星光行造價半年跌20%

尖沙嘴星光行去年錄5宗成交,其中以日本建築公司西松建設以8480萬沽售一批單位最矚目,海景單位呎價僅1.18萬,於半年間跌20%。

去年錄6宗買賣

西松建設早前沽售該廈5樓一批單位,有代理表示,該批單位部分海景戶,成交呎價約1.18萬,另一批屬沒有窗戶單位,呎價7000元。

該廈造價半年間急跌,去年7月,804室海景單位,面積920方呎,以每呎1.57萬易手,可見成交價於半年間跌約20%。

代理又說,不過,需要留意的是804室單位擁有獨立冷氣,每呎管理費只需1.65元,5樓配備中央冷氣,管理費高達4元,兩者坐擁不同客路。

西松建設沽售星光行5樓6至12室,24至26室,成交價8480萬,總建築面積約8339方呎,5樓6至12室為望海景 (5491方呎),24至26室為無窗單位 (2848方呎),成交呎價分別1.18萬及7000元。

管理費同廈不同價

而去年5月,該廈720室面積675方呎,以1229.2萬易手,呎價高達18210元,可見價格起落大。

(星島日報)

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

九龍灣德福大廈 教育商廈交通便利

九龍灣一帶商廈林立,德福大廈位處宏開道16號,為九龍灣知名教育商廈,最大賣點是交通便利,故為區內指標甲廈之一。

德福大廈為一幢樓高23層之商業大廈,1994年落成,樓齡約28年,屬混合用途建築,結合寫字樓及商場,商場內設有銀行、馬會投注站及各式商店,地下至1樓為商舖,2樓為停車場,3樓至22樓則為寫字樓。

物業總樓面面積約30萬平方呎,寫字樓每層樓面面積16,300平方呎,每層至少設有11個單位,單位面積由1,277至2,379平方呎不等。寫字樓大堂設有6部載客電梯,方便疏通人流,另外設有停車場,方便駕車人士出入。

大廈內籠四正 實用率近8成

由於大廈外形呈四方形,故大廈內籠十分四正,中間不設柱位,故實用率接近8成。景觀方面,物業主望開揚樓景,部分可望海景及郵輪碼頭景。

東九龍近年有不少企業落戶,該廈亦吸引不少大型銀行進駐,作為財務理財中心,其中恒生銀行佔用兩層全層作財務中心,另大廈亦有不少貿易及採購公司,商戶十分多元化。

交通方面,物業距離港鐵九龍灣站僅6至7分鐘路程,附近亦有巴士及小巴站,直達港九新界,交通四通八達。

飲食配套方面,大廈內有24小時便利店,附近亦有不少餐廳可供選擇。大廈設有天橋連接德福廣場,舉步直達大型商場,內設大量食肆,有不同國家的美食選擇,滿足不同需要。

大廈去年以租務為主,共錄得6宗租務成交,面積由1,067至3,428平方呎,平均呎租26元。最新一宗租務成交為1,603室,面積1,277平方呎,以2.2萬元租出,呎租約23元。

另外,大廈近年共錄得3宗買賣成交,面積由1,277至1,609平方呎。最新一宗買賣成交為2108室,面積1,277平方呎,以1,618萬元成交,呎價12,670元。

(經濟日報)

更多德福大廈寫字樓出租樓盤資訊請參閱:德福大廈寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多德福大廈寫字樓出售樓盤資訊請參閱:德福大廈寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

上環信德中心 高層意向呎價2.9萬

指標甲廈料成交增,現上環信德中心單位放售,意向呎價逾2.9萬元。

面積2537呎 叫價7400萬

有代理表示,近日有業主以交吉形式放售上環信德中心西座一個高層單位,單位建築面積約2,537平方呎,業主意向價約7,400萬,意向呎價逾2.9萬元。

該代理指,單位坐擁夾角海景,維多利亞港、青馬大橋盡收眼底,室內附設豪華裝修,適合集團總部自用或投資。該廈的海景單位一向深受用家及投資者追捧,夾角海景位更是罕有出售,而上述的單位放盤價更比同類單位低近一成。

該代理補充,信德中心西座於上月錄得1宗成交,該中層11號夾角全海景單位以每平方呎33,200元易手。

(經濟日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

商廈去年買賣665宗 按年跌5成

據一間代理行數據,去年市場暫錄得約665宗寫字樓買賣成交,比2021年急減約50%,對比2019年社會運動及2020年疫情初起時的全年成交量更低。

租賃錄約5149宗 減24%

買賣成交量長期低迷,對商廈市場買賣金額影響大,去年度總成交金額共錄得約181.16億元,按年下跌約41%,為2003年後新低。按月分析,情況更為嚴峻,自2021年8月起連續16個月寫字樓買賣宗數單月不超過100宗,當中表現最差為今年9月,全月僅錄得約29宗買賣個案,去年單月最多成交記錄為6月份,亦只錄得約85宗。

租賃市場走勢雖然見輕微波幅,但整體而言尚算平穩,去年暫錄得約5,149宗租務個案,總金額涉及約4.82億元,對比2021年分別減少約24%及36%。

另外,指標商廈走勢更見嚴峻,香港區指標商廈全年共錄得約14宗水平,第四季暫錄得約4宗買賣成交,較第三季上升1倍,屬表現最佳的季度,惟季內平均呎價則處於約1.2萬元水平,按季下跌約36%,反映買賣叫價回軟即獲市場較多承接;租賃成交走勢平穩,今年每個季度均維持於約60至70宗水平,平均呎租約40至50餘元。

九龍區方面踏入第四季亦見好轉,第四季暫錄得約7宗指標商廈買賣個案,平均呎價錄得約1.1萬餘元水平,對比第三季約1宗及7,500餘元有顯著增長。租賃成交量則每季維持於約40至50宗,平均呎價約30元水平。

該行代理續稱,港島區11月份整體甲廈空置率錄得約10.68%,刷新歷史新高記錄。當中中環最新空置率約9.5%,金鐘亦錄得約9.99%;九龍區11月份整體甲級商廈空置率則錄得約11.63%。甲廈空置率高,多區商廈新供應緊接出場,個別發展商積極與大型企業洽商及落實承租旗下全新商廈大樓面,如國際機構瑞銀預租高鐵西九龍站上蓋商業項目最高的9層樓面,涉及約25萬平方呎,料為近年最大宗寫字樓租賃個案。

代理指出,2023年本港全面開放,對寫字樓市場會更為有利,預測今年寫字樓出現量升價跌局面,第一季商廈買賣成交量有機會達約200宗水平,全年展望交投量可有六成升幅至1,000宗水平,而買賣價則料會有約5%窄幅上落。租務交投就預測第一季會有輕微升幅,至約1,400宗水平,全年料會有約5,500宗,但租金則料會平穩至微跌約5%。

(經濟日報)

基金趁低撈貨 成投資市場主力

大額買賣近期略增,先後錄得大額商廈及酒店成交,呎價均相當便宜,而買家均涉及外資基金,反映基金趁低撈貨,料今年仍是投資市場主力之一。

近期市場錄得兩宗大手買賣,新近宏安 (01222) 夥拍安祖高頓基金,以20億元向新世界 (00017) 購入新蒲崗貝爾特酒店。物業位於六合街19號,佔地2.38萬平方呎,在2013年才開幕,總樓面逾28.5萬平方呎,設約695間客房,以成交價20億元計算,平均每間客房作價約288萬元,呎價僅約7,000餘元。消息指,新世界早前放售多項非核心物業,包括貝爾特酒店,叫價約25億元,如今降價約2成沽出。

宏安夥美資基金 購九龍酒店

據了解,買家為宏安地產跟美資基金安祖高頓 (Angelo Gordon) 旗下基金合組的財團,前者佔35%權益、後者佔65%權益,計劃翻新該酒店項目作商業投資用途。據了解,即使中港通關在即,新買家是次入貨,料非主打旅客市場,預計把物業改裝成共居空間或服務式住宅。

近兩年市場出現多幢大額酒店成交,新買家主要改裝成共居空間,包括去年初Weave Living以13.75億元,購入九龍珀麗酒店,將進行改裝。按是次貝爾特酒店20億元成交價計,為近5年本地最大額酒店成交,對上一宗逾20億元買賣,為2017年舖王鄧成波以23億元購入恒地麗東酒店。至於商廈方面,近期罕有錄得全幢商廈買賣,九龍灣高銀金融國際中心早前撻訂重售,結果獲兩基金合組財團以56億元承接,較2個月前成交價再跌約16%。

本年5月,外資測量師行獲接管人委託,標售九龍灣高銀金融國際中心全幢,項目獲5個以上財團入標,包括本地財團及外資基金,其後進入次輪競投,並於去年7月截標,9月份項目獲財團以約67億元購入。不過,交易一波三折,因買家未有完成交易,最終項目重新放售。土地註冊處資料顯示,近日物業以56億元成交,較去年9月67億元成交,價格再跌16%。

是次購入商廈的財團,為太盟投資 (PAG) 及豐樹基金,兩外資基金各佔5成權益。PAG過往亦有投資東九龍甲廈,如位於牛頭角國際貿易中心。

九龍灣高銀金融國際中心樓高31層,總樓面約92萬平方呎,現時出租率約7成,呎租約27至33元。以約56億元成交價計,呎價僅6,000餘元,較東九龍甲廈低至少4成,為區內逾十年新低。

分析指,息口仍向上,對大額投資物業有一定影響,而外資基金有充足資金,尋找投資機會。近日市場錄得的酒店及商廈成交,呎價跌至6,000至7,000餘元,明顯低於市價,而基金低價入市作長綫投資,相信今年外資基金仍是投資市場主力之一。

(經濟日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

灣仔中國恆大中心全幢傳流標 財團出價審慎 擾攘多時未落實

灣仔中國恆大中心全幢備受注目,該廈去年由接管人委託測量師行,推出公開招標,財團出價審慎,擾攘多時未落實,根據外電最新引述消息人士指,由於接獲出價未達要求,項目最終流標收場。

中國恆大中心全幢去年被接管後,推出招標,商廈市場吹淡風,財團表現審慎,擾攘多時落實。昨日有外電引述兩名消息人士透露,由於接獲出價未達要求,該全幢最終流標收場。本報昨日亦向負責該全幢招標的代理行查詢,發言人則回應指,未收到任何最新消息,未有任何回應。

外電:出價未達要求

中國恆大中心全幢作為中國恒大總部,恒大以該全幢作抵押,換取76億貸款融資,債權人為國企中信銀行旗下的中信銀行國際,當恒大陷入財務危機後,於2021年,國企越秀地產曾計畫以105億收購該全幢,惟最終考慮到恒大未償還負債,將為交易帶來潛在不穩定因素,遭越秀董事會反對計畫,收購方案最終被推倒。

代理行:未有任何回應

該廈於去年兩度推出招標,首先去年7月,在該廈未被接管時,由恒大推出招標,恒大主席許家印曾高調表示,意向價100億。當時,長實更率先確認入標,市傳獲數家財團入標,不過,由於出價與意向價相距大,未能成功出售。

去年兩度推出招標

去年9月,該全幢由安邁企業諮詢接管後,委託代理行標售,去年9月25日推出,10月31日截標,市場估值80億至90億,該代理行曾表示,逾10家財團有興趣。不過,根據市場消息透露,截標反應未如預期,在商廈市況低迷下,財團紛以審慎保守價投標,與估值80億至90億有距離。

中國恒大於2015年11月向華置購入灣仔告士打道38號美國萬通大廈全幢,作價125億,呎價高達3.6萬,造價及呎價雙破頂,創當時本港商廈歷來最高紀錄,及後大廈易名中國恆大中心,作為集團在港總部。該廈佔地23021方呎,樓高27層,總面積345423方呎,寫字樓每層面積介乎12000至14000方呎,物業提供55個車位。

(星島日報)

更多中國恆大中心寫字樓出租樓盤資訊請參閱:中國恆大中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

新世界 KOHO 全幢獲洽 準買家出價逾16億

近期積極出售非核心物業的新世界,最新旗下觀塘全幢商廈 KOHO,獲準買家出價洽購,出價逾16億,有機會於短期內成事。

平均呎價7309元

繼早前沽出新蒲崗全幢酒店,市場消息透露,新世界旗下觀塘鴻圖道73至75號 KOHO,獲準買家積極洽購,出價逾16億,以該廈總樓面約21.89萬計算,平均呎價約7309元,昨日更有市場消息盛傳該廈已告易手,惟有關消息未獲證實。該廈樓高13層,1樓至12樓為寫字樓,地下為停車場及商店,每層樓面面積由16000至24500方呎,新世界發展於2014年10月,以約16億購入項目。

觀塘首幢活化工廈

早於今年9月,新世界就該廈向城規會申請放寬地積比率20%,興建一幢樓高29層商廈,項目佔地盤約20001方呎,地積比率擬由12倍提升至14.4倍,提供辦公室、商店及服務行業和食肆用途,落成後總樓面約28.8萬方呎,較現有樓面多出逾30%。KOHO 前身為建大工業大廈,2013年,鵬里資產於以9.8億購入,斥資1.7億將之活化成商廈,是觀塘區首幢活化工廈,易名為 KOHO (Kowloon Head Office),隨後售予新世界。

(星島日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

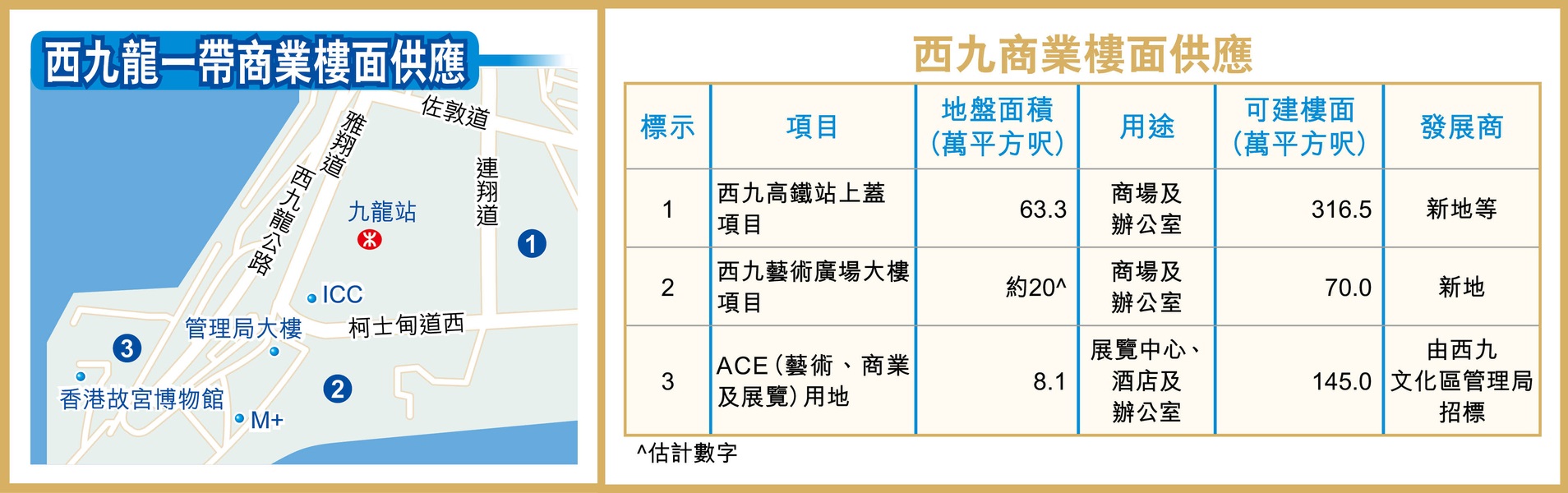

新地擁540萬呎商業樓面 西九大地主

隨着西九高鐵站用地批出及西九文化區項目陸續推出,九龍站一帶未來數年將新增逾530萬平方呎樓面供應。計入現有的商業項目,新地 (00016) 已擁涉逾540萬平方呎樓面,陸續鞏固區內勢力。

