場2個單位連租約放售,面積分別約4699及2622方呎,售價約3900萬及2176萬元,呎價均約8300元。

該行表示,單位擁有4.2米特高樓底,空間感倍增。物業備有2部載客電梯及1部載貨電梯,用戶上落非常方便。

(信報)

聯想11萬租栢麗大道複式舖 首設街舖專門店 較高峰租平71%

尖沙咀昔日一線購物地段栢麗購物大道空置率高企,導致租金大跌,早前街內「頭段」位置甚佳的兩個打通相連舖位以35年前月租25萬元租出後,為同街舖位租金確立新指標,並陸續錄得長租約租賃成交。同位於「頭段」的一個複式舖位,最新以每月11萬元獲中國科企巨頭聯想 (Lenovo) 承租,開設首間街舖官方專門店,租金較高峰期大瀉逾71%。

市場消息指出,尖沙咀彌敦道111至181號栢麗購物大道地下G21號舖及1樓11A號舖,地下建築面積約766方呎,1樓建築面積約766方呎,合共建築面積約1532方呎,已丟空約兩年,終以每月11萬元租出,呎租約71.8元,租期為兩年。

處同街「頭段」 毗鄰港鐵站

是次新租客為聯想,用作開設官方專門店。資料顯示,現時聯想在港只設有一間官方專門店,位於銅鑼灣渣甸街的樓上舖,今次屬首度進駐街舖開店。

是次聯想租用的舖位處於栢麗購物大道的「頭段」位置,較接近尖沙咀港鐵站,鄰近舖位多由連鎖店或珠寶金行承租,人流屬整條栢麗購物大道較旺的一段。

該舖1998年起由連鎖鞋店Mirabell承租多年,期間曾有數年由其他商戶租用,但亦間斷地在此舖經營約15年,最後一份租約月租為38萬元,呎租達248元。惟該品牌在2019年租約期滿後不再續租,舖位交吉兩年才再度租出,惟新約月租急跌27萬元或71.1%。

翻查資料,該舖在1986年物業落成時,由渣打銀行以每月9.5萬元承租,呎租約62元,即現租金較35年前僅略高1.5萬元或15.8%。

至於相隔上址一個舖位的G23號舖及1樓12A號舖,地下建築面積約651方呎,1樓建築面積約671方呎,合共建築面積約1322方呎,最近亦成功租出,由銷售翡翠珠寶的「潮州佬」以每月9.5萬元承租3年,呎租約71.9元。

據了解,此舖原由時裝店租用,月租最高曾達33萬元,每呎約250元,如今租金較高位下挫23.5萬元或71.2%。代理指出,舖位今年初曾以每月6萬元短租形式租出,現時長租租金回升58.3%。

附近舖主接受議價 租賃轉活

栢麗購物大道租賃突趨活躍,除因為消費市道回穩外,與業主接受大幅議租亦有直接關係。

8月栢麗購物大道位置更佳的地下G9、G10號舖連1樓5號舖,地下建築面積共1411方呎,1樓建築面積1357方呎,合共建築面積2768方呎,由連鎖珠寶金行謝瑞麟 (00417) 以每月25萬元租用3年,呎租約90元,租金與1986年的水平一樣,令街內不少業主接受以相若呎租水平與長租客洽租,促使交投加快。

(信報)

Minister floats idea of setting minimum size for nano flats in space-starved Hong Kong

Acknowledging cramped living spaces are ‘pain point for society’, development chief says government could limit how small new flats can be

While Michael Wong does not give exact figure, he notes suggestions of setting starting point at 200 sq ft

Hong Kong could require property companies to build flats measuring at least 200 sq ft, the development minister has said, but even that size is much smaller than the bare minimum recommended by a government adviser and a research group.

Secretary for Development Michael Wong Wai-lun made the suggestion on Friday as he acknowledged cramped living spaces were a “pain point for society”. While he did not specify what the minimum would be, he noted recent suggestions of setting the starting point at 200 sq ft or 210 sq ft for the private sector.

“There are still many factors to think about, but we will consider doing it in future,” he said at a press conference.

Wong also said that new public housing flats could be 10 or 20 per cent bigger than their current size – but only more than a decade later when land supply was more abundant.

Introducing a minimum in private construction and increasing the size of public flats demonstrated the government’s commitment to fulfilling Hongkonger’s hopes of more living space “was not empty words”, Wong said, adding: “We can do it, but it will take time.”

With just 1,114 sq km (275,280 acres) for 7.5 million people, Hong Kong has long struggled to find land for housing.

The median floor area per capita is 161 sq ft, based on the 2016 census, and as home prices continue to outpace what most people can afford, developers have turned to building smaller flats.

A report by Liber Research Community, a civic group that focuses on housing and land issues, found that private developers built 10,900 nano flats – which the group defines as ones not bigger than 260 sq ft – over the past decade. They made up 10 per cent of the new homes last year.

But the flats often lack an enclosed kitchen or bedroom, and in many instances, do not have any windows in the bathroom.