財團審慎入標投中國恆大中心 市況低迷下傳收5至6標

備受矚目的灣仔中國恆大中心昨日截標,受加息等負面因素影響,加上近期股市暴跌,消息指,在市況低迷下,財團紛以審慎保守價投標,該廈反應未如預期中熱烈,市場消息盛傳截收5至6張標書。

灣仔中國恆大中心早前被銀行接管,再度推出招標以來,一直備受關注,早前市場消息指,有逾十家財團表示興趣及作查詢,不過,該項目昨日截標,據說反應未如預期中熱烈,市場消息盛傳,昨日有5至6家財團入標,少於預期,入標的包括港資及中資發展商等財團,在市況低迷情況下,出價普遍趨向審慎保守,與市場估值的80億至90億有一定距離。該項目在被接管之前、今年7月首次招標時,長實曾高調確認入標,近期,華懋亦曾表示積極研究中、有興趣入標,此外,市場消息亦傳越秀極具興趣,本報昨日逐一向他們查詢,均未有收到任何回應。

長實華懋越秀未作回應

曾出任發展商高層的資深老行尊陳觀展則評論道,目前經濟環境欠佳,貴重物業售價相信會有一定折讓,看中該物業的,相信都是極具長遠眼光兼財政雄厚的公司,惟此類型的實力買家並不多!

位於灣仔核心商業區的中國恆大中心,年前當恒大財政出現危機時,該全幢商廈已廣受注目,早於今年7月時,該廈尚未被銀行接管,業主恒大將之推出招標,當時,長實率先確認有入標,儘管當時市況較現時好,市傳數家財團入標,但標價與恒大主席許家印意向價一百億,相差很大,最終沒有出售。

老行尊:實力買家不多

隨後,物業被接管,今年9月第二度推出招標,市場估值80億至90億,該廈欠銀行按揭貸款76億,市場人士認為,由於物業估值高於欠款,成功出售的機會相當高。

近期來,整體商廈供應龐大,空置率屢攀新高,不過,有市場人士分析,中國恆大中心賣點是位置佳,灣仔區供應較為罕有。該物業有一定樓齡,設施陳舊,因此,特別適合拆卸重建為地標甲廈,料受中資及外國金融機構追捧。該廈位處灣仔告士打道38號,總樓面34.5萬方呎,以估值逾80億計算,平均呎價逾2.3萬。中國恒大於2015年10月,斥資125億向華人置業購入該廈,自用作為集團在香港的總部。

(星島日報)

更多中國恆大中心寫字樓出租樓盤資訊請參閱:中國恆大中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

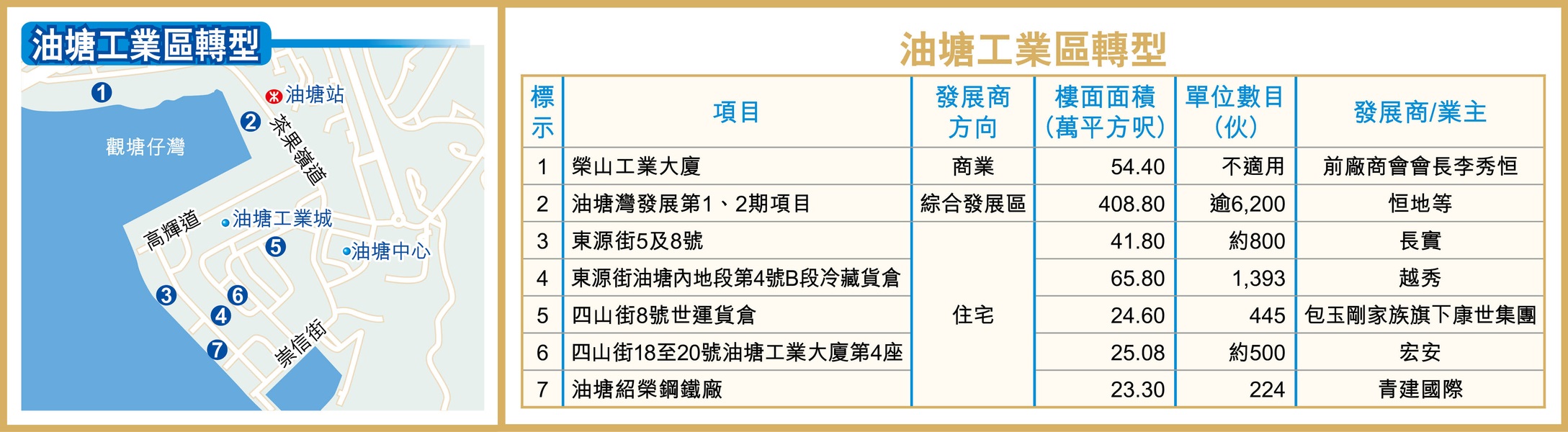

油塘大益貨倉工廈標售 集99.32%業權 市值7億

疫市下大手工業物業仍頻錄成交,有業主趁勢放售旗下工廈。油塘大益貨倉工業大廈,由小業主集齊99.32%業權推出標售,市值約7億,該項目具重建價值,並極具重建住宅的潛力。

尚餘一車位未加入

有代理表示,大益貨倉工業大廈位於油塘四山街14號,地盤面積約25295方呎,可重建樓面多達約151770方呎,目前由小業主集齊99.32%業權,推出標售,市值約7億,截標日期12月6日。該廈餘下一個車位,尚未加入齊集業權,由於業主身處海外,正在處理當中,料短期內大廈集齊100%業權。

該代理續說,項目具備打造住宅潛力,可透過申請更改地契及補地價重建住宅,由於大廈位處三面單邊,將來若重建住宅,可望無敵海景,景觀壯闊,位處同區有多項近年落成的地標住宅包括曦臺、海傲灣及蔚藍東岸等。

佔地面積近2.53萬呎

該代理又表示,由該廈步行至港鐵油塘站,需時約5分鐘,購物商場「大本型」及旅遊點鯉魚門海港漁村。近年市區臨海住宅發展地皮罕見,受惠起動九龍東計畫,區內商業氣氛濃厚。各項交通基建將帶動油塘區發展,如中九龍高速幹道 (六號幹綫) 及於最新《施政報告》中所提及興建將軍澳第三條公路隧道「將軍澳─油塘隧道」,加強對外連接。此外,多項大型住宅項目相繼落成,帶動油塘前景。

(星島日報)

葵涌華利工中全幢意向2.5億

傳統工業區葵涌配套充裕,區內工廈受投資者及用家追捧。區內永基路華利工業中心全幢,意向價2.5億,平均呎價4330元。

平均呎價4330元

有代理表示,葵涌永基路13至15號華利工業中心全幢放售,樓高15層,總樓面57734方呎,以意向價2.5億放售,平均呎價4330元。物業以交吉形式推出,該廈樓底特高,備1部客貨運升降機及1部消防升降機,方便用戶。大廈有車場,具私家車及貨車車位。目前,外牆、電梯及窗戶正進行翻新工程。物業毗鄰工廈及貨倉,附近設有多條路綫巴士及小巴往來各區,近月,葵涌金星工業大廈申強拍,市值逾5.65億。

另一代理表示,九龍灣宏開道8號其士商業中心10樓10室,面積約1102方呎,意向呎價約9600元,金額約1057.9萬,可買賣公司,以交吉出售,景觀開揚;實用率高達70%,備寫字樓裝修,同時業主亦接受售後租回,市值租金每呎17元,回報逾2厘。

該代理續稱,其士商業中心鄰近德福花園,該廈放售盤源中,大多數意向呎價約1萬,比較下,今番放售呎價僅約9600元,具競爭力。

(星島日報)

更多其士商業中心寫字樓出售樓盤資訊請參閱:其士商業中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

朗壹廣場寫字樓意向呎租20元

北部都會區發展帶來新機遇,信和亦趁勢推出旗下的元朗地標甲廈及商場朗壹廣場 (ONE NORTH) 預租,寫字樓意向呎租約20元;該地標項目基座商場獲攀石公司垂青,承租地下面積約1萬呎樓面,設立攀石場。

信和蔡碧林:吸金融創科等客戶

信和集團資產管理董事蔡碧林表示,朗壹廣場寫字樓部分,每層面積約17000方呎,意向呎租20元,目標引入金融、財富管理、創科、物流、貿易等企業外,更配備醫療中心、診所、美容及健身等的系統配套。

該項目由2座大樓組成,每座14層高,總面積約44.5萬方呎,提供228個單車位,大廈注入可持續發展及綠色元素,花園佔地2萬方呎,設置戶外健身設備、表演區、綠色草地供瑜伽練習。

項目亦是新界區首座設有200米緩跑徑的辦公大樓,連接多條單車徑。

該廈獲本地攀爬運動公司Hong Kong Climbing Park承租地面樓層逾1萬方呎,打造室內攀石場,HongKong Climbing Park負責人朱嘉偉表示,攀爬運動最近更成為《施政報告》所推廣的運動,集團選址朗壹廣場興建攀石場,是因為商場地點匯聚寫字樓、住宅及郊遊景點,集團在商場中庭設立近10米高攀石設施,顧客在專業及安全指導下,進行攀石運動。

她補充說,旗下錦上路站上蓋住宅項目栢瓏,ONE NORTH朗壹廣場,將令集團在新界西北投資組合多元化。

該地標項目採用環保設計,由設計、營運到管理,均採用世界級方案,以用家身心健康為發展依歸。

(星島日報)

更多朗壹廣場寫字樓出租樓盤資訊請參閱:朗壹廣場寫字樓出租

更多元朗區甲級寫字樓出租樓盤資訊請參閱:元朗區甲級寫字樓出租

長沙灣工商物業 外資基金垂青

近期整體大手買賣未見活躍,而成交卻集中出現於長沙灣,工業及商業均獲外資基金承接,反映該區前景理想。

近日大額買賣回落,而市場錄大手工廈及商廈買賣,均來自長沙灣區。市場消息透露,長沙灣荔枝角道永新工業大廈全幢,近日以約8.5億元易手,以現有樓面約15萬平方呎計,呎價逾5,600元。

永新工業大廈 8.5億易手

資料顯示,永新工業大廈由「毛紡大王」之稱的曹光彪家族持有,樓齡約45年,地盤面積約1.51萬平方呎,今年初曾向城規申請,希望將地積比率由12倍增至14.4倍,以重建1幢26層高 (包括4層地庫) 的商廈,作為寫字樓、食肆、商店及服務行業用途,總樓面涉約21.5萬平方呎。該工廈鄰近長沙灣四小龍 (泓景臺、昇悅居、宇晴軒及碧海藍天) 住宅區,故日後發展成迷你倉,有一定商機。

據了解,新買家為私募基金黑石 (Blackstone) 夥迷你倉集團合資入市。該基金近年積極入市,主要吸納工廈,發展迷你倉業務,先後購入觀塘、柴灣、粉嶺等工廈,對上一宗為去年尾,以5億元購入筲箕灣精雅印刷集團大廈全幢,總樓面69,680平方呎,呎價約7,176元。

長沙灣區有利迷你倉發展,資料顯示,新加坡迷你倉品牌StorHub以9,800萬元,購入長沙灣長裕街18號柏裕工業中心7、8樓全層樓面,連兩個車位,面積約19,210平方呎,呎價約5,102元。據悉,原業主1977年以292萬元購入,持貨45年,帳面獲利9,508萬元,升值逾32倍。

StorHub今年積極在港入市,早前亦已收購該廈單位,包括以3.5億元,向鄧成波家族購入該廈約50%業權,包括地廠及樓上多層,面積合共約68,779平方呎,平均呎價5,089元。上月份,該財團再購入物業2樓單位,涉約6,627萬元。另集團亦於紅磡、新蒲崗等掃入工廈,發展迷你倉業務。

新世界項目51%業權 逾30億沽

至於商廈方面,早前新世界 (00017) 出售長沙灣永康街商廈項目51%業權,涉資30.788億元,物業可售面積約274,547平方呎的商業綜合體,平均呎價約11,214元。據了解,新買家為新加坡基金Ares SSG,基金為亞太地區最大的另類資產管理公司之一,在管資產達約98億美元 (約769億港元)。翻查資料,商貿地位於永康街、汝州西街與永明街交界,新世界於2017年,以29.7億元投得,樓面呎價7,996元創區內新高。

分析指,受加息及環球經濟不穩因素下,第3季整體大手買賣稍淡靜,財團入市甚為審慎。相比之下,長沙灣大手買賣較為理想,因近年該區漸由工業區,成工商業綜合發展,而長沙灣位處市區,交通便利。前景上,該區現時有多個工業及商業全新項目在建築中,相信前景更為理想,故財團睇長綫,特別吸引外資基金,購入物業再進行改裝、重建等,提高價值,料該區續錄大額買賣。

(經濟日報)

尖沙咀太興廣場 享地利合中小企

太興廣場最大優點,是坐落尖沙咀心臟地段,物業更位處港鐵站出口,極為便利。

尖沙咀商業地段主要分為尖東、中部及尖西,而太興廣場位於金馬倫道連接彌敦道,屬尖沙咀中部核心位置,而大廈正對尖沙咀港鐵站出口,步行至該廈僅1分鐘內。交通上,金馬倫道本身四通八達,彌敦道一帶巴士綫甚多,若前往港島區,亦可選擇到漆咸道南一帶坐巴士。

另外,自東鐵綫過海段通車,尖東站亦變得四通八達。

飲食配套上,大廈多層可作飲食用途,現時有米綫店、西餐等。而金馬倫道、加連威老道等食肆林立,亦有大型商場THE ONE、iSQUARE等,生活及飲食配套完善。

多層作食肆 11至19樓為寫字樓

大廈於1994年落成,而位處單邊,觀感不俗。物業樓高19層,地下至10樓作零售樓層,現時租客有餐廳、VR體驗館等,11至19樓則作傳統寫字樓用途。由於多層用作食肆,地下有廣告位,供給餐廳作宣傳。

分層面積最大約5,215平方呎,主要分間為1至4號單位,面積由數百平方呎起,適合中小型公司。單位間隔頗為四正,而景觀上,高層單位一面望向九龍公園,另一面遠望小量海景,整體來說頗為開揚。

買賣方面,據了解,物業大部分樓面,由大業主持有,故買賣向來極少,對上一宗成交已為2012年。

租務方面,大廈去年錄數宗租務,包括10樓1至3室,面積約2,322平方呎,成交呎租約27元。而去年10月,物業1601室面積約896平方呎,以每呎約31元租出。

據悉,本月該廈亦錄一宗租務,中層單位面積約523平方呎,成交呎租約34元。據了解,現時大廈出租率極高,亦乏盤源可租。

地段前景方面,凱龍瑞與亞洲聯合基建近年一直正在收購金馬倫道35號至37號,以及毗連的嘉蘭圍16號永興大廈,將重建成商廈,早前更引入醫思健康 (02138) 參與該舊樓收購項目。

(經濟日報)

極高層單位 呎價1.38萬放售

尖沙咀太興廣場極少單位放售,現物業極高層單位,以每平方呎約1.38萬元放售。

面積1582呎 叫價2183萬

有代理表示,太興廣場有單位現正放售,涉及物業極高層1至2室,面積約1,582平方呎,意向價約2,183萬元,呎價約1.38萬元。該單位原由公司自用,故具備寫字樓裝修,而單位提供會議室等。因位處極高層,景觀非常開揚。

同區市況上,尖東康宏廣場高層12室,面積約952平方呎,成交呎租約30元,另尖東新文華中心A座中高層07至08室,面積約2,627平方呎,以每呎約24元租出。

買賣方面,近日尖東新文華中心A座錄成交,涉及低層05室,面積約830平方呎,以約747萬元成交,呎價約9,000元。

(經濟日報)

更多康宏廣場寫字樓出租樓盤資訊請參閱:康宏廣場寫字樓出租

更多新文華中心寫字樓出租樓盤資訊請參閱:新文華中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

觀塘萬兆豐中心 意向價2643萬

觀塘萬兆豐中心單位現進行放售,意向呎價約1.38萬元。

面積1915呎 呎價1.38萬

有代理表示,觀塘海濱道133號萬兆豐中心18樓D室,面積約1,915平方呎意向價約2,642.7萬元,呎價為13,800元;該單位將以交吉形式出售,新買家更可以約200萬元配售區內罕有車位乙個。

同時間,物業亦進行放租,月租叫價約5.1萬元,呎租約26.6元。該代理續稱,原業主因近期有意重整投資組合,故決定把單位推出市場。

代理指出,業主叫價克制,翻查資料,該廈最新一宗買賣成交為去年11月錄得,其低層B室,以呎價13,500元售出,而目前放售中的單位樓層較高,叫價亦僅為13,800元,反映業主放售價相當貼市。

(經濟日報)

更多萬兆豐中心寫字樓出售樓盤資訊請參閱:萬兆豐中心寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

Negative equity cases soar tenfold

The number of negative equity cases in Hong Kong rose nearly tenfold to 533 in the third quarter to a six-year high for a single quarter, as home prices continued to fall.

