指標甲廈交投按年急跌54% 代理:首九個月僅錄52宗

受疫情等負面因素,甲廈市場交投急速放緩。據代理資料顯示,50大甲廈於今年首9個月僅錄52宗成交,較去年同期的114宗急跌約54%。

綜合代理的數據顯示,9月份50大指標甲廈合共錄得8宗買賣,較8月的修訂數字增加3宗,亦是近4個月以來的新高,最新的成交面積約1.79萬方呎,按月上升約121%。

上月錄八宗成交

上月的買賣個案分布較為平均,面積介乎數百至數千方呎不等,地區集中於九龍,當中不乏短綫買賣,是近期較罕見的情況。

交投集中九龍區

總計今年首9個月,指標甲廈共錄得52宗買賣,較去年同期的114宗急跌約54%,與商廈市道暢旺時,例如2017年3月單月錄得53宗相比,更顯出今年以來甲廈交投十分淡靜。

9月份買賣主要集中於九龍區,期內共錄5宗,至於港島及新界區,分別各錄1宗及2宗買賣。上月港島區的成交來自金鐘力寶中心1個單位,以逾億元易手,是今年分層甲廈罕有錄得逾億元的買賣個案。此外,9月份錄得「零」成交的甲廈共有44座,較8月的46座稍為減少。

尖區錄短炒個案

代理表示,本港第三波疫情緩和,加上個別業主願意擴大議價空間,令上月的指標甲廈交投略為增加。隨疫情再次出現緩和,預計第四季甲廈租售價跌勢有望開始喘定,如果市場未出現更多壞消息,租售價料平穩。

市場資料顯示,今年甲廈錄首宗短炒個案,康宏廣場20樓9至11室,面積約2842方呎,望維港景,今年7月由投資者以每呎1.25萬購入,低市價20%,涉資3552.5萬,買物業,上月以賣公司沽貨,平均每呎1.58萬,涉資4490.36萬,帳面獲利937.86萬,物業升值約26%。

(星島日報)

更多力寶中心出售樓盤資訊請參閱:力寶中心出售

更多康宏廣場出售樓盤資訊請參閱:康宏廣場出售

山頂文輝道地估值86億

政府今季僅推出2幅住宅地招標,最矚目為重推山頂文輝道地王,並「一拆二」、細分兩幅土地出售。

拆細重推招標

山頂文輝道地皮2、4、6、8、9及11號,前身屬於政府高級公務員宿舍,是山頂最高地段,該地皮曾於於2018年10月時流標,整幅地皮佔地18.9萬方呎,可建樓面約40.4萬方呎。而是次拆細重推,季內推招標的地皮,佔地逾13.4萬方呎,可建樓面約28.7萬方呎,可建約240伙,最新市場估值介乎約86億至112億,樓面呎價約3萬至3.9萬。

有測量師表示,該地皮將分拆為兩部分出售,可降低投資總額及減低流標風險,相信能吸引更多發展商入標,惟地價會有折讓,難創新高;而率先推出招標的地盤面積佔原先地皮的七成,佔比較大。

(星島日報)

上月50大甲廈成交創4個月新高

本港第三波新冠疫情有所緩和,加上寫字樓物業價格普遍累積一定跌幅,吸引部分投資者入市,令指標甲廈交投略為反彈。代理資料顯示,9月50大指標甲廈合共錄得8宗買賣,按月增加3宗,亦是近4個月以來的新高。

代理數據顯示,9月指標甲廈共錄得8宗買賣個案,較8月的5宗略為上升,最新的成交面積約1.79萬方呎,按月上升約1.21倍。上月的買賣個案分布較為平均,面積介乎數百方呎至數千呎,地區則集中在九龍區,當中不乏短線買賣獲利個案,是近期較罕見的情況。

9月買賣成交主要集中於九龍區,期內共錄得5宗;港島及新界區,分別各錄得1宗及2宗買賣。上月港島區的成交來自金鐘力寶中心一個單位,以逾億元易手,是今年分層甲廈罕有錄得逾億元的買賣個案。此外,9月錄得零成交的甲廈共有44座,較8月的46座稍為減少。

總計今年首9個月,指標甲廈合共僅錄得52宗買賣,按年急跌約54%,與商廈市道暢旺時,例如2017年3月單月錄得53宗相比,更顯出今年以來甲廈交投十分淡靜。

代理表示,本港第三波疫情緩和;加上個別業主願意擴大議價空間,令到上月的指標甲廈交投略為增加,但仍然屬於個位數的甚低水平。由於本港經濟前景疲弱,加上政治氣候不明朗,削弱本港的營商環境,令寫字樓市場表現持續未見突破。

展望未來,該代理認為,本港疫情再次出現緩和,如果本港稍後可以恢復局部通關,內地資金或會重新投入市場,令交投有所反彈。該代理又預計,第四季甲廈租售價跌勢有望開始喘定,如果市場未再出現更多壞消息,租售價可保持平穩。

(信報)

更多力寶中心出售樓盤資訊請參閱:力寶中心出售

Travel clamp boosts home deals

Property agency recorded 36 secondary transactions at ten blue-chip housing estates over the four-day weekend.

Only Mei Foo Sun Chuen in Lai Chi Kok reported no deal, according to the agency.

Meanwhile, the number of transactions at the ten major estates was 15 over the past two days, down by one from a week before.

Restrictions on outbound travel stimulated home viewings and transactions in the secondary market over the four-day weekend, property agent said.

In the secondary market, a 717-sq-ft flat at Taikoo Shing in Quarry Bay changed hands for HK$13.55 million, or HK$18,898 per sq ft, after HK$850,000 was cut from the original asking price.

In Kwun Tong, a 687-sq-ft flat at Laguna City fetched HK$12.08 million, or HK$17,584 per sq ft.

In Tin Shui Wai, a 552-sq-ft flat at Kingswood Villas sold for HK$5.45 million, or HK$9,873 per sq ft, after HK$550,000 was cut from the first asking price.

In Sha Tin, a 304-sq-ft flat at City One Shatin is available for sale for HK$6.2 million, or HK$20,394 per sq ft, after HK$400,000 was cut from the initial asking price.

In Tseung Kwan O, a 406-sq-ft unit at Metro City fetched HK$7.26 million, or HK$17,882 per sq ft.

In Pok Fu Lam, an 844-sq-ft flat at Residence Bel-Air changed hands for HK$22.4 million, or HK$26,540 per sq ft.

In the primary market, a homebuyer forfeited deposits of HK$220,000 after walking away from the purchase of a 238-sq-ft flat at Emerald Bay Phase 2 in Tuen Mun. The flat was offered at HK$4.32 million.

Wheelock Properties collected about HK$143 million after selling 12 flats at seven projects in Tseung Kwan O over the past four days.

In the commercial property market, another property agency recorded eight transactions at 50 major Grade A office buildings last month, compared to five transactions in August. That hit a four-month high but remained at the single-digit level, amid political uncertainties and a bleak economic outlook, agent said.

The number of transactions of the major Grade A office buildings slumped by 54 percent year-on-year to 52 in the first three quarters.

(The Standard)

Hong Kong’s home rental market faces tough fourth quarter as recession makes redundancies more likely

With many companies reliant on government handouts to stay afloat, more redundancies are likely in the next six months, which will dent local housing demand, property agency said

Landlords have been trying to boost demand by offering incentives other than direct reductions in rent, according to property agents

Hong Kong’s residential leasing market will be under pressure in the last three months of this year as the traditional low season coincides with the worst recession

in decades, property agents said.

With many companies reliant on government handouts to stay afloat, more redundancies are likely in the next six months with obvious negative implications for local housing demand, according to property agency.

“The rental market still seems precariously balanced as tenants and landlords face uncertain prospects,” agent said. “We expect the final quarter of 2020 to present further challenges.”

The official rental index in August was down 9.2 per cent from its peak a year earlier, according to data from the government’s Rating and Valuation Department. Monthly rents for apartments have been dropping steadily.

A flat measuring 551 square feet with three bedrooms at Kingswood Villas in Tin Shui Wai was leased for HK$10,000 (US$1,290), or HK$18.1 per sq ft, last week, according to property agent. That compares with the usual HK$10,500 to HK$13,500 monthly rent for flats in that area.

A tiny apartment at Ava 61 in Cheung Sha Wan was leased for just HK$8,000 last month, 12.5 per cent lower than the market rate, another agent.

Landlords have been trying to boost demand by offering incentives other than direct reductions in rent, agents said.

“Landlords and tenants are learning to navigate the current uncertainty with one-year leases, early handovers and rent-free periods,” agent said. “The fourth quarter is likely to see more challenges and we expect rents to soften further.”

Another agency has also seen more landlords willing to provide incentives to attract tenants, rather than lowering the asking rent.

“Prices will still be under pressure because of protracted unfavourable factors, including the weak economy and rising unemployment rate, which might erode affordability over time,” agent said.

Town house rents slipped by 0.8 per cent in the third quarter, representing a sixth consecutive quarter of decline, according to property agency.

Ina Chan, the third wife of the late gaming tycoon Stanley Ho, recently leased a house at Unir Garden in Shek O measuring 2,564 square feet to Harry Lee, a member of the controlling family of Hysan Development, for HK$135,000 a month, about a third less than the rate in 2013, according to Land Registry records.

Luxury residential rents traditionally mirror movements in prime office rents in Central, where rates have fallen and vacancy has been creeping up, according to agency.

Serviced apartments have offered a series of promotions to rescue shrinking occupancy levels, such as flexible lease terms, according to the agency. They are popular given concerns over the tough operating environment faced by many businesses.

Some hotel-like apartments offer ‘two for one’ deals – a two-month stay for the price of one. Rents in this segment are continuing to drift downwards.

Activity in Hong Kong’s overall property sector is picking up speed, according to property agency.

The agency expects the total number of property transactions, including homes, parking spaces, retail, commercial and industrial properties to reach 6,500 in September, up 20.6 per cent from August.

(South China Morning Post)

接管人保華指高銀賣總部無效

高銀 (00530) 總部所在、子公司賜譽持有的九龍灣高銀金融國際中心,早前遭接管人保華顧問委託代理放售,然而高銀9月30日於業績公告中提及,疑「搶先」以總作價143億元,向獨立第三方出售持有賜譽100%股本的成美及Goal Eagle。就此,保華昨天致函代理,強調高銀有關公告內容存在缺陷,包括並不會影響賜譽旗下九龍灣物業的擁有權變更;又指高銀聲稱的交易,明顯破壞賜譽發行68億元浮息優先抵押票據的責任。

致函代理繼續放售

保華向代理確認,九龍灣物業正由保華一方接管,高銀正進行的交易無論如何都不會影響該物業買賣,成美及Goal Eagle均沒有權力出售賜譽或有關物業。保華表明,賜譽及該物業現時並非由高銀、成美或Goal Eagle控制,而是由接管人掌管;接管人是唯一處理賜譽及該物業事務的代表,高銀的交易並未徵詢接管人及未有得到其同意;接管人由德意志信託香港委託,現時該物業實際權益應歸於德意志信託香港;該代理仍為物業獨家銷售代理。

保華上月中就其作為賜譽接管人權力的頒令發出原訴傳票,9月25日法院判定,在10月29日作出裁決之前,保華有權行使賜譽與德銀訂立的抵押協議,以及股份押記項下授予他們的權利及權力,直至被合法免職,意味最終由哪一方持有賜譽及九龍灣物業,仍有待本月底法院裁決結果。

(信報)

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

接管人保華指高銀無權出售高銀金融國際中心 143億易手羅生門

高銀金融其總部所位處的九龍灣高銀金融國際中心,早前被接管人接管及放售,高銀隨即擬以一百四十三億元,將之有條件售予獨立第三方;不過,身為接管人的保華顧問,昨日強調高銀無權出售高銀金融國際中心,令到該宗買賣形成羅生門事件。

代理負責招標意向120億

身為接管人的保華顧問,就日前高銀金融公布作回應,保華顧問董事總經理保國武昨日發信給代理,指高銀及其附屬公司成美及Goal Eagle,無權出售有關物業,接管人唯一代表,以及委託該代理為獨家代理,負責招標出售該全幢商廈事宜。

高銀抵押旗下的高銀金融國際中心舉債,早前遭債主德銀委託保華顧問放售持有該廈的子公司賜譽,意向一百二十億元,惟高銀周三公布,直接向獨立第三方出售持有賜譽百分百股本的成美及Goal Eagle,並於周二訂立臨時買賣協議,總作價一百四十三億元。

高銀金融國際中心於二○一六年竣工,樓高二十八層,佔地面積約七萬一千零四十二方呎,總樓面約八十五萬二千多方呎,現時出租率約七成六,除了高銀集團總部外,租客包括珠寶、金融、零售服務行業,代理指項目意向約一百二十億元,呎價約一萬四千元。

(星島日報)

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

核心區商場空置率逾10% 代理:疫下租戶頻撤出

今年以來在疫市下,遊客「消失」,本地零售消費亦疲弱,導致商場生意大減,租戶頻撤走,代理指出,全港商場空置率增加,其中,核心區商場空置率更攀升至逾10%。

代理指出,過往10年,遊客購物消費平均約佔本港零售總額約三分之一,但自從政府於3月起限制非香港居民訪港,該項消費不再存在。該行追蹤40個商場貿易及租戶組合數據顯示,全港商場總體空置率已由2018年9月2%,增長至今年9月的7%,由於一些主力租戶,通常是中檔時裝品牌和傳統中餐廳撤租,導致新界區商場空置率高達12%。核心地段,尖沙嘴海港城、銅鑼灣時代廣場及沙田新城市廣場,這些等受內地遊客青睞的商場,空置率短短數個月,攀升至逾10%。

本地客流主導市場

該代理行發布第三季零售租賃報告,今年7月和8月零售,銷售降速趨緩,酒吧、食肆等受限聚令制約客流及營業時間,餐飲業受到嚴重衝擊,不過,由於一些商場受業主提供的激勵措施刺激,以及9月初政府放鬆限制措施,8月下旬及9月周末均錄大量本地客流,部分奢侈品牌店鋪及餐館更有人排隊。

第三季零售觸底反彈

在今年首七個月內,本地需求保持相對穩定,創造1800億零售銷售額。第三季度末,零售市場有觸底反彈迹象,本地餐飲連鎖店於將軍澳等民生區拓展,日用雜貨類零售商則於核心區包括中環,以及非核心區尋求擴張,服裝化妝品及珠寶鐘表等持續受挫,7月按年跌44%至54%不等。

零售租金於第三季跌勢減少,其中核心區鋪租按季跌2%,商場租金穩定,業主傾向與現有租戶續約,並願意提供多達30%租金優惠,而一年期租約亦日趨普遍。

代理表示,雖然零售業短期交出好成績,但9月下旬表明市場正在好轉,進入一個新常態。

(星島日報)

更多時代廣場出租樓盤資訊請參閱:時代廣場出租

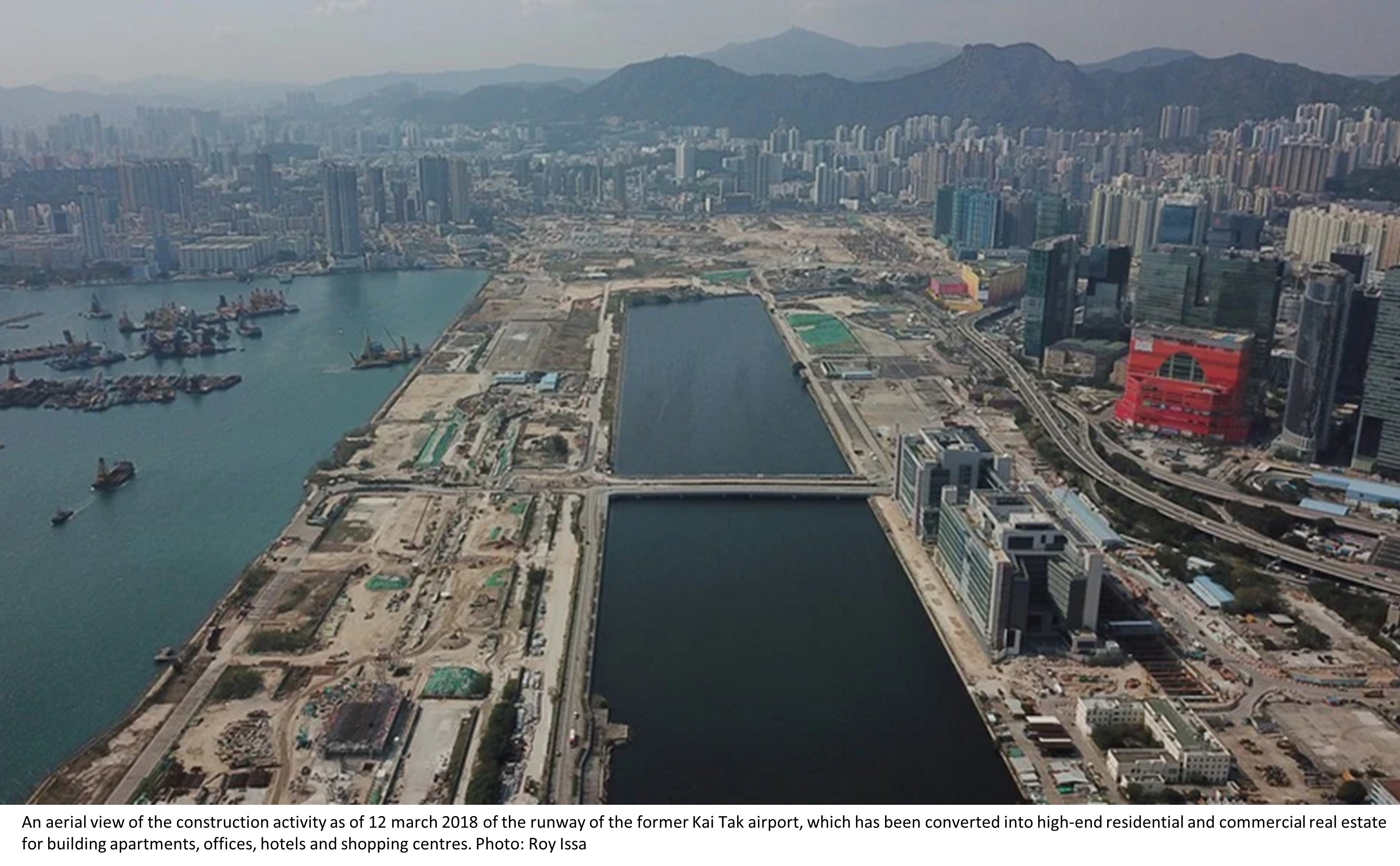

啟德地估值34億

作為新盤供應重鎮的啟德區,再有地皮於季內推出招標,為啟德第4E區1號用地,該地位於舊跑道區,可享內港景,前臨九龍灣商貿區。業界人士指,估計該項目日後落成後周遭亦發展成熟,料吸引本地大型發展商及中港合組財團競投,最新估值介乎34億至41億。

