疫情走勢持續緩和,帶動商廈交投轉活,市場再錄逾億元大手買賣。市場消息指,灣仔資本中心高層全層以2.28億成交,呎價21965元,創該廈逾2年來呎價新高,原業主持貨8年、帳面獲利5673萬,期間升值逾三成。

市場消息指出,告士打道151號資本中心高層全層,面積約10380方呎,以股權轉讓方式連三個車位售出,作價約2.28億,呎價約21965元。據悉,原業主於2013年以約1.7127億購入,持貨8年帳面獲利約5673萬,物業升值約33%。

面積1.03萬呎 連三車位易手

代理指出,上述成交價較市價高約10%,事實上,受社會運動於2019年中萌芽發酵,加上新冠肺炎於去年初爆發,整體商廈租售價回落約三成,資本中心最高成交呎價約2.45萬,故最新成交價較最高價僅約九折水平,故於疫市下屬進取價,買家為用家,環顧灣仔區內逾萬呎的商廈,現時市場上的供應屬買少見少,故吸引該買家一擲千金入市。

高市價一成

據代理資料顯示,該廈近期成交呎價均低於兩萬元水平,其中,該廈15樓2室,於今年1月以3900萬售出,以面積約2017方呎計,呎價約19336元;另一成交為24樓全層,於2019年9月以1.8043億售出,以面積10380方呎計,呎價約17382元。

八年升值約33%

該廈近期呎價較高的成交個案為中層全層,面積14500方呎,於2019年5月以3.616億售出,呎價約24938元,故最新成交呎價創該廈逾兩年以來新高。

灣仔區內近期較矚目為由「鋪王」鄧成波家族持有的莊士企業大廈18層樓面,包括酒店及寫字樓各9層,涉資4.15億,平均呎價9257元,持貨7年,帳面獲利約3150萬,物業升值9.2%。

中海日升中心錄2618萬成交

另外,商廈市場亦錄成交個案,由億京發展的觀塘中海日升中心中層G室,面積約1715方呎,以2618.805萬售出,呎價約15270元;據發展商指出,買家為用家。

(星島日報)

更多資本中心寫字樓出售樓盤資訊請參閱:資本中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

更多中海日升中心寫字樓出售樓盤資訊請參閱:中海日升中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

力寶中心呎租35元創11年新低

疫情走勢平穩,惟甲廈租金仍彈升乏力,市場消息指,金鐘力寶中心二座低層單位,於交吉約1年半後,以每方呎約35元租出,創該甲廈11年以來新低。

市場消息指出,力寶中心二座低層02室,面積約2168方呎,以每方呎約35元租出,月租約75880元;據地產代理指出,該單位於放租已有一段時間,惟市場問盤及承租力一般,故租金明顯屬低市價水平。

交吉約一年半

據代理資料顯示,該甲廈近期承租個案為2座低層04B室,面積約1151方呎,於本月初以56399元租出,平均呎租約49元;惟該甲廈租金低至35元水平,需追溯至2010年9月,當時該甲廈2座低層506室,面積1100方呎,以3.85萬租出,呎租約35元,故最新呎租創11年以來新低。

據業內人士指出,疫情走勢持續平穩,現今甲廈市場空置率已逐步改善,惟整體租金表現仍備受壓力,隨踏入年尾,部分業主希望於農曆新年前將單位租用,令議價空間逐步擴闊,故近期甲廈租金均見折讓。

中環中心呎租65元

另外,市場消息指出,由外號「殼后」朱李月華持有的中環中心中層12室,面積約1625方呎,以每方呎約65元租出,月租約105625元;據地產代理指出,上址舊租金為每呎約80元,故租金下跌約18%。

(星島日報)

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

波斯富街全幢1.3億獲洽

整體市況不俗,傳統核心區頻現大手成交,市場消息指,由資深投資者陳宗武持有的銅鑼灣波斯富街全幢商住樓、獲準買家以1.3億洽購,若成交最終落實,平均呎價約5.3萬。

市場消息指出,銅鑼灣波斯富街53號,為全幢商住物業,總樓面約2450方呎,獲準買家以1.3億洽購,若成交落實,平均呎價約53061元。

據業內人士指出,上述物業由資深投資者陳宗武持有,該洽購價亦屬合理水平,料買賣已洽至尾聲。

投資者陳宗武持有

事實上,陳宗武近期連環沽貨,資料顯示,陳氏早前沽出銅鑼灣波斯富街84至94號寶富大廈地鋪,成交價約8038萬,以鋪位建築面積800方呎計,呎價約100475元。

另一方面,工廈市場亦頻錄大手成交,消息指,葵涌昌榮路9至11號同珍工業大廈A座G-3樓一籃子單位,總面積約37081方呎,以約1.4億售出,呎價約3775元。

此外,大埔汀角路51號太平工業園A座5樓A室,面積約13972方呎,以約4800萬售出,呎價約3435元。

(星島日報)