The number of residential mortgage loans in negative equity soared to 533 from July to September from 55 in the previous quarter, the Hong Kong Monetary Authority found after surveying 99 percent of the banks in the city.

This came as private home prices fell 8.07 percent for the first nine months of this year to a new low since February 2019, official data showed.

Further, the total value of residential mortgage loans in negative equity surged tenfold quarter-on-quarter to HK$3.01 billion during the third quarter, while the unsecured portion jumped 14.75 times to HK$59 million over the same period.

The HKMA also said that lenders have not recorded any residential mortgage loans in negative equity which have been in default for more than three months.

However, a mortgage broker estimated the residential mortgage loans in negative equity will exceed 1,000 in the fourth quarter, as international rating agencies Moody's and S&P Global both expect Hong Kong's home prices might fall up to 10 percent in the coming six months or next year.

A property agency said that transactions of Taikoo Shing in Quarry Bay saw prices of HK$16,433 per square foot on average in October, down by 9.6 percent in a month.

Meanwhile, China Resources Land (Overseas) and Poly Property (0119) launched a new project Pano Harbour in Kai Tak, offering 582 units.

In other news, the SAR government said its 10-year housing supply target will remain at 430,000 units.

(The Standard)廣東道「鋪王」呎租302元跌80% 位處尖沙嘴「名店街」 重返沙士價

近期市況低迷,負面消息充斥,有零售商趁勢平租黃金地段鋪位,尖沙嘴廣東道由周大福承租多年的一個「鋪王」,在租金遷出一個月後,鋪位旋即由零售商垂青,以每月70萬承租該巨鋪,平均呎租302元,新租金較舊租金大跌80%,重返沙士時水平。

上述地址尖沙嘴廣東道54至66號帝國大廈地下E、F及G鋪,建築面積2318方呎,坐落海防道大單邊,屬超級鋪王,長情租客周大福上月撤出後,鋪位剛覓到新租客,市場消息透露,最新月租約70萬,較三年前舊租金每月380萬,大跌80%。本報昨日就上述租賃向業主查詢,惟業主未作確實回應。

月租約70萬 UPSO呼聲高

知情人士則表示,新租客以國際品牌UPSO呼聲最高,該店售賣以環保物料製作的各類型單車袋、行山袋及配襯輕便服飾的手袋,受年輕人追捧;此品牌月前亦承租銅鑼灣東角道 (東角Laforat) 一個複式巨鋪,建築面積約7200方呎,月租約70萬。

上述的廣東道單邊鋪,曾由周大福承租9年,當年為追逐自由行生意,於2013年10月以「天價」665萬進駐,較前租戶名店Armani Exchange月租205萬,大升2.2倍;及後在2019年,仍提價至每月798萬續租,加幅133萬或20%,到2019年10月,原本租約到期,由於社會運動引起動亂愈演愈烈,獲減租約52%,以每月約380萬續租多3年,最後,周大福已於上月撤出。

周大福承租9年 上月撤走

有代理評論道,廣東道該巨鋪佔盡有利位置,極盡搶眼。過往,奢侈品爭相進駐廣東道,近年隨着疫情持續,街道吉位漸多,租金拾級而下。

該代理續說,幸好經過大調整,最近國際租客陸續進駐,趁勢平價承租,現時正值金融動盪時刻,上述鋪位若以此價錢租出,業主租客「雙贏」!

該鋪由廠家潘正洲或有關人士於2004年斥資近2.09億購入,過往收租回報可觀,周大福於高峰期年繳租金達9576萬,現時雖大幅減租,回報仍不俗。

內地體育用品店李寧繼10年前撤出尖沙嘴金馬倫道據點,早前回歸香港,承租廣東道新港中心一個複式鋪,面積約7800方呎,月租高達200萬,較高峰期跌逾70%。

(星島日報)

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

富豪酒店1.2億統一海壇街舊樓業權

尼格風球襲港,天文台於昨日下午發出八號熱帶氣旋警告信號,惟當日早上舉行的強制拍賣會未受影響。富豪酒店併購的深水埗海壇街227B至227C號舊樓,昨早舉行公開拍賣,該公司在無對手下,成功以底價1.2億統一業權發展。

近年該公司密密併購深水埗區舊樓,最新該公司再下一城,併購的海壇街227B至227C號舊樓9月初獲批強拍令,相隔短短不足兩個月,昨早在物業拍賣會,由手持「1號牌」的富豪物業代理董事衛振聲,在無對手下以底價1.2億投得,成功統一業權發展。

合併後可建樓面逾4.1萬呎

該項目坐落於九龍深水埗海壇街之東南面,介乎九江街與欽州街之間,現址為一幢樓高6層的商住物業,地下為商鋪,樓上為住宅,早於1960年落成,至今樓齡約62年。上述地盤面積約2322方呎,若以9倍地積比率作商住發展,涉及可建總樓面約20898方呎。

據該公司年報顯示,海壇街227B至227C號,將聯同已完成併購的海壇街227至227A號項目合併重建為作商業 / 住宅發展用途,地盤面積擴展至4644方呎,若以9倍地積比率作商住發展,涉及可建總樓面約41796方呎。

(星島日報)

港島兩住宅項目估值齊跌15% 賣地表堅尼地城地明截標 市建西營盤矚目

在疫情及加息等不利因素影響下,日前市建局土瓜灣住宅項目地價短短7個月跌價逾24%,連帶本月有多幅地皮截標估值亦級級下跌,其中2幅港島區地皮、包括率先明日截標屬賣地表地皮的堅尼地城西寧街住宅地及市建局西營盤皇后大道西發展項目,其估值同告下跌約15%。業界人士指,雖然上述兩個項目發展規模不大,惟受一連串不利因素影響,料財團出價審慎及保守。

率先明日截標屬賣地表地皮的堅尼地城西寧街住宅地,最新市場估值約5.7億至6.1億,每方呎估值約1.2萬至1.3萬;而本月底截標的市建局西營盤皇后大道西項目,最新估值約12.5億至14億,每方呎估值約1.03萬至1.15萬。

業界:料財團出價審慎

相隔約37年再有賣地表用地招標的堅尼地城西寧街及域多道「蚊型」住宅地,將於明日 (周五) 截標,項目地盤積僅5780方呎,住宅可建總樓面僅4.6萬方呎。上述項目可發展純住宅或商住,有側海景,地皮北面向西寧街的是招商局碼頭及貨倉,早前有申請改建酒店、商業及海濱長廊。南面向域多利道,面對油站及山坡。

地皮亦有不少限制,據賣地條款顯示,向西寧街的地面將主要作停車場出入口,而向域多利道的人流欠奉,作商業用途的價值不大。地皮往港鐵堅尼地城站要步行10多分鐘,西寧街設巴士總站,往中環等商業區,交通便利。

堅尼地城地估值5.7億起

有測量師表示,由於上周土瓜灣項目以低價批出,其價遠低於市場預期,由於上述兩幅用地發展規模不大,料可吸引各大中小型發展商競爭,惟受一連串不利因素影響,料財團出價審慎及保守,最新兩地估值調低約15%,其中明日截標的堅尼地城西寧街住宅地估值約5.7億至6.1億,每方呎估值約1.2萬至1.3萬。

除政府賣地表地皮外,市建局皇后大道西/賢居里發展項目亦於本月24日截標,該測量師指,該項目估值亦跌價約15%,最新市場估值約12.5億至14億,每方呎估值約1.03萬至1.15萬。

該項目於9月底完成招收意向書程序,合共接獲33份意向書,該局上月邀請32家發展商及財團入標競投,即有1家不獲邀請,項目將於11月24日截標。市建局指出,招標遴選小組將評審收到的標書,並於稍後就批出本發展項目的發展向市建局董事會提交建議,由董事會作最終決定。

西營盤項目估值12.5億起

市場消息指出,項目售樓收益達35億,中標財團便須與市建局分紅,固定分紅40%,若以項目總樓面約12.15萬方呎計,相當於每方呎售價約2.88萬便需要分紅,對比今年8月批出的崇慶里/桂香街發展項目當時每方呎售價逾3.16萬便需要分紅為少。

另外,發展商亦需向市建局自行提出「一口價」建議,將成為勝負的關鍵。該項目設有限呎條款,住宅單位面積不得少於300方呎,同時規定至少一半的單位面積不可超過480方呎。上述項目位於皇后大道西129至151號 (單數),鄰近港鐵西營盤站,步行前往約其中一個出口約3分鐘步行程。市建局於2018年3月展開上述項目,並於2019年8月以實用面積每方呎24051元向小業主提出收購價建議。項目地盤面積約1.69萬方呎,可建總樓面約12.15萬方呎。

(星島日報)

嘉里粉嶺貨倉 11億洽至尾聲

呎價料逾3900元 凱龍瑞基金奪得呼聲高

投資市場仍以工廈最受捧,嘉里 (00683) 旗下粉嶺貨倉,獲財團出價11億元洽購至尾聲,物業總樓面28萬平方呎,據悉以凱龍瑞基金奪得呼聲最高,料改裝成凍倉。

市場消息指,嘉里旗下嘉里貨倉 (粉嶺) 工廈,正獲財團洽購。物業位於安樂門街,屬粉嶺傳統工業地段。項目樓高5層,每層面5萬餘平方呎,總樓面約28萬平方呎,現作貨倉用途,消息稱,項目獲財團以約11億元洽購至尾聲,可望短期內易手,呎價約3,928元。

總樓面28萬呎 料改裝成凍倉

據了解,是次洽購財團包括基金、中資物流公司,消息稱以凱龍瑞基金奪得物業呼聲高,預計購入後,改裝成凍倉用途。凱龍瑞基金近年不時吸納工廈,包括本年8月,以4.3億元購入葵涌永昇工業大廈9成業權,預計亦加以改裝,或作凍倉之用。

嘉里今年曾沽兩倉 套逾46億

嘉里今年已曾大手沽售貨倉物業,本年5月,集團出售旗下嘉里 (沙田) 貨倉及嘉里 (柴灣) 貨倉兩項物業,面積分別約40萬及52萬平方呎,分別涉資23.3億及22.9億元,合共涉及46.2億元。兩項物業均有中資華潤物流承接。若最終以約11億元沽出粉嶺項目,3貨倉合共套現約57.2億元。

近期受加息等因素衝擊,大額投資市場甚為淡靜,在工商舖買賣上,僅工廈成交較為理想,如早前長沙灣荔枝角道永新工業大廈全幢,以約8.5億元易手,呎價約5,600元。新買家為外黑石基金,將發展迷你倉業務。另新加坡迷你倉集團StorHub,近日斥億元,購入長沙灣柏裕工業中心單位。

另工廈買賣及租務上,黃竹坑瑞琪工業大廈中層A室,面積約4,000平方呎,以約2,800萬元沽出,呎價約7,000元。另租務方面,葵涌嘉里貨運中心低層全層,面積約9.6萬平方呎,以每呎約17元租出,涉及月租達163.5萬元。

(經濟日報)

Contracted sales plunge 45pc to $27b

Contracted sales of private homes in Hong Kong fell 45 percent year-on-year last month, government data showed yesterday, as developers put more new projects on the market.

The Land Registry received 3,148 sale and purchase agreements for residential units in October, which was 32.2 percent less than a year ago and down by 18.8 percent from September, according to a statement.

That brought the total consideration for these contracts down by 45.3 percent to HK$27.2 billion, or 6.6 percent lower than September's figure.

Home prices in the city have declined by 8.1 percent in the first nine months of this year and are expected to slump by 10 percent for the full year, hammered by rising interest rates and a gloomy economic outlook.

Meanwhile, more new homes are hitting the market.

In Ap Lei Chau, The Corniche, co-developed by Logan Group (3380) and KWG Group (1813), will release the sales brochure shortly, the mainland developers said.

The completed project provides 295 flats with sizes ranging from 1,393 to 3,635 square feet.

The two builders purchased the land for HK$16.9 billion, or HK$22,118 per sq ft in 2017.

In Yuen Long, Sun Hung Kai Properties (0016) released the fourth batch of Park Yoho Bologna, offering 20 homes at an average price of HK$13,910 per sq ft after discounts, up by 1 percent from the last batch.

The batch, which comprises homes from 279 to 674 sq ft, is priced at between HK$4 million and HK$9.3 million after discounts, or between HK$13,227 and HK$15,152 per sq ft. The developer said it has sold 102 units in the project in six days since the sales were launched.

In Hung Hom, Henderson Land Development (0012) has opened the showrooms for Baker Circle Euston to the public and may unveil the first price list this week, offering at least 56 units.