九龍站一帶較具規模的商業樓面供應非新地旗下九龍站上蓋環球貿易廣場 (ICC) 莫屬,所涉總樓面達295萬平方呎,但未來該帶將會陸續有更多新項目,當中大部分由新地擁有,進一步穩固區內勢力。

新供應集中西九文化區

未來的新供應之中,部分來自西九文化區。整個西九文化區佔地約38.6公頃,面積相等於2個維園 (19公頃),除了提供博物館、藝術館、表演場地外,亦設有零售、商業及酒店樓面等。按過往規劃,西九文化區總樓面約916.4萬平方呎,4成屬於文化藝術用途,其餘約394.6萬平方呎或43%作為酒店、辦公室或住宅,及約148.9萬平方呎,約佔16%用作零售、餐飲及消閒設施,1%作政府、機構或社區用途。

而其中的藝術廣場大樓項目之發展及營運權已由新地於去年11月投得,並需以「建造、營運及移交」模式負責藝術廣場大樓項目的設計、建造、融資、市場推廣、租賃、管理等工作。該項目由3幢商業大樓組成,總樓面面積合共約69.97萬平方呎,其中約67.2萬平方呎作辦公室用途,零售/餐飲/消閒用途則佔約2.69萬平方呎。

值得一提的是,上述項目曾於去年2月截標,惟西九管理局隨後在6月表示,決定不接受任何標書,並且修訂方案在同年9月重新招標。事實上,除了上述項目,西九文化區管理局亦有另一商業項目待推出,所指的是西隧出口上方的ACE (藝術、商業、展覽) 項目,總樓面約145萬平方呎,包括興建1個約50萬平方呎的展覽中心、酒店、辦公室及零售用途等。

高鐵站商業地 樓面達316萬呎

至於區內另一大型商業樓面供應西九高鐵站商業地,同由新地於2019年以約422億元奪得,總樓面高達約316.5萬平方呎。不過,中國平安 (02318) 旗下的平安人壽其後於2020年斥資約112.73億元入股項目的辦公大廈約30%權益,成郭氏家族公司後、項目的另一長綫策略性投資者。據新地年報所示,新地持有約115.4萬平方呎寫字樓,及整個零售樓面 (涉約60.3萬平方呎),即合共約175.7萬平方呎總樓面。

換言之,西九管理局旗下2個商業項目及西九高鐵站用地,日後有望增逾530萬平方呎商業樓面供應。若計入環球貿易廣場 (ICC)、前述藝術廣場大樓及高鐵站用地,集團已經手持區內3個大型商業項目,即逾540萬平方呎商業樓面,可謂是區內大地主。

(經濟日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

Tender for Evergrande tower in Hong Kong 'lapses again'

A tender for the sale of embattled China Evergrande's (3333) headquarters in Hong Kong has lapsed again, two sources with knowledge of the matter said yesterday, because the offer prices and terms fell short of requirements.

Lenders to the office tower, China Evergrande Centre, valued at between HK$8 billion and HK$9 billion, appointed a receiver in September to seize the asset and tender it for sale with a bid deadline of October 31.

The tower had been pledged against a loan of HK$7.6 billion from lenders led by the Hong Kong subsidiary of Chinese state-owned China Citic Bank (0998).

One of the sources close to Citic said the lenders may put the asset on sale again when market conditions are more stable than in the second half of last year.

Citic did not immediately respond to a request for comment. Evergrande and the agent for the tender sale, declined to comment.

Evergrande, saddled with liabilities of more than US$300 billion (HK$2.34 trillion), is at the centre of China's unprecedented property sector crisis and had been trying to sell the 27-story tower to raise cash before it was seized.

Reuters reported in July that Evergrande was looking to sell the tower, located in the busy commercial district of Wan Chai, by tender, but drew only a couple of bids, with offers below HK$10 billion and its 2015 HK$12.5 billion purchase price.

CK Asset (1113), billionaire Li Ka-shing's real estate unit, also submitted a bid for the building at that time.

The 2021 collapse of a potential US$1.7 billion deal to sell the building to Chinese state-owned Yuexiu Property (0123) dealt a blow to Evergrande's efforts to divest assets to repay creditors after missing interest payments on offshore bonds.

Evergrande's land in Yuen Long was sold by receivers last November, with the defaulted developer projecting a loss of about US$770 million. The site, which was used as security for a financing transaction worth US$520 million, was sold for US$636.9 million.

The troubled builder failed to deliver its offshore debt-restructuring plan by the end of last year, missing its self-imposed deadline for the second time.

On New Year's Day, chairman Hui Ka-yan said in a letter to employees that this year will be a "crucial year" for the developer to fulfil home delivery to buyers and he trusted the firm would be able to repay all its debt.

(The Standard)

For more information of Office for Lease at China Evergrande Centre please visit: Office for Lease at China Evergrande Centre

For more information of Grade A Office for Lease in Wan Chai please visit: Grade A Office for Lease in Wan Chai

Luxury lodge slashes asking price by 40pc

The asking price for a luxury project in Jardine's Lookout has been cut by about 40 percent to HK$500 million amid the sluggish property market.

Located at 4 Moorsom Road in Jardine's Lookout, 83.33 percent ownership of the luxury Moorsom Lodge has been put for tender by the homeowners jointly, a surveyor said.

They aim to cash in HK$500 million, or HK$50,854 per sq ft based on the rebuildable floor area of 9,832 square feet.

Moorsom Lodge measures about 13,109 sq ft in site area and has six homes. The tender closes on February 23.

However, the new asking price is 39 percent lower than the intended price of HK$820 million for 100 percent ownership in 2018, as the homeowners take the sluggish property market and the falling home prices into consideration.

The surveyor said buyers can buy the remaining units through private negotiation or compulsory auction to consolidate ownership, with the total acquisition cost of the lot expected to be about HK$600 million.

After acquiring all of the ownership, the surveyor expects the project to be redeveloped into two 5,000-sq-ft villas plus facilities like a garden and a swimming pool on an area of 4,000 sq ft, bringing the asking price to more than HK$120,000 per sq ft upon completion.

Meanwhile, three flats at St. George's Mansions in Ho Man Tin, developed by Sino Land (0083) and CLP Group (0002) were sold for HK$276 million, at prices ranging from HK$46,176 to HK$47,991 per sq ft.

Citibank Hong Kong says home prices could slide by another 5 percent this quarter amid rising interest rates but may rebound by 5 percent in the second half.

(The Standard)

Hong Kong home prices: Citibank predicts U-shaped recovery, matches Morgan Stanley’s 5 per cent upside for 2023

Hong Kong’s home prices will drop 5 per cent in the first quarter, before gaining 5 per cent towards the end of the year, Citi said in a report

Property transactions in the city slumped to a 32-year low of 59,604 in 2022, 38 per cent lower than a year earlier, according to a property agency’s estimates

Citibank has joined Morgan Stanley in predicting a U-shaped recovery for Hong Kong’s home prices, with the reopening of the city’s border with the mainland to provide a much-needed boost.

Home prices in the city will drop 5 per cent in the first quarter of 2023, before gaining 5 per cent towards the end of the year, Citi said in a research report on Tuesday led by Ken Yeung.

“After a sharp drop in Hong Kong home prices, down 15 per cent in 2022, amid rapid rate rises, Hong Kong’s residential market is starting to see positive drivers that we think will lead to a bottoming of prices in the first quarter of 2023 and a U-shaped recovery,” the report said.

Hong Kong's home prices dropped by the most in 14 years in November, with analysts predicting another 2.5 per cent decline in December, bringing an end to a 13-year rally. In the first 11 months of 2022, home prices fell by 13.8 per cent and 14.75 per cent since hitting an all-time high in September 2021.

A market index meanwhile has declined 18.07 per cent since its peak of 191.34 in early August 2021.

Citi’s forecast came as property transactions nosedived to a 32-year low of 59,604 in 2022, 38 per cent lower compared with a year earlier, according to estimates compiled by the agency on Tuesday. It is lower than the previous estimate of 64,000 by another agency.

The number of first-hand home sales hit a nine-year low of 10,262 last year, while the number of second-hand deals hit 31,814, the lowest since records started in 1996, according to the agency.

Citi said its forecast is based on four “potential catalysts”. These are: population changes turning favourable, local mortgage rates peaking in the second quarter, border reopening unleashing pent-up demand and policy relaxation in the first quarter if home prices drop more than estimated.

Hong Kong is aiming for quarantine-free travel with mainland China as early as January 8 to pave the way for a full reopening of the border, Chief Secretary Eric Chan Kwok-ki said in his weekly blog on Sunday, echoing Financial Secretary Paul Chan Mo-po’s sentiments.

The border reopening with the mainland will not only help boost the economy but also the housing market, Chan said in his blog on Sunday.

Hong Kong’s home prices are expected to bottom out in the second quarter and rise 5 per cent by the end of 2023, following a sharp decline in 2022, Morgan Stanley said in a report on December 6.

This is in contrast to the consensus expectation of a further decline of 5 to 15 per cent, Morgan Stanley said, adding that a peaking of rates and reduced outflow of people because of the border reopening between Hong Kong and the mainland will provide the impetus for housing prices this year.

Last year, the property market was weak because of the pandemic and interest rate increases, agent said.

“The slowdown in interest rate hikes in the United States, withdrawal of anti-epidemic measures by the government and the news of the imminent border reopening has improved the sentiment of the property market,” the agent said.

(South China Morning Post)加連威老道巨鋪呎租31元升16% 丟空2年始租出 護老院取代老牌餐廳

疫市持續下,核心地段熱鬧不再,曾是旅遊旺區的尖沙嘴加連威老道,最新錄護老院進駐,該巨鋪丟空約兩年始租出,月租35萬,呎租31元逆市升16%。舊租客為印尼餐廳,曾是街道熱門景點之一。

上址為加連威老道66至76號威華大廈巨鋪,面積合共11160方呎,由護老院承租,月租35萬,平均呎租31元。

面積逾1.1萬呎 月租35萬

現場所見,該家名為雲起護老中心剛開張,地鋪入口放着花牌,該位置較接近漆咸道,人流沒有近彌敦道地段暢旺,不過,昔日仍然聚集時裝店,現時到處見吉鋪,街道甚為冷清。有代理表示,該巨鋪前身為印尼餐廳,開業49年,早於2年前撤出,鋪位丟空多時,屬罕見護老院進駐旅遊區的例子。

布代理表示,該護老院對面的一列單號舊樓,由「鋪王」鄧成波家族收購多時,大部分地鋪近年已丟空,亦令該地段人流大減。

印尼餐廳曾經營逾40年

該巨鋪包括地下威華大廈A號鋪600方呎,1樓及2樓全層各3200方呎,3樓301、302及304室2173方呎,4樓1987方呎,該廈1979年落成,屬樓齡43年舊樓,舊租客則是一家有49年歷史的印尼餐廳,由大廈落成經營至2年前,於結業前月租30萬,最新護老院租金,逆市上升16%。

該印尼餐廳為該街道最老牌的食肆,由2名低調印尼華僑商人經營,40多年堅持同一個餐牌,同一種賣相,曾為印尼華僑們一解鄉愁,近10多年廣受遊客歡迎,現時餐廳已換上護老院,曾經滋味濃郁,現時有點暮氣沈沈。

(星島日報)

恒基灣仔舊樓強拍底價3億

恒基積極擴充灣仔版圖發展,該公司併購的灣仔活道19至21號及永祥街22至30號舊樓,最新落實於下周三 (11日) 舉行公開拍賣,底價為3億,將是今年首個舉行公開拍賣的舊樓項目。而該項目日後將與毗鄰項目合併發展,可建總樓面增至逾7萬方呎。

料與毗鄰項目合併發展

該項目於去年11月底獲土地審裁處批出強拍令,底價為3億,對比2019年提出申請強拍時,市場估值2.1506億,高出39.5%。最新落實於下周三 (11日) 舉行強制拍賣會,並由萊坊負責。

上述舊樓位於活道19至21號及永祥街22至30號,現址1幢樓高6層的商住大廈,現時地下部分用作商鋪、涉及7個單位,樓上為住宅樓層,涉及10伙,該物業於1961年落成入伙,至今樓齡約62年。

可建總樓面7萬呎

該項目地盤面積約2208方呎,位於職業訓練局大樓對面,鄰近摩利臣山游泳池。毗鄰港鐵灣仔站,步行前往約7分鐘,同時亦有多條巴士綫行走,交通便利,極具重建價值。

據該公司年報顯示,上述項目將會連同鄰近地盤合併發展,即活道13至21號及永祥街22至30號,地盤面積擴展至6392方呎,預計未來重建後之自佔合共樓面面積增至約70790方呎。

(星島日報)

Property deals fall to 32-year low

Registration for property sales received by Land Registry slumped to a 32-year low in 2022, while property transactions are expected to bottom out this year with the border reopening.

The number of property deals was 59,619 last year, down by 38 percent from a year earlier, a new low since 1991, official data shows.

The figure also fell for four months in a row to 3,565 in December.

It comes as home prices in Hong Kong fell 15 percent for the whole year due to local Covid infections and interest rate rises, a property agency said.

However, the real estate agent expects the transactions to rebound this year, as China's reopening might boost the recovery of the city's economy and the interest rate hike might peak in 2023.

Last year, deals of residential units plunged 39.3 percent to 47,271, excluding public flats, while the commercial registrations decreased 35.2 percent to 4,494, plus 6,964 cases of car parking space and others.

Meanwhile, Henderson Land Development (0012) raised the prices of its project One Innovale - Cabanna in Fan Ling, offering 108 new units in the No.4 price list.

The prices after discount start from HK$3.43 million for a flat, or HK$13,608 per sq ft, higher than the lowest HK$3.36 million in the previous price list released in November 2022.

Elsewhere, Yau Lee (0406) put 23 more units of L. Living in Tai Kok Tsui for sale, with the price starting from HK$4.97 million with no discount.

