荃灣協和廣場銀主盤10億售 亞證地產承接 擬翻新提高租值

由太平協和集團持有的荃灣協和廣場,涉及樓面逾16萬方呎,連同該廈91個車位,於去年淪為銀主盤,由債權人李明治家族旗下的亞證地產購入,成交價10億,新買家擬翻新物業,作加建或改建,以提高項目的租值。

太平協和集團持有的荃灣協和廣場連一籃子車位,去年6月淪為銀主物業,由李明治家族旗下聯合地產以銀主身分推出招標,當時市場估值達15億,物業近日落實以10億賣出,新買家為李明治家族旗下公司亞證地產,即項目的債權人所購入。

逾16萬呎樓面 連91個車位

聯合集團、天安中國和亞證地產聯合公布,亞證地產斥10億收購荃灣海天豪苑協和廣場地庫1層、地下至4樓若干商業單位及91個泊車位全部股權連貸款,總樓面面積約16.35萬方呎,物業市值12.4億。亞證地產正在審閱由顧問提出的,將項目翻新計畫方案,計畫加建改建,以提高出租或轉售價值。

公告又指,亞證地產同時重組物業組合,包括以3.3億出售物業,當中以8000萬元出售內地6個獨立住宅物業或綜合商業物業予天安中國,總樓面面積8514方呎;以及以2.5億出售香港一個辦公物業、3個住宅及5個車位予聯合集團。

平均呎價6116元

位於荃灣川龍街88號的協和廣場,樓高5層,易手包括地庫1層、地下至4樓一籃子單位及91個車位,建築面積合共約163538方呎,惟項目的大部分由散業主持有,不包括今番易手的部分。若以易手價計算,平均呎價6116元。李明治於80及90年代叱咤於本港金融界,高峰期持有10家上市公司,當時市值共逾90億,贏得「股壇梟雄」的稱號,其中,旺角聯合廣場及灣仔聯合鹿島大廈,中半山地利根德閣都是他的代表作。

荃灣協和廣場銀主盤,由李明治家族旗下的亞證地產購入,作價10億,新買家亦屬項目的債權人。

(星島日報)

更多聯合鹿島大廈寫字樓出租樓盤資訊請參閱:聯合鹿島大廈寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

前高銀九龍灣商業地 意向價32億放售

由高銀金融及集團前主席潘蘇通持有的九龍灣宏泰道 (常悅道15號) 商業地盤,最新持有該項目的公司,為爪哇控股相關人士,物業現時於市場放售,意向價32億。

該物業原本由高銀金融持有,持貨公司為高銀環球廣場有限公司,不過,該公司去年11月易名為耀基物業控股有限公司,新登記地址為灣仔光大中心26樓,為爪哇控股的註冊辦事處。公司董事包括爪哇控股執行董事葉思廉。

持貨公司為爪哇相關人士

有代理表示,該物業已放售一段時間,並由爪哇控股相關人士推出放售,相信物業已轉讓予爪哇控股,本報昨日向爪哇控股查詢,惟直至截稿時,尚未獲得回覆。

去年11月公司易名

據了解,該項目意向價為32億,每方呎樓面地價8000元,代理指,較去年易手的同區 KC17 (前稱高銀金融國際中心) 現樓呎價6000多元高,相信要待甲廈市況復甦才能以此價賣出。

項目佔地3.3萬呎

該項目佔地33584方呎,為其他指定用途 (商貿),地積比為12倍,可興建一幢樓高22層連3層地庫的甲廈,總樓面40.3萬方呎。2011年,潘蘇通及旗下公司以8.5億向英皇購入該廈,易名為高銀環球廣場,及至2019年9月,項目由高銀金融以46億承接。

(星島日報)

更多光大中心寫字樓出租樓盤資訊請參閱:光大中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多KC17寫字樓出租樓盤資訊請參閱:KC17寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

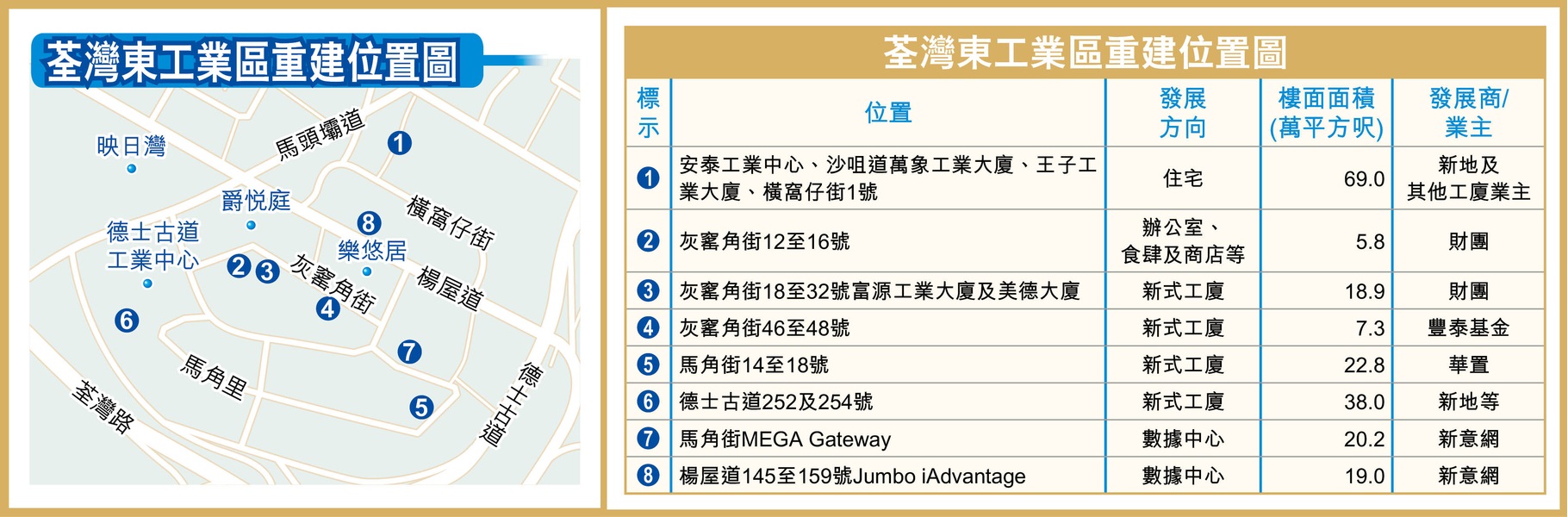

荃灣東轉型住宅 再添變數

政府早前將荃灣東大窩口工業區改劃成綜合發展區,推動轉型成住宅發展,雖然沙咀道一帶近年陸續有重建成住宅的項目,惟沙咀道一帶轉型較慢,新意網更申請將旗下工廈重建成數據中心,令轉型成住宅發展的大方向再添變數。

荃灣東工業區分別兩部分,首先是楊屋道、德士古道及沙咀道交界的大窩口工業區,佔地約4.4公頃,早在逾10年前已經獲規劃署由工業改劃成綜合發展區,用意是促進轉型成住宅區。至於楊屋道以南由馬頭壩道及德士古道組成的工業區,佔地約11.9公頃,多達40幢工廈,目前仍然維持作「工業」。

新意網楊屋道地 擬建數據中心

雖然大窩口工業區已經改劃成綜合發展區多年,但近年成功轉型住宅發展的項目集中在沙咀道一帶的2幅小區,分別是由房委會旗下大窩口工廠大廈成功重建成居屋尚翠苑,以及由新地 (00016) 牽頭提出將沙咀道及聯仁街交界的安泰工業中心、王子工業大廈及亞洲脈絡中心等4幢工廈,重建成5幢31層高私樓,總單位數目約1,330伙。

在橫窩仔街及楊屋道以北的3個小區,目前仍然未有轉型成住宅發展的傾向。早前新地旗下新意網持有楊屋道145至159號Jumbo iAdvantage,在2016年申請改劃並重建成數據中心被拒後,近日捲土重來,再申請改劃成「其他指定 (商貿)」用途,並以地積比率9.5倍重建,較2016年方案的地積比率5倍大增,擬建18層高數據中心,總樓面約19萬平方呎,樓面較舊方案大增90%。新意網質疑,荃灣東工業區實現住宅發展進度緩慢,從區內的已遞交的規劃申請可見,相對發展住宅,區內各業主皆傾向作不同非住宅用途。

新地德士古道工廈 涉38萬呎樓面

根據規劃署最新的《全港工業用地分區研究報告》顯示,區內有7成工廈樓面用作貨倉用途,另有2成樓面作為非工業用途,包括數據中心等。據當局早前報告則指,會維持作綜合發展區用途,但將來檢討時候要考慮推動加快重建轉型。

至於楊屋道以南的部分,目前仍然規劃「工業」用途,故此範圍內的6個工廈重建計劃之中,亦有4個計劃重建成新式工廈,預計可帶來約87萬平方呎樓面。當中規模最大屬於新地等重建的德士古道252及254號項目,前身為半島工業大廈,按照2014年批出的建築圖則,將會興建2幢27層高工廈,涉及近38萬平方呎樓面。

(經濟日報)

灰窰角街工廈地盤 獲3億元洽購

荃灣區工廈重建有價,近期豐泰就灰窰角街工廈地盤放售,有指獲約3億元洽購,每呎樓面地價約4,100多元。

該地盤為灰窰角街46至48號,地盤面積約6,382平方呎,在去年放售,市場估值約3.3億元。早前有傳,獲本地財團及一家基金公司積極洽商中,洽購價近3億元。

可建21層 樓面地價4100元

該地盤在2022年9月曾獲屋宇署批准興建為1幢樓高21層及2層地庫之新型工廈,涉及面積約72,755平方呎,以此計算,樓面地價約4,100多元。

另外,舖王梁紹鴻旗下大鴻輝興業,據指正在放售一批物業,當中亦包括德士古道荃灣工業中心的一籃子單位,總面積約222,630平方呎,叫價約11億元,呎價約4,941元。

而立泰工業中心1期早前有1個15樓單位,面積約2,342平方呎,成交價約798萬元,平均呎價約3,407元,屬略低於市價約5%成交。資料顯示,業主持貨30年,早於1993年以約230萬元一籃子形式購入單位、天台及車位,今次成功售出單位,保守估計帳面獲利約568萬元,物業升值近2.5倍。

(經濟日報)

Buying caution urged by property chief

A property agency founder says it is not a good time for investors to buy property because the recent rebound in the market may be temporary and primarily driven by rigid demand.

The chief also warned that the government's cooling measures may not be a sustainable in the long term.

The government implemented stamp duties in response to the housing under-supply and increasing property prices but relying on these cooling measures in the long term was not a sustainable solution, the chief said at a seminar held by Bank of East Asia (0023).

Residential properties below HK$10 million were benefiting more from the recent improvement in the property market, primarily due to rigid demand.

The chief said that despite the government implementing stamp duties for many years, the supply of residential properties has not seen a significant increase. On average, only a little over 10,000 flats have been added each year.

Home prices have rebounded from last year's lows by about 3 to 5 percent, but any further increase will depend on whether the economic environment improves and if other measures, such as the reopened border, can bring benefits.

In addition, the cheif cautioned that even though the population exodus in Hong Kong has eased, underlying social unrest has not been fully resolved.

Worsening Sino-US relations could also have an impact on Hong Kong and have negative effects on the property market, the chief added.

At the seminar BEA revealed it expects Hong Kong's economy to grow by 5 percent in 2023.

Meanwhile, the primary market recorded several transactions recently.

In South West Kowloon, The Grand Victoria II achieved a new record for the sale of a 489-square-foot two-bedroom unit with a transaction price of HK$15.15 million, or HK$30,985 per square foot, marking the highest price paid for this type of flat in the project.

The Grand Victoria, co-developed by Sino Land (0083), Wheelock Properties, K Wah International (0173), Shimao Property (0813) and SEA Holdings (0251), sold 45 flats in February, cashing in more than HK$800 million.

In Cheung Sha Wan, a 446-sq-ft, two-bedroom unit at The Vertex sold for nearly HK$11 million. The development held by VMS Asset Management and Twin City has sold a total of 31 flats since the Lunar New Year, earning more than HK$300 million.

In Ho Man Tin, St George's Mansions, a luxury project co-developed by Sino Land (0083) and CLP (0002), sold a three-bedroom unit with 1,868 sq ft for nearly HK$90 million.

In upcoming sales, Koko Rosso in Lam Tin, developed by Wheelock Properties, will launch its second batch of sales today, with a total of 160 flats having received 6,398 checks, oversubscribed about 39 times.

Also, the sales brochure for After The Rain, a residential building developed by Star Group (1560) in Yuen Long, has been released.

The brochure shows the project's 335 flats spread across 23 floors.

In Happy Valley, over 91 percent of the flats in The Sanitarian Apartments will be sold through a tender process. According to a property agency, the site is situated at 20-30 Green Lane, known for its luxury estates. It spans about 24,025 sq ft and is considered to have significant potential for redevelopment.

(The Standard)觀塘同得仕大廈7.9億易手 投資者梁安琪沽貨7年升值63%

近年工廈受追捧,市場再錄1宗全幢買賣,身為投資者的澳博聯席主席兼執行董事梁安琪,沽售觀塘同得仕大廈全幢,作價7.9億,物業具重建價值,每呎樓面地價5448元,持貨逾7年間升值63%。

消息人士透露,由賭王四太梁安琪持有的觀塘全幢工廈,亦以7.9億易手,平均呎價7467元,若以重建樓面計算,每方呎樓面地價高達5448元!知情人士續說,該宗成交早於半年前已落實,一直不為人所知,直至近日成交,消息終於曝光,新買家為持有毗鄰兆富工廠大廈的財團,有見擴大地盤規模,增加協同效應,因而高價承接。

平均呎價7467元

觀塘偉業街203號同得仕大廈,現為1幢13層高工廈,現址建築面積約10.58萬方呎,地盤面積約10075方呎,早於2020年,業主建議放寬兩成地積比率,以最高14.4倍重建,興建1幢25層高新型工廈,涉及樓面約14.5萬方呎,獲得規劃署不反對,若以重建樓面及易手價計算,每呎樓面地價5448元。

梁安琪早於2014年9月向同得仕購入該廈全幢,作價4.85億,持貨逾7年,帳面獲利3.05億,物業升值63%。

上述同得仕大廈的新買家,正是持有偉業街201號兆富工廠大廈的財團,日後將合併2項目重建,兆富佔地約10075方呎,樓高僅6層,重建價值高於同得仕,財團早於多年前涉足收購,其中3樓全層,於2020年4月,向正八集團主席廖偉麟購入,建築面積約9300方呎,涉資8500萬。

由毗鄰地盤業主承接

據了解,財團並於2021年,就該廈申請放寬地積比率20%,至14.4倍,重建1幢29層高商廈,總樓面約14.5萬方呎。

觀塘同得仕大廈全幢工廈,以7.9億易手,平均呎價7467元,每方呎樓面地價5448元,買家為持有毗鄰地盤的財團。

(星島日報)

長沙灣東方國際呎價1.17萬易手

兩地全面通關,帶動商廈交投,長沙灣東方國際大廈高層單位,以每呎1.17萬易手,由經營食肆配套的用家承接。

用家2141萬承接

地產代理表示,長沙灣大南西街1018號東方國際大廈26樓03室,面積約1830方呎,現以交吉形式售出,成交價約2141.1萬,呎價約11700元,是次沽出單位屬發展商一手物業,買家從事與餐飲支援相關行業,在疫情期間,生意未有受太大影響,加上隨着全面通關,預料生意額將有所遞增,故決定購入單位自用作長綫發展。

代理續稱,今次易手單位屬高層,擁開揚景觀,單位無柱位設計,毗鄰荔枝角港鐵站。

(星島日報)