每呎估價1.05萬至到1.25萬

近年土地供應較多的啟德區,於季內推出的4E區1號用地,位處舊機場跑道西北端,屬該區尾段位置,可享內港景,前臨九龍灣商貿區。該地佔地面積約5.97萬方呎,以地積比率約5.5倍發展計,可建樓面約32.84萬方呎,涉及約390伙。最新市場估值介乎34億至41億,即每方呎樓面地價約10500至12500元。

有測量師表示,該地皮發展規模適中,而且啟德為近年供應重心,坐擁基建優勢,發展漸趨成熟,而屯馬綫1期早前亦已通車,帶動區內住宅需求。

(星島日報)

恒基高價併購西半山舊樓

整體樓市氣氛持續好轉,財團不惜以高價併購餘下單位,以統一業權發展。由恒基申請強拍的西半山翡翠園,具有新進展,新近斥4016萬增購1伙高層戶,成交價高於2年前「樓上樓下」單位約17%。

翡翠園高層4016萬沽

市區舊樓有價,恒基早於去年7月已申請強拍翡翠園,但發展商作兩手準備,一面仍向餘下單位業主商討購入單位,新近該財團就斥資4016.23萬高價增購1伙高層戶。

較兩年前高17%

是次收購單位為7樓F室,面積1240方呎,以4016.23萬成交,呎價約32389元;對比2年前收購的樓上及樓下單位,當時成交價3427.2萬,事隔2年,收購價高出約17%。事實上,恒基早於2018年開始收購翡翠園,去年向土地審裁處申請強拍,當時集齊逾80%業權,市值超過12.8億。

另外,一級歷史建築物北角舊皇都戲院大廈,今年8月獲土地審裁處批出拍賣令,底價逾47.74億,創歷來金額最多的強拍底價紀錄,當時集齊逾98%業權,餘下5個單位並未收購,部分屬失蹤小業主或未能聯絡上。最新消息指,項目將於本周四舉行強拍,以統一業權發展。

皇都戲院大廈周四強拍

事實上,皇都戲院前身為璇宮戲院,於1952年落成,而戲院頂部採用「拱橋式建築」設計,被評為是全球獨一無二的設計。另外,戲院的外牆有一幅名為《蟬迷董卓》的浮雕,出自中國畫家梅與天之手,將中國筆觸融入西洋畫,結合中西文化特色,具有保育價值,並在2017年獲古諮會評為一級歷史建築物。

(星島日報)

租金下調 品牌趁機核心區擴充

疫情下核心區舖位租金明顯調整,隨着近期疫情有放緩迹象,個別零售商進行搬遷,亦有品牌趁機擴充,令近期核心區租務略為回升。

核心區交吉舖位仍多,租金向下,9月份似乎整體租務活動略好轉,核心區主要地段錄得商舖租務成交。以銅鑼灣為例,希慎廣場對出的啟超道及恩平道,先後錄新租務。其中恩平道50號地下,面積約700平方呎,獲便利店以約25萬租用,短期內正式開業。

舖位原由莎莎化粧品租用,月租約65萬元,去年品牌遷出,僅由手機配件店以約10萬元短租。按是次便利店以約25萬元租金計,租金跌逾6成。

啟超道7500呎舖 莎莎60萬租

另外,連接恩平道的啟超道,近日亦錄租務成交,涉及啟超道12號地下至4樓,面積約7,500平方呎,獲莎莎以約60萬元承租。該舖原租客為粵港澳湛周生生,租用物業多年,高峰期月租達150萬元,對上租金跌至約100萬元。

據悉,該珠寶行更租用比鄰啟超道14號地下及1樓,面積達3,000平方呎舖,組合成一個萬呎旗艦店。惟疫情衝擊下,品牌決定棄用12號全幢,如今由莎莎以60萬元租用,租金跌約4成。

至於旺角區,亦錄得一宗大額租務,運動服裝店Foot Locker在逆市下進行擴充,預租旺角家樂坊商場舖位,開設大型分店。涉及物業地下全層,面積約1.8萬平方呎。物業位於西洋菜南街及登打士街交界。

家樂坊地舖租金 跌約一半

事實上,今年零售受嚴重衝擊,逾百萬舖位租務成交個案極罕有,是次Foot Locker以200萬元租舖,已屬今年市場上最大手租務個案。該舖目前租客為H&M時裝,於2014年租用旺角家樂坊地庫至1樓,合共5.4萬平方呎樓面,月租高達900萬元。

據了解,H&M僅保留1樓全層,按地舖租值計,是次Foot Locker租金下跌約一半。

最近另一體育用品牌迪卡儂 (DECATHLON) 亦積極擴充,包括8月預租中環娛樂行地庫,面積約8,500平方呎,即將開業。月租約80萬元,較舊租跌約7成。

疫情下旅客近乎零,零售商生意急挫,紛減核心區分店,令舖租明顯回調,吉舖數字上升。隨着第三波疫情放緩,個別零售商有見租金從高峰期回調5至7成,即重啟擴充,或同區搬遷。

(經濟日報)

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多旺角區甲級寫字樓出租出租樓盤資訊請參閱:旺角區甲級寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

荃灣Plaza 88 集購物商務一身

荃灣一帶近年隨不少住宅物業相繼落成,區內亦有不少商業項目落戶。億京發展旗下的Plaza 88,屬銀座式商廈,為區內提供商業新供應。

億京發展的荃灣西楊屋道88號綜合項目之商業部分早前正式命名為Plaza 88。項目由16層銀座式購物中心、19層辦公樓及1層空中花園組成,合共35層,總樓面面積逾642,000平方呎。

行人天橋連接多個屋苑

Plaza 88以玻璃幕牆設計,外形時尚,設有行人天橋連接多個已陸續入伙的新屋苑,包括於本年4月入伙的億京發展旗下映日灣。此外,項目鄰近不少商廈林立,形成周邊龐大消費力,當中中產專業人士及家庭消費群更為主要。億京發展瞄準該優質中產消費群,並銳意將Plaza 88塑造為荃灣全方位的Social Hub。

Plaza 88地下至18樓為購物中心,19樓為空中花園,20至39樓為寫字樓,合共提供樓面面積逾32.8萬平方呎的購物中心及樓面面積逾31.4萬平方呎的辦公樓空間,銳意成為集購物、娛樂、消閒、運動、親子、餐飲、商務一體的商業項目。項目停車場設於地庫兩層,提供逾370個有蓋車位,供辦公樓及購物中心顧客及用戶使用。

部分樓層設主題特色

Plaza 88位處荃灣西核心區域,為荃灣區內最高購物中心,坐擁青馬大橋及藍巴勒海峽怡人景觀,24小時荃灣架空行人天橋設於商場1樓,貫穿區內各大購物中心、車站及港鐵站,而荃灣西西鐵站與柯士甸西鐵站/高鐵站僅3個車站之距,往來各區方便快捷,亦同時與中港交通連接,由項目驅車至港珠澳大橋及香港國際機場約25分鐘,往來中環只需約15分鐘車程,荃灣西區完善交通配套帶動該區發展。

Plaza 88商場部分定位為銀座式購物中心,部分樓層更設計成主題特色樓層,為商場帶來多元特色並同時吸納人流。億京發展項目及銷售策劃總監潘志才表示,Plaza 88位處荃灣西,地點四通八達,加上近年不少新樓盤落成,該區不少中產年輕家庭或分支家庭遷入,大大提升區內消費力。

(經濟日報)

尖沙咀嘉芙中心全層 減價放售

隨着疫情有所緩和,最新確診個案持續回落,部分行業已陸續恢復開業,包括已停業兩個月的酒吧都可重開,為舖市帶來曙光。新近有業主乘利好消息,將意向價調低約225萬元,放售尖沙咀嘉芙中心高層全層,最新叫價約2,775萬元。

面積2832呎 叫價2775萬

代理表示,該獨家放售項目位於尖沙咀漆咸道南53至55號嘉芙中心13樓全層,面積約2,832平方呎,以每平方呎約9,800元放售,涉及金額約2,775萬餘元。物業連租約出售,現由酒吧以月租約7.5萬元租用,租期至2021年中,按此計算,新買家可享租金回報約3.2厘。

該代理指,業主於去年底原叫價約3,000萬元放售,是次下調意向價約7%,租金回報上升令物業更具競爭力。代理表示,嘉芙中心樓上租客多以酒吧為主,出租率約9成,相信在疫情消退後,主題大廈的協同效應會發揮所長,租務需求可望更趨穩定,極其適合購入作長綫收租投資之用。

代理續稱,嘉芙中心位處漆咸道南,屬尖東區主要街道,被商廈群包圍,屬上班一族消遣熱門去處。物業早前已完成全幢內部工程,配套上更見完善,為物業升值。代理續表示,最近工商舖物業按揭成數上限獲放寬,中細價物業備受追捧,而是次放售物業調整價格後,租金回報更為可觀,長遠而言核心商貿區物業投資價值優厚,預料會獲實力投資者洽購。

(經濟日報)

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

NWD closes in as State Theatre goes on sale for record $4.7b

The compulsory sale of the State Theatre building, which is mostly held by New World Development (0017), opens Thursday with a reserve price of HK$4.77 billion.

The price would be a record high for a compulsory auction in the city.

New World has already acquired 98 percent of the ownership of the historic building in North Point. It has pledged to preserve the 68-year-old property, which was not only a cinema but art and cultural venue. Following approval from the Lands Tribunal in late August, it is the first Grade I historic building to go on sale. Market watchers believe the valuation of shops in North Point could benefit from the sale.

Meanwhile, retail shop rents in have shown signs of stabilizing in the third quarter but vacancy rates rose sharply, according to a report by a property agency.

Prime street shop rents fell by 2 percent quarter-on-quarter. Although shopping center rents remained largely stable in the last quarter, the overall vacancy in 40 shopping centers surveyed increased more than two-fold from 2 percent in September 2018 to 7 percent in September this year, the report showed.

The vacancy rate of shopping malls in New Territories was the highest, with 12 percent. Some core shopping malls vacancy rates reached over 10 percent or above, such as Harbour City in Tsim Sha Tsui, Times Square in Causeway Bay, and New Town Plaza in Sha Tin.

This came as The Estate Agents Authority revealed that the number of licensed estate agents fell for a second consecutive month to 39,815 in September, dropping 43 from a month ago. The number of property agency branches in Hong Kong, however, rose for the fifth month to 7,061 ended September, the highest since last December.

In the primary market, New World Development expects to release the first price list for The Pavilia Farm at Tai Wai Station tomorrow and open show flats by Saturday at the earliest.

In the secondary market, a total of 22 deals in Yuen Long were recorded over the long weekend. There were four transactions for The Reach in Yuen Long. Among them, a 414-square-foot unit changed hands for HK$5.98 million, or KH$14,444 per sq ft.

Among other transactions , the father of actor Andy Lau Tak-wah bought a 1,981-sq-ft unit in Braga Circuit in Ho Man Tin for HK$38 million or 19,182 per sq ft. Andy Lau's house in Kadoorie Avenue is nearby, and the Lau family own at least three units in Ho Man Tin.

(The Standard)

For more leasing information of Times Square please visit: Leasing Information of Times Square代理:中環甲廈租金 全年跌25%

疫情衝擊商業市場,代理預計,今年中環甲廈租金全年跌幅高見25%,而環球疫情未受控下,調整期持續至明年。

調整期料持續至明年

代理提供的數字顯示,中區甲廈最新呎租約108.4元,跌幅約17%,而整體中環租金較2019年高峰期 (139.4元) 下跌22%。新需求減少而經濟轉差,退租樓面增至62.6萬平方呎,甲廈待租率升至11.6%,為2005年後新高。

代理指,環球疫情未受控,跨國機構乏擴充,後市要視乎疫情走勢。按目前情況,第四季甲廈租金仍跌5至10%,全年中環跌幅達25%。由於疫情加上中美關係緊張,影響甲廈需求,明年甲廈租金跌勢持續。

商舖方面,4大零售核心區空置率,第三季升至13.2至23.6%,而第三季核心區舖租跌幅由5.3至7.9%。該行香港商舖部主管林應威指,封關持續,旅客未重返香港,令核心區今年出現舖租調整。

(經濟日報)

第一集團千禧大廈 申建新工廈

工廈重建活躍,第一集團在今年3月疫情期間7.9億元購入的長沙灣工廈千禧大廈,最新向城規會申請放寬地積比率兩成,以興建1幢17.2萬平方呎的新式工廈。

上月申請重建比鄰工廈

該工廈位於長沙灣道924及926號,發展商指因應新推出的活化工廈政策,可申請額外增加2成樓面,故此申請以地積比率14.352倍重建,可建樓面約17.2萬平方呎,將會興建1幢27層高新式工廈,另設1層地庫。

至於該財團曾經在上月申請重建比鄰的長沙灣道916至922號工廈,同樣是重建成一幢27層高的商廈,總樓面約12.92萬平方呎。資料顯示,物業是第一集團於今年初時以6.4億元購入。

另外,活化工廈措施下,工廈收購重建增多。舖王鄧成波家族申請強拍葵涌永基路永昇工業大廈,現時持有逾9成業權,現時估值約3.86億元。

土地審裁處接獲今年第30宗強拍申請,涉及永基路26至30號永昇工業大廈,現為樓高約11層的工業大廈,於1979年落成,至今樓齡約41年,由鄧成波、鄧耀邦旗下的兩間有限公司收購至逾9成業權,並申請強拍。該工廈佔地面積約2.2萬平方呎,若果以放寬地積比率2成至11.4倍計算,即可建樓面約25.1萬平方呎。物業估值3.32億元。

(經濟日報)

粉嶺安樂門街工業地 估值最高9.5億

工業地市場需求增多,政府將於下季推出粉嶺安樂村安樂門街工業地,可建樓面約21.7萬平方呎,市場估值最高約9.5億元,每呎樓面地價約4,400元。

近期政府推出的工業地招標反應不錯,早前火炭的大型工業地獲中國移動 (00941) 以約56億元投得,遠高於市場估值5成,反映市場對於能夠作為電訊、數據中心等用途的工業地有相當需求。因此,發展局日前公布新一季度 (10月至12月) 賣地計劃的時候,除了推出住宅地之外,還推出粉嶺安樂村一幅工業地,屬於近兩年之內,同區再度有地皮推出。

可建工業樓面逾21.7萬呎

該幅用地位於安樂門街、安全街與安居街交界,屬於安樂村工業區的邊陲地段,鄰近是勉勵龍中心、有成行等,距離港鐵粉嶺站的位置亦相對較遠。地皮佔地約43,357平方呎,現時屬於「工業」規劃用途,估計地積比率約5倍,可建樓面約21.7萬平方呎。按照市場現時估值,用地估值約6.5億至9.5億元,每呎樓面地價介乎3,000至4,400元。

事實上,該幅安全街工業地在2018年7月由億京以約7.3億元投得,項目在去年獲屋宇署批出建築圖則,可興建1幢15層高 (1層地庫上) 新型工廈,涉及總樓面約30.18萬平方呎,若以中標價計算,每平方呎樓面地價約2,430元,估計主要作工業物流等用途,近年中、港兩地運輸及物流往來增多,預計落成後用戶來往上水、落馬洲及皇崗口岸等甚為方便。按用地的賣地地契條款,在不扣減可建樓面面積下需提供約118個車位的公眾停車場,估計地庫部分將用作公眾停車場,預計可為項目帶來額外的商業價值。

佳明兩地皮 擬發展數據中心

至於近期亦有發展商進駐買地發展數據中心,佳明公布,旗下兩間接全資附屬公司分別以約1.68億及約1.88億元,買入粉嶺安居街3號地皮及粉嶺安福街7號地皮。兩幅地皮面積分別約1.79萬及1.91萬平方呎,如果以地積比率5倍發展,經補地價之後,分別可以興建約8.95萬及約9.55萬平方呎樓面的工廈。據了解,佳明購入地皮後,將補地價發展數據中心。

(經濟日報)

銅鑼灣Oliv呎價2.06萬沽「物流張」持貨七年蝕3000萬

疫情重創鋪市,資深投資者亦減磅蝕讓沽貨。由「物流張」張順宜持有的銅鑼灣銀座式商廈Oliv中層全層,以約4000萬成交,持貨7年帳面勁蝕逾3000萬,創區內歷來同類最大金額蝕讓個案,幅度為44%。

市場消息指出,上述為霎東街15至21號Oliv中層全層,面積約1933方呎,以買賣公司形式,作價約4000萬成交,呎價約20693元。據土地註冊處資料顯示,原業主於2013年以7152.1萬購入,以公司名義佰立有限公司 (MEGA STANDARD LIMITED) 持有,註冊董事為張順吉及張順宜,故持貨7年帳面蝕讓約3152萬,期間貶值約44%。

作價4000萬跌幅44%

代理指出,上述成交價貼近區內寫字樓水平,並創區內樓上鋪歷來最大額蝕讓個案,該廈於鋪市高峰期開售,當時已屬高於市價開售,惟及後市場經歷多番起伏,核心區鋪價從高峰期回落約60%,樓上鋪價格亦備受壓力,故上述蝕讓成交反映現今市況。

據代理指出,上述成交價屬市價水平,上址由髮型屋以8.6萬承租,料買家享回報約2.5厘。

創區內同類最高蝕讓

事實上,該銀座式商廈早前已錄大幅蝕讓個案。資料顯示,該廈中層全層,面積約1809方呎,於2016年以4100萬成交,呎價22664元,原業主持貨約3年,帳面勁蝕2864萬,貶值幅度達4成;同區銀座式商廈THE SHARP低層全層,面積約1580方呎,於今年7月以3000萬成交,呎價約18987元,創該廈歷來呎價新低,原業主於2013年1月以5688萬購入,持貨7年帳面勁蝕約2688萬,物業期間貶值約47%。