(The Standard)市局觀塘商業項目 大財團必爭地

周三截標 區內大地主有望擴版圖

市建局觀塘市中心第4及5區發展項目,將於本周三 (11日) 截標,地皮屬近年最大型商業項目之一,料鄰近擁項目的發展商,如新地 (00016)、信置 (00083) 等,將踴躍競投。

觀塘市中心第4及5區商業用地,坐落於觀塘道及協和街交界,鄰近apm及凱滙等,佔地約27.6萬平方呎,總樓面高達約216.6萬平方呎,可作商業發展,而市建局已因應市況為中標發展商提供設計彈性,在總樓面面積維持不變的前提下,靈活調配寫字樓、酒店及商舖樓面,當中商舖等樓面不能少於約67.97萬平方呎,日後亦可以選擇棄建酒店。

可打造東九主題地標商場

地產代理預計,地皮規模相當龐大,可建約216.6萬平方呎商業項目,將會成為區內地標,而當中約70萬平方呎的商場,更有潛質打造成東九龍具吸引力的主題地標商場。此外,因為地皮規模龐大,總投資額將逾百億元,投資風險高,故他預計,大型發展商入標為主。

該帶最主要發展商要數新地,其於觀塘道一帶先後發展多期創紀之城系列商廈,如創紀之城5期商場apm等,亦有 The Millennity 的全新商業項目,因此代理估計,相信新地或其他在周邊已經擁有其他商場的發展商,出價會較進取。而於區內已發展凱滙的信置,料亦會出價競投。

但代理相信,日後項目的租務競爭頗為激烈,因為要面對apm的競爭,而且啟德具規模的商場亦會在未來數年間落成,所以將來的設計及概念上要花心思。此外,東九龍目前有不少寫字樓項目,部分亦將陸續落成,屆時寫字樓會面對供過於求的情況,故料在落成首數年,出租或有難度。

測量師調低估值至97.5億

考慮到近月商業市場吹淡風,加上持續加息,代理已經調低地皮估值至約每平方呎4,500元,即總價約97.5億元。代理亦相信在目前市況下,市建局會調低其底價。

市建局近年除舊區重建外,亦推動舊樓復修。市建局行政總監韋志成在網誌指,做好樓宇復修延長樓宇壽命,才能減低重建壓力,並給予時間,集中資源加快重建老舊殘破的樓宇,同時為市區更新累積資源儲備,令其可持續發展。

(經濟日報)

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多The Millennity寫字樓出租樓盤資訊請參閱:The Millennity寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

上半年大手買賣料放緩 代理:受加息影響

經歷漫長3年疫市,市況起伏不定,地產代理對前景審慎樂觀,受加息影響,上半年大手買賣料放緩,寄望下半年進入佳景,今年將是先苦後甜的一年。

過去3個月,市場變化迅速,早前悲觀氣氛瀰漫,低價成交震撼市場,近日落實了通關後,市場情緒突然高漲,不少人轉軚看好。

代理則保持審慎樂觀,代理坦言,九龍灣高銀金融國際中心 (呎價6086元),新蒲崗九龍貝爾特酒店 (每呎7017元),低價「震散」洽商中的大刁,買家紛向低價看齊,業主則仍企硬價格,最終令交易中止。

利息處20年來新高

「事實上,高銀被接管,加上銀碼大,屬於特殊個案,不能以此作標準。」代理續說,去年,基金買家吼全幢商廈外,更頻吸納酒店及工廈,相信今年表現不如往年,原因是利息處20年來新高,借貸息率動輒高逾5厘,物業回報不高,對於利用槓桿原理運作 (借貸一般為60%) 的基金來說,成本增加,窒礙入市步伐。反而,部分個人投資者、老牌家族手持現金,可趁勢吸納,在整合後提高物業回報,再向銀行借貸,在高息環境下靈活應付,將會主導今年的市場。

個人投資者主導市場

代理看好商廈市場,過去兩年來,商廈成交量急挫,拖累大手買賣大跌逾30%,隨着商廈價格高位急挫逾30%,不論全幢或分層,今年將追落後,吸引投資者出手,加上今年新股上市勢增加,帶動商廈需求。

酒店去年表現出色,宗數及金額屬歷年高位,隨着疫情放緩,經營壓力大減,放售意欲減少,價格提高,今年買賣將減少。

商廈追落後料交投大增

代理預期,今年上半年,大手買賣放緩,過往炙手可熱的酒店及工廈,交投大減,寄望下半年利息見頂回落,形勢好轉,相信大手買賣集中下半年。

(星島日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

Henderson Land gets ‘good’ start in Hong Kong’s first weekend property sales as border reopening fuels optimism

Almost 40 per cent of 108 units in One Innovale were snapped up by buyers as of 5pm local time on Sunday, coinciding with Hong Kong-mainland border reopening

Henderson has generated more than HK$5.26 billion (US$673.7 million) sales since the 1,576-unit development was launched in August last year

Hong Kong’s first weekend property sales of the year got off to a relatively good start with buyers snapping up more than 40 per cent of the flats offered by Henderson Land, while local residents flock instead to the border after China officially scrapped quarantine requirements.

The developer sold 45 of 108 units on offer in the third phase of One Innovale development in Fanling, New Territories as of 6.30pm local time, according to sales agents. Momentum is expected to sustain before the doors are closed after 8pm, they added.

“Sales have been good in progress,” property agent said. “Confidence in the market is improving. China reopening is a good incentive for buyers to start acquiring properties.”

The units on sale average about HK$14,560 (US$1,865) per square foot after discounts. They range from open-plan units to three-bedroom units, measuring 231 to 683 square feet. The cheapest units were HK$3.43 million by price, and HK$13,608 on a per square foot basis, according to the developer.

Sunday’s property sale coincided with the official end of China’s zero-Covid policy, as pandemic curbs are dismantled. Three years of strict lockdowns, mass testing and quarantines have been blamed for halting the flow of big-spending mainland visitors and depriving the city’s economy of its lifeblood.

Hong Kong’s property market was one of the casualties, with developers and landlords relying on local buyers to push home sales, retail shops and office spaces.

Prices of lived-in homes in Hong Kong fell 3.3 per cent in November, the biggest drop since November 2008. The cumulative drop amounted to 14.8 per cent from the peak in September 2021. A property agency expects property transactions to fall to 65,000 in 2022, the slowest activity since 1996 based on government records.

“It would take some time before buyers become active again,” another agent said. “There are also ample unsold units in the market. The improvement would be more obvious in the second half of the year.”

Since One Innovale was launched in August last year, it has generated HK$5.3 billion in total sales for Henderson Land before this weekend. Some 188 of the 505 units in the current third phase have been sold since it started taking orders from October last year.

Beijing’s zero-Covid pivot will be a shot in the arm for the industry, property agents.

“Reopening the border and dropping restrictions is a game-changer,” another agent said. “We’ve already seen a bounce in sentiment and we were busier in December 2022 alone than in the entire second half of the year.”

Still, higher borrowing costs could temper the expected market recovery, according to another agent.

Lenders in Hong Kong have increased their prime rate three times in 2022, by a total of 62.5 basis points. HSBC, Bank of China (Hong Kong) and Hang Seng Bank are charging their best customers 5.625 per cent per annum, while Standard Chartered, Bank of East Asia and other lenders pegged theirs at 5.875 per cent.

(South China Morning Post)

Busy day for property deals in Fan Ling

One Innovale - Cabanna from Henderson Land Development (0012) in Fan Ling saw at least 46 deals struck yesterday with one flat fetching more than HK$20,000 per square foot - a high for the project - as the border with the mainland reopened.

The record was set for a 338-square-foot special unit with a 258-sq-ft garden. The two-bedroom flat was bought for HK$6.83 million, or HK$20,200 per sq ft, through a tender.

A total of 113 flats, including 108 on price lists and five via tenders, were up for sale yesterday, with Henderson raking in over HK$200 million from the deals.

The developer earlier released a fourth price list for 108 homes with sizes ranging from 231 to 683 sq ft. The cheapest flat - a 231-sq-ft studio - went for HK$3.43 million, or HK$14,848 per sq ft after discounts.

The project provides 565 homes between 158 and 1,054 sq ft.

In Yuen Long, Sun Hung Kai Properties (0016) will put 10 flats at Grand Yoho II on the market on Thursday.

The flats, which range from 524 to 634 sq ft, are priced from HK$8.84 million to HK$11.5 million, or from HK$16,882 to HK$18,988 per sq ft, after discounts.

In Kai Tak, Pano Harbour sold four flats yesterday with the developers China Resources Land (Overseas) and Poly Property (0119) collecting over HK$190 million. Three of the units were purchased by the same group of buyers for over HK$100 million in total. Prices for the three 950-sq-ft homes range from HK$32 million to HK$36.2 million, or HK$33,687 to HK$38,084 per sq ft.

But momentum in the secondary market was not sustained over the weekend.

The number of transactions in a property agency's top 10 estates nearly halved to 14 compared to the previous weekend.

An anget said that many owners narrowed the room for price negotiations or raised asking prices as the number of transactions looked like rebounding on the border reopening.

Buyers, however, were reluctant to increase their bidding prices, leading to some seesaw battles.

Another agency also saw a 38 percent decline in transaction numbers at the 10 largest estates over the weekend to 18 deals. The agent expects a seasonal boom to occur as economic activities in the SAR return to normal gradually and full-year property prices go up by 10-15 percent.

(The Standard)

去年商廈797買賣 按年跌4成

去年下半年息口上升,加上環球投資氣氛轉弱,導致商廈交投疲弱。地產代理資料顯示,去年全年商廈買賣僅錄797宗成交,按年跌約4成。

地產代理指出,2022年受到環球經濟疲弱、本地股市表現低迷的影響,商廈物業表現疲弱。去年全年商廈成交量錄797宗,按年下跌約41.2%,而成交金額同樣錄跌幅,按年跌約43.5%,僅錄218.8億元。

甲乙廈售價齊下挫

指標甲廈及乙廈售價按年分別挫4.1%及4.0%,當中中環甲廈售價更繼續按年跌8.9%。同時,往來香港進行商務活動的國際及內地企業因疫情受阻而減少,對甲廈的需求增長構成壓力,導致整體空置樓面上升。截至去年12月底,中環甲廈空置率為8.3%,東九龍更錄16.8%,拖累整體甲廈空置率升至10.3%。

代理預期,本港甲級商廈供應進入高峰期,2023年將有近400萬平方呎(建築面積)商廈落成,其中部分更成功錄得預租個案,例如恒地 (00012) 旗下位於中環的超甲級商廈新項目 The Henderson 已獲投資公司凱雷及拍賣行佳士得承租,可見個別實力租戶積極承租優質甲廈辦公室,代理認為優質物業仍受追捧,加上中港兩地通關因素帶動,相信投資者對位處良好地理位置的寫字樓,如中環及金鐘等地區仍看高一綫。同時,現時整體售價處於低位,一旦有多重利好消息推動,寫字樓物業表現將有望跑贏大市。

代理又預計,甲廈供應於明年見頂,長遠供應量於2024至2025年逐步回落,建築面積減少逾5成。雖然環球經濟周期仍處於下行局面,加上全面通關後的實際情況仍有待觀察,相信買賣及租賃需求在通關初期內未必反彈,但隨着經濟及社會逐步復常,相信內地及海外企業再次來港,帶動需求回升,交投亦會見好轉。

(經濟日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

灣仔智群商業中心 享地利配套齊

灣仔智群商業中心為區內較舊式商廈,勝在位於傳統商業地段,不論交通、飲食配套等均理想。

灣仔為香港傳統核心商業區,附近一帶商廈林立,商業氣息濃厚。智群商業中心位於灣仔皇后大道東,屬區內乙級商業大廈。

大廈為一幢分散業權的商業大廈,寫字樓單位可供出租及出售,放租或放售單位均以全層為主。樓高22層,總建築面積約44,000平方呎,每層標準建築面積約2,555平方呎。大堂設有兩部載客升降機,方便疏通人流。

飲食方面,物業位於民生區,附近有不少餐廳及酒樓,亦有酒吧,有不同國家的特色美食可供選擇。物業鄰近合和中心,為綜合寫字樓及購物商場於一身的大廈,內有不少高級餐廳,包括香港唯一360度旋轉餐廳。

鄰近港鐵站 路程7至10分鐘

交通方面,物業距離灣仔港鐵站A3出口僅7至10分鐘路程,附近亦有巴士站及小巴站,提供多條路綫,直達港九新界,十分便利。

物業去年成交以租務為主,錄得約3宗租務成交,均為全層單位,最新一宗市場成交為中層單位,建築面積約2,555平方呎,以7.2萬元租出,呎價28元。

另外,低層單位建築面積約1,277平方呎,以29,394元租出,呎價23元。

去年初物業中層單位,面積約2,555平方呎,以每月約5.1萬元租出,呎租約20元。

中層戶2915萬售 呎價11409

而物業最新一宗買賣成交為中層戶,建築面積約2,555平方呎,以2,915萬元成交,呎價11,409元。另高層戶建築面積同樣為約2,555平方呎,以3,061萬元成交,呎價11,980元。

(經濟日報)

更多智群商業中心寫字樓出租樓盤資訊請參閱:智群商業中心寫字樓出租

更多智群商業中心寫字樓出售樓盤資訊請參閱:智群商業中心寫字樓出售

更多合和中心寫字樓出租樓盤資訊請參閱:合和中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

3樓全層放售 意向價5760萬

灣仔 智群商業中心鄰近地鐵站及巴士站,交通四方八達,飲食配套齊備,現物業低層單位正進行放售,意向價5,760萬元。

面積4500呎 呎價12800元

代理表示,智群商業中心3樓全層放售,單位面積約4,500平方呎,意向價5,760萬元,呎價12,800元,單位已交吉,可即買即用,內設獨立洗手間,並附設雅致裝修。單位甚為寬闊,間隔四正,空間感十足,外望景觀尚算開揚,望樓景。

大廈附近物業同樣表現不俗,佳誠大廈12樓全層,建築面積約2,975平方呎,以約4,150萬成交,呎價約13,949元,同大廈27樓全層連平台,建築面積約2,825平方呎,以3,800萬元成交,呎價約13,451元。另駱克道88號3樓全層,建築面積約3,361平方呎,以約3,697萬成交,呎價11,000元。其次,宜興大廈23樓全層,建築面積約1,198平方呎,以1,650萬成交,呎價13,772元。

(經濟日報)

更多智群商業中心寫字樓出售樓盤資訊請參閱:智群商業中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

上環商廈相對低水,現業主放售德輔道西9號全層,意向呎價約1.2萬元。

叫價8550萬 重返6年前水平

代理表示,近日獲業主委託放售上環德輔道西9號低層全層,建築面積約6,884平方呎,意向價8,550萬,呎價約12,420元,叫價低於2017年以來該大廈的成交價,重返6年前水平。

代理續指,上環可供出售的全層海景寫字樓供應量不多,德輔道西9號位於上環臨海地段,坐擁維港景觀。配套方面,大廈自設停車場亦屬區內罕有,而且比鄰港澳碼頭及西隧,港鐵站近在咫尺,來往全港各區均極為方便,享有絕佳地理優勢,無論自用或作長綫投資同樣具吸引力。

租務上,資料顯示,該行去年9月錄全層租務,涉及高層全層,面積約7,192平方呎,成交呎租約27元。

(經濟日報)

更多德輔道西九號寫字樓出售樓盤資訊請參閱:德輔道西9號寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

甲廈上季租金 較高位挫逾30%

地產代理最新發表的2022年第四季香港寫字樓租賃市場報告指出,甲級寫字樓租金較2019年高位回落多達30%,空置樓面則急增至660萬淨平方呎。

甲級寫字樓租金在2022年第四季進一步下跌2.3%,九龍東及九龍西的跌幅較溫和,分別跌1.5%及1.6%;港島區則跌幅較大,灣仔/銅鑼灣按季跌3.5%,港島東則跌3.3%。甲廈租金在2022年全年下跌7.6%,目前租金水平較2019年高位下跌了31.4%。

空置率亦由2021年底的9.9%上升至2022年底的10.4%,淨空置空間達到660萬平方呎。去年內落成的380萬淨平方呎甲級寫字樓空間中,截至年底僅有19%獲預先承租,因此本年市場供應除了計劃本年落成項目的190萬平方呎空間外,還包括來自去年供應的額外310萬平方呎空間。盡管今年企業承租空間有可能回升至130萬平方呎,即2011至2019年的每年平均水平,今年底總空置空間仍將達到978萬平方呎,空置率為14.2%。

今年供應處高位 租金料跌1成

季內最主要成交為新落成或即將落成甲級寫字樓的多層預租個案,在核心商業區及非核心地區均有出現。最矚目的成交是瑞銀預租新地 (00016) 高鐵站上蓋發展項目合共9層,面積達25萬平方呎,該行的辦公室將於2026年起由國際金融中心搬遷至該地。於其他非核心地區新落成的寫字樓繼續獲跨國企業青睞,以作減省成本。