指標甲廈交投靜 租金漸回穩

近期整體甲廈買賣仍非常淡靜。而疫情緩和下,租務氣氛有改善,個別甲廈租務成交上升,租金表現頗理想。

甲廈交投淡靜,據代理行每月10大指標甲廈買賣上,錄得零成交,為今年首次出現,反映整體交投氣氛極淡靜。個別投資者於非核心區入市,如正八集團主席廖偉麟,以1.43億元購入九龍灣企業廣場高層全層,面積約1.61萬平方呎,呎價約8,900元。據了解,成交價低市價逾20%,創疫市以來呎價新低。原業主於2008年以1.05億元購入,持貨13年帳面獲利3,800萬元,物業期間升值約36%。

甲廈空置率高見10%

目前整體甲廈空置率仍偏高,代理資料顯示,9月港島區整體甲廈空置率為10.00%,對比8月上升0.21個百分點,較2020年同期更大幅遞增1.83個百分點,最新空置率數字接近歷來次高,對上一次新高水平為今年7月的10.02%,反映今年港島區空置情況仍見嚴重。

分區方面,金鐘區情況最差,9月空置數字為9.02%,為一綫核心商業區中最高,按月上升0.23個百分點,對比去年9月則輕微增加0.01個百分點。至於中環區方面,甲廈空置率升幅較輕微,由8月約7.29%,上升0.35個百分點至最新9月約7.64%;比鄰的上環區向來維持於約9.00%水平,9月輕微遞增0.20個百分點至約9.61%。而灣仔及銅鑼灣空置情況對比8月有所改善,然而整體空置率則處於偏高水平,兩區9月空置率分別為13.12%及10.59%。

恒地投得地王 料推動市況

有代理認為,整體投資氣氛今年轉好,惟甲廈持貨業主仍叫價硬淨,令交投仍淡靜。另外,近日中環新海濱3號商業地公布結果,由恒地以約508億元成功投得,按項目扣除政府設施報的商業樓面約161萬平方呎計算,每平方呎樓面地價高達約31,463元。他認為,地皮成交反映財團看好中環前景,對核心區甲廈租售仍是正面消息。

該代理表示,近期租務市場亦稍有改善,個別租務成交個案中,租金表現不俗,如力寶中心一座中高層單位,面積約950平方呎,成交呎租約50元,另上環皇后大道中181號中層單位,面積約2,211平方呎,成交呎租約41元。該代理分析,疫情緩和下,整體營商氣氛改善,機構租寫字樓興趣提升,故趁租金回調,租用核心區優質甲廈,該代理料租金即使未有明顯反彈,跌勢現已喘定,短期內平穩發展。

(經濟日報)

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多皇后大道中181號寫字樓出租樓盤資訊請參閱:皇后大道中181號寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

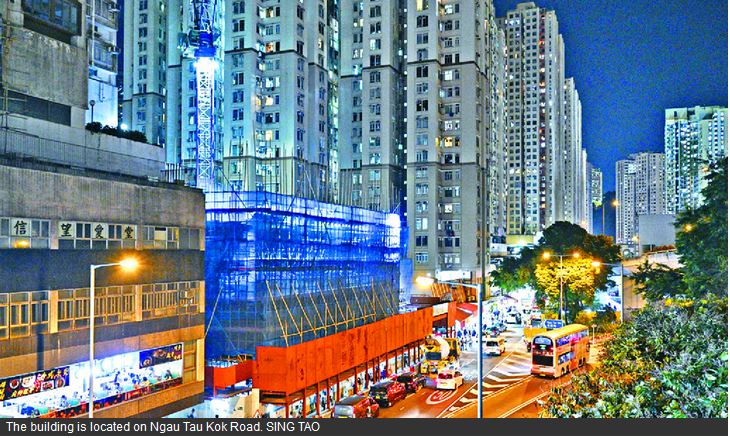

Aperture to offer 294 homes

Hang Lung Properties' (0101) new project at 11 Ngau Tau Kok Road in Kowloon has been named as The Aperture, and will offer 294 flats.

The expected handover date will be October 2023, which indicates a pre-sale period of about 24 months.

Typical units in the project are in one to three-bedroom layout designs, with areas ranging from 320 to 771 square feet. Nearly half of them are two-bedroom units.

The single-block residential building includes a 15,000-sq-ft clubhouse, 37 car parking spaces and a shopping center at the podium.

Teresa Pang, developer's senior manager in property sales, said show flats are close to completion and will be made available to the public shortly. The selling price of the project will take reference from new projects in East Kowloon, according to Pang.