市場知情人士透露,受本港經濟前景欠佳影響,張順宜近期紛放售旗下物業,其中,旺角彌敦道724號至726號漢英大廈中層,面積1933方呎,以4280萬放售,呎價約22412元。

(星島日報)

銅鑼灣鋪空置率13.2% 代理:屬歷來新高

受疫情衝擊,鋪市大受影響。據代理指出,銅鑼灣鋪位空置率於今年第3季達13.2%,創歷來新高水平,該區租金今年以來累跌逾40%,惟隨租金錄大幅調整,該行預測鋪市已離谷底不遠。

代理發表最新的統計報告指,受疫情及封關影響,訪港旅客近絕迹,消費力疲弱不堪,各區鋪租於今年第3季持續下跌,幅度介乎3.5%至7.9%,惟跌幅已較上季放緩,當中以銅鑼灣跌幅「最傷」,按季跌幅7.9%,該區今年至今租金累跌約41.3%,惟隨租金已錄大幅調整,料下季租金將逐步回穩,並稱市場已接近「見底」。

代理料鋪市離谷底不遠

代理續指出,傳統四大核心區空置持續持續高企,當中銅鑼灣空置率今年第3季新報13.2%,較今年第2季的7.9%,按季急升逾6成,創歷來新高水平;中環及尖沙嘴區鋪位分別新報16.9%及16.7%,數字較今年第2季明顯擴闊,惟旺角區空置率新報23.6%,雖為核心區中最高,惟數字已與上季相若,反映該區空置情況已見「登頂」。

料甲廈租金持續調整

代理表示,甲廈租金連跌六個月,中區租金從去年首季回落約22%,料該區今年全年租金跌幅約25%,屬過去12年以來按年跌幅新高,頂租率於今年第3季錄62.6萬方呎、待租率更錄11.6%,後者創過去15年以來新高水平。代理稱,受多項不明朗因素困擾,跨國機構擴充步伐審慎,企業遷出核心區已成大趨勢,故料甲廈租金持續調整。

(星島日報)

鄧成波等申強拍葵涌工廈收逾90%業權 市場全幢估值逾3.8億

近年不少財團密密收購舊樓,以增加土地儲備。其中由鋪王鄧成波家族收購多年的葵涌永昇工業大廈,新近申請強拍,統一業權,目前已收集約90%業權,市場全幢估值逾3.86億。

葵涌永昇工業大廈位於永基路26至30號,佔地面積約2.2萬方呎,早年獲鄧成波家族收購,目前集齊90%業權,餘下7個物業未成功收購,當中包括2個車位,是次申請強拍的公司為Day Lucky Enterprises Limited及Jumbo Fair Limited,公司董事分別為鄧成波、鄧耀邦,物業市場全幢估值逾3.86億。

尚餘七伙待收購

現為樓高約11層的工業大廈,於1979年落成,至今樓齡約41年。鄧成波家族曾於2011年斥資約1.4億,購入該廈約8成業權;而連同上述申請屬今年第30宗強拍申請,與去年同期的31宗相若,可見不少發展商積極收購具重建價值的舊樓。

本報昨日向鄧成波家族作進一步查詢,發言人指,不作回應。

今年第30宗強拍申請

事實上,鄧成波近年不時參與強拍項目,如本來7月強拍的尖沙嘴加連威老道61至73號舊樓,因有小業主向高等法院申請覆核,令該強拍程序未能展開;9月時土地審裁處處理有關強拍令期限問題,指由於案件仍在上訴中,故決定待上訴庭有結果再處理,押後3個月再作聆訊。

雖然波叔正申請強拍葵涌永昇工業大廈,但近日卻接連推出物業放售,當中包括推出深井服務式住宅汀蘭居全幢,意向價23.8億。同時亦包括西貢工廈項目包括實惠大廈、四洲食品網匯中心、四洲集團大廈、中華製漆大廈1座和2座、葵涌光輝凍倉2期全幢、九龍城衙前塱道3至13號80%業權等。

千禧大廈申放寬地積比

另外,第一集團就旗下長沙灣千禧大廈,向城規會申請略為放寬兩成地積比率,以重建成1幢樓高27層的新式工廈發展,涉及樓面約17.2萬方呎,將重建成1幢樓高27層物 (包括地下和1層地庫停車場) 的新式工廈。

申請人指,擬議發展仍然符合現時「其他指定用途」 註明「商貿」地帶的規劃意向,而提供「新」樓面面積作非污染工業用途,可支援及加快長沙灣工商貿區的轉型。

(星島日報)

鄧成波葵涌工廈申強拍 估值3.86億

近月多次傳出財困的舖王鄧成波,其家族最新向土地審裁處入紙,就葵涌永基路26至30號永昇工業大廈申請強拍,為今年市場上第30宗強拍申請。資料顯示,項目佔地約2.2萬方呎,現為一幢落成於1979年之物業,申請人現持有不少於90%業權,整個項目估值逾3.86億元。

7月底強拍尖沙嘴舊樓觸礁

資料顯示,上述申請為鄧成波家族今年首個入紙申請的強拍項目,對上一次申請,則於去年11月,鄧成波或相關人士持有超過85%業權的大角嘴廣東道1163號、鴉蘭街5B號中華漆廠大廈,向土地審裁處申請強拍,項目估值超過3.3億元。中華漆廠大廈佔地約8000方呎,現為一幢9層高的工廈。

不過,若要數到鄧成波家族有關強拍的矚目事件,就要數到尖沙嘴加連威老道61至73號 (單號) 舊樓,鄧成波等於2017年12月申請,當時估值逾9.13億元,有關申請於今年6月初獲批,當時批出底價19.26億元,惟在今年7月底進行強拍前夕,遭其中一名小業主向高等法院申請禁制令,並獲批出禁制令,令拍賣急煞停。至今年9月有關強拍令期限屆滿,鄧氏家族向土審處申請延期3個月再作聆訊,惟遭第一答辯人反對,指申請人未有提出具體發展方案,反對其延期申請,惟該處當時指,基於當事人及公眾利益作考慮,批准延期3個月再作聆訊,並要求反對的第一答辯人支付申請人兩名律師的費用。

(明報)

銅鑼灣Oliv全層4000萬沽 6年勁蝕近半

疫情下銀座式商廈接連錄得多宗大幅蝕讓,其中銅鑼灣Oliv中層全層樓上舖,最新以約4000萬元售出,帳面蝕約3152萬元,為區內最大額同類物業蝕讓個案,若連同使費更實蝕約3500萬元。

上述舖位面積約1933方呎,最新以約4000萬元易手,呎價20,693元。原業主於2014年以約7152萬元購入,帳面蝕約3152萬元或44%,以金額計為區內最大額同類物業蝕讓,若連使費計料實蝕近3500萬元或約49%。物業現由髮型屋租用,月租約8.6萬元,新買家租金回報約2.6厘。

代理料中區甲廈租金全年跌25%

事實上,代理表示,截至今年第三季,銅鑼灣區舖位空置率進一步上升至13.2%,按季增加5.3個百分點,並首度衝破10%;旺角則維持23.6%為各區最高。截至第三季,四大核心購物區今年租金跌幅介乎20.2%至41.3%,最嚴重地區為銅鑼灣,該區舖位平均呎租893元。

商廈方面,代理指,截至今年第三季中區超甲廈平均呎租126.5元,按年跌20.3%,同區甲廈呎租則為108.4元,按年亦跌19.6%,預期該區超甲級及甲級寫字樓租金全年跌幅均可達25%,為2008年金融海嘯後最大跌幅。代理又指,整體甲廈平均待租率亦攀升至11.6%,為2005年有紀錄以來新高。

第一集團申重建長沙灣工廈

此外,第一集團新近就長沙灣道924至926號千禧大廈,向城規會申請略為放寬地積比率限制。據城規會文件顯示,地盤約1.2萬方呎,第一集團申請發展地積比率由現時的12倍,放寬不多於20%、至14.352倍,擬將該工廈重建為1幢27層高新式工廈,涉及總樓面約17.22萬方呎。資料顯示,第一集團今年3月以7.9億元購入上述物業,以地積比率12倍計,可建樓面約14.4萬方呎,即每方呎樓面地價5,486元。第一集團董事魏深儀曾指,項目將重建成新式工廈,預計總投資金額約14億元,計劃於2023年落成。

(明報)

豫港電力發展大廈高層戶叫價766萬

代理表示,北角豫港電力發展大廈高層單位,面積約923方呎,業主意向售價約766萬元,呎價約8300元;意向租金約18460元,呎租約20元。物業以交吉形式租售,屬市場上極為罕有的細單位,投資自用皆適宜。

該代理行指出,物業間隔方正實用,配備24小時獨立冷氣系統,彈性極大,單位景觀開揚,大廈擁有玻璃外牆設計,外形時尚美觀,適合中小企及各機構設立辦公室,作發展業務之用。

物業地理位置優越,位於東區最繁盛的主要幹道英皇道,而且交通便利,只需步行約5分鐘即可到達港鐵北角站,巴士、小巴及電車站近在咫尺,可迅速貫穿港九新界。

(信報)

Flat sales jump 15pc, worth $43b in September

The number of residential home deals rose more than 15 percent in September and were worth a total of HK$43.4 billion, data from the Land Registry showed.

The number of agreements was up 15.3 percent month-on-month, or 45.7 percent year-on-year. The value of the agreements rose 8 percent compared to a previous month and 41 percent compared to a previous year.

The transaction number for all property categories totaled 6,581 last month, rising 22.1 percent from a month ago, or surging 60.9 percent year-on-year. The total worth improved by 12.6 percent on-month or 14 percent on-year.

Meanwhile, CK Asset (1113) will launch the fifth batch of flats at Sea to Sky in Tseung Kwan O this Saturday, offering 285 units at an average price of HK$17,441 per square foot after discounts.

The developer has cashed in HK$9.27 billion after selling 874 units in the project.

Henderson Land Development (0012) has named its residential project in Tong Yan San Tsuen, Yuen Long, as The Hampstead Reach.

The project offers 16 luxury houses sized between 1,772 sq ft and 1,826 sq ft. It may launch sales this month.

The one-month Hong Kong Interbank Offered Rate dropped for a second day to 0.44036 percent.

In the commercial and industrial market, Hong Kong's overall office rentals fell for six consecutive quarters, with rents in Admiralty, Central and Sheung Wan falling 22 percent from the peak in the first quarter of 2019, property agency reported.

And retail rentals continued to decline in the last quarter, though at a slower pace, with the Causeway Bay vacancy rate climbing to 13.2 percent, the highest on record.

Shop King Tang Shing-bor applied for compulsory sale of Wing Shing Industrial Building in Kwai Chung. Market watchers estimate its value at more than HK$386 million.

Hong Kong businessman Johnny Cheung Shun-yee lost HK$3.15 million, or nearly 45 percent, after selling a floor of a commercial building, Oliv in Causeway Bay, for HK$40 million.

(The Standard)

金鐘力寶中心及海富中心單位放租,意向呎租約38至40元。

代理表示,力寶中心2座低層03室,面積約4541方呎,意向呎租約40元,涉及月租約18萬餘元。單位現已交吉,備有豪華裝修及來去水茶水間,為租戶節省一筆可觀的裝修支出。

另一宗放租個案位於海富中心2座低層01室,面積約2611方呎,以呎租約38元招租,總月租近10萬元。單位即將交吉,同樣備有寫字樓裝修,面積適合中小企承租,可打開品牌的知名度。

(信報)

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

核心地區甲廈租金向來高企,但隨着過去一年工商舖市場租、售價向下調整,反而吸引個別企業重投區內物色寫字樓單位,以提升品牌的形象。

而新近放租的力寶中心及海富中心兩個寫字樓單位,均為金鐘區內指標商廈,兩者均附設豪華裝修之餘,租金叫價較市價有一定程度折讓空間,料短時間內可獲承租。

力寶中心低層戶 意向呎租40元

代理指,金鐘道89號力寶中心2座低層03室,面積約4,541平方呎,現以意向呎租約40元放售,涉及月租約18餘萬元,單位現已交吉,內有豪華裝修、來去水茶水間,可為新租戶省卻一筆可觀的裝修開支,而據資料顯示,截至今年8月止,力寶中心2座共錄得逾22宗租務成交,平均呎租約52元,而對上一宗低層戶成交,為4樓02室,面積約598平方呎,7月底以呎租約46元成交,月租約2.75萬元,相比現有放租單位,其叫價甚為吸引。

海富中心逾2千呎 月租約10萬

代理續指,同區亦有另一個商廈單位出租,位處金鐘夏愨道18號海富中心2座低層01室,面積約2,611平方呎,以每平方呎38元招租,月租叫價約10萬元,該單位亦已交吉,同樣備有寫字樓裝修,面積適合中、小企承租,以打開品牌的知名度。至於,海富中心2座今年暫僅得3宗租賃成交,平均呎租約50元,而新近租出為6樓09室,面積約1,155平方呎,於8月底以每平方呎約43元租出,月租約5萬元。

事實上,力寶中心及海富中心均為港鐵上蓋優質商廈,質素及配套均有保證,而且一直深受企業歡迎,而隨着核心區甲廈空置率續升,整體呎租亦按市場所需向下調整以提升吸引力,成為租客進駐良機,而上述兩個放租的商廈,叫價上已極具競爭力,再者單位附有裝修,租客可即租即用,屬市場上矜罕盤源。

(經濟日報)

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

皇都戲院大廈今拍賣 底價48億

新世界 (00017) 已併購約98%業權的北角皇都戲院大廈,將於今天早上10時進行拍賣,拍賣底價為47.776億元,物業地盤面積約3.62萬平方呎,物業坐落於北角英皇道、渣華道的南面及與電照道交界,物業現狀為一幢於1959年落成的商住樓宇,其中包括商場、桌球室及兩幢住宅樓宇,部分獲古諮會評為一級歷史建築物。

羅便臣道全幢物業 月底拍賣

有測量師表示,今次推出拍賣的物業位於北角核心區,三面臨街,加上地盤面積大,屬近期市場罕有,因此古諮會的評級應不會影響發展商的競投意慾。

另一測量師亦指,將於本月29日 (周四) 下午5時拍賣羅便臣道27E及27F號全幢物業,底價為2.34億元,物業現址為一幢1960年落成的6層高大廈,地下單位為商舖,現劃為住宅 (乙類) 用途,地盤面積3,822平方呎。

(經濟日報)

荃灣UML TOWER兩全層戶 月租叫價5.5萬

轉型中的荃灣工業區,由於區內交通極為便利,而且不乏逾千平方呎的單位供應,加上門檻吸引,吸引用家及投資者進駐,而新近放租的UML TOWER,兩個全層單位月租均為55,000元,並配備裝修,可望短時間內獲承租。

代理指,荃灣灰窰角街42至44號UML TOWER 2樓及6樓全層放租,其中,2樓全層面積約4,350平方呎,意向月租約55,000元,平均呎租約13元,而6樓全層面積約4,155平方呎,月租叫價同樣約為55,000元,平均呎租約13元。

附裝修 鄰近港鐵交通便

兩個單位間隔均四正寬敞,實用率高,用途靈活,其中,2樓單位附設私人會所裝修,6樓屬寫字樓裝修,外望樓景,並配備獨立冷氣。至於物業設有一部客梯,樓底高逾11呎,每平方呎可負重約150磅,以應不同行業所需,而位置上,亦佔盡地利,比鄰為多個大型屋苑及商場,另商店、銀行、食肆林立,鄰近的交通配套、社區設施完善,同時坐享港鐵荃灣站及西鐵荃灣西站之便,而前臨的楊屋道更備有多綫巴士、小巴綫,貫通港九新界各地。

而同地段上面積逾4,000平方呎的工廈,呎租介乎7元至13元不等。

代理指,UML TOWER鄰近青山公路葵涌段,前往葵涌貨櫃碼頭及機場均甚為方便,而往返港珠澳大橋香港口岸,亦只需約20分鐘車程,同時亦靠近羅湖及深圳灣口岸,盡享大灣區發展機遇;至於荃灣區工商物業投資價值持續上升,加上物業自身及外在條件優越,料可享可觀的回報保證,能獲投資者及用家垂青。

(經濟日報)

甲廈780萬呎樓面空置 21年最多

代理:中區租金全年料跌逾20%

疫情下商業市道受衝擊,代理指,目前全港共有780萬平方呎甲廈樓面空置,為1999年後21年最多,而甲廈空置率今年料突破10%,中區租金全年跌逾20%。

該代理數據顯示,疫情下第三季甲廈錄67.5萬平方呎負吸納,整體空置率升至9.6%,而目前全港共有780萬平方呎甲廈樓面空置,為1999年後最多。中區方面,空置率單季升2.1個百分點至7.3%。

舖租已調整 可望回穩

代理指,疫情下商廈租務仍疲弱,相信第四季租務淡靜,甲廈整體空置率料突破10%。租金方面,代理料整體甲廈租金跌約15至20%,而中區租務最受影響,全年跌幅約20至25%。另一代理指,由於不少業主以優惠條件挽留租客,個別更為租客提供裝修津貼,令不少原租客傾向續租,搬遷活動較少。

商舖市場上,由於疫情持續,首三季商舖租金已跌2成。該行預計,第三波疫情緩和下,而租金已大幅調整,商舖租務料較之前活躍,租金料漸回穩。

至於投資市場方面,今年第三季大手買賣 (1,000萬美元以上) 僅涉44億元,為09年後單季最低。代理認為,環球疫情影響基金、內地資金來港投資,故令成交金額偏低。對於金管局放寬工商舖按揭,代理認為由於放寬幅度不算高,加上銀行取態仍保守,對大額買賣市場即時推動不高,惟仍屬正面消息。多項物業中,代理較看好工廈市場,包括數據中心等,投資回報率較穩定,料可吸引財團承接。

(經濟日報)