(The Standard)上環富衛金融中心呎租48元 郵政署續約3年

港島區地標商廈,租戶不乏政府部門,往往大手承租全層或部分樓面。其中,郵政署新近續租上環富衛金融中心單位,呎租分別為48元及50元,屬原價續租三年。

上環富衛金融中心17樓3至5室,建築面積約3317方呎,以每月16萬租出,平均呎租48元,該廈21樓亦以40.5萬租出,建築面積約8016方呎,平均呎租50元,租客為郵政署,屬原價續租,市場消息指,郵政署屬該廈長情租客,早於大約2000年進駐該廈。

20年前進駐 屬長情租客

早前,《施政報告》指,金鐘政府合署將有近40%的辦公室遷往北部都會區,有代理表示,目前港島區有不少商廈,均為政府部門所承租,選址為地點方便,租金較廉宜的物業,不排除當金鐘政府合署部分辦公室遷往北部後,政府將部分部門遷入金鐘政府合署,從而減少在私人市場承租樓面。該代理又說,不過,這是很長遠的事,現階段未能預期對市場的影響。

涉全層及部分樓面

另一代理則強調,近年商廈空置率雖然創高,不過,假若疫市一過去,長綫勢必平穩及向好,早在疫市之前,中環是最核心商業區,空置率曾出現1%至2%的低水平,當扣除正常租客更替後,等於「零」空置,大機構找不到合適位置,故此,超級甲廈國際金融中心呎租被推至逾200元,連分散業權的美國銀行中心呎租也曾創下100元新高。2017年及2018年,很多中資來港承租寫字樓,現時市況低迷,他們沒有擴張,但也沒有遷走。

(星島日報)

更多富衛金融中心寫字樓出租樓盤資訊請參閱:富衛金融中心寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

中環威靈頓街鋪7800萬易手 每呎3.62萬 15年升值1.8倍

疫市下,核心區鋪位仍不乏追捧客,中環威靈頓街一個地鋪,建築面積約2150方呎,以約7800萬易手,平均每呎3.62萬,新買家料回報2.85厘,物業於15年間升值1.8倍。

上址為威靈頓街112至114號新威大廈地下B及D號鋪,建築面積約2150方呎,市場消息透露,以約7800萬易手,平均呎價3.62萬,租客為金禾冰室,月租18.5萬,租期至明年3月,續租每月加至19.5萬,至2025年3月為止,回報分別為2.85厘及3厘,據了解,新買家屬新晉鋪位投資者,過往鍾情投資住宅。

連約回報2.85厘

原業主於2007年11月以2750萬買入該鋪,持貨15年,帳面獲利5050萬,物業升值1.8倍。

盛滙商舖基金創辦人李根興形容,該鋪位「大大件」,內里可容納60個座位,可惜鋪型呈L形,門面難於分間,不能拆售為細鋪圖利,若以收租角度而言,尚算不俗,月租近20萬,估計每月營業額90萬至100萬才可收支平衡,若果以人均消費計算,若每人100元,每日要做5轉才夠數,早餐午餐下午茶及晚市,以及外賣一轉就可以,估計達標不難。他又說,翠華2012年於上市時,指翻枱數目是每日25次,屬「人間極限」。他又補充,上述新威大廈樓齡47年,門闊約16呎,內里闊約30呎,鋪深約68呎。

新晉鋪位投資者承接

位處該鋪位對面的威靈頓街97號威利大廈高層地下H鋪,建築面積約4400方呎,現址Pizza Express,於2021年3月以1.35億易手。原業主為百年涼茶店「春回堂」及有關人士,於2011年8月以9800萬買入,持貨11年,帳面獲利3700萬,物業升值逾37%,該鋪位門闊約22呎, 內闊約44呎,深約80呎。Pizza Express月租32萬,料回報約2.8厘。

業內人士指,近期在加息等負面因素衡擊下,鋪位交投亦轉向淡靜,不過,由於威靈頓街鋪位罕有放售,尤其旺市時業主惜市,仍然受到投資者追捧,上述鋪位回報不足3厘,即使明年3月起,租金回報達3厘,惟扣除差餉及稅項等支出,低於3厘,尤其現時銀行存款趨向高息,令鋪位吸引力減少。

西營盤第三街101號怡豐閣地下1號鋪,鋪面向第二街,地鋪及自建閣建築面積各約800方呎,平台約1000呎,以 1500萬易手,平均呎價1.875萬 (不計閣樓與平台),該鋪位門闊約13呎,鋪深約40呎,樓齡31年,月租3.3萬至2024年3月,料回報2.6厘。

第三街鋪每呎1.875萬售

原業主於2006年11月以370萬買入,持貨16年,帳面獲利1130萬,物業升值3倍。

(星島日報)

中鐵綫效應 助中葵涌工業區轉型

施政報告提出「中鐵綫」新鐵路,由元朗錦田經葵涌連接九龍塘的走綫,現時距離葵興港鐵站較遠的中葵涌工業區,周邊未來有機會設新車站,有望加快區內工廈轉型。

葵涌工業區大概可以分為3個部分,分別是青山公路,葵涌段西北面的中葵涌工業區、葵涌道東面的葵涌工業區及葵青交滙處周邊的南葵涌工業區。

7宗重建或改裝 涉256萬呎

雖然葵涌區內現時有葵興及葵芳2個港鐵站,不過兩者距離中葵涌工業區相對較遠,以比較近的葵興站為例,步行至中葵涌工業區的工廈需要12至20分鐘。

按照政府構思中的中鐵綫將會由錦田出發,經葵涌至九龍塘,發揮分流屯馬綫的作用,將會採用快綫形式營運,減少中途站,有機會只會在東北葵、石籬一帶設車站。若果構思落實,中葵涌工業區交通將會進一步改善,推動該區轉型。

近年受惠於新的工廈活化政策推動,中葵涌亦有不少工廈計劃重建或改裝,城規會近年批出至少7宗申請,涉及約256萬平方呎,包括作為住宅、數據中心、新式工廈及酒店用途,類型相當多元化。

醬油廠重建規模最大 供1336住宅

規模最大屬於同珍集團旗下葵涌同珍醬油廠重建計劃,位於昌榮路1至7號,在2019年獲城規會批准,將重建成4幢住宅物業及1幢商廈,樓高14至40層,總樓面約103.7萬平方呎,提供1,336個住宅單位、15.8萬平方呎辦公室及9.2萬平方呎的零售樓面。

另一方面,近年數據中心需求殷切,吸引不少財團收購區內工廈以重建成為數據中心,當中萬國數據 (09698) 便在區內3個工廈重建項目,均是計劃重建成為數據中心,涉及約75.9萬平方呎樓面。

其中包括大圓街2至10號美羅工業大廈,現為約47年樓齡舊式工廈,申請以地積比率11.7倍重建,將建成22層高的數據中心,總樓面涉約23.5萬平方呎;而打磚坪街57至61號中央工業大廈,計劃重建成20層高數據中心,總樓面約27.7萬平方呎。

除了數據中心之外,近年不少工廈希望重建成為新式工廈,以獲得額外的樓面,例如南豐計劃重建打磚坪街94至100號工業地盤,以重建23層高的新式工廈,總樓面約19萬平方呎。

(經濟日報)

全幢工廈招標 可建樓面19萬呎

葵涌區工廈有價,早前藍田街30至38號全幢工廈放售,可建樓面約19萬平方呎,將於11月23日截標。

藍田街30至38號現狀為1幢3層高的工業大廈,總樓面面積約3.5萬平方呎,並可經由藍田街及打磚坪街進入,地盤面積約1.67萬平方呎,最高重建面積19萬平方呎。

重建數據中心成趨勢

負責項目招標的代理指,區內周邊落戶多個重建項目,數據中心龍頭企業萬國數據在過去4年間,已斥資逾25.5億元購入位於藍田街2至6號、打磚坪街57至61號及大圓街2號的3個地盤,作重建高端數據中心用途。

另外,由金朝陽發展的打磚坪街105至113號新式工廈iCITY,在今年初開售,短短一周沽出逾百伙,標準單位建築面積約335至510平方呎,售價多為400萬至450餘萬元,例如其中1個中層09室,面積444平方呎,以約427.9萬元售出,呎價約9,637元。

(經濟日報)

Warburg Pincus’ Storhub Buys Two More Floors in Kowloon Self-Storage Building

Top fund managers continue to snatch up properties to expand self-storage businesses in Asia’s biggest markets, with Warburg Pincus-backed Storhub having expanded its holdings in a Hong Kong industrial building for the second time in two months and the third time this year.

Already the largest self-storage operator in Singapore, in this latest deal, Storhub has agreed to acquire two floors and a pair of parking spaces in the Precious Industrial Centre in Cheung Sha Wan for a combined HK$98 million ($12.4 million), according to Land Registry records seen by Mingtiandi.

Storhub’s latest purchase in the 1977-vintage building will give it ownership of 10 of the 13 floors in the property at 18 Cheung Yue Street in northwestern Kowloon, potentially setting it up to take full ownership of the tower, which is located within a two minute walk of an industrial building acquired by a Blackstone self-storage joint venture earlier this month.

Taking Over in Cheung Sha Wan

In its latest acquisition, Storhub is buying the seventh and eighth floors in the Precious Industrial Centre from a local private company named Cathay United Garment Factory Ltd, adding 19,210 square feet (1,784 square metres) in gross floor area to its Hong Kong portfolio, according to local media accounts.

At the agreed compensation and given the reported area of the properties, the mini-storage firm is paying the equivalent of HK$5,102 per square foot – slightly less on a unit basis than it paid in a HK$66.27 million purchase of the second floor of the building last month.

During the first quarter, Storhub paid HK$350 million to acquire seven floors, including the lowest levels of the building and six parking spaces.

Strata title sales of similarly aged industrial buildings in the area have been transacted at prices running from HK$4,500 to HK$5,000 per square foot, a surveyor said in an earlier comment to Mingtiandi.

Storhub’s latest acquisition is its fifth major buy in the city this year, and would add to the 75,297 square feet which it already owns in the building about a 3-minute walk from the Lai Chi Kok MTR station.

Situated in an area where the Urban Renewal Authority plans to build 1,830 residential units, Storhub sees its Cheung Sha Wan location benefiting from potential demand from new residents in the neighbourhood, according to its website.

The Precious Industrial Centre is also a 5-minute drive from four private residential estates containing 8,827 flats, known locally as “Four Little Dragons”, which analysts say would provide steady demand for self-storage due to high flat prices in Hong Kong.

Mini-Storage Strategy

With 713 self-storage facilities in Hong Kong as of September 2022, according to government statistics, the biggest demand drivers for the sector continue to be high population density and expensive home prices, the surveyor said, with operators rushing to acquire aged industrial assets in the city to meet growing demand.

About 400 metres (437 yards) from the Precious Industrial Centre, a Blackstone joint venture this month acquired an industrial building in Cheung Sha Wan for HK$850 million from the family of the late “Wool Magnate” Chao Kuang Piu, marking the partners’ fourth en-bloc purchase in the city since April of 2021.

One month before that deal, Canadian investment giant Brookfield acquired a pair of units in the Chai Wan Industrial Centre, and a ground floor parking area in the property, in a move to beef up its self-storage portfolio, for HK$55 million.

Separately, Dutch pension fund manager APG and Singapore’s CapitaLand Investment announced this week that they would commit up to S$1.14 billion ($810 million) to take over and expand the region’s largest self-storage operator, Extra Space Asia.

(Mingtiandi)

Hang Lung Approved to Build $637M Luxury Project on Former US Site in Hong Kong

Hang Lung Properties has been given the green light to build luxury homes on a former US government site on Hong Kong’s Shouson Hill, according to a recent report by the city’s Buildings Department, with analysts predicting that the villa project will be worth as much as HK$5 billion ($637 million) upon completion.

The 47,296 square foot (4,394 square metre) luxury development will be built on a site which was once home to a set of residences owned by the US consulate in the city, and will comprise five detached homes covering about 9,459 square feet each, according to the approved plan.

Hang Lung sees the project on the south side of Hong Kong island as an opportunity to profit from strong demand in the luxury market, where the company’s chairman, Ronnie Chan sees buyers from north of the SAR’s borders driving high-end home sales. “The last time I saw so many wealthy mainlanders arrive in Hong Kong was probably in the early 1950s due to political changes up north,” Chan said in announcing the developer’s interim results in September.

Despite Chan’s enthusiasm, property analysts see challenges even for elite home sales with a recent report by a property agency forecasting that luxury residential values are “likely to correct by 10 percent over 2022, and to decline by a further 5 to 10 percent over 2023,” as greater economic uncertainty and rising interest rates make buyers more cautious.

Shouson Hill Mansions

“(37 Shouson Hill Road) will be redeveloped into luxurious detached houses and is now in the planning stage,” said Hang Lung in its 2022 interim report. “Each home in the project could sell for as much as HK$100,000 per square foot,” a property agent said.

Located in a neighbourhood close to the residences of Hong Kong billionaires including CK Asset’s Li Ka-Shing and Alibaba’s Joe Tsai, each of the five homes in Hang Lung’s residential project would span three storeys atop a basement level.

New homes covering around 10,000 square feet of area are considered prestigious and rare, a surveyor said. Houses on 37 Shouson Hill Road will enjoy views of the city’s Deep Water Bay, which is the main selling point of the project, the surveyor said.

Comparable homes in Shouson Hill and Repulse Bay sell for around HK$80,000 to $110,000 per square foot of saleable area, according to another agent.

The developer’s land parcel on Shouson Hill, which was one of the US government’s most valuable assets in the city, is about a 5 minute drive from the Ocean Park MTR station, and about 2 minutes by car from Emperor International’s luxury villa project at 15 Shouson Hill.

While Hang Lung looks set to move forward with the luxury development, the early days of the project showed slower progress as the developer’s purchase of the site hit some early resistance from the mainland government.

Hang Lung initially purchased the nearly 95,000 square foot parcel from the US government in September of 2020 for HK$2.6 billion, but that transaction was blocked by China’s central government just three months after the sale was agreed to, on the grounds that that the US Consulate General in Hong Kong needed to seek approval from Beijing before signing the deal.

According to its interim report released last month , Hang Lung succeeded in completing its acquisition of the site in February last year.

High-End Resilience

Despite an economic downturn and a slump in mass housing market Hong Kong continued to witness landmark luxury housing deals during the third quarter, according to an agency’s report last month. Among the high-end transactions was the HK$430 million sale of House 3B at Wheelock’s Gough Hill Residences in August.

In July, one of the 15 luxury villas at Deep Water Bay’s No. 15 Shouson – jointly developed by CC Land, Emperor International, CSI Properties Ltd and Mingfa Group – was sold for HK$435 million to an unnamed buyer. During June, another unnamed buyer purchased a detached home at the same project for HK$870.2 million, which marked the city’s priciest residential transaction this year.

Mingfa agreed in September to sell its 20 percent stake in No.15 Shouson to CC Land and Emperor International for HK$650 million.

