港島寫字樓租金按年跌8%

有外資代理行發布最新的香港物業市場報告指,去年12月,港島區寫字樓整體租金維持於約每呎69.5元,去年全年港島租金按年下跌8.2%。

而九龍區的寫字樓整體租金趨勢與港島區相若,但12月份,寫字樓租賃交易按月下跌40%,跟往年同期的租金變化模式相似。

自通關以來,中小型寫字樓的需求不斷增加,令共享工作空間經營商有機會受惠,大多數的寫字樓租賃查詢都來自內地企業。

展望未來,該行預期今年首季九龍區的寫字樓租賃市場將保持穩定。雖然有些企業將繼續搬遷以節省租金成本或改善營運,但相信內地通關對租戶的需求,及市場趨勢都會帶來正面的作用。

零售物業租金 料繼續受壓

另外,2022年首11個月,零售總銷貨額按年下跌1.1%,但在市場逐步復甦下,零售物業的租賃市場在今年1月逐漸恢復動力。

隨着社交距離限制的進一步放寬和入境限制的取消,該行相信零售銷貨額將在今年回升,並預計隨着內地客回歸,零售市場將出現穩定的復甦趨勢。但是,整體而言零售物業的租金將繼續受壓,下跌0至5%。

(經濟日報)

中環逾百萬呎商業樓面 料今年落成

中環新落成的甲廈項目供應罕有,而區內2個甲廈重建項目預計陸續於今年落成,單計該2項目,料提供於逾100萬平方呎樓面,環顧該區未來商廈供應,恒地 (00012) 所佔的樓面最多,涉逾200萬平方呎。

The Henderson 36層甲廈 外型破格

中環、金鐘一帶為傳統商業核心區,區內的新商業用地供應極度罕有,有價有市,故每當有地皮推出,吸引大型發展商競投,其中恒地早於2017年以約232.8億元奪得 (每平方呎樓面地價逾5萬元) 的前美利道停車場大廈項目,已發展為 The Henderson。項目為1幢36層高 (另設5層地庫) 的甲級商廈,總樓面面積約46.5萬平方呎,料於2023年落成。

項目由世界知名扎哈·哈迪德建築師事務所 (Zaha Hadid Architects) 設計,引入曲面玻璃幕牆,建築外形破格新穎,在該帶的商業建築群中相當突出。

長江集團中心二期較舊址增高18層

另外,前身為和記大廈的長實 (01113) 夏愨道和記大廈重建項目,去年亦已經正式命名為長江集團中心二期 (Cheung Kong Center II),預計同樣於今年落成。早在1974年落成的和記大廈當年樓高23層,重建後物業樓高將增至41層,提供約185個車位,總樓面面積約55萬平方呎。換言之,兩個料於今年落成的中環全新商廈項目,將為區內新增約101.5萬平方呎的商業樓面。

值得留意的是,恒地近年密密擴展區內勢力,約於5年內已經連奪2幅中環地王。繼上述投得美利道商業地王後,恒地於2021年再以約508億元 (每平方呎樓面地價約3.1萬元) 投得中環新海濱3號用地,成交總價創下全港歷來最貴重地皮紀錄。據發展商早前透露,項目將會分2期發展,第1期將於2027年落成,包括約27萬平方呎辦公室樓面、約34萬平方呎零售、餐飲和娛樂空間;第2期涉約39萬平方呎,辦公室樓面及約60萬平方呎零售空間,將於2032年落成。

至於中環、金鐘未來潛在的大型商業地供應要數到金鐘高等法院及金鐘廊重建項目,前者總樓面高達約150萬平方呎,後者則涉近100萬平方呎。兩者除規模龐大,亦鄰近港鐵站,交通方便。此外,中環新海濱1號及2號用地亦有待批出,總樓面分別涉約17.4萬平方呎及20.5萬平方呎。

(經濟日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

大額成交增 海富中心1.88億沽

中港兩地已經展開首階段通關,市場憧憬商業市道會進一步好轉,最近金鐘一帶亦錄得大額商廈成交。據資料顯示,金鐘指標商廈海富中心二座 15樓全層近日以約1.88億元沽出,按該層面積約10,627平方呎計,呎價約1.77萬元成交,屬低於市價成交。據了解,新買家為內企信義玻璃。

6年貶值4成

資料顯示,上述樓面原業主為上市公司,該公司於2017年以約3.18億元買入物業作為總部,不過該公司早前被停牌,並於去年3月初遭清盤,其後淪為銀主盤。若以1.88億元成交價計,該單位於6年間帳面貶值約1.3億元,虧損約41%。

另外,有業主亦看準市場好轉的趨勢而放售旗下商廈,有業主最新委託特約代理放售金鐘力寶中心一座低層單位,面積約1,495平方呎,意向價約4,000萬元,平均呎價約2.68萬元。

事實上,有物業顧問最新預計,內地通關將為香港經濟帶來正面影響,相信來自內地的企業將在港擴充或開設辦公室,料對寫字樓市場具利好作用,於今年下半年將更顯著。

(經濟日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

More flats at Koko Hills poised to go on sale

Flats at the third phase of Koko Hills, named Koko Rosso, are expected to go on sale this month.

The development by Wheelock Properties is located near Lam Tin MTR station and Phase 3A will provide 392 one-bedroom and two-bedroom units, most of them under HK$10 million.

In the luxury market, Far East Consortium International (0035) will sell the last 26 duplex flats and four villas at Mount Arcadia in Sha Tin via tender.

Villa No 2 will open as a show unit to public from today.

The project has sold 36 homes since going on the market, cashing in a total of HK$800 million.

The developer has appointed a property agency as its sole agent. The agency said that with the border reopening, mainland investors will come to Hong Kong to purchase luxury homes.

Meanwhile, two houses on Sassoon Road in the Southern District are up for sale with a reserve price of HK$550 million.

Villa Ellenbud, a Grade III historic building which includes two houses at No 50 and No 52 Sassoon Road in Pok Fu Lam, was commissioned by the executor to be put up for tender. The site can be redeveloped into two mansions with a total floor area of 1,645 square feet.

Elsewhere, Triplex A at CSI Properties' (0497) Dukes Places at Jardine's Lookout on Hong Kong Island - a special unit with an area of 4,102 sq ft, a private garden of 2,817 sq ft and two parking spaces - was sold for HK$287 million.

And Sino Land (0083) has sold four homes at Grand Central in Kwun Tong, earning more than HK$79 million.

(The Standard)

Hong Kong developers raise concerns over plan to build 10,700 temporary public flats in prime urban site, cast doubt on Kai Tak’s ability to handle new residents

Association representing real estate developers says it only learned about government’s plan recently and has received letters from concerned residents

According to government source, flats ‘will not obstruct’ original vision of turning Kai Tak into business hub

Hong Kong developers and a lawmaker have raised concerns about the government’s plan to build 10,700 temporary public flats on a commercial plot in a prime urban site at Kai Tak, casting doubt on the area’s ability to cope with an influx of new residents.

An association representing the city’s real estate developers on Tuesday said it would accept the government’s plan for “light public housing” as long as the arrangement was only for a short period.

“Hong Kong in fact is in need [of more housing], and we think we can compromise,” said Stewart Leung Chi-kin, the executive committee chairman of the Real Estate Developers Association. “The most important thing is to address the traffic problem.”

The group only learned of the project recently from the media and had received letters from concerned residents, he added.

The 5.7 hectare (14 acre) site in Kai Tak, which the government has earmarked as a new business hub in the long run, is among eight plots selected by authorities for 30,000 temporary flats.

The project aims to provide a short-term housing solution for residents who have been on the waiting list for subsidised homes for at least three years.

A government source said building 10,700 temporary homes at the former airport “would not obstruct” the original vision of turning the area into a business hub.

Out of the 30,000 flats, 7,400 homes in four other areas will be available in 2025, while the remaining 22,600 – including those at the Kai Tak site – will be completed in 2026. They are expected to remain in place for at least five years.

Leung explained that transport links in Kai Tak, particularly ones leading to existing upscale residential developments and hotels along the former runway, have been a long-standing concern since the government scrapped proposal for a monorail in 2020.

He said developers were worried that the wave of new residents would overwhelm the Kai Tak MTR station, but he added officials had assured him that many would take buses and the transport issue would be resolved.

Leung said developers were especially concerned about the future of a community isolation facility for Covid-19 patients located near the cruise terminal.

With 2,100 units, the Kai Tak facility began operations in August last year and currently has a mock-up flat for the light public housing scheme.

Chief Executive John Lee Ka-chiu on Tuesday said the isolation and treatment centres built for the coronavirus pandemic may be dismantled or repurposed after a review.

The Housing Bureau earlier said they were open to the idea of turning the centres into light public housing units.

Leung predicted developers would make “a lot of noise” if the facility in Kai Tak was repurposed. They feared doing so would clash with the area’s positioning as an upmarket residential area and undermine its appeal to land bidders.

“Repurposing that facility will ruin the entire Kai Tak area,” he said. “The government must stick to the plan it had previously envisioned.”

Legislator Kitson Yang Wing-kit, a Kowloon City district councillor, said he planned to stage a rally on February 11 to oppose the Kai Tak proposal. He predicted the project would cast a shadow over the area’s positioning as a new core business district.

The government source said community leaders would be consulted, adding the Kai Tak site did not adjoin any private residential developments and that neighbours would benefit from the amenities provided on the ground floor of the light public housing blocks.

The source on Tuesday confirmed it would cost HK$2.5 billion (US$319 million) to operate and maintain the scheme’s 30,000 units for five years. The amount is in addition to the HK$26.4 billion construction cost announced earlier.

The source said operations would be outsourced to non-governmental organisations and property management companies.

The government will make a HK$14.9 billion funding request at a meeting of the Public Works Subcommittee on February 8. A second funding request is expected to be made for the scheme before the second quarter of 2024.

(South China Morning Post)漢口大廈獲批強拍底價21.34億 新世界持尖沙嘴舊樓業權逾98%

新世界併購的尖沙嘴漢口大廈,新獲土地審裁處批出強拍令,底價為21.34億,最新擁有業權逾98%業權,較2019年申請強拍時大為增加,只餘下2個住宅單位尚未收購。

新世界早於19年5月申請強拍時,當時持有業權為88.6%業權,包括鋪位及多個住宅未收購,涉及被申請強拍的答辯一方多達14名,其中亦包括1個地鋪,由兆安地產李應流等持有,現時估值約3224萬,當時市場就所持有88.6%業權,估值約9.55億。

尚餘2伙未收購

隨後於過去數年來,新世界相繼收購該廈鋪位及住宅,最新已擁有逾98.2456%業權,只餘下兩個住宅單位未收購,最新就持有的業權,獲批出底價21.34億。

該2個尚未收購的住宅單位為2樓E室 (559方呎) 及8樓F室 (473方呎),以物業現狀估值,分別為705.5萬及624.8萬,發展商於2019年3月至2022年7月期間,曾四度向餘下2個單位進行收購,最初出價1457萬及1245.5萬,唯1年後降價至1280萬及1090萬,減幅約12%。及在2022年7月,出價再次提升至1660萬及1480萬,即較最初出價高出14%及19%。

曾出價1660萬及1480萬

漢口大廈位於尖沙嘴漢口道43至49A號,現址為11層高商住樓,項目地盤面積約11565方呎,土地現規劃為商業用途,若以地積比率12.2倍發展,可重建為1幢24層高、設有3層地庫的商廈,總樓面約14.1萬方呎,每呎樓面地價約1.5萬。

項目將重建商廈

新世界於尖沙嘴持有不少地標項目,最大型為旗下Victoria Dockside,提供商場及商廈,項目總樓面面積達300萬方呎,商場部分K11 MUSEA提供115.7萬方呎零售樓面。

2伙尚未收購單位,2樓E室 (559方呎) 及8樓F室 (473方呎),最高獲出價1660萬及1480萬。

(星島日報)

佳明1.9億購堡壘街銀主地盤

北角堡壘街66號及建華街57號銀主地盤,上月初以1.9億成交,每方呎樓面地價僅約5735元,據悉,買家為佳明集團及有關人士。

上述住宅地盤位於北角堡壘街及建華街交界,地盤面積為3248方呎,以住宅商業項目地積比約10.2倍發展,可建總樓面約33130方呎。

翻查資料顯示,上述地盤早前由金朝陽持有,該集團於2018年公布,以約4.67億售予一家海外註冊公司,故該項目最新成交價對比5年前低出約2.77億,帳面貶值59.3%。

(星島日報)

TST site approved for $2.13B compulsory sale

A site in Tsim Sha Tsui was approved by the Lands Tribunal for compulsory sale with a reserve price of HK$2.13 billion.

On the site is currently an 11-story building, Hankow Apartments, which was completed in 1959 and has a site area of about 11,565 square feet. There are commercial shops on the ground floor and the first to tenth floors are for residential use.

New World Development (0017) and other partners purchased the property and applied for a compulsory sale in 2019.

The sold ownership of Hankow Apartments has risen to over 98.24 percent, with only two units left.

The property could be redeveloped into a 24-story commercial building with a three-story basement, based on a plot ratio of about 12.2 times. With a gross floor area of about 141,000 sq ft, the rebuilt property could be valued at HK$15,000 per sq ft.

Elsewhere, a property in North Point was sold by tender for HK$190 million last month, with the price per sq ft of floor area at only HK$5,735. This deal was made about 60 percent lower than a purchase of around HK$468 million four years ago.

Previously held by Irene Au Chung-yee, daughter of Hong Kong philanthropist Au Shue Hung, the property was foreclosed last August and was later purchased by Grand Ming (1271).

The mentioned property involves a site on Fort Street and another on Kin Wah Street, with only a narrow lane in between them.

With a total site area of 3,248 sq ft, the property could be rebuilt into a residential project of 33,130 sq ft in gross floor area on the highest plot ratio of 10.2 times. But it is still uncertain whether two sites could be consolidated.

The deal comes as land prices on the Island continue to fall. A site in Kennedy Town, for example, was sold for HK$439 million last December – HK$9,500 per sq ft of floor area. The price was around 10 percent lower than the bottom range of market valuations and also marked a new eight-year low for land sales on the Island.

Meanwhile, China Resources Land (1109) agreed to pay HK$13.7 billion as premium for a Cheung Sha Wan site, the second highest ever paid for the area.

The premium per floor area amounted to HK$8,692 per sq ft, with the 1.58 million sq ft of gross floor area.

Known as Yuen Fat Godown, the site is held by a joint venture set up by China Resources and China Overseas Land (Overseas).

(The Standard)

Sino Land's five projects will offer 3,000 homes

Sino Land (0083) has joined other developers to announce its sales plans this year, saying it aims to launch five new projects offering over 3,000 homes.