士美菲路鋪4450萬售 持貨16年升值1.86倍

民生區鋪位仍然活躍,西環士美菲路一個地鋪,建築面積760方呎,以4450萬易手,平均呎價5.86萬,物業於16年間升值1.86倍,新買家料回報3.1厘。

市場消息透露,西環士美菲路12號文光閣地下B鋪,以4450萬易手,建築面積約760方呎,現址為來自台灣的連鎖日式食肆爭鮮,月租11.5萬直至2022年5月,目前新租約則按市值計算,料回報逾3.1厘。

原業主於2007年8月以1555萬買入,持貨16年帳面獲利2895萬,物業升值1.86倍。

料回報約3.1厘

盛滙商舖基金創辦人李根興表示,上述鋪位門闊14呎,深約35呎,旁邊為麥當勞及7-Eleven,選址於此,代表該地段具有消費力,人流暢旺,可惜該鋪前面有小巴站,擋住門面,鋪價因此將被打9折。

金百利意向呎價1.74萬

此外,地產代理表示,銅鑼灣記利佐治街1號金百利15樓06室,面積約1022方呎,意向價約1780萬,平均呎價約17417元,

據了解,物業現以連約出售,現租客為牙醫,若以現時市值呎租約28元計算,回報約2厘,不過,隨着通關後經濟復甦,社會及經濟復常,在利好因素帶動下,商廈市況好轉,預料租金仍有升值空間。

(星島日報)

葵涌裕林工廈全層意向3300萬

地產代理表示,葵涌葵定路32至40號裕林工業大廈12樓全層連租約放售,建築面積共約10200方呎,意向價約3300萬,平均每呎3235元。

代理表示,該物業間隔方正,適合作辦公室及倉庫等。大廈備2部載貨電梯及1部載客電梯,設有車場及貨台,可供大型貨車出入。

東角全層每呎45元放租

地產代理表示,銅鑼灣軒尼詩道555號東角中心中層全層放租,建築面積約11953方呎,意向租金約53.8萬,每呎約45元,單位間隔方正實用,外望鬧市,大廈配備6部客梯及1部貨梯,位處銅鑼灣核心地段,相連崇光百貨,由港鐵銅鑼灣站步行1分鐘即可到達。

(星島日報)

Mong Kok landmark on way as SHKP wins site for $4.7b

Sun Hung Kai Properties (0016) has won a commercial site at the junction of Sai Yee Street and Argyle Street in Mong Kok for HK$4.73 billion - 16.1 percent below the lower end of market estimates - and pledged to create a new landmark.

The site, near the Mong Kok East MTR Station and the developer's Moko shopping mall, has an area of some 11,537 square meters and could provide a maximum gross floor area of 141,600 sq m.

Valuations for the plot ranged from HK$5.64 billion to HK$10.97 billion, or HK$3,700 to HK$7,200 per square foot.

"I think the government has accepted the reality and trimmed its reserve price as the commercial market has been under pressure in recent years, with rents hitting record lows," a surveyor said.

Another surveyor said it was slightly surprised by the low price for such a prime site in a prime location and believes the authorities' main consideration may be providing a stable supply.

The project with a height of up to 320 meters is expected to be completed by 2030. And a footbridge connecting Moko mall will be built to create synergy.

The other two bidders for the huge commercial plot in the area were CK Asset (1113) and a consortium of Great Eagle (0041) and Sino Land (0083), according to the Lands Department.

SHKP is required to build a day care center for the elderly, a neighborhood elderly center, an integrated children and youth services center, an integrated community center for mental wellness, a community hall, a public transport interchange as well as a public vehicle park and public toilets.

(The Standard)

A three-bedroom home on the higher floors of The Vertex in Cheung Sha Wan sold more than HK$14.42 million via tender yesterday.

The flat has an area of 639 square feet and sold for HK$22,567 per sq ft.

The tower is held by VMS Asset Management and Twin City and more flats may be offered for sale in the near future.

In Ma On Shan, Sino Land (0083) sold a 1,111-sq-ft four-bedroom flat at Silversands for HK$26.5 million or HK$23,853 per sq ft.

In South West Kowloon, a 741-sq-ft three-bedroom flat at The Grand Victoria II sold for HK$21.5 million.

The Grand Victoria is jointly developed by Sino Land, Wheelock Properties, K Wah International (0173), Shimao Property (0813) and SEA Holdings (0251).

In Kwun Tong, the first price list of 56 flats at Bal Residence -jointly developed by Lai Sun Development (0488) and the Urban Renewal Authority - was subscribed two times over. And in Tuen Mun, Novo Land's phase 2B had received more than 8,000 checks for the first batch of 352 flats, making them 21 times oversubscribed as of February 28. Novo Land is developed by Sun Hung Kai Properties (0016).

In other news, a report by a property agnecy revealed that luxury property prices in Hong Kong fell 1.6 percent in 2022, leaving the city in the 89th spot among the 100 locations covered in the report. Nevertheless, Hong Kong's overall property prices remained the second most expensive in the world for the 16th consecutive year.

(The Standard)

Wheelock sells 92 per cent of flats in second batch of Koko Rosso project in Lam Tin, despite higher prices

Wheelock Properties sold 148 of 160 flats on offer in the second launch of the project within three hours on Wednesday night

The developer raised the average price to HK$18,441 (US$2,349) per square foot, 0.5 per cent higher than the last round of sales on February 24

Hong Kong’s homebuyers are trickling back into the market.

Wheelock Properties sold 148, or 92 per cent, of the 160 flats on offer at its Koko Rosso project in Lam Tin within three hours after opening the sale at 9pm local time on Wednesday, according to agents. The company raised the average price of the current offer to HK$18,441 (US$2,349) per square foot, 0.5 per cent higher than the last round of sales on February 24.

“The sales have been strong, and there are many buyers,” said Ricky Wong, managing director at Wheelock. The response matched the bullish first launch of the 392-unit Koko Rosso project, when all 148 flats were snapped late last month.

The buoyant sale – despite the higher average price – underscored rising confidence in Hong Kong’s property market following the city’s abandonment of Covid-19 restrictions, the last of which was the mandatory wearing of face coverings on Wednesday.

The reopening of the border between Hong Kong and mainland China has raised hopes for the city’s battered property market, as buyers are seen anticipating an economic recovery following nearly three years of Covid-19 restrictions.

“The units on offer were sold by 11.30pm,” an agent said.

Hong Kong saw an uptick in the property market in February. Overall transactions increased 34.8 per cent month over month to 5,969 deals, hitting the highest level since June 2022, according to data released by another property agency on Wednesday.

The total value of the transactions also surged 35.1 per cent month over month to HK$43.9 billion, the highest since August 2022.

“The data showed a growing market sentiment after the border reopening,” agent said. “Buyers who turned to the home market before [Lunar New Year] led the rise in transactions, and the market retained its heat after that.”

Transactions should rise to around 7,000 in March thanks to a slower pace of interest-rate increases and the Hong Kong government’s decision to cut the ad valorem stamp duty, the agent said.

The latest batch of flats on offer at Koko Rosso range in size between 308 and 497 sq ft, according to Wheelock. The cheapest unit is priced at HK$6.06 million, after discounts.

“Most of the units for sale are priced below HK$10 million,” the agent said. “The flats have a good location and a walking distance from the subway station with a good view of the mountains and the sea.”

The strong sales also came in the wake of a stamp duty cut announced by the government last week.

Financial Secretary Paul Chan Mo-po announced adjustments to Hong Kong’s ad valorem stamp duty, which will amount to HK$100 for homes worth up to HK$3 million, instead of up to HK$2 million previously. The changes to the stamp duty, which are on a sliding scale, apply to homes worth HK$10 million or less.

Given that the flats at Koko Rosso are being sold for lower than HK$10 million, the project was expected to benefit from the policy.

(South China Morning Post)

疫後靈活辦公擴充 出租率理想

疫情令靈活辦公興起,如今本港商業復常,共享空間續擴充辦公室,品牌出租情況亦理想,反映市場漸對靈活辦公受落。

據一間外資代理行每月商廈租金走勢,1月份本港多個商業區租金均平穩向下,如中環超甲廈呎租為124.8元,按月跌0.6%,而區內傳統甲廈呎租為95.4元,按月跌1.2%。港島多區租金表現平穩,鰂魚涌呎租45.6元,按月微跌,惟過去1年租金更跌近13%,為各區最高。

置地Centricity Flex 總樓面2.5萬呎

疫情後,靈活辦公興起,租出率亦想想,置地表示,旗下靈活辦公空間Centricity Flex於2021年啟用,坐落於中環置地廣場-公爵大廈17樓及18樓全層,總樓面面積約2.5萬平方呎。置地公司Centricity主管班立德 (Paul Bennett) 指,現時出租率逾9成,自啟用以來,Centricity Flex吸引了不同專業領域的租戶,例如發現金融 (Discover Financial Services)、Toscafund和國際人力資源顧問公司Argyll Scott等。

Centricity Flex提供的設施包括智能螢幕、會議室、私人工作隔間、開放式共享辦公空間和活動空間,內設專營咖啡廳,由前文華東方酒店集團行政總廚主理。

另外,靈活辦公品牌積極擴充,theDesk近期租用九龍灣企業廣場五期全層,面積約1.7萬平方呎,開設新分店,提供13間私人辦公室外,座位數量合共達250個,另提供會議室、咖啡店及瑜伽房等,月租由3,300元起。

theDesk行政總裁及聯合創辦人許飈指,品牌現在港擁14間分店,會員人數達5,000。過往3年疫情下,會員增長理想,去年增長更加達100%,而大部分營運1年以上的分店,出租率均逾9成。

代理行:市場對大樓面需求仍弱

他指,疫情下更加推動靈活辦公,企業亦要在不同地區,提供彈性工作空間滿足員工需求,未來集團仍有擴充空間,包括與商廈大業主合作,因較適合中小企租用樓面,如涉及2至3人,或2至3個月租期的公司,可以互相配合。

整體租務市況上,有代理行指隨着內地通關和經濟前景樂觀,市場氣氛正面。然而,預計需求復甦將緩慢,寫字樓租賃活動尚未顯著回升。隨着跨國企業優先考慮成本和優化營運,甲級寫字樓搬遷到非核心區的趨勢持續。該行指,內地企業對3,000平方呎以下細面積的寫字樓的查詢增加,然而,市場仍然較為缺乏對大面積單位的需求。

(經濟日報)

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

罕有港島地 西寧街項目料掀爭奪

繼去年推出堅尼地城一幅位於西寧街地皮後,下個財政年度的賣地表中,再有鄰近的一幅住宅地推出,並將於下季 (4至6月) 打頭陣推出,屬於年度罕有的港島地供應。地皮規模適中,估值約22億元,料將發展市場需求佳大的中小型單位。

下財年推出的12幅住宅官地中,只有2幅位於港島,包括早前流標、滾存至本財年的赤柱環角道用地,及新增的堅尼地城西寧街與域多利道交界用地。後者現為巴士總站,比鄰招商局第二貨倉及公眾殮房,亦鄰近去年11月以4.39億元 (每呎樓面地價約9,500元) 批出予興曄發展有限公司的西寧街地皮。

市場估值約22億至27億

該地佔地約24,327平方呎,現規劃為「住宅 (甲類)」用途,若以地積比率約10倍發展,可建樓面約24.3萬平方呎,可提供約450伙。若於去年批出的西寧街地皮相比,這地皮的規模較大逾4倍。

事實上,以往堅尼地城為傳統的物流貨運區,西寧街一帶設有部分貨倉及工廠,而近年才慢慢轉型為商住發展。而該地皮的前方正為招商局第二貨倉,雖然旗下兩座招商局貨倉早於2019年已提出重建為商廈及海景酒店,但申請人最新已經撤回申請。

有測量師表示,地皮規模適中,總投資額數十億元,預計除大型發展商外,新型發展商亦有意競投,初步預計可接獲約10份標書。測量師亦指,項目日後會供應1至2房戶型為主,相信會吸引小家庭及區內客。另外,由於地皮鄰近香港大學及核心商業區,不排除亦會吸引學生或上班族租客。

地皮現時市場估值約22億至27億元,每呎樓面地價約9000元至1.1萬元。

(經濟日報)

旺角商業地成本大增扯高「地價」 業界:每呎3103元看似「筍價」 還需計政府設施

受關注的旺角洗衣街「巨無霸」商業地日前由新地以47.29億奪標,每方呎樓面地價約3103元,屬低於市場估值下限價約16%;地價看似「超筍價」,有業界人士分析指,除地價外亦需計額外設施成本,由於該用地不單止是建商業項目的地皮,惟牽涉興建大量政府設施,如社福設施、長者中心及公眾停車場等,料佔項目建築成本約20%;而且目前寫字樓氣氛不景氣,加上項目不可分拆,需要長時間營運,亦推高項目的成本。

有業內人士指,該地每呎樓面地價約3103元看似「超筍價」,惟該地不是單單只建商業項目,而是牽涉大量政府社福設施,如長者日間護理中心,綜合青少年服務中心及幼兒中心,提供約800個車位的公眾停車場;以及4條行人天橋通道接駁附近建築物,包括2條橫跨聯運街連接旺角政府合署及港鐵旺角東站平台、1條連接至現有旺角道行人天橋系統及1條橫跨亞皆老街連接黑布街,而政府物業並不計算總樓面內。

估計整個項目建築成本約每呎8000元,而政府設施料已佔整個項目建築成本約20%,連同其他費用成本並不便宜。而且近年本港商業氣氛不景氣,加上未來寫字樓新樓面供應多,加上項目不可拆售,回本期長等,亦令成本增加,故只有具實力的發展商才做得到。

不可拆售需長時間營運

有測量師預計,近年建築成本增加,在目前市況而言初步項目估計建築成本約每方呎8000元。

另一測量師指出,初步估算興建政府設施佔整個項目建築成本約1成至2成,惟仍要視乎發展商的用料、整體設計、以及交樓標準等因素。

預計2030年落成回本期長

另有測量師指,中標發展商要投入過百億的建築成本和利息支出,低地價亦無可厚非。由於項目需建小巴交匯處,公共停車場補償政府合署的車位,項目本身的商業和社福樓面車位,相信項目要建五層地庫,增加項目長建築期,大大加重項目的發展成本。

項目牽涉大量政府社福設施,料發展商會興建多層地庫以容納公眾停車場等,佔整個項目建築成本約20%,大大增加項目發展成本。

(星島日報)

Property transactions rise to 8-month high

The Land Registry received a total of 5,980 sale and purchase agreements for all building units for registration last month, the highest in eight months, which marks a monthly increase of 35.1 percent and a year-on-year growth of 49.6 percent.

The total consideration for these agreements also jumped by 34.8 percent from January to a six-month high of HK$43.8 billion, according to the registry's data released yesterday.

Among the registered contracts in February, 4,282 were for residential units, which soared by 40.3 percent from a month earlier and 47 percent compared to 12 months ago.

Their value amounted to HK$36.7 billion, which was up by 44.4 percent month-on-month and 24.4 percent from February 2022.

The registration number for first-hand private homes in the month, which reflected January's sales performance, surged by 83.2 percent from the previous month to 643, a property agency said.

The number of new homes sales in the first quarter might rocket by nearly four times quarter-on-quarter to 4,200 and second-hand home transactions could also increase by nearly 70 percent to 14,000, leading to a 5 percent rise in property prices, an agent said.

The agent said the accumulated purchasing power will be released continuously in the post-Covid era especially after the government announced a series of measures to boost the economy, including reviving the Capital Investment Entrant Scheme, and trimmed the stamp duty for first-time buyers of properties under HK$10.08 million.