(Mingtiandi)新甲廈供應增 第4季租金仍受壓

甲廈租務需求仍未見活躍,有代理行認為,因新甲廈陸續落成,將令第4季甲廈租金仍有輕微下跌。

據該行每月商廈租金顯示,10月份本港各商業區租金普遍下跌,整體中環呎租為110.4元,按月跌1.3%,而上環區現呎租約56.7元,按月跌2.5%,為港島區最高。至於尖沙咀及東九龍,按月跌幅不足1%。該行指,個別地區空置率稍為下跌,包括上環現時空置率,由8.2%下跌至7.7%。

10月甲廈租務方面,消息稱,鰂魚涌港島東中心錄得租務成交,涉及物業高層,面積約7,600平方呎,以每平方呎約50元租出,屬市價水平。據了解,新租客為一家律師樓,原租用中環置地廣場-公爵大廈高層單位,按現時物業呎租約100餘元計,相信搬遷可節省一半租金。

財滙局擴充 租太古坊二座

港島東新商廈吸引租客搬遷,今年落成的太古坊二座錄得全層租務,涉及約3萬平方呎,獲租客以每平方呎約50餘元預租。據悉,新租客為半官方機構「會計及財務滙報局」,原租灣仔合和中心,現升級及擴充。太古坊二座已獲入伙紙,而物業出租情況不錯,已預租逾5成樓面,包括銀行、顧問公司等。

另一幢樓齡較新的甲廈,北角K11 ATELIER King's Road,新出租樓面面積於今年5至7月逆市突破5萬平方呎,並獲知名建築設計顧問公司Leigh & Orange及會計諮詢服務公司Baker Tilly Hong Kong,分別承租全層作辦公室,兩層合共約4萬平方呎。集團對明年租務市場感樂觀,期望出租率達90%。

啟德 AIRSIDE 錄首宗租務

九龍區方面,南豐旗下啟德地標甲廈 AIRSIDE 招租2年後首錄預租,涉及物業22樓全層,面積約3.75萬平方呎。據悉,新租客為一家跨國採購公司,主要業務為生產及採購家庭電器、廚具等。據了解,該租客原租用大角咀嘉運大廈約2萬多平方呎辦公室,由於業主將重建物業,故需尋找新寫字樓,現搬至全新甲廈,兼作出樓面擴充。消息稱,是次成交呎租約30元,翻查資料,南豐於2020年尾時開始為 AIRSIDE 進行招租,當時環球出現疫情近1年,因應市況業主方面表示項目商廈部分意向呎租約40元,已較原先的呎租50元向下調。

該行指,明年中環將有2大項目落成,獲不少大型機構感興趣,惟新甲廈供應增加,將令業主有降低叫租壓力,相信第4季甲廈租金仍下跌。

(經濟日報)

更多太古坊寫字樓出租樓盤資訊請參閱:太古坊寫字樓出租

更多K11 Atelier King's Road寫字樓出租樓盤資訊請參閱:K11 Atelier King's Road 寫字樓出租

更多鰂魚涌區甲級寫字樓出租樓盤資訊請參閱:鰂魚涌區甲級寫字樓出租

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多合和中心寫字樓出租樓盤資訊請參閱:合和中心寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

工商鋪錄1357宗註冊 代理行:按年下跌39%

有代理行綜合土地註冊處資料顯示,截至10月份為止,今年下半年 (7至10月份),工商鋪共錄1357註冊宗數,按年跌約39%,全年宗數較早前預測的5555宗還要低,預計短期內工商鋪難回復至昔日高峰期,但本月整體宗數及金額分別微升約0.6%及8.4%。

細價物業主導市場

工廈註冊量按月降約16.2%,錄145宗,金額按月挫約26.9%至12.67億,為工商鋪市場唯一跌幅板塊。反觀,商廈及鋪位造好,註冊量分別按月升約17.2%及25%,分別錄68及100宗,10月份金額錄39.28億,按月升約8.4%。

細價物業主導市場,300萬共錄86宗,雖按月下降約13.1%,宗數卻最多,其次逾1000萬至2000萬共錄71宗,按月急升約82.1%。逾億元買賣錄4宗,維持上月水平,當中工廈註冊佔1宗,香港仔興偉中心22樓全層,由惠理集團創辦人之一葉維義以1.20億承接。

過億註冊維持上月水平

上月錄全幢商廈個案,中環皇后大道中118至120號聯盛大廈全幢以2.75億成交,刺激商廈註冊總值攀升至10.84億,按月回升約18.9%。大手成交集中鋪位,銅鑼灣羅素街8號英皇鐘錶珠寶中心19樓全層及九龍城馬頭圍道209號海悅廣場全幢,分別以1.1億及4.25億成交。

本港今年第三季本地生產總值按年實質跌4.5%,遜市場預期的0.8%,代理表示,《施政報告》聚焦中長綫發展策略,未再大規模放寬防疫限制,股市波動影響投資者信心,11月舉行的美國中期選舉及二十國集團峰會亦受關注,期望釋放積極訊號。

(星島日報)

新世界統一九龍塘舊樓業權 底價20.75億 無對手下投得

九龍塘豪宅用地新供應罕有,不少財團透過舊樓強拍途徑增土儲。其中,由新世界併購的九龍塘玫瑰苑舊樓,昨日舉行強拍,該公司昨天在無對手下,以底價20.75億成功統一業權發展,為今年以來金額最大宗的強拍底價紀錄。據悉,併購財團為新世界及相關人士。

市區新供應短缺,財團加快併購步伐。新世界早於2020年就上述項目向土地審裁處提出強拍申請,並於今年9月獲該處批出強拍令,底價為20.75億,昨日在仲量聯行舉行公開拍賣,由手持「1號牌」的新世界代表在無對手下以底價投得,成功統一業權發展,結束歷時約2年的併購程序。

每呎樓面地價1.77萬

而是次強拍金額為今年以單一項目最大,以可建總樓面約11.68萬方呎計,每呎方樓面地價約17753元。玫瑰苑位於又一村玫瑰街23A至34B號,現址現為1幢3層高的住宅樓宇,由12組相連街號組成,建於車庫層之上,每一組街號設有一條公用樓梯,該舊樓早於1967年落成入伙,迄今樓齡達55年;按獲批的建築圖則顯示,該物業共有66個住宅單位及66個車位。該地皮現劃為「住宅 (丙類) 7」用途,物業佔地約38960方呎,以最高地積比為3倍,涉及可建總樓面約116880方呎,料可發展成低密度豪宅。

創今年最高底價

有代理表示,又一村作為九龍低密度高尚住宅區,一直深受投資者的青睞,加上物業地理位置優越,與石硤尾及九龍塘港鐵站僅10分鐘路程,駕駛前往中環亦只需15分鐘,交通便利。鑑於市區的住宅供應買少見少,而且市場對優質住宅用地的需求有增無減,相信九龍傳統住宅區的物業具有進一步升值潛力,此次交易相信備受市場注目。

施政報告公布將放寬強拍門檻,該代理預期,將對舊樓強拍有刺激作用,認為降低門檻後將會有更多項目符合資格申請強拍,料屆時申請宗數將會增加。另外,近年投地市場面對激烈競爭,故不少財團「變陣」併購舊樓發展,料未來會有更多中小型發展商透過舊樓強拍,以增加土地儲備。

除上述項目外,近年新世界更密密併購舊樓發展,最矚目為該公司今年5月向土地審裁處提出強拍申請銅鑼灣波斯富街一列未有窗花的「沽窿舊樓」,當時市場對整個項目估值45.05億,單計強拍申請金額更是歷來銀碼新高紀錄,對比2018年同樣由該公司申請強拍的北角皇都戲院大廈、當時申請估值約31.17億,多出44.5%。

據文件顯示,上述項目位於銅鑼灣波斯富街54至76號、利園山道5至27號快樂大廈、羅素街60號等多個地段舊樓;該舊樓群,坐落銅鑼灣核心一綫購物地段,鄰近希慎廣場及時代廣場,極具重建價值;地盤面積約1.98萬方呎,若以地積比率15倍重建發展,預料可建一個總樓面達29.75萬方呎的商業項目。

(星島日報)

更多時代廣場寫字樓出租樓盤資訊請參閱:時代廣場寫字樓出租

更多希慎廣場寫字樓出租樓盤資訊請參閱:希慎廣場寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

萬科香港牛頭角舊樓批強拍

近年東九龍發展迅速,區內牛頭角一帶的舊樓群即時成為發展商併購對象,萬科香港更密密在該區「插旗」擴充版圖,最新該公司收購的定富街71至79號舊樓獲土地審裁處批出強拍令,底價為1.415億,對比今年4月提出申請強拍時,市場估值1.12284億,高出26%。若上述項目連毗鄰的舊樓合併發展,可建總樓面擴展至逾9.34萬方呎。

據土地審裁處文件顯示,是次獲批強拍令的定富街71至79號 (單號) 商住舊樓,現址為一幢樓高6層的商住舊樓,地下設有4個商鋪,樓上則提供約30個住宅單位,該廈早於1971年落成入伙,至今樓齡約51年。該項目今年4月申請強拍時,已持有上址約81.58%業權,最新持有89.47%業權。

底價1.415億

根據判詞指出,申請人曾委託結構工程師對該舊樓進行結構評估,認為該建築物落成約51年,已達其設計壽命,加上維修情況欠佳,部分混凝土出現剝落、裂縫等,部分設施未能符合現代安全標準和法定要求,而且維修成本與重建成本不成比例,故重建發展是合適做法。再者申請人已採取一切合理步驟取得全部業權,故批出強拍令。

上址地盤面積約2787方呎,若以重建地積比9倍重建發展,可建總樓面約25083方呎。

萬科香港去年曾向土地審裁處申請強拍定富街45至47號華發樓、49至51號安賢樓、53至63號定勝樓3幢舊樓,整個項目地盤面積約7595方呎,可建總樓面約68355方呎,若上述富定街45至79號 (單號) 一列舊樓合併重建發展,地盤面積擴展至約10382方呎,涉及可建總樓面約93438方呎。

另外,由財團併購的西營盤高街120至122號翠樺樓,將於今日舉行公開拍賣,底價為5.25億。

(星島日報)

Price war looms as more new flats are rolled out

More developers rolled out new projects at competitive prices after the local banks raised the prime rates.

Baker Circle Euston in Hung Hom, developed by Henderson Land Development (0012), has released its first price list, offering 56 units with the cheapest priced at HK$4.59 million after discounts.

The flats in the first batch include 10 studios, 34 one-bedroom, 10 two-bedroom and 2 three-bedroom units, with areas ranging from 222 to 514 square feet.

The average discounted price is HK$21,238 per square foot, and the discounted prices of the flats range from HK$4.59 million to HK$11.26 million.

Meanwhile, phase 2A of Silicon Hill in Tai Po has been named University Hill, offering 607 flats, and is expected to launch sales this month, according to Sun Hung Kai Properties (0016).

SHKP said the sale will be its last project for the year and it expects to launch a new phase of Novo Land in Tuen Mun in the first half of next year.

In other news, a property agnecy expects a price war among developers.

The discounted average price of Baker Circle Euston's first batch is 11 percent lower than that of the former phase in June, according to the agency.

An agent said that the price is very attractive and believed that the first batch will be sold out soon.

The agent expects a price war in the primary market and believes prices this month will be very attractive for buyers.

It is estimated that the number of transactions in the primary market will reach 1,500 this month.

(The Standard)

工商鋪錄253宗買賣 代理行:按月微升2.8%

據代理行統計,10月份工商鋪物業買賣錄253宗,按月微升2.84%,僅次於上月新低,金額錄約41.2億,按月減約67.36%。該行預測,股票市場波動以及銀行拆息持續上升,投資者持保守觀望態度,預料交投氣氛持續淡靜,料明年首季才見改善。

該行代理表示,10月份市場共錄約253宗工商鋪買賣,對比9月份稍為上升約2.84%;成交數字仍處低水平,再次跌破300宗水平,暫為2022年第二低,按年同期遞減約37.37%。在大額成交宗數欠奉下,10月總成交金額錄約41.2億,按月跌約67.36%,相對與去年同期亦見萎縮,下滑約45.68%。

金額錄41億按月減67%

該代理指,工商鋪三個範疇當中,寫字樓買賣先見起色,呈量升價跌,月內錄約35宗成交,對比9月回升近35%,涉成交額7.8億,對比9月份72.12億 (包括高銀金融國際中心約67億) 大跌近90%。土地註冊處資料顯示,中環威靈頓街99號威基商業中心15樓02室,面積816方呎,以850萬易手,平均呎價10417元。

料明年首季氣氛見改善

今年第三季本地生產總值較上年同期實質下跌4.5%,反映經濟復甦步伐緩慢,進入加息周期,投資者尋找更高選項,令買賣陷入拉鋸局面;幸好疫情漸穩,加上金融峰會上特首李家超強調,香港匯聚環球和內地帶來機遇及優勢,預料待市場消化加息因素,明年第一季工商鋪前景改善。

(星島日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

從甲級寫字樓數據看出端倪

香港金融管理局舉辦的「國際金融領袖投資峰會」於上星期圓滿結束,這峰會進一步發揮香港吸引投資的優勢和作為國際金融中心的影響力,與特首在《施政報告》中提出的「搶人才、搶企業」互相呼應。過去四年,香港飽受中美貿易戰、社會事件、新冠疫情,以及俄烏戰爭所帶來的能源短缺及通貨膨脹影響,導致經濟呆滯不前,不少高端企業面對運營壓力,縮小在港業務的規模,從甲級寫字樓不同的數據中可以看到一些端倪。

本港其中兩間外資代理行的報告不約而同地強調,甲級寫字樓的空置率,由2019年第一季到2022年第三季持續攀升,分別上升5.7及7.6個百分點,明顯反映在港企業業務收縮甚至結束經營。而又有另外兩間代理行的分區數字中看到,五大寫字樓核心區域中,甲級寫字樓空置率由2019年第一季到2022年第一季,尖沙嘴的增幅最為厲害,達8至9.4個百分點;港島中環、灣仔 / 銅鑼灣及港島東,空置率增幅則由5.1至8個百分點不等,反觀九龍東,其空置率只稍為上升0.8個百分點。

租金方面,其中一間代理行的報告指出從2019年第一季度至2022年第一季,上述五大寫字樓核心區域,均錄得17%至29.7%不等的跌幅。但以租金平均數字來看,九龍東的水平遠低於其他四區,市場人士認為此乃九龍東甲級寫字樓空置率並沒有跟隨大市大幅上漲的主因。事實上,九龍東在這段時期,庫存量上升了100萬平方呎,扣除這個因素,企業租用九龍東甲級寫字樓的樓面正在上升。

九龍東區較受捧

在疫情下,傳統銀行與金融業的運作,不少已轉到網上進行,後勤支援部門亦遷至租金相對較便宜的商業區,例如:港島東及九龍東,傳統中環寫字樓租賃首當其衝。代理行數據顯示,銀行及金融業租用中環區的比率由2019年第一季的59%下跌至2022年同期的56%,即使中環商業區的租金已大幅下跌約30%,但以今年第一季中環商業區平均呎租約97.8元與九龍東約29.1元對比,如租用面積不變,租金成本由中環遷往九龍東可減少約70%。

在這個情況下,九龍東的吸納量維持正增長,而且企業租用的面積已經超越中環核心區,該行指出,今年第一季九龍東已租出的面積達約1440萬平方呎,較2019年第一季的約1370萬平方呎增加約70萬平方呎。整個九龍東,作為政府銳意打造的香港第二個核心商業區,受惠於近年觀塘及九龍灣一帶之轉型,以及啟德區商業、住宅、旅遊、文化及體育的綜合發展,相信可成為引領全港經濟復甦的其中一個火車頭。

應提升基礎建設

九龍東擁有低租金,龐大的發展規模等競爭優勢,而政府應更進一步強化,包括提升基礎建設,如:完善啟德發展區的交通運輸系統,再配合政府招商引資的政策,好好利用九龍東的優勢,以加快香港經濟復甦的步伐。

這裡只是從一些甲級寫字樓市場數據去看商業情況,這冰山一角的分析只能作基本參考。政府擁有龐大的數據庫,絕對有能力使用它們作出深入的市場調研,從而對不同的施政作出「動態評估」及「適時優化」。

(星島日報)

屯門城‧點基座商場 4.5億售

民生區商舖承接力理想,消息指,資本策略以約4.5億元沽出屯門城‧點基座商場。

在舖位買賣市場中,近月民生區商舖較理想,如近日屯門錄大額舖位成交,涉及啓發徑8號城‧點基座,物業地庫、地下及1樓,面積約1.7萬平方呎,舖位以約4.5億元成交,呎價約2.6萬元。

月租140萬 回報約3.7厘

舖位現時租客包括銀行、餐廳及便利店等民生商戶,每月租金收入約140萬元,回報率約3.7厘。據悉,該物業原由資本策略持有,早年投得地皮,發展住宅項目,舖位部分一直保留作收租之用。據了解,早年資本策略曾放售物業,現因應市況降價放售物業。事實上,今年舖位成交焦點,多在民生區商舖基座,如土瓜灣馬頭圍道209號海悅豪庭基座商場「海悅廣場」,獲本地財團以4.25億元承接。

加息下工商舖投資氣氛淡靜,有代理行資料顯示,10月份市場共錄得約253宗工商舖買賣個案,對比9月份稍為上升約2.84%;而成交數字實際仍處於低水平,再次跌破300宗水平,暫為2022年第二低,按年同期比較更遞減約37.37%。至於金額方面,在矚目大額成交宗數欠奉下,10月總成交金額錄得約41.2億元,按月下跌約67.36%,相對與去年同期亦見萎縮,下滑約45.68%。

(經濟日報)

Secondary sales fall to a trickle amid price wars

Only four secondary transactions were recorded at 10 major housing estates tracked by a property agency over the weekend as buyers were lured by new projects that offer deep discounts amid a sluggish market.