甲廈空置率高達9.6% 代理:創11年來新高

受疫情打擊,商廈市場疲憊不堪。外資測量師行世邦魏理仕指出,今年第3季整體甲廈空置率高達9.6%,創過去11年以來新高。

代理表示,甲廈市場租賃於今年第3季略有改善,按季增加25%,然而僅佔過去5年季度平均水平的一半,惟整體甲廈於今年第3季錄負吸納量67.35萬方呎,整體空置率新報9.6%,屬自2009年以來新高水平,若以空置樓面計,涉及面積約780萬方呎,更是過去21年以來新高,反映甲廈市場疲憊不堪。

空置樓面多達780萬方呎

若以各區劃分,以中環區空置率升幅最急,該區空置率新報7.3%,為2004年以來新高,同時,該區負吸納量新報45.27萬方呎,為歷來新高水平,反映核心區甲廈需求疲弱。

代理指,第3季整體甲廈租金跌幅約3.9%,以中環區「最傷」,按季跌幅達4.8%,今年該區累跌達14.8%。受疫情等不明朗因素困擾,甲廈空置率有機會突破10%水平,預測今年整體甲廈租金介乎15%至20%,惟中環區跌幅較大市高,高見25%。

代理稱,受疫情打擊,零售商保持審慎態度,隨鋪位租金顯著回落,吸引部分商戶疫市擴充;據該行統計資料顯示,核心區鋪位整體租金按季下跌約5.7%,較上季的5.5%稍為加速。

代理:商廈租金按季跌3.4%

另一代理指出,商廈租金按季跌3.4%,跌幅較上季的3.8%放緩,港島租金在第3季度跌5.8%,中環、灣仔 (銅鑼灣) 及港島東租金分別跌5%、6.6%及4.2%。該代理行預期整體甲廈租金全年將跌15%至20%。中環則將下跌20%至25%。

空置率由今年6月的6.02%升至9月的6.82%,中環及灣仔 (銅鑼灣) 空置率由第2季度末的5.6%及6.3%,分別升至6.8%及7.2%。港島東空置率雖然由2020年6月的1.9%升至2.4%。除了九龍東外,九龍區空置率同樣上升,尖沙嘴及九龍西空置率分別由6月底的4.2%及3.8%上升至6.0%及4.6%。

(星島日報)

銅鑼灣鋪租跌得最傷

疫情雖稍為緩和,但日常民生離重回正軌仍遙遙無期,「通關」時間仍屬未知之數,零售業隆冬期尚未見盡頭,致鋪市低處未算低,核心區鋪位所受的打擊既廣且深,租售價未有止跌迹象,其中以整體租售價水平最高的銅鑼灣區,在今次的大跌市中表現最傷。有統計就顯示,年初至今區內租金累跌逾40%,為各核心區中最高,更甚是區內空置率急升,令租金進一步受壓,要租金築底亦短期內達到。

租金累跌逾四成

自去年中的社會運動開始,本地零售業就進入盛極而衰的周期,今年初疫情爆發,更造成鋪市內傷,不但及筋骨,更流血不止,令本地鋪市進入一種新常態,就是大型連鎖店撤退潮,加上不少大型及連鎖品牌不惜拖欠租金以求「生存」,全方位打擊心鋪市,令銅鑼灣、尖沙嘴、旺角等主要依靠遊客生意擊撐高昂租金地區,承受的打擊更加致命。

大型連鎖店紛撤退

現時不但解決疫情的時間表仍毫無頭緒,就算是通關亦未有任何時間表,令核心區鋪位的前景仍在一片迷霧當中,同時亦大大削弱業主議價能力,不借以超低價租出物業,以減少損失,更造成雪球效應。

(星島日報)

Prime office vacancies soar to 21-year high

Vacant Grade A office space hit a 21-year high of about 7.8 million square feet in September, according to property agency, with a unit at Admiralty Centre available for rent at HK$38 per sq ft - close to the average office rent in Kowloon West.

The unit at Admiralty Centre measures 2,611 sq ft, according to agent. In comparison, average office rent in Kowloon West was HK$37.1 per sq ft in the third quarter, data from property agency.

Another agency expects Grade A office rents in Hong Kong will fall 15 to 20 percent this year, noting that Grade A office rents have fallen 13.8 percent in the first three quarters of this year.

the agency also estimates the vacancy rate of Hong Kong Grade A offices will reach 10 percent at the end of the year from 9.6 percent in the third quarter.

Meanwhile, high-street shop vacancies in four core districts - Central, Causeway Bay, Tsim Sha Tsui, and Mong Kok - rose 4.8 percentage points to 18.3 percent in the third quarter from the second quarter.

High street shop rents fell 5.7 percent quarter-on-quarter in the third quarter, agent said.

"With many social distancing measures remaining in place, retailers continued to adopt a cautious approach," agent said. "Significant rental drops since last year, however, encouraged some local brands to explore leasing opportunities at low costs that had not existed for many years. Should the local pandemic remain contained, we expect to see a slight rebound in leasing activity in the fourth quarter."

In the primary market, New World Development (0017) opened three show flats for The Pavilia Farm atop Tai Wai Station.

In the secondary market, a 649-sq-ft flat at Taikoo Shing in Quarry Bay changed hands for HK$13.7 million, or HK$21,109 per sq ft, after HK$1.3 million was cut from the original asking price.

Separately, the one-month Hong Kong Interbank Offered Rate, a benchmark for the local mortgage rate, rose to 0.44125 percent.

(The Standard)

For more leasing information of Admiralty Centre please visit: Leasing Information of Admiralty Centre

Desperate landlords offer renovation subsidies to lure tenants as Hong Kong’s vacant office space hits 21-year high

Some landlords have begun offering a one-off subsidy to help new tenants fit out their office space, according to property agency

The property services company says 7.8 million sq ft of office space – about the size of four Central Plazas – sat vacant in Hong Kong in September, the highest since 1999

Hong Kong’s commercial landlords are offering incentives such as renovation subsidies to lure tenants, as the amount of office space lying empty reaches the highest level in 21 years, according to a property services company.

Some landlords have begun offering a one-off subsidy to help new tenants fit out their office space, agent said.

“In some cases, the landlord would offer a subsidy of about HK$100 (US$12.9) per square foot,” an agent said on Wednesday.

The subsidy is attractive because relocation costs in Hong Kong are very expensive, agent said. For a prime renovation costing HK$1,000 per sq ft, the relocation cost may add up to HK$1,200 per sq ft after including the price of returning the office to its original state when the lease ends. The cost can be spread out to a monthly HK$30 per sq ft or thereabouts over three years.

“For most relocations with cutting costs as the objective, it takes a place with a rent of HK$30 per square foot less than” the original rent to justify the move, agent said. “Some offices do not have their head offices in Hong Kong. It is not that easy to approve that sum [for renovation].”

According to the property agency, 7.8 million sq ft of office space – greater than the size of four Central Plazas – sat vacant in Hong Kong in September, the highest since 1999. An additional 950,000 sq ft of surrendered space – returned by tenants before the lease expires – is available in the market, just shy of the size of the HSBC building.

Desperate landlords have been offering a broader range of incentives in lieu of rental discounts, to try to fill the space.

The agent said that some of the landlords have increased the commission they give to property agents from the normal one month of rent to 1.5 to 2 months’ equivalent. Some in Kowloon are even offering three months of rent.

“Of the total [amount of surrendered space], 70 per cent was surrendered by multinational corporations. This upward trend is expected to continue for the remainder of 2020,” another agent said.

Office rents in Central are expected to fall by up to 25 per cent this year, though the agent said the drop could actually be greater.

Agent said that landlords’ attitude to lease negotiations has been “quite flexible” for months and some are mulling more innovative solutions, like partnering with co-working operators to reduce vacancy.

Market anticipation of more listings of mainland Chinese companies in Hong Kong has so far not translated to heightened demand for office space with the projected expansion of professional services companies, agent said.

“We do not see a big trend yet. So far companies are tending to wait and see,” agent said, adding that things may pick up after the first quarter of next year if the IPO boom continues.

The vacancy rate in Kowloon East remains the highest among all Hong Kong’s districts, at 15.4 per cent, according to property agency.

Compared to their counterparts on Hong Kong Island, landlords of premium offices in Kowloon are less willing to cut rents because at HK$20 to 30 per sq ft they are already the lowest, according to another property agency.

“Rental markets are being buffeted by corporate uncertainties and a tendency [of companies] to cut costs and downsize where possible,” agent said. “As long as Central maintains its significant premium over other districts, and given the current business environment, corporates will continue to look for cost-saving relocation options elsewhere on the island or in Kowloon.”

(South China Morning Post)

繼美國政府於上月以約二十五億六千萬,沽出壽山村道豪宅物業後,美國商會日前亦以暗盤方式沽出中環美國銀行中心中層單位,作價約一億四千多萬,平均每呎造價約二萬四千元,較市價低近兩成。

董事會曾就出售事宜爭辯

本報獲悉,香港美國商會近日出售位於中環美國銀行中心的寫字樓,並由一家代理負責放售物業。有知情者向本報透露,美國商會董事會中亦有該代理行的代表在內,董事會曾就出售一半還是整個物業有過一番爭辯。據悉,有商會前任主席對出售物業感到不捨,因當年有份決定購入寫字樓,希望在香港建立長久基地,惟有關人士已離開董事會,未能影響決定,最終疑因會方出現財務狀況問題,甚至有債務未清,逼於無奈賣樓「冚數」。

據知情人士指,該會近來連支薪亦出現問題,加上疫情影響,業務萎縮,形容商會已沒有任何辦法在短期內解決財赤問題。但消息人士認為,會方不會承認財赤,或會以近日中美雙方關係轉差等原因作藉口。

事實上,本報六月時曾報道,香港美國商會在過去三年出現財政問題,財赤由一七年約六十六萬元,擴大至一八年逾一百五十七萬元,一九年更達逾二百五十萬元。商會疑因財政問題在三年間大幅度裁員,令員工由一七年的二十六人減至目前十一人。

今年中市場已流傳,指美國商會因財困需要低價放售寫字樓,而當時美國商會曾澄清,指沒有陷入財務困境,無意撤出香港,亦不會沽出中環辦公室,並指會繼續留港發展最少多另一個五十年。

多家財團低價洽購不遂

知情人士指,今年六月,美國商會將自用逾二十年的美國銀行中心單位放租,並承租同區面積較細的商廈單位,該商會其實一直低調部署出售物業,直至本月初,正式委託代理放售,該單位為美國銀行中心十九樓四室、七室及十三室,合共面積約五千九百六十八方呎,以意向呎價三萬元放售,於推出市場後,迅速獲數名準買家洽購,有準買家大膽還價每呎低至二萬一千元,惟業主拒絕,亦有買家出價每呎二萬三千元,業主則堅持每呎二萬四千元以上才出售,最終該名買家追價,以每呎約二萬四千元落實購入,涉資約一億四千三百萬元。該廈對上一宗成交為高層十二室,於今年二月以每呎二萬八千八百元售出。

本報昨日就上述消息向美國商會查詢,惟於截稿前均未獲回覆。同時,本報亦向負責放售的代理查詢,惟該行未有回應。

據土地註冊處資料顯示,美國商會於一九九六年以五千四百六十萬購入上址,故持貨二十四年帳面獲利逾八千八百六十二萬,物業期間升值約一點六倍。

(星島日報)

更多美國銀行中心出售樓盤資訊請參閱:美國銀行中心出售

星光行呎租21元低市10%

受疫情打擊,商廈租金持續受壓。消息指,尖沙嘴星光行高層單位,以每方呎21元租出,低市價約10%。

市場消息指出,尖沙嘴星光行高層32室,面積約754方呎,呎租21元,月租約15834元;據代理指出,上址雖位處高層,惟因無天井位及沒有窗,以現時市況計,低市價約10%。

據代理資料顯示,該商廈近期承租個案為低層46室,面積331方呎,於9月以9500元租出,平均呎租約29元,較是次租金折讓約28%。

旺角中心造價重回六年前

另外,代理表示,旺角中心錄連環成交,其中,1期高層12至13室,面積約1492方呎,以約2700萬成交,呎價約18096元,造價重回6年前水平,上址以連租約形式售出,月租收入約8.2萬,料買家享租金回報約3.6厘。原業主於2012年以呎價約11400元買入,持貨8年物業升值約58%。

代理續稱,該商廈另一成交為同層06室,面積約1007方呎,以約1800萬售出,呎價約17874元。單位現由眼科診所租用,呎租約50元,租金回報約3.3厘,原業主於2012年買入,當時呎價約1.1萬元,8年間升值約62%。

(星島日報)

更多星光行出租樓盤資訊請參閱:星光行出租

鄧成波3.18億沽楚留香舊址筲箕灣地鋪連一樓持貨三年平手離場

受疫情衝擊,鋪位市場陰霾密布,資深投資者紛減磅沽貨。消息指,近期連環沽售物業的「鋪王」鄧成波,以3.18億沽出筲箕灣地鋪連1樓,即楚留香酒樓舊址,料持貨3年平手離場,買家享租金回報約3.4厘。

市場消息指出,上述為筲箕灣道407至409號筲箕灣中心地下29至31號、63及64號地鋪連1樓,總樓面約32330方呎,以買賣公司形式易手,作價約3.18億,平均呎價約9836元,據悉,該鋪由護老院以每月90萬承租,料買家享租金回報約3.4厘;本報昨日就有關消息向系內陞域集團作出查詢,惟該集團則對消息不作回應。

據土地註冊處資料顯示,上述物業由祥藝發展有限公司 (ACEGROWTH DEVELOPMENT LIMITED) 持有,註冊董事分別為鄧成波及鄧耀昇;此外,資料亦顯示,鄧成波於2017年以3.18億購入,故持貨3年屬平手離場,該鋪上一手業主為已故粵劇名伶「新馬師曾」鄧永祥,該鋪舊址於上世紀80年代,曾開辦楚留香酒樓。

陞域:不作回應

據市場知情人士透露,受疫情等不明朗因素困擾,鋪位售價早已顯著回落,部分投資者因本港經濟前景欠佳,遂減磅沽貨離場,上述鋪位早於2年前已於市場上放售,意向價為3.6億,該鋪現時作護老院用途,租務需求殷切,故料買家租金回報穩定。

事實上,投資市場受淡風吹襲,鄧成波近期已連環放售旗下多項物業,其中,灣仔軒尼詩道168至170號煥然樓,以意向價4億放售,地盤面積約1915方呎,可建樓面約28725方呎,每呎樓面地價約13925元。現址為一幢14層高商住大樓,地下至閣樓為商鋪,1樓至12樓為住宅,總樓面約22368方呎。

另外,鄧成波於今年以來放售旗下物業包括旺角豉油街地盤及九龍城衙前塱道項目8成業權,市場估值分別為4.5億及6.5億;同時,西貢康定路5座工廈亦推出市場放售,包括實惠集團大廈、中華製漆大廈1及2座等。

(星島日報)

北角皇都戲院強拍新世界底價47億投得鄭志剛:形神俱備保育天台飛拱物開放「打卡」

屹立北角六十多年的皇都戲院大廈為一級歷史建築,八月獲土地審裁處批准強拍,昨日由提出申請強拍的新世界發展,在無競爭對手下,以底價四十七億七千六百萬元投得,為本港歷來金額最多的強拍個案。新世界早前已經收購約九成八業權,預計於十一月中完成法律程序後,正式成為該地段的業權持有人,並會啟動保育計畫。新世界昨表示,將盡力保留和重塑戲院的歷史面貌,包括保留天台俗稱「飛拱」的桁架建築並開放予公眾「打卡」,變身為戲院及劇院於一身的文化綠洲項目,料明年可完成具體的保育方案。

皇都戲院前身為璇宮戲院,於一九五二年落成,五九年易手後,改名為皇都戲院,屬單幢式戲院,過去集電影、粵劇、海外歌舞團等於一身,至一九九七年二月底上映最後一部電影《一個好人》後正式結業,昔日的堂座部分被改為桌球室。

活化為全新文化綠洲

新世界發展決定將皇都戲院大廈進行「三保」保育管理計畫,即保建築、保飛拱、保用途,亦即保留並復修整個戲院部分的外牆、天台拋物綫型桁架,以及重構集戲院及劇院於一身的藝術表演場地,把皇都戲院昇華為「文化綠洲」。兩年前,新世界發展已聘請保育經驗豐富中外精英團隊,包括Purcell、WilkinsonEyre、AGC開展「保育管理計畫」,研究皇都各處歷史價值,以便籌備詳細保育藍圖,將在場內各處3D掃描、勘探等,以掌握皇都結構。

3D掃描掌握各處結構

皇都戲院多年失修,經歷一九九五年四級火警,及曾改建成桌球室,當年大規模改動令原本戲院殘破不堪,預料勘探會困難重重,現時只有初步保育計畫及「三保」承諾,詳細發展要待完成勘探再作公布。

新世界發展執行副主席兼行政總裁鄭志剛昨表示,皇都戲院是現今碩果僅存的珍貴文化古迹,類似這類富歷史價值的五十年代戲院,香港早已蕩然無存。皇都戲院不但止擁有六十八年歷史,其建築富現代主義色彩,五十年代時更一度成為國際文化表演地標。他指,保育並非只是保留舊建築,而是要形神俱備,希望盡一切努力,令皇都戲院「重生」,讓這座一級歷史建築重拾生命力,成為香港下一代的文化綠洲。鄭又指,集團需要時間讓保育團隊到場勘探,以及制定保育計畫,並期望將項目打造成聯合國教科文組織認可的國際古迹。

皇都戲院屋頂採獨特的「拱橋式建築」設計,此「飛拱」被國際保育組織DOCOMOMOInternational喻為舉世無雙的建築設計,設計有實際建築力學用途,令戲院可無柱設計,同時可減低外來聲音對戲院的震盪,令視聽質素得以提升。惟天台過往是機房、員工休息室,禁止公眾進入。據了解,新世界發展正研究如何改造為公眾可進入的休憩空間,讓公眾近距離欣賞及「打卡」。活化後的皇都戲院將發展作多元化表演場地,並打算引入國際級表演,同時成為支持本地藝術人創作及表演的地點。