The projects are Villa Garda III in Tseung Kwan O with 664 flats, Grand Mayfair III in Yuen Long with 680 flats, One Central Place in Central with 121 flats, The Southside Phase 4 in upper Wong Chuk Hang MTR station with 800 flats and the Yau Tong Ventilation Building development with 792 flats.

Meanwhile, St George's Mansions, a luxury project co-developed by Sino Land and CLP Holdings (0002), notched up two deals with a family of mainland spinning producers paying HK$190.5 million for two duplex flats.

Victor Tin Sio-un, an executive director at Sino Land, said the group sold another 55 flats in January, cashing in nearly HK$1.9 billion.

Meanwhile, Mount Regalia in Sha Tin, jointly developed by Paliburg Holdings (0617) and Regal Hotels International (0078), saw its first transaction in the Year of the Rabbit when detached house No 25 with an area of 2,576 square feet was sold for HK$68.04 million or HK$26,413 per sq ft via tender.

Separately, a property agency put the number of potential homes at 105,000 but said supply has not caught up with demand, and it would take more than three years to reach a balance between supply and demand. The agency expects prices to rebound by 8 percent this year and said it will recruit 300 new agents into its fold.

In other news, the number of mortgages for presale homes in January slumped 66 percent year-on-year to 209, while loans for completed homes tumbled over 50 percent to 5,924, according to data from a mortgage brokage service porivder and the Land Registry.

(The Standard)鰂魚涌甲廈傳逾百億放售 新世界:無意出售 與投資者交談屬正常商業活動

外電引述消息人士透露,新世界旗下鰂魚涌甲廈 K11 ATELIER King's Road,傳以110億放售,不過,新世界作出否認,指集團無意出售該物業,強調與投資者交談,屬於正常商業活動。

去年,新世界放售大批非核心物業,包括商場、酒店及商廈等,不過,上述的鰂魚涌甲廈 K11 ATELIER King's Road 甲廈,並沒有在放售之列。昨日,有外電引述消息人士透露,該項目的多數權益,並獲準買家洽商,新世界亦有意放售該物業,項目估值110億,提供預期達4厘回報。

傳提供預期達4厘回報

不過,新世界接受本報查詢,否認有意出售該物業,並強調與投資者交談屬於正常商業活動,無意出售任何 K11 ATELIER King's Road 股權,同時亦沒有計畫出售其他K11的物業。

K11 ATELIER King's Road 甲廈,樓高28層,總樓面約44萬方呎,目前出租率約70%,市值呎租逾40元。

該廈前身為大型舊樓吉祥大廈,新世界早於2005年項目透過代理收購,重建而成,並於2019年入伙。

觀塘 KOHO 申重建商廈

新世界持有的觀塘 KOHO,去年9月向城規會申請放寬20%地積比,以重建一幢樓高29層的商廈,可建總樓面約28.8萬方呎,最新獲規劃署不反對,城規會將於明日舉行會議審議,料「開綠燈」通過。

項目位於觀塘鴻圖道73至75號,目前屬「其他指定用途」註明「商貿」,申請略為放寬地積比率限制,以作准許辦公室、商店及服務行業和食肆用途,佔地面積約2萬方呎,項目地積比率限制由12倍,略為放寬至14.4倍,即增加2.4倍或20%,以重建一幢樓高29層商業大廈,涉可建總樓面約288002方呎。

第一集團長沙灣項目申重建

第一集團旗下長沙灣的2個相連項目,去年11月向城規會遞交新發展方案,申請重建2幢樓高29層的商廈,涉及可建總樓面合共約31.1萬方呎。最新獲規劃署不反對,城規會將於明日舉行會議審議,料會「開綠燈」通過。

新世界表示,無意出售 K11 ATELIER King's Road。

(星島日報)

更多K11 Atelier King's Road寫字樓出租樓盤資訊請參閱:K11 Atelier King's Road 寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

市建局觀塘「巨無霸」商業項目流標

上月截標市值約百億的市建局觀塘「巨無霸」商業項目,遭遇「滑鐵盧」,該局昨公布,收回上述招標項目,即以流標收場。業界人士指,商業氣氛不景氣,並未因通關效應而復甦,未來商業樓面供應多,財團採保守策略投地。這是繼上月赤柱環角道豪宅流標後,不足1個月再有地皮以流標收場。

該項目於去年9月合共接獲24份意向書,同年11月邀請19家發展商入標競投,惟上月僅接獲新地1份標書入標競投。市建局昨公布,該局董事會設立的招標遴選小組,經詳細審議觀塘市中心第四及第五發展區標書的入標價後,向董事會建議不接納有關標書。該局董事會認同招標遴選小組的建議,決定收回項目。

市建:擬訂項目未來發展路向

市建局發言人表示,該局董事會議決收回有關招標項目後,管理層將進行市場調查,評估未來市場需求狀況,以及聽取發展商對是次招標的意見,從規劃、發展和財務等不同層面,研究適當的方案,擬訂項目未來的發展路向。

有測量師指,現時商業樓面空置量維持較高水平,商業市道前景並未因通關效應而復甦,未來仍大量甲級寫字樓樓面新供應,市場消化速度緩慢。另外,過去一年發展商銷售新盤速度緩慢,資金回籠速度延長,故出價較低。

另一測量師表示,未來觀塘區的商業樓面供應多,出價不會太進取。估計短時間內重推的機會低。

業界:商業不景氣低價競投

有測量師期望,在通關後,經濟稍有改善,發展商能夠對未來租金增長較有信心,對項目再招標才有幫助。估計發展商考慮到資金回籠的年期,未來租務上的難度,故入標價錢稍為保守。

上述觀塘市中心第四和第五發展區項目、是該局歷來規模最大的單一重建項目,地盤面積為27.55萬方呎。當時市場估值約87億至108億,每呎估值約4000至5000元。據了解,該項目招標條款不設分紅比例,發展商需自行提出「一口價」,以價高者得決勝負;對入標財團設有資格限制,包括合資格具建築經驗的財團,資產淨值或市值不少於251億等。

(星島日報)

宏基匯連錄3宗成交

自從政府推出「躍動港島南」政策後,黃竹坑發展成熟,近期有見市場氣氛好轉,宏基資本推售區內全新甲廈宏基匯,連環沽出3個單位,最高呎價1.5萬。

最高呎價1.5萬

有代理表示,宏基資本推售黃竹坑道23號宏基匯,建築面積由約747方呎至全層6187方呎,連環沽出3個單位,包括1205室,建築面積約801方呎,以每呎約1.3萬易手,還有,該廈高層單位,亦以每呎1.5萬售出,該廈呎數具彈性,適合不同行業進駐。

宏基匯為港島南全新甲廈,樓高27層,2至5樓作零售用途,6至29樓為寫字樓用途,大廈設計由日本六本木JERDE大師操刀,陳設別有一番風格,工作空間充滿雅致藝術氣息。物業約10.5米高的大堂,每層樓高約4.75米,部分單位更附設來去水位,16樓為空中花園,提供休閒空間。大廈提供3部載客電梯及1部消防電梯。

由宏基資本發展

該代理續稱,由該廈僅需步行5分鐘,即抵達港鐵黃竹坑站,只需約8分鐘便到達金鐘及中環等核心商業區。

(星島日報)

外資代理行:港島甲廈呎租 全年跌8.2%

有外資代理行統計指,去年港島甲廈租金向下,跌約8.2%,預計中港通關後,整體租務市場將轉好。

據該行每月商廈租金統計,去年12月各區商廈租金變化不大,港島因租務較淡靜,中環超甲廈呎租及整體中環呎租,分別為125.5元及106.4元,按月並無起跌,其他區如灣仔、上環等亦如是。總括全年,港島區整體租金持平於每平方呎69.5元,租金按年下跌8.2%。

觀塘 The Millennity 全層 呎租28元

踏入2023年,整體甲廈租務加快,全新甲廈成租客搬遷熱點。新地 (00016) 旗下觀塘巧明街98號九巴車廠重建項目,早前命為「The Millennity」,物業2座29樓全層,面積約1.26萬平方呎,以每平方呎約28元租出。據了解,新租客為科網公司。該公司原租用同區駿業街商廈,涉及面積約7,400平方呎,是次搬遷既擴充樓面,亦可搬至全新甲廈項目作升級。

The Millennity 現已落成,比鄰港鐵觀塘站及牛頭角站。項目2座大樓各提供20層甲級寫字樓,總樓面約65萬平方呎,其基座10層為大型商場,商場佔地約50萬平方呎,規模與apm相若。目前商廈部分最大租客為積金局,租用約8萬平方呎樓面。

啟德 AIRSIDE 兩層 獲日資機構洽租

新甲廈獲洽租,去年落成大型商廈項目啟德 AIRSIDE 兩層樓面,合共逾7萬平方呎正獲洽租,呎租約35元,預計快將落實。據了解,洽租機構為日本三菱銀行集團,該機構目前租用中環友邦金融中心逾10萬平方呎樓面,預計是次洽租,將把集團後勤部分遷入啟德,而核心業務仍保留在中環。按目前友邦金融中心平均呎租約110至120元計,搬遷可大幅節省成本。啟德 AIRSIDE 為近2年最大型商業項目,去年落成,並於第3季錄首宗租務,近期則有所加快,包括高層全層,面積約3.75萬平方呎,以每平方呎約35元租出。

該行指,自內地重新通關以來,中小型寫字樓的需求不斷增加,令共享工作空間經營商有機會受惠。大多數的寫字樓租賃查詢都來自內地企業。業主除了為租戶提供租金優惠之外,其他因素如大廈的ESG評級及裝修,對於吸引或留住租戶都愈來愈重要。跨國公司,特別是銀行和金融的跨國公司的租戶需求仍然疲弱。新的工作場所策略令企業縮減所需要的寫字樓面積。在疫情後,不少企業都已經轉租或退租多餘的寫字樓面積。

九龍區方面,該行指,預期今年首季九龍區的寫字樓租賃市場將保持穩定,雖然有些企業將繼續搬遷以節省租金成本或改善營運,但相信內地通關對租戶的需求和市場趨勢都會帶來正面的作用。

(經濟日報)

更多The Millennity寫字樓出租樓盤資訊請參閱:The Millennity寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多友邦金融中心寫字樓出租樓盤資訊請參閱:友邦金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

整體甲廈空置率 升至12.1%

有外資代理行報告指,目前甲廈空置率仍偏高,最新空置率升至12.1%。

該行最新發表的香港地產市場報告中指出,受到有新落成樓面落成影響,12月底整體市場空置率上升至12.1%。

11.6萬負淨吸納量

由於年底租賃活動有限,整體甲級寫字樓市場在去年12月錄得116,900平方呎的負淨吸納量。同時,非核心商業區的新供應也推高整體空置率,九龍東的空置率上升至19.5%,中環及灣仔/銅鑼灣的空置率則分別微升至8.8%及10.2%。

該行代理表示,內地通關將為香港經濟帶來正面影響,大部分企業今年將會受惠。相信來自內地的企業將在港擴充或開設辦公室,預期對香港寫字樓市場的正面影響於今年下半年將更顯著。

(經濟日報)

URA withdraws mega Kwun Tong tender

The Urban Renewal Authority's mega project in Kwun Tong was withdrawn after receiving only one bid.

Upon the closing date of tender submission on January 11, 2023, the only bid received was from Sun Hung Kai Properties (0016) for its Kwun Tong Town Centre Development Areas 4 & 5 project. The board of authority then rejected the tender after deliberating the submission.

As the commercial property market has declined recently, the URA has introduced "floating planning parameters" to increase adjustability and avoid bidding failures.

These parameters allow developers to flexibly allocate the floor area of commercial, office and hotel facilities, which means that the winning developer can abandon the facility's construction.

The Kwun Tong Town Centre project, which has lasted for over 20 years, is the largest single redevelopment project ever launched by the URA. It will be developed in five phases.

The now-withdrawn project is the final development space with a site area of 275,500 square feet which can be reconstructed into buildings with a total floor area of about 2.2 million sq ft.

Before the tender was closed, the valuation of the project ranged between HK$8.7 billion and HK$13 billion - or HK$4,000 and HK$6,000 per square foot - down by up to 50 percent from August last year.

When the project was launched and began to receive expressions of interest last August, the market valuation reached HK$25.9 billion.

However, due to the softening of market sentiment, the project valuation was reduced to between HK$4,300 and HK$10,000 per sq ft mid-November, representing a valuation range of HK$9.31 billion to HK$21.66 billion.

Initially, the project received 24 expressions of interest last September and the URA invited 19 developers and consortiums to bid - including Henderson Land (0012), CK Asset (1113), Sino Land (0083), China Overseas (0688), SHKP and others.

This is the second bidding case withdrawn this year. On January 10, a site in Stanley had only received four tenders but they did not reach the government's reserve price.

In other news, the Planning Department has given the green light to New World Development's (0017) project in Kwun Tong.

The site covers an area of about 20,001 sq ft at No 73 to No 75 Hung To Road and the latest plan will increase the plot ratio to 14.4 times by redeveloping it into a 29-story commercial building with a total floor area of 288,008 sq ft.

(The Standard)

Flats at Kai Tak and Tuen Mun set to go on sale

KT Marina 1 in Kai Tak, a project that is being jointly developed by K Wah International (0173), Wheelock Properties, and China Overseas Land & Investment (0688), will be available for sale this month at the earliest.

Tony Wan Wai-ming, sales and marketing director for Hong Kong properties at K Wah, said standard units at the project will provide one to three bedrooms and two-bedroom flats account for 60 percent of the total.

Five showrooms are ready to open for view and the developers will make reference to nearby projects in pricing, he added.

The entire project totaling 2,138 flats will be developed in two phases with the first phase offering 1,017 homes.

Also expected to open sales this month is Sun Hung Kai Properties' (0016) Phase 2B of Novo Land in Tuen Mun.

The project has been granted presale consent and the sales brochure as well as the first price list will be released in the coming two weeks, the developer said.

The project provides 729 flats, 90 percent of which have one or two bedrooms. Phase 2A is awaiting presales permission and the two phases together have over 1,600 flats, it said.

In Tseung Kwan O, Nan Fung Group's project with MTR Corporation (0066) - LP10 - will soon unveil the first batch after its completion, Nan Fung said.

In the secondary market, University Heights at the Mid-Levels sold a 1,584-square-foot unit with a parking space for HK$80.8 million via tender yesterday. The developer Chinachem has raked in more than HK$1.7 billion after selling 21 units at the project.