The number of deals at the 10 estates plunged by 43 percent week-on-week, and eight of the estates had no transactions at all, according to the agency.

Meanwhile, two new projects were rolling out steep discounts to lure buyers looking for smaller flats.

Baker Circle Euston, a project developed by Henderson Land (0012) in Hung Hom, began to collect checks last Saturday and was subscribed twice over in a day for 56 flats on its first price list.

The apartments in the first batch include 10 studios, 34 one-bedroom units, 10 two-bedroom units and 2 three-bedroom units, with areas ranging from 222 to 514 square feet.

With discounts of up to 10 percent, the flats are priced between HK$4.59 million and HK$11.26 million.

Meanwhile, Bondlane I in Cheung Sha Wan, a project of Vanke Hong Kong, has collected enough checks and will launch sales in the near future.

The first batch includes 19 studios, 23 one-bedroom and 8 two-bedroom flats with areas ranging from 232 to 401 sq ft.

With discounts of up to 16 percent, they are priced between HK$4.16 million and HK$7.82 million.

Also, Sun Hung Kai Properties' (0016) Park Yoho Bologna has sold 108 flats in 11 days, or 66 percent of total units.

The project launched its third batch yesterday with 12 units, including 4 studios and 8 three-bedroom apartments and sold six on the same day.

The secondary market saw sellers at the losing end.

A three-bedroom unit in 63 Pokfulam with an area of 494 sq ft sold for HK$13.28 million, 29 percent lower than the price originally paid by the seller back in March 2018.

And a four-bedroom flat in Lohas Park with an area of 985 sq ft sold for HK$9.8 billion or HK$9,949 per sq ft, the lowest price at the project in five years.

In other news, the Lands Department approved presales of 3,828 new flats in October, 1.3 times more than last month and the most in four months, as a survey by the Hong Kong Research Association revealed that about 60 percent of the respondents expect home prices to drop further in the next six months.

(The Standard)

Evergrande takes US$770m hit as plot sold

China Evergande (3333) said a piece of undeveloped land in Yuen Long has been sold by its creditors for US$636.94 million (HK$4.97 billion).

The debt-burdened mainland developer expects to record a loss of about US$770 million from the deal.

Earlier in January, Evergrande was notified that receivers had been appointed to the piece of land in Yuen Long for security for a financing transaction in the principal amount of around US$520 million.

Evergrande bought the plot of land from Henderson Land Development (0012) for HK$4.7 billion in 2018, and planned to offer more than 260 luxury houses, including one unit of about 250,000 sq ft in floor area.

Saddled with more than US$300 billion in total liabilities, the defaulted Chinese property developer has already seen many of its assets, both in mainland China and Hong Kong, seized by creditors.

Last week, a mansion belonging to Evergrande's chairman in Hong Kong's prestigious The Peak residential enclave was seized by lender China Construction Bank (Asia), as per records from the Land Registry.

The mansion, which HK01 said was valued at HK$700 million, had been reportedly pledged to raise about HK$300 million to repay an overdue Evergrande bond.

A filing with Hong Kong's Land Registry confirmed in October 2021 that the property had been pledged for a loan from CCB (Asia), although it gave no monetary figure.

The disposal might help a project in Hunan province, which has received investments worth 30 billion yuan (HK$32.7 billion) and involves building a 1.8 million-square-meter tourism development, according to people familiar with the matter.

Construction of the project was suspended last September amid Evergrande's debt crisis, but resumed in May this year.

Chairman Hui Kayan might have sold private assets worth at least 16.6 billion yuan in total to inject funds into the real estate company, including his houses in Hong Kong and Guangdong, private aeroplanes and other collections as well as part of his equity in Evergrande, according to the sources.

(The Standard)

九龍灣高銀金融國際中心出售一波三折,在早前遭接管後雖然成功以67億元獲投資公司購入,不過近日該公司入稟稱,接管人在11月1日通告終止協議並沒收訂金,要求法庭頒令賣方執行買賣協議。

HG房地產投資香港有限公司入稟稱,早前以67億元買入九龍灣高銀金融國際中心,並稱已支付訂金2.5億元。惟被告於本年11月初通知原告,會終止協議,並沒收訂金。

原告指,被告的做法是違反買賣協議,要求法庭頒令執行買賣協議,以及禁制被告出售涉案物業。

(經濟日報)

更多高銀金融國際中心出租樓盤資訊請參閱:高銀金融國際中心出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

新世界5.25億 統一翠樺樓業權

西營盤高街120至122號翠樺樓,於昨日早上舉行強拍,最終由新世界 (00017) 或有關人士以底價5.25億元投得項目,成功統一業權,預計將會合併比鄰地盤重建。

項目早於1968年落成,現為1幢樓高12層的商住物業,當中地下為商舖,1至11樓每層設有4個住宅單位,地盤面積約4,967平方呎,擬以地積比率約8.3倍重建,總樓面面積約41,294平方呎。

(經濟日報)

Hong Kong developers may apply to build estates mixing private and public housing after three applications were approved

Authorities have given the greenlight to three housing projects under a pilot scheme launched by former chief executive Carrie Lam in 2019

The government is still considering two other applications under the Land Sharing Pilot Scheme

More Hong Kong developers may apply to participate in a government pilot scheme aimed at using private land for public housing after authorities endorsed three applications, which aim to build a total of 21,600 flats, with 15,100 for public housing.

The three applications made under the Land Sharing Pilot Scheme involved sites in Yuen Long and Tai Po districts, and were endorsed by the Executive Council, a key decision-making body. A panel of advisers established by the government under the pilot scheme earlier backed the proposals.

One of the applications, jointly made by Topwood, Success King and Richduty Development, which are all under Sun Hung Kai Properties, seeks to build about 1,870 public housing or starter flats and 1,260 private homes on a site on Ho Chau Road in Yuen Long, covering a total gross floor area of about 133,400 square metres (1.4 million square feet). The panel said the proposal struck a balance between housing demand and conservation.

Another application, for a 19.3-hectare site (47.7 acres) on She Shan Road and Lam Kam Road in Tai Po, was made by Ocean Target Enterprises of Henderson Land Development and Gettenwood Company and Fullmark Development, all under Wheelock Properties.

They plan to build 9,190 public housing or starter homes and 3,640 private flats with a total gross floor area of about 606,000 square metres. Both sites are made up of private lots and adjoin government land.

The panel said the scale of the project would allow the provision of more government, institutions or community facilities to serve the residents.

The third application, made by Busy Firm Investment under its parent company New World Development, concerns a site on Long Ping Road in Yuen Long for using the current green belt for residential purposes with supporting facilities. The development, which covers a total gross floor area of about 265,900 square metres, seeks to build 4,020 public housing and 1,600 private flats.

The panel said the project would help the transformation of brownfield sites in the area and match with the housing estates in the vicinity.

The projects would have a total of 21,600 flats, 75 per cent of which would be public housing.

The government has so far received five applications, with the other two – from Nan Fung Development and Wheelock Properties – still being vetted.

A Development Bureau spokesman said the scheme aimed to unlock the development potential of private land in areas not covered by the government’s planning studies or conservation areas, adding applicants were still subject to town planning procedures.

“If the progress is smooth, it is expected that work may start from 2025 at the earliest,” the spokesman said.

Under the scheme, owners of farmland can apply to the government to increase the development density of their sites, but must set aside at least 70 per cent of the increased floor area for affordable public sector housing. Applicants will be charged a premium.

In return, the government will carry out infrastructural improvements to enhance the development intensity of the private lots and speed up various planning and project approvals. The scheme was expected to identify 150 hectares for housing in three years.

The pilot scheme was set up by former chief executive Carrie Lam Cheng Yuet-ngor in 2019 as a way to help solve the city’s housing crunch, which she said was fuelling the social unrest that broke out that year. She appealed to developers to share their “social responsibility”.

At that time, state media criticised private developers for hoarding land and not developing their plots to meet Hong Kong’s housing shortage.

Panel adviser Billy Mak Sui-choi, associate professor at Baptist University’s department of finance and decision sciences, said the scheme might attract more applications if it proved feasible.

“Now that three applications have been approved, the city’s developers will keep monitoring their progress. If they prove to be feasible and profitable, developers may be attracted to submit more applications,” he said.

Francis Lam Ka-fai, vice-president of the Institute of Surveyors, said the announcement was a step forward and might draw a few more applications.

But he said that the scheme would only be more attractive when the first batch of housing started construction.

“Developers will observe how things go as it is just the beginning. Town planning and lease changing process were still under the way. They also need to know how much land premium they will be paying. There will be more applications in the future provided that there are enough financial incentives.”

Anthony Chiu Kwok-wai, executive director of the Federation of Public Housing Estates hoped that the government could speed up the process in the future to encourage more developers to participate.

“The scheme has already been around for some time. We hope more projects can start soon to ease the public housing demand,” Chiu said.

Chan Kim-ching, founder of the Liber Research Community, a local NGO focusing on land and development, said developers would dominate the planning of the area, including the infrastructure nearby, which might not answer the society’s needs.

“Under the scheme, the development density of private flats is increased, but developers are subsidised to build infrastructure in the area by enjoying land premium discount,” Chan said. “Developers are enjoying more benefits than the public.”

(South China Morning Post)

中環美國銀行中心呎租33元 見13年低

甲廈空置率高,租金持續低企。消息指,中環美國銀行中心一大單位,以每平方呎約33元租出,屬09年後新低。

市場消息指,中環美國銀行中心中高層04至07室及13室租出,單位面積約6,632平方呎,以每月約22萬元租出,平均呎租約33元,據了解,是次成交呎租,不僅為疫情以來新低,更是自09年後該廈最低呎租水平。翻查資料,對上一宗呎租33元水平,為09年11月,即金融海嘯翌年,物業高層08室,成交呎租約33元,故是次成交,屬該廈13年來新低。

業主叫租 減價一半

據了解,原業主為投資者,於2020年斥1.45億元購入,其後曾放售物業,未獲承接,即轉放租。代理指,業主最初叫租每呎約68元,其後不斷降價至54元及45元,直至最近才以每呎約33元租出,減價一半。

整體指標甲廈呎租均向下,消息指,金鐘力寶中心二座高層06室,面積約1,209平方呎,成交呎租約34元,亦屬低市價水平。據了解,該廈近兩年最低呎租為33元。

另消息稱,尖東永安廣場中層02室,面積約1,140平方呎,成交呎租約32元。另黃竹坑W50高層06室,面積約562平方呎,以每平方呎約23元租出。

(經濟日報)

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多永安廣場寫字樓出租樓盤資訊請參閱:永安廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多W50寫字樓出租樓盤資訊請參閱:W50寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

九龍灣國際交易中心單位景觀,整體配套理想,為區內優質甲廈之一。

國際交易中心位於九龍灣宏照道和宏泰道交界,屬核心商業圈,比鄰主要商廈包括企業廣場項目、一號九龍、Manhattan Place,近年亦有新落成的富通中心、金利豐國際中心等,全屬新式商廈,令商業氣氛濃,觀感甚佳。由九龍灣港鐵站步行至該廈,需時約10分鐘,而前往近年落成啟德站,車程約5分鐘。另外,大廈附近設有巴士及小巴站,而物業亦設有180個私家車車位,以及46個貨車車位。

飲食配套方面,物業地下至2樓為商舖,設有餐廳等,而大廈對面為大型商場Megabox,餐廳選擇甚多,各式店舖齊全。另大廈對面為零碳天地公園,提供舒適環境。

大廈於2008年落成,樓高31層,總樓面面積約70萬平方呎。電梯大堂設於2樓,可經扶手電梯到達。大堂樓高13米,極具氣派。大廈共設14部升降機,有效疏導人流。

每層2.8萬呎 合大企業

物業分高中低層3段,6至12樓為低層,16至22樓為中層,23樓至31樓為高層。

寫字樓樓面每層面積約2.8萬平方呎,樓面夠大,適合大型企業使用,同時最細單位面積約1,500平方呎起。單位樓底高2.9米,空間感充足。

景觀方面,每層可分成1至12個單位,景觀以1至5號單位最佳,因前方沒有大型項目,可享開揚海景,另一面望向東九龍住宅樓景,同樣開揚。

發展商早年已為大廈提供環保元素,15樓全層為一個逾2萬平方呎空中花園,設有大量梳化及桌子,非常寬敞,員工可到空中花園稍作休息,可供樓上用戶舉辦活動。另外,每層分層大堂旁,亦設有一個小露台。

翻查資料,發展商信置 (00083) 管理及持有收租數年,2012年拆售,當時先將16至22樓合共7層樓面,以及30個車位售給恒生 (00011),涉約15.67億元,共涉約19.6萬平方呎,平均呎價近8,000元。其後發展商再沽出多層,包括23及25樓,以呎價約1.02萬元售予基金,現時信置僅持有數層樓面,包括極高層優質單位。

(經濟日報)

更多國際交易中心寫字樓出租樓盤資訊請參閱:國際交易中心寫字樓出租

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多一號九龍寫字樓出租樓盤資訊請參閱:一號九龍寫字樓出租

更多Manhattan Place寫字樓出租樓盤資訊請參閱:Manhattan Place 寫字樓出租

更多富通中心寫字樓出租樓盤資訊請參閱:富通中心寫字樓出租

更多金利豐國際中心寫字樓出租樓盤資訊請參閱:金利豐國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多企業廣場寫字樓出售樓盤資訊請參閱:企業廣場寫字樓出售

更多國際交易中心寫字樓出售樓盤資訊請參閱:國際交易中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

大廈可租可售 平均呎租18元起

九龍灣國際交易中心質素高,根據市場成交顯示,目前該廈平均呎租約18元起。

年中放售單位 呎價約1.35萬

國際交易中心早年賣散,現時大廈有放租及放售單位。成交方面,代理指,該廈現平均呎租約18元起,如數月前,物業中層單位,面積約1,500平方呎,成交呎租約18元。

買賣方面,本年中一家外資貿易公司委託測量師行,放售國際交易中心23樓、25樓及27樓全層,該物業面積約81,300平方呎,每層面積約27,000平方呎。物業市值約11億元,意向呎價約1.35萬元。