逾百件文物將展出

新世界發展又已收集逾百件與皇都相關的文物,包括戲院告示牌、當年與片商簽訂的協議等。新世界亦正搜尋當年戲院的吊燈,同時也會公開向公眾徵集文物,期望在保育後,於場內展出。戲院的外牆有一幅名為《蟬迷董卓》的浮雕,出自中國畫家梅與天之手,將中國筆觸融入西洋畫,結合中西文化特色,具有保育價值,二〇一七年獲古諮會評為一級歷史建築物。新世界指由於浮雕多年來缺乏保養,且部分已破損,團隊將盡力研究復修。

負責是次拍賣的代理表示,該項目的成交價屬市價水平,惟項目保育工作有一定限制,料增加發展商建築成本。

(星島日報)

上季寫字樓成交 57億按季增85%

去年下半年呈膠着狀態的買賣市場逐步起動,最新季度的寫字樓買賣成交走勢平穩,代理數據顯示,第三季寫字樓錄約57億元買賣,按季增85%。

根據代理資料顯示,第三季截至9月22日,市場共錄得約133宗寫字樓買賣成交,預料全季會與第二季宗數相若,呈回穩迹象。金額方面,由於季內錄得多宗全幢寫字樓成交個案,帶動總成交金額暫錄56.59億元,按季已增加約85%,相比第一季勁升3倍。今季租賃就呈量穩價跌走勢,第三季錄得約1,268宗寫字樓租務個案,涉及總金額約9,804萬元,成交量與次季相若,金額就下跌約兩成。

中環空置率10年新高

指標商廈市場表現良好,港島區第三季共錄得約4宗指標商廈買賣個案,比次季僅2宗為多,而累計全年僅錄得9宗,遠低於去年全年26宗水平;而平均成交呎價則有所下調,第三季錄得2.2萬元,按季下跌約16%。九龍方面,第三季有約6宗指標商廈買賣成交,平均呎價約1.3萬元,對比第二季僅約2宗及呎價約1.11萬元表現為佳。指標商廈租務成交走勢則普遍平穩,港九指標商廈第三季暫錄得約114宗租賃個案,預料整季與第二季約128宗相若。

至於甲廈空置率方面,陳氏指出,各核心區包括金鐘、中環、上環、灣仔及銅鑼灣,自年初起一直遞增,例如金鐘及中環已分別升超過8%及5%,創近10年及7年新高;不過自8月起,最新空置率升幅有所收窄,8月中環甲廈空置率比7月回落約0.37個百分點,空置情況有所改善。

代理分析,雖然現時受環球經濟不景氣拖累,但香港位居亞洲金融地位扎根多年,不論其與國內及外國的貿易交流或稅務條件等都極具優勢,長遠而言本港寫字樓物業前景亮麗,整體保持審慎樂觀態度。預計第四季商廈買賣成交量會輕微上升至150宗水平,租務則會增加至約1,500宗,然而租售價短期內仍有下調壓力,兩者跌幅約5%。

(經濟日報)

啟德旅遊商地變陣 增商業樓面

比鄰郵輪碼頭 助增競投意慾

前身啟德旅遊中樞的第4D區2號地皮,政府改變推地策略,項目可建樓面247萬平方呎,當中娛樂消閒部分比例由4成大降至15至20%,增加可發展寫字樓的空間,料有助增加發展商競投意慾。

該幅用地比鄰啟德郵輪碼頭,佔地約64萬平方呎,屬於「其他指定 (旅遊相關的商業、酒店及旅遊)」用途,在2015年時起動九龍東辦事處曾稱為「啟德旅遊中樞」用途,可建樓面達247萬平方呎,屬於近年推出規模最大型的商業地之一。

娛樂休閒比例 4成變20%

據當時負責項目的起動九龍東辦事處公布的資料,項目由「娛樂及休閒」、「酒店、零售、辦公室」及「其他 (包括交通設施)」三部分組成,分別佔總樓面面積的4成、5成半以及半成,並提供彈性給發展商提交方案,上下調動「娛樂及休閒」、「酒店、零售、辦公室」的樓面比例5%。

不過,根據起動九龍東辦事處最新提交規劃草案,將「娛樂及休閒」比例大幅下調至15至20%,以樓面計算,相當於由原本近百萬平方呎,減少最少37萬平方呎,減幅多達60%。

至於原本的「酒店、零售、辦公室」樓面,佔比增加至75至80%,較原本的55至65%有所增加。當局特別分拆成為「酒店」,以及「零售及辦公室」用途,前者佔比為15至20%,後者則大約55至65%。

因此,整個4D區項目的寫字樓樓面,將會多達135.8萬平方呎。有測量師指出,相信政府是參考郵輪碼頭的發展未如預期,再加上區內不少商業、酒店地均改成住宅發展,所以娛樂及旅遊配套減少。

(經濟日報)

旺角中心連錄兩宗減價易手 涉資共4500萬

有業主減價放售旗下兩個位於旺角中心高層寫字樓單位,成交價共約4500萬元,減幅約25%。

代理表示,旺角彌敦道688號旺角中心1期高層12至13室,面積約1492方呎,成交價約2700萬元,平均呎價約18097元。單位以連租約形式售出,現時月租收入約8.2萬元,呎租約55元,租金回報約3.6厘,租期至今年11月。據悉,買家為醫務行業相關人士,不排除單位在租約屆滿後會作自用。

另一宗成交個案亦由上述業主沽出,位處同層06室,面積約1007方呎,以約1800萬元易手,成交呎價約17875元。單位現由眼科診所租用,呎租約50元,租金回報約3.3厘,租期至2021年底。據知,買家為投資者。

(信報)

State Theatre to be reborn as cinematic cultural landmark

New World Development (0017) won the auction for the historic State Theatre in North Point at the reserve price of HK$4.776 billion, a record high for compulsory auctions in the city.

The developer said it will conserve the iconic architecture, including the parabolic exoskeleton truss and mural relief, and "transform the 68-year-old building into a landmark steeped in cinematic culture."

NWD had acquired 98 percent of the ownership in the building, and the reserve price was 53 percent higher than a market valuation of HK$3.12 billion in 2018.

NWD is to launch a conservation project for the building, and an international team will start to revitalize its architecture. They will preserve the building's iconic architecture, including the parabolic exoskeleton truss and mural relief.

Leading the team are British firms WilkinsonEyre and Purcell - who worked on the Gasholders London redevelopment scheme and the restoration of Tai Kwun, the former Central Police Station Compound in Hong Kong, respectively - as well as Hong Kong-based AGC Design, who took part in the revitalisation of Lui Seng Chun, a 89-year-old house in Hong Kong, restored as a Chinese medicine centre.

Chief executive and executive vice-chairman Adrian Cheng Chi-kong said it takes time to revitalize the architecture and make detailed plans, and the company is yet to figure out the total investment and preservation costs. He hopes the building can be turned into a historical site that could be recognized by The United Nations Educational, Scientific and Cultural Organization.

Cheng expects the parabolic exoskeleton truss on the rooftop, as well as a part of the shopping mall, would be redeveloped into a performing venue.

Surveyor says that the conservation may reduce the gross floor area and increase the development costs. Market surveyors expect the cost could reach HK$40,000 per sq ft after completion.

The cinema building first opened in 1952 and was declared as a Grade I historic building in 2017.

(The Standard)

美國商會日前沽售中環美國銀行中心自用單位,平均每方呎2.4萬,造價重返7年前水平。有代理指出,目前甲廈市場呆滯,有見業主賣樓勢在必行,多家財團出動希望「執死雞」,洽購期間一減再減,最終低市價20%易手。

美國商會於本月初,正式委託代理放售美國銀行中心19樓4、7及13室,面積約5968方呎,知情人士指,雖然業主意向呎價3萬,為市價水平,惟當一眾準買家得悉美商會財政出現問題,紛低價試盤,有出價每方呎低至2.1萬,「難得有盤源可有鋤價空間。」結果,業主亦將價格一減再減,最終每方呎2.4萬售出,造價約1.4億多元。

美商會1.4億售 低市價20%

代理指出,要追溯與同類型單位成交,為2013年10月,該廈10樓6至7室,建築面積約3060方呎,呎價2.2萬,單位同樣望城市景及山景,惟層數較低,以此推算,最新成交呎價已重返7年前。追溯該廈對上一宗成交為今年2月,每呎2.88萬,及後放盤呎價普遍逾3萬,業主持貨能力強,鋤價不易。

本報昨日向代理查詢,惟該代理行表示不作回應。

(星島日報)

更多美國銀行中心出售樓盤資訊請參閱:美國銀行中心出售

中環甲廈租售價明顯下跌,美國銀行中心中層04至07及13室,面積約5,968平方呎,市傳以約1.4億元沽出,呎價近2.4萬元,單位交吉交易。按此呎價計,屬該廈自2013年後新低。

據了解,該單位由香港美國商會持有,1996年以5,460萬元購入,作會址自用,提供餐廳、會議室等,不時舉行講座。據悉,該商會早前已搬至同區甲廈,面積約2,000平方呎,故把美銀中心單位放售。若最終以1.4億元售出,持貨24年轉手,獲利約8,540萬元。

(經濟日報)

更多美國銀行中心出售樓盤資訊請參閱:美國銀行中心出售

牛津道一號洋房 減價1400萬易手

二手豪宅錄得大額成交,市場消息指,九龍塘牛津道一號,一幢洋房剛減價1,400萬以1.96億元售出,原業主連雜費計算,料是次交易實蝕約600萬離場。

跑馬地樂景園9600萬售

據悉,牛津道一號雙號屋,實用面積4,908平方呎,洋房開價2.1億元,新近減價至1.96億元售出,實用面積呎價39,935元。原業主於2017年以1.9億元購入物業,持貨3年,帳面雖賺600萬元,但若連同釐印費及代理佣金計算,料是次交易實蝕約600萬元。

另外,消息指跑馬地樂景園中層B室,新近以9,600萬元售出,實用面積2,583平方呎,成交呎價37,166元。原業主於2009年以5,950萬元購入單位,持貨21年,易手帳面賺3,650萬元,賺幅61%。市傳屋苑低層B室亦獲買家以9,100萬元洽購。

鴨脷洲南灣 呎價20457元

代理表示,鴨脷洲南灣9座高層A室,實用面積1,051平方呎,望遊艇會海景,開價2,300萬元,議價後以2,150萬元售出,實用面積呎價20,457元。買家為同區客,購入作換樓之用。原業主於2010年以1,808.3萬元購入單位,易手帳面獲利341.7萬元,升值約19%。

(經濟日報)

Hong Kong’s home sales fizzle for a second weekend ahead of key policy address expected to boost supply of affordable homes

CK Asset and Sun Hung Kai Properties sold 65 of the 303 units on offer in two projects as of 9pm, an agent said

The lacklustre result comes as Chief Executive Carrier Lam is due to deliver her annual policy address on Wednesday and the index of second-hand homes tumbled in August

Hong Kong’s weekend home sales sputtered as buyers remained cautious ahead of Chief Executive Carrie Lam Cheng Yuet-ngor’s annual policy address next week, expected to increase land supply for affordable housing to rein in one of the world’s most expensive property markets.

In the two projects that were on offer on Saturday, CK Asset Holdings sold 59 out of the 285 units at the Sea To Sky project at Lohas Park in Tseung Kwan O, while Sun Hung Kai Properties (SHKP) sold six out of the 18 flats at Mount Regency in Tuen Mun as of 9pm, according to property agent.

There are signs that property buyers “are more and more reluctant to negotiate” or settle for more over catalogue prices, which compels developers to cut prices if they want to find willing buyers, the agent said.

The slump extends the disappointment of the September 26 weekend, when investors turned their backs on the biggest combined launch of 726 flats by six developers. CK Asset, SHKP, Henderson Land Developments and others managed to sell only 40 per cent of the flats on offer. At the Sea To Sky, only 68 of 285 apartments on offer found buyers.

Two continuous weekends of lacklustre sales underscores the challenges faced by Hong Kong’s real estate market, as the city’s worst recession on record gave buyers cause for pause, while an oversupply of flats released before the coronavirus pandemic earlier in the year remains mostly unsold. Hong Kong’s index of second-hand houses fell 1.1 per cent in August, its biggest drop in six months, extending the declines to 4.1 per cent from the May 2019 record.

“Prices may stabilise in the short term, despite the decline in the housing price index,” agent said.

Prices at Sea To Sky started from HK$7.09 million (US$914,223), going up to HK$20.4 million for the biggest units, while Mount Regency ’s prices ranged between HK$5.9 million and HK$9.3 million.

When CK Asset began selling Sea To Sky in June, it was the costliest launch of a property project in the Tseung Kwan O neighbourhood, with prices starting from HK$6.4 million for a two-bedroom flat measuring 471 sq ft, going up to HK$17.7 million for a four-bedroom unit of 1,077 sq ft. Still, the project’s first batch was mostly sold out, with 28 buyers submitting bids for every available unit.

Four months on, and with several more developers jumping back into the market with newly completed flats for sale, buyers have more to choose from, driving some to pause to consider.

With buyers remaining on the sidelines, the Hong Kong government may resort to reclaiming more land to build affordable housing, a way to address the chronic housing problem in the former British colony.

The city’s real-estate federation has proposed to reclaim three islands around Guishan

that will accommodate around 800,000 residents, adding to the HK$624 billion Lantau Tomorrow project that was approved last year. Lam is due to address the public in her annual policy speech on Wednesday.

Hong Kong is set to miss the annual target of land supply for a third consecutive year in 2020 because of the lack of land plots available to be developed, according to analysts. The government plans to supply 12,900 new private homes for the year through March 31 next year and 7,400 have been added so far.

(South China Morning Post) 黃大仙地鋪3050萬易手

市場消息透露,黃大仙雙鳳街20號,建築面積1000方呎,原業主叫價3600萬,成交價3050萬,租金84000元,租客為英都燒味茶餐廳,該鋪位門面闊23呎,深40呎,原業主於2012年4月用2900萬買入,雖然帳面獲利,不過,連手續費,則明賺暗蝕約50萬。

持貨八年「暗蝕」50萬

盛滙商舖基金李根興指出,該鋪位放盤一段長時間,一減再減,缺點是位處斜路位置,優點是人流旺,門面夠闊,對正燈位,由長情租客承租,感覺平市值10%。他又說,可惜位置為黃大仙,日後甩手比較難。租客燒味工場位處後巷,由另一獨立業主持有,萬一那名業主不續租,該餐廳經營立即有問題,租客做不到生意。

受疫情衝擊,甲廈租金顯著回落。金鐘區內兩大甲廈單位分別以38元及40元放租,代理表示,金鐘道89號力寶中心2座低層03室,面積約4541方呎,意向呎租約40元,涉及月租約18萬餘元。

力寶意向呎租40元

該代理續表示,單位現已交吉,備有裝修及來去水茶水間。資料顯示,今年截至8月止,該甲廈共錄得約22宗租務,平均成交呎租約51.58元;而對上一宗低層戶租務為4樓02室,面積約598方呎,7月底成交呎租約46元,故相比下,是次放租折讓逾10%。

代理續稱,另一放租為海富中心2座低層01室,面積約2611方呎,以每方呎約38元招租,月租近10萬。該單位即將交吉,同樣備有寫字樓裝修,面積適合中小企承租。該甲廈今年暫僅錄約3宗租賃,平均成交呎租約50.22元,最近一宗為6樓09室,面積約1155方呎,於8月底以呎租約43元租出,同樣地,與成交呎租相比,今次招租物業更顯相宜及貼市。

(星島日報)

更多力寶中心出租樓盤資訊請參閱:力寶中心出租

更多海富中心出租樓盤資訊請參閱:海富中心出租

上月中環商廈空置率7.2% 代理:創海嘯以來新高

疫情重創甲廈市場。據代理資料顯示,上月中環甲廈空置率報7.2%,創海嘯以來新高,另外,該區甲廈租金今年以來累跌23.8%,較整體大市的19.7%「更傷」。

據該行報告指出,證監會9月由中環遷至港島東,市場增加10多萬方呎的交吉寫字樓單位,亦令中環甲廈空置率升至7.2%,而中區 (包括上環、中環及金鐘) 空置率也躍升至7.3%,雙雙創下金融海嘯後新高水平。報告續指,現時中環個別由發展商持有的優質甲廈,空置率罕見逼近20%,情況屬多年來首見,而全港整體甲廈空置率也升至7.9%。

甲廈租金連跌15個月

由於整體甲廈空置率持續上升,分散業權甲廈租金更見下調壓力,9月份指標甲廈租金按月下挫0.1%,連跌15個月,今年以來累瀉19.7%;至於空置率連月來急升的中環更是跑輸大市,本年至今累跌23.8%,最新平均呎租僅約63.7元。報告又指,由於經濟疲弱以及政治環境不明朗,部分外資機構決定放售旗下商廈物業,包括一家日資金融機構有意放售持有的金鐘甲廈物業,而香港美國商會據報早前也放售旗下寫字樓物業。

代理指出,本港經濟持續疲弱,加上政治環境不明朗,企業對於寫字樓需求減少,而中環由於租金高昂,近年一直有不少企業「去中環化」以節省成本,令該區近月空置率急升,租金水平也不斷向下,跑輸其他地區。

該代理續指,由於經濟環境仍未轉好,本港恢復通關尚未有具體時間表,加上中環陸續有甲廈租戶的租約屆滿,相信短期內中區空置率仍會上升,租金仍會較疲弱。他又補充,近期有個別新成立的公司為節省成本,改以短租形式進駐商務中心,以觀望市場發展,若這成為新趨勢,或會對傳統辦公室構成競爭。

(星島日報)

商廈項目價格料跌至谷底 星星地產陳文輝:疫市下趁勢吸納

疫市下投資物業市況低迷,較高峰時大幅回落,星星地產主席陳文輝表示,集團向來主力打造工廈及商廈項目,其中,商廈項目價格料跌至谷底,現時是趁勢吸納好時機。

陳文輝表示,疫市對鋪位及商廈衝擊最大,價格比高峰時,跌幅至少五成至六成,集團向來對商廈項目頗具興趣,將趁勢吸納。「現時不是賣的時候,而是入貨時機,相信價格已跌至谷底。」