展望今年,雖然通關及復常後商機看漲,但本年寫字樓供應仍處於高位,加上本港及內地經濟前景仍存在憂慮,在好淡因素爭持下,預計今年寫字樓租金仍將下跌10%。而即使吸納量回升,預計在未來供應較多及目前空置率較高的地區,其租金將可能受壓而出現較大折讓。

代理指出,股市反彈、大部分疫情相關措施放寬,加上與內地通關在即,三者皆是利好寫字樓需求的因素,但由於去年落成項目的空置空間過剩,加上本港及內地經濟復甦的速度未明,本年寫字樓市況仍存變數。

(經濟日報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

崇光撤出尖沙咀 4層舖擬分拆招租

即使中港通關,大型百貨公司仍放棄核心區據點,崇光百貨租用尖沙咀喜來登酒店舖位十年,租約期滿不續租,並於短期內結業。據了解,4層商場逾13萬平方呎,月租料約500萬元,消息指業主或會重新分間招租。

料進駐啟德商地王項目

尖沙咀彌敦道喜來登酒店基座商舖部分,為大型連鎮百貨祟光舖址,近日店外店內均貼上結業大減價告示,就本報記者昨日現場所見,中午時分百貨公司內人流仍不算多。據了解,崇光百貨租約將於本年3月結束,將不續約。

酒店由長實 (01113) 持有,據業界代理指,由於涉及大樓面,加上近年罕有大手租舖個案,或會分柝招租。至於棄舖後,相信崇光百貨不會於同區另覓舖址,將搬至啟德。利福 (01212) 於2016年以73.88億元,奪得啟德商業地王,計劃合共撥出約140億元,發展成約109萬平方呎零售綜合大樓。

零售高峰期 月租逾千萬

翻查資料,崇光百貨早於2005年,於新世界中心地庫名店城開業,其後新世界中心進行重建,崇光百貨則於2013年尾,預租喜來登酒店地庫等4層舖位,面積合共約14萬平方呎,當年因屬零售高峰期,月租逾千萬元。百貨公司於2014年尾開業,當時稱網羅超過190個品牌進駐,開幕時更請來韓國人氣偶像出席。

消息指,崇光百貨於數年前續約,惟整體零售市況已不如2014年,租金已回落,估計月租涉及約500萬元,而長達3年疫情,香港零旅客到訪,生意受嚴重衝擊。該公司去年指,由於缺乏遊客消費及本地消費意慾低迷,消費券計劃的短期刺激對集團依賴遊客的尖沙咀崇光營運僅提供有限支持,該店去年上半年的銷售額大跌22%,若干期間亦縮短營業時間。

業界指,中港通關後,料商舖租務仍會受帶動,惟因商舖空置率仍偏高,整體租金仍處低位,估計現時該舖位部分,月租料跌至約300萬元。估計業主或把4層樓面化整為零,分拆樓面重新招租。

(經濟日報)

中資斥5700萬購南和行大廈全層 通關效應帶動 上環乙級商廈受捧

華魯集團購入南和行大廈22樓全層,作價5700萬元。

通關效應帶動商廈市場氣氛,上環乙級商廈備受追捧,來自山東的華魯集團斥資5700萬,購入上環南和行大廈全層,建築面積4928方呎,物業將作為自用。

中港兩地通關,商廈氣氛漸受帶動,中資公司率先出手,上環永樂街148號南和行大廈22樓全層,建築面積4928方呎,由華魯集團以5700萬承接,平均每呎11567元,市場消息透露,該集團總部設於灣仔會展廣場辦公大樓寫字樓,因擴充規模,購入該全層作為自用。

華魯集團承接 每呎1.15萬

華魯集團主要經營進出口貿易,收集、傳遞世界經濟技術訊息,屬華魯控股集團旗下子公司,華魯控股為山東省政府於1985年所設立,經營化工、醫藥、貿易及房地產等,旗下業務多元化。

上述22樓全層,原業主為外籍人士,於2010年以約2266.88萬購入單位,平均呎價4600元,持貨12年,帳面獲利3433.12萬,物業升值逾1.51倍。

據了解,南和行大廈於過去一年沒錄成交,正八集團主席廖偉麟早於去年2月,以1.38億購入上環南和行大廈鋪位及2層寫字樓,平均呎價1.02萬,最終,他基於商業決定,去年10月取消交易。

持貨12年升值逾1.5倍

該廈對上1宗成交為2121年中,該廈6樓4室,建築面積1832方呎,以2100萬易手,平均每呎11463元,業內人士指,最新該廈22樓成交價不俗,反映了通關的利好因素。

中資來港「三部曲」

地產代理表示,隨着市況回暖,末來將有更多中資企業來港上市集資,將動帶商廈租賃及買賣市場,中資來港「三部曲」,率先承租寫字樓,然後,在上市集資後購入商廈,接着公司要員物色住宅自用,由於中資不會買鋪,只有寫字樓受惠。

(星島日報)

更多南和行大廈寫字樓出售樓盤資訊請參閱:南和行大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多會展廣場辦公大樓寫字樓出租樓盤資訊請參閱:會展廣場辦公大樓寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

灣仔卓凌中心兩層6748萬售 持貨12年升值1倍

灣仔乙級商廈卓凌中心2全層,資深投資者羅守輝旗下的TOYOMALL,以約6748萬易手,平均每呎9800元,持貨12年升值約1倍。

上址為灣仔道133號7樓及8樓全層,每層建築面積3443方呎,合共6886方呎,以每呎9800元易手,涉資6748.2萬,交易交吉,新買家購入物業,並非買公司。原業主於2008年5月以3392.73萬購入,持貨12年,帳面獲利3355.47萬,物業升值約1倍。

TOYOMALL沽貨 每呎9800元

繼去年7月購入荃灣新村街一個地鋪,街市承包商建華集團及有關人士再下一城,購入毗鄰的地鋪,作價3380萬,呎價約11.27萬。上址為荃灣新村街56至58號地下8號鋪,建築面積約300方呎。鋪位由牀上用品公司承租多年,原業主於1992年7月以290萬購入,持貨逾30年帳面獲利3090萬,升值10.7倍。

建華等連環購荃灣新村街鋪

新村街屬於露天街市地段,建華集團及有關人士去年7月亦以3580萬元購入56至58號地下7號鋪,建築面積同約300方呎,呎價約11.93萬,建華集團等自2006年購入新村街56至58號地下4至8號共5個,涉資逾1.36億。

(星島日報)

更多卓凌中心寫字樓出售樓盤資訊請參閱:卓凌中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

核心區鋪租年內料升5%至10% 代理:內地遊客陸續回歸

隨着本港與內地通關,地產代理指出,內地遊客將陸續回歸,帶動零售市場好轉,鋪位需求及租金隨之上升,預期今年核心區鋪租反彈5%至10%,藥房、運動服裝等商戶,成為鋪市生力軍。

代理表示,在第四季度放寬旅遊及防疫限制下,市場情緒升溫,隨着內地旅客逐漸回歸,預計零售業、尤其遊客為主的行業好轉,鋪位租賃需求增加,帶動租金上升,事實上,疫市以來,核心區鋪租下跌40%,預計今年鋪租將反彈5%至10%,醫療健康、藥房、運動服裝等商戶,成為鋪市生力軍。

藥房運動服裝成生力軍

零售樓面新供應於去年及今年分別達150萬及540萬方呎,尤其今年供應為過去10年新高,一半來自香港國際機場航天城,市場吸納量受關注。

截至2022年12月底,根據該行資料,四大核心區整體空置率15.4%,按年增1個百分點。尖沙嘴最嚴重,高達20.3%,其次旺角17.1%,分別按年增加4.4及0.5個百分點。銅鑼灣同期空置率為14.5個百分點,按年升1.3個百分點;中環為8%,按年減1.3個百分點,唯一有改善地區,溫運強預期,市場需時兩至三年消化空置量。

尖區空置逾20%冠絕全港

代理表示,去年外資基金佔大手買賣金額40%,料今年仍活躍,惟所佔比率將減少,中資客影響力大增,甲廈及豪宅最受追捧。代理表示,隨着通關後市況逐步復常,加上息口預計將在下半年見頂,預料寫字樓及零售租賃上升,當中以零售物業較具潛力。

中資客追捧甲廈豪宅

去年寫字樓空置率創歷史新高,該行代理預料,通關後,中資需求增加,惟全球經濟不穩,融資成本高,跨國公司審慎擴張,節省成本為原則,料今年商廈租金進跌幅5%或以內。

代理表示,去年工業物業空置率持續偏低,過往多年租金持續增長,為租戶帶來壓力,令租戶謹慎,預計今年租金持平。

截至去年底,根據該行資料,四大核心區整體空置率15.4%,需時兩至三年消化。

(星島日報)

市建觀塘商業「巨無霸」今截標 業界:出價趨審慎 估值跌30%

商業市道前景未明,市建局歷來規模最大的單一重建項目,觀塘市中心第4和第5發展區「巨無霸」商業項目,將於今日截標。由於赤柱豪宅地昨以流標收場,業界人士指,該地估值對比去年推出時已調低約30%,惟目前商業氣氛不景氣,不排除有流標風險。

上述項目綜合最新市場估值約87億至130億,每方呎估值約4000至6000元,對比去年11月推出招標時估值約108.29億至194.93億,當時每呎估值約5000至9000元,估值下跌約30%。

華坊諮詢評估資深董事梁沛泓表示,市場憧憬住宅樓價在今年回升,但商用物業仍未見有起色。由於觀塘區寫字樓空置率高,又預期有大量供應。今次項目規模大,投資回報期長。而且昨日赤柱豪宅地收流標收場,認為上述商業場流標的機會大增。

業界:具流標風險

萊坊估價及諮詢部主管方耀明指,由於項目規模比較大,對很多發展商來說這個規模是最主要的考慮因素。在目前市況下,市建局亦對各用途面積採用浮動性。他認為項目存有流標風險,由於商業市場始終存在着不確定性,但要視乎市建局對與市況及底價的取態,預計發展商出價都會偏向保守。

普縉助理總監(專業產業諮詢及估值)李雋傑說,項目位於觀塘核心地段,鄰近住宅區,有足夠的消費力,預期會側重提供商業樓面。觀塘區新寫字樓供應於未來2至3年充足,而商業樓面直接面對鄰近商業項目競爭,料財團出價會審慎。

該項目於去年9月合共接獲24份意向書,該局同年11月邀請19家發展商及財團入標競投。消息指,發展商需自行提出「一口價」,以價高者得決勝負,不設分紅,而且對入標財團設有資格限制,包括合資格具建築經驗的財團,而且資產淨值或市值不少於251億等。

該項目於去年9月初合共接獲24份意向書,當時據現場所見及綜合市場消息,多家本地大型和中型發展商都有遞交意向書,包括長實、新地、恒基、信和、會德豐地產、鷹君、華懋、遠東發展、中國海外,另亦有多家不知名財團。

「一口價」決勝負不設分紅

觀塘市中心項目是市建局歷來規模最大的單一重建項目,以五個區域進行分階段發展,本項目為最後一個發展區域,地盤面積為27.55萬方呎,可建總樓面約216.59萬方呎。

市建局在該項目標書試行「浮動規劃參數安排」,有關規劃許可申請已於去年9月獲得城規會批准。

「浮動規劃參數安排」容許成功取得本項目的發展商及財團,在總樓面面積保持不變的前提下,靈活調撥在指定範圍內商業樓面面積作辦公、酒店和其他商業用途;當中,商業樓面面積不可少於約69.97萬方呎,並需設於項目的低層樓層,以保持本項目位處觀塘區策略性位置的「市中心」特色。

綜合最新市場估值約87億至130億,每方呎估值約4000至6000元。

(星島日報)

金鐘海富中心全層1.888億易手 每呎造價1.77萬 屬八年來新低

金鐘海富中心二座15樓全層,以1.888億易手。

金鐘海富中心二座15樓全層,由接管人推出放售,去年兩次傳易手,最終未落實,該項目近日剛告易手,作價1.888億,平均呎價17766元,屬八年來新低,較四個月前,對上一宗銀主盤再低2.1%,買家為信義玻璃相關人士。

海富中心15樓全層單位,建築面積10627方呎,由接管人放售逾3個月,最新以約1.9億易手,平均呎價17766元。

由接管人推出放售

該宗亦是海富中心繼早前銀主盤易手,最新出現由接管人放售單位,呎價較四個多月前,該廈13樓全層輕微低2.1%,亦為該廈過去八年的新低水平。新買家為信義玻璃相關人士,物業作投資作用,市值呎租40至45元,料回報2.7厘。

該15樓全層單位,原業主為國安國際,於2017年1月商廈高峰期斥3.18億購入,每呎接近3萬元,去年3月公司被清盤,物業隨後被接管,並曾傳出去年4月及11月傳易手,惟最終沒有成功沽售,直至近期終於落實成交,若以易手價計算,5年間帳面虧損約1.292億,幅度約41%。

信義玻璃相關人士承接

該廈對上一宗成交為銀主盤買賣,為該廈2座13樓全層,於去年8月以1.93億易手,平均呎價18161元,意味着在過去4個多月,該廈售價再跌2.1%。買家湯臣集團,將持有物業作投資,並於適當時候作為總部。

海富中心15樓全層單位,新買家為信義玻璃相關人士,該公司為內地玻璃產業鏈主要製造商之一,多家汽車生產包括商福特、通用及奇瑞等都是她的客戶,在1988年成立,總部設在香港,在2005年上市。

海富中心因位於港鐵站上蓋,大部分單位面向政府總部及維港海景,在2017年至2018年市道暢旺時,成交呎價超過3萬。

該宗由接管人放售,呎價較四個多月,該廈13樓全層銀主盤再輕微低2.1%。

(星島日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

代理:商務旅遊逐步恢復 零售商廈市場率先復甦

地產代理預期,隨着通關,商務旅遊逐步恢復,零售及商廈市場率先復甦,帶動整體甲廈租金按年升5%,核心區鋪租料升8%。

代理指,2022年度寫字樓淨吸納量達35.3萬方呎,為自2019年首次錄正增長,整體租金按年跌4.5%,僅九龍東錄增長,中環按年下調1.9%。今年將有逾320萬方呎新供應,集中九龍及新界區。高力香港商業物業服務主管顏慧萍表示,隨着商務旅遊逐步恢復,有助支撐寫字樓租金,預期整體甲廈租金今年微升3%,與2022年底按年下調2.3%比較,今年按年增長5%。

甲廈租金料按年升5%

代理表示,零售市場整體情緒樂觀,中港通關後,預期下半年顯著復甦,全年租金升幅約8%。

代理表示,整體工廈需求可能維持不變,料今年租金升2%。

代理表示,去年大手宗數創10年來新低,成交額按年跌4%至700億,最少6宗大刁為銀主盤,今年首季持續,預計今年投資量將增加5%。

住宅樓價料跌5至10%

根據土地註冊處資料,2022年住宅交易總額按年跌39.4%至45050宗(不包括公屋),為97年以來最低,代理指出,加息將持續拖累樓價,預期今年將按年5至10%。

(星島日報)

長沙灣中國船舶大廈連平台放租

地產代理表示,位於長沙灣道650號中國船舶大廈低層全層現正放租,總面積約11,535平方呎,另附特大平台約2,882平方呎,意向月租約25.3萬元,平均呎租叫價約22元,現由業主自用,新租客可即租即用。

可全層或分拆

上址除全層放租外,亦可分成面積約7,111平方呎或全層11,535平方呎2個不同面積的組合出租,由於單位位於低層,因此上落十分方便,同時配備13呎高樓底,又設有獨立冷氣,令商戶營運更具彈性,配合不同用家的需要。

據市場租務成交所見,該廈去年平均呎租介乎22至31元不等,又以面積1,000餘平方呎單位交投最為活躍,而新近租出的單位如低層2室,面積約1,371平方呎,以約3.7萬元承租,平均呎租約27元。