同區市況方面,位於九龍灣港鐵站旁的德福大廈,早前錄一宗租務,涉及低層03室,面積約1,277平方呎,成交呎租約26元。另億京中心A座中高層E室,面積約3,247平方呎,上月租出,呎租約23元。

(經濟日報)

更多國際交易中心寫字樓出售樓盤資訊請參閱:國際交易中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

更多國際交易中心寫字樓出租樓盤資訊請參閱:國際交易中心寫字樓出租

更多德福大廈寫字樓出租樓盤資訊請參閱:德福大廈寫字樓出租

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

工商舖第三季1032宗登記 創9季低

有代理表示,工商舖低迷時期在第三季持續浮現,冀施政報告塵埃落定後,挾搶企業、振經濟的大方向,可一併激活今季的市道。

根據代理行資料所得,2022年9月全港共錄303宗工商舖物業買賣登記 (數字主要反映2至4星期前市場實際狀況),較8月的367宗下跌17%,創28個月以來新低,險守300宗關口;至於月內買賣合約總值只有37.21億元,按月急挫94%,主因前月有3宗合共527.39億元的疑屬內部轉讓巨額登記抽高基數所致,倘撇除相關登記後,月內實際登記總值跌幅約23%。

按工商舖三個物業類別劃分,工廈按月登記量跌幅相對較少,而按月交投佔總體比率亦進一步升至近57%。9月全月工廈共錄得172宗登記,按月跌13%,而月內買賣登記總額則相應減少17%,錄得17.33億元。當中仍以細價工廈登記較活躍,其中銀碼介乎200萬至500萬元以內者,錄72宗,為買賣最活躍的銀碼層,惟按月跌9%;而500萬至1,000萬元以內者則逆市升7%,月內錄45宗登記。

疫情受控 料第四季回暖

商廈買賣登記量跌勢持續,連跌4個月並創近半年新低;9月份商廈買賣登記只有52宗,按月再挫26%,為三類物業中跌幅最大者。當中登記量跌幅集中在細價商廈,其中200萬元以下,9月份大減70%至只有3宗登記;而200萬至500萬元以內者亦下跌41%至17宗,反映細價商廈入市步伐亦見轉慢。此外,月內商廈買賣登記總額急挫98%,至只有8.05億元,主要涉及前述巨額登記拉高前月基數使然。

至於店舖買賣登記量方面,再次出現回落的情況,進一步失守80宗水平,9月店舖買賣登記量按月減少兩成,只錄得79宗,創下近半年來低位。另外,因應8月有一宗大額商場登記扯高金額,故導致9月份店舖買賣登記總額大減57%,只錄得11.83億元,創下自2020年7月以來的22個月最少。

該代理指出,第三季為今年之中最淡的一季,季內工商舖合共只錄得1,032宗買賣登記,較第二季的1,334宗跌近23%,創了自2020年第三季以來的9季新低。不過,代理相信,施政報告銳意搶企業、搶人才,加上疫情受控,通闔條件可望陸續放寬,勢必利好經濟,帶動第四季的工商舖市道回暖,故期待年底前買賣登記量可止跌回穩,甚或重踏升軌。

(經濟日報)

灣仔英皇集團中心 中層戶1.038萬放售

灣仔英皇集團中心單位,現以約1.038萬元放售。

面積692呎 呎價1.5萬

有代理表示,灣仔軒尼詩道274至288號英皇集團中心中層03室連租約放售,物業建築面積約692平方呎,意向售價約為1,038萬元,折合每平方呎約15,000元。

該代理表示,單位方正實用,附設全寫字樓裝修,外望城市景觀。大廈玻璃外牆設及雲石大堂寬敞舒適、簡約時尚。物業設中央冷氣,提供舒適辦公環境,同時配備6部載客電梯及1部載貨電梯,方便用戶上落。

成交方面,上月尾英皇集團中心中層04室,面積約1,582平方呎,以約1,582萬元成交,呎價約1萬元,低市價約兩成。消息稱,買家為英皇集團,近年不時回購該廈單位。據了解,原業主於2009年以1,265萬元購入,近期淪為銀主盤。

(經濟日報)

更多英皇集團中心寫字樓出售樓盤資訊請參閱:英皇集團中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

松本清40萬租尖沙咀舖 跌約7成

港設第5分店涉6千呎 成九龍區旗艦

日本人氣藥妝店松本清繼續擴充,剛落實以約30萬元,租用尖沙咀金巴利道約6,000呎,作本港第5分店,租金跌約7成。

尖沙咀金巴利道26號地下舖位,近日獲新租客承租,物業位處尖沙咀加拿分道及金巴利道交界,鄰近美麗華廣場及諾士佛臺。據了解,舖位由日本人氣藥妝店松本清承租,近日品牌已在舖位外掛起廣告,公布作第5分店,現正進行裝修,而該舖面積頗大,料成九龍區旗艦店。

上手租客莎莎 曾134萬租用

翻查資料,該廈由投資者梁安琪持有。物業地舖面積約6,081平方呎,早年由化妝品連鎖品牌莎莎租用,而2018年,品牌以每月約134萬元續租,惟2020年疫情爆發,旅客數字大跌,而品牌早前約滿決定不續租,舖位交吉一段時間。消息稱,是次松本清以每月約40萬元租用,租金較舊租跌約7成。

松本清今年攻港,連續租用多間街舖及商場舖,首間分店位於觀塘apm商場,早於5月開幕。另外,品牌早於年初,以約100萬元預租銅鑼灣恒隆中心,面積約8,500平方呎,作為品牌於香港最大旗艦店,並於兩星期前正式開業,相信因品牌見本港核心區舖位租金下挫,趁機在港擴充。

「0+3」入境措施下,核心區舖位租務稍增,如廣東道54至66號帝國大廈地舖位,面積約2,318平方呎,早前獲零售品牌以約70萬元租用,較舊租跌約8成。

另商舖租務方面,消息指,旺角西洋菜南街200號地下舖位,面積約900平方呎,以每月約8萬元租出,呎租約89元。另尖沙咀金馬倫道19至21號地下B號舖,面積約800平方呎,以每月約13.8萬元租出。至於深水埗汝州街237至241號地下舖位,面積約1,000平方呎,成交月租約8.8萬元。

(經濟日報)

更多美麗華廣場寫字樓出租樓盤資訊請參閱:美麗華廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多恒隆中心寫字樓出租樓盤資訊請參閱:恒隆中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

民生區大樓面舖 投資者淡市承接

民生區商舖收入相對穩定,而坐落於民生區的大樓面舖位,出租情況理想,淡市上仍獲投資者承接。

整體工商舖買賣仍低迷,有代理行資料顯示,10月份市場共錄得約253宗工商舖買賣個案,對比9月份稍為上升約2.84%;而成交數字實際仍處於低水平,再次跌破300宗水平,暫為2022年第二低,按年同期比較更遞減約37.37%。至於金額方面,在矚目大額成交宗數欠奉下,10月總成交金額錄得約41.2億元,按月下跌約67.36%,相對與去年同期亦見萎縮,下滑約45.68%。

屯門錄大額舖位成交

在舖位買賣市場中,近月民生區商舖較理想,如近日屯門錄大額舖位成交,涉及啓發徑8號城.點基座,物業地庫、地下及1樓,面積約1.7萬平方呎,舖位以約4.5億元成交,呎價約2.6萬元。舖位現時租客包括銀行、餐廳及便利店等民生商戶,每月租金收入約140萬元,回報率約3.7厘。據悉,該物業原由資本策略持有,早年投得地皮,發展住宅項目,舖位部分一直保留作收租之用。

另外,投資者羅守輝沽售錦綉花園大道1號首譽兩組舖位,其中,地下3至6號舖,面積約1,433平方呎,以2,800萬元易手,現由寵物醫院、洗衣店及車房等租用。另外,集團亦沽出項目地下1及2號舖及1樓,面積合共約3,000餘平方呎,成交價亦為2,800萬元,現由1車房承租,合共涉約5,600萬元。據悉,羅守輝於2011年6月購入上址,作價2,088萬元,持貨11年,帳面獲利3,512萬,升值約1.68倍。

荃灣惠康超市舖 1.1億售

至於荃灣區,較早前亦錄大樓面舖位成交,牛奶公司早前以暗標形式推出荃灣路德圍51至63號昌華大廈地下舖位,面積約6,939平方呎,原由惠康超市自用,舖位以約1.1億元易手,呎價1.59萬,賣方售後租回長達9年。牛奶公司早於1989年6月以1,130萬購入舖位,持貨33年,帳面獲利9,870萬,物業升值8.7倍。

投資者見民生區商舖受捧,趁機拆售。消息指,宏安地產 (01243) 等部署拆售屯門天生樓地下及1樓商舖,涉及約15個舖位,面積由253至5,498平方呎,現租客包括餐廳、健身中心等民生商戶,入場費約1,520萬元起,回報率約2.4至3厘。翻查資料,項目曾由新世界 (00017) 持有,去年宏安地產夥拍資深投資者趙朗,以約3億元購入天生樓地下及1樓共11個商舖。物業面積約14,000平方呎,計劃將項目打造成區內全新民生消費圈。

分析指,目前因核心區消費尚未回復,投資者仍未敢積極於核心區尋寶,反之民生區商舖因消費穩定,回報率亦較高,在加息情況下,投資者追求較穩定回報物業。同時間,大樓面舖位始終變化較多,呎價相對便宜,故仍吸引投資者留意。

(經濟日報)

屯門城.點基座商場易手老牌家族斥4.5億承接

民生地段鋪位受追捧,資本策略沽售旗下屯門城.點基座商場,作價4.5億,新買家為本地老牌家族,料回報高達4厘。上址成交為城.點基座3層商場,包括地庫、地下及1樓等一籃子鋪位,項目屬於民生商場,在疫市下受追捧,消息指,新買家為本地老牌家族,向來有投資住宅項目。

平均呎價2.61萬

城.點商場地庫面積約4419方呎,地下一籃子鋪位面積約5651方呎,1樓面積約7160方呎,總面積約17230方呎,以成交價約4.5億計算,成交呎價約2.61萬。現時,該商場租客以民生行業為主,地庫及1樓現分別由2家銀行租用,地下街鋪租客包括家品店、便利店等,每月總租金收入約140萬,新買家料回報約3.7厘,惟目前尚有兩個鋪位待租,若成功租出,料回報4厘。

資本策略發展於2014年投得城.點所在的屯門地皮,作價4.27億,發展成為城.點,涉及204個住宅,以樓花形式發售,並於短時間內售罄,項目於2020年初入伙,基座商鋪則一直持有收租。

連約回報4厘

今年以來,市場接連錄民生地區商場易手,俊業集團於今年8月向中國海外購入土瓜灣海悅廣場,作價約4.25億連一籃子車位易手,項目位於馬頭圍道209號海悅豪庭基座商場海悅廣場,包括項目2層地庫、地鋪及1至2樓商場,總建築樓面39147方呎,同時包括42個車位,以易手價計算,呎價約10856元。該商場商戶組合包括連鎖快餐店、酒樓及美容中心等。

(星島日報)

羅素街8號地舖等租戶出價 周大福約滿撤離 逾十年首度丟空

政府放寬入境檢疫至「0+3」,惟對旅遊觀光客吸引力不大,加上仍未與內地全面通關,主打旅客生意的店舖持續收縮。連鎖珠寶金行周大福 (01929) 在銅鑼灣一線地段羅素街月租達130萬元的分店,亦於近期租約期滿結業,該品牌更在羅素街、啟超道一帶銅鑼灣人流暢旺地段地舖分店數目「清零」,而該騰空的舖位未有放租意向價,由租戶出價洽租。

資料顯示,周大福在2019年底、即新冠肺炎爆發前,以每月130萬元租用銅鑼灣羅素街8號英皇鐘錶珠寶中心地下3及5號舖作分店,建築面積3068方呎,呎租約424元。周大福進駐時租金已較前租戶卓悅 (00653) 舊租160萬元低30萬元或18.8%。

疫情打擊 名店紛棄一線地段

周大福租用上述舖位後,本港以至全球多個國家即經歷史無前例的封鎖措施,遊客絕跡,令旅遊區人流銳減,生意急跌,故有不少名店已於過去兩年多相繼撤出貴租的羅素街。

據了解,周大福的租約在今年10月底到期,但早於7月已通知業主不欲續租,直至近期正式結業並拆掉舖位內的裝修。代理表示,目前該舖位並無放租的意向價,由租戶出價洽租。此舖位更是過去十多年來首度丟空待租。

英皇鐘錶珠寶中心另一組地舖,即地下1及2號舖,建築面積3367方呎,在去年5月由時裝品牌Brandy Melville以每月60萬元租用,呎租約178元。以此呎租推算,估計地下3及5號舖市值月租只約55萬元,將較周大福舊租大跌75萬元或57.7%。

事實上,周大福年內在銅鑼灣持續收縮店舖規模,在羅素街至啟超道一段、昔日最多內地遊客的購物街道曾有2間分店,均在今年內相繼結業。例如今年7月,周大福便放棄租用位於啟超道10號地下至1樓的複式舖位,建築面積共約2500方呎,原月租為120萬元,呎租約480元。該舖9月以每月約38萬元租予時裝店,呎租約152元,租金大跌68.3%。

渣打五折續租廣東道現址

周大福目前在銅鑼灣區僅餘4間分店,當中街舖只得2間。在2015年時,周大福在銅鑼灣區的分店達11間,即過去7年在區內收縮63.6%規模。

旅遊區舖位租金持續大幅調整,尖沙咀一線地段廣東道86至98號文利大廈地下4號舖部分連1樓,地下建築面積約1000方呎,1樓建築面積約7000方呎,合共建築面積約8000方呎,由渣打銀行租用多年,現時月租90萬元,呎租約113元。該份租約快將到期,原本合約訂明租客可加租15%至每月103.5萬元優先續租多3年。惟因舖市急劇變化,故渣打銀行與業主另簽一份新租約,租金毋須增加之餘,更獲減租50%續租上述舖位多3年,最新月租為45萬元,呎租回落至約56元。

(信報)

Property foreclosures soar to 13-year high

The number of home foreclosures in Hong Kong has jumped to a 13-year high with the economy heading south, new data showed yesterday.

The news came as the Hong Kong Association of Banks said that customers can now use the interbank payment system for mortgage refinancing transactions.

Data from a property agency showed that the number of properties offered for sale at auction reached 226 as of November 4, marking a 13-year high following 249 in April 2009.

The figure is also 82 percent higher than the 124 recorded a year ago.

Moreover, the number of existing foreclosed homes reached 70 percent of those during the financial crisis, when the number of homes to be auctioned jumped to 316 in December 2008.

The rise came as several property owners failed to continue mortgage loan repayments amid a fall in home prices, leading to their homes being auctioned.

Among the total number of foreclosed homes, residential units reported a 6 percent monthly increase to 187 while small and medium-sized properties with a mortgage as high as 90 percent and priced at HK$10 million or below accounted for 133 or 71 percent of them.

Meanwhile, the HKAB announced it will include direct real-time electronic fund transfer as an additional payment option for residential mortgage refinancing, which might be more efficient and help avoid delays compared to existing methods.

Currently, the mortgage loan proceeds need to go through a law firm for custody and subsequent issuance of solicitor's cheque for repayment.