「雲之端」錄大手買賣

自3年前上市以來,星星地產主力發展新穎的工廈及商廈項目,自從2018年拆推元朗活化工廈虹方,最近推售大角嘴全新活化工廈項目「The Cloud雲之端」,項目位於通州街111號,樓高28層,共有233個單位,單位建築面積由92方呎起,入場費約70餘萬。

由於入場費低,在疫市下仍有市場,目前已沽售逾50個位,當中有用家亦有投資者承接,包括有個別大手買賣,如19樓全層,面積2807方呎,以每方呎約9300元沽,涉資約2610萬。而項目最高呎價為1803室,平均每方呎9908元。

陳文輝表示,料該項目投資額4億至5億,料套現約6億。現時市場氣氛不理想,若不是疫市的話,相信呎價可賣高2000元!「不過,市況高時貴賣,低時平賣,最重要因應需求,創造價值。」

星星地產於今年初,將旗下荃灣柴灣角街11至15號商廈地盤 (佔地面積約16312方呎,以地積比率9.5倍算,可建樓面約15.5萬方呎),售予第一集團,持貨逾6年,帳面獲利逾3.8億。

首度進軍住宅市場

目前疫情持續,惟陳文輝依然看好後市,認為疫情總會過去,只要一有疫苗,情況已不同,物業市場將反彈,樓價甚至有機會作報復式上升。

集團多方位吸納土儲,包括從二手市場吸納,同時亦留意政府賣地。目前,旗下有2個項目經營中,當中元朗宏業西街21號住宅地盤,屬重頭戲,集團首次進軍住宅市場,突破過往投資項目一般為10億元以下的框框,投資額高達20億,項目本身為工業地,將補價重建商住樓,總樓面逾18.2萬方呎,將提供335伙中小型單位,目前正等待補地價,他估計,每方呎約3000多元。

還有,觀塘偉業街107號工業地盤,擁有開揚海景,亦將考慮補地價重建成為商廈。

(星島日報)

工廈雲之端沽60伙 加推提價2至5%

受疫情影響,今年極少工商新盤推售。星星地產 (01560 旗下大角咀工廈新盤雲之端毋懼「疫市」開盤,首批已累售約60個單位,當中有買家大手斥資2608.8萬元購入一層,發展商加推提價2%至5%

星星地產主席及首席執行官陳文輝表示,雲之端開售至今推出70個單位,已售出約60個,成交呎價最高達9908元。有買家購入19樓全層,建築面積約2807方呎,成交價約2608.8萬元,呎價約9294元。

陳文輝指出,項目按原定時間表推出,在疫情下推盤,氣氛會受影響,訂價亦較之前預計調低約20%。猶幸市場反應理想,項目加推單位的售價已調高2%至5%。

雲之端屬罕有配備5G流動通訊和10Gbps寬頻的工廈,適合資訊科技、高科技及藝術工作室等行業,現時入市的買家中有半數為用家。是次項目投資額約4億至5億元,涉及宣傳費約300萬元,預計全數售罄可套現6億餘元。

雲之端位於大角咀通州街111號,提供24層工作室樓層,共有233個單位,標準單位建築面積100至460方呎,全層單位建築面積為2807方呎。

(信報)

舖市未來兩年難樂觀 價格勢大跌

鄧鉅明:政治環境未穩 特別看淡商廈

疫情下奢侈品銷售受嚴重影響,太子珠寶鐘錶主席鄧鉅明認為,是次疫情重創零售,需時復原。樓市方面,他認為住宅樓價尚有調整空間,而寫字樓則受多路負面因素夾擊,前景黯淡。

疫情持續大半年,最受影響行業,必定為與旅遊行業相關的零售。而零售業中,最倚靠旅客消費的奢侈品,絕對是重災。鄧鉅明指,旗下生意較高峰期大跌9成,「封關下完全沒有旅客,有時分店兩日也沒有客進來,因此生意已跌9成,僅餘部分本地客。9月份疫情略為緩和,本地消費有好轉,但涉及遊客生意仍完全無起色。」

佔中事件 生意4年才復甦

他指,由於環球疫情未受控,除非疫苗出現,否則奢侈品零售復原時間更長。「疫情下限制人與人之間接觸,無接觸那如何做生意?要待疫苗推出才有轉機。況且今次疫情令很多老闆生意上有所損失,只是輸多還是輸少的分別。他們是奢侈品的主力消費者,必定減少購買貴價貨品。」他提到:「2014年本港出現佔中事件,當時生意曾跌5成,直至2018年下半年才開始復甦,足足4年時間。今次疫情衝擊,到底何時重返正常也難料,復原期料漫長。」

樓市方面,從各項數字顯示,住宅樓價在疫情下未見明顯下跌,他指目前住宅市場表現,未足以反映實際情況。「住宅價跌得較少,其實發展商推新盤以優惠計劃配合,如先住後付、低息、高成數按揭等,故價錢仍硬淨。以我所觀察,二手市場要成功沽貨,減價幅度要大才吸引,故始終會出現調整。」

他認為,近月租金明顯下跌,反而是樓價走勢指標,「如我們旗下豪宅,租金也較高峰跌3成,租務才反映經濟及物業價值,相信疫情下樓價並不是跌1至2%那麼少,不過香港人持貨能力仍強,未現斷崖式下挫。」

非住宅市場上,鄧鉅明認為商用物業租售價面對極大回調壓力,特別睇淡寫字樓。「香港政治環境未完全穩定,機構收縮業務,在家工作亦令需求向下。目前全世界受疫情影響,外資機構自身難保,不往外擴充,寫字樓跌幅大,未來一至兩年前景相當黯淡。」

商舖市場上,他指吉舖最壞情況尚未來臨,「二、三綫舖很多交吉,只有一半有人租,因為商戶生存不到,尖沙咀、銅鑼灣靠遊客,開業做生意的老闆,連人工也賺不到,還未計租金。政府保就業若完結,關店情況更惡劣,商舖價未來兩年難樂觀,勢大幅回調。」

(經濟日報)

Tai Wai flats heavily oversubscribed

The first batch of flats at The Pavilia Farm atop Tai Wai Station was 21 times oversubscribed with New World Development (0017) receiving 4,000 checks for the 180 units offered, while homebuyers thronged the sales office to see the show flats.

The 180 units were offered at HK$18,921 per sq ft after discounts.

The cheapest flat, measuring 322 sq ft, was priced at HK$6.28 million, or HK$19,531 per sq ft, after discounts.

Meanwhile, the primary market saw 353 forfeitures in the first three quarters this year, local media reports.

In Lohas Park, Wheelock Properties collected HK$69 million after selling all the six flats on offer at Malibu yesterday.

As new projects lured away home buyers, a property agency reported only 12 secondary transactions at 10 blue-chip housing estates over the weekend, down by 20 percent from a week before, agent said.

In Tin Shui Wai, a 1,280-sq-ft flat at Kingswood Villas changed hands for HK$12.8 million, or HK$10,000 per sq ft, after HK$2 million was slashed from the asking price.

Another 544-sq-ft flat at the estate fetched HK$5.4 million, or HK$9,926 per sq ft, after HK$600,000 was cut from the asking price.

In Quarry Bay, a 591-sq-ft unit at Taikoo Shing fetched HK$9.5 million, or HK$16,074 per sq ft, after HK$2.5 million was cut from the asking price.

In Lai Chi Kok, a 1,112-sq-ft flat at Mei Foo Sun Chuen changed hands for HK$14.7 million, or HK$13,219 per sq ft, after HK$800,000 was cut from the asking price.

And in Tseung Kwan O, a 441-sq-ft flat at Metro City fetched HK$6.83 million, or HK$15,488 per sq ft, after HK$370,000 was cut from the asking price.

In the rentals market, a 460-sq-ft unit at Amoy Gardens in Ngau Tau Kok was rented for HK$15,500 per month, or HK$33.7 per sq ft, after HK$1,000 was cut from the asking price.

In Sai Wan Ho, a 462-sq-ft flat at Grand Promenade was rented for HK$21,000 per month , after HK$4,000 was cut from the asking rent.

(The Standard)

蛋糕店月租18萬進駐海防道

核心零售區地舖空置率高企,業主亦接受現實大幅減租。位處尖沙咀海防道及漢口道交界的單邊舖位,過去一年接連只獲租客短租,最新終獲商戶長租,由蛋糕店以每月18萬元承租,租金較之前一份長約租金銳減七成。

原卓悅舊舖 跌價七成

屬於尖沙咀一線地段的海防道,年內已有不少舖位空置,原由本地化妝品連鎖店卓悅 (00653) 租用的海防道45號地下,建築面積約818方呎,卓悅原租約月租60萬元,本已於去年9月到期,但因未有新租戶承租,卓悅遂以每月30萬元短租至今年3月,繼續在原址經營。但今年初新冠肺炎疫情爆發,零售進一步跌入谷底,卓悅在3月後未有再租用。在丟空約一個月後,舖位獲出售餐具碗碟的「缸瓦佬」短租,月租較卓悅短租價下降56.7%,至13萬元,租約至本月底屆滿。

據了解,舖位今年初開始以每月35萬元放長租,在短租期內亦未有降價,隨着短租客租期臨近屆滿,而本地零售業未見起色,業主亦擴闊議租空間,近期終以每月18萬元租出,呎租約220元,新租戶為蛋糕店,雖然租金較「缸瓦佬」短租價回升5萬元或38.5%,卻比卓悅原先長租約60萬元低70%。事實上,卓悅自2011年10月起承租上址,2014年月租最高曾達120萬元,最新租金與6年前相比,跌幅更達85%。

中達大廈地舖短租20.8萬

同一地段海防道38至40號中達大廈地下A及B舖,建築面積約2100方呎,去年11月起丟空,至今年1月初即疫情開始前,獲時裝店以每月30萬元短租逾半年,已在近月遷出。據悉,舖位剛由口罩專門店短租兩個月,雖然都屬短租個案,但月租較9個月前下跌30.7%,至最新僅20.8萬元,呎租約99元。此舖原由金行粵港澳湛周生生承租,在2017年底續租時月租130萬元,如今租金蒸發84%。

(信報)

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

中環萬邦行地舖 麵包店35萬承租

疫情下租金回調 較高峰期跌7成

疫情下中環舖位租金大幅回調,漸見民生商戶承接。皇后大道中萬邦行地下一舖位,獲麵包店以約35萬元租用,舖位對上租客為錶行,月租約70萬元,租金跌逾半,較高峰期更低7成。

市場消息指,中環萬邦行地下錄得一宗新租務成交,涉及舖位面積約1,540平方呎,以每月約35萬元租出,呎租約227元。該舖位於中環皇后大道中核心地段,對面為娛樂行並鄰近港鐵站出口。據了解,新租客為本地飲食集團,將開設麵包店,由於舖位面積較大,預計除了售賣麵包外,亦會推出蛋糕、特色小食等。

翻查資料,該舖因位處核心旺段,在零售高峰期時以高價租出。物業早年曾獲中藥店北京同仁堂租用,2011年品牌在約滿前為保據點,加租5成至約120萬元,呎租達779元。

數年前北京同仁堂棄租後,舖位獲鐘錶店以約70萬元租用,今年該錶店亦遷出,舖位交吉多月後,獲麵包店租用。以最新約35萬元月租計,較對上租金跌約5成,若與高峰相比,新租金平7成。

中環空置率 升至16.9%

據代理資料顯示,疫情下中環、銅鑼灣、尖沙咀及旺角4大核心區,第三季商舖空置率上升;而中環空置率由第二季12.7%,升至第三季16.9%。目前該區商舖呎租約395元,今年累跌40.8%。事實上,皇后大道中目前尚有不少吉舖待租,包括鄰近萬邦行的華人行,地下兩大舖位原由Swatch旗下品牌租用,數月前突遷出,現業主仍在放租。

近期整體租務活動略好轉,核心區主要地段錄得商舖租務成交,亦因舖租大幅回調,最近漸見民生商戶重返核心區。

以銅鑼灣為例,希慎廣場對出的啟超道及恩平道先後錄新租務。其中恩平道50號地下,面積700平方呎,獲便利店以約25萬元租用。舖位原由莎莎化粧品租用,月租約65萬元,去年品牌遷出,僅由手機配件店以10萬元短租。按是次便利店25萬元租金計,跌逾6成。

(經濟日報)

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

北角3重建項目 新增樓面逾140萬呎

屬於傳統住宅區的北角區,近年有不少收購重建,當中獲新世界發展 (00017) 完成收購的前皇都戲院大廈,有望展開保育及重建方案,若作商業發展,最多可提供逾54萬平方呎樓面。

皇都戲院大廈 保留文藝特色

現時屬於一級歷史建築的前皇都戲院大廈,位於英皇道271至291號,由皇都戲院、住宅大廈及商場所組成,新世界日前成功以約47.76億元透過強制拍賣統一業權,創歷來最貴的舊樓強拍。由於前皇都戲院頗具建築特色,並且屬於一級歷史建築,發展商計劃保留整個戲院建築及天台桁架,重塑戲院部分成為文化藝術表演場所,而比鄰的住宅大廈則有望展開重建。

該物業面積約3.62萬平方呎,規劃用途為「商業/住宅」,再加上屬於「舊契」地皮,發展商可以彈性重建成為商廈或者住宅。若作住宅發展,地積比率最高10倍,可建樓面約36.2萬平方呎。至於作為商業發展,項目的地積比率更會多達15倍,可建樓面逾54萬平方呎。由於發展商計劃保留前皇都戲院的部分,預計會影響可以重建地盤的範圍。

恒隆地產 (00101) 等亦正在重建電氣道226至240號舊樓地盤,項目佔地約7,000平方呎,將重建成1幢商業及辦公大樓,總樓面約10.5萬平方呎,項目預算總投資額約25.6億元,以此計算,投資額每平方呎約2.4萬元。

據資料顯示,電氣道226至240號屬於8幢相連的舊樓,在多年前已經開始獲財團收購,包括電氣道230號全幢於2013年2月以約1億元易手;至於電氣道238至240號以每伙約860萬至約1,817萬元不等作收購。

水務署大樓 港島東最大型商業地

另外,位於英皇道611號的北角水務署大樓,政府將北角水務署大樓連同灣仔的水務署總部,以及懲教署總部一併遷入柴灣區盛泰道作重置,預計將於2020年動工,2024年可落成,而水務署大樓用地可釋放作商業發展。而該地現時已改劃為商業用途,佔地約5.06萬平方呎,估計可重建樓面約75.9萬平方呎,將為港島東區罕有的大型商業地供應。

而上述三個重建項目預計可望提供最多140.7萬平方呎的樓面供應,有望加快舊區的蛻變及轉型。

(經濟日報)

京瑞每呎1.1萬易手持貨五年升值70%

疫情持續發酵,商廈市場觀望氣氛揮之不去,惟部分商廈仍備受追捧。沙田京瑞廣場1期低層C室,以943萬易手,原業主持貨5年帳面獲利約386萬,物業期間升值近70%。

商廈物業再錄承接。據土地註冊處資料顯示,沙田京瑞廣場1期低層C室,於本月5日以943萬成交,買家以公司名義登記,為權浩有限公司 (STRONG VAST CORPORATION LIMITED),註冊董事為姚姓及陳姓人士,以單位面積853方呎計,每呎造價約11055元。原業主於2015年以556.2萬購入,以個人名義持有,持貨5年帳面獲利386.8萬,物業升值約70%。

作價943萬

據代理資料顯示,該商廈近期成交為1期低層F室,面積757方呎,於今年9月以1020萬售出,每呎造價約13478元;另一成交為1期低層G室,面積734方呎,於同日以989萬沽出,成交呎價約13474元。資料亦顯示,該廈再對上一宗成交為1期中低層L室,面積約1734方呎,於今年8月以約2167.5萬成交,呎價約1.25萬。

(星島日報)

西環地鋪每呎2.26萬易手位處聖士提反里連約回報3.4厘

受疫情打擊,鋪位市場觀望氣氛仍濃,惟市區鋪位仍備受追捧。消息指,西環聖士提反里地鋪,以1400萬售出,成交呎價約2.26萬,料買家享租金回報約3.4厘。原業主於鋪位高峰時購入,八年僅升值9.4%。

市場消息指出,上述鋪位成交為西環聖士提反里1至2號金鳳閣地下單號鋪,面積約617方呎,以約1400萬成交,呎價約22690元,該鋪由音樂中心以4萬元承租,租約至明年12月,料買家享租金回報約3.4厘。

八年僅升值9.4%

據土地註冊處資料顯示,原業主於2012年以1280萬購入,以公司名義嘉盈國際投資有限公司 (OCEAN PROFIT INTERNATIONAL INVESTMENT LIMITED) 持有,註冊董事為甄姓人士,持貨8年帳面獲利120萬,期間升值約9.4%。

據業內人士指出,上述鋪位人流量雖不高,惟因位處半山區,用作教育用途屬相當適合,故雖然鋪位市場受疫情重創,觀望氣氛持續濃厚,惟料該鋪租金收入仍然穩定,認為上述成交價屬市價水平。

據代理資料顯示,上述地段對一宗鋪位成交於為該街道1至2號地下6室,面積530方呎,於2017年3月以1250萬售出,呎價約23585元;另一買賣則須追溯至2012年,當時為該街道3號地下A室,面積550方呎,附設天井250方呎,以1450萬成交,每呎造價約26363元。

瑞信低層意向1500萬

另一方面,商廈市場受淡風吹襲,叫價顯著回落。代理表示,尖沙嘴柯士甸道140至142號瑞信集團大廈低層單位,面積約1488方呎,以意向價1500萬放售,呎價約10080元,較早前叫價減幅約17%。

代理指,上述放售單位間隔實用,適合作寫字樓用途,現租戶將承租至2022年,租金回報逾3厘,屬不俗水平;據代理資料顯示,該商廈近期成交於去年3月,當時該13樓A室,面積1123方呎,以988萬售出,每呎造價約8798元。

(星島日報)

Hong Kong’s mid-sized developers seek to create markets in unlikely niches to survive city’s worst economic slump on record

Far East Consortium Limited, the biggest operator of three-star hotels in Hong Kong, launched 4,500 safe deposit boxes at the basement of its Silka Far East Hotel in Tsuen Wan

Kowloon Development, a developer of tiny flats in Hong Kong, recently diversified into mass retailing

Hong Kong’s real estate developers, particularly mid-sized companies that rely on a narrow segment for their sales, are diversifying their product offerings to find potential revenue in new market niches to help them survive the city’s worst recession on record.