中國船舶大廈於2018年落成的,屬區內甲級商廈,位處長沙灣道當眼位置,距離港鐵荔枝角及長沙灣站均僅數分鐘步程可至,另,周邊備有多綫巴士往來全港各區,交通相當便利。而物業樓高25層,3樓以上為寫字樓,室內間隔方正,樓底高,用途多元化,另外,低層單位設有特大平台,另有多個高層特色單位配備私人平台等。

代理續指,放租單位,為該廈唯一連平台特色戶,其景觀開揚,環境舒適,加上周邊鄰近多個屋苑,帶動民生相關行業,人流有增無減,而上址租金叫價相宜,預料通關後租金會隨大市上升,創業或擴展業務的投資者宜把握先機。

(經濟日報)

更多中國船舶大廈寫字樓出租樓盤資訊請參閱:中國船舶大廈寫字樓出租

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

永安廣場銀主盤 2100萬將易手

在通關效應下,商廈漸受追捧,尖東永安廣場銀主盤,獲準買家洽購,物業將以約2100萬易手,平均每呎1.75萬,雖是罕有盤源,呎價仍是該廈近年新低。

平均每呎1.75萬

市場消息透露,上述為永安廣場403室,建築面積約1200方呎,由銀行推出放售,獲2名準買家出價,其中一名出價到達賣方意向,物業即將以約2100萬易手,每呎1.75萬,該物業坐擁全海景,屬優質盤源,不過,呎價仍是近年該廈新低,可見商廈市況處低潮。永安廣場位處尖東麼地道62號,於1981年落成,毗鄰九龍香格里拉大酒店。

呎價屬該廈近年新低

近期市場不乏另類盤源,除了銀主盤外,還有被接管的盤源,金鐘海富中心二座15樓全層,由接管人推出放售,建築面積10627方呎,以約1.9億易手,平均呎價17766元,買家為信義玻璃相關人士;同廈13樓全層,亦於去年8月以1.93億易手,平均呎價18161元,買家湯臣集團,將持有物業作投資,並於適當時候自用作為總部。

有代理表示,深水埗南昌街223至239號南昌戲院大廈高層地下G5A號鋪,面積約700方呎,意向價約2500萬,平均每方呎約3.57萬,物業間隔四正實用,門闊約10呎,設有三相電及來去水,現時由特色食肆承租,料回報約3.6厘。

(星島日報)

更多永安廣場寫字樓出售樓盤資訊請參閱:永安廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

中港通關 商廈交投勢回升

中港正式通關,而甲廈買賣亦略為增加。業界人士預計,通關後用家及投資者將加快入市,交投量勢回升。

據一間代理行每月10大商廈交投上,去年12月合共錄4宗買賣,略為好轉。4宗成交不乏理想造價,信德中心西座中層11室,面積約2,559平方呎,以約8,500萬元成交,呎價約33,216元。據悉,單位屬正海景,成交呎價理想。原業主於2010年以約3,761萬元購入,其後作收租,而高峰期呎租約高達60元。如今以約8,500萬元沽貨,持貨12年,帳面獲利約4,739萬元,升值約1.3倍。

據了解,去年初上環信德中心西座高層02室,面積約1,400平方呎,約以3,000萬元成交,呎價約21,429元,買家為中聯辦或有關人士。按最新成交價計,呎價明顯有所上升。

星光行單位拆售 呎價1.2萬元

九龍區方面,資深投資者盧華拆售星光行12樓單位,其中1單位錄得成交,面積約1,298平方呎,作價約1,557.6萬,呎價約1.2萬元,盧華於2021年3月向日本玩具商TOMY,以1.412億元購入的尖沙咀星光行12樓一籃子物業,現進行拆售,據悉早前率先推出的是07至08室、09室、16及16A室,面積約由878至1,756平方呎,意向呎價1.25萬元起,總樓面約9,624平方呎,意向價約1.45億元。

內企購上環乙廈 料作自用

乙廈方面,近日出現內地客入市個案,上環永樂街148號南和行大廈22樓全層,面積約4,928平方呎,由內企華魯集團以約5,700萬元承接,平均每呎約11,567元。據悉,集團總部設於灣仔會展廣場辦公大樓,現購入該全層作為自用。華魯集團主要經營進出口貿易。該物業22樓全層原業主於2010年以約2,266.88萬元購入,持貨12年,帳面獲利約3,433.12萬元,升值逾1.51倍。

有代理分析,因中港封關近3年,內地企業未能來港擴充,令商廈交投低迷,租售價回落。日前中港正式通關,必能帶動企業來港進行擴充。該代理指,近日不論甲廈及乙廈,漸出現內地資金入市,包括金鐘遠東金融中心、上環信德中心,以至乙廈南和行大廈等,反映通關加快用家及投資者入市。該代理預計今年商廈整體成交量將明顯回升,惟因空置率較高,租售價將平穩,難以出現大幅反彈。

(經濟日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多南和行大廈寫字樓出售樓盤資訊請參閱:南和行大廈寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多會展廣場辦公大樓寫字樓出售樓盤資訊請參閱:會展廣場辦公大樓寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

更多遠東金融中心寫字樓出售樓盤資訊請參閱:遠東金融中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

甲廈空置率15.1%創新高

據一間外資代理行統計,目前甲廈空置率達15.1%,創出有紀錄以來新高。

該行指,香港早前採取嚴厲的防疫政策,加上全球加息及地緣政治局勢緊張,企業於2022年保持謹慎,寫字樓租賃勢頭於年內放緩。全年新租賃量按年下跌11%至約380萬平方呎,但仍較2020年水平高出64%。銀行及金融為最活躍的行業,佔全年租賃量的27%。

在計算新竣工大廈預租面積的情況下,淨吸納量在2022年回復至正數。在2021年收縮約841,500平方呎,及2020年收縮約220萬平方呎後,2022年總佔用空間擴大了約601,100平方呎。然而,若撇除新供應中的預租面積,2022年淨吸納量約為(負)321,600平方呎。

去年供應達410萬呎

2022年錄得自2008年以來新增供應量的高峰,達約410萬平方呎。租賃承諾低,僅佔吸納空間20%。因此,全港甲級寫字樓空置面積創下約1,300萬平方呎的歷史新高,較1999年的空置高峰高出約53%,空置率亦創新高,達約15.1%,超過1999年記錄的14.4%,為新冠疫情之前10年的平均水平4.7%的3倍多。

低迷的租賃氣氛及屢創新高的空置率已導致租金連續第4年下跌,唯下跌速度有所放緩。繼2021年按年下降約7.3%後,整體淨有效租金按年下跌約2.3%。

該行代理表示,2022年寫字樓市場的新租賃量減少,空置率創歷史新高。即使市場氣氛低迷,但留意到通關所帶動的潛在需求,特別是中資企業的需求回升,並將支持2023年的租賃活動。而由於全球經濟不穩及高融資成本,跨國公司將繼續對擴張計劃的成本開支保持審慎的態度。

然而,企業的成本控制政策及不斷上升的空置數字造成租金下行壓力,此情況將持續,直至需求強勁至足以扭轉為止,預計主要子市場的租金將進一步下降0至5%。

(經濟日報)

Debt-laden Goldin’s former Hong Kong headquarters sells for ‘significant discount’ of US$713 million to PAG and Singaporean investment firm

Deal ends more than two years of legal wrangling over the 28-storey Goldin Financial Global Centre

The price agreed on by PAG and Singapore’s Mapletree Investments is well below market value, PAG said

The former headquarters of embattled Goldin Financial Holdings has been bought by PAG and a Singaporean investment firm for HK$5.6 billion (US$713 million), according to a statement from the joint venture.

The confirmation of the acquisition ends more than two years of legal wrangling over the 28-storey office building, known as the Goldin Financial Global Centre (GFGC).

The price agreed on by PAG, a pan-Asian investment company, and Singapore government-backed Mapletree Investments, is well below market value, PAG said.

“GFGC is an iconic building in Hong Kong’s [second central business district], and represents very good value at a significant discount to replacement cost,” said J-P Toppino, PAG’s president, in the statement.

“This transaction further expands PAG Real Assets’ footprint in Hong Kong, where we see the ongoing post-Covid recovery creating attractive opportunities for us and our investors.”

In September, several local media outlets reported that the property in the Kowloon Bay district was sold for between HK$6.5 billion and HK$7 billion, a long way shy of its estimated value of HK$10 billion. It is unclear whether the acquisition confirmed on Thursday is the same deal referred to in those reports.

The acquisition is a “great opportunity to own a high-quality office building, boosting our presence in Hong Kong’s commercial sector at an attractive price,” said Wong Mun Hoong, regional chief executive officer, Australia and North Asia, for Mapletree.

“With the reopening of the border with China and the easing of travel restrictions, we are confident in the recovery of the office sector in Hong Kong,” he added.

Hong Kong-listed Goldin Financial holds Chinese tycoon Pan Sutong’s finance and property development businesses. The firm and its creditors have been engaged in a tussle since July 2020 over who controlled the building, which the developer has used as collateral for loans. Pan resigned as Goldin’s chairman in June last year.

In September 2020, the receivers appointed an agency to sell the tower after the developer failed to meet its debt obligations. But two days later, Goldin said it had entered into a provisional sale-and-purchase agreement for the building with an independent third party for HK$14.3 billion.

Two months after that, however, the receivers said the company had no right to sell it. Then, in October the same year, the Hong Kong High Court ruled that Pan, Goldin’s chairman back then, had lost control of its assets to creditors.

The receivers sold the building, located at 17 Kai Cheung Road, for a reported HK$14 billion later that year, but failed to complete the deal.

The property received LEED platinum and BEAM Plus platinum certification upon completion in 2016, the highest global and Hong Kong local industry standards for healthy, sustainable and cost-saving green buildings.

Goldin has been selling its assets in recent years to pare down a mountain of debt. In 2020, the company agreed to sell a residential plot at Kai Tak at an estimated record loss of HK$2.57 billion.

It is also looking for a buyer for half-completed twin towers in Guangzhou Science City, with a starting price of 1.64 billion yuan (US$242 million).

Goldin is facing a petition for liquidation in Bermuda and a bankruptcy petition in Hong Kong owing to its debts. Pan, a billionaire, was also ordered by the Hong Kong High Court in July to wind up one of his holding companies over unpaid liabilities of HK$8 billion owed to China Citic Bank. The order is being appealed.

PAG Real Assets, the property business of PAG, has more than US$10 billion in equity under management across the Asia-Pacific region. Over the past two decades, it has bought and managed over 7,000 properties across the Asia-Pacific region, in sectors that include office and logistics, hotel, retail, digital infrastructure and renewables.

Mapletree, a unit of Singapore’s Temasek Holdings, owns Festival Walk, an upscale Hong Kong shopping centre. It manages a portfolio of S$78.7 billion (US$59.1 billion) in property assets including offices, industrial buildings, data centres, retail and residential premises in markets such as Asia-Pacific, Europe and the US.

(South China Morning Post)

For more information of Office for Lease at Goldin Financial Global Centre please visit: Office for Lease at Goldin Financial Global Centre

For more information of Grade A Office for Lease in Kowloon Bay please visit: Grade A Office for Lease in Kowloon Bay

施永青2500萬再沽新港中心單位

中原集團創辦人施永青旗下的施永青基金減持甲級商廈物業,繼去年11月以1875萬元沽售尖沙咀新港中心高層寫字樓單位後,上月再以2500萬元售出同層另一單位,一個月內共套現4375萬元。

資料顯示,新港中心一座17樓5B室,建築面積約2047方呎,在上月下旬以2500萬元成交,呎價約12213元。據了解,有關單位已交吉一段時間,去年第四季起以2825萬元放售,終降價325萬元或11.5%出售。物業由施永青基金在2010年3月以1801.4萬元購入,持貨近13年,賬面獲利698.6萬元,升值38.8%。

施永青基金在去年11月底,以1875萬元沽出同層的3室,建築面積約1500方呎,呎價約12500元。以成交呎價計,最新售出的單位一個月內跌價2.3%。施永青早前稱,現時寫字樓收租回報低,欲將資金轉為定期存款,故在去年11至12月一個月內先後賣出2個新港中心單位,共套現4375萬元。

另外,有外資代理行發表2022年第四季香港寫字樓租賃市場報告指出,甲級商廈空置樓面增至660萬方呎,而第四季租金進一步下跌2.3%,導致2022年全年下跌7.6%,較2019年高位下跌了31.4%。雖然今年通關,經濟有望復常,但本年寫字樓供應處於高位,加上本港及內地經濟前景仍存在憂慮,預計今年租金仍將下跌10%。

位元堂4880萬售佐敦物業

此外,宏安集團 (01222) 及子公司位元堂 (00897) 宣布,位元堂於周五 (6日) 收市後與買方訂立臨時協議,以買賣項目公司股份連股東貸款的模式,向一家海外公司出售佐敦寶靈街14號寶靈大廈地下的零售物業,作價4880萬元;買家公司由「Wang Haiyue」全資擁有。

位元堂在2013年購入該物業,總銷售面積約388方呎,連約37方呎天井,今次以連租約形式出售,月租11.68萬元,租期至今年7月底,預計今年3月22日或之前完成交易;宏安集團和位元堂估計,該交易扣除相關開支及費用後,可錄得約1630萬元的收益;出售所得款項淨額擬用作償還該物業的按揭貸款。

(信報)

更多新港中心寫字樓出售樓盤資訊請參閱:新港中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

代理行:料今年內甲廈租金升5%

有代理行指,去年商務活動大減,甲廈需求增長構成壓力,隨着通關計畫逐步實施,預料全年整體甲廈租金升5%,售價升幅5%以內。

該行代理表示,通關後實際情況仍有待觀察,故買賣及租賃需求在通關初期內未必反彈。該行預計,若2023年下半年完全恢復與外地來往,達致全面通關並配合其他利好消息推動,交投將回穩,預料全年整體甲廈售價升5%以內,租金升幅高達5%。

整體甲廈空置率10.3%

該代理表示去年商務活動大減,甲廈需求增長構成壓力,加上供應進入高峰期,整體空置率上升,截至12月底,中環甲廈空置率8.3%,東九龍更錄16.8%,拖累整體甲廈空置率升至10.3%。

受到疫情反覆、經濟疲弱影響,去年寫字樓量齊跌,該行發表的商廈報告指,全年商廈成交量錄797宗,按年跌約41.2%,金額按年跌約43.5%,僅錄218.8億。全年甲廈售價跌4.1%,乙廈售價亦跌4%。甲廈及乙廈按年分別下挫6.8%及4.1%。

去年甲廈租金下挫6.8%

報告指出,12月散業權甲廈售價按月微升2.5%,散業權乙廈售價按月跌3.2%,50大甲廈錄6宗成交,略為帶動售價拉升,成交集中於港島核心商業區如上環及金鐘,較矚目為上環信德中心西座大額交易,以8500萬易手,呎價3.32萬,高市價約20%。散業權甲廈和乙廈租金分別按月跌1.3%及1.7%。

(星島日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

代理行:工商鋪交投料反彈 預期全年6350宗增50%

有代理行指出,隨着兩地實施免檢疫通關,工商鋪氣氛轉活,本地購買力配合旅客重臨,零售餐飲業即時受惠,帶動鋪位租賃及買賣。旺角洗衣街商業地王快將招標,該行料今年第一季買賣及租務漸入佳境,升幅逾五成至6350宗,整體金額可達約1050億,不過,價格於短期波動,全年徘徊上落幅度約10%至20%。