Meanwhile, in the primary market, Sun Hung Kai Properties (0016) said it received more than 10,000 checks for 352 flats at phase 2B of Novo Land in Tuen Mun, making them 27 times oversubscribed. The first round of sales will take place tomorrow and a new price list may be unveiled by then as well.

In Tseung Kwan O, Kowloon Development (0034) has raked in around HK$3.6 billion after selling 647 homes at Manor Hill. A total of 39 flats will be up for sale today and a new batch may be launched next week, the developer said.

In Lam Tin, Wheelock Properties recorded three more transactions at Koko Rosso yesterday for HK$24.8 million, and 300 units, or 77 percent of the total flats in the project have been sold.

(The Standard)工商鋪錄273宗買賣 代理行:創6個月來新高

有代理行統計,2月份共錄約273宗工商鋪成交,宗數創下6個月以來新高。

金額72.55億按月升77%

該行代理表示,根據資料,2月共錄約273宗工商鋪買賣,按月升約26%,為過去半年以來單月新高;惟與第五波疫情前相比,仍有改善空間,按年減約28%,金額錄約72.55億,較上月急升約77%,主因月內錄多宗大額成交,商鋪最突出,月內錄共9宗逾億成交中,商鋪佔逾60%。

市場錄9宗逾億元買賣

代理續稱,上月錄約86宗備商鋪買賣,總金額約37.89億,分別按月升約50%及約77%,核心消費區鋪位連錄成交,旺角亞皆老街16至16B號旺角商業大廈地下E鋪及1樓至4樓,總面積約1.7萬方呎,市傳以約3.5億易手,曾獲火鍋店作旗艦店,高峰期月租逾90萬,2016年遷出後分拆出租,現獲3間食肆租用。

代理指,寫字樓價量齊升,2月份宗數約42宗,按月微升約5%;金額錄約23.74億,按月攀升約1.6倍。觀塘鴻圖道73至75號 KOHO 全幢,以約17億易手,呎價約8340元。工廈錄約145宗成交,按月回升約22%,金額約10.83億,與1月約10.42億相若。

(星島日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

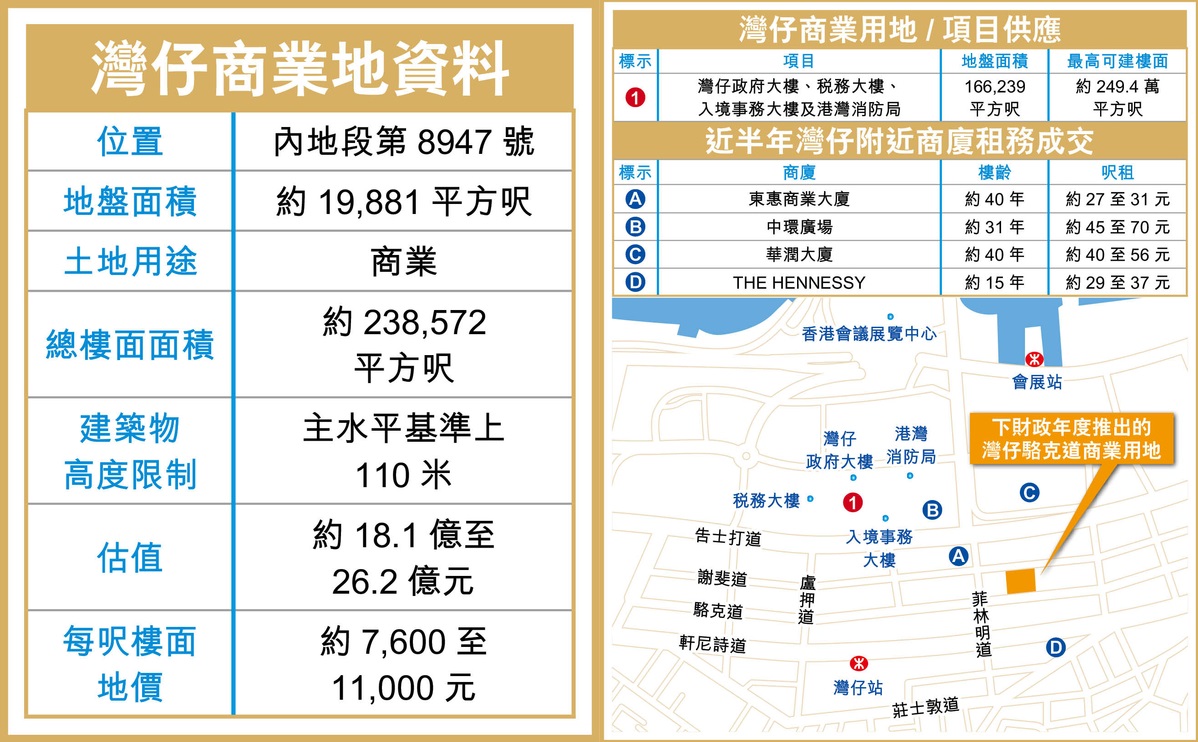

灣仔商業地 入場門檻低吸引競投

下財政年度 (2023至2024年) 將會推出3幅商業地,其中兩幅位於傳統核心商業地段,包括多年前已經計劃推出的前灣仔警察已婚宿舍用地。該地屬多年來區內罕有的商業用地供應,而且規模是3幅中最細,入場門檻相對低,估計將吸引不少發展商競投,尤其是中型發展商。

前宿舍地 逾30年新供應

前灣仔警察已婚宿舍用地位於傳統商業地段駱克道,附近有不少商廈,亦鄰近世紀香港酒店、比鄰前灣仔警署,目前規劃為「商業 (4)」用地,最高地積比率限制為12倍,總樓面約23.9萬平方呎,規模適中,市場估值18.1億至26.2億元,每呎樓面地價約7,600至1.1萬元。

翻查賣地紀錄,不計及2011年推出的酒店用地,灣仔逾30年來未曾有新商業官地供應,因此是次地皮供應罕有,而且地皮的規模適中,屬於下財年推出的3幅商業地中規模最細,投資額相對較細,入場門檻較低,估計除大型發展商外,可吸引更多財團參戰。

有測量師認為,地皮位置不俗,在沙中綫通車後更具優勢,而且沙中綫通車後,區內未有商業地推出,所以地皮成交價具指標作用。參考上周批出的旺角洗衣街商業地已以低價批出 (每呎樓面地價約3,103元),估計灣仔商業地每呎樓面地價只有7,600元左右。考慮整幅地皮規模及近期投標氣氛後,預測可接獲至少6至8份標書。

此外,上述用地早前已經放寬其建築物高度限制,由80米 (主水平基準上,下同) 增加約37.5%至110米,估計日後建成項目最高樓層可達20多至30層。

(經濟日報)

Novo Land sells out with more units to hit market

All 352 homes available at Sun Hung Kai Properties' (0016) phase 2B of Novo Land in Tuen Mun were sold out after the sales launched last Saturday, while the secondary market saw weekly transactions fall.

An additional 171 flats will be put on the market on Wednesday, as part of the 180 units revealed in the fourth price list last Saturday, said the developer. The latest batch of units was priced between HK$4.2 million and HK$9.3 million, or at an average price of HK$14,098 per square foot after discounts.

The project so far has been 29 times oversubscribed with a total of 10,691 checks received last week, cashing in at least HK$2 billion. It is the first new residential development project to receive over 10,000 applications after seven months when phase 1B of Novo Land got 12,887 checks last August.

In Tai Kok Tsui, Henderson Land Development's (0012) The Quinn Square Mile sold seven flats yesterday, raking in HK$41.58 million. The most expensive unit was a two-bedroom 382 sq ft flat, sold at HK$8.88 million. The remaining were studios and one-bedroom units ranging between 209 sq ft and 272 sq ft, with prices between HK$4.6 million to HK$6.5 million.

At least 600 deals were recorded in the primary market this month, a property agent said. The agent expects the figure to triple by the end of March to reach over 2,500.

In the secondary market, 17 secondary transactions were recorded in the ten benchmark housing estates over the weekend -- a decrease of 29 percent from last week's 24 deals, according to a property agency.

Whampoa Garden in Hung Hom notched up the most transactions at five.

Tai Koo Shing in Quarry Bay was the only housing estate that had zero transactions over the weekend, after five deals were made during a frenetic weekend late February.

Meanwhile, the number of transactions in Hong Kong's industrial, commercial properties and shops jumped by 27 percent to 273 last month from January, the agency said, marking the highest record in six months. The total considerations also rocketed 77.5 percent to about HK$7.2 billion, the agency remarked.

(The Standard)

Cheaper land in Hong Kong: what low-price parcel sales mean to buyers, renters, developers and government coffers

Developers are the only players likely to benefit from sales such as one in Mong Kok on March 1 that fetched 35 per cent less than a pessimistic estimate

The low-water mark for the slab of prime commercial real estate could have an adverse impact on government land revenue, analysts say

The recent sale of a parcel of prime commercial land in Mong Kok for 61 per cent less than the HK$12 billion (US$1.53 billion) some thought it might be worth is likely to mean a more handsome margin for Sun Hung Kai Properties (SHKP), rather than any profound change to the city’s real estate fundamentals, according to analysts.

SHKP prevailed over two other bidders to secure the 124,184 sq ft plot on March 1, winning the right to develop and lease the land for 50 years for HK$4.73 billion. That price is 35 per cent below the HK$7.3 million that a property consultancy estimated as the low end of the land’s value, and 61 per cent below the HK$12 billion it cited as the high end of the range.

Market observers were left to wonder whether the lower-than-expected bid indicates that lower rents or selling prices lie ahead in the property market, as well as what the transaction says about future government land sales.

The deal is “very good for SHKP”, said Raymond Cheng, managing director and head of China/Hong Kong research and property at CGS-CIMB Securities.

“The winning bid could be considered surprisingly low,” Cheng said. “It was a reflection of the current state of the market, particularly the office and retail segments. We expect office property prices to drop by 5 to 10 per cent year on year for 2023.”

SHKP plans to construct a 320-metre building with 1.52 million square feet of space on the site, which will be the “largest landmark office cum shopping centre in Mong Kok”, Raymond Kwok Ping-luen, SHKP’s chairman and managing director, said in a statement released on March 1.

Even given some constraints on construction on the site, the effective costs will end up being between HK$4,000 and HK$5,000 per square foot, “which is still quite cheap”, said CGS-CIMB’s Cheng.

“Our conservative estimate of the initial yield of about 5.5 per cent is quite high versus the average of 3 per cent during normal times,” Cheng said.

The property market will likely have recovered by the time SHKP starts pre-leasing the project, a property agent said.

“The commercial property market is expected to be better than the status quo in a few years,” the agent said. “Rental performance will be better after 2025, when the market is gradually moving from a tenant market to a balanced market.”

Now is a fortuitous time for developers to acquire parcels of land for their projects, according to another international property consultant.

“It is the right time for developers with a good balance sheet and strong holding power such as SHKP to enter the market,” an agent said, as the medium-term outlook is strong.

However, buyers and renters should not count on seeing lower costs trickle down to them, analysts said.

“It does not directly translate to cheaper office prices and rents when the buildings are completed,” the agent said. “Developers are conservative in land biddings as the prevailing development costs are high, including the interest-rate environment and construction costs.”

The current environment means higher risks for developers, given the poor uptake of office space at the moment, Au said, adding that they are being more conservative in their bidding as a way to minimise risk.

“SHKP will not only pay $4.7 billion for the site, but will invest a huge amount of capital and effort into developing the second-tallest commercial landmark complex in Kowloon,” said a representative from the developer, which plans to complete the project by 2030.

The tender came in the wake of unsuccessful sales of three other parcels of land – in Lantau Island’s Oyster Bay, Kwun Tong, and Stanley – so far this year, an occurrence that likely convinced the Lands Department to adjust its expectations for the Mong Kok site, a surveyor said.

“Due to lower land costs, [SHKP] may be able to offer a more reasonable rental level to the potential tenants,” the surveyor said. “Their construction costs, including financing costs required for the subject site, are significant. Therefore the developer reflected those in their bidding price.”

The Mong Kok site will be a reference point for other commercial sites to be sold outside the Central business district in 2023/2024, such as a 115,000 sq ft commercial and hotel site in Kai Tak, another agent said. The sale will also factor into land-premium discussions between the government and developers when it comes to converting developers’ sites for commercial use, the agent added.

“As such, this transaction price would cause an adverse impact on government revenue,” the agent said.

The government plans to put 18 more plots – 12 residential, three commercial and three industrial – on the market this year, contributing to a projected HK$85 billion in land premium income, according to Financial Secretary Paul Chan Mo-po.

(South China Morning Post)伯恩楊建文11.3億 統一觀塘年運業權

伯恩光學創辦人楊建文近年積極收購工廈重建,昨日透過強拍以拍賣底價11.28億元,統一觀塘年運工業大廈業權,每呎樓面地價約9,600元。

位於巧明街119至121號的年運工業大廈,屬於樓高5層的工廈,樓齡約45年,楊建文家族多年前開始收購,並在2020年初申請強拍,並在去年底正式獲土地審裁處批出強拍令,拍賣底價為11.28億元。

該物業最終在昨日經公開拍賣,以底價11.28億元獲財團代表投得。若果以該工廈佔地約1萬平方呎,重建地積比率12倍,可建樓面12萬平方呎,每呎樓面9,400元。

早已收購比鄰業發工廈

楊建文家族近年在區內積極收購重建,除了上述年運工業大廈外,亦早已收購比鄰的業發工業大廈第1及2期,更曾經向城規會申請合併地盤,並申請放寬地積比率至14.4倍重建,將會建1幢39層高的商廈 (另設5層地庫),其中地庫1至10樓屬零售餐飲用途,樓上則屬辦公室用途,涉及總樓面約72萬平方呎,屬於區內規模較大型的商廈重建地盤之一。

(經濟日報)中環中心錄2車位成交 作價600萬及538萬

中環中心地庫2樓及3樓各1個車位,分別以600萬及538萬易手,買家君豪 (中國) 有限公司,為該廈頂樓業主相關公司,料作為自用。

君豪 (中國) 承接料自用

上述為地庫2樓F2093號車位,以及地庫3樓F3139號車位,各以600萬及538萬成交,儘管該2個車位都以公司持貨 (The center (car parks 3) limited及The center (car parks 7) limited持有,不過,新買家君豪 (中國) 有限公司買物業,其母公司君豪集團業務多元化,為房地產開發、酒店物業,醫藥生物科技製造及銷售。

市傳投資者蔡志忠沽貨

君豪集團總裁石金禹及相關人士,多年來在港大手掃入商廈及豪宅,2017年9月,斥資7.4億購入中環中心79樓頂樓全層,呎價5.58萬,創當時全港商廈呎價新高,由於現時自用物業,業界預期,上述2車位作為自用。

石氏亦於2017年及2019年間,連番購入3間山頂MOUNT NICHOLSON洋房,涉資共17.8億。

市場消息指,上述2個單位原業主為投資者蔡志忠,車位為該廈22樓全層配給的,蔡於2017年11月購入該全層,2018年收樓即拆售,於2019年沽清。本報昨日聯絡蔡志忠,惟直至截稿時,未聯絡得上。

(星島日報)

更多中環中心寫字樓出售樓盤資訊請參閱:中環中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

中環安和里商住樓3700萬售

市場消息透露,中環安和里6號全幢,以3700萬易手,地下建築面積約500方呎,1至5樓每層各400方呎,合共2500方呎,地下連閣樓由The Flow精品店承租,月租3.6萬。盛滙商舖基金創辦人李根興表示,該物業樓上每層月租1.5萬,連同地鋪3.6萬,月租約11.1萬,料回報3.6厘。

連約回報3.6厘

原業主早於2006年11月以122.8萬買入4樓,同年9月以138萬買入5樓,然後於2007年4月,以580萬買入地鋪連閣樓,同年7月150萬買入2樓,以150萬買入3樓,於2010年7月以233萬買入1樓,涉資合共1373.8萬,帳面獲利2323.2萬,物業升值1.69倍。