(The Standard)代理行:市場氣氛回暖 商廈交投按月升66%

中港兩地通關,帶動工商鋪氣氛回暖,有本地代理行資料顯示,商廈買賣顯著向好,上月錄40宗買賣,按月升66%。

金額9.01億按月升62.3%

該行代理表示,上月商廈價量齊升,共錄約40宗買賣,總金額約9.01億,按月升約66.6%及約62.3%,從商廈市況持續改善看來,證明動亂及疫情洗禮,商廈價格觸底回升。通關伴隨龐大商務需求,跨國企業購入指標商廈。長沙灣荔枝角道888號南商金融創新中心,連沽7個單位,總金額逾1.25億;其中22樓3伙獲新加坡公司購入,涉資約6325.1萬元。

鋪位交投金額按月升49%

商鋪買賣則錄57宗,較12月的71宗回落約19.7%,金額錄約21.40億,按月急升約49.7%。工廈較平穩,1月共錄約118宗成交,對比12月減少約接近一成半,成交金額則大致相若。

上月錄215宗工商鋪成交

據該行資料顯示,1月份工商鋪暫錄約215宗成交,對比2022年12月約230宗輕微下跌,今年農曆年假較以往早,減慢買家入市步伐,總成交金額走勢凌厲,1月份總成交金額錄約40.83億,對比去年12月大幅增加約35%,主因月內錄多宗大手成交,反映通關消息刺激市場氣氛回暖,資金隨之流向工商鋪物業,尤其是商廈。

(星島日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

代理行:工商鋪交投料按年升30%

在與內地通關效應下,工商鋪交投活躍,有本地代理行預期,今年全年工商鋪將回升至5800宗,較去年增加約30%。該行代理表示,內地居民赴港澳旅行團,相信優化措施能吸引旅客來港,重振本港零售業及旅遊業,帶動核心區地鋪,代理續指,財政預算案快將出爐,若有進一步政策,將吸引中資及海外企業來港投資及設立據點。

料全年數目達5800宗

該行綜合土地註冊處資料顯示,1月份工商鋪註冊量共錄259宗,較去年12月223宗按月升16.1%,連跌兩個月後首度回升,金額錄32.04億,按月跌約64.3%,1月份註冊個案主要反映12月份市況。

短期內未能回復疫情前水平

1月份工商鋪各板塊註冊宗數全綫上升,工廈及商鋪較佳,註冊量分別按月升約10.4%及29.2%,最新分別錄127及84宗。商廈註冊量按月升約11.6%,錄48宗。市場氣氛逐漸回暖,令註冊量增加,但投資者態度仍趨審慎,交投增長速度未明顯回升,預料整體註冊量及金額未能在短期內回復疫情前水平。

該代理又說,美國聯儲局宣布加息0.25厘,顯示加息幅度放緩,有望改善市場氣氛。代理認為,投資市場逐漸適應後疫情時代,更了解各板塊物業增長潛力及未來價值,部分工商鋪價格已累積一定跌幅,吸引投資者趁低吸納。

(星島日報)

市建局擬為觀塘商業項目增住宅元素 改作混合模式

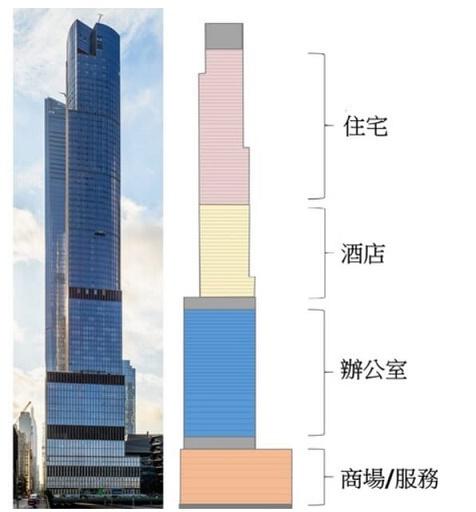

市建局觀塘市中心第4、5區巨無霸商業項目(總樓面面積逾216.5萬方呎),早前因為只接獲新地 (0016) 一份標書,上周決定收回、即流標收場;市區重建局行政總監韋志成今日在網誌透露,市建局團隊希望為項目加入住宅元素,局方會以新規劃思維,因應市場對房屋、辦公室、酒店和零售等需求,將地標大樓的發展規劃,包括加入住宅元素,應對不斷變化的市場和社會環境,以配合九龍東核心商業區的未來發展,提升項目吸引力。

為衝破上述傳統「甲類」住宅項目的地積比率限制,市建局團隊認為應將第4、5發展區土地,由「商業用途」改變為「其他指定用途 (混合發展)」的發展模式,並結合「一地多用」概念,在地盤獲准發展的地積比率為12倍及「浮動規劃參數」機制維持不變的基礎上,加入住宅發展元素,讓日後的中標發展商可更靈活調撥發展樓面,作住宅、辦公、酒店和零售等不同業務。

市建局研究紐約、倫敦和東京等高密度大城市所提倡的「垂直城市」(Vertical City) 發展理念,由「二維」的橫向規劃,革新至「三維」的垂直規劃,將不同的土地用途,融合在一座高層綜合用途的地標建築物內。韋續指,市建局團隊已就「混合發展」規劃的概念,初步與相關政府部門交流,並得到正面回應;同時,市建局亦就此展開全面技術評估,特別是交通負荷的評估。

(明報)

東九CBD搖搖欲墜

地產市場近日有兩單大新聞備受議論,首先是「簡約公屋」選址風波,引起啟德私樓業主群情洶湧;其次,繼赤柱超級豪宅地皮流標後,市建局旗下觀塘商業項目亦告「收回」。這兩宗新聞有其關聯,背景是本港商業活動暫時復甦乏力,甲級寫字樓空置率頗高,尤其是九龍東接近20%樓面丟空。在供過於求之下,九龍東的所謂CBD 2定位面臨重大挑戰,發展商對於斥資「起新office」難免非常審慎。

自從2019年爆發社會運動及新冠疫情,本港經濟活動嚴重受創,商業地產租賃市場首當其衝。據一間外資代理行研究報告,截至去年12月底,本港甲級寫字樓整體空置率達12.1%,整體租金水平較2019年高峰期下滑接近三成。其中,中環、港島東、九龍東的空置率分別達8.8%、11.1%、19.5%。

作為比較,在2019年風風雨雨刮起前,本港甲級寫字樓整體空置率長期低於4%,尤其是中環寫字樓極之搶手,影響到一些大企業擴張受限制,部分公司遂把總部或個別部門辦公室搬到港島東,隨後又進一步遷徙到九龍東。正因如此,港府才在大約十年前提出CBD 2大計,擬把啟德新區至觀塘重建區一帶打造成本港第二核心商業區,為經濟活動提供更多空間。

全面通關 甲廈未必即受惠

這3年多香港發生巨變,如今連中環寫字樓也「十室一空」,地標商廈大業主需要大幅減租留住客戶,部分企業更趁機由港島東「回流」到中環,作為「核心外圍之外圍」的九龍東商廈,面臨更大挑戰。

本港與內地今日起全面通關,初期料將帶挈商舖、商場等零售物業回暖;反觀甲級寫字樓主要用於企業營運,暫時未必立竿見影受惠。對於香港作為「亞太營運總部」之前景,其中一個參考指標是外籍人員派駐香港數量。資料顯示,入境處去年根據一般就業政策批出13495個工作簽證,較2019年勁減63%,創逾20年新低。有國際獵頭公司指出,看不到外籍僱員「大量回流」跡象,因為「這幾年離開香港的外派員,大部分已在其他地區開展生活,料不會回港」。

同時值得留意,近年WFH (居家工作)、遙距辦公等模式興起,全世界商廈需求都有機會受到一定影響;但有別於紐約、倫敦等其他商業中心,香港還面對傳統定位備受動搖、企業及人才流失等因素困擾,堪稱多重打擊,商廈前景難以樂觀。

短期而言,「核心中核心」的中環CBD料仍可保持繁榮,九龍東則尚欠利好因素。基於寫字樓供應明顯供過於求,無從說服眉精眼企的發展商斥資興建「純商廈」項目,潛在回報與風險不容易「計得掂數」。所以港府早前已把啟德5幅商業地皮改劃為住宅用途,該區仍有大量空地用於商業規劃,料將繼續「曬太陽」一段時間。既然如此,當局擬順手借其中一幅空地發展「簡約公屋」,提供逾萬伙單位,並承諾7年後「還地於區」,背後邏輯可以理解。

此外,市建局旗下觀塘市中心第四及第五重建區商業項目去年邀請19家發展商入標,市場估值約87億至130億元,結果只收到「一千零一份」標書,來自區內「大地主」新地 (00016);其餘18家發展商「連入標都慳返」,反映業界整體上興趣缺缺。但市建局上周宣布,在全面考慮入標價格及市場數據等因素之後,決定不接納唯一一份標書,即是流標收場。

觀塘項目混合發展增吸引力

市建局行政總監韋志成昨日透露,將會收回觀塘項目,用「新思維」重新規劃,革新發展模式,包括把項目定位由「商業用途」改變為「其他指定用途 (混合發展)」,「加入住宅元素,應對不斷變化的市場和社會環境」,以提升項目吸引力。由此可見,觀塘市中心純商業項目再沒多少吸引力,不得不像啟德般,把部分樓面改劃作住宅用途。

總的而言,九龍東CBD 2亦可說是本港經濟之縮影,假若企業及人才流失趨勢未能逆轉,「亞太營運總部」定位失色,不但啟德、觀塘的甲級寫字樓陸續丟空,本港整體經濟亦難奢望重拾當年勇。繼推出「Hello香港」吸引遊客大計後,特首李家超馬不停蹄,現正出訪沙地阿拉伯,努力「說好香港故事」。且看特首能否說服一批中東企業來港投資或上市,不妨考慮選址九龍東設立營運總部,讓啟德有機會變身「遠東杜拜」,啟德業主們相信會歡迎酋長和油王做鄰居。

(信報)

Commercial deals jump in value

The value of commercial property transactions in Hong Kong surged by 35 percent month-on-month in January to HK$4.08 billion as sentiment improved following the reopening of the border with the mainland, according to a property agency.

This was even though the number of deals in January fell 6.5 percent to 215, mainly due to the Chinese New Year holidays at the end of the month.

The property agent expects the commercial market to further recover, with Covid PCR test requirements and quotas for cross-border travel scrapped from today.

Turnover from commercial buildings soared 62 percent monthly to HK$901 million from last December, and the number of transactions jumped 66 percent to 40 in January, though both were still below the levels seen a year ago.

The agency believes prices of commercial buildings are rallying, amid a surge in business activities following the border reopening.

A new tower, NCB Innovation Centre in Cheung Sha Wan, for example, sold seven car-parking lots for over HK$125 million, as well as three flats on the 22nd floor to a Singaporean firm for HK$63.25 million.

Meanwhile, shops transactions rose about 50 percent to HK$2.14 billion from a month ago, despite a 19 percent fall in deals to 57.

Turnover for industrial buildings remained flat while the number of deals fell 15 percent to 118.

(The Standard)

For more information of Office for Sale at NCB Innovation Centre please visit: Office for Sale at NCB Innovation Centre

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan

Kwun Tong center redevelopment will now add residences

The Urban Renewal Authority plans to introduce residential elements into its Kwun Tong Town Centre Development Areas 4 & 5 project, whose tender was canceled last week after the only bid from Sun Hung Kai Properties (0016) was rejected.

Managing director Ir Wai Chi-sing said in his blog that in line with the future development of the Kowloon East central business district, the authority decided to introduce residential housing into the project to enhance its attractiveness.

The residential area will be built above the hotel, office and shopping areas.

Wai said that if the site is granted in a depressed market, the project will suffer a serious financial loss and hurt the resources for future urban renewal projects.

Besides, the project involves the acquisition of more than 400 private homes and disposing of over 100 unauthorized structures, which was a huge expenditure.

The site of Kwun Tong Town Centre is strategically located adjacent to Kwun Tong MTR Station and Yue Man Square Public Transport Interchange and the URA said its role as a "town center" in terms of traffic, logistics and economic activity will not change.

The URA's revenue has been significantly reduced amid the housing market downturn.

Its To Kwa Wan Road/Wing Kwong Street development scheme was awarded last October at a price of HK$9,200 per square foot, 33 percent lower compared to the Hung Fook Street/Ngan Hon Street development project which was tendered in late 2021 at a price of HK$13,700 per sq ft.

URA estimates the tender for future projects will be under pressure as the acquisitions for the sites were done when property prices were high.

(The Standard)

Luxury home sales surge amid reopening

The number of transactions of new luxury homes costing more than HK$50 million hit a 16-month high last month and weekend transactions in 10 major housing estates reached a three-week high as the border reopening with the mainland and slowing interest rate hikes fueled the market.

A total of 503 new home sales were recorded last month, which was up by 87 percent from December and the highest in four months, according to a property agency. Among them, homes priced over HK$50 million saw 41 transactions, up by nearly 2.2 times to a new high in 16 months, the agency said.

The momentum in the upscale home market is expected to sustain as the economy picks up.

Yesterday, Kerry Properties (0683) sold a 1,699-square-foot luxury home with a parking space at Mont Rouge on Beacon Hill in Kowloon Tong for HK$70.3 million, or HK$41,376 per sq ft via tender.

Only four flats are left for sale and the developer has collected over HK$6.5 billion from selling 41 homes at an average price of more than HK$60,000 per sq ft at the project.

In the mass market, Minmetals Land's (0230) Montego Bay in Yau Tong sold a 517-sq-ft flat with two bedrooms for HK$12.77 million, or HK$24,700 per sq ft, the highest at the project in more than one year.

In Fo Tan, Centralcon Properties will launch sales of 389 completed flats at The Arles, including 306 flats on price lists and 83 homes via tender on Thursday.

In Cheung Sha Wan, Seaside Sonata saw 300 groups of home viewers over the weekend after slashing prices of 10 flats on the last price list by as much as 16 percent to attract buyers, the developer CK Asset (1113) said.

The remaining 22 flats, including 12 flats to be sold via tender will be put on the market on Friday, it said.

In the secondary market, A property agency saw a three-week high of 22 home sales in 10 major housing estates over the weekend, up by nine deals or 69.2 percent from a week ago.

The market is on track for recovery after the Chinese New Year holiday and some buyers had to raise their bidding prices to clinch a deal, an agent said.

The agent expects both the transaction prices and volumes to increase this month.

However, a luxury apartment with a parking space at Mount Nicholson on the Peak recently sold for HK$390 million with the vendor suffering a loss of HK$139 million or 26 percent after buying it for HK$520 million in 2018.