Some of them are developing data centres, while others are expanding into industrial facilities and self-storage warehouses, said Maggie Hu, an associate professor of finance and real estate at the Chinese University of Hong Kong. Mid-sized developers are particularly vulnerable to the adverse impact of the business downturn in Hong Kong, giving them a bigger incentive than large, cash-rich companies in adapting to changing needs of the market.

“(They) are often much less diversified in their assets and types of income streams, [so] diversification is more important and imperative for them to navigate through the crisis,” Hu said. “Different types of real estate assets are affected by the pandemic in different ways. Self-storage facilities, industrial facilities and data centres have faced much less declines than malls, lodging, hotel and housing.”

Hotels and shopping centres are bearing the brunt of Hong Kong’s economic slump as the number of tourists in the city began to dwindle last year following the massive street protests that rocked Hong Kong, and further reduced by the Covid-19 pandemic that led to travel restrictions. Falling retail sales caused rental charges to slip, forcing some luxury retailers to shut outlets and drove Russell Street in Causeway Bay off the perch as the world’s most expensive retail strip.

Far East Consortium Limited, the biggest operator of three-star hotels in Hong Kong, is going into the business of providing private vaults for customers to store their valuables. The operator of the Dorsett hotels in Wan Chai and Kwun Tong launched 4,500 safe deposit boxes in a private vault measuring 3,000 square feet (279 square metres) at the basement of its Silka Far East Hotel in Tsuen Wan, converting space that previously hosted a foot massage parlour, and a bank vault.

Kowloon Development, a developer of tiny flats in Hong Kong, recently diversified into mass retailing, with the 2,000-sq ft Soda Mall that features a supermarket and a grocery store for health foods.

“We see great potential in this segment, [because] banks are downsizing their operations” offering safe deposit boxes, said Chris Hoong, managing director of Far East. “Generally you have to wait six to seven years to get a safe-deposit box, depending on the location.”

The customers aimed for by Far East Vault are the residents living close to the hotel in Tsuen Wan, Hoong said, adding that in Hong Kong, the small flats mean little space for valuable items that are hardly used or worn every day.

“We have some space in our hotel in the basement in Silka …, and we decided the best way to utilise the space is to put up a safe-deposit box [business],” Hoong said. “Depends on how this one goes, we need a year to observe, at least a year before making a decision whether to start a new one.”

So far, the company is getting 20 inquiries a day. With the smallest box available for HK$218 (US$28) a month, Far East expects the private vault business to yield an income that is comparable to revenues coming from a small hotel with 100 rooms.

The business model is responding to an unmet demand in the city, property agent said.

“We do see that demand for safe deposit boxes has always been present in Hong Kong, but sadly the supply has never been able to meet the demand,” the agent said. “Given the high security and loading specification requirements, as well as larger space required, specifically basement or ground floor areas, suitable space for private vaults and safety deposit boxes is extremely limited.”

Locations outside Hong Kong’s core business and retail districts are also ideal for a private vault business, agent said.

“Even now, with the rentals having dropped significantly in core districts, it hasn’t reached the point where this business can be sustainable on the high street level,” agent said. “For residential areas, where the rental decline is rather mild, it remains challenging to find a location that fits the technical requirements and caters to local demand.”

(South China Morning Post)

尖沙咀一帶有不少商廈,位於廣東道一帶鄰近購物商業中心,其中力寶太陽廣場位於廣東道核心位置,坐擁地理優勢。

力寶太陽廣場位於廣東道28號,於1988年落成,至今樓齡約32年。項目基座設有商舖,而商場更設有通道連接尖沙咀港鐵站,而物業外亦有巴士綫。由物業步行至天星小輪碼頭不過10分鐘的步程,前往中環及灣仔等商業中心亦見方便。物業自設停車場,為駕駛人士提供車位。

大廈大堂與街道分隔,需經由扶手電梯連接,私隱度十足。載客電梯以樓層分隔,每邊設有4部升降機,有效分散人流。

項目大堂設有通道,可經由此前往比鄰的朗廷酒店,及通往亞士厘道,方便出入。而物業位於廣東道,主要購物消閒之地點,日常飲食及購物選擇相當多元化。

每層最多可分14單位

物業樓層每層面積約25,860平方呎,故分間成多個單位方便使用,每層最多可分間成14個單位使用,單位面積由305平方呎起。每層的業戶需共用洗手間,單位內未有設來去水位,故每層設有共用的茶水間,方便業戶。

物業可享雙邊景致,而一邊望尖沙咀廣東道一帶都市景,而另一邊則外望九龍公園一帶景致,相當開揚。大廈業戶多元化,包括不少貿易公司、航空公司及醫療中心等在此均設有辦公室。

去年10月呎價18995

項目買賣成交不多,最新一宗成交要追溯至去年10月,為頂層1B室單位,面積4,359平方呎,以8,280萬元成交,呎價約18,995元。至於租賃方面,高層14B室,面積816平方呎,最新近於本月以30,192元租出,呎租約37元。

參考比鄰的物業成交,如比鄰的新港中心1座一個中層08室,約1,443平方呎,於今年7月以2,207.79萬元售出,呎價約15,300元。租務方面,星光行一個754平方呎的中層單位,以17,342元月租租出,呎租23元。

(經濟日報)

更多力寶太陽廣場出租樓盤資訊請參閱:力寶太陽廣場出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

法時裝公司尖東轉九龍灣 可省4成開支

疫情下機構選擇搬遷節省租金,法國時裝公司租用九龍灣One Kowloon單位,呎租約25元,該機構原租用尖東帝國中心商廈,是次搬遷可節省4成租金。

消息指,九龍灣甲廈One Kowloon錄得一宗租務成交,涉及物業約1.1萬平方呎,成交呎租約25元。在整體商廈呎租回落後,現成交呎租亦較高峰期逾30元,跌約2成。

新客原租帝國中心 呎租35

據悉,新租客為一家法國時裝公司,該租客原租用尖東帝國中心約1.3萬平方呎樓面,按該廈呎租水平約35元計,是次搬遷既縮減業務,搬至東九龍呎租亦平3成,連同縮減樓面,可省4成開支。

環球疫情持續,跨國企業生意難免受打擊,故有需要節省開支,而搬公司至東九龍是選擇之一。據代理資料顯示,東九龍最新呎租約32.4元,按月跌約3.3%,今年累跌約9.5%,相比港島區甲廈,租金亦較低,故可吸引租客搬遷。東九龍今年最大手租務,為觀塘海濱道Two Harbour Square 15及19樓全層,以及12樓部分樓面,合共面積約7.3萬平方呎,成交呎租約25元。按面積計算,為今年市場上錄得最大宗商廈租務個案。新租客為香港按揭證券公司,把部分原租用上環樓面放棄,轉租可節省逾5成租金。

其他租務方面,消息指,尖東新文華中心B座中層5室,面積約730平方呎,以每月約1.75萬元租出,呎租約24元,較兩年前高峰期相比,租金跌約25%。買賣方面,沙田石門京瑞廣場1期低層C室,面積約853平方呎,以約938萬元成交,呎價約1.1萬元。

(經濟日報)

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

甲廈需求急降 租金料跌至明年

環球疫情未停,甲廈租務需求急降,業界人士預計,今年商廈租金未見底,跌勢持續至明年。

代理數字顯示,甲廈寫字樓租賃活動,在2020年第三季略有改善。新租賃活動按季增加25%,然而僅佔過去5年季度平均水平的一半。整體甲廈市場第三季度淨吸納量錄得負673,500平方呎,整體空置率升0.8個百分點至9.6%。中區的空置率錄最大升幅,上升2.1個百分點至7.3%,淨吸納量為負452,700平方呎,屬有紀錄以來最大負值。

僅東九錄正數淨吸納量

東九龍是唯一在第三季尾錄得正數淨吸納量的分區市場,淨吸納量為44,700平方呎。第三季觀塘錄得大手甲廈租務成交,涉及海濱道Two Harbour Square,為物業15及19樓全層,以及12樓部分樓面,合共面積約7.3萬平方呎,成交呎租約25元。按面積計算,為今年市場上錄得最大宗商廈租務個案。新租客為香港按揭證券公司。

據了解,該公司原租用中遠大廈逾6萬平方呎,涉及3層並由不同業主持有,較早前該機構續租其中一層,放棄其他兩層,合共逾4萬平方呎樓面,搬至觀塘新商廈,並作出擴充。按中遠大廈呎租水平約50至55元計,可節省逾5成租金。

甲廈租金 連跌六季

租金方面,代理數據顯示,甲廈租金連續六季下跌。整體而言,全港租金在今年首三季下跌13.9%,按季下跌4.7%,各區租金皆呈下行趨勢,其中以中區及灣仔/銅鑼灣區跌幅最大,按季分別跌6.3%及5.2%,按年則跌16.9%及15%。

由於租賃需求縮減,本港寫字樓需求持續偏軟,料中區超甲級寫字樓及灣仔/銅鑼灣,租金全年跌幅達25%及23%。

代理指,在環球疫情下,跨國機構乏擴充,租金仍尋底,第四季甲廈租金仍跌約5至10%,全年中環跌幅達25%。他認為由於疫情加上中美關係緊張,影響甲廈需求,明年甲廈租金跌勢持續。

代理表示,企業租戶對作出房地產決策時會更為謹慎,繼續以節省成本為首要目標。至於一些需要被頂租及附帶完善裝修的寫字樓單位,受到希望節省開支的租戶歡迎。

另外,有見空置率上升及頂租空間增多,為挽留租客,業主立場軟化,個別情況下甚至會為租戶提供裝修津貼,以鼓勵租用空置空間。

(經濟日報)

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多中遠大廈出租樓盤資訊請參閱:中遠大廈出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

商廈物業有價有市,部分業主亦趁勢放售。觀塘萬兆豐中心中層以意向價約1902萬放售,呎價約8980元。

代理表示,上述放售物業為觀塘海濱道133號萬兆豐中心中層,面積約2118方呎,以意向價約1902萬元放售,呎價約8980元;代理指,單位間隔四正實用,外望開揚城市景,以交吉形式出售。據代理資料顯示,該商廈早前成交為高層K02室,面積1048方呎,於上月以1098萬沽出,呎價10477元。

平均呎價8980元

另外,另一代理表示,尖沙嘴力寶太陽廣場4樓08B及C室,總面積約2950方呎,以意向呎租約30餘元放租,單位位處大單邊。資料顯示,該廈現時約有22個放租盤,每呎叫價由約30至48元,當中佔4個為面積約3000方呎單位。徐氏補充,業主因應現時市況,租金具商議空間。

該代理續稱,力寶太陽廣場位處尖沙嘴廣東道,屬港鐵站上蓋商廈。

(星島日報)

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多力寶太陽廣場出租樓盤資訊請參閱:力寶太陽廣場出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

鄧成波3.5億沽基隆街地盤

受疫情衝擊,鋪位市場陰霾密布,資深投者紛減磅沽貨。消息指,近期連環沽售物業的「鋪王」鄧成波以3.5億沽出太子基隆街地盤,項目佔地5654方呎,每呎樓面地價約6878元。

市場消息指出,上述為太子基隆街1、3、5及7號全幢,現址4幢唐樓,樓高4至10層,地盤面積5654方呎,為住宅 (甲類) 用途,最高地積比9倍,可重建樓面50886方呎,以成交價3.5億計,樓面呎價約6878元。

上述項目早前以6億放售,故減幅逾40%;資料顯示,上述物業由鄧成波收購多年,當中基隆街1、3號在2014年以1.6億整幢購入;5號全幢在2011年斥2820萬買入。

樂風周佩賢:現階段不回應

市場消息盛傳,上述買家為本地發展商,並以樂風集團呼聲最高。本報昨日就上述消息向樂風集團作出查詢,該集團主席周佩賢回應指,現階段不便回應;至於陞域集團亦不作回應。

市場消息盛傳,由鄧成波放售的旺角豉油街61至67號地盤,亦獲準買家以約3.55億洽至尾聲,地盤面積3534方呎,屬住宅 (甲類) 用途,已獲批重建一幢23層高、總面積約31807方呎的商住大廈。

財團洽購豉油街地盤

事實上,鄧成波近期連沽多個物業,早前以3.18億沽筲箕灣道地鋪連1樓,即楚留香酒樓舊址,料持貨3年平手離場,買家回報約3.4厘。

金巴利道80號下月截標

鄧成波再有物業放售。代理表示,尖沙嘴金巴利道80號全幢,樓高14層,總面積約19923方呎,門闊約77呎,最高地積比率12倍,可建樓面約2.3萬方呎,可重建為銀座式商廈及酒店,市場估值約3.88億,以現狀及連約標售,截標日期下月12日。

土地註冊處資料顯示,鄧成波於2018年以3.3億購入上址,平均呎價16564元。

鄧成波近期連環放售物業,灣仔軒尼詩道168至170號煥然樓,以意向價4億放售,地盤面積約1915方呎,可建樓面約28725方呎,每呎樓面地價約13925元。現址為一幢14層高商住樓,地下至閣樓為商鋪,1樓至12樓為住宅,總樓面約22368方呎。

(星島日報)

金巴利道全幢物業招標 估值近3.9億

尖沙咀金巴利道80號公開招標出售,代理表示,截標日期為今年11月12日正午12時,市場估計市值逾3.88億元。

物業坐落於尖沙咀核心地段,四通八達,鄰近尖沙咀、尖沙咀東港鐵站、西九龍高鐵站及多個旅遊景點,周邊大型商場及甲級寫字樓林立,地標性商場如美麗華廣場、天文臺道8號及The ONE等近在咫尺。物業將以現狀及連現有租約出售。

物業現為一幢14層高商業大廈,現有建築面積約19923方呎,位處小巷單邊,門面闊度約77呎,城市規劃為商業用途,地積比率最高為12倍,可建銀座式商廈及酒店。

物業適合酒店、服務式住宅或商廈投資者購入作長線投資,亦適合教育、醫療、宗教、會所或慈善團體等自用,集團機構更可自置作總部。物業外牆及天台可配置大型廣告牌,帶來龐大廣告效益。物業更可進行公司股權交易,以節省印花稅。

代理表示,這是一個難能可貴的機會擁有一座位處尖沙咀優越地段的大廈,每年此區的全幢成交寥寥可數。對上一次的成交要數去年11月售出的金馬倫道37號,成交價4.48億元,呎價接近1.9萬元。不同之處是本物業現時寫字樓部分以酒店形式營運,買家可考慮翻新整幢大廈作服務式住宅、共享居住或共享工作空間,預計租金收入可以大幅增加一倍以上;亦可把物業重建為酒店或半零售商廈,收租或自用皆可看高一線。

(信報)

永安祥大廈地舖全數沽出 均價5萬

代理表示,上環永樂街5至9號永安祥大廈13層寫字樓 (包括高低樓層) 及2個地下旺舖放售,剛成功售出全部地下旺舖,平均呎價5萬元,租金回報率3%至4%,買家屬長線投資者。

目前餘下樓上寫字樓,每層約1700方呎,現時呎價1.4萬餘元起,較一年前同類型物業折讓20%以上。

(信報)

Pandemic fails to deter luxury buyers

Deep-pocketed buyers continued to pick up luxury homes in Hong Kong in the face of the ongoing pandemic and strained Sino-US relations.

Hang Lung Properties' (0101) chief executive Weber Lo Wai-Pak purchased a flat at Pine Crest in Repulse Bay for HK$70 million.

The flat measures 1,971 sq ft, according to local media reports.

In Jardine's Lookout, Fuman executive director Lawrence Lam Chi-bun bought a 1,580-sq-ft luxury house at Mount Butler Drive for HK$85 million.

Fuman makes Gundam toys in partnership with the Japanese intellectual property owner Bandai.

In Tuen Mun, Wing Tai Properties (0369) sold a 1,878-sq-ft luxury house at The Carmel for HK$32.28 million, at HK$17,188 per sq ft.

And Nan Fung Group sold a 2,865-sq-ft flat at 8 Deep Water Bay Drive for HK$174.76 million, or HK$61,000 per sq ft.

But a vendor suffered a loss of HK$3.79 million on paper after selling a 1,587-sq-ft luxury house at Valais in Sheung Shui for HK$18.2 million, or HK$11,468 per sq ft.

Meanwhile, in the primary market, New World Development's (0017) first batch of flats at The Pavilia Farm atop Tai Wai Station was oversubscribed 54.5 times with the developer receiving around 10,000 checks for the 180 units offered in the first price list.

In Yau Tong, Minmetals Land (0230) expects to launch Montego Bay for sale as early as this month.

Meanwhile, Lai Sun Development (0488) will offer a 1 percent discount for LS Club members if they buy Monti units before November 30.

In Tai Kok Tsui, a buyer forfeited deposits of HK$304,000 after calling off the purchase of a 257-sq-ft studio flat at AquilaSquare Mile, which was priced at HK$6.07 million.

In other news, Billionaire Tang Shing-bor, known as the "shop king," is putting up the Kee Shing Commercial Building in Tsim Sha Tsui for sale. The property is valued at HK$388 million. Tang also sold a property at Ki Lung Street in Prince Edward for HK$350 million, after HK$250 million was cut from the original asking price.