李根興分析道,該全幢位於中環高消費段,料回報3.6厘,屬不俗水平,不過,該位置人流少,樓上尚未全部租出,住宅印花稅也較高。

(星島日報)

金鐘力寶中心 享地利商業氣氛濃

東鐵綫過海段通車後,金鐘交通配套更完善,而力寶中心比鄰的金鐘廊料重建,未來區內商業氣氛更佳。

金鐘為傳統商業核心區,商廈林立,以太古地產 (01972) 旗下太古廣場為核心,惟屬大業主長綫收租項目,可供買賣的商廈,主要為力寶中心、海富中心、統一中心及遠東金融中心等。以質素及規模計,力寶中心兩座合共樓面達130萬平方呎,為散業權商廈中最具規模,單位面積由數百平方呎至2萬餘平方呎。

比鄰金鐘廊重建項目

值得一提,是力寶中心及太古廣場,有金鐘廊商場連接,而該地皮列入下年度 (2023/24年度) 賣地計劃中,估值高達200億元,整幅地皮佔地9.6萬平方呎,可興建86萬平方呎商業樓面作辦公室及酒店用途,而基座部分需要興建414萬平方呎的商場,提供零售及餐飲,並作連接金鐘道南北兩端各商場的行人天橋。因此日後大廈落成,力寶中心一帶商業氣氛更加理想。

物業處金鐘商廈群正中心,多個出入口連接金鐘廊、太古廣場、海富中心等,四通八達。另一邊設有天橋連接花園道,可通往長江集團中心及花園道3號。另物業對面為高等法院,故力寶中心亦獲不少律師行租用。

由金鐘港鐵站出口步行至該廈需時約5分鐘,東鐵綫過海段通車後,前往新界、紅磡等極為方便,加上早年通車的南港島綫,金鐘站為多條鐵路綫的轉車站。另大廈地下設有巴士總站、的士站,而物業亦有停車場。

飲食配套方面,基座設兩層零售商舖,設咖啡室、酒樓及西式餐廳等,上班人士亦可前往太古廣場,餐廳選擇多,金鐘區擁多間5星級酒店,設有高級餐廳供商戶作商務午餐。

力寶中心共兩幢寫字樓,1座樓高45層,而2座則樓高47層。大廈在設計上頗獨特,外形凹凸不平,單位大細不一。電梯大堂設於物業高層地下,甚為寬敞,兼設玻璃採光,並提供座位,樓底高環境舒適,絕對為同區散業權商廈中質素最理想。

景觀上,部分單位享全維港海景,前方仍有多幢商廈,中低層單位景觀難免受遮擋,另一面享中半山景觀,同樣開揚舒適。

買賣方面,今年錄得1宗成交,資深投資者正八集團主席廖偉麟,購入金鐘力寶中心一座37樓4至6室,面積3,475平方呎,涉資約7,818萬元,成交呎價約2.25萬元,物業市值呎租約60元。原業主早於2003年約1,130萬元購入3個單位。

(經濟日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多遠東金融中心寫字樓出租樓盤資訊請參閱:遠東金融中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多花園道3號寫字樓出租樓盤資訊請參閱:花園道3號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多統一中心寫字樓出售樓盤資訊請參閱:統一中心寫字樓出售

更多遠東金融中心寫字樓出售樓盤資訊請參閱:遠東金融中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

中高層全層放租 每呎約45元

力寶中心為區內指標商廈,物業中高層全層單位放租,以每呎約45元放租。

面積12083呎 月租54萬

有代理表示,有業主放租金鐘力寶中心二座28樓全層單位,面積約12,083平方呎,以每月約54萬元放租,呎租約45元。單位擁裝修,質素甚佳。

租務方面,大廈近期租務稍加快,上月大廈錄數宗成交,包括2座3604B室,面積約2,412平方呎,成交呎租約40元,另2座2501至01A室,面積約3,281平方呎,以每呎約40元租出。

同區買賣方面,上星期金鐘海富中心一座高層19室,面積約757平方呎,以每呎約19,287元售出,涉約1,460萬元。

(經濟日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

工商舖2月268宗註冊 連升兩月

工商舖物業市場持續造好,有代理行綜合土地註冊處資料顯示,2月份工商舖註冊量共錄268宗,按月微升3.5%,連升兩個月,而註冊金額則錄32.64億元,按月微升約1.9%。

工廈商舖表現佳 升2.4及11.9%

2月份工商舖各板塊註冊宗數個別發展。工廈及商舖表現較佳,註冊量分別按月升約2.4%及11.9%,最新分別錄130及94宗。只有商廈註冊量按月跌約8.3%,僅錄44宗。2月份整體註冊宗數最新報268宗,按月微升3.5%,註冊金額則錄32.64億元,按月微升1.9%。中港全面通關後,註冊量未有迅速反彈,反映投資者仍觀望通關等消息對市場的利好程度。

若按金額劃分,2月份註冊量最多的為500萬元或以下物業,共錄142宗,按月上升約6%。逾500萬元以上至1,000萬元的物業,共錄48宗,按月升約2.1%。價值1,000萬元以上至2,000萬元的物業錄得37宗登記,按月下跌9.8%。至於2,000萬元以上至5,000萬的註冊則錄得29宗,按月增加11.5%。在逾億元買賣註冊成交方面,月內錄得4宗,其中商廈及舖位物業註冊分別有1宗及3宗,商廈包括有中環皇后大道中9號1403室,成交價為1.05億元。商舖則包括有佐敦大觀樓地下及1至3樓多個舖位以及西營盤昌寧大廈地下及1樓共8個舖位,作價分別為1.46億元及1.17億元。

該行代理表示,雖然中港全面通關已接近一個月,但今年首兩個月的工商舖註冊數字未見迅速反彈,反映投資者仍觀望通關等消息對市場的利好程度。不過,隨着「口罩令」撤銷,香港全面復常,本地市民的消費信心可望恢復,再加上目前內地來港旅客顯著回升,本港的私人消費開支將會反彈,並帶動本港的經濟在今年步入復甦。投資者的信心會逐步恢復,預料工商舖成交會在未來繼續增加。

(經濟日報)

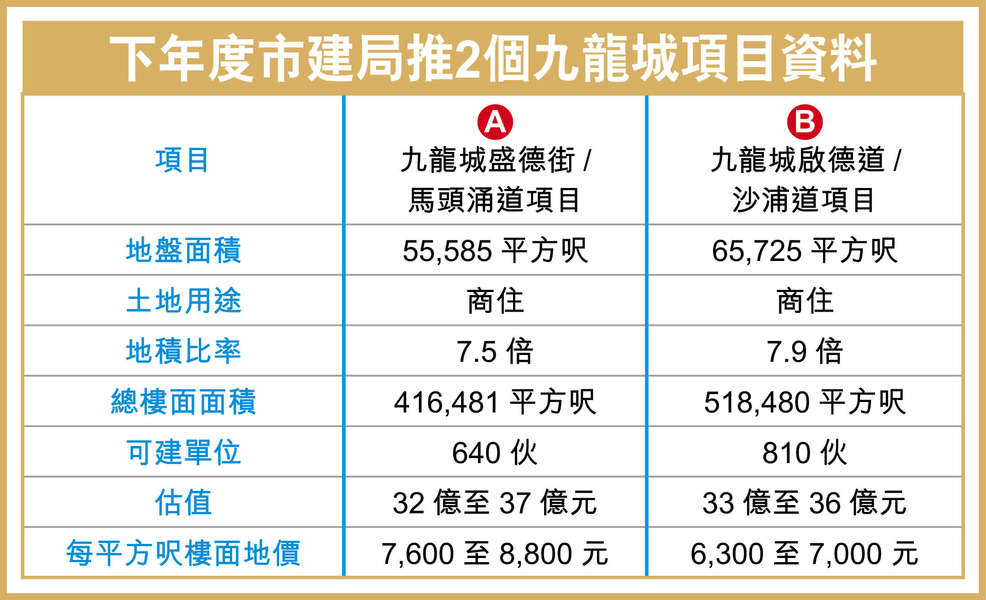

九龍城2地待推 區內勢變天

九龍城未來勢變天,下年度 (2023/24年度) 賣地計劃,市建局將推出3個重建項目,當中兩個位於九龍城,分別為盛德街/馬頭涌道項目,以及啟德道/沙浦道項目,各提供640伙及810伙,市場估值最高共73億元。

馬頭涌道項目 估值最高37億

其中位於盛德街/馬頭涌道項目,涉及馬頭涌道51至77號、盛德街12至34號、及馬頭角道2至4A號,地盤呈長形,北面比鄰九龍靈光小學及聖母院書院,南面面向馬頭角政府合署,項目與港鐵宋王臺站相距約7分鐘步程,地盤面積約5.55萬平方呎,將以地積比7.5倍發展,可建樓面逾41.64萬平方呎。

據市建局披露資料,項目重建為商住用途,並附設低層商業及零售平台設施,以及地下附屬停車場和上落客貨設施,其中住宅樓面佔約34.7萬平方呎,預計可提供640伙中小型單位;而非住宅樓面積約6.94萬平方呎,預計落成日期為2029年至2030年。綜合市場估值約32億至37億元,每呎樓面地價約7,600至8,800元。

沙浦道項目 提供約810伙

另一個位於啟德道/沙浦道項目,位置鄰近富豪東方酒店及住宅御‧豪門,地盤面積約6.57萬平方呎,同樣以商住發展,重建地積比7.9倍,最高可建樓面逾51.84萬平方呎,住宅樓面佔約43.2萬平方呎,料提供約810伙,市場估值約33億至36億元,每呎樓面地價約6,300至7,000元。

參考九龍城一帶一、二手住宅,過去1年平均成交價呎價介乎1.7萬至2.6萬元,其中即將入伙的新盤瓏碧,錄30宗成交,平均呎價26,033元。而樓齡約18年的傲雲峰,同期也有30宗二手買賣,平均呎價約17,738元。

(經濟日報)

六福70萬租羅素街8號 奢侈品牌重返核心區 通關後首宗

香港今年2月起全面通關,加上政府本月正式宣布解除口罩令,經濟及旅遊業復常,零售商對後市恢復信心,開始租用核心區地舖。昔日全球最貴舖租地段銅鑼灣羅素街錄得長租成交,連鎖珠寶金行六福 (00590) 落實承租羅素街的英皇鐘錶珠寶中心地下一個面積逾3000方呎地舖,月租約70萬元,成為通關後首宗奢侈品牌租用全港主要零售區地舖的個案。

據了解,六福最新承租銅鑼灣羅素街8號英皇鐘錶珠寶中心地下3及5號舖,建築面積3068方呎,舖位面向時代廣場,成交月租約70萬元,呎租約228元,為銅鑼灣、中環、尖沙咀及旺角在全面通關後,首度有珠寶金行此類奢侈品零售商承租街舖,反映承租能力較高的商戶開始陸續重返核心零售區。

呎租228元 高位插74.6%

上述舖位已丟空5個月,一直在市場上放租,但並無放租的意向價,由租戶出價洽租。市場人士表示,在今年1月香港與內地恢復有限度通關後,已有零售商洽租上址,出價40萬至60萬元,惟仍遭業主拒絕,最終由六福成功租得舖位。

是次租出的地舖,上一手租戶為另一連鎖珠寶金行周大福 (01929),在2019年底即新冠病毒爆發前,以每月130萬元租用,呎租約424元,直至去年10月租約期滿撤出,令此舖位於過去十多年來首度丟空待租。該舖歷來最高租金時期,為2014年由英皇鐘錶珠寶 (00887) 以每月276萬元租用作為名錶卡地亞 (Cartier)專門店,現租金較9年前大跌206萬元或74.6%。

事實上,本港核心零售區仍有一定數量的舖位空置,租金低位徘徊,為個別零售商戶進駐一線地段帶來契機。資料顯示,在2010至2019年零售業「正常時期」,六福一直未能夠成功租得任何位於羅素街的地舖經營,只有在周邊波斯富街及利園山道開店,是次料屬首度成功進駐銅鑼灣最一線位置。

藥妝店15萬租麗園大廈舖

羅素街近日亦錄得另一宗舖位租賃成交,為羅素街59至61號麗園大廈地下B6號舖,建築面積約350方呎,原本在2021年1月獲健康食品店承租兩年,月租20萬元,呎租約571元。不過,該健康食品店去年3月在第五波疫情下突然提早近一年結業。

其後該舖位分別由口罩店及利是封店短租,月租由7萬至8萬元,而長租叫價一直維持原本舊租20萬元。市場消息指出,舖位剛獲藥妝店租用,月租約15萬元,呎租約429元,租金較2年前長租租金低5萬元或25%。

此舖2018年曾由一家藥妝店租用,當年月租曾達45萬元,呎租1286元,可見目前同一行業付出的租金仍較疫前低66.7%。

(信報)

更多英皇鐘錶珠寶中心寫字樓出租樓盤資訊請參閱:英皇鐘錶珠寶中心寫字樓出租

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租中環美國銀行中心每呎3.83萬交吉易手 疫市以來新高 15年升值3倍

中港兩地通關後,商廈市場漸活躍,中環美國銀行中心錄1宗成交,一個面積約1300方呎單位,以5000萬易手,平均呎價約38373元易手,屬3年以來、即疫市後新高,買家承接單位自用。

上址為美國銀行中心2903室,建築面積約1303方呎,以5000萬易手,由用家承接,原業主於2007年2月以1250萬購入,持貨15年,帳面獲利3750萬,物業升值3倍。該單位望海景,現址交吉,新買家為用家,以「買物業」形式承接,須付相等於樓價4.25%的印花稅。

面積約1303方呎

業內人士分析,該單位易手呎價38373元,為過去3年來該廈新高,自從2020年疫市以來,該廈僅錄6宗成交,最新成交呎價創新高,其餘5宗呎價由24296元至3.7萬,對上1宗於2021年11月錄得,該廈1108至9室,建築面積1410方呎,以5217萬成交,平均呎價3.7萬,2020年間,該廈錄3宗成交,每呎介乎24296元至28800元,其中香港美國商會沽售會址最矚目,19樓4、7及13室,建築面積約5968方呎,涉資1.45億,平均每呎24296元,創下近年來新低,較高峰期成交呎價普遍逾5萬,跌足50%。

投資者向香港美國商會低價購入單位,一直以每呎65元放租,未覓得租客,最終租金一減再減,在交吉一年後,以每月約22萬租出,平均每呎37元,回報只有1.8厘。該單位曾由香港美國商會自用,於1996年以5460.72萬購入。

用家斥5000萬承接

該廈於2019年3月創下新高呎價紀錄,涉及2807及08室,建築面積2659方呎,以逾1.43億易手,平均每呎高達5.38萬;最新呎價較高位跌23%,不過,比較低位時呎價2.43萬,上升逾57%。

另外,中環「醫生大廈」金利豐中心再錄1宗承租,該廈3樓,建築面積約1958方呎,以每呎約60元租出,月租約11.748萬。該廈7樓及8樓,建築面積各約1982方呎,早前以每呎62元租出,每層月租12.3萬,亦是金利豐集團於去年第3季收回該廈後首錄承租,可見在兩地通關後,商廈租賃逐漸回暖。

美國銀行中心一個面積約1300方呎的單位,以每呎3.83萬易手,為疫市以來新高價,不過,與高峰期呎價普遍逾5萬,仍然相差約23%。

(星島日報)

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多金利豐中心寫字樓出租樓盤資訊請參閱:金利豐中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