(The Standard)力寶中心低層單位叫價4000萬

有代理行表示,金鐘力寶中心一座低層單位,面積約1495方呎,意向價約4000萬元,呎價2.68萬元,可交吉或連租約放售。

該行指出,放售物業屬於罕有對正升降機大堂,並享有海景,而大樓地庫及物業附近亦設有充足泊車位,也令物業租金看高一線。

(信報)

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

山頂MOUNT NICHOLSON 4年蝕1.4億

二手樓市交投氣氛雖然有所改善,但市場仍錄大幅蝕讓個案。「亞洲樓王」山頂MOUNT NICHOLSON剛錄二手成交,短短4年多大幅蝕讓近1.4億元,夠買近30間沙田第一城的上車盤。不過,市場人士強調,超豪宅蝕讓僅屬個別事件,而且是原業主資金鏈斷裂,不代表豪宅市場出現問題。

4596呎分層戶 3.9億連車位售

資料顯示,山頂MOUNT NICHOLSON D座中層的一個分層單位,實用面積4,596平方呎,原業主2018年10月以5.199億元購入,實用呎價約11.3萬元,並在2021年再以900萬元增購一個車位,總成本增加至約5.29億元。單位剛登記以3.9億元連車位售出,4年間帳面蝕讓約1.4億元,若連購入單位的釐印費 (約2,210萬元) 計,估計實質蝕讓逾1.6億元,屬於近年最大宗蝕讓個案,現時沙田第一城的兩房上車盤一般市價約400萬至500萬元,單是帳面蝕讓的金額,已經夠買接近30間上車盤。

區內代理指出,原業主為具內地背景的新港人,近期資金鏈斷裂,去年9月開始放盤,一直叫價4.8億元放售,最終累減9000萬元沽出單位。至於新接貨的買家,據知亦屬於普通話拼音名字,但據土地註冊處資料顯示,新買家是次以首置身份入市,僅支付1,658萬元印費稅。

另外,掃管笏上源2B座中層J室,實用面積738平方呎,3房套房間隔,剛以約803萬元成交,實用面積呎價10,879元。原業主於2018年10月以851萬元購入上址,持貨至今手,帳面蝕48萬元。

(經濟日報)加息放緩 外資代理行估下半年投資市場向好

2022年投資市場受加息影響,下半年轉弱。有外資代理行認為,息口加幅漸放緩,料各路資金將部署入市,下半年投資市場明顯向好。

美國聯儲局一如預期日前加息0.25厘,聯邦基金利率升至介乎4. 5厘至4.75厘,為今年內第8次加息,累計加息已達4.5厘。該行代理指,去年投資市場下半年開始轉弱,主因息口向上,「H按由去年不足1厘,加上目前近5厘,對投資市場有一定衝擊,令投資市場交易量跌至10年來最低水平,而成交額按年下跌4%至700億元。」

對於今年市況,該代理認為,香港是次未有跟隨加息,而美國有機會加多兩次,香港亦沒有跟隨,上半年息口見頂,對投資市場有利,「下半年不加息亦不等於快減息,若下半年橫行,可以給市場清晰前景,就是息口見頂,好讓投資者部署入市。」

代理:大額買賣將理想

此外,代理指去年中港兩地相對嚴謹的檢疫措施導致商用物業租金水平受壓,而現時中港通關,經濟可望向好,「通關顯示逐步復常,預計第二季左右,本港經濟向好,投資氣氛將顯著改善。」該代理強調,投資者向來較為早着先機,會提早入市,「現階段息口相對較高,投資物業回報率或欠吸引。投資者會預計經濟轉好,憧憬工商物業租售價向上,便會開始入市,料下半年大額買賣將理想。」

該行數據顯示,去年700億元成交中,工商舖三項範疇上,以工廈表現最佳,佔成交金額約26%,事實上,近兩年工廈買賣表現均理想,大型物流中心、貨倉等相繼獲基金承接。

代理指,2021年工廈成交及買賣,分別涉57宗及285億元,2022年明顯下跌,「疫情令工廈受捧,惟投資者追捧下,回報率開始下降,投資者會開始留意其他板塊;現時通關下,更留意商舖及商廈。」該代理認為,與旅客相關的舖位及酒店,均值得留意。舖位是率先看好,因社運至疫情,舖位受打擊最大,旅客逐步重返,在租售價大幅調整後,投資價值出現。同時間,旅客重返意味酒店入住率高,亦有利投資。

至於寫字樓方面,代理認為新供應達數百萬呎,無疑數量高,但集中於非核心區,「與內地通關後,會有需要擴充,始終內地人才、公司,部分資金希望在港建立一個據點。香港為中國以至全球重要金融城市地位不變,故商廈需求同樣向上。」

(經濟日報)

尖東新文華中心位於區內核心地段,交通極為便利,而單位面積由數百平方呎起,適合中小用家。

新文華中心在80年代初落成,屬尖東區內其中一幢地標商廈,而尖東主要商廈包括康宏廣場、永安廣場、東海商業中心等,新文華中心最大優點是設於尖東百周年紀念花園旁,屬於尖東區最多人流的地段。同時坐享港鐵站優勢,由紅磡、尖東及尖沙咀港鐵站行至該廈,約10至15分鐘步程。

值得一提,港鐵屯馬綫及東鐵綫過海段相繼通車,紅磡站成為主要轉車站,尖東新文華中心更加方便,加上鄰近紅隧交通交滙處,方便上班人士出入。

飲食配套上,大廈亦設有2層商場,舖位用戶以食肆為主,提供快餐店、茶餐廳等,而附近亦有多間酒店包括Hotel Icon、帝苑酒店等,可提供優質餐廳作商務午餐,上班人士亦可選擇前往漆咸道南一帶有更多餐廳可選擇。

單位最細數百平方呎

大廈由A座及B座組成,物業樓高13層,辦公室樓層由3樓起,每層樓面約1.99萬平方呎。物業開則呈正方形,間隔亦實用,大部分單位屬長形。以A座標準間隔為例,每層設有20個單位,位於每層四角的13、8、3、18室,擁多邊窗,視野相對開揚,惟單位近出入口設有小玄關位置。物業最細單位由數百平方呎起,正適合中小型公司使用。

景觀方面以A座較為優勝,其中向百周年紀念花園單位,主要分布於1至3、及18至20號,可望園景及噴水池景,屬最優質單位。

另B座部分單位,可望紅隧及紅磡方向,感覺開揚。至於其他單位,主要望區內市景及樓景。

成交方面,近兩年受疫情影響,該廈呎價回落至約9,000至1萬元,大廈去年錄2宗買賣,包括4月份A座高層17室,面積約769平方呎,以約792萬元易手,呎價約1.03萬元,另去年10月,A座低層05室,面積約830平方呎,以約750萬元易手,呎價約9,036元。

(經濟日報)

更多新文華中心寫字樓出租樓盤資訊請參閱:新文華中心寫字樓出租

更多康宏廣場寫字樓出租樓盤資訊請參閱:康宏廣場寫字樓出租

更多永安廣場寫字樓出租樓盤資訊請參閱:永安廣場寫字樓出租

更多東海商業中心寫字樓出租樓盤資訊請參閱:東海商業中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多新文華中心寫字樓出售樓盤資訊請參閱:新文華中心寫字樓出售

更多康宏廣場寫字樓出售樓盤資訊請參閱:康宏廣場寫字樓出售

更多永安廣場寫字樓出售樓盤資訊請參閱:永安廣場寫字樓出售

更多東海商業中心寫字樓出售樓盤資訊請參閱:東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

中層1915呎單位放租 每呎25元

尖東新文華中心享地理優勢,現物業中層近2,000平方呎單位放租,意向呎租約25元。

提供基本裝修 意向4.78萬租

有代理表示,有業主放租尖東新文華中心8樓12室,面積約1,915平方呎,單位意向月租約4.78萬元,呎租約25元,單位提供基本裝修。代理指出,以叫租約25元計,屬大廈目前放租盤最便宜,故有一定吸引力。

新文華中心單位多,租務成交頗旺,去年11月錄兩宗租務,其中A座中層05室,面積約977平方呎,成交呎租約27元。另今年亦錄兩宗租務,包括A座極高層19室,面積約930平方呎,成交呎租約28元。

同區商廈租務方面,指標甲廈康宏廣場上月錄租務,包括低層01室,面積約1,158平方呎,以每平方呎約30元租出。

(經濟日報)

更多新文華中心寫字樓出租樓盤資訊請參閱:新文華中心寫字樓出租

更多康宏廣場寫字樓出租樓盤資訊請參閱:康宏廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

金鐘力寶中心低層戶4千萬放售

甲廈買賣氣氛稍轉好,現金鐘力寶中心低層單位,以約4,000萬元放售。

面積1495呎 呎價26756

有代理表示,近日有業主放售金鐘力寶中心一座低層單位。該物業面積約1,495平方呎,意向價約4,000萬,呎價約26,756元,可交吉或連租約放售,自用或投資均適合。

力寶中心位處港鐵金鐘站上蓋,金鐘站為全港首個四綫交滙轉車站,既是港島綫與荃灣綫的中途站,亦是東鐵綫與南港島綫的下行總站,來往全港各區都很方便。

最近一宗力寶中心單位成交為上月尾,物業1座3704至06室,面積約3,475平方呎,呎價約22,498元。

(經濟日報)

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

商廈去年781宗成交 按年跌4成

有代理指出,總結2022年全年,商廈整體買賣登記僅錄得781宗,較2021年的1,299宗急挫40%,跌至歷史次低,是繼2019及2020年後第3次史上不足千宗的低潮年。

以價格類別劃分,中細價商廈仍是去年買賣登記的主流,當中以介乎200萬元至500萬元以內價格類別的商廈佔比較多,全年錄得238宗,佔了整體商廈成交量逾3成。另外,銀碼介乎2,000萬至5,000萬元以內的登記量則錄得最大跌幅,挫61%,至只有69宗。至於去年7個價格類別的商廈買賣宗數之中,只有1億元或以上者出現逆市上升,去年共錄49宗登記,按年大增40%,主因去年5月有一幢全幢商廈 (英皇道1111號 (前稱太古城中心一座) ) 疑似內部轉讓是以分層拆細形式登記,故抽升了逾20宗逾億元的登記個案。

今年買賣估達1200宗

從地區層面分析,在該行定期觀察的11個主要商業區中,2022年登記量全綫下跌,當中跌幅最大者為長沙灣區,全年只錄得30宗登記,按年急挫85%;其次葵涌區亦跌83%,至5宗登記;而沙田區亦急跌73%至12宗,反映一些廠區商廈在疫情之下亦大受影響。另一方面,2022年最貴重的商廈登記個案除了前述3項巨額轉讓外,接着最矚目的登記為啟祥道17號全幢 (前稱高銀金融國際中心) 涉資的56億元,再者是彌敦道74至78號文遜大廈的近15.34億元,亦因此帶動全年總金額得以創下歷史新高。

展望2023年,該代理表示,中港恢復通關對商廈市場來說是極大的喜訊,隨着內地企業重返香港擴展業務,商廈買賣及租賃需求勢必大升。內地資金來港,其中很大部分都喜歡投放在商廈市場,加上引入人才計劃,及經濟重踏復甦之軌,令企業擴充樓面、甚至轉租為買的意慾大增。代理預期2023年商廈市道將明顯轉向樂觀,因為香港將再次肩負起連接海外及中國內地市場的角色,相信今年商廈買賣登記宗量將在低基數下大升逾5成 (54%),料達1,200宗的水平。

(經濟日報)

更多太古城中心寫字樓出租樓盤資訊請參閱:太古城中心寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

「亞士厘21」首錄醫療中心承租

建灝地產旗下尖沙嘴醫務商業發展項目亞士厘21 (21 ASHLEY),打造「醫生大廈」,率先由本地醫療集團承租近3000方呎,成為首個選址亞士厘21之醫學集團。

建灝打造「醫生大廈」

建灝地產發言人表示,上述租客為本地醫學影像診斷集團,承租的屬特大地台承租樓層,可放置大型儀器,作其擴充業務第4家分店,租金未能透露,惟該廈意向呎租55元至67元,自從兩地通關消息宣布後,集團收逾100個醫療及醫學美容相關行業查詢,有意選址該廈,預計今年第2季落成,現時進行預租。

意向呎租55至67元

他又說,亞士厘21標準樓層建築面積約5500方呎,個別樓層設特高樓底 (高度達5米) 及特大地台承重 (達7.5kPa),均提供穩定及充裕電力供應,兼設置後備電力,同時,每層均配備符合政府要求的通風及換風系统,並預留位置供裝配醫療級別的換風系统。大廈通道及升降機均可容納擔架牀進出,方便醫生及求診者需要。

(星島日報)

Hong Kong property developers, led by Sun Hung Kai, K Wah, rush 27,000 new homes to market as sales uptick stokes hopes

Developers will launch around 36 developments with 27,350 homes this year, according to the Post’s calculations

An increase in transactions and stabilising interest rates have developers expecting a return to normalcy after sales fell 41.3 per cent in 2022

Hong Kong’s major property developers are rushing to put more than 27,000 new homes on the market this year, seizing on an uptick in buying sentiment and transaction volume after the relaxation of anti-pandemic measures and the reopening of the border with mainland China.

At least 14 developers, including Sun Hung Kai Properties (SHKP), Henderson Land Development, New World Development, Sino Land and K Wah International, plan to launch some 36 developments with around 27,350 homes this year, according to the Post’s tracking of sales plans revealed in late January and early February.

The pressure of high interest rates on the property market will gradually diminish, said Victor Lui Ting, deputy managing director at SHKP, Hong Kong’s biggest developer by market value.

“In the past month, home prices in the local second-hand market have picked up, and the turnover of first-hand transactions is even more active than before,” he said, adding that home prices are expected to see a mild increase of 5 to 10 per cent this year.

Six major lenders, including HSBC, Hang Seng Bank, Citibank and Standard Chartered, said on February 2 that they would keep their prime lending rates unchanged after Hong Kong’s monetary authority raised the city’s base rate by 25 basis points in lockstep with an increase by the US Federal Reserve.

In addition, the Hong Kong interbank offered rate – the interest banks charge each other for borrowing money – has dropped by half in the past two months, Lui added.

In January, new home sales jumped 54.9 per cent over December to 350, although this fell short of November’s 371, according to a property agency.

SHKP expects to launch phase 2B of Novo Land in Tuen Mun, with 729 flats, in February and University Hill in Tai Po, with 746 flats, around Easter.

K Wah International appears to have the biggest sales plan, as it is involved in five projects with other developers, with 8,072 homes set to hit the market.

The total of 27,350 includes developments in the Kai Tak area, where a government plan to erect temporary public housing, as well as its decision to reduce office space in the area and scrap a planned monorail, have adversely affected public perception of the area’s prospects.