(The Standard) 中環中心全層9.8億易手 三年升值逾15%內 房合生創展承接

疫市下經濟前景未明,商廈市場淡靜,有用家趁勢置業。「磁帶大王」陳秉志剛沽出中環中心全層,作價9.8億,平均呎價3.8萬,買家為內房合生創展。儘管物業於三年間升值逾15%,陳秉志坦言:「僅獲微利!」

市場消息透露,中環中心48樓全層由內房合生創展購入,作價約9.8億,以該全層建築面積約25695方呎計算,平均呎價約38139萬。原業主陳秉志接受本報查詢,證實沽出物業,他表示,今番並沒有連5個車位出售,他於三年前購該全層連5個車位,當時呎價3.3萬,涉資約8.48億,儘管帳面獲利逾1.3億,再加上車位,僅獲微利!原因是物業按予銀行,要計及三年利息。他又說,該宗買賣並沒有連車位,買家或稍後再洽商購入車位。

原業主陳秉志:僅獲微利

上址由基金公司承租,月租210萬,租約尚有兩年,以易手價計算,回報約2.57厘。合生創展於2018年10月向資深投資者「物流張」張順宜購入該廈49樓,作價以11.18億,以建築面積約25695方呎計算,平均呎價43510元。換言之,今次成交呎價較兩年前低約12%。

星星地產銷售及推廣董事總經理廖漢威表示,旗下大角嘴工廈新盤雲之端,最新售出一個單位,呎價創項目新高,涉及為1609室,建築面積約192方呎,以192萬成交。早前記錄為1709室,建築面積192方呎,以每呎9650元成交。該項目亦提價推售,最新售出的1512室,建築面積約137方呎,以每呎8350元易手,早前較高層的1712室,建築面積同樣約137方呎,以每呎8350元易手。

(星島日報)

更多中環中心出售樓盤資訊請參閱:中環中心出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

太古突拆售太古城車位持貨逾40年指引價300萬

市區車位有價有市,由太古地產持貨逾40年的太古城第6期車位,昨突擊推出拆售,共涉227個車位,首批先推32個招標,指引價為300萬,較同區二手車位價高約80%。

已入伙逾40年的鰂魚涌太古城,其車位一直由太古地產持有,昨日推出第6期的車位拆售,太古地產發言人稱,將於今個月起會分階段拆售該批車位,共涉及227個私家車車位,以及62個電單車位。

首批先推32個車位及4個電單車位,並以招標形式發售,只供屋苑第6期 (即青松閣、翠榕閣及綠楊閣) 業主購買,其中車位指引價為300萬,電單車車位指引價則為15萬,截標日期為下月2日。

太古:出售資金投資於新商機

此外,是次推售車位,符合集團出售部分非核心資產,並將資金投資於新商機及公司核心項目的發展策略,上述車位售出後,將由集團旗下管理公司負責日後的管理及日常營運。

只限六期業主購買

業主可以遞交一份招標文件,並以購買最多一個車位及一個電單車車位,入標買家需提供20萬本票,以作購買私家車車位,若購買電單車位,本票則為3萬。

據區內代理指出,整個太古城共有約2500個車位,全數均由太古地產持有,部分車位以月租3180元放租。

若對比同區二手屋苑車位價,其中康怡花園車位售價介乎150萬至160萬,即現時太古城六期車位的指引價,較同區二手車位價高約80%。

(星島日報)

內企9.8億購中環中心全層

整體甲廈買賣淡靜,中環罕有錄全層買賣。內企以約9.8億元買入中環中心全層,呎價3.8萬元,較兩年前樓上全層低約12%。

消息指,中環中心錄得全層成交,涉及物業48樓全層,面積約25,695平方呎,以約9.8億元成交,呎價約3.8萬元。是次屬該廈相隔一年後,首次錄全層買賣,亦為今年最大宗甲廈成交。據了解,該層樓面現時租金收入約210萬元,租約兩年後到期,回報2.5厘。

磁帶大王陳秉志沽貨

該層樓面由磁帶大王陳秉志持有,陳秉志接受查詢時指,把物業沽予內地企業合生創展。據了解,合生創展於2018年中環中心展開拆售時,以11.18億元購入49樓全層,呎價約4.35萬元。

陳秉志指,原沒打算放售該層,惟該機構希望購入相連樓層,並積極洽購,故最終沽貨。按是次呎價計,已較兩年前樓上49樓低約12%。對上一宗全層成交,為去年中佳兆業以約8.86億元購入30樓全層,呎價約3.55萬元。是次沽出的48樓享有全海景,質素較佳,惟疫情下造價亦偏低。

現持有多層中環中心樓面的陳秉志稱,中環甲廈租售均由中資機構承接,如今封關下,內地資金未能來港,因此今年難望反彈,相信要待明年通關後,甲廈市場才有望反彈。

(經濟日報)

更多中環中心出售樓盤資訊請參閱:中環中心出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

太古城車位首拆售 意向價300萬

首階段涉36個 總數共3826個估值逾百億

鰂魚涌老牌屋苑太古城入伙逾40年來,太古地產 (01972) 罕有首度拆售車位,率先推出第6期289個車位(包括私家車及電單車)招標,私家車位每個指引價達300萬元,以現時月租約3,000元計,回報率僅1.2厘。集團現時持有總數達3,826個太古城住宅車位,市值估計高達逾百億元。

疫情衝擊下,太古集團除了旗下國泰航空 (00293) 經營困難外,系內的太古地產租金收入亦大受影響,在缺乏大批可出售住宅項目下,太古亦罕有拆售太古城的收租車位。

太古城最早的一期在1976年落成,至今長達44年,但單位數目超過1.2萬伙的屋苑,一直以來屋苑車位都是由發展商太古所持有管理,由業主輪候租用,據悉每個車位月租約3,000元。

邀6期業主 電單車位15萬

發展商近日向太古城第6期業主發邀請信,將分階段招標227個停車位及62個電單車位,首階段先以招標形式出售32個車位及4個電單車位,限第6期青松閣、翠榕閣及綠楊閣業主購買。

首批車位會以招標形式發售,由10月13日 (周二) 起,至11月2日 (周一) 截標,並會在11月13日 (周五) 前公布結果。每份標書可以一次過競投所有車位,但最終只能夠選購其中一個車位及電單車位,而持有多於一個單位的業主,可提交多於一份標書。

值得留意的是根據地契,所有住宅用途的私家車車位只可由太古城的住戶或其訪客使用,然而車位轉售則沒有限制。據記者取得的標書顯示,發展商提出的每個私家車車位指引達高達300萬元,而電單車位指引價亦要15萬元。按照首批招標總數36個車位,預計能夠套現9,660萬元,整個第6期車位計算,更有望套現6.91億元。

據EPRC經濟地產庫資料顯示,同系的鯉景灣今年車位成交價介乎115萬至202萬元,而康怡花園則約138萬至173萬元,而鄰近同由太古發展的逸意居車位成交價則介乎270萬至280萬元。

太古:其他期數 仍在審視

太古地產發言人指,推售計劃符合出售部分非核心資產,並將資金投資於新商機及公司核心項目的發展策略,至於會否推售其他期數車位,仍在審視有關安排。

翻查太古地產在2012年上市的招標文件顯示,其分別持有太古城第1至第10期合共3,826個住宅車位,以及太古城中心共834個商業車位。

假設太古進一步拆售全數車位,同樣私家車及電單車位比例為8比2,並以私家車位每個300萬元、電單車位每個15萬元,估計能夠套現高達103.3億元,跟轉售成幢商廈的價值相若。

(經濟日報)

合生創展9.8億增購中環中心48樓全層

市場消息指出,中環皇后大道中99號中環中心48樓全層,建築面積約25695方呎,剛以約9.8億元易手,呎價約38140元,新買家為內房合生創展(00754)。單位原由基金公司承租,呎租約70元,但租約已於數月前屆滿。

據了解,該層由資深投資者「磁帶大王」陳秉志持有,兩年前已在市場上放盤,叫價一直「企硬」每方呎4.8萬元,直到今年投資氣氛轉差,才接受接近以每呎4萬元洽購。而最終成交價,較最初叫價低20.5%。

單位新買家合生創展,早於2018年10月斥資11.18億元,購入樓上的49樓全層,建築面積約25695方呎,呎價43510元。事隔兩年,以呎價低12.3%再增購一層。

(信報)

更多中環中心出售樓盤資訊請參閱:中環中心出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

雲之端192呎呎價1萬創新高

星星地產 (01560) 旗下大角咀工廈新盤雲之端銷情理想,並首錄呎價1萬元成交。市場消息透露,雲之端16樓9室,建築面積192方呎,成交價192萬元,呎價1萬元,創開售以來呎價新高。

樓上17樓9室,面積一樣,早前以185.28萬元售出,呎價9650元,以此作比較,即賣貴近4%。

雲之端位於大角咀通州街111號,提供24層工作室樓層,共233個單位,標準單位建築面積100至460方呎,全層單位建築面積為2807方呎。據悉,項目現累售約70伙。

(信報)

Kowloon, Sai Kung flats sell for new highs

A luxury unit at St George's Mansion in Kadoorie Hill, developed by Sino Land (0083) and CLP (0002), sold for HK$238 million, or HK$71,471 per square foot, the highest among their peers in Kowloon so far this year.

This came as a 1,239-sq-ft special unit at 133 Portofino in Clear Water Bay, also developed by Sino Land, went for HK$39.69 million, or HK$32,03 per sq ft, the highest in Sai Kung so far this year.

Meanwhile, Farzon Group released 50 units in the first price list of Eight Kwai Fong Happy Valley at HK$31,129 per sq ft after discounts. The cheapest unit is priced at HK$8.44 million.

In the secondary market, a descendant of the founder of Chong Hing Bank (1111) has acquired a luxury unit at Mid-Levels for about HK$41.88 million.

In other news, the 48th floor of The Center in Central, measuring 25,695 sq ft, sold for HK$980 million, or HK$38,140 per sq ft only, down over 10 percent from two years ago.

A 749-sq-ft flat at Grand Promenade in Sai Wan Ho was rented for HK$32,000 per month, or HK$42.7 per sq ft, after HK$4,000 was cut from the original asking rent.

Also, stamp duty collected from property transactions surged by 60.5 percent to about HK$4.12 billion in the third quarter from the previous quarter, data from the Inland Revenue Department showed.

In September, the stamp duty collected almost doubled to about HK$2.02 billion from a month before.

(The Standard)

For more information of office for sale in The Center please visit: The Center for Sale

For more information of Grade A office for sale in Central please visit: Grade A office for sale in Central

For more information of Grade A office for sale in Sheung Wan please visit: Grade A office for sale in Sheung Wan

疫市甲廈需求未反彈 續尋底價

環球疫情未退,令甲廈需求持續疲弱,買賣淡靜而租金向下,業界人士料由於疫情未完結,甲廈租售價格尚在調整。

據代理每月商廈交投數據顯示,9月十大指標商廈買賣仍見淡靜,合共僅錄4宗成交,而港島僅錄1宗。其中康宏廣場低層02室,面積1,201平方呎,以約1,621萬元成交,呎價約1.35萬元。

美國銀行中心傳2.4萬沽 7年新低

另外,近期核心區甲廈呎價回落,消息指,美國銀行中心中層04至07及13室,面積約5,968平方呎,市傳以約1.4億元沽出,呎價近2.4萬元,單位交吉交易。按此呎價計,屬該廈自2013年後新低。據了解,該單位由香港美國商會持有,1996年以5,460萬元購入作會址自用。該商會早前已搬至同區甲廈,面積約2,000平方呎單位,故將美國銀行中心單位放售。若最終以1.4億元售出,持貨24年轉手,獲利約8,540萬元。

代理分析,由於疫情持續,甲廈投資氣氛仍弱,個別業主願降價,惟數目不多,成交偏低,令造價未完全反映。租金方面,代理指業主相對願減租吸客,而近期個別租務成交造價偏低。包括金鐘力寶中心1座中層01室,面積約1,495平方呎,成交呎租約45元,另同座高層7至8室,面積約3,690平方呎,以每呎約41元租出,兩宗成交租金同樣較數月前下跌。

海富中心 每呎38元招租

據了解,目前金鐘商廈業主仍願降租吸客,如金鐘力寶中心2座低層03室,面積約4,541平方呎,意向呎租約40元,涉及月租約18萬餘元。另外,同區海富中心2座低層01室,面積約2,611平方呎,以每平方呎約38元招租,總月租近10萬元。海富中心2座今年暫僅錄得約3宗租賃個案,平均成交呎租約50元,最近一宗為6樓09室,面積約1,155平方呎,於8月底以呎租約43元租出。

後市方面,代理認為,由於環球疫情尚未完結,甲廈需求未能反彈,有意放售甲廈單位的業主,略為調低叫價。租金上,近期成交呎租維持偏低,反映需求向下,業主降租幅度較明顯。他料由於整體市況尚未穩定,相信甲廈租售價續尋底。

(經濟日報)

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

第三季大額買賣 僅44億11年新低

疫情下投資市場淡靜,有代理的數據指,今年第三季大額買賣 (7,800萬元或以上 ) 成交僅涉44億元,為2009年以後新低。

代理指,雖然香港金融管理局放寬非住宅物業按揭貸款的適用按揭成數,上限從40%上調至50%,然而2020年第三季的商業房地產投資交易額跌至2009年第一季以來的最低季度總額,僅完成44億元的交易,而年初至今則錄得180億元交易額,僅佔2019年全年達688億元總交易額的26%。

內地投資者入市 共涉22億

成交上,發展商繼續出售非核心零售物業,其中包括會德豐和華懋集團,分別以2億元和4.57億元的價格出售旗下商場。至於沉靜了數個季度的內地投資者,在2020年第三季購入共22億元的商業物業。

代理表示,雖然過去數月有大量資金流入本港市場,但大手物業投資市場仍然疲軟。疫情和地緣政治的不確定性仍然會是投資者在第四季的主要擔憂,因此在年底前能見到交易額明顯反彈的機會較低。然而,較低的融資成本及有限的商業房地產新供應,加上價格已經出現較大折讓,將會繼續吸引投資者對香港物業的興趣。另外,新股市場持續暢旺亦會逐漸產生財富效應,為未來企業物業投資需求帶來潛在增長機會。

工業物業市場上,該行數據指,9月底的倉庫空置率上升0.3個百分點至4.2%,除數據中心和凍倉營運商外,工廈租賃需求仍然疲軟。倉庫租金在2020年第三季按季下跌2.4%,而第一季和第二季度的按季跌幅分別為3%和1.3%。

另一代理表示,物流營運商在2020年第三季繼續尋求可以節省成本的選擇。由於租戶的營運規模縮減或選擇搬遷至成本較低的空間,因此有車路直達樓層的倉庫物業項目尤其受壓。但是,隨着科技公司、電訊營運商、食品和網上零售商的業務擴張,市場對數據中心和凍倉的需求仍然強勁。鑑於在可預見的將來,大多數歐美經濟體能完全控制新冠疫情的機會率比較低,預期物流營運商在第四季將保持非常謹慎態度,而第四季的倉庫空置率將進一步上升。

(經濟日報)

第三季補地價涉38.4億 增5.7倍

全港首宗工廈建骨灰龕 補15億元

地政總署公布今年第三季補地價涉及38.4億元,按季增加5.7倍,惟首三季仍只有44.21億元,較去年同期跌7成,包括多宗工業地補地價,如葵涌永立街工廈補地價15億元作骨灰龕。

另外,嘉民亞洲的荃灣沙咀道地皮則補地價3.87億元,作數據中心。

首3季44億 按年跌7成

據地政總署公布,2020年7月至9月季度內在土地註冊處共註冊了23宗契約修訂及1宗換地個案,地價收入總額約38.47億元,相較第二季的5.74億元,按季大增5.7倍,不過整體而言,今年補地價仍然不算活躍,累積首三季合共只有44.21億元,較去年同期的152.57億元,按年大跌7成。

值得留意的是,近期錄得的補地價大部分涉及工業地重建,而且用途廣泛,除了傳統常見的重建作商廈外,還出現重建成數據中心,甚至骨灰龕大樓個案。

當中屬於全港首宗工廈重建骨灰龕大廈的葵涌永立街2至6號項目,補地價金額近15億元,項目由經營屯門龕場「善緣」的財團提出,將重建成12層高大廈,總樓面9.7萬平方呎,以補地價金額計算,每呎樓面地價高達1.53萬元,相較目前全港最貴的商業地補地價,每呎5,334元高1.9倍。

不過,按照項目將提供約2.3萬個骨灰龕位,每個龕位補地價約6.5萬元。

此外,由嘉民亞洲重建的荃灣中央紗廠項目,再有一個地盤批出補地價3.87億元。涉及荃灣市地段第436號,地盤面積2.5萬平方呎,將會重建成數據中心,以可建樓面23.75萬平方呎計算,每呎補地價約1,631元。另外,億京就沙咀道37至43號文迪工業大廈重建,補地價4.93億元。

(經濟日報)

洋松街舊樓強拍底價3.26億

疫情持續發酵,惟市區舊樓依然為財團併購目標,宏安持有大部分業權的大角嘴洋松街舊樓獲批強拍,底價為3.26億。

據土地審裁處資料顯示,上述為洋松街56至62號與菩提街6及8號,現址為1幢9層高商住大廈,該廈樓齡已達56年,因維修問題,認為該廈作重建屬合理做法,故頒令將該廈進行強拍,底價3.26億,並指有關重建工程需於成交後6年內完成;該項目1樓至8樓合共提供48伙住宅,另設6個鋪位,總樓面約27125方呎。

宏安持逾八成業權

資料顯示,宏安早年已對該廈進行收購,於2018年底時已收購該廈逾80%業權,僅餘數伙尚未購入。是次強拍底價3.26億,較2018年底申請時估值3.01億、高約8%。

另外,由雅居樂收購逾九成業權、位於鰂魚涌栢架山道2至8號公務員合作社舊樓物業,於今日進行強拍,底價4.52億。收購財團尚餘最後1伙未收購,惟該名小業主曾開價8000萬賠償、及獲得項目重建後逾5000方呎單位。

首個公務員合作社今強拍

拍賣行指出,是次為首個公務員合作社物業進行強拍,對於日後同類型重建有啟示作用。

東涌商業地今截標

疫情下零售及商廈市道備受壓力,東涌市地段45號商業地皮,於今日截標,地皮可建逾126萬方呎。

業內人士指出,樓市觀望氣氛密布,預料發展商出價會趨保守審慎,料樓面呎價約3250至4000元,成交價約41億至約50億,更不排除會有流標風險。

(星島日報)雅居樂4.5億 奪柏架山道合作社

首宗公務員合作社強拍項目昨日進行,由雅居樂 (03383) 收購的鰂魚涌柏架山道2,4,6及8號屬於公務員合作社物業,拍賣底價4.52億元,由發展商代表以底價投得。

項目由雅居樂早前收購至逾9成業權,獲土地審裁處批出強拍令。今次強拍只餘最後一個單位未獲收購,但該名「釘子戶」卻向發展商開價8,000萬元賠償,以及獲得項目重建後面積逾5,000平方呎的單位。

擬合併比鄰地皮 建3幢住宅