The company expects that extended families in the district and those looking to upgrade their homes, as well as professionals and young families, will be interested in the project.

In 2019, Hang Lung paid the equivalent of HK$11,100 per square foot to unify the ownership of the site, which had previously served as an industrial centre, through a public tender.

Meanwhile, Monaco One in Kai Tak sold at least 150 units in the second round of sales yesterday.

(The Standard)

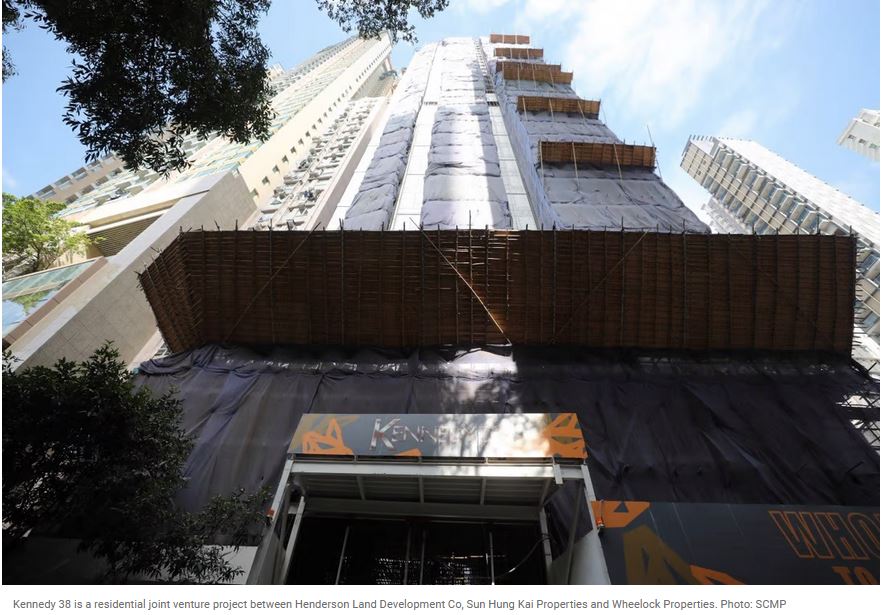

Hong Kong homebuyers snap up flats at new Kennedy Town project on strength of location, well-known developers

Sun Hung Kai Properties sold 100 of the first batch of 130 small units on offer at Kennedy 38, a joint venture with Henderson Land and Wheelock Properties

The project, which has 431 total flats, represents the first new flat sale in Kennedy Town in five years

Homebuyers on Saturday flocked to the first new flat sale in five years at Kennedy Town, which property agents attributed to the project’s ideal location in the northwestern part of Hong Kong island and the large developers behind it.

Sun Hung Kai Properties sold 100 of the first batch of 130 small units on offer, with sizes from 229 to 332 square feet, as of 6pm at Kennedy 38, a joint venture with Henderson Land Development Co and Wheelock Properties.

The average sale price stood at HK$27,522 per sq ft. There are 431 total flats in the project.

The flats received more than 1,400 registrations of interest on Friday, which translated to 10 bids for every available unit, according to property agents. Each buyer can purchase up to three flats.

The one-bed room unit measuring about 300 sq ft are the most popular, while the project’s 229 studio units are not so well received, according to property agent.

“The studio flats are less popular than the one-bed room unit,” the agent said. “We have seen a mixture of end users and investors who plan to buy the flats at Kennedy 38 for lease with an expected yield of about 3 per cent per year.”

“Kennedy Town, which is located on Hong Kong Island near the MTR station and close to Central, is an attractive location for many people who work in Central,” the agent said. “The project is also popular because of the three well-established developers behind it.”

The Kennedy Town units on sale cost from HK$6.28 million to HK$9.96 million each, or HK$26,341 per sq ft to HK$30,818 sq ft, after factoring in a discount of up to 10 per cent. The cheapest flat in the project is a 229-sq ft unit on the tower’s 7th floor, which is on offer at HK$6.28 million.

The results of this weekend’s new property sale show strong sentiment among homebuyers, who expect increased demand when the border with mainland China reopens as early as next month.

The first phase of the much-anticipated reopening of the border between Hong Kong and mainland China, without having to undergo Covid-19 quarantine, was brought forward to early next month from an original start date of December 17, according a South China Morning Post report on Thursday, citing sources.

Meanwhile, Sino Land Co on Saturday offered 134 car parks to flat owners of Grand Central in Kwun Tong at HK$2.65 million to HK$2.99 million each. The results of that sale will be released later today.

A 449-sq ft, one-bedroom flat at Grand Central was recently offered in a lucky draw to encourage the city’s residents to get the Covid-19 vaccine. A 35-year-old chef, surnamed Lee, won the lucky draw in September, receiving a flat worth HK$10.8 million.

(South China Morning Post)