New-home sales fell 41.3 per cent year on year in 2022 to a nine-year low of 10,261, according to the agency, which expects a recovery to a normal level of around 18,000 this year.

New homes had the worst performance among all property categories in 2022 according to another agency, as overall property transactions nosedived 38 per cent to a 32-year-low of 59,619, according to the first agency.

The difficult market prompted the total number of property agent licences to sink to a 23-month low of 40,807 in January, according to data from the Estate Agents Authority.

SHKP sold 3,053 new homes last year, the most among all developers, bringing in HK$24.76 billion (US$3.16 billion), according to the agency. Sino Land was next with 2,248 homes worth HK$23.03 billion.

About two-thirds, or 14,104, of the private homes completed in 2022 have been sold, according to the agency – a sales ratio lower than the usual range of 70 to 80 per cent in previous years.

To be sure, the market is not completely rosy. Notably, CK Asset cut prices last week for 10 remaining flats at Seaside Sonata in Cheung Sha Wan by 10 to 16 per cent, or as much as HK$2.4 million “because of market correction”.

The developer wanted to finish the sales effort and believes market recovery will take time despite the border reopening, it said, adding it wanted to use a reasonable price to proactively drive sales amid keen competition.

Meanwhile, the luxury segment could suffer a price decline of 5 to 10 per cent in 2023, given looming recession risks in the United States and European Union economies, elevated interest rates, and “punitive” measures on residential-property transactions, another agency warned in a report on Monday.

“For a long time, demand for luxury units by non-locals has boosted and extended support to luxury home prices,” an agent said. “However, the economic headwinds in mainland China and continued difficulties and hindrances in the expatriation of funds to offshore markets could result in less buying intentions and more selling pressure in the luxury sales market.”

For example, in the fourth quarter of 2022, homes at Mount Nicholson on The Peak and 39 Conduit Road in Mid-Levels were sold by mainland Chinese for HK$500 million and HK$378 million, resulting in estimated losses of HK$134 million and HK$39 million, respectively, the agency said, citing media reports.

(South China Morning Post)

非牟利機構1060萬購東貿廣場

恒基旗下柴灣甲廈東貿廣場,沽出1個單位,買家為香港書刊版權授權協會,涉及東貿廣場15樓D室,建築面積約1424方呎,以每呎約7444元易手,作價1060萬。市場消息指,該協會現時承租北角泓富產業千禧廣場單位,東貿廣場單位料作為自用。

平均每呎7444元

根據該會網站顯示,該會為一家非牟利機構,提供授權方案,「為版權擁有人及公眾提供一個既經濟又有效率的一站式授權方案,讓公眾可以取得授權,使用世界各地創作者及出版商的作品。」「一方面滿足了本地人士希望使用已出版材料的需要,另一方面又能尊重版權擁有人的權利。」

東貿廣場為柴灣區內指標甲廈,過往亦曾有知名機構購單位自用,地產代理監管局先後於2021年及2018年購入23樓及6樓,作價分別為7000萬及6100萬。

(星島日報)

更多東貿廣場寫字樓出售樓盤資訊請參閱:東貿廣場寫字樓出售

更多柴灣區甲級寫字樓出售樓盤資訊請參閱:柴灣區甲級寫字樓出售

更多泓富產業千禧廣場寫字樓出租樓盤資訊請參閱:泓富產業千禧廣場寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

受惠香港與內地全面通關,新世界 (00017) 長沙灣南商金融創新中心,近日獲內地資金逾1,750萬元購入高層單位,呎價逾1.56萬元。

該單位面積約1,118平方呎,成交價1,750萬元,呎價逾1.56萬元。據成交資料顯示,南商金融創新中心在通關前後,合共錄得8宗買賣成交,共套現近1.5億元。

上述8宗成交,亦包括早前有用家大手掃入南商金融創新中心高層3伙,涉資逾6,300萬元,平均呎價約1.5萬元。

(經濟日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

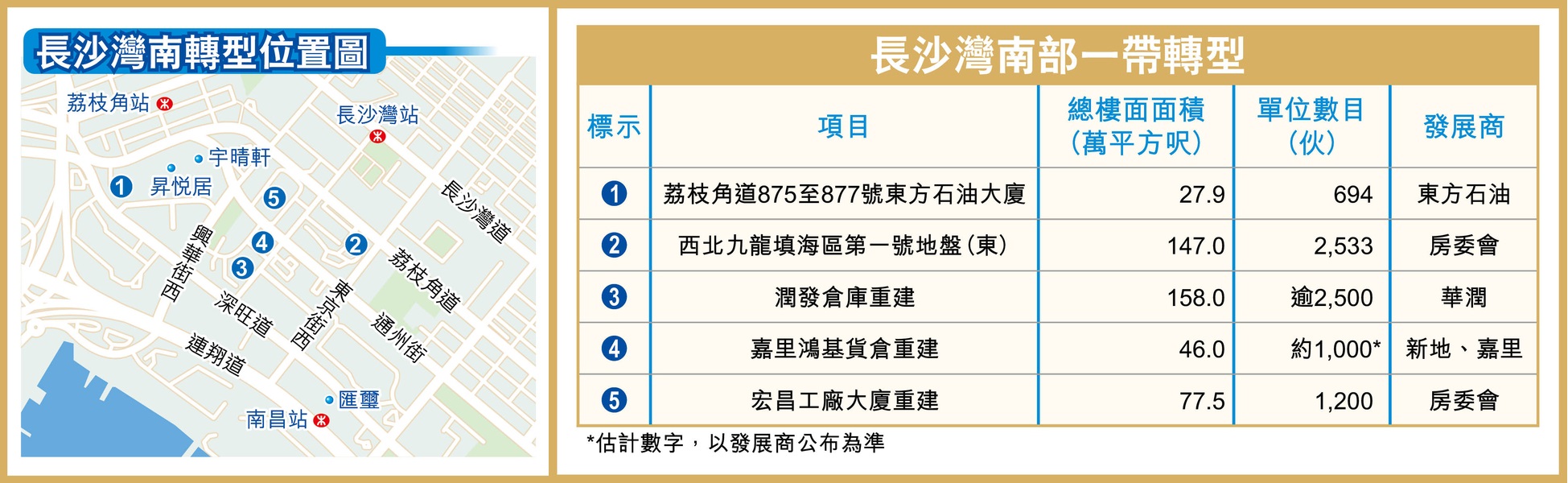

長沙灣南5項目 重建7927伙住宅

長沙灣過往屬傳統工業區,但近年正加速轉型,當中南面、近港鐵南昌站一帶不少工廈、貨倉等正重建成住宅發展,目前區內有5個重建項目,估計將可提供逾7,900伙公、私營房屋。

長沙灣工業區若果以荔枝角道作為分界,北面長沙灣道、近港鐵荔枝角站一帶,近年正在轉型成為商貿地區,不少舊式工廈均在重建、翻新成為新商廈。至於荔枝角道以南,由泓景臺至東京街、深旺道一帶,當年有不少船廠、貨倉林立,亦成功轉型成為住宅區,當中泓景臺、昇悅居等大型屋苑前身亦為船廠用地,區內私樓星匯居亦是由工廈重建而成。

公私營各佔一半

目前長沙灣南部至少有5個住宅項目正在發展,涉及單位約7,927伙,公、私營房屋大約各佔一半,不少前身亦屬工廈或貨倉,在重建後將會令該區煥然一新。

潤發倉庫住宅樓面148萬呎 另設商舖

當中位於發祥街的嘉里鴻基貨倉、潤發倉庫,現時屬於綜合發展區規劃,早於1998年已提出,並曾經在2000年獲批准重建,但再改方案將分為2個地盤進行重建,總樓面超過約200萬平方呎。而由華潤置地 (01109) 夥母公司華潤集團合作的潤發倉庫,則在較早前公布跟政府達成換地協議,並會補地價約137.3億元,將現有貨倉重建成大型商住項目,總樓面面積達158萬平方呎,每呎樓面補地價約8,692元。當中住宅佔逾148萬平方呎,將提供約2,500伙,另設10萬平方呎的非住宅樓面包括商舖。

隨着潤發倉庫落實補地價,預計對於旁邊的嘉里鴻基貨倉重建起帶動作用。嘉里鴻基貨倉由新地 (00016) 、嘉里 (00683) 合作發展,預計重建後總樓面約46萬平方呎,將可提供逾1,000個單位。另外,由東方石油持有的東方石油大廈,亦在多年前獲批重建成2幢樓高39層住宅,將提供約694個中、大型單位。

除了私樓之外,房委會亦在區內有不少公營房屋項目,當中屬於近年宣布收回重建的宏昌工廠大廈,將以最高地積比率9倍發展2幢住宅,提供約1,200個單位,預計容納約3,240人,料2030或2031年落成。

(經濟日報)

基金斥8.5億購長沙灣全幢工廈

長沙灣荔枝角道以北一帶,近年轉型成商業區,吸引不少基金注意,當中私募基金黑石 (Blackstone) 以約8.5億元購入區內工廈全幢;而新加坡基金則以近31億元購入永康街商廈地盤一半權益。

黑石夥迷你倉集團建商廈

黑石於去年10月購入的永新工業大廈全幢,上址位於荔枝角道850至870號,物業樓齡約45年,地盤面積約1.51萬平方呎,現有樓面約15萬平方呎,由黑石夥迷你倉集團合資入市,以購入價約8.5億元計算,平均呎價約5,700元。

據資料顯示,該地盤曾申請將地積比率提高至14.4倍重建,興建1幢26層高 (包括4層地庫) 的商廈,作為寫字樓、食肆、商店及服務行業用途,總樓面涉約21.5萬平方呎。

至於新世界 (00017) 持有的永康街項目,亦在去年9月底沽出51%權益出售予新加坡基金Ares SSG Capital Management,作價近31億元。上址地盤正重建成1幢商廈,可售面積約27.5萬平方呎,將於今年落成。而新世界將負責興建、管理及銷售該項目。

(經濟日報)

One Innovale at Fan Ling poised to restart sales

One Innovale-Bellevue, the second phase of One Innovale in Fan Ling, is poised to restart sales.

The developer Henderson Land (0012) plans to sell 82 flats in phase 2 of One Innovale-Bellevue at prices ranging between HK$3.33 and HK$7.01 million.

From this Saturday, 82 flats on price lists will be available at an average price of HK$14,883 per square foot after discounts.

The 82 flats on offer come from previous price lists and include studio to three-bedroom units with areas ranging from 228 to 501 sq ft.

The prices, discounted by up to 7 percent, range from HK$3.33 million to HK$7.01 million, or HK$13,681 to HK$16,172 per sq ft.

Of the available units, the most affordable is flat 12 on the first floor of Tower C, which is a 228-sq-ft studio with a discounted price of HK$14,611 per sq ft.

The best value for price per sq ft is flat 18, a two-bedroom apartment on the same floor, with a discounted price of HK$13,681 per sq ft and an area of 477 sq ft, amounting to about HK$6.52 million.

Since its launch in September last year, One Innovale-Bellevue has sold 297 flats, making up 73 percent of the total 408 units in this phase and bringing in more than HK$1.5 billion in revenue for Henderson Land.

Meanwhile, Sun Hung Kai Properties' (0016) Victoria Harbour project in North Point will launch a tender for six four-bedroom units in Tower 5 on Saturday.

The six flats have areas ranging from 1,488 to 1,602 sq ft and feature a private lobby with a lift.

In other new projects, The Vertex, a project by Twin City Holdings in Cheung Sha Wan, recorded six deals in the first three days of sales by tender.

The average sales price was more than HK$22,222 per sq ft, earning the developer a total of HK$51 billion.

In the commercial market, a 500-sq-ft shop on Prat Avenue in Tsim Sha Tsui sold for around HK$45 million or HK$90,000 per sq ft, along with a lease contract.

The seller lost more than HK$8 million after purchasing it in 2018 for over HK$53 million, with the shop's value depreciating by more than 15 percent over the four-year period.

(The Standard)

小蠔灣1期3標書 港鐵項目8年最少

長實會德豐新地競投 估值39.4億起

屬於未來大型住宅供應來源之一的港鐵 (00066) 大嶼山小蠔灣項目第1期昨日截標,僅接獲3份標書,主要吸引大型發展商入標,標書數目亦屬港鐵項目約8年來最少。業內人士認為,這反映發展商投地時充滿戒心,尤其大型項目。

項目於昨日下午2時截收標書,港鐵公布,項目昨共接獲3份標書,港鐵公司將詳細考慮收到的標書文件,並於稍後公布招標結果。

去年接獲33份意向書

據昨日現場所見,有3個財團到場入標,包括長實 (01113) 、會德豐及新地 (00016) 。事實上,項目於去年12月時,共接獲33份意向書,反應相當不俗,惟是次入標的反應則明顯轉淡,僅接3份標書。資料顯示,是次接獲的標書數目,屬於2014年4月同屬港鐵項目日出康城4期後最少,當年標書數目同為3份。

會德豐地產物業發展高級經理何偉錦表示,集團是次獨資入標,鑑於項目屬於新發展區,而集團在日出康城亦有發展經驗,看好小蠔灣項目未來發展潛力,又指出價已經考慮各類因素。對於近期發展商投地時出價較低,亦有地皮接連流標,他就認為這反映目前市況。

業界指項目規模大 有戒心

有代理認為,是次招標反應符合預期,因為項目規模大,屬於長綫投資,加上目前樓市充斥不利因素,發展商投地時十分有戒心。該代理又直言,目前土地供應量大大增加,對於壓低樓市可謂「萬試萬靈」。

有測量師表示,鑑於項目屬於港鐵項目,一般而言較其他遠離鐵路站的流標風險低,但若不幸流標,會影響日後項目其他期數的招標進度及短期內的政府土地招標反應,對後市影響頗深遠。

是次招標項目的總樓面達約131.3萬平方呎,截標前市場估值約39.4億至60億元,每平方呎樓面地價約3,000至4,570元。

(經濟日報)

市建西營盤項目中標價高次標22%

去年底由長實以11.61億投得的市建局西營盤皇后大道西/賢居里項目,該局昨日公布其餘6份落選標價,出價介乎7.08億至9.5億,呎價約5826至7817元,而中標價較次標高出約22.2%,可見長實出價進取。

該項目在去年11月底共接獲7份標書,市建局於同年12月中旬批出項目發展權,最終長實以11.61億力壓6財團奪得項目,當時每方呎樓面地價約9554元。市建局以不具名方式,公布其餘6份落選標價,首兩標出價已見差距,其中次標出價約9.5億,與中標價相差約2.11億,樓面呎價則約7817元,首標較次標僅高約22.2%。

次標出價9.5億

緊隨其後為9.08749億,與中標價相差約27.8%;同時有4標出價不足9億,當中最低入標價僅7.08億,與中標價相差約4.53億,差幅達約64%,樓面呎價僅約5826元。

市場消息指出,項目售樓收益達35億,中標財團便須與市建局分紅,固定分紅40%,若以項目總樓面約12.15萬方呎計,相當於每方呎售價約2.88萬便需要分紅,對比今年8月批出的崇慶里/桂香街發展項目當時每方呎售價逾3.16萬便需要分紅為少。

另外,發展商亦需向市建局自行提出「一口價」建議,將成為勝負的關鍵。該項目設有限呎條款,住宅單位面積不得少於300方呎,同時規定至少一半的單位面積不可超過480方呎。

項目位於皇后大道西129至151號,鄰近港鐵西營盤站。市建局2018年3月展開上述項目,並於2019年8月以實用面積每方呎24051元向小業主提出收購價建議。項目地盤面積約1.69萬方呎,可建總樓面約12.15萬方呎。

(星島日報)

Oyster Bay gets only three bids

MTR Corporation (0066) received only three bids for phase 1 of its Oyster Bay/Siu Ho Wan property development - lower than market expectations - when the tender closed yesterday.