The new arrangement, which is endorsed by the Hong Kong Monetary Authority, covers refinancing cases for residential properties, including residential car-parking spaces.

Data from a mortgage consultancy and the HKMA showed amount of mortgage refinancing for the first nine months climbed 24.5 percent yearly to HK$94.31 billion and the number rose 16.7 percent to 21,054 from a year ago.

Moreover, the number of refinancing cases accounted for 35.3 percent of new loans approved in September, a new high in three years.

Separately, Pano Harbour in Kai Tak, developed by China Resources Land (Overseas) and Poly Property (0119), expects to release the sale arrangement of the first batch this week and start sales within this month, while Henderson Land Development (0012) said the 56 units in the first price list of Baker Circle Euston in Hung Hom were 2.8 times oversubscribed as of 7pm yesterday.

(The Standard)

美國銀行中心每呎37元租出

投資者於兩年前向香港美國商會購入美國銀行中心單位,於放租一年後,以每呎37元租出,以購入價計算,回報只有1.8厘。

屬美國商會舊址

美國銀行中心19樓4至7及13室,建築面積約5968方呎,香港美國商會於1996年以5460.72萬購入自用,該會於2020年10月以1.45億沽售單位,呎價24296元,帳面大賺9039.28萬離場,升值逾1.6倍。

租金回報約1.8厘

該單位以交吉成交,香港美國商會遷出後,新業主最初以每呎65元放租,惟疫情下商廈出現大量空置率,租金下跌,最終租金一減再減,以每月約22萬租出,呎租約37元。以業主兩年前購入價計算,料回報僅約1.8厘。美國銀行中心今年內成交呎租介乎43至50元不等,對上一次呎租錄低過40元,時為2010年5月,故今次呎租屬大廈逾12年新低。

利群商廈意向呎價7153元

有代理表示,香港仔大道223號利群商業大廈中層3室,建築面積約643方呎,意向價約460萬,每呎約7153元。單位方正實用。

(星島日報)

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

國安公署斥5億買豪宅 呎價逾7萬

嘉里旗下筆架山豪宅緹山,上月初以五億零八百萬售出一幢單號洋房,創一手住宅銷售條例實施之後,九龍區一手洋房成交價新高,買家身分終於曝光。市場消息透露,該洋房買家為「中央人民政府駐香港特別行政區維護國家安全公署」,相信是該署首度購入本港豪宅物業。

嘉里早前全數售出緹山洋房及頂層特色大宅之後,上月三日又成功透過招標方式,售出項目最後一幢洋房,該洋房為別墅一號,面積為七千一百七十一方呎,五房五套房間隔,單位的花園、天台、平台及梯屋面積,分別為五千零一十四方呎、一千三百零六方呎、六百九十一方呎及七十一方呎,連帶三個住宅停車位,以五億零八百萬成交,呎價約七萬零八百四十一元,造價不僅創項目成交價新高,更是一手住宅銷售條例實施之後,九龍區一手洋房成交價新高。

造價九龍區新高

市場消息透露,上述洋房買家為駐港國安公署,惟發展商沒有就消息置評。事實上,緹山買家中不乏知名人士,例如全國政協委員、體育學院主席及理工大學校董會主席林大輝,今年中以首置身分,斥資逾二億二千七百萬,買入緹山一座高層A室連兩個車位。根據代理透露,他需要支付近九百六十七萬稅款,相等於樓價百分之四點二五,屬基本印花稅稅率,可見是以首置名義入市。

該單位為項目僅有兩伙連天台大宅,面積三千零一十七方呎,四房四套連工人房間隔,擁有私家電梯大堂,連九十一方呎平台、三百八十方呎前庭及二千一百一十一方呎天台,能俯瞰九龍半島,遠眺維港景。

暫未悉購豪宅用途

政府發言人回覆表示,根據《香港國安法》第四十八條,中央人民政府在香港特區設立維護國家安全公署。而《香港國安法》第五十一條訂明,駐港國安公署的經費由中央財政保障。

多名立法會議員表示不知悉事件,沒有掌握細節不願評論。目前暫未悉國安部門購入豪宅的用途。

新思維主席、立法會議員狄志遠認為,內地在港機構及員工一直比較樸實,即使是中聯辦官員或其他官員都不是採用豪華安排,今次購置如此高檔、豪華的洋房或不符合內地機構在港的運作風格。他相信事件將引起公眾及傳媒關注,擔心會影響駐港國安公署形象。由於駐港國安公署購置物業不需經立法會審批,他不知悉事件細節,亦不掌握該洋房用途,如果涉及香港公帑,須作跟進追問、調查清楚,但目前仍未掌握資料。他將向政府提出查詢,會先聯絡有關部門,再考慮去信。

港府:經費由中央財政保障

位於筆架山龍駒道九號的緹山,由五座別墅、十四幢洋房及兩幢住宅大樓組成,合共提供四十五伙,目前已為現樓,項目年初至今合共錄得十宗成交,涉及總成交金額超過十六億,最新一宗成交為第二座二樓A室分層大宅,面積一千七百六十方呎,三房三套房間隔,連同一個住宅停車位,昨日透過招標方式,以七千三百零八萬八千四百元成交,呎價約四萬一千五百二十八元。

資料顯示,項目現時已累積售出三十九伙,佔全個樓盤單位數目逾八成六,總成交金額六十三億,平均成交呎價逾六萬。

(星島日報)

荔崗街住宅地估值下調15% 相隔7年再有新供應 業界:財團出價審慎

近期樓市受一連串不利因素影響,連帶地價估值亦回軟;其中,本周五 (11日) 截標的葵涌荔崗街用地招標,業界因應早前市區用地以低價批出,下調估值約15%,最新估值約12億至20億,每方呎估值約4800至8000元,並料財團出價審慎及保守。

在疫情及加息等負面因素影響下,本月截標的多幅地皮業界均下調估值。最近於本周五截標的葵涌賣地表地皮,是政府相隔7年再推出該區用地,該地位於葵涌半山之上,可俯瞰葵涌一帶市區及山景,惟因日前市建局土瓜灣住宅項目地價短短7個月跌價逾24%,業界亦下調該地估值,綜合市場最新估值約12億至20億,每方呎估值約4800至8000元。

最新估值約12億至20億

有測量師表示,早前土瓜灣項目以低價批出,而且近期市場氣氛未如理想,最新估值下跌15%,該地發展規模適中,涉及投資額大,料以中大財團為主,亦不排除有財團以合資方式競投,料財團及發展商出價會較為審慎及保守。該地周遭生活配套不多,惟出入需小巴接駁港鐵站。料日後項目落成後每方呎可售1.6萬起。

另一測量師指出,該地皮可作商住項目發展,亦可發展純住宅,根源據條款,日後需要提供公共交通總站,以及供有需要人士作宿舍的福利設施。另外,該地位於葵涌半山之上,景觀開揚,可俯瞰葵涌一帶市區及山景。

料以中大財團為主

上述葵涌荔崗街 (葵涌市地段第515號) 用地,位於葵涌半山的荔崗街,鄰近夾屋浩景臺,地盤面積約41764方呎,作私人住宅用途可建總樓面約25.06萬方呎;亦可作非工業 (不包括私人住宅、倉庫、酒店及加油站) 用途。該地將於周五 (11日) 截標。

未來土地供應主要來自新界區,該葵涌荔崗街地皮,位處地勢較高,環境清幽,可俯瞰葵涌一帶市區及山景;而鄰近以資助房屋和醫院為主;不過交通方面,位置偏離港鐵荔景站,主要依靠小巴前往荔景或荃灣市中心等地;而日後小巴站將藏於項目之內,更方便住戶出入。

該區近年少有住宅地供應,更是自該區2015年1月後相隔約7年再有賣地表地皮新供應,資料顯示,該區對上一次批出同類住宅地為由豐資源於2015年1月以3.721億投得的葵涌興芳路地皮 (現已發展為豐寓),當時每方呎樓面地價約6700元;換言之,是該區相隔約7年再有賣地表地皮新供應。

(星島日報)

尖沙咀港威大廈 連錄保險機構租務

中銀人壽永明金融 呎租45元作擴充

近期尖沙咀港威大廈租務較理想,據悉近日該廈錄4層全層樓面租務,並以保險為主,包括中銀人壽及永明金融,分別承租全層單位,呎租約45元。

尖沙咀指標甲廈,海港城港威大廈近期租務甚理想,消息指,項目5期近月連錄租務成交,包括低層全層,面積約2.5萬平方呎,成交呎租約45元,新租客為中銀人壽,該租客為本身亦有租用港威大廈環球金融中心單位,如今屬擴充業務。

另外,5期另一低層全層,面積約2.5萬平方呎,獲永明金融租用,呎租同約45元。

星資加密貨幣 租全層

另消息稱,5期極高層全層單位,面積約2.5萬平方呎,成交呎租約55元。消息稱,新租為一家中資保險機構。分析指,市場憧憬中港通關不遠,而保險機構過往亦集中在尖沙咀,特別海港城商廈,希望趁通關前進行擴充。

除了保險機構外,亦有其他租戶進駐港威大廈,消息指,項目5座低層,面積約2.5萬平方呎,獲一家新加坡機構租用,該機構主要業務為加密貨幣。

另有代理表示,荃灣大涌道18至20號國際企業中心3期16樓全層,分間成9個單位,單位建築面積由954至1,844平方呎,意向呎租約30元。

灣仔會展辦公大樓 呎租40元

港島甲廈租務方面,消息指,灣仔會展廣場辦公大樓錄租務成交,涉及中高層09室,面積約2,696平方呎,成文呎租約40元,屬市價水平。

另外,長沙灣全新工廈東方國際大廈錄租務,涉及低層03室,面積約1,830平方呎,以每呎約25元租出。

(經濟日報)

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多環球金融中心寫字樓出租樓盤資訊請參閱:環球金融中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多會展廣場辦公大樓寫字樓出租樓盤資訊請參閱:會展廣場辦公大樓寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

舊樓有價 尖沙咀增112萬呎商業樓面

作為核心商業區之一,尖沙咀的舊樓商業價值高,因此區內舊樓一直吸引不少發展商或財團收購。粗略估計,區內現時至少有9個重建項目,共提供約112萬平方呎樓面。以舊樓重建項目計算,香檳大廈B座重建計劃規模最大,預計可提供14.7萬平方呎的商業樓面。

據初步統計,區內至少有9個重建項目正在進行,涉約112萬平方呎樓面,當中有8個屬於舊樓收購重建,只有中間道11號前「海員之家」的重建項目不屬於舊樓收購。而在上述多個舊樓收購項目之中,以香檳大廈收購計劃最為矚目。

9項目重建 香檳大廈規模最矚目

香檳大廈位於金巴利道,早在1960年代落成,曾經是九龍區最高物業。而恒地 (00012) 早在10年前已經展開收購項目。香檳大廈分A及B座發展,目前為1幢樓高10層的商住物業 (包括地庫樓層),地盤面積約2.33萬平方呎,以地積比率約12倍計,未來可重建樓面約28萬平方呎。當中以B座的收購比較順利,發展商已集合逾8成業權,並在約2年前申請進行強拍統一業權。如發展商先獨立展開重建,單計B座地盤面積約1.23萬平方呎計,商業總樓面約14.74萬平方呎。值得一提的是,香檳大廈的對面為恒地旗下的美麗華廣場及酒店,意味發展商進一步鞏固區內勢力。

樂風完成收購 漢口道建甲廈

另外,中小型發展商亦積極在區內「插旗」,其中近年積極併購舊樓的樂風集團於今年5月公布,集團已夥拍BentallGreenOak及施羅德資本,並斥資逾15億元完成收購尖沙咀漢口道31至37號物業的大部分業權,計劃重建為甲級商廈。整個項目的地盤面積約9,650平方呎,規劃為「商業 (甲類)」地盤,總樓面面積約11.58萬平方呎。而樂風集團等其後於今年7月,就當中的漢口道35至37號恕園大樓,向土地審裁處申請強拍,其現況市值逾6.3億元。

而本地老牌家族永倫集團,早前購入的金馬倫道6號及6A號全幢物業,亦已經於今年2月獲屋宇署批出建築圖則,獲准興建1幢18層高 (另設有2層地庫) 的商業樓宇,涉及可建總樓面約29,434平方呎。至於同由集團持有的金馬倫道2至4A號的利達行,亦於去年10月獲批重建為1幢設有兩層地庫的25層高商廈,總樓面約70,563平方呎。

(經濟日報)

更多美麗華廣場寫字樓出租樓盤資訊請參閱:美麗華廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

Sale of Kerry Properties’ Mont Rouge villa in Kowloon Tong to Beijing’s national security office fetches record US$64.7 million

The five-bedroom villa in Kerry Properties’ Mont Rouge development measures 7,171 sq ft

The transaction is likely to be exempt from stamp duty as the sale involves a government entity, according to the Stamp Duty Ordinance

The office of Beijing’s national security arm in Hong Kong has spent a record HK$508 million (US$64.7 million) for a luxury villa in Kowloon Tong.

The national security office bought the three-storey Villa No 1 in Mont Rouge measuring 7,171 sq ft with five bedrooms, a rooftop, a garden and three parking spaces from Kerry Properties last month, according to official documents.

The HK$508 million price tag, which works out to HK$70,841 per square foot, is the highest for a new villa in Kowloon, according to market observers. The sale is likely to be exempted from stamp duty as the transaction involves a government entity, as per government rules.

“The purpose of the purchase may be for work-related use or receiving guests as there are three parking spaces,” a property agent said, referring to dignitaries like politicians, businessmen and tycoons.

The agent indicated that the villa is set apart from other houses, which allows for a greater sense of privacy.

The advantage of Kowloon is the proximity to the High Speed Railway, the agent said, adding that the price and size of the villa compares with those on The Peak and the Southern district, such as Mount Nicholson.

According to the Stamp Duty Ordinance, transactions that involve the local or central governments are not liable for stamp duty. Hence, the office is not expected to pay any levies.

Villa 1 was the last of the five villas in the development that Kerry Properties had yet to sell. Apart from villas, Mont Rouge has 14 smaller houses and flats in two towers.

Kerry Properties did not immediately respond to requests for comment.

Five per cent of the price has been paid on the signing of the preliminary agreement on October 3. The remaining 95 per cent has to be paid within 60 days of the initial signing.

The deal comes amid a decline in Hong Kong’s overall property market.

DBS expects home prices in the city to fall 5 per cent next year. Goldman Sachs, Morgan Stanley, HSBC and two property agencies have also predicted a slump in prices.

Goldman’s predictions have been the direst. It expects home prices to plummet by 30 per cent by the end of 2023, as sharply increasing interest rates continue to pressure affordability and repel investors from the market.

The national security office, which was created in 2020, is responsible for supervising and guiding the Hong Kong government’s enforcement of the national security law, which outlaws acts of secession, subversion, terrorism and collusion with foreign forces.