旅客重臨帶動零售消費

該行代理表示,去年12月工商鋪量升價跌,市場共錄約230宗買賣,按月微升約1.32%,對比去年12月大跌約57.56%,金額約30.20億,較上月減少約26.50%,按年則遞減約65.73%,金額為2022年按月新低,亦是自2020年2月份後新低,鋪位跌幅較明顯,皆因當時仍在觀望通關,12月份商鋪買賣宗數較上月微跌約5.33%,共錄71宗,總金額約14.29億,按月跌約34.14%。

價格升跌幅度10%至20%

代理續表示,受第五波疫情、俄烏戰事、加息等利淡因素影響,2022全年共錄約4016宗工商鋪成交,金額約862.90億,按年下跌約39.27%及36.64%,去年,投資者及發展商沽貨,轉投其他渠道獲取更豐厚回報,拖累工商鋪交投創自1999年後新低。銅鑼灣怡和街19至31號樂聲大廈地下1A1及1A2號地鋪,以約4680萬沽。

(星島日報)

太子HQ全幢商廈 約3.5億易手

減價逾半 基金持貨8年平手離場

市況好轉,基金亦趁機沽貨。消息指太子全幢商廈HQ,以約3.5億元易手,由本地買家承接。據了解,基金於2015年以3.5億元購入,近年數度放售,叫價最高逾7億元,減價一半沽出,持貨8年僅平手離場。

市場人士透露,太子砵蘭街450至454號HQ全幢易手,物業樓高15層,總樓面約38,228平方呎,每層面積約3,000餘平方呎,現時出租率約97%,主要租客為教育中心、宗教團體等。

據悉,項目以約3.5億元成交,呎價約9,155元,屬略低於市價成交。據悉,新買家為本地投資者,並以豐資源旗下基金奪得呼聲較高。另外,該廈已獲屋宇署批准酒店改建圖則,可提供84間客房。

新買家料豐資源旗下基金

翻查資料,項目前身為炳富商業大廈,鵬里資產於2015年以3.5億元購入該廈,由於物業原本較舊,基金購入斥資數千萬元進行翻新,包括入口、大堂等,並易名為HQ,打造成教育作主題的商廈。兩年前,基金曾以7.8億元放售物業,未獲承接,而業主去年再委託測量師行放售,降至約6億元。

如今基金大幅降價至3.5億元沽出,造價較高峰期減價逾半。基金持貨8年轉手,帳面僅平手離場,惟若計算印花稅及翻新費用等,料有所虧損。

通關帶動投資氣氛,業主亦趁機放售物業,而鵬里資產沽出HQ同時,近日亦放售紅磡海名軒3樓、5樓及6樓全層,總樓面約7.7萬平方呎,市值逾11.55億元。鵬里2018年向資深投資者林子峰以約11.6億元購入,若以市值出售,帳面將微蝕離場。

去年工商舖買賣錄4016宗

另有代理行資料顯示,2022年12月錄得約230宗工商舖買賣成交,總成交金額約30.20億元,而所錄成交金額為全年最低;至於去年全年工商舖買賣成交宗數,錄得約4,016宗,按年下跌近4成,成交宗數創下1999年後新低。

而另一代理行則指出,去年商廈成交量錄797宗,按年下跌約41.2%,成交金額按年跌約43.5%,僅錄218.8億元。

(經濟日報)

Luxury, secondary deals perk up market

Hong Kong's residential property market picked up with at least four luxury homes costing more than HK$70 million each sold in the primary market and a nearly 80 percent surge in the transactions at the 10 major housing estates over the weekend.

At the Mid-Levels, University Heights sold a 1,584-square-foot flat with a parking space for HK$76.8 million, or HK$48,485 per sq ft.

The four-bedroom unit was sold via tender yesterday, the developer Chinachem said, adding that it has collected HK$1.47 billion from selling 18 homes in the project.

In Tuen Mun, Kerry Properties' (0683) The Bloomsway sold a 2,877-sq-ft house for HK$86.3 million, or around HK$30,000 per sq ft.

The four-bedroom house was sold together with a 2,469-sq-ft garden, a 1,106-sq-ft rooftop and three parking spaces.

In Kai Tak, Pano Harbour, which is developed by China Resources Land (Overseas) and Poly Property (0119), sold a 2,088-sq-ft flat for HK$98.96 million, or HK$47,395 per sq ft yesterday.

A unit with the same area on a different floor was purchased for HK$102.55 million with two parking spaces on Saturday.

In Tin Shui Wai, Sun Hung Kai Properties (0016) released the latest price list for phase three of Wetland Seasons Bay, offering 40 flats at an average price of HK$17,266 per sq ft.

The flats in the batch have areas ranging from 268 to 795 sq ft and cost HK$5 million to HK$12.4 million, or HK$14,693 to HK$20,644 per sq ft. They include 26 special units and eight flats that were up for sale by tender previously.

In the secondary market, a property agency said the number of deals recorded in the 10 estates jumped by 79 percent week-on-week to 25 over the weekend.

An agent said that the long-accumulated purchasing power was released rapidly on news of the border reopening as well as expectations of slower US interest rate hikes.

In the office market, another agency estimates that demand for Hong Kong offices may not rebound significantly in the initial stage of the border reopening, but the market might pick up in the second half of this year, leading to a 5 percent rise in both prices and rents for the full year.

It said office transactions slumped by over 40 percent in both volume and value last year.

(The Standard)尖東康宏廣場高層 呎價1.48萬

通關帶動商廈交投,消息指,尖東康宏廣場高層09室,面積約1,213平方呎,以約1,800萬元成交,呎價約1.48萬元,單位以交吉交易。

據了解,原業主於2011年以約1,673萬元購入單位,持貨12年轉手,帳面獲利約127萬元,單位升值約7.6%。

(經濟日報)

更多康宏廣場寫字樓出售樓盤資訊請參閱:康宏廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

有代理行表示,銅鑼灣萬國寶通中心中層04室,建築面積約2594方呎,業主意向售價約4487萬元,呎價約1.73萬元;意向租金約5.18萬元,呎租約20元。

該行指出,單位間隔四正實用,附全寫字樓裝修,適合不同類型的中小型企業進駐。大廈設有11部載客電梯及1部載貨電梯,用戶出入極為方便。

(信報)

更多萬國寶通中心寫字樓出售樓盤資訊請參閱:萬國寶通中心寫字樓出售

更多北角區甲級寫字樓出售樓盤資訊請參閱:北角區甲級寫字樓出售

China border reopening to boost demand for Hong Kong office space, but rents won’t rise significantly, analysts say

Property agency expects vacancy levels to go up from 14.6 per cent currently to closer to 16 per cent by the end of 2023, because of a ‘supply boom’

Pace of economic recovery and overhang of new office spaces from last year are likely to temper any expansion afforded by mainland Chinese firms, another agency says

The reopening of Hong Kong’s borders with mainland China and the rest of the world is likely to boost the take up of office space in the city, but rents are not expected to rise significantly, analysts said.

They have given a wide range of forecasts for office rents, from an increase of as much as 3 per cent to a decline of as much as 10 per cent this year.

Hong Kong’s new office stock is estimated to hit 14.5 million sq ft in 2023, a record high and the equivalent of the total gross floor area of every building in Hong Kong’s core Central business district, a property agent said.

“We will continue to see a supply boom coming into the market,” the agent said. “So, we do expect the vacancy level will continue to go up from, like I said, 14.6 per cent currently. We forecast that by the end of 2023, the market vacancy level will be getting closer to 16 per cent, if all new supply or the pipeline is completed in the next 12 months.”

Rents are likely to decline by as much as 5 per cent. “We are seeing a potential demand recovery, particularly from Chinese firms that will support leasing activity for 2023, thanks to the border reopening, while [multinational companies] will continue to stay cost-cautious on expansion plans due to global economic headwinds and high financing costs,” another agent said. “However, cost control and escalating vacancy pressures will continue to weigh on rents until demand is strong enough to reverse this trend.”

The pace of recovery and overhang of new office spaces from last year are likely to temper any expansion afforded by mainland Chinese firms, another agency said, which forecast a further slump of as much as 10 per cent in office rents this year.

“The rebounding stock market, a loosening of most Covid-19-related measures, as well as the scheduled border reopening with the mainland, are all positive spins for office demand, but uncertainties linger given hangover vacancy from 2022 completions, and concerns over the speed of recovery,” another agent said.

Others see office rents rising this year. “The reopening of China’s borders will be a game changer for the sector,” another agent said. “As business travel resumes across borders, we expect more viewings and leasing enquiries, which are likely to strengthen office rents, with overall grade-A office rents estimated to increase moderately by 3 per cent year on year.”

Hong Kong’s Central is likely to “benefit the most with 5 per cent year-on-year growth compared to a dip of 2.3 per cent year on year at the end of 2022”, the agent added.

Beijing abandoning its zero-Covid policy will definitely be a positive for Hong Kong’s property investment market and the rest of the region, an agent said.

However, the return of Chinese tourists and Chinese businesses to the region could also drive up prices with higher demand. This, in turn, is likely to trigger further increases in interest rates by monetary authorities, tempering any recovery.

“We expect the inflow of Chinese tourists into the rest of Asia-Pacific to be very, very positive for not just hotels and retail, but also for corporate profits and office demand,” the agent said, adding that China’s closed borders had allowed for slower inflation, and its reopening could push up inflationary pressures.

(South China Morning Post)尖東康宏廣場13216元易手

近期寫字樓市況趨活躍,業主趁勢放售,尖東康宏廣場一個中層單位,以2700萬易手,物業於13年間升值26%,新買家為用家。

13年升值26%

尖東康宏廣場錄1宗買賣,該廈中層2012至13室,約2043方呎,以2700萬易手,平均呎價13216元,買家為用家;該物業原由漢晨煙草自用,於2009年2138.8萬買入,持貨13年,帳面獲利561.2萬,物業升值26%,新買家為自用客。

有代理表示,九龍灣臨樂街19號南豐商業中心7樓26室,面積約1020方呎,以交吉形式交易,成交價約595萬,呎價約5833元,單位望公園景,景觀開揚。買家為用家,原業主去年中放售單位,當時叫價約643萬,其後因應市場變化調整,售價較原先叫價低約7.5%。該單位於2006年以260萬購入,持貨16年半,帳面獲利約335萬,物業升值約128%。

代理表示,南豐商業中心剛錄一宗租務成交,單位為15樓06室,面積約1187方呎,月租約1.78萬元,呎租約15元。

(星島日報)

更多康宏廣場寫字樓出售樓盤資訊請參閱:康宏廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多南豐商業中心寫字樓出售樓盤資訊請參閱:南豐商業中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

中環大道中巨鋪月租120萬 「戲院大王」陳俊巖家族持有 空置3年始租出

受通關效應帶動,核心區鋪位租賃轉活,「戲院大王」陳俊巖家族於三年前重建的中環豐樂行,基座巨鋪丟空3年,終以每月120萬租出,為今年以來最大宗鋪位租賃個案。

中環皇后大道中54至56號豐樂行地下、1樓、2樓及3樓,每層面積分別為2065、2205、2185、2280方呎,總面積共約8735方呎,以月租120萬計算,平均呎租137元,有代理表示,此類型複式巨鋪於市況暢旺時受捧,疫市下難於出租,現時租金大約為2008年至2009年的水平。

每呎137元重返2008年

該物業由「戲院大王」陳俊巖家族,早於三年前完成重建,上述4層複式巨鋪,空置3年,年前曾叫租180萬,直至近日通關後,才成功租出,為今年暫錄最大宗鋪位租務個案。

有代理估計,租客為中檔零售品牌,昨日市傳是早前以200萬於廣東道承租複式巨鋪的體育用品店李寧,惟相關消息未獲證實。

豐樂行全幢由單一業主持有,樓高22層,總樓面約35867方呎,樓上寫字樓每層面積約1428方呎,業主為南源有限公司,公司董事包括陳榮裕、陳榮美及陳榮民,均為「戲院大王」陳俊巖子女。

斥3400萬購銅鑼灣地鋪

早前,銅鑼灣怡和街19至31號樂聲大廈地下1A1及1A2號地鋪易手,作價3400萬,買家為陳裕榮,正是「戲院大王」家族成員。

於2021年9月,購入中環德輔道中113號遠東發展大廈地鋪,作價1.15億,成交呎價9.9萬。

陳俊巖家族早於1962年,購入銅鑼灣摩頓台11至13號,作價250萬,開設第一家叫「新都」的戲院,其間不斷擴充,直至1992年,更「大手筆」斥1.894億,一口氣購入旺角金聲、深水埗華聲及樂聲三家戲院,高峰期,旗下擁有戲院數目多達17間。

陳俊巖家族旗下4層複式鋪巨鋪,空置3年,直至近日通關後才成功租出,為今年暫錄最大宗鋪位租務。

(星島日報)

更多豐樂行寫字樓出租樓盤資訊請參閱:豐樂行寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多遠東發展大廈寫字樓出售樓盤資訊請參閱:遠東發展大廈寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

教育機構3.5億購HQ全幢商廈

鵬里資產沽售太子全幢商廈HQ,作價約3.5億,由一家本地教育機構承接,平均呎價約9155元。

呎價約9155元

太子砵蘭街450至454號HQ全幢易手,消息人士透露,買家為一家本地教育機構,該廈樓高15層,每層面積約3000餘方呎,總樓面約38228方呎,呎價約9155元,現時出租率約97%,租客以教育中心主導,並有部分宗教團體。該廈已獲屋宇署批准酒店改建圖則,可提供84個客房。鵬里資產於2015年以3.5億購入,近年曾多次放售,最高叫價逾7億,現時減價50%售出,持貨8年平手離場。

該項目前身為炳富商業大廈,由於物業原本較舊,鵬里資產斥資數千萬翻新,包括入口及大堂等,並易名為HQ,打造為教育主題的商廈,兩年前以7.8億放售,去年以意向價6億放售,最終大幅減價沽售,持貨8年帳面僅平手,若計及印花稅及翻新費用等,料有所虧損。

鵬里資產近日放售紅磡海名軒3樓、5樓及6樓全層,總樓面約7.7萬方呎,市值逾11.55億,單位於2018年向資深投資者林子峰以約11.6億元購入。

(星島日報)

大手買賣低位回升 外資代理行:料全年達700億

有外資代理行指出,今年在高息大環境下,投資者傾向選擇高回報物業,實力業主不會輕易劈價求售,部分交易需要更長談判時間,市場上有不少被銀主接管資產出售的個案發生,財團積極放售非核心物業,預期今年大手買賣由今年低位回升,全年達至700億水平。

去年第四季錄153億

該行代理表示,季內逾億元的大手物業成交額約153億,按季升6%,但按年下降53%,大多數投資者加息環境中觀望,第四季度交易量主要由兩筆大型與接管個案有關的易手推動,合計106億,佔本季度總投資額69%。縱觀2022年,全年總成交額錄約625億,按年跌36%,其中交投宗數主要集中上半年。

按年大跌53%

寫字樓交易佔第四季度總投資額的39%,主要為太盟投資集團 (PAG) 和豐樹產業以56億 (每呎6100元) 收購高銀金融國際中心,分層寫字樓交易第四季度相對淡靜,建築地盤佔第四季度總投資額33%,元朗和生圍住宅發展項目被接管人以近50億售出。

第四季度亦錄一全幢酒店成交,宏安地產夥拍安祖高頓基金收購新蒲崗九龍貝爾特酒店。工業物業投資放緩,受注目的有黑石 (Blackstone) 夥拍迷你倉集團合資以8.5億買入長沙灣永新工業大廈,觀塘世達中心其中三層樓面亦以約3.3億沽。