CK Asset (1113) and Wheelock Properties were two of the bidders.

Wheelock said it remains positive about Oyster Bay's potential and has taken the recent withdrawal of previous projects into account while placing its bid.

Phase 1 will offer about 1,400 flats with 1.25 million square feet for residential use as well as 67,400 sq ft of retail space.

Market valuations range from HK$3.94 billion to HK$6.56 billion, or HK$3,000 to HK$5,000 per sq ft of floor area.

Surveyor says it is unlikely that the tender will be withdrawn as it is a key project, sitting atop a subway station. It had forecast eight bids at most, taking into account interest rate hikes.

Elsewhere, a residential site on Po Fung Road in Tsuen Wan will close bids tomorrow. The plot has a site area of 89,987 sq ft and an estimated buildable floor area of 314,309 sq ft.

Another surveyors expects the site to be valued at HK$1.41 billion or HK$4,500 per sq ft, which could be attractive for medium- or small-sized developers.

Meanwhile, the Urban Renewal Authority revealed that the second highest bid for its Queen's Road West/In Ku Lane development project was HK$950 million, 22.2 percent lower than the winner offer of HK$1.16 billion from CK Asset.

(The Standard)

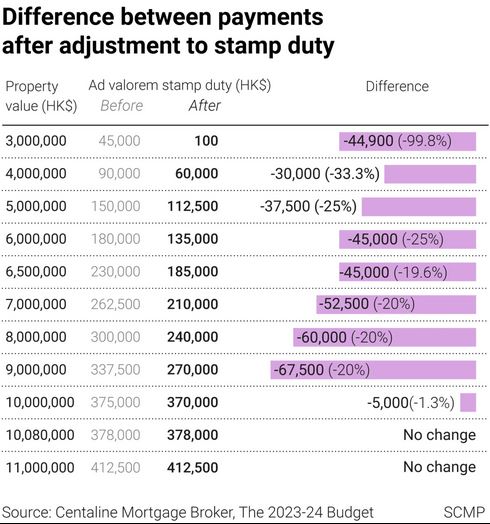

Property prices set to rise 10pc amid rebound

Morgan Stanley has raised the property price forecast for Hong Kong this year to a 10 percent rise from 5 percent earlier.

The number of transactions in the primary market will rebound by 28 percent and the secondary market by 15 percent in 2023 from a low base in 2022, as interest rate peaks and the border with the mainland reopened, the investment bank said.

Rents of street shops will also rise by 5 percent this year after a 7 percent drop in 2022 and retail sales growth projection is revised up by 6 percentage points to 15 percent as mainland tourists return to the city, it estimates.

Hong Kong Property Services is even more upbeat, expecting local home prices to rise up to 15 percent this year.

If the upcoming budget provides more stimulus to the economy or even cuts the stamp duty, new home transactions could soar by over 60 percent and second-hand transactions by over 20 percent, the agency said.

New home sales nearly doubled after the border reopened with China on January 8 compared to the previous 31 days started December 8 and overall home prices have increased 0.88 percent since the beginning of the year, its peer a property agency said.

In the primary market, meanwhile, Sun Hung Kai Properties (0016) said the sales brochure of phase 2B of Novo Land in Tuen Mun will be released next week and sales could take place as soon as this month. Showrooms will open next week and the first price list may be unveiled as well, the developer said.

The project, atop a mall, provides 729 flats.

In Ap Lei Chau, Chuang's China Investments (0298) has named its new project - which includes 105 flats with sizes ranging from 205 to 317 square feet - as Aruna. The flats include 20 studios, 77 one-bedroom and eight special units. The sales brochure will be released next week and sales could be launched in the quarter, the developer said.

In Tseung Kwan O, Nan Fung Group has trimmed the maximum discount for 54 flats at LP10 by 1 percent, according to its updated price lists.

In Tai Kok Tsui, 18 flats at The Quinn Square Mile will be put on the market on Sunday, the developer Henderson Land Development (0012) said.

Ranging from 206 to 382 sq ft, the flats are priced at between HK$4.68 million and HK$8.88 million after discounts, or from HK$22,385 to HK$26,220 per sq ft.

In Cheung Sha Wan, Grand Victoria II, co-developed by Sino Land (0083) and others, sold five homes yesterday for a total of HK$77.38 million.

(The Standard)中環中心每呎40元租出

近期商廈租賃漸活躍,中環指標商廈中環中心剛租出一個單位,呎租40元,較去年低位升逾10%。

租金較去年低位升逾10%

上址為中環中心2210室,交吉逾1年,以每呎45元放租,議價後以每呎40元租出,月租7.24萬,該單位望城市景,同類型單位於去年11月及12月低潮時,呎租普遍低於35元。

其中39樓1室,建築面積2726方呎,去年11月以每呎約32元租出,為該廈13年來新低;而且,39樓樓層較22樓為高,景觀較開揚,可見最新租金較低位反彈,幅度超過10%。

雖然租金略為上升,該業主於2019年以6335萬購入2210室,回報僅約1.37厘。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

香港與內地全面通關,帶動商廈氣氛,有業主趁勢放售,金鐘遠東金融中心高層單位放售,意向價約7050萬,每方呎約2.88萬。

力寶禮頓大廈呎價2.2萬放售

有代理表示,金鐘夏愨道16號遠東金融中心高層1室,面積約2449方呎,意向價約7050萬,平均每方呎約2.88萬,上述單位呎價為該廈全幢最平,迅即接獲多個查詢及洽購表態,該單位間隔四正,外望維港景及城市景

另一代理表示,銅鑼灣禮頓道103號力寶禮頓大廈中層A01室,建築面積約1132方呎,意向價約2490.4萬,平均每呎約2.2萬,意向租金約3.96萬,呎租約35元。該單位間隔四正,外望園景,附設寫字樓裝修,買家可即買即用。

(星島日報)

更多遠東金融中心寫字樓出售樓盤資訊請參閱:遠東金融中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多力寶禮頓大廈寫字樓出售樓盤資訊請參閱:力寶禮頓大廈寫字樓出售

更多銅鑼灣區甲級寫字樓出售樓盤資訊請參閱:銅鑼灣區甲級寫字樓出售

太古廣場去年續約租金 減租18%

太古坊二座租用率升至56% 呎租略低一座

太古地產 (01972) 公布去年第四季營運數據,香港寫字樓旗艦項目太古廣場 2022年全年租金調幅為-18%,與首3季數據一致。

另一方面,鰂魚涌太古坊二座去年9月落成,太古地產首次披露,該物業至去年底租用率為53%,每平方呎租金為50中位至60高位,略低於同區較新的港島東中心及太古坊一座的50中位至70低位。

太古地產補充,截至最新數據,太古坊二座租用率升至56%,目前租戶包括瑞士寶盛、東方匯理香港、巴斯夫集團、波士頓顧問公司、中信銀行 (國際),以及Ankura Consulting等。

截至去年底,太古廣場一、二座最新每平方呎租金現為100至120元,三座呎租為95元,與前一季度大致相若。出租率方面,截至去年底,太古廣場和整體太古坊物業租用率分別為97%和96%,較前一年同期約跌1個百分點。

太地:港人外遊 致消費力外流

內地物業方面,三大主要寫字樓物業--太古滙辦公樓、頤堤港一座、香港興業中心一座及二座租用率介乎94%至99%,與前一年度相若。

零售物業組合方面,太古廣場購物商場、東薈城名店倉第四季零售銷售額增長加快,全年銷售額增長分別為1.9%和3.8%,高於首三季增長1.5%和1.7%。不過,太古城中心銷售額跌幅由首3季的4.3%,擴大至全年的5.3%。

太古地產指,去年第四季香港市場消費氣氛改善,但出境旅遊活動恢復令消費力外流,零售業短期內受到影響,整體市場需要一段時間才能夠明顯改善。

公司續稱,有信心現時旅遊限制完全解除後,零售市場會得到更有力支持,會繼續提升租戶組合、優化會員計劃。

內地新春奢侈品銷售 顯著回升

內地去年底疫情升溫,北京三里屯太古里、頤堤港項目的零售銷售額跌幅,都由首三季跌21%至24%,擴大至全年跌逾25%。廣州太古滙銷售額跌幅,更由首三季僅跌2%,急擴大至全年跌10.5%。

成都遠洋太古里、上海興業太古滙第四季銷售額則有所改善,全年跌幅分別為15.4%和35.7%。

太古地產稱,內地防控措施於12月放寬,商場人流及整體零售額隨即好轉,新年及新春期間的人流更回升至2022年實施嚴格防控措施前的水平,當中奢侈品、餐飲和生活消閒類別銷售額錄得顯著回升。

太古地產股價昨跟隨大市上市,收報21.2元,升1%,成交額6,310萬元。

(經濟日報)

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多港島東中心寫字樓出租樓盤資訊請參閱:港島東中心寫字樓出租

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

1月工商舖259成交 連跌兩月回升

根據一間本地代理行綜合土地註冊處資料顯示,1月份工商舖註冊量共錄259宗,較去年12月223宗按月升16.1%,連跌2個月後首度回升,而註冊金額則錄約32.04億元,按月下跌約64.3%,主要原因是1月份註冊個案主要反映12月份市況,當時受長假期及未全面通關等因素影響,拖低成交金額,呈量升價跌的趨勢。

1月份工商舖各板塊註冊宗數全綫上升。工廈及商舖表現較佳,註冊量分別按月升約10.4%及29.2%,最新分別錄127及84宗。商廈註冊量按月升約11.6%,錄得48宗。雖然市場氣氛逐漸回暖令註冊量增加,但投資者態度仍趨審慎,交投增長速度未明顯回升,預料整體註冊量及註冊金額未能在短期內回復到疫情前的水平。

細銀碼物業普遍錄升幅

若按金額劃分,1月份註冊量最多的為500萬元或以下物業,共錄134宗,按月上升約15.5%,其次為逾500萬元以上至2,000萬元的物業,共錄88宗,按月升約7.3%。在逾億元買賣註冊成交方面,月內僅錄2宗,其中商廈及舖位物業註冊各佔1宗,商廈為金鐘海富中心二座 15樓全層,以約1.88億元成交,平均呎價約1.77萬元,較高峰期回落約4成,屬低於市價的成交。同時,舖位亦錄得較貴重成交,由本地發展商新世界及恒地共同發展的西營盤瑧璈,其基座商場亦以2億元成交。

踏入兔年,終於迎來憧憬多時的中港通關,加上長假期結束及社會有序復常,展望全年工商舖成交量回升至5,800宗,較去年增加約3成。該行代理表示,國務院港澳事務辦公室宣布自2月6日起全面恢復內地與港澳人員往來,並取消出入境預約通關安排達致中港全面通關、恢復內地居民赴港澳旅行團,相信優化措施能吸引旅客來港,重振本港零售業及旅遊業,可望帶動核心區商舖表現。代理續指,財政預算案快將出爐,如有更進一步招商引資的政策,將吸引中資及海外企業來港投資及設立據點,相關措施或對經濟及樓市有提振作用。

同時,美國聯儲局宣布加息0.25厘,顯示加息幅度放緩,有望改善市場氣氛。該代理認為,投資市場已逐漸適應後疫情時代,更了解各板塊物業的增長潛力及未來價值,而部分工商舖物業價格已累積一定跌幅,能吸引投資者趁低吸納。

(經濟日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

山頂馬己仙峽道地 逾40億快售

通關後大額豪宅買賣續現 近年最大額屋地

通關後接連出現豪宅大額買賣,消息指,由老牌家族持有山頂馬己仙峽道地皮,獲本地財團以逾40億元洽購至尾聲,預計短期內成交,樓面地價高見約10萬元,成為通關後最大額買賣。

傳統豪宅地段地皮非常罕有,市場人士指,由馬來西亞「錫礦大王」陸佑家族持有,馬己仙峽道30至38號地皮,早前獲本地財團積極洽購,雙方已達成協議,預計快將易手。該地皮位於山頂,盡享地勢,現時享維港景,加上地盤面積約66,650平方呎,可重建4至5間獨立屋,私隱度極高,重建後單位可享全維港海景。

據了解,業主早於2019年中,曾委託測量師行放售該地皮,當時叫價逾50億元,惟其後遇上疫情等被迫收回,直至近兩個月,中港正式通關消息帶動,本地財團重新洽購。

消息稱,是次洽購價約43億元,按物業可重建樓面面積約43,322平方呎計,每平方呎樓面地價約10萬元。買賣正式落實後,將成中港通關後,市場錄得最大額豪宅買賣,亦為近期單一獨立豪宅地段計最大手成交。而對上一宗大手屋地成交,為2018年華潤置地 (01109) 以59.29億元,購入南區壽山村道39號屋地,每平方呎樓面地價約8.6萬。

「錫礦大王」陸佑家族持有

翻查資料,項目現為金馬倫大廈,由數幢低密度住宅組成,由馬來西亞華僑「錫礦大王」陸佑家族持有多年,現時家族成員自用作住所外,部分分層單位作收租用途。該家族亦持有不少香港貴重物業,包括中環、上環全幢寫字樓。

事實上,項目前身亦有一段歷史。據悉,二戰期間日軍佔領香港,曾於該地建造「忠靈塔」,紀念戰死的日本官兵,該塔原打算建至80米高,並於1942年動土,數年後日本戰敗投降,英軍於1947年將之炸毁,而其基座仍保留,數年後財團在上面建成住宅。

山頂大型地皮甚罕有,2021年2月,山頂文輝道9及11號地皮,由九倉 (00004),夥拍信置 (00083) 主席黃志祥家族、中渝置地 (01224) 主席張松橋、「大劉」劉鑾雄妻「甘比」及胞弟劉鑾鴻以72.5億元投得,每呎樓面地價50,010元,當時打破全港住宅官地呎價新高。

而附近地段亦不乏大手成交,包括長實 (01113) 去年尾,以公司股份轉售方式,出售波老道21號項目未售出的152個住宅單位予新加坡基金,涉逾207.66億。另去年尾,港島山頂道8號第A2座頂層A室複式戶,實用面積3,306平方呎,另設平台、天台連私人泳池,成交價約4.1億元,呎價逾12.4萬元,可見山頂豪宅造價理想。

業界:本地客趁低價入市增

有外資代理行代理分析,通關後即使內地資金未有即時流入,整體市場氣氛明顯向好,而整體豪宅去年亦因加息等因素影響,價格有少許調整,但市場資金仍充裕,只是等待入市機會。代理指,現時加息放緩,加上中港通關,本地豪宅投資者及用家為免日後價格急升,便開始積極出價入市,相信整體豪宅買賣將上升。

(經濟日報)

Hong Kong’s commercial property market set for tough first half as high interest rates subdue demand, says MSCI analyst

Investment volumes will be subdued for the next few months, falling some way below where they were even in 2022, says MSCI’s head of Asia real assets research

Investors such as the late ‘shop king’ Tang Shing-bor’s family have been offloading properties at massive losses

Hong Kong’s beleaguered commercial property investment market is likely to take a further hit as higher borrowing costs dent demand in the first half of this year, according to an analyst at MSCI, as some investors take massive losses.