長沙灣中國船舶大廈低層逾萬呎全層特色單位放售,有代理表示,長沙灣道650號中國船舶大廈3樓全層連平台及1個車位,屬罕有逾萬呎全層特色單位,面積約11535方呎,平台約2882方呎,以現狀出售,每呎1.73萬,意向價約2億,裝修豪華,樓底高度約4米,部分樓面列明可作零售用途,適合教育及培訓中心、宴會場地、陳列室或展銷廳等,市值呎租約25元。

TOYOMALL放售觀塘廣場地鋪

投資者羅守輝旗下TOYOMALL放售觀塘廣場地鋪,另一代理表示,觀塘開源道68號觀塘廣場地下2號鋪,面積約477方呎,意向價9500萬,每呎叫價19.92萬,現為連鎖便利店,月租22萬,料回報約2.8厘。羅氏2001年10月以1068萬購入該鋪。

(星島日報)

更多中國船舶大廈寫字樓出售樓盤資訊請參閱:中國船舶大廈寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

前灣仔已婚警察宿舍商地 下財年推

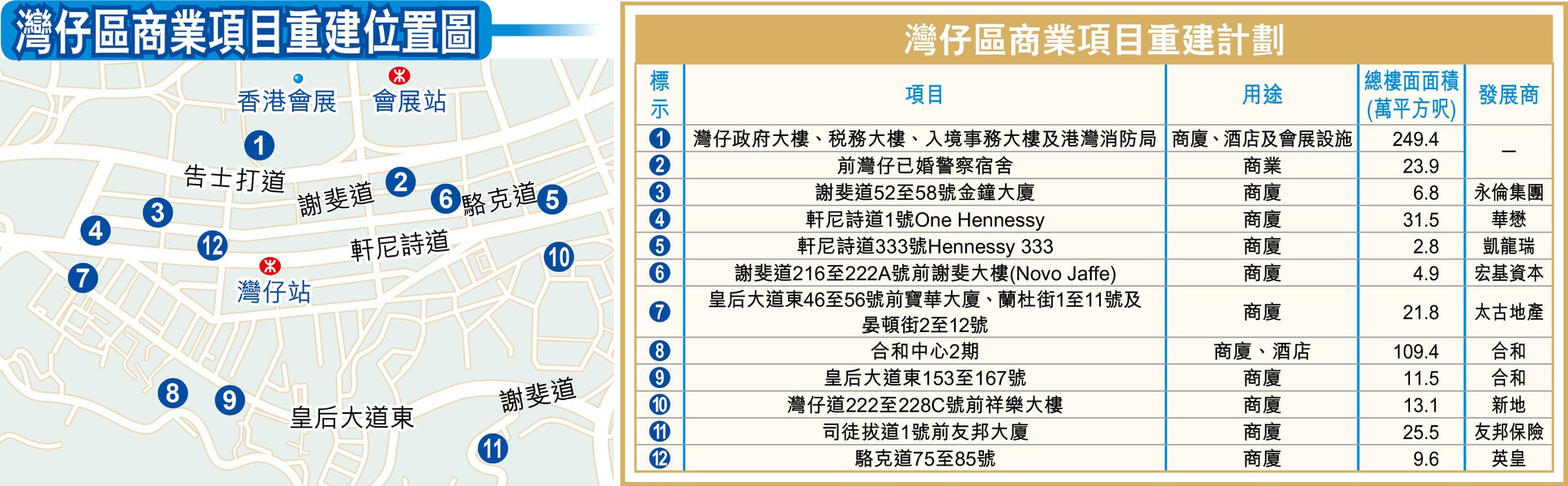

隨東鐵綫過海段通車,灣仔的發展潛力進一步提升,下個財政年度區內將會推出前灣仔已婚警察宿舍用地,總樓面涉約23.9萬平方呎。計入前述用地,目前區內有至少12個商業重建項目,總樓面面積涉逾510萬平方呎。

樓面23.9萬呎 估值18億至26億

相隔多年,灣仔再有新商地推出。政府近日公布,將會推出位於駱克道219號至227號,即前灣仔已婚警察宿舍的商業地。地皮比鄰前灣仔警署,現規劃為「商業 (4)」用地,地盤面積約19,881平方呎,最高地積比率限制為12倍,總樓面約238,572平方呎,市場估值約18.1億至26.2億元,每呎樓面地價約7,600至1.1萬元。事實上,因地皮所牽涉的《灣仔分區規劃大綱圖》早前受到司法覆核影響,所以一度拖延多年至今才推出。鑑於地皮規模不大,投資額較細,料可以吸引各類發展商投標。

值得一提的是,政府早年曾計劃將地皮前方的前灣仔警署用地與上述已婚宿舍一併出售,發展成一個商業及酒店項目。不過,考慮到警署屬於二級歷史建築,日後不可重建,其用地的規劃意向主要是保存及活化舊警署,以作酒店、商業、社區及/或文化等用途。

3政府大樓 重建會展酒店甲廈

另一潛在的大型商業供應要數到位於灣仔北的3座政府大樓項目,包括灣仔政府大樓、稅務大樓、入境事務大樓,及港灣消防局用地,早前已落實重建為會展設施、酒店和甲級寫字樓等。根據區議會文件,上述組成的重建地盤面積166,239平方呎,以地積比率15倍重建,總樓面高達約249.4萬平方呎,料重建後樓高可達52層,其中最低10層將發展為會議及展覽樓面,涉約92.6萬平方呎,而中間的27層則重建為甲級商廈,總樓面達97萬平方呎。而項目最高15層則作為酒店用途,涉約57萬平方呎總樓面,提供近500間客房。

由於灣仔的商業官地供應不多,發展商主要靠收購區內舊樓,有重建項目已經陸續在今年竣工,包括太古 (01972) 旗下的太古廣場六座,總樓面約21.8萬平方呎,前身為寶華大廈等舊樓。此外,本地老牌家族永倫集團去年就灣仔謝斐道52至58號金鐘大廈申請強拍,項目當時市值約8.43億元。

(經濟日報)

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

全面通關 有利商廈需求增

據一間外資代理行近日發表的香港地產市場報告,受農曆新年的傳統淡季影響,截至今年1月底,整體市場空置率上升至12.2%,當中中環和灣仔/銅鑼灣的空置率分別微升至8.9%和10.3%,而港島東的空置率則下跌至11%。

凱利商廈全層 叫價4000萬

同時,在各主要分區市場中,中環及灣仔/銅鑼灣租金均下跌0.2%,而尖沙咀租金保持平穩。該行指,近期接獲來自保險及金融機構的租賃查詢增加,其業務料將受內地開關所帶動,估計本地的寫字樓市場租賃交投將於今年下半年顯著改善。

另一方面,有業主看準市場需求,放售灣仔凱利商業大廈中層全層,意向價約4,000萬元。有代理指,是次獨家放售單位位於灣仔摩利臣山道70至74號凱利商業大廈12樓全層,面積約3,468平方呎,意向價約4,000萬元,每呎叫價約11,534元。

該單位亦歡迎企業洽租,意向呎租約30元。據了解,原業主於2014年以約3,000萬元購入單位,一直持有物業自用至今。

(經濟日報)

Tai Po luxury homes go on sale

Villa Lucca, a completed luxury residential project in Tai Po developed by Hysan Development (0014) and HKR International (0480), will put 53 homes up for sale via tender on Saturday.

The units include 34 standard flats, 6 penthouses with rooftops and 11 ground-floor flats with gardens, with areas ranging from 1,028 to 2,745 square feet. There are also two five-bedroom detached mansions with ares of 3,322 and 3,245 sq ft respectively.

In Kwun Tong, Lai Sun Development's (0488) Bal Residence may kick off sales this week. The first batch will consist of 56 flats with an average discounted price of HK$19,554 per sq ft. The cheapest option is a one-bedroom unit priced at HK$5.81 million after the discount.

In Yuen Long, Star Group (1560) unveiled the first price list of After The Rain, which offers 68 flats at an average price of HK$14,491 per sq ft after discounts.

And in Tseung Kwan O, Kowloon Development (0034) will add 26 flats for sale at Manor Hill on Saturday. The discounted prices for these units range from HK$5.5 million to HK$6 million or HK$19,354 to HK$20,882 per sq ft.

In other news, many homes to be sold by Sun Hung Kai Properties (0016) are priced under HK$10 million and would benefit from the cut in stamp duty for first-time home buyers, Morgan Stanley said, while maintaining its buy rating for the developer with a target price of HK$122.

Mortgage rates in Hong Kong are expected to increase this year with double stamp duty hurting demand. As a result, the current rebound in property prices is predicted to be temporary, and it is expected that the prices will decline by 5 percent in 2023, according to Bloomberg.

(The Standard)差估署:商廈去年落成量378萬呎 創過去23年來新高甲廈佔85%

近年寫字樓供應量處於高水平,差餉物業估價署數字顯示,2022年寫字樓落成量高達378萬方呎,按年急升4倍,創23年來新高,其中並以甲廈比例最多,佔整體的85%。

差餉物業估價署公布的臨時數字顯示,2022年商廈落成量為378.15萬,比較2021年的74.9萬方呎,多出約303.25萬方呎,幅度為4倍,去年落成量更是過去23年來最高,對上一個高位為1999年約456.63萬方呎。去年寫字樓落成量佔最多類別為甲級商廈,共提供樓面約322.17萬方呎,佔整體比例約85.2%。而截至2023年1月的商廈落成量,暫時只有約1.72萬方呎。

較2021年增4倍

今年1月整體商廈租金指數報226.9點,按月跌約0.7%,按年更下跌約1.8%,甲廈租金指數報229.8點,按月跌約0.48%,按年跌約1.6%。港島區表現不俗,上環及中區租金指數報271.1點,按月升約1.6%,較去年同期升約0.15%。灣仔及銅鑼灣租金指數報223.5點,按月升約2.1%,連升兩個月,不過,按年則回落約1.6%;尖沙嘴表現差,該區指數報190.9點,按月下跌約2.9%,較去年同期急挫約4.9%。

商廈租金按年跌約1.8%

有代理表示,商廈由土地規劃,賣地及落成,歷時長達10年,2012年經濟暢旺,政府規劃更多商廈地皮,新世界於2017年連奪長沙灣3幅商貿地,其中去年落成的長沙灣南商金融創新中心,當時每呎樓面地價7478元;目前市場吹淡風,旺角洗衣街商業地每呎樓面地價僅3103元。

有測量師表示,去年市場有重磅甲廈落成,包括啟德 AIRSIDE,黃竹坑的 Landmark South 等等,對租金亦構成壓力。

今年1月,上環及中區租金指數報271.1點,按月升約1.6%,亦較去年同期升約0.15%。尖沙嘴報190.9點,按月跌約2.9%,較去年同期急挫約4.9%。

(星島日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多Landmark South寫字樓出租樓盤資訊請參閱:Landmark South寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

培新:尖沙咀酒店 料年中開業迎客

核心區商廈仍具吸引力,培新集團旗下中環雲咸街33號商廈進行翻新,現寫字樓出租率約5成,呎租約42元起。另集團旗下尖沙咀酒店翻新近完工,料年中開業迎旅客。

中環雲咸街33號前身為蘭桂坊酒店,培新早年為物業改裝成寫字樓出租,而近期更為物業進一步翻新,主要為寫字樓大堂打造成文化藝術共享空間Wyndham Social,並邀請多位本地藝術家作個人展覽,租戶亦可租用Wyndham Social舉辦講座、分享會及商業活動等。

雲咸街33號兩層招租 呎租42元起

培新集團地產總監吳美綺表示,14層寫字樓現時租出5成,租客包括共享辦公室等,現推出兩層招租,每層面積約5,100平方呎,呎租約42元起。另頂層複式單位,預留作特色餐飲出租。

去年受疫情影響,商廈租務淡靜,吳美綺指去年底開始租務查詢增加,現全面通關後,睇樓活動倍增,料今年租務向好,而全幢物業租出,租金收入料達9,000萬元。

赫德道酒店2億翻新 涉324間房

另集團旗下的上水匯商場方面,她表示受惠於通關,商場生意有所上升,大致上已回復前疫情前水平,而今年舖租有1成升幅。

至於酒店方面,集團旗下尖沙咀赫德道酒店於疫情期間關閉,吳美綺透露,集團斥約2億元為物業進行翻新,並獲國際酒店品牌作營運,料今年中開業,涉及324間房。

(經濟日報)

更多雲咸街33號寫字樓出租樓盤資訊請參閱:雲咸街33號寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Twenty One Whitfield酒店放售 市值6.5億

中港兩地全面通關,帶動本港旅遊業,投資者趁勢頭好放售酒店物業。高力承業主委託獨家代理出售銅鑼灣威非路道21號Twenty One Whitfield酒店,物業的收取意向書截止日期為今年5月10日。該項物業市場估值約6.5億元。

是次放售物業為一幢樓高32層酒店,地盤面積約1984方呎,總建築面積約34803方呎。物業的地下為酒店大堂及蠔吧,5樓為花園平台,6樓至36樓為客房,每層設有2個房間,共提供54間酒店客房。房間擁多面落地玻璃,自然光線充足,部分房間享有維港海景及維多利亞公園景致。

有外資代理行代理表示,物業位於銅鑼灣,屬港島優越地段。區內有多條著名食街,特色食肆林立,迅步即達維多利亞公園。物業的房間偌大、設計時尚舒適,深受商務客戶歡迎。而受惠於全面通關、社會復常,香港將舉辦眾多大型國際盛事,旅客和商務客戶的入境人數與日俱增,勢必帶動對高端酒店房間的市場需求。

資料顯示,Twenty One Whitfield酒店在2011年落成,現業主在2014年斥資約3.95億元購入該項目。

(信報)

Office supply at 23-year-high

Private office completions in Hong Kong surged to a 23-year high last year.

New built offices jumped by more than four times to 351,300 square meters in 2022, of which Grade-A offices accounted for 299,300 sq m, according to the data from the Rating and Valuation Department.

The office rental index slid by 0.7 percent month-on-month in January but rents of Grade-A offices in Sheung Wan and Central rose 1.6 percent.

The data came as Bloomberg said BNP Paribas intends to move the majority of its Hong Kong staff out of the Central business district as the lender looks to cut costs and adjust to the post-Covid era.

The bank's asset management business is already located in Lincoln House at Taikoo Place in Quarry Bay.

It currently occupies four floors in Two International Finance Centre, according to its website.

The move is set to take place as soon as next year and some bankers may remain in the Central office, it added.

(The Standard)

For more information of Office for Lease at Lincoln House please visit: Office for Lease at Lincoln House

For more information of Grade A Office for Lease in Quarry Bay please visit: Grade A Office for Lease in Quarry Bay

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

BNP Paribas to shift most staff from Two International Finance Centre to Taikoo Place in cost-cutting move

BNP Paribas SA plans to move the majority of its Hong Kong staff out of offices in the city’s central business district as the lender looks to cut costs and adjust to the post-Covid era, according to people familiar with the matter.

The French lender is weighing shifting nearly all of its staff in Two International Finance Centre, a prestigious complex in a coveted location, to offices in Taikoo Place on the east side of Hong Kong Island, the people said. The move is set to happen as soon as next year, and some bankers may stay behind in the Central building, the people said.

BNP Paribas’ asset management business is already based in Lincoln House of Taikoo Place, according to its website. It currently has four floors in Two International Finance Centre, the people said, asking not to be identified as the information is private.

“The Hong Kong financial industry has entered a new phase of workspace transformation, and we have reassessed our operations post pandemic and taken the opportunity to shift to a more dynamic smart workspace which allows greater collaboration and mobility,” a spokesperson for BNP Paribas said in response to a Bloomberg News query.

The move comes as financial institutions are looking to trim costs by cutting staff globally amid persistent inflation and a slowdown in dealmaking. Citigroup Inc. is set to join Wall Street rivals JPMorgan Chase & Co. and Goldman Sachs Group Inc. in cutting jobs, Bloomberg News has reported.