(星島日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

商務活動漸復常 大手買賣有望增

正式通關,帶動投資氣氛,近一星期市場錄數宗工商舖大手成交,預計商務活動漸恢復,大手買賣有望增加。

近一星期市場相繼錄大手買賣,而近期積極沽貨的資深投資者羅守輝,以約7.48億元沽出大角咀海桃灣基座「西九匯」商場。陽光房地產基金 (00435) 公布,以7.48億元購入「西九匯」,位於大角咀櫻桃街38號海桃灣基座商舖,物業樓高3層,可出租面積約58,836平方呎,並連同8個外牆廣告位及17個商業停車位。據了解,項目現時每月租金收入約300萬元,回報率接近5厘。

翻查資料,項目早年由基匯資本持有,2012年羅守輝以6.3億元承接。現持貨11年轉手,獲利約1.18億元離場,升值近兩成。近期羅守輝連環沽貨,包括日前沽出灣仔乙廈兩層單位。

鄧成波家族 蝕沽尚翹峰商舖

另消息指,「舖王」鄧成波家族,以約2.1億元沽出灣仔尚翹峰1座商舖及停車場,面積約1.82萬平方呎,連50個車位。波叔於2016年,以5.642億元買入尚翹峰1至3座商舖及停車場,當中1座商舖及停車場,共涉2.43億元,是次家族沽貨帳面蝕3,300萬元。另外,家族仍持有項目第2及3座舖位,面積約7,922平方呎。

至於商廈方面錄中資機構入市。資料顯示,海富中心二座 15樓全層以1.88億元沽出,按面積約10,627平方呎計,呎價約1.77萬元,仍屬低市價成交。據了解,新買家為內企信義玻璃,購入樓面或自用。

翻查資料,該層樓面原業主為上市公司,於2017年以3.18億元買入物業作總部,不過該公司早前被停牌,並於去年3月初被清盤,上述物業及後成為銀主盤。以1.88億元成交價計,該物業在過去5年期間帳面貶值約1.3億元,跌幅約40%。

至於全幢商廈亦有投資者留意,消息指太子砵蘭街450至454號HQ全幢易手,物業樓高15層,總樓面約38,228平方呎,每層面積約3,000餘平方呎,現時出租率約97%,主要租客為教育中心、宗教團體等。據悉,項目以約3.5億元成交,呎價約9,155元,略低於市價。

項目前身為炳富商業大廈,鵬里資產於2015年以3.5億元購入,翻新並易名為HQ,基金持貨8年沽出,帳面平手離場,惟若計算支出,料有所虧損。

分析指,中港落實通關,市場氣氛轉好,由於投資者憧憬本港經濟今年向好,即使目前息口未下降,仍希望趁工商物業價格有所回調,趁早入市。隨着香港與內地及海外地區商業活動復常,料投資氣氛持續向好,大手成交可望勝去年。

(經濟日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

去年商廈成交 量價跌逾4成

有代理行發表的商廈報告指出,去年全年商廈成交量錄797宗,按年下跌約41.2%,成交金額同樣錄跌幅,按年跌約43.5%,僅錄218.8億港元。全年甲廈售價下跌4.1%,乙廈售價亦跌4%。租金方面,甲廈及乙廈按年分別下挫6.8%及4.1%。

該報告指出,12月商廈售價個別發展,分散業權甲廈售價按月微升2.5%,而分散業權乙廈售價則按月跌3.2%,甲廈售價上升主要是錄得6宗50大甲廈成交,略為帶動售價拉升,成交集中於港島的核心商業區如上環及金鐘,其中較為矚目為上環信德中心西座中層的大額交易,業主以8,500萬易手,呎價3.32萬元,高於該區市場水平約20%。

甲廈今年租售價料升5%

租金方面,分散業權甲廈和乙廈租金分別按月下降1.3%及1.7%。上月租務市場發展多元,包括不同類型的預租個案及低於市價的租賃成交。根據市場消息,蘇富比拍賣行預租太古廣場六座多層樓面,涉及面積近3萬平方呎,成交呎租約60元。同時,中環長江集團中心及環球大廈錄得租務成交,市值呎租分別料約120元及43.5元,目前新租金較高峰期回調3成至5成。

該行代理表示,由於國際及內地企業往來香港進行商務活動減少,對甲廈的需求增長構成壓力,加上商廈供應進入高峰期,整體空置樓面因而上升。截至去年12月底,中環甲廈空置率為8.3%,東九龍更錄16.8%,拖累整體甲廈空置率升至10.3%。

展望來年,本港通關計劃自2023年1月已經逐步實施,惟市場初期反應較慢、通關後的實際情況仍有待觀察,故買賣及租賃需求在通關初期內未必反彈。該行預計,若2023年下半年完全恢復與外地的來往達致全面通關並配合其他利好消息推動,交投亦會回穩,預料全年整體甲廈售價及租金分別錄5%以內和5%的升幅。

(經濟日報)

更多信德中心寫字樓出售樓盤資訊請參閱:信德中心寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

更多太古廣場寫字樓出租樓盤資訊請參閱:太古廣場寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多環球大廈寫字樓出租樓盤資訊請參閱:環球大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

尖沙咀堪富利士道全幢 意向價4.6億

全幢物業具投資價值,現老牌業主放售尖沙咀堪富利士道全幢物業,意向價約4.6億元。

有代理表示,有業主以公開招募意向書形式出售尖沙咀堪富利士道11號全幢,意向書截止日期為2023年2月17日 (星期五) 中午12時正。

每月租金收入約138萬

物業建築面積約23,047平方呎,基座為零售商舖部分,包括地庫、地下、及1樓至3樓,建築面積約10,243平方呎,樓上商業樓面包括4樓至11樓,建築面積約12,804平方呎。物業位於堪富利士道頭段,鄰近彌敦道,步行至尖沙咀港鐵站入口僅需1分鐘。

業主持有該物業超過40年。是次放售意向價約為4.6億元,基座零售商舖部分市場估值約3.3億元,樓上商業樓面市場估值約1.3億元。物業計劃翻新後可作餐飲、美容、醫療及其他零售等用途,屆時全幢預計總租金收入預計將可達每月約138萬元,預計租金回報約4厘。

(經濟日報)

尖沙咀瑞信集團大廈 合中小企

尖沙咀瑞信集團大廈位處柯士甸道,優質景觀為該優賣點之一,適合中小型公司使用。

瑞信集團大廈位於尖沙咀柯士甸道,位置上稍接近佐敦港鐵站,由港鐵站出口步行至該廈,需時約5至10分鐘,大廈附近亦有巴士、小巴站等。

飲食配套上,柯士甸道有不少餐廳,近年地段亦有新式文青咖啡室。此外,附近的柯士甸路及山林道餐廳選擇亦多,或可前往尖沙咀THE ONE等商場。

柯士甸道附近以乙廈為主,包括好兆年行等,而地段因不算非常繁忙,屬靜中帶旺,觀感不錯。

大廈地下現由超市租用,而地下大堂並非連接大廈入口,觀感上稍遜。物業提供兩部升降機,通往各樓層。大廈樓高16層,樓層不算多,故升降機尚算足夠。

大廈放盤少 租務不多

物業全層面積主要約2,858平方呎,個別樓層逾3,000平方呎,普遍每層可分間為兩單位,面積分別約1,130及1,488平方呎。大廈所有單位,均望向九龍木球會方向,並可以遠望何文田及紅磡,景觀非常開揚舒適,為該廈賣點之一。單位樓底不高,空間感一般。

該廈向來極少買賣,一年未必有一宗成交,2019年3月,物業13樓A室,面積約1,123平方呎,以約988萬元易手,呎價約8,798元。其後一宗買賣,為去年4月,物業4B室,面積約1,488平方呎,以約1,280萬元易手,呎價約8,602。

因大廈放盤少,租務亦不算多,2021年12月,物業8B室,面積約1,481平方呎,以每呎約22元租出。對上一宗租務為去年6月,涉及15B室,面積約1,488平方呎,成交呎租約21元。

(經濟日報)

更多好兆年行寫字樓出售樓盤資訊請參閱:好兆年行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

Wheelock's six projects will offer 3,000 flats

Wheelock Properties will launch six new projects offering altogether 3,000 units this year, expecting to benefit from Hong Kong's recovery.

Managing director Ricky Wong Kwong-yiu said in a ceremony that "the bad news has left" as the transaction in Wheelock's projects is increasing and the appointments of home viewing and inquiries have rebounded significantly after the border with the mainland reopened.

Wong is optimistic about the property market this year as Hong Kong is accelerating its recovery. HSBC (0005) raised Hong Kong's economy growth forecast to 3.8 percent this year.

The developer sold 587 units last year, cashing in over HK$9.5 billion together with car parking spaces.

But Wheelock will speed up this year, with a plan to offer more than 3,000 units in six new projects, including Miami Quay II and No 19 Shing Fung Road in Kai Tak, Koko Hills Phase 3A in Lam Tin, Phase 12 of Lohas Park in Tseung Kwan O, Spring Garden Lane in Wan Chai, plus a luxury project of No 1 Plantation Road on the Peak.

(The Standard)

Home sales tick up with border reopening

A mainland buyer has purchased a Lohas Park apartment in Tseung Kwan O for HK$12.8 million, according to real estate agecny.

The property, with a stamp duty of HK$3.84 million, was sold as market sentiments improved after China reopened its border.

The four-bedroom unit was priced at HK11,297 per square foot following a 6 percent discount offered by the owner, the agency said.

The sale was reported as the agency’s index tracking deals in 138 housing estates in the preceding fortnight increased 0.27 percent this week. The index has gone up by 0.31 percent since the beginning of the year.

Meanwhile, the index increased for eight weeks in a row - up 0.9 percent this week - indicating a recovery in homebuyers' confidence amid China's reopening. The agency expects home prices in Hong Kong to continue to rebound if the confidence index stays positive.

Another property agency said that 197 properties in Tseung Kwan O were sold in the first half of January, up 22 percent from a month ago.

Attributing the increase to border reopening, The agency expects the rebound to continue in Tseung Kwan O before the Chinese New Year.

Elsewhere on the Mid-Levels, Chinachem sold a three-bedroom flat at University Heights for HK$68 million by tender, or HK$44,884 per sq ft. The property includes a 429-sq-ft terrace.

A duplex of K Summit in Kai Tak, developed by K Wah International (0173), was sold by tender for HK$73.89 million yesterday, marking a new high for the project. The 1,798-sq-ft property was traded at HK$41,096 per sq ft.

The rebound followed a relatively weak year. Last year, land premium payments dropped by 7.6 percent to HK$41.48 billion from the previous year - although the sum for the fourth quarter surged strongly by 6.4 times to HK$15.08 billion, according to Lands Department data.

(The Standard)

Hong Kong property: cash is king as rate hikes, capital depreciation raise the bar on investment returns

Property investment loses appeal as homebuyers, investors get better returns from keeping cash in time deposits

Analysts at Wall Street firms, real estate consultancies and agencies are still divided on price recovery prospects in 2023

Hong Kong’s economic troubles and higher bank deposit rates are raising the bar on property investment returns in the city, persuading homebuyers and speculators alike to hold onto their cash for now, according to industry analysts.

Interest rates have risen since last March as the Hong Kong Monetary Authority lifted its base rate in lockstep with US hikes, prompting some commercial banks in the city to raise their lending and deposit rates to levels last seen more than two decades ago.

Fubon Bank, for example, last month offered up to 5.1 per cent interest on 12-month deposits of at least HK$200,000 (US$25,600). Annual rental yields on typical flats measuring up to 430 sq ft in Hong Kong have slipped below 3 per cent on average since August 2016, according to government data, while home prices retreated 17.3 per cent from an all-time high in August 2021.

“When people see weaker [property or] asset prices, they will say cash is king,” said Lee Shu-kam, head of economics and finance department at Shue Yan University. “So I will be pessimistic” on the industry outlook, he added.

That suggests the slump in Hong Kong’s property market activity is not about to reverse soon. Home transactions fell last year to a 27-year low of 45,050, according to data compiled by a property agency. Deals involving residential properties liable for extra stamp duties shrank 42 per cent to 2,972, the least since government records began in 2014.

Hong Kong’s economy shrank 4.5 per cent in the third quarter, in addition to a 1.3 per cent contraction in the preceding three months. While China’s reopening will spur recovery, Financial Secretary Paul Chan Mo-po has cautioned the rate-hike cycle is far from over.

The outlook appears to be equally weak in the commercial real estate market. Volumes involving deals worth at least HK$78 million tumbled 36 per cent last year to HK$52 billion, according to another agency, while the number of transactions almost halved to 129.

“The overall investment volume is forecast to remain weak in the first half of 2023 as high financing costs will remain a major barrier,” an agent said. Activity, however, could improve in the second half as economic recovery gains traction, the agent added.

What could brighten the outlook? Some analysts believe the city’s property market will start rebounding soon after China abandoned its zero-Covid policy and reopened its borders from this month. The Federal Reserve is also expected to temper its hawkishness after inflation cooled last month.

“Interest rates are likely to fall [later this year], so high interest rates will only be a short-term phenomenon,” said Chong Tai-leung, associate professor of economics at Chinese University of Hong Kong. The return of mainland visitors will generate economic activity and upwards pressure on prices, he said.

Beijing abandoned its zero-Covid policy last month. The border reopening will help boost the city’s economy and housing market, Chan said in his blog earlier this month.

That may take time to crystallise. The jury is still out as industry analysts at Wall Street firms and global real estate consultancies and agencies are divided on the recovery outlook.

There are three agencies and Goldman Sachs said home prices could fall by 5 to 15 per cent this year, while Citigroup and Morgan Stanley predict they will rise by 5 per cent by year’s end. Another two local property agencies said prices may climb by as much as 15 per cent.

Investors have been reluctant to part with their cash over the past year, many stunned by steep losses in the equity and bond markets and erosion in their pension funds. China’s zero-Covid curbs contributed to a 15 per cent slump in the Hang Seng Index last year, the most in 11 years.

Besides, interest income from cash deposits is now greater than the average annual cost of living. Inflation in Hong Kong eased to a six-month low of 1.7 per cent in November, after netting out the effects of government subsidies.

“Basically, there is still very weak investment demand,” said Billy Mak, an associate professor in the department of of accountancy, economics and finance at Baptist University in Hong Kong. Without the prospect of near-term capital appreciation, investors will take five years of rental yields just to cover the 15 per cent extra stamp duty on their home purchases, he added.

“From an investment perspective, it won’t look smart to buy a home just to collect rents,” he said. Home prices are still prone to further weakness given more rate hikes in store, he added.

For instance, the number of transactions in South Horizons in the southern district declined 45 per cent last year to a four-year low of 216, according to one of the local property agency. The average price retreated 18 per cent to HK$14,519 per square foot.

“Investment demand might not come back in full force as long as interest rates or [time] deposit rates remain elevated or get even higher,” agent said.