Property investment volumes will be subdued for the next few months, falling some way below where they were even in 2022, said Benjamin Chow, head of Asia real assets research at the financial data company.

“That is largely because at the start of 2022, the full impact of the interest rate hikes was not yet felt so it only came towards the end of the year,” Chow said. “And obviously, Hong Kong’s monetary policy and exchange rate policy is, in some sense, quite heavily influenced by the US.”

Earlier this month, the Hong Kong Monetary Authority raised the city’s base rate by 25 basis points to a 15-year high of 5 per cent in lockstep with the US Federal Reserve to maintain the local currency’s peg to the US dollar.

Chow’s pessimistic forecast comes after deal-making in Hong Kong and other markets in the region endured a dire 2022, according to a report on Thursday from MSCI Real Assets, a part of MSCI.

For the whole year, activity dropped by 41 per cent to just US$6.7 billion. Trading of offices continued to languish throughout 2022, with rising interest rates squeezing rental rates for office assets in the central business district.

“Given the adjustments started to happen in the middle of last year, we would expect at least 12 months of subdued investment activity,” said Chow. “The quicker markets will start to pick up in the third quarter, and the slower ones may not pick up until 2024.”

That prediction is based on how quickly prices and volumes adjusted in previous cycles such as that triggered by the global financial crisis, he said.

Chow’s expectations are in stark contrast to a recent forecast by a property consultancy, which predicts growth of 10 to 15 per cent in the total transaction volume of commercial properties in 2023.

Chow expects the prices of commercial real estate to fall as financing costs increase, but declined to say by how much. Prices in both the office and retail sectors have already fallen by about 20 to 25 per cent, he said.

“[The decline] is probably going to be a bit harsher for Hong Kong compared to some of the other markets,” he said.

Notably, investors such as the late “shop king” Tang Shing-bor’s family and Hoixe Cake Shop’s co-founder have been offloading properties at massive losses.

At least seven properties belonging to Hoixe and its co-founder Siu Wai-kin have been sold this year – some of them by creditors – for a total of HK$476 million (US$60.64 million), according to agents. The first six incurred a loss of HK$20.3 million between them, according to Bridgeway Prime Shop Fund Management.

Hoixe did not respond to the Post’s request for comment.

Tang’s family has sold dozens of properties in recent years, some of them at huge losses. They sold a shop on Jordan Road for HK$46 million (US$5.86 million) in the last few days – a loss of HK$18 million over 10 years, according to agents.

A spokeswoman for Stan Group, the company chaired by Tang’s son, Stan Tang, declined to comment.

“A number of these have been sold at losses, while some have barely broken even,” said Chow. “They [the Tang family] even sold a senior housing property last year, so essentially they are really clearing out their entire portfolio and downsizing it very significantly.”

Institutional investment managers and funds that have a specific period of investment of perhaps five or seven years might start to feel the pressure, if they have already held on to a particular asset for four years or more.

Even though most of Hong Kong’s traditional commercial sectors continued to contract in 2022, Chow said hotel investment volumes had posted strong year-on-year gains, driven by deals involving assets intended for repositioning for different uses.

Similarly, the value of rental apartments acquired for investment – as opposed to redevelopment – also grew significantly, breaching the HK$1 billion mark for the first time.

(South China Morning Post)

Mainland homebuyers offered low rate, rebates

A mainland bank in Hong Kong is said to be offering attractive mortgage rates and cash rebates to lure mainlanders looking to buy homes in the city, according to local media reports.

The move could help boost stamp duty revenues at a time when the market is gaining momentum.

Without naming the bank, the reports said it was offering a mortgage rate of 3.225 percent - the lowest in the city - and additional discounts for mainland customers to increase its market share.

The lowered rate could slash off HK$413 in repayments each month for a homebuyer who borrows HK$5 million with a 30-year term, compared with the lowest cap rate of 3.375 percent for the mortgage plan based on the Hong Kong Inter-bank offered rate.

The move comes when the market share of small and mid-sized banks slid 50 basis points monthly to 32.6 percent in January, further solidifying the dominance of four major local lenders.

Banks will offer various benefits, including lower mortgage rates and cash rebate, to attract new clients, a mortgage broker said.

Meanwhile, Hong Kong's stamp duty revenue plunged 40 percent month-on-month in January to HK$334 million even after the border reopened, data from the Inland Revenue Department showed.

While the number of cases involving stamp duties rose 8.3 percent monthly to 157 in January, buyer's stamp duty, which mainly targets investors from mainland China and companies in property purchases, fell 2.9 percent monthly to 34 transactions, a new low in three months.

But it is expected to rebound in the coming months.

A property agency said more mainland investors will come to Hong Kong after the full reopening of the border, though it might take time.

And more new homes are on the way.

Wheelock Properties said it will unveil the first batch of flats at Koko Rosso in Lam Tin, offering at least 80 units.

Sun Hung Kai Properties (0016) plans to release the first price list of Novo Land's phase 2B in Tuen Mun next week. The whole phase will offer 729 units.

Moreover, the Buildings Department approved eight building plans in December, including one by Swire Properties (1972) to build a three-storey single-family house on the Peak.

Separately, Swire Properties saw the occupancy rate in its Hong Kong office portfolio fall a percentage point to 96 percent but remain flat in its retail portfolio as of the end of last year compared to 12 months earlier.

Another agency anticipates investment demand for offices will remain weak this year due to the high vacancy rate and glut in the market, while China's reopening will boost the investment in retail property in Hong Kong.

(The Standard)工商鋪錄1169宗租賃按月跌7.2%

有代理行統計,1月份市場共錄約1169宗工商鋪租賃,按月微跌約7.2%,按年減少約33.8%,1月總租賃金額約7953萬,按月回升近20%,按年下滑約30%,主因新年假期影響,令租務有所放緩。

代理行:上水區錄13宗鋪位租賃

1月份商鋪反彈力度明顯,共錄約265宗租賃,對比2022年12月份上調約2.7%,金額錄約3089萬,按月急升逾兩成,上水區租賃宗數回升,資料顯示,12月份及1月份均錄13宗成交,較過去按月單位數字明顯上揚,2月份首9日亦錄約6宗成交,反映租賃活躍。

新康街地鋪每呎95元租出

上水新康街20號地下連入則閣,地鋪面積約1000方呎,閣樓面積約800方呎,總面積約1800方呎,獲零售商以月租約9.5萬承租,平均呎租約95元 (不計閣樓)。原業主早前以每月約8萬元招租,獲多組準租客洽租,新租金較意向月租高出約18.7%。

隨着疫情漸穩,加上通關效應,香港已邁向復常之路,該行代理表示,不少企業及商戶看好經濟前景,已加快步伐趕在市況全面回升前入市,故帶動租賃需求有所上升。

日本大型連鎖雜貨店擴充步伐不斷,新近以月租約22萬元承租荃灣如心廣場2座25樓1至2室,涉及面積約10418方呎,平均呎租約21元。資料顯示,原租客為成衣製造商,舊月租約21.8萬,對比下輕微增長0.9%。

受惠通關效應,本港經濟前景將更見明朗,工商鋪物業租賃交投量會逐步回升,價格亦會持續上揚,預料工廈及寫字樓租賃市場,亦會跟隨大市向好走勢,價量穩步上揚。

(星島日報)

通關效應 嘉里料商廈租務加快

旗下企業廣場全層 共享空間theDesk租用

通關後經濟活動漸復常,嘉里 (00683) 表示,旗下九龍灣企業廣場五期商廈部分,出租率逾9成,料通關後租務活動加快,而物業其中一層獲共享工作空間theDesk租用,該品牌指靈活辦公興起,尚有擴充空間。

過去數年受疫情衝擊,整體商廈空置率上升,而九龍灣企業廣場五期商廈部分,早前有大租客DHL遷出,空置率曾一度上升。不過,據悉項目獲政府部門、共享空間等租用,出租率改善。嘉里商業項目高級總監吳鎧廷指出,企業廣場五期兩幢商廈,涉及50萬平方呎樓面,現時出租率逾9成,平均呎租約25元。

企業廣場五期 出租率逾9成

吳鎧廷表示,中港通關後,因很多機構重啟擴充計劃,故相信租務市場好轉。今年為商廈供應高峰期,他指對業主來說,最重要是經濟基調向好,而企業廣場五期其中一大優勢,是啟德前景理想,因有多個大型住宅項目落成,對商業樓面同樣有需求,料今年租金平穩。

集團早前把物業1座26樓全層,租予共享工作空間theDesk,他透露是次與租客屬合作形式,theDesk用戶可以享有優惠,並在Megabox商場舉行推廣活動等,屬互相配合。

theDesk是次租用樓面約1.7萬平方呎,提供13間私人辦公室外,座位數量合共達250個,另提供會議室、咖啡店及瑜伽房等,月費由3,300元起。

theDesk租1.7萬呎 月費3300起

theDesk行政總裁及聯合創辦人許指,品牌現在港擁14間分店,會員人數達5千。他透露,過往3年疫情下,會員增長理想,去年增長更加達100%,而大部分營運一年以上的分店,出租率均逾9成。

許認為,疫情下更加推動靈活辦公,企業亦要在不同地區,提供彈性工作空間滿足員工需求,故未來集團仍有擴充空間。他認為,與商廈大業主合作好處,是適合中小企租用樓面,如涉及2至3人,或2至3個月租期的公司,可以互相配合。

疫情緩和後零售氣氛轉好,吳鎧廷指出,九龍灣Megabox商場出租率達92%,而他指新春期間人流及生意,大致上已回復前疫情前水平。

(經濟日報)

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

黃竹坑全幢工廈放售 意向價12億

黃竹坑商業前景理想,現業主放售區內科達設計中心全幢工廈,意向價約12億元。

29層高 呎價約1.02萬

有代理表示,有業主放售黃竹坑黃竹坑道62號科達設計中心。物業為一幢29層高的新型商貿工廈,總批積面積約11.7萬平方呎。大廈設有5個貨車位及8個私家車車位,地下層高達5.57米,樓上層高約4米。據悉,物業市值約12億元,呎價約1.02萬元。

該代理指,物業位處黃竹坑之主要幹道黃竹坑道,鄰近黃竹坑港鐵站,隨着該站上蓋住宅項目及大型商場配套相繼落成,住宅陸續入伙,將帶動和增加整個區份人口和消費力。代理提到,該區只有23幢全幢統一業權之工商廈,當中2幢將發展為酒店,餘下業主大多為只租不賣,願意全幢出售的不多。

近日同區有新商廈拆售,宏基資本 (02288) 旗下黃竹坑道23號宏基匯,近日正式推出,樓高27層,2至5樓作零售用途,6至29樓則為寫字樓用途,單位建築面積由約747至6,187平方呎,意向呎價約1.3萬元起。

據悉,目前已錄數宗成交,包括1205室,面積約801平方呎,以每呎約1.3萬元易手,另高層單位亦以每呎1.5萬元售出。

(經濟日報)

Sentiment improving despite rental index drop

Sentiment in both the primary and secondary property markets in Hong Kong improved over the weekend although a rental index showed that local rents dropped to a level from six-and-a-half years ago.

VMS Group sold three units at The Vertex in Cheung Sha Wan at an average price of HK$22,500 per square foot over the weekend, raking in a total of HK$39 million. More than 400 groups of buyers visited its showrooms during the weekend.

Also in the area, the Grand Victoria series, which is developed by Sino Land (0083) and others, sold seven homes over the weekend for more than HK$120 million.

In Tseung Kwan O, Kowloon Development's (0034) Manor Hill sold at least eight homes for a total of HK$44 million in the latest round of sales of 36 units yesterday. Among the deals was a 203-square-foot unit sold for HK$4.7 million - or HK$23,172 per sq ft.

In Fanling, Henderson Land Development (0012) sold 21 units at its One Innovale project over the weekend, raking in over HK$99.05 million. Among these, 12 homes, worth HK$57.15 million, were from One Innovale - Bellevue - phase two of the project. And One Innovale - Cabanna, in phase 3 saw a 337-sq-ft flat fetch HK$4.71 million or HK$13,966 per sq ft.

In Kai Tak, Pano Harbour recorded three deals on Saturday, with the developers, China Resources Land (Overseas) and Poly Property (0119), raking in more than HK$100 million. A 950 sq ft three-bedroom flat was purchased for HK$37.11 million together with a parking spot.

In the second-hand market, a property agency said the top 10 blue chip estates recorded 24 deals over the weekend - up by two cases from a week ago. Positive news, including the fully reopened border with the mainland, has continued to boost the market sentiment and the upward trend will continue, an agent said.

But the agency’s rental index fell 0.42 percent last month to 108.13 points amid the Lunar New Year holidays - the lowest since August 2016. The index has fallen by 4.11 percent in total over the past five months, the agency said.