A rise in Hong Kong’s office vacancy rates and falling rents during the pandemic has weighed on the city’s premier properties. Jefferies Financial Group Inc. moved from billionaire Li Ka-shing’s skyscraper in Hong Kong’s Central district to Two International Finance Centre in December. The building is also home to the regional offices of financial firms including UBS Group AG.

Comprising 4.5 million square feet, International Finance Centre features more than 200 stores and office space as well as a Four Seasons hotel, its website shows. The complex is a collaboration between developers Sun Hung Kai Properties Ltd. and Henderson Land Development Co. and utility company Hong Kong & China Gas Co., according to the website.

(The Standard)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at Lincoln House please visit: Office for Lease at Lincoln House

For more information of Grade A Office for Lease in Quarry Bay please visit: Grade A Office for Lease in Quarry Bay

$334m luxury deals lift market

Three luxury homes were sold in the primary market yesterday for a total of HK$334 million.

In Tai Tam, Chinachem sold a 2,773-square-foot four-bedroom home at Redhill Peninsula for HK$90 million, the first tender transaction at the luxury low-rise residential development since November 2021.

In Ho Man Tin, Sino Land's and CLP's (0002) St George's Mansions sold a 2,140-sq-ft four-bedroom flat for HK$119 million or HK$55,607 per sq ft, both records for standard units in the project.

And in Kai Tai, Longfor's (0960) Upper River Bank sold a 2,567-sq-ft duplex four-bedroom unit for HK$125 million or HK$48,695 per sq ft, also a record for the project.

Meanwhile, the first price list of Chinachem's In One phase 1B atop Ho Man Tin MTR Station will be revealed next week, offering a minimum of 50 flats.

Show apartments open next week and the first batch of sales will commence within the month.

Phase 1B offers 183 one- to four-bedroom flats with areas ranging from 336 to 1,234 sq ft.

In Lam Tin, Wheelock Properties will launch phase 3B at Koko Hills by the end of this month, featuring 444 flats.

This phase will primarily consist of small flats, with 60 percent offering harbor views.

After two rounds of sales, phase 3A - Koko Rosso - has sold a total of 306 flats, bringing in about HK$2.43 billion in revenue.

In Tuen Mun, Sun Hung Kai Properties (0016) sold 88 out of 171 flats in phase 2B of Novo Land yesterday. One customer purchased two apartments for approximately HK$13 million.

In the same district, phase 2 of Grand Jeté, CK Asset's (1113) project with SHKP, will unveil the first price list of at least 80 flats next week.

Around 60 percent of the apartments on the first price list consist of one-bedroom units. These units will be priced according to market rates and are anticipated to be available for sale within the month.

(The Standard)

Sun Hung Kai Properties poised to sell all 171 flats in latest batch at Tuen Mun project as life returns to Hong Kong housing market

Nearly 10,000 potential buyers have registered an interest in the 171 flats available in the second batch of Phase 2B of the Novo Land project, meaning about 58 people will compete for each unit

Hong Kong’s residential property market appears to be on an upswing, with developers such as SHKP and Wheelock Properties achieving strong sales in their respective projects in recent weeks

Sun Hung Kai Properties (SHKP) looked set for another sell-out at its Novo Land project in Tuen Mun as life returns to Hong Kong’s housing market after almost three years of subdued demand under Covid-19 restrictions.

Nearly 10,000 potential buyers have registered an interest in the 171 flats available in the second batch of Phase 2B of the project in the New Territories, according to SHKP, which means about 58 people are competing for each unit.

As of 9:10pm on Wednesday, some five hours after sales formally opened, 165 units had found buyers, according to agents.

During the weekend, Hong Kong’s most valuable developer sold all 352 units on offer at the development.

Hong Kong’s residential property market appears to be on an upswing, with developers such as SHKP and Wheelock Properties achieving strong sales in their respective projects in recent weeks.

The improvement in the property market comes after Hong Kong fully reopened its border with mainland China. The government has also broadened the set of buyers exempted from paying ad valorem stamp duty as it extends tax concessions to buyers of units worth less than HK$10 million.

“Both have helped the property market, but opening the borders is more important as it has a very positive impact on market sentiment and the business environment,” a property agent said.

With Hong Kong and Beijing abandoning almost all their Covid-19 containment curbs, buyers and investors are motivated to snap up new flats as they anticipate an economic recovery, which in turn is likely to boost demand for homes.

SHKP said its latest batch of one- to three-bedroom flats have sizes ranging from 277 to 678 square feet. They are priced between HK$4.232 million (US$539,000) and HK$9.366 million, or an average of HK$14,098 per square foot.

Cash buyers could be entitled to discounts of as much as 15 per cent as well as a furniture package bonus, according to SHKP.

“As a new home, the prices of the units are relatively cheap. The stamp duty cut is pushing buyers to make decisions fast,” another agent said. “It’s proving to be quite popular among young homebuyers.”

The project’s location – it is part of the Northern Metropolis plan that aims to create new towns close to the border with mainland China – also adds value to the flats, the agent said.

Not all analysts are convinced the property market is on a path to recovery.

Although home prices have risen – a foreign property agency’s mass residential capital value index gained 2.6 per cent in the last two months – the number of transactions has remained low since January, according to the agency.

“The reopening of the economy at the turn of the year was a timely event to help release pent-up demand to the market. However, once the demand is digested, turnover will likely return to a low level,” an agent said.

In January, 3,051 residential transactions were recorded, 18.7 per cent lower than the monthly average of 3,755 in 2022. Demand from non-local buyers was also low, accounting for only 34 transactions, far lower than the monthly average of 53 last year, the agency said.

“The rising home prices since entering 2023 may not last,” the agent said.

(The Standard)

氣氛轉好 商廈買賣交投增

全面通關後,整體商廈買賣氣氛轉好,而核心區甲廈交投亦稍增,個別造價亦理想。

據一間代理行資料顯示,2月份共錄得約273宗工商舖買賣成交,按月上升約26%,亦是近半年以來單月新高。寫字樓市場同樣呈價量齊升之勢。2月份商廈成交宗數約42宗,按月微升約5%;金額則錄得約23.74億元,較上月大幅攀升約1.6倍。當中全幢商廈因投資方向靈活備受追捧,消息指,觀塘鴻圖道73至75號 KOHO 全幢,總面積約203,829平方呎,作價約17億元易手,平均呎價約8,340元。

中環美國銀行中心呎售3.84萬 近年高位

傳統核心區甲廈成交稍增,個別成交造價理想,消息指出,中環美國銀行中心高層03室,面積約1,303平方呎,以約5,000萬元成交,呎價高見約3.84萬元。疫情以來,該廈成交偏低,2020年初該廈1單位成交,呎價更曾低見2.88萬元,按最新成交價計,屬近年該廈呎價新高。

單位原業主於2006年以約1,250萬元購入,持貨17年轉手,獲利約3,750萬元,升值約3倍。

另外,金鐘海富中心一座中高層19室,面積約757平方呎,以約1,460萬元易手,呎價約1.93萬元。原業主於2015年斥資約1,700萬元購入,持貨8年,帳面損手約240萬元,貶值14.1%。

金鐘指標商廈力寶中心錄得成交,資深投資者正八集團主席廖偉麟,購入力寶中心一座37樓4至6室,面積約3,475平方呎,涉資約7,818萬元,成交呎價約2.25萬元,物業市值呎租約60元。原業主早於2003年約1,130萬元購入3個單位。

核心區優質盤供應少 後市看俏

至於甲廈新盤,銷情同樣不錯,黃竹坑甲廈新盤宏基匯連錄多宗成交,其中23樓全層,面積約6,178平方呎,以每呎約1.6萬元易手,涉資約9,885萬元;另物業1105室,面積約801平方呎,以每呎約1.28萬元易手,涉資約1,025萬元。翻查資料,宏基資本於2017年以約14.8億元,購入區內標達中心全幢工廈。宏基匯樓高27層,總樓面約10.7萬平方呎。

分析指,中港全面通關後,整體工商舖買賣亦轉好,其中以商舖市場反應最快,核心區錄得多宗大額買賣成交。至於商廈市場方面,疫情期間甲廈成交偏少,租售價亦明顯調整,主因通關下租務淡靜。如今全面通關,個別機構重新擴充,令甲廈重獲留意,投資者入市興趣亦加快,特別核心區優質單位供應始終少,料交投持續向好。

(經濟日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

奢侈品迎通關 旗艦店重現核心區

Swatch百萬租皇后大道中4層舖 設Omega展館

中港全面通關,帶動旗艦店重新出現核心區,早前中環皇后大道中54至56號豐樂行4層約8,735呎舖,以100萬元租出。消息指,新租客為Swatch group,料作旗下名錶Omega旗艦店。另外,近日珠寶店有所擴充,業界指通關後奢侈品亦加快租務決定,預計今年租務市況轉旺,舖租有望從低位反彈約1成。

較早前,中環皇后大道中54至56號豐樂行多層舖租出,物業地下至3樓,面積合共約8,735平方呎,以每月約100萬元租出。物業位於皇后大道中的正中段,人流非常暢旺,比鄰Zara複式旗艦店。豐樂行由老牌業主持有,數年前業主進行重建,並於2020年落成。物業樓高28層,總樓面面積3.3萬平方呎,而地下至3樓為商舖部分。

消息指,是次新租客為國際大型連鎮鐘錶集團Swatch Group,該集團擁多個名錶品牌如浪琴、雷達錶等,過往亦活躍租舖,惟疫情期間大幅收縮。消息人士指,是次集團租用,料作旗下歐米茄 (Omega) 之用。

六福珠寶洽租 栢麗大道舖

據了解,該品牌目前亦有租用同區中建大廈地下,是次預租豐樂行,因看中物業樓面大,可打造具氣派的旗艦店。據悉,在4層樓面中,除了銷售名錶外,更會預留部分樓面作展覽館,介紹品牌故事及展示經典款式等,增加體驗成分,以吸引更多客人前來。是次亦屬疫情以來,罕見奢侈品租用多層舖位打造旗艦店。

中港全面通關後,核心區租務加快,初期以藥房租務較多,最近漸見奢侈品重新落戶,如六福珠寶早前承租,銅鑼灣羅素街8號英皇鐘錶珠寶中心地下3及5號舖,面積約3,068平方呎,月租約70萬元,呎租約228元,亦為通關後,核心區首宗珠寶租用核心區舖位。市場消息指,六福近期亦有物色其他核心區舖位,包括正洽租尖沙咀栢麗購物大道舖,可見心態轉為積極。

通關兩月 核心區錄10租務

1月初中港初步通關,至今約兩個月,核心區已先後錄得十多宗商舖租務成交,主要為本地藥房,包括租尖沙咀廣東道、海防道及旺角西洋菜南街,當中如藥房1月以約30萬租廣東道86至98號地下,近日已極速開業迎接旅客。

有外資代理行代理指,通關後普遍零售商對市況感樂觀,深信零售銷售業務將遠比疫情期間理想。該代理指首階段仍以本地藥房落戶為主,而國際奢侈品牌,則因需時觀察,並需要獲總部批准增分店,落實時間不及本地商戶快,但近期亦轉正面,加快查詢及洽商。代理指出,疫情3年多,核心區舖租累跌4成,對零售商來說,租舖成本降低,故感一定興趣,預計計今年舖位租金可從低位反彈約1成。

(經濟日報)

更多豐樂行寫字樓出租樓盤資訊請參閱:豐樂行寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多英皇鐘錶珠寶中心寫字樓出租樓盤資訊請參閱:英皇鐘錶珠寶中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

名店核心區有選擇 租金難大升

市況復常,商舖租務市場同樣復甦,惟核心區空置舖位仍多,消化需時,相信舖位租金仍處於較低水平。

近兩個月旅客重返香港,特別過往支撑本港旅遊業及零售業的內地客逐步訪港,帶旺本地市況。人數上,據入境處數字顯示,前日 (3月8日),訪港內地客數字達50,889人,較通關初期約2萬餘人明顯增多,而上星期六 (3月4日),內地訪港人數更高見86,811人。

訪港人數大增,與封關期間零旅客,完全兩個世界。旅遊業正在穩步復甦,加上本港撤銷口罩令等,相信可帶動消費市場進一步轉好。

大量吉舖 等待長租客吸納

近期漸見零售商重新租舖,相信個案會持續增加。不過,租金方面則預計難大幅反彈,主因核心區吉舖仍甚多。據統計數字顯示,去年尾4大核心區,包括中環、銅鑼灣、旺角及尖沙咀,空置率分別為8%、14.5%、17.1%及20.3%,即使近期租務增加,本港主要街道如彌敦道、西洋菜南街,仍有大量吉舖、短租舖,正在等待長租客吸納,要消化仍然需時。

至於租金方面,按近期多宗核心區舖位租務成交,涉及月租普遍在30萬元起,至百萬元以下,涉及銀碼不算大。

此外,從成交租金計,即使比起疫情期間的短租有一定升幅,若與零售高峰期相比,仍跌約6至7成以上,反映目前吉舖數量偏高,租客選擇亦較多,業主亦不敢大幅提價,故相信租務增加同時,租金仍會處於偏低水平。

(經濟日報)

翠華重返中環 35萬租荊威廣場舖

租務氣氛向好,不同商戶亦趁機擴充。消息指,翠華茶餐廳以每月35萬元,重新落戶中環威靈頓街。

市場消息指,中環威靈頓街1號荊威廣場高層地下舖位,面積約5,089平方呎,以每月約35萬元租出。據了解,新租客為本港知名茶餐廳品牌翠華,該集團近年放棄多間分店,消息稱是次集團租用中環店,將以全新餐飲概念配合,帶來新意。

租金回落 餐飲租二綫舖增

翻查資料,翠華自1998年,租用中環威靈頓街華商會所大廈3層,涉及約8,160平方呎,打造集團旗艦店,由於該舖位處蘭桂坊,鄰近夜店,生意非常理想。該舖高峰期月租達230萬元,及後受疫情衝擊,翠率於2020年不續租。2021年譚仔三哥米綫以45萬元租用該舖,同年開業至今。如今翠華以35萬租荊威廣場舖,重返中環。

荊威廣場地下、地庫、1至2樓,面積合共約2萬平方呎,曾由渣打銀行租用多年,而一家內地財團,於2019年以310萬元租用舖位,開設夜店,惟僅經營一段短時間便結業。期間物業一直交吉,現業主決定把樓層分拆招租,以吸引更多租客。

整體商舖空置率仍高,在租金回落後,近年核心區二綫地段,餐飲租舖的個案有所增加,如最近尖沙咀加連威老道愛賓商業大廈地庫舖位,面積逾3,000平方呎,近日獲日式人氣餐廳壽司郎租用,現正進行裝修。

(經濟日報)

更多荊威廣場寫字樓出租樓盤資訊請參閱:荊威廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

恒大許家印山頂銀主盤招標市場估值8.8億

恒大創辦人許家印持有的山頂布力徑一幢洋房早前已被銀行接管,淪為銀主盤,最新中原及世邦魏理仕已被委託為聯合獨家代理出售該大宅。目前物業市場估值約8.8億,每呎估價約17.6萬。

接獲數10組買家查詢

一間本地代理行及一間外資代理行表示,是次大宅將按現狀交吉出售,並計畫於3月下旬選定買家。他們表示至今已接獲數十組買家查詢,當中超過6成屬本地老牌家族及超級富豪,約3成為內地客。

外資代理行代理表示,由於內地與香港兩地通關,經濟逐步復常,加上美國加息估計將近見頂,豪宅市場可看高一綫。

本地代理行代理表示,自本港與內地通關後市況回暖,豪宅成交活躍,豪宅買家對後市信心加強,加上新一份財政預算案重啟投資移民,能引進資金、人才和企業,令市場觀望氣氛消散,豪宅交投升溫。是次大宅位於罕有獨立地段,亦為傳統名門望族聚居地,是次放盤備受市場關注。今年首2個月,全港一二手5000萬以上成交錄得約96宗,當中洋房成交佔14宗。

(星島日報)

Stamp duty revenue soars 66pc

Hong Kong's stamp duty revenues soared 66 percent month-on-month to HK$556.2 million in February, according to the data from the Inland Revenue Department.