(South China Morning Post)星光行連錄3宗買賣 最高呎價1.73萬

資深投資者盧華拆售星光行12樓單位,繼早前沽出一個單位後,於通關消息落實後,至今連錄3宗買賣,成交呎價最高約1.73萬。

盧華拆售星光行12樓,去年12月推出首批4個單位,僅沽出1個,及後在落實通關消息後,3個單位陸續沽出,買家有用家及投資者,呎價最高為1207室,面積約878方呎,呎價約17330元,成交價約1521.57萬,套現約5512萬,儘管他推出按揭計畫 (8年、70%借款優惠,利息以「大P」計算),最終未有買家使用。

投資者盧華拆售

有代理表示,隨着首批4個悉數沽出,業主最新加推3個單位,意向呎價由約15320元,預料首批連加推單位,可為業主套現近1億元。

加推單位為09、12及14室,面積878方呎及920方呎,呎價約15320至17630元,交吉放售,叫價最相宜為1214室,面積約878方呎,意向呎價約15320元,涉資約1345萬。

該批放售中單位擁維港景。該廈地契屬999年期,對用家及投資者具吸引力。

加推3單位呎價逾1.53萬

據了解,盧華去年3月向日本玩具商TOMY,以1.412億購入星光行12樓一籃子物業,合共有10單位,目前已沽4個,3個推售,3個單位則尚未推出。

(星島日報)

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

永安廣場銀主盤呎價1.83萬售

尖東永安廣場403室銀主盤,早前由銀行推出放售,獲準買家爭奪,最終約2200萬易手,平均每呎約1.83萬,物業擁全海景,屬優質盤源。

造價高位回落32%

有代理表示,永安廣場銀主盤建築面積約1200方呎,以約2200萬售出,平均每呎約1.83萬,該單位拍賣消息傳出後,迅即接獲逾6名準買家出價,最後由實力投資者投得。

代理又說,同類型單位於商廈高峰期呎價高見約2.7萬,現時較高位回落約32%。

另一代理表示,灣仔巴路士街14號京都大廈低層全層,面積約1600方呎,意向價1680萬,租客為酒吧,料回報率約3.3厘。

(星島日報)

更多永安廣場寫字樓出售樓盤資訊請參閱:永安廣場寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

商廈受惠通關租務增 聚焦新甲廈

科企擴充租觀塘 The Millennity 啟德 AIRSIDE 兩層獲洽

中港通關後商業氣氛向好,商廈租務有所加快,新甲廈成焦點。新地 (00016) 觀塘「The Millennity」入伙,全層獲科技公司租用;另啟德 AIRSIDE 租務活動亦加快,兩層共7萬平方呎,獲日資銀行大手洽租料快落實。

中港正式通關,商務活動可復常,有代理指出,近期租務氣氛明顯轉好,通關後即使大手租務個案落實未算多,查詢及睇樓活動增加。該代理指近來中資機構,特別保險業正積極查詢,而尖沙咀一帶商廈,成不少中資機構留意對象。

業界:尖沙咀成中資對象

該代理認為,由於最近是聖誕假期後及農曆年前夕,屬傳統租務淡季,隨着睇樓量上升,預計3至4月甲廈租務將加快落實,而過去3年受疫情衝擊,特別去年第5波疫情,令租務活動叫停,直至去年第四季,商廈稍轉好,並已錄正吸納量,料今年租務成交為近年最多。

近日甲廈租務加快,全新甲廈成租客搬遷熱點。新地旗下觀塘巧明街98號九巴車廠重建項目,早前命為「The Millennity」。消息指,物業2座29樓全層,面積約1.26萬平方呎,以每平方呎約28元租出。據了解,新租客為科網公司。該公司原租用同區駿業街商廈,涉及面積約7,400平方呎,是次搬遷既擴充樓面,亦可搬遷至全新甲廈項目作升級。

The Millennity 現已落成,比鄰港鐵觀塘站及牛頭角站。項目兩座大樓各提供20層甲級寫字樓,總樓面約65萬平方呎,其基座10層為大型商場,商場佔地約50萬平方呎,規模與apm相若。目前商廈部分最大租客為積金局,租用8萬平方呎樓面。

另外,去年落成大型商廈項目啟德 AIRSIDE,近來租務洽商的進度亦有加快迹象。消息指,項目兩層樓面,合共逾7萬平方呎正獲洽租,呎租約35元,預計快將落實。據了解,洽租機構為日本三菱銀行集團,該機構目前租用中環友邦金融中心 (AIA Central) 逾10萬平方呎樓面,預計是次洽租,將把集團後勤部分遷入啟德,而核心業務仍保留在中環。按目前友邦金融中心 平均呎租約110至120元計,搬遷可大幅節省成本。啟德 AIRSIDE 為近兩年最大型商業項目,去年落成,並於第三季錄首宗租務,近期則有所加快,包括高層全層,面積約3.75萬平方呎,以每平方呎約35元租出。

長沙灣南商金融創新中心 半層租出

至於西九龍區方面,新世界 (00017) 旗下長沙灣南商金融創新中心去年落成,近日物業半層樓面,涉及約1萬平方呎,獲科網公司租用,租客原使用科學園寫字樓。

除了全新商廈外,傳統甲廈亦有錄得搬遷升級個案。消息指,灣仔中環廣場低層全層,面積約2.5萬平方呎,以每平方呎約45元租出。新租客為邦民財務,原租用同區商廈,搬遷可作升級。

(經濟日報)

更多The Millennity寫字樓出租樓盤資訊請參閱:The Millennity寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

更多友邦金融中心寫字樓出租樓盤資訊請參閱:友邦金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多南商金融創新中心寫字樓出租樓盤資訊請參閱:南商金融創新中心寫字樓出租

更多長沙灣區甲級寫字樓出租樓盤資訊請參閱:長沙灣區甲級寫字樓出租

更多中環廣場寫字樓出租樓盤資訊請參閱:中環廣場寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

商廈供應高峰待消化 租金難大升

通關後料租務活動加快,惟今年屬商廈供應高峰,加上疫情令空置率升至新高,現時大批樓面待消化,相信租金上升空間有限。

據一間外資代理行資料顯示,受疫情衝擊下,甲廈空置率持續上升,目前最新空置率約14.7%,屬近年新高,而空置樓面涉約1,100萬平方呎。

自2020年初疫情爆發,商業活動大受影響,甲廈租金亦連續3年下挫,累積跌幅近3成。以中環超甲廈為例,呎租由高峰約180至200元,已跌至約120至130元;而東九龍全新甲廈呎租,普遍跌至每呎30元或以下水平。

由於長期錄負吸納情況,空置率上升,直至去年第四季,「0+3」入境措施推出,香港與海外商業活動稍恢復,有利商廈租務,最終出現全年35萬平方呎正吸納量,為近3年最理想。

今年將有320萬呎樓面落成

中港通關,預計中資機構加快來港擴充及開業,亦可帶動其他專業服務行業拓展業務,無疑有利租務市場。不過,除了市場上仍有大批樓面待消化後,去年及今年均為甲廈供應高峰,今年市場上將有320萬平方呎樓面落成,包括中環兩幢全新商廈,另灣仔、長沙灣等均有新項目落成。

空置率高加上新供應多,要消化樓面亦不容易,而甲廈業主為保持競爭力,在叫價上不能太進取,特別空置率較高、或全新招租項目的業主,當務之急是盡快降低空置樓面,故仍會貼市價招租。租客在市場上選擇多,料租務個案明顯增加,惟在業主叫價克制下,租金今年料僅平穩,難以明顯上升。

(經濟日報)

工商舖今年買賣 業界估增逾3成

隨着中港正式通關,有代理行預計,2023年全年整體工商舖買賣宗數可增逾3成,重上5,800宗水平,當中核心區商舖的造價及租金更可望升逾兩成,升值潛力尤為看好。

代理行料5800宗 金額970億

有代理預計,2023年全年的整體工商舖買賣登記宗數可增逾3成至5,800宗水平,宗數創2019年5月以來次高;惟在未有大額全幢商廈買賣成交之下,整體買賣金額料回落近4成至970億元。該代理又看好核心區商舖的造價及租金齊升兩成,主要有見自由行旅客重新返港,令核心區商舖重生。

回顧2022年,該代理表示,受疫情持續、港股急挫,以及美國持續加息3項負面因素夾擊,去年全年僅錄4,431宗工商舖買賣登記,宗數為歷來次低,較2021年全年6,895宗大減約36%;當中商廈2022全年僅錄781宗買賣,按年大挫4成最多。然而,按買賣合約總值劃分,2022全年總金額達1,595.74億元,按年上升約4%。

凱施餅店蝕300萬 沽大圍舖

個別業主加快沽貨,消息稱,近月捲入欠薪事件的凱施餅店,沽出大圍道金禧花園地下舖位,面積約1,349平方呎,以約8,200萬元成交,呎價約6萬元。舖位由莎莎化粧以每月約25.5萬元租用,回報率約3.6厘。

據了解,凱施餅店或有關人士於2013年以8,500萬元買入,持貨9年轉手,帳面蝕約300萬元。集團近期亦放售多項舖位、工廈等物業。

(經濟日報)

九龍灣工轉商成形 8項目涉930萬呎

九龍灣商貿區屬於起動九龍東重要部分,區內不少舊工廈、貨倉正部署重建,區內8個重建成商業的項目,預計將提供930萬平方呎樓面供應。

九龍灣屬於成功轉型的前工業區,目前區內甲級商廈林立,餘下尚未展開重建的工廈,亦陸續部署重建。據資料顯示,區內至少有9個重建項目,其中8個計劃重建成商業用途,合共提供約930萬平方呎樓面。

當中規模最大屬於由政府主導的「九龍灣行動區」,將區內多個大型政府設施,包括廢物回收中心、驗車中心等搬遷,以騰出土地興建大型的商業、零售及文化中心,涉及超過430萬平方呎。

前回收中心 供220萬呎樓面

前身為環保署的九龍灣廢物回收中心、屬於常悅道的第2號用地,佔地約1.7公頃,將以地積比率12倍發展,提供約220.2萬平方呎樓面,當中設6層基座作為零售及餐飲等用途,總樓面59.3萬平方呎,上蓋再興建3幢商廈,辦公室樓面面積高達155.5萬平方呎。

另一個大型重建項目,則為億京等斥105億元購入九龍灣國際展貿中心,總投資額高達200億元,將會重建為3幢23至25層高的商廈,總樓面面積涉約177.5萬平方呎,當中辦公室總樓面佔約142.6萬平方呎,作為商業或零售用途的總樓面涉約22.8萬平方呎,工業展覽館則佔約12.1萬平方呎。

大昌行獲批重建2幢商廈

同時,由中信持有的啟祥道20號大昌行集團大廈,項目早前已獲城規會批准重建為2幢32層高 (包括2層零售平台) 的商廈,另設3層地下停車場,涉及總樓面面積約147.75萬平方呎。

至於在九龍灣臨海的啟興道一帶近年亦有變化,當中由九龍倉 (00004) 規劃逾10年重建的啟興道1至5號九龍貨倉,屬於「綜合發展區」用途,最新以20.9億元完成補地價,將由現時工業用途轉作商住項目,以重建後總樓面面積約82.9萬平方呎,每方呎樓面補地價約2,520元。

按照發展商2021年8月向城規會提交方案,項目將建7座住宅,提供1,782伙,總樓面約82.9萬平方呎,單位平均面積約465平方呎,以現時進展,相信最快可於1至2年後預售樓花。

至於鄰近原本由南豐發展的臨澤街8號啟匯,在2018年以約80億元出售予「重慶李嘉誠」張松橋及資本策略 (00497) 等後,再在2020年6月獲屋宇處批出圖則,可建2幢商廈,涉及67.98萬平方呎樓面。

(經濟日報)

更多啟匯寫字樓出租樓盤資訊請參閱:啟匯寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

Green light for 13 projects

The Buildings Department has approved 13 plans, including one in Kai Tak and another on Robinson Road in the Mid-Levels in November.

The 13 approvals include two on Hong Kong Island, six in Kowloon and five in the New Territories.

Eight are for apartment or apartment/commercial developments, two for commercial developments, one is for factory and industrial developments, and two are for community services developments. The number four site in area 4B, Kai Tai, codeveloped by New World Development (0017) and Far East Consortium (0035), has gotten the go-ahead for four 24- to 26-story residential buildings and one six-story residential block, with a total floor area of about 574,744 square feet.

In addition, plans were also approved for some urban redevelopment projects in November.

Henderson Land's (0012) project at No 94-100 Robinson Road will result in a 20-story residential building with two lower basement floors and a total floor area of 60,783 sq ft.

The department has also issued 16 occupation permits, with three on Hong Kong Island, five in Kowloon and eight in the New Territories.

(The Standard)

Testing time for new flat sales

Hundreds of new apartments will be put on the market as sentiment improves, with the new projects including Henderson Land's (0012) One Innovale in Fan Ling and La Marina at Wong Chuk Hang station, codeveloped by Kerry Properties (0683) and Sino Land (0083).

One Innovale - Cabanna released its fifth price list yesterday, offering 108 units at an average HK$14,598 per square foot after discounts.

The flats range from studios to three-bedroom units with sellable areas of 195 to 672 square feet. Prices are between HK$2.83 million and HK$9.59 million after discounts or from HK$13,838 to HK$16,011 psf.

The sales launch will be on Saturday, and besides units on the price list, five flats will be sold via tenders.

The last 104 La Marina flats take in 59 on a price list and 45 via tenders.

The new batch in the second phase of The Southside will be launched on February 2. The lowest price is HK$10 million, and the show flats were available for visiting from yesterday.

Kerry Properties said 496 flats have been sold so far, bringing in HK$12.1 billion, and that the project is set to be delivered in time as occupation permits have been received and just needs the certificate of compliance.

The 59 flats on the price list are one-to three-bedroom units, with sellable areas of 320 to 955 sq ft.

Discounted prices range from HK$10 million to HK$38.9 million, or from HK$31,388 to HK$40,892 psf, based on discounts of up to 20 percent.

In other news, luxury homes costing over HK$50 million will see a sharp rise of up to 20 percent in prices this year due to the economic recovery and a lack of new supply, a property agency predicts.

It expects such homes to rebound significantly, with the number of primary-market deals soaring by more than two times to 350 and secondary sales rising 40 percent to 300.

Luxury properties are expected to outperform the general market and their prices are estimated to rise 15 to 20 percent for the whole year.

Another agency forecasts property investment will pick up in the second half, with the transaction volume rising 5 percent year-on-year in 2023.

Real estate turnover hit HK$70.3 billion last year, a slight drop of 4 percent compared with 2021, but 42 percent lower than the prepandemic level.

(The Standard)

Mainland China money trickles into Hong Kong property market, especially luxury homes, as analysts expect slow recovery

Luxury homes are attracting mainland Chinese buyers, with three Ho Man Tin flats recently selling for about US$38 million

Given high interest rates, it will take time for buying by mainland residents to rebound from a 75 per cent drop during the pandemic, analysts say

Hong Kong property-market insiders see signs of mainland China residents returning to the housing market after the reopening of the border, although a full recovery is expected to take months amid high interest rates.

Mainlanders have started to buy homes in Hong Kong again, with interest concentrated in luxury properties so far, Victor Tin, executive director at Sino Land, told the Post.

“Luxury homes are seeing an earlier kick-off,” Tin said. “Later when the border reopening is further relaxed, there may be even more mainland buyers coming, boosting other kinds of properties.”

For example, mainlanders bought three of the six flats sold at St George’s Mansions in Ho Man Tin, a luxury project jointly developed by Sino and CLP Group, in the first 10 days of this year, Tin said. The three flats sold for around HK$300 million (US$38.41 million).

In west Kowloon, a mainland buyer forked out HK$166 million for eight flats at Grand Victoria on January 12, Tin said. Sino and three other companies developed the project.

In the pre-pandemic year of 2019, buyers with mainland China backgrounds accounted for 8.4 per cent of total home sales in Hong Kong, according to Midland Realty. Buying by mainland Chinese peaked in 2011 at 11 per cent of all homes, or 30.2 per cent of new homes.

Annual transactions by buyers who were not Hong Kong permanent residents or companies fell by about 76 per cent during the pandemic, according to Inland Revenue Department statistics cited by a property agency.

This is based on the number of cases liable to pay the Buyer’s Stamp Duty, which only applies to such buyers. There were 2,311 such transactions from 2020 to November 2022, or about 770 deals per year. In contrast, there were 9,484 such deals from 2017 to 2019, or about 3,160 deals per year.

In other words, the border closure cost the market about 2,400 deals a year, or 7,200 deals over three years, the agency said.