(The Standard)觀塘 KOHO 全幢商廈17億沽 新世界售非核心物業8年升值7%

本港與內地通關後,近期市況漸有起色,大手買賣漸活躍,繼早前沽出新蒲崗全幢酒店,新世界再趁勢減磅,沽售旗下觀塘鴻圖道 KOHO 全幢商廈,作價約17億,平均呎價約7766元,物業8年間升值約7%。

近年積極放售旗下非核心物業的新世界,近期再有新動作,市場消息透露,旗下觀塘鴻圖道73至75號 KOHO 商廈,亦覓得新買家,全幢以約17億易手,以總樓面約21.89萬計算,平均呎價約7766元,新買家為收租客,預料回報約4厘,物業以買賣公司形式進行,買家無需支付相等於樓價4.25%釐印費。

平均呎價7766元

KOHO 位於鴻圖道73至75號,前身為建大工業大廈,樓高13層,1樓至12樓為寫字樓,地下則為停車場及商店,每層面積由1.6萬至2.45萬方呎,地下為停車場及商店,2013年,鵬里資產以9.8億購入建大工業大廈,將之活化為寫字樓,成為區內首幢活化工廈項目,工程費用約1.7億,並將大廈易名 KOHO (KOwloon Head Office),2014年10月,由新世界以約16億承接,今番沽售帳面獲利約1億,物業於8年間升約7%。

KOHO 位處地段現規劃「其他指定 (商貿)」用途,佔地約2萬方呎,去年9月,新世界向城規會申請放寬地積比率,由12倍放寬至14.4倍,將該廈重建為1幢樓高33層的商廈 (另4層地庫停車場) 提供辦公室及商店等,總樓面約28.8萬方呎,較現有樓面多逾30%,近期,獲規劃署亦不反對申請。

屬工廈活化寫字樓項目

新世界於去年12月,亦沽出新蒲崗九龍貝爾特酒店,作價20億,佔地約23800方呎,設有約690間客房,買家為美國私募基金AG夥拍宏安地產。

有代理表示,觀塘開源道55號開聯工業中心1樓,建築面積約5710方呎,以3540萬放售,平均呎價約6200元,該單位可從地下由樓梯直達,低層用途廣闊,可申請食堂、教育或者作零售用途。

該單位擁寫字樓及貨倉裝修,設有會議室、洗手間及冷氣配備。大廈於1985年落成,設有雲石大堂,車場可入40呎貨櫃。開聯工業中心位處觀塘開源道,工商廈及酒店林立。

觀塘鴻圖道73至75號 KOHO 全幢,以約17億易手,新買家為收租客,預料回報約4厘。

(星島日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

灣仔卓凌中心1330萬售15年升值72%

資深投資者羅守輝旗下的TOYOMALL近期積極沽售,最新再沽出灣仔卓凌中心一個單位,作價1330萬,平均呎價8504元,15年間升值逾72%。

平均每呎8504元

上址為卓凌中心10樓A室,建築面積約1564方呎,以每呎約8504元易手,涉資1330萬,新買家購入物業,需支付相等於樓價4.25%釐印費,涉資約56.5萬,TOYOMALL於2008年以770.58萬購入該單位,平均每呎4927元,持貨15年,帳面獲利559.42萬,物業升值逾72%。

TOYOMALL早前沽售香港仔朗盈商業大廈基座,作價5200萬,買家為南記粉麵,亦是租客之一,今番轉租為買,持有物業自用兼收租。

南記粉麵購香港仔巨鋪

香港仔東勝道10號朗盈商業大廈1至4樓連平台,早前以5200萬易手,買家為南記粉麵,以月租14.15萬承租1樓,租約至今年4月,續約月租15.28萬至2024年4月,今番購入物業自用。1樓為德善醫療,月租3.5萬,租期至2024年4月,續約月租4.2萬至2027年4月。TOYOMALL早於2003年以600萬購入該物業,持貨19年,帳面獲利4780萬,物業升值近8倍。

(星島日報)

更多卓凌中心寫字樓出售樓盤資訊請參閱:卓凌中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

港鐵小蠔灣住宅項目流標收場

剛於上周四截標的港鐵小蠔灣車廠發展項目第1期,雖然有3家大型發展商入標,惟最終亦流標收場,港鐵昨日宣布決定不接納任何有關該項目的標書文件,並會於適當時間重新招標。業界人士認為,項目建築成本高,而樓市未完全復甦,加上屬「開荒牛」項目,具有一定難度,而且回本期相對較長,以致財團出價相對審慎,尤其是分紅比例更成為關鍵,最終導致項目流標。

港鐵小蠔灣是繼政府招標赤柱豪宅地及市建局觀塘商業項目後,於一個多月內第3幅地皮錄得流標個案,業界認為除了因疫情持續打擊外,樓價於去年跌幅高達15%亦是主要原因,加上樓市仍未完全復甦,導致發展商競標意欲低迷,特別是大型地皮項目,出價亦相對審慎及保守

一個多月連環3宗流標

一家大型發展商指出,今次小蠔灣項目流標,最主要是項目建築成本太高,發展商需要負責興建商場及車站等設施,加上日後商場建成更要交還港鐵,而且區內配套未必能夠配合首期項目,出現「開荒牛」項目性質,回本期長及極具挑戰,將來能夠「打和」更有難度,同時樓市仍未真正復甦,發展商出價審慎及分紅比例未符港鐵要求,自然有機會流標。

有測量師表示,過去港鐵車站上蓋發展項目甚少流標,對上一次可能要追溯至大圍站上蓋項目。該測量師又說,項目變數不太多,相信今次流標主要原因是項目位處新發展區,而且涉及規模較大,加上未來政府有不少土地推出招標,以致發展商出價較審慎,建議港鐵推措施降低發展商成本,例如港鐵自行負責興建車站設施,藉此增加項目吸引力。

回本期長 分紅比例未符要求

另一測量師亦認同,該項目規模比較大,而且小蠔灣屬於一個新發展區,發展商出價趨向保守,最後導致流標。測量師又說,其實小蠔灣地理上屬於一個策略性位置,但需要比較長期的發展及配套,發展商現階段對這個位置的期望比較保守,尤其是首期項目未必配合到車站即時開通。

有測量師表示,小蠔灣車廠發展項目第1期屬於「開荒牛」項目,發展商需要負責興建商場、平台及車站等設施,由於車站未必能夠配合項目首期即時通車,因此具有很大挑戰。測量師又說,作為整個項目的「開荒牛」,流標將會影響之後期數的進度。

據悉,小蠔灣車廠發展項目第1期不設補地價條款,惟入標發展商須提供「一口價」固定金額12億。另外,發展商須就分紅比例向港鐵自行提出建議,而分紅比例不設限制。此外,發展商須負責興建商場、平台及車站設施等,商場建成後須交還港鐵。項目於上周四截標,合共接獲3份標書,入標發展商包括長實、新地、會德豐地產。

(星島日報)

尖東永安廣場 交通便利配套齊

尖東一帶商廈林立,商業氣氛濃厚,永安廣場為區內甲級商業大廈,交通便利,飲食配套齊全。

永安廣場於1981年落成,樓齡約42年,樓高12層,地下至3樓為商舖,包括永安百貨佔用地下及地庫。物業4樓至12樓為寫字樓單位,寫字樓樓面面積近2.2萬平方呎。物業共設有6部客用升降機,可疏通人流。

L形設計 單位內籠四正

大廈設計呈「L」形,單位內籠四正,未有多餘角位。由於樓面較大,故可分間出15個單位,最細單位面積由1,000多平方呎起,適合不同用家。景觀方面,物業處臨海地段,單位擁全落地玻璃,向梳士巴利道單位,可望無遮擋海景景觀。另一邊單位望向漆咸道南一帶樓景及公園景,十分開揚。

交通方面,物業舉步直達港鐵尖東站及尖沙咀,附近亦設有巴士總站,提供多條行車路綫,直達港九新界,十分方便。

飲食配套方面,物業鄰近尖東海旁,大廈地下至尖沙咀中心、帝國中心等地下,均設有特色餐廳及酒吧,物業鄰近五星級酒店香格里拉,而尖東一帶亦有多間酒店,提供商務午餐。另外,步行5至10分鐘可到達K11 MUSEA商場,內有多間餐廳、商店等提供,配套齊備。

買賣方面,今年永安廣場今年暫錄1宗買賣成交,為物業低層03室,面積約1,200平方呎,以2,200萬元成交,呎價18,333元。物業去年錄3宗成交,去年6月,物業中層06室,面積約1,382平方呎,以1,769萬元易手,呎價12,800元。去年4月錄2宗成交,分別為中層06室,以及08至09室,面積約1,382及2,318平方呎,成交價1,520.2萬及2,230萬,呎價11,000元及9,620元。

(經濟日報)

更多永安廣場寫字樓出租樓盤資訊請參閱:永安廣場寫字樓出租

更多尖沙咀中心寫字樓出租樓盤資訊請參閱:尖沙咀中心寫字樓出租

更多帝國中心寫字樓出租樓盤資訊請參閱:帝國中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多永安廣場寫字樓出售樓盤資訊請參閱:永安廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

低層單位放租 意向呎租45

尖東永安廣場為尖沙咀東核心商業區的指標商業大廈,質素頗佳,物業低層單位正進行放租,意向呎租45元。

面積3151呎 逾14萬放租

有代理表示,有業主放租永安廣場低層04至05室,面積約3,151平方呎,現以14.18萬元放租,呎租約45元,單位主要享有開揚海景,同類供應甚為罕有。上一手租客為金融商業公司,室內裝修雅致,甚為寬闊,間隔四正,空間感十足。

物業去年租務成交表現不俗,共錄得17宗租務成交。最新一宗為高層03室,面積約913平方呎,成交呎租約35元。另外,11月份高層13室,面積約894平方呎,以每呎約26.7元租出。物業去年10月份共錄得3宗租務成交,當中,呎租最高屬中高層09室,面積約1,241平方呎,成交呎租約50元。

(經濟日報)

更多永安廣場寫字樓出租樓盤資訊請參閱:永安廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

Warmer price outlook drives One Stanley

K&K Property plans to sell by tender the luxury project One Stanley as early as the second quarter as sentiment in the property market has improved.

The smallest unit would be 800 square feet and the prices will refer to similar projects in the Southern District of Hong Kong Island, as well as Ap Lei Chau and Wong Chuk Hang.

The transaction price of the larger units had recently reached up to HK$50,000 a square foot, said Tony Cheng, the investment and sales director of K&K.

One Stanley is designed by Robert Stern, a New York City-based architect and the founding partner of the architecture firm Robert A M Stern Architects.

Stern has been the designer of many luxury projects in Hong Kong, including Mount Nicholson and The Morgan on the Peak.

One Stanley, a low-density project, has a site area of 272,300 sq ft and a buildable floor area of 226,000 sq ft, while the area with plantation is 81,000 sq ft, accounting for 30 percent of the total site.

The projects will offer 50 flats in 11 four-storey buildings and 32 independent houses.

Cheng predicts prices of luxury homes could rise 10 to 15 percent, compared with the estimated growth of 5-10 percent for other private homes, citing the rising transactions after China's reopening, the expected peak of interest rates in the third quarter and the Top Talent Pass scheme by the Hong Kong government.

In Kowloon Tong, a luxury house on Oxford Road is up for sale with an intended price of HK$450 million, or HK$58,000 per sq ft, an agent said.

Four houses on Plantation Road on The Peak jumped into the market by starting the tender sale this Friday.

For private homes, The Vertex in Cheung Sha Wan, held by Twin City, sold five more flats yesterday, cashing in HK$45 million, adding up to a total of 18 homes sold in one week. The manager of the project, VMS, will put four more flats on sale on Friday, with the size ranging from 408 to 439 sq ft.

And there are more new homes to come.

Star Group (1560) said the project After the Rain in Yuen Long expects to release the first price list in March, offering at least 67 units in the first batch for "reasonable" prices. And in Tuen Mun, Sun Hung Kai Properties (0016) will upload the prospectus of Novo Land 2B this week, involving 729 units.

(The Standard)

Hong Kong property developers dismiss investor confidence fears over national security law clauses in land sale documents

Land tender documents found to have clauses to warn potential buyers of disqualification for national security breaches

But real estate association says no objections registered from members and move would not affect bidding

Hong Kong property developers have dismissed fears about a drop in investor confidence after the authorities added national security clauses to land sale documents.

Provisions from the Beijing-imposed national security law were found in recent tender documents for land sales, including one for a site at the junction of Sai Yee Street and Argyle Street in Mong Kok, where submissions will close on February 24.

The document warned potential buyers they could be disqualified if they engaged in activities that endangered national safety or affected public order.

Stewart Leung Chi-kin, the chairman of the executive committee of the Real Estate Developers Association, said he had heard no objections from members, despite there being no consultation on the change.

“The latest practice will not have an impact on a developer’s desire to tender for land or not,” he told the Post. “It will not scare away foreigners who are true investors, but only those that hope to disturb and obstruct the city’s development with political motives.

Leung, also the chairman of real estate giant Wheelock Properties, said he believed the new arrangements were related to the 2019 anti-government protests.

Beijing imposed the national security law on Hong Kong in June 2020 with penalties of up to life in prison for people convicted of subversion, secession, collusion with foreign forces and terrorism.

“Now it must be clearly stated, and it’s not just Hong Kong, many countries across the world have such a security law to protect themselves,” Leung said. “Even though there are no such clauses for old land leases, the law is enforced in the city already, and people have to obey and follow it.”

Other developers echoed Leung’s views.

Nick Tang, chief executive officer of Wang On Properties, said the clause was reasonable from a business perspective.

“While it is in place, in practice I don’t think anyone will trigger this clause. Chances of that happening are very slim. So it definitely will not affect land prices,” Tang predicted. “If a Hongkonger buys anything in the US, the US government will also examine the background before allowing the investment,”

A spokesman for the Development Bureau said the Lands Department had added new provisions in land sale papers and short-term leases after the government’s Stores and Procurement Regulation was updated last August to take account of the national security law.

“Safeguarding national security is the shared responsibility of the entire Hong Kong society. For law-abiding bidders, the relevant terms should not affect their willingness to bid, and we are not worried that the terms will affect the government’s push for land,” he said.

He added the first land sale in Kai Tak Area 2A, which included the national security terms, had attracted six bidders and the site was sold by the end of last year.

The city’s property stocks were down as much as 4.9 per cent to the lowest level in six weeks on Monday, compared with a 0.1 per cent slip in the benchmark Hang Seng Index.

Donald Choi, the chief executive of property giant Chinachem Group, said: “The government always has the right to withdraw the tender or choose who can win. The government is like any landlord, who can choose the tenant or buyer. This is naturally their right.”

Allen Fong, a veteran developer who earlier worked for a state-owned developer and has more than 25 years of experience, said he did not see how construction of residential property could violate national security law, despite the legislation’s range.

“If you talk about residential, industrial property or street shops, I don’t think there will be any major violations,” Fong said. “The biggest chance is when an office is leased to a renter who violates the national security law.”