There were 234 property transactions, 76 more than the number in January, resulting in a 48 percent increase.

Out of the three stamp duties - special stamp duty, buyer's stamp duty, and double stamp duty - the SSD saw the largest surge.

The revenue from SSD soared 93 percent compared to HK$180 million and the number of transactions also jumped by 79 percent to 61 transactions.

In the primary market, Chinachem's In One atop the Ho Man Tin MTR station uploaded its sales brochure yesterday and plan to release its first price list next week.

The developer also plans to unveil the show flats next week. The first batch of units, which consists of no less than 50 one- to three-bedroom units, is expected to go on sale this month.

The project is equipped with three designated lifts, which access the concourse of Ho Man Tin Station directly.

Grand Victoria II in Cheung Sha Wan, co-developed by Sino Land (0083) and others, will put 117 units on the market tomorrow, including 59 on price lists and 58 via tender.

The units offered for sale on price lists cover a range of studio to three-bedroom units, with a discounted price of HK$23,017 to HK$30,943 per sq ft.

Sun Hung Kai Properties (0016) will put 189 flats at phase 2B of Novo Land in Tuen Mun on sale on Sunday, of which around 60 percent are priced under HK$6 million after discounts.

Also in Tuen Mun, Grand Jeté, jointly developed by CK Asset (1113) and SHKP, has released the sales brochure for Phase 2 which has 400 flats.

(The Standard)

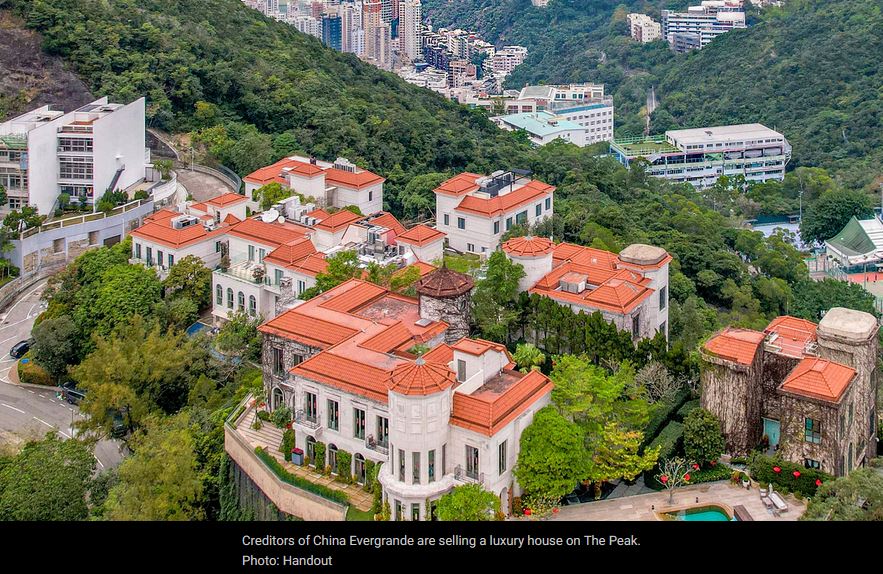

Receivers of a luxury property on The Peak linked to top Evergrande executive put the asset up for sale

Two property agencies have been appointed as sole co-agents to sell the ultra-luxury property on The Peak

The mansion being put on the market is 10B, Black’s Link, which could be valued at over HK$800 million

Receivers of a Hong Kong luxury property owned by a company linked to top China Evergrande executive have put the asset on The Peak up for sale in an attempt to recover unpaid bills.

Two property agencies have been appointed as sole co-agents to sell the ultra-luxury property on The Peak, they said in a joint statement on Thursday.

The mansion being put on the market is 10B, Black’s Link, which could be valued at over HK$800 million (US$101.9 million) given comparable properties on The Peak are valued at HK$140,000 to HK$150,000 per square foot, a source familiar with the sale process said.

It is owned by Better Vision, whose director is Tan Haijun, according to a companies search. Tan is also the director of Giant Hill, which owns 10C and 10E, Black’s Link, according to Land Registry data. Hui Ka-yan, Evergrande’s founder and chairman, resigned as a director of Giant Hill on July 30,2021. On the same day, Tan Haijun was appointed as Giant Hill’s director.

Dozens of potential buyers have inquired about the house, of which over 60 per cent are local ultra-rich families and tycoons, and around 30 per cent are from the mainland, the agents said.

A decision on the winning bidder is expected in the second half of March.

“Thanks to the Hong Kong-mainland border’s reopening and the ensuing economic recovery, prospects in the luxury property market are looking good,” an agent said. “Expectation that US interest rates will be peaking around midyear also helps.”

Some 96 residential property transactions worth more than HK$50 million were recorded in the first two months of this year, of which 14 deals were mansions, according to the property agency.

Hui, whose wealth has shrunk from US$9.1 billion to US$3 billion as estimated by Forbes, has put some of his personal assets on sale to repay Evergrande’s debt. The company’s total liabilities are estimated at more than US$300 billion.

Three adjoining mansions of up to 5,400 square feet each at 10 Black’s Lane on The Peak in Hong Kong were remortgaged in late 2021 for HK$1.1 billion.

Hui’s business empire spans a diverse range of businesses including banking, bottled water, real estate, electric cars, wealth management and even a football club.

(South China Morning Post)

Hong Kong property: border reopening not quite the magic bullet hoped for, property agency report suggests

Transactions involving buyers from outside Hong Kong were still dramatically lower in January than in pre-pandemic times, a property agency’s data shows

Interest from Hongkongers looking to buy property in the mainland cities of the bay area has increased markedly since the reopening, however

The reopening of the border with mainland China failed to boost Hong Kong’s beleaguered property market as much as had been anticipated, according to a report released by a property agency on Wednesday.

The report showed that 3,051 homes changed hands in January, almost a fifth lower than the monthly average of 3,755 seen in 2022.

Transactions involving buyers from outside Hong Kong were particularly tepid. Just 34 such transactions – signified by payment of Buyer’s Stamp Duty (BSD) – were recorded in January, below last year’s average of 53 and a far cry from pre-pandemic levels.

“The average monthly transaction volume involving BSD was 294 in 2018 and 178 in 2019, so it’s still significantly below the pre-Covid level,” an agent said.

In 2019, the year before the coronavirus broke out, mainland Chinese buyers accounted for 8.4 per cent of overall home sales in Hong Kong, according to data compiled by another property agency.

But annual transactions involving buyers who were non-permanent residents or non-domiciled companies slumped by about three quarters under the strict travelling restrictions introduced during the pandemic, according to Inland Revenue Department statistics cited by the agency.

The resumption of cross-border travel had been seen by industry watchers as the key to reviving Hong Kong’s weakened property market, which saw residential transactions plummet 39 per cent year on year to 45,050 last year, the lowest level since record-keeping began in 1997.

Hong Kong’s government last month announced it would cut stamp duty for first home buyers to spur demand, the latest in a slew of easing measures aimed at bringing the housing market back to life.

Instead of the anticipated rush of mainlanders across the newly opened border to buy Hong Kong property, the reverse appears to have happened.

Inquiries from Hongkongers looking into property projects in the mainland cities of the Greater Bay Area have shot up. Agents have resumed marketing these developments in Hong Kong, luring buyers to attend home viewing tours in mainland China.

Each tour might draw about 20 to 30 potential buyers from Hong Kong, several agents told the Post.

“We’ve seen enquiries from Hong Kong buyers asking about homes in the Greater Bay Area has surged several-fold from before [the cross-border opening],” an agent said.

“I had expected an improvement in the market with the resumption of cross-border travel and recovery of the economy, no matter whether it’s the Hong Kong market or the mainland market.”

The Greater Bay Area includes Hong Kong, Macau, and nine mainland cities in Guangdong province: Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing.

(South China Morning Post)中環「92 Wellington」拆售 一樓全層呎價2.92萬易手

資本策略旗下中環銀座式商廈「92 Wellington」,以賣樓花形式拆售,連錄2宗買賣,包括1樓全層成交呎價高達2.92萬。

錄2宗成交套現逾1.22億

市場消息透露,威靈頓街92號「92 Wellington」連沽2個單位,該廈1樓全層,建築面積約1971方呎,剛以每呎約2.92萬成交,涉資5755.32萬;7樓全層上月以約6470.2萬易手,至今合共套現逾1.22億。

輕微提價重推5單位

資本策略去年8月以樓花形式推售該廈7層全層單位,上月錄得首宗成交,為7樓全層,建築面積約2941方呎,成交價6470.2萬,呎價約2.2萬。發展商最新重推5個單位,8、9、15、17及19樓,建築面積由2371方呎至2941方呎,售價由5880萬至6711.36萬,平均呎價2.27萬至2.48萬。

是次推出單位作輕微提價,其中,該廈9樓,建築面積2491方呎,去年8月定價6646萬,呎價約2.26萬,最新定價6711.36萬,呎價約2.282萬,輕微加價1%。

預計明年首季入伙

「92 Wellington」來自舊樓併購,佔地約3000呎,項目屬於「鋪契」,該廈樓高23層,總樓面約4.5萬方呎,實用率60%,預計明年第1季入伙。

(星島日報)

更多92 Wellington寫字樓出售樓盤資訊請參閱:92 Wellington寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

黃竹坑全新甲廈獲租客承接,消息指,黃竹坑 Landmark South 中高層03至08室,面積約8,713平方呎,成交呎租約30元。

另中環甲廈租務稍轉好,有消息指,美國銀行中心錄租務成交,涉及中層03室,面積約623平方呎,以每月約3萬元租出,呎租約48元。

(經濟日報)

更多Landmark South寫字樓出租樓盤資訊請參閱:Landmark South寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Brisk sales continue at Novo Land

Sun Hung Kai Properties (0016) sold 172 of 189 units at Novo Land phase 2B in Tuen Mun in the third batch yesterday.

This round of sales includes 52 one-bedroom flats, 116 two-bedroom flats and 21 three-bedroom flats, with an area of 282 to 678 square feet.

The discounted prices range from HK$4.29 million to HK$9.48 million, or HK$13,476 to HK$15,893 per square foot.

The price list of 189 units gathered a total of 9,703 checks, resulting in an oversubscription of 50 times. A single buyer was able to acquire a one-bedroom unit worth HK$4.6 million after subscribing nine times for a flat at Novo Land.

A customer bought a two-bedroom unit and a three-bedroom unit for over HK$16 million, a record-breaking transaction in the last three batches.

Victor Lui Ting, the deputy managing director of SHKP, said that Novo Land has sold 690 apartments in just nine days, resulting in more than HK$4 billion in cash. In the past eight months, they have sold a total of 2,238 apartments and generated over HK$13.7 billion.

Lui said there was a possibility of releasing Novo Land phase 2A for sale this month.

Wheelock Properties is set to release Koko Hills phase 3B in Lam Tin for sale as early as this month.

Phase 3B offers 444 units, most of them small flats. About 60 percent have harbor views.

In One on top of Ho Man Tin MTR Station, co-developed by Chinachem and MTR Corporation (0066),will release its first price list for phase 1B this week.

The first batch will include at least 50 flats, covering one to three-bedroom units.

On the other hand, when homebuyers flocked to the primary market this weekend, the secondary market experienced a decline in transactions.

A property agency said that the 10 major housing estates registered only 10 transactions over the weekend, marking a 41 percent decrease from the previous week and hitting a 12-week low. Three estates recorded zero transactions: Taikoo Shing in Quarry Bay, Metro City in Tseung Kwan O and Caribbean Coast in Tung Chung.

(The Standard)

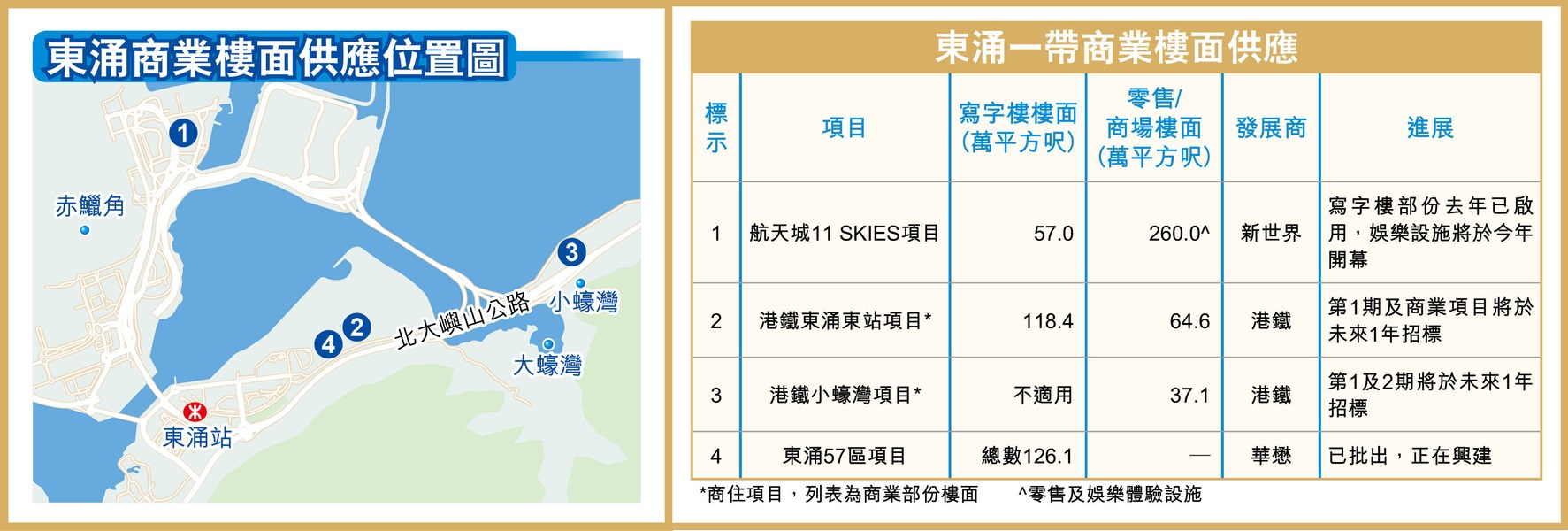

Kowloon East to launch more commercial sites

The Development Bureau said yesterday that it will continue to launch commercial sites in Kowloon East.

The commercial floor space in Kowloon East has increased by about 90 percent over the past 10 years to 3.2 million square meters, including more than 60 redeveloped or converted industrial buildings, it said.

Together with the projects under construction or approved, the commercial space in the area will reach more than 4 million square meters, which is similar to the core business district in Central, it said.

Other commercial sites will be put on the market in the future, including a number of sites in Kai Tak that will provide a total of about 910,000 sq m of commercial floor space, it noted.

The bureau added that many multinational companies and financial institutions have already moved to Kowloon East, indicating that it is growing as a second major business district and enhancing Hong Kong's status as an international financial and trading center.

Separately, Financial Secretary Paul Chan Mo-po said in his blog that Hong Kong should target its resources on economic development as its recovery is at a critical stage.

(The Standard)

中環矚目新甲級商廈項目 The Henderson,再錄大手租務成交,加拿大退休金計劃投資局 (Canada Pension Plan Investment Bond,CPPIB) 預租兩層共約2.8萬方呎樓面面積,料作同區升級搬遷。

市場人士指出,The Henderson 獲CPPIB承租兩層,每層租用面積約1.4萬方呎,合共約2.8萬方呎,以市值呎租130元計算,涉及月租約364萬元。

靄華主席再購好運中心地舖

據資料顯示,CPPIB現時租用同區置地公司旗下約克大廈,最少租用3層樓面,是次租用 The Henderson 料作升級,而租用樓面則相若。據了解,現時約克大廈市值呎租約90至100元。

另外,舖位市場方面,上月斥1880萬元買入沙田好運中心商場地舖的靄華押業信貸 (01319) 主席兼行政總裁陳啟豪或有關人士,近期加碼斥1920萬元買入相連的另一個舖位。

資料又提及,沙田橫壆街1至15號好運中心地下10C舖,建築面積約521方呎,由陳啟豪或有關人士斥資1920萬元購入,呎價約3.69萬元。舖位現時由財務公司租用,月租2.9萬元,租金回報約1.8厘。原業主1987年以110萬元購入,賬面獲利1810萬元或16.5倍。

上月毗連由同一租客承租的地下10B舖,陳啟豪或有關人士以1880萬元買入,即兩個月內斥資3800萬元入市。

(信報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多約克大廈寫字樓出租樓盤資訊請參閱:約克大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

Unit of Li Ka-shing’s Hutchison submits plan to build 15,075 homes in Tsing Yi to add to Hong Kong’s housing supply, help ease shortage

Hutchison’s Hongkong United Dockyards Limited (HUD) unit has submitted a proposal to the Town Planning Board to erect 15,075 homes in Tsing Yi

The site next to the Tsing Ma Bridge will comprise 10,370 apartments and 4,700 public housing units, HUD says

CK Hutchison Holdings, the flagship company of Hong Kong’s wealthiest man, plans to turn a waterfront dockyard into the city’s second-largest housing enclave, adding much needed supply to the world’s least affordable major urban centre.

Hutchison’s Hongkong United Dockyards Limited (HUD) unit submitted a proposal to the Town Planning Board to erect 15,075 homes on its site and adjacent government land in Tsing Yi. The site, next to the Tsing Ma Bridge, will comprise 10,370 apartments and 4,700 public housing units, HUD said.

“There is a long-term pressing housing need in Hong Kong and HUD hopes to contribute its part to the resolution of housing problems through this proposal”, said a statement by HUD, whose parent Hutchison is chaired by Victor Li Tzar-kuoi, the elder son of tycoon Li Ka-shing. “Under Hong Kong’s current land scarcity situation, HUD believes large-scale industrial land and idled government land can be part of a solution to alleviate Hong Kong’s housing needs.”

The proposal combines HUD’s plot with a piece of idle land owned by the government under the Tsing Ma bridge, using a road to connect the two parcels into a site measuring 19.9 hectares (49.2 acres) overlooking the Ma Wan Channel. The size of the project is second only to the 21,500 homes at Hong Kong’s largest residential enclave, Lohas Park in Tseung Kwan O, and bigger than Hutchison’s Whampoa Garden in Hung Hom, with 10,285 flats.

The land value is estimated at HK$22 billion (US$2.8 billion) after the payment of land premium and assuming that the developer is not required to bear the cost of building the public homes, according to a surveyor.

Hutchison has not put a price tag on the project, which has not been given a name. The proposal calls for 34 residential towers, each between 27 and 48 storeys, with amenities such as shops, kindergartens, a primary school,, a marina club and social welfare facilities.

Public housing will be located in 10 blocks of between 22 and 34 storeys on the plot of land owned by the government, according to the proposal. A 15 metre-wide waterfront promenade will be built to serve both the private apartments and public housing, according to the proposal.

Hutchison bought 50 per cent of HUD from Swire Pacific in August 2021. The site measures 10 hectares, and is currently a so-called brownfield plot used for cement works, open storage and workshops, the application said.

“This is a medium-to-long term planning proposal”, HUD said. “HUD is willing to make suitable arrangements regarding its existing business operations at the appropriate time, with the hope that this will help contribute to the resolution of Hong Kong’s housing problems”.

Tsing Yi has a residential community and commercial zone on an island that also accommodates heavy industries, a transport interchange, shipbuilding works and dockyards.

“The most [often-heard] criticism of Tsing Yi is its transport and amenities”, which need a government commitment to “upgrade”, the surveyor said.

The surveyor said more commercial amenities are needed in Tsing Yi, not just a large shopping centre. The surveyor also pointed to the logistics warehouses located south of the proposed housing estate, asking whether that is “really suitable”.

The proposed estate will form part of the Harbour Metropolis under the Hong Kong 2030+ territorial strategic planning framework. Under the plan, a new central business district known as CBD3 will be located at the Kau Yi Chau (KYC) artificial islands, about 5 kilometres from HUD’s proposed project.

The low proportion of public housing in the proposal may, however, hamper its approval, another surveyor said, who pointed to the government’s 2018 housing supply target of 70 per cent.

The surveyor said that it is “not sure if the government will approve it”, adding that its entrance may be near an industrial site, which might affect its sales value.

(South China Morning Post) 九龍灣恩浩國際中心全層1.1億售 持貨9年貶值逾11%

近年商廈市場吹淡風,部分業主不惜損手離場,九龍灣恩浩國際中心全層單位,以1.1億易手,物業於9年間貶值11%。

上址為恩浩國際中心32樓全層,建築面積11430方呎,以1.1億易手,呎價9624元,買家光榮電業為觀塘區內廠廈用家,趁現時商廈市況低沉,購置物業作為自用,原業主於2013年12月以1.24358億購入,持貨逾9年,帳面蝕損1435.8萬,物業貶值逾11%。

呎價9624元屬年半新低

過去1年半以來,該廈成交呎價維持1.2至1.4萬之間,最新成交屬接近1年半來新低。恩浩國際中心位於常悅道1號,樓高32層,全層建築面積約11145至12528方呎,大廈地下為商鋪,1樓至3樓為停車場,5樓設2個商鋪及4個寫字樓單位,6至36樓為則寫字樓,為區內指標甲廈之一。

沙田京瑞廣場每呎8810元易手

沙田安群街2號京瑞廣場二期27樓J室,建築面積約7605方呎,以6700萬易手,平均呎價8810元,原業主於2016年6月以5309.1萬購入,持貨逾6年,帳面獲利1390.9萬,物業升值26%。京瑞廣場二期於2016年落成,亦由億京發展,為沙田區內指標甲廈。

(星島日報)

更多恩浩國際中心寫字樓出售樓盤資訊請參閱:恩浩國際中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

亮碧思7505萬沽夏慤大廈

亮碧思沽售灣仔夏慤大廈 706至707室,建築面積約4415方呎,以每呎約1.7萬易手,作價7505.5萬,該單位望樓景,以交吉形式易手,新買家購入物業需要支付相等於樓價4.25%的釐印費,原業主為亮碧思,於2012年8月以6100萬購入單位,持貨逾10年,帳面獲利逾1405.5萬,物業升值23%。夏慤大廈向來鮮有買賣,現時放盤叫租每呎35至47元水平。

(星島日報)

更多夏愨大廈寫字樓出售樓盤資訊請參閱:夏愨大廈寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

IT公司擴充 18.7萬租一號九龍

消息指,九龍灣一號九龍錄租務成交,涉及物業高層01至03室,面積約6,940平方呎,以每月約18.7萬元租出,呎租約27元,租金屬市價水平。據了解,新租客為一家IT公司,原租用同區商廈國際交易中心,現進行擴充。

另消息稱,尖沙咀星光行高層23A室,面積約445平方呎,成交呎租約26元。另尖東好時中心高層15室,面積約1,023平方呎,成交呎租約25元。

(經濟日報)

更多國際交易中心寫字樓出租樓盤資訊請參閱:國際交易中心寫字樓出租

更多一號九龍寫字樓出租樓盤資訊請參閱:一號九龍寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多星光行寫字樓出租樓盤資訊請參閱:星光行寫字樓出租

更多好時中心寫字樓出租樓盤資訊請參閱:好時中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

中環威靈頓街92號 5層推售呎價2.28萬起

資本策略 (00497) 推售中環商廈重建項目威靈頓街92號,呎價約2.28萬元起。

重建項目 加價約4%

近日資本策略推售中環銀座商廈「威靈頓街92號」(92 Wellington) 重建項目,並錄兩層買賣,現發展商推出8、9、15、17及19樓全層,每層面積約2,371至2,941平方呎,呎價由2.28萬至2.48萬元,加價約4%。

物業8樓全層,面積約2,941平方呎,定價為6,711萬元,呎價約22,820元。另19樓全層,面積約2,371平方呎,定價為5,880萬元,呎價約24,800元。

項目近日首錄成交,物業7樓全層,面積約2,941平方呎,以6,470萬元沽出,呎價約2.2萬元。另物業1樓全層,面積約1,971平方呎,以約5,755萬元易手,呎價約2.92萬元。

翻查資料,資本策略早於2014年,以1.05億元購入威靈頓街96號,其後2017年,再斥2.28億元向文輝墨魚丸大王老闆黃俊新及有關人士購入地段94號。去年中,發展商部署推出項目,當時呎價約2.16萬元起,並表示因應市況,已下調價格約25%,惟當時反應一般,留待現時再正式推售。

(經濟日報)

更多92 Wellington寫字樓出售樓盤資訊請參閱:92 Wellington寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

消費向好 零售餐飲核心區擴充

通關加上撤銷防疫措施,消費市道料向好,近期不論零售及餐飲,均進行核心區擴充,令租務市場頗為熱鬧。

近期商舖租務市場轉旺,更出現近年罕見的奢侈品複式舖租務。消息稱,中環皇后大道中54至56號豐樂行多層舖租出,物業地下至3樓,面積合共約8,735平方呎,以每月約100萬元租出。豐樂行由老牌業主持有,數年前進行重建,並於2020年落成。物業樓高28層,總樓面面積3.3萬平方呎,而地下至3樓為商舖部分。

鐘錶集團 100萬租中環多層舖

消息指,是次新租客為國際大型鐘錶集團Swatch Group,該集團擁多個名錶品牌如浪琴、雷達錶等,是次集團租用,料作旗下歐米茄 (Omega) 之用。

據了解,該品牌目前亦有租用同區中建大廈地下,是次預租豐樂行,因看中物業樓面大,可打造旗艦店。據悉,在4層樓面中,除了銷售名錶外,更會預留部分樓面作展覽館,介紹品牌故事及展示經典款式等,增加體驗部分,以吸引更多客人前來。是次亦屬疫情以來,罕見奢侈品租用多層舖位打造旗艦店。

奢侈品重新擴充業務,六福珠寶承租銅鑼灣羅素街8號英皇鐘錶珠寶中心地下3及5號舖,面積約3,068平方呎,月租約70萬元,呎租約228元,亦為通關後,核心區首宗珠寶店租用核心區舖位。翻查資料,舖位對上租戶為周大福 (01929),在2019年底即新冠病毒爆發前,以每月130萬元租用,去年10月租約期滿撤出。另外,2014年舖位由英皇鐘錶珠寶 (00887) 以每月276萬元租用,現租金較9年前大跌75%。

翠華重返中環 租逾5千呎舖

除了零售外,餐飲亦租大樓面舖位,中環威靈頓街1號荊威廣場高層地下舖位,面積約5,089平方呎,以每月約35萬元租出。據了解,新租客為本港知名茶餐廳品牌翠華,該集團近年放棄多間分店,消息稱是次集團租用中環店,將以全新餐飲概念配合,帶來新意。翻查資料,翠華自1998年租用中環威靈頓街華商會所大廈3層,涉及約8,160平方呎,惟疫情衝擊,於2020年不續租,如今翠華重返中環。

荊威廣場地下、地庫、1至2樓,面積合共約2萬平方呎,內地財團於2019年以310萬元租用舖位,開設夜店,惟僅經營一段短時間便結業。期間物業一直交吉,現業主決定把樓層分拆招租,以吸引更多租客。

分析指,因中港正式通關,旅客重返,令零售商重啟擴充意慾,而本港撤走防疫措施,市民消費意慾亦提升,在旅客及本地消費提升下,餐飲及零售均有興趣租舖迎接商機,料第二季商舖租務數字顯著上升。

(經濟日報)

更多豐樂行寫字樓出租樓盤資訊請參閱:豐樂行寫字樓出租

更多中建大廈寫字樓出租樓盤資訊請參閱:中建大廈寫字樓出租

更多荊威廣場寫字樓出租樓盤資訊請參閱:荊威廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多英皇鐘錶珠寶中心寫字樓出租樓盤資訊請參閱:英皇鐘錶珠寶中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

灣仔凱利商業大廈 交通方便配套齊

灣仔一帶商業氣氛濃厚,商廈林立,受惠於會展站開通,加上區內商廈質素佳選擇多,甚受企業用家歡迎。而凱利商業大廈位於灣仔摩利臣山道74號,物業裝修雅致,景觀開揚,質素不俗。

凱利商業大廈位於灣仔摩利臣山道74號,為一座樓高22層的商業大廈,每層樓面面積約3,014平方呎,物業地下大堂光綫尚算充足,設有兩部載客電梯,可有效疏通人流。物業每平方呎管理費約2.5元。

5分鐘可到港鐵銅鑼灣站

交通方面,大廈地利優勢不俗,5分鐘可步行至銅鑼灣港鐵站或會展站,附近亦有不少過海巴士及小巴站,加上中環及灣仔繞道落成及東鐵綫過海段開通令交通變得更為便利。

飲食方面,若時間緊逼,鄰近有24小時便利店,可購買小食。附近亦有不少茶餐廳及酒樓,提供傳統中式美食,上班人士亦可以選擇步行10至15分鐘到銅鑼灣時代廣場,內有多間餐廳可供選擇。

鄰近合和2期項目 提升價值

同時該廈用戶多元化,計有會計、建築師樓、教會等。周遭有多個發展項目,包括較大規模的合和2期項目,料將發展為擁有約1,000間客房的大型會議酒店,並設有零售區以及綠化公園,提供面積約109.4萬平方呎,料對灣仔區商業活動有正面幫助,可產生協同效應,提升附近的工商舖物業投資價值。

大廈今年暫未錄得買賣或租務成交,對上一宗買賣成交為高層全層,面積約1,748平方呎,以2,500萬成交,呎價14,302元。而對上一宗租務成交為中層單位,面積約1,323平方呎,以39,690元租出,呎租約30元。

(經濟日報)

跑馬地合作社放售 估值3.6億

屬於公務員合作社項目的跑馬地藍塘道111至117號住宅地盤之全數業權,現公開出售,截收意向書日期為5月2日。據了解,項目市值約3.6億元。

地盤面積約10,360平方呎,享山景及城市景觀,補地價後可重建為獨立屋或分層住宅,最高可建樓面21,762.3平方呎。有代理表示,業主暫無正式開價,將收集各個潛在買家出價,價高者得。

事實上,參考由爪哇 (00251) 近年收購的大坑道89至93號龍風臺公務員合作社成交,計及補地價的總收購成本約6.27億元,每呎樓面地價約2.85萬元。該用地的地盤面積約1.1萬平方呎,最高可建樓面約2.2萬平方呎,與是次出售用地規模相若。

(經濟日報)

The Vertex earns $4.6b from sales of 47 flats

The Vertex, a project held by Twin City and VMS Asset Management in Chang Sha Wan, has cashed in HK$4.6 billion from selling 47 completed units since February.

The revenue generated from the project is expected to surpass HK$5 billion by tomorrow, according to VMS Asset Management.

Depending on market demand, they are considering the possibility of adding more flats for sale.

Furthermore, the company has announced a collaboration with a property agency to promote the sale of the project.

One unit of the luxury project 21 Borrett Road on Mid-levels, previously owned by CK Asset (1113) was sold for HK$162.8 million.