(South China Morning Post)東亞銀行港灣中心 連租約叫價5980萬

最新發表的施政報告2022中提出一系列措施,以提升香港金融服務的競爭力,料將吸引更多金融相關行業落戶進駐核心商業區,從而帶動更多寫字樓需求,新近有業主看準市場趨勢,將旗下的灣仔東亞銀行港灣中心中層單位推出市場放售,意向價約5,980萬元。

租金回報2厘 備裝修

有代理指,物業位於灣仔告士打道56號東亞銀行港灣中心 11樓C室,面積約2,600平方呎,意向價約5,980萬元,每平方呎叫價約23,000元。單位以連租約形式出售,涉及每月租金收入約101,440元,租期至2023年9月,以意向價計算,新買家可享回報達2厘。

單位實用率高,且享部分維港景觀,甚為舒適,另外,物業亦配有精緻寫字樓裝修,間隔方正易用,設有會議室及茶水間,為準買家節省裝修時間及開支,屬同幢物業質素較優越。

位處金融圈 協同效應大

而東亞銀行港灣中心位處灣仔區商業金融圈,地理佔優,協同效應下亦吸引更多金融服務業進駐,支持該廈買賣租賃走勢向好,加上交通便利,港鐵會展站開通後更有助該地段一帶的商廈物業需求。

該代理續指,該廈業主向來持貨力強,據代理行資料顯示,該廈對上一宗買賣成交需追溯至2017年8月,成交單位為15樓05室,面積約2,495平方呎,成交價約5,638萬元,呎價約22,597元。

而本港疫情漸趨穩定,市場憧憬全面通關,國際金融領袖投資峰會成功舉行亦象徵香港對外漸見復常,有利本港經濟發展。再者,配合灣仔北發展計劃,多項大型基礎建設及發展項目陸續上馬,料將促進區內商業、會議展覽和旅遊業進一步發展。而今番出售物業具穩定租務回報,投資潛力優厚,適合中、長綫投資者外;由於業主叫價亦見克制,故對企業用家而言亦相當有吸引力,相信物業洽購反應會見理想。

(經濟日報)

更多東亞銀行港灣中心寫字樓出售樓盤資訊請參閱:東亞銀行港灣中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

堅尼地城「蚊型地」呎價跌穿1萬 創逾8年新低

上周五截標的堅尼地城西寧街及域多利道「蚊型」住宅用地,招標結果昨日揭盅。地政總署公布,該地皮由一家名為興曄發展的公司,以約四億四千萬投得,每呎樓面地價失守一萬元關,低見九千五百元,創逾八年港島住宅地皮呎價新低。

興曄發展4.4億元投得

該幅位於堅尼地城西寧街的「蚊型」住宅地,是相隔約三十七年,再有賣地表用地招標,地政總署合共接獲九份標書,除中標的興曄發展之外,尚包括信和、長實、嘉華、鷹君、其士國際、佳明,以及百利保與富豪酒店合組的財團等。

由於市建局位於土瓜灣的住宅項目,地價於七個月下跌逾兩成四,市場早前調低該幅「蚊型」住宅地的估值約一成五,金額介乎五億七千萬至六億一千萬,每呎樓面地價料約一萬二千至一萬三千,然而最後中標價僅四億三千九百二十九萬九千元。

翻查資料,對上一幅每呎樓面地價不足一萬元的港島住宅地,為永泰地產於二零一四年四月九日,以約四億三千四百萬投得的筲箕灣愛勤道與愛德街交界住宅地,呎價只有九千三百九十六元。

有測量師指出,中標價較市場預期差,證明中小型發展商亦非常看淡後市,市區地皮只能以低價成交。

有代理表示,每呎樓面地價九千五百元屬於略低水平,但仍屬合理範圍,始終位於堅尼地城,屬於名校網,但該幅地皮周邊環境不太理想,所以價格略低。

另一測量師表示,港島區很少有住宅地皮的每呎樓面地價跌穿一萬元,是次造價可說是近期市區的新低,又指該地皮面積很細,即使風險相當有限,發展商態度依然審慎。

測量師:發展商態度審慎

該幅「蚊型」地面積只有五千七百八十方呎,住宅可建總樓面亦只有四萬六千方呎,地皮有不少限制,據賣地條款顯示,向西寧街的地面將主要作停車場出入口,向域多利道的人流欠奉,作商業用途的價值不大。地皮往港鐵堅尼地城站要步行十多分鐘,然而西寧街設有巴士總站,往返中環等商業區,交通依然便利。

(星島日報)

Kennedy Town site sells below estimates for $439m

A site in Kennedy Town was tendered out for HK$439.3 million, or around HK$9,500 per buildable square foot yesterday, much lower than market estimates.

Located at Sai Ning Street and Victoria Road, the plot was valued at between HK$490 million and HK$740 million, or between HK$10,600 and HK$16,000 per square foot.

The lot was awarded to Grand Harvest (HK) Development, according to a statement from the Lands Department yesterday.

It has a site area of about 537 sq m and the maximum gross floor area for private residential purposes that may be attained is 4,296 sq m.

It can also be used for non-industrial purposes - excluding godown, hotel and petrol filling station - and the floor area allowed will be computed according to the relevant special condition in the conditions of sale, the department said.

The site drew nine bids from developers, including CK Asset (1113), Sino Land (0083), K Wah International (0173), Grand Ming (1271), Chevalier International (0025), Great Eagle (0041), the statement showed.

It is a rare sea-view site in the urban area of Hong Kong Island, a surveyor said.

Developers are required to provide facilities such as parking spaces on this small site and these costs may be reflected in the price, the surveyor said. And the quiet property market also makes builders more cautious in their bids, he added.

(The Standard)

Surprise as 118 Kai Tak flats put up for tender

Pano Harbour in Kai Tak, developed by China Resources Land (Overseas) and Poly Property (0119), will put all 118 units in the first batch, including two-bedroom flats, up for tender next Monday.

It is rare for developers to sell homes for the mass market by tender. They usually offer several price lists in batches - each comprise at least 10 percent of the total number of flats in the project for buyers to subscribe to by submitting checks. Should there be an oversubscription, developers draw lots to pick the buyers.

But amid a lackluster property market, flats on price lists might not be able to attract enough subscriptions.

The tendering decision is against the guidelines issued by the Real Estate Developers Association but the two mainland developers said they are not members of the association.

The REDA issued guidelines to its members in 2019 that only houses, townhouses, special units, units with three or more bedrooms with a saleable area of over 70 square meters, and flats larger than 100 sq m are allowed to be sold via tender to offer transparency to the mass market buyers. The 582 flats on sale at Pano Harbour, which has two to four bedrooms, range from 564 to 2,088 square feet.

Under the Residential Properties (First-hand Sales) Ordinance, price lists are not required if the properties are for sale by tender, but developers still need to provide sales brochures, arrangements, and register of transactions. They must set out the transaction prices and terms of payment in the register of transactions in relation to the properties sold by tender, just as homes sold on the price lists.

Meanwhile, data from the Inland Revenue Department showed that Hong Kong's overall stamp duty revenue plunged by 66 percent month-on-month to a new low of HK$159 million last month.

(The Standard)

金鐘海富中心全層1.9億易手 單位屬銀主盤 平均呎價17879元

受疫情及加息等因素打擊,甲廈售價備受壓力,金鐘海富中心連錄銀主盤成交,最新為海富中心15樓全層單位,建築面積10627方呎,以1.9億易手,平均呎價17879元,物業於5年間虧損40%。該宗亦是海富中心於3個月內,再度出現全層銀主盤,呎價較上一宗輕微低1.5%。

市場消息透露,海富中心二座15樓全層銀主盤,建築面積10627方呎,以1.9億易手,平均呎價17879元,今番亦是該廈於短短3個月內再出現銀主盤,較對上一次的同類型位,呎價低1.5%。

2017年3.18億購入

原業主為上市公司國安國際,於2017年1月商廈高峰期斥3.18億購入,隨後以物業抵押借貸,早前淪為銀主盤,若以購入價計算,5年間帳面虧損1.28億或40%。

海富中心對上一宗成交亦是銀主盤買賣,2座13樓全層於今年8月以1.93億易手,買家湯臣集團,趁疫市下吸納,指該收購屬於策略性的長期投資,可產生穩定租金收入,進一步加強集團於本港長遠發展,公司於適當時候可能將該物業用作為本港總部。原業主早於2004年以6800萬購入,惟及後淪為銀主盤,若以購入時間計算,物業於18年間升值約1.25億,升幅約1.8倍。

當時,市場人士指出,上址13樓銀主盤,建築面積約10627方呎計算,每呎造價約18161元,低市價約20%,創該廈過去八年呎價新低,最新成交的層數較高,呎價卻輕微下跌。

市場消息指,金鐘區內甲廈各有特色,其中,海富中心實用率高,向來受用家追捧。根據代理行資料顯示,金鐘區內甲廈平均呎價25688元,按月減1.6%,呎租則為43.8元,按月加幅2%,區內甲廈空置率8.8%。

區內甲廈空置率8.8%

疫下商廈擴張需求疲軟,有外資代理行早前公布第三季各項商用物業數據,今年第三季度租賃量按季下跌8.8%至901400方呎,首三季租賃量達至300萬方呎,按年跌12.1%。

新商廈陸續落成,今年第三季新增達180萬方呎,為2008年第三季度以來錄得最大升幅,整體空置率推高至1190萬方呎的歷史新高,空置率上升2個百分點至14.1%。

(星島日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

TOYOMALL連沽兩物業 一賺一蝕共套現1.7億

投資者羅守輝旗下TOYOMALL,最新沽售旺角登打士廣場1至3樓全層,1至3樓建築面積約9072方呎,作價1.2億,平均呎價13228元,另有地下入口、4樓後平台及天台建築面積約2879方呎,合共面積11951方呎,物業屬鋪契,租客包括多家食肆,月租54.3萬,料回報5.43厘,未來合約亦釐定加租,回報可逾6厘。

TOYOMALL於2004年以4000萬購入上址,持貨18年,帳面賺8000萬或2倍。

登打士廣場升值2倍

TOYOMALL旗下北角和富道巨鋪亦以5000萬沽出,涉及96至106號僑裕大廈地下1號鋪連入則閣樓,地鋪建築面積約2676方呎,平均呎價18684元 (未計入則閣),另入則閣約2396方呎,總面積達5072方呎,新買家料回報約4厘。TOYOMALL於2017年以5180萬購入鋪位,帳面損手180萬或3.4%。

北角巨鋪輕微損手180萬

TOYOMALL日前沽紅磡馬頭圍道一個巨鋪,作價9880萬,18年間升值逾5倍,馬頭圍道37至39號紅磡商業中心戲院部分連2樓V9號車位,地下入口約1004方呎,1樓約12196方呎,2樓約10289方呎,合共23489方呎,租戶護老院未來數年具加租空間,月租46.8萬至明年3月,料回報約5.6厘;由明年3月起三年月租53.8萬,隨後3年月租約61.89萬,回報高達7.5厘。原業主於2004年以1620萬購入上址,帳面獲利8260萬,18年升值逾5倍。

(星島日報)

代理行:指標甲廈售價按月挫1%

有代理行發表商廈市場報告指出,上月商廈售價略為回軟,指標甲廈售價按月挫1%,乙廈價格按月則跌0.7%。不過,甲廈租金及乙廈租金分別按月反彈0.7%及0.3%。

空置率錄4連升

該報告指出,今年下半年 (即7至10月份),50大甲廈成交僅錄14宗,按年跌65%。上月全月50大甲廈買賣只有3宗,數字徘徊於今年甲廈成交低位。同時,整體甲廈空置率連續四個月上升,最新達10.2%,亦為近一年以來新高。

根據政府初步數字,今年第三季本地生產總值按年實質跌4.5%,營商環境及投資市場負面情緒蔓延,寫字樓成交陷入低谷,月內欠缺大額成交。10月部分矚目成交以細面積及低呎價為主,集中於柴灣、北角及尖沙嘴東,金額約1億以下,主要為分層寫字樓成交,反映買家保守審慎。

金融機構部署擴充

該行代理表示,雖然近期加息及經濟環境不明朗,但租務較買賣暢旺。10月份錄406宗寫字樓租務成交,按月增加4.6%。租金方面,灣仔區表現較突出,按月升5.8%。

(星島日報)

油塘工廈逾99%業權 7億標售

油塘配套改善,前景不俗,故工廈具重建價值,現業主標售油塘大益貨倉工廈逾99%業權,市值約7億元。

佔地2.5萬呎 可享海景

有外資代理行代理表示,大益貨倉工業大廈99.32%業權現正標售,物業位於油塘四山街14號,比鄰多項新住宅項目,例如曦臺、海傲灣、蔚藍東岸等。地盤面積約25,295平方呎,最大可建批則面積約151,770平方呎,可重建為住宅 (需向有關部門申請)。截標日期為2022年12月6日正午12時正。據了解,物業市值約7億元。

該代理指,該物業屬三面單邊地盤,重建後可享海景。此外,物業地理位置優越,只需步行5分鐘即可到達港鐵油塘站、購物商場「大本型」及旅遊名勝鯉魚門海港漁村。他亦指,各項的交通基建亦將帶動油塘區的發展,如中九龍高速幹道 (6號幹綫) 及於2022年施政報告中所提及興建的將軍澳第3條公路隧道「將軍澳——油塘隧道」,加強對外連接。

(經濟日報)大額投資市場 工廈獨撑

投資氣氛持續低迷,近期大額投資物業上,僅工廈獨撑市場。只要根據工廈與商廈、舖位多項數據作比較,便一目了然,解釋為何工廈仍是一枝獨秀。

今年第三季,投資氣氛明顯放緩,主要受美國加息步伐轉急所致,與供樓相關的港元1個月同業拆息 (HIBOR),續高於3厘水平,最新1個月同業拆息報3.21厘。

大額工商舖物業,向來由投資者入市主導,基金過去兩年積極在港入市,全因在低息環境下,享穩定回報率,故過去兩年投資市場整體表現不差。不過,隨着息口預期持續向上,借貸成本上升,基金及本地投資者要追求更高回報率,抵銷加息影響。但同時間,持貨業主減價幅度未算強勁,導致成交量偏低。

基金吸納工廈 拓迷你倉業務

單計近兩三星期,市場上大額工商舖物業買賣,涉及3億至5億元以上實在不多,而10億以上大手成交更是極少。從成交中,資金集中追捧同一個範疇,就是工廈。如長沙灣永新工業大廈,原由「毛紡大王」之稱的曹光彪家族持有,總樓面涉約21.5萬平方呎,以8.5億元成交,新買家為私募基金黑石 (Blackstone) 夥迷你倉集團合資買入。

該基金近年積極入市,主要吸納工廈,發展迷你倉業務。另外,新加坡迷你倉品牌StorHub以9,800萬元,近日購入長沙灣長裕街18號柏裕工業中心7、8樓全層樓面,而該集團今年積極在港入市,早前亦已收購該廈單位,包括以3.5億元,購入該廈約50%業權,如今再增持單位。

工廈回報率3.5% 勝甲廈商舖

在多項不利因素下,工廈仍是投資者,特別基金首選。若參考工商舖3項數字,一作比較便得知原因。據一間外資代理行數據,今年9月份,甲廈及商舖空置率,分別為14.4%及10.2%,兩項數字均偏高,而工廈空置率,僅為2.7%。租金方面,近3年甲廈及商舖租金,分別大幅下挫26.6%及35.6%,而工廈租金卻錄2.1%升幅,表現相距極遠。對投資者來說,回報率甚為重要,工廈現時回報率平均約3.5%,而甲廈及舖位,則低於3%。

以上多項數字,足以反映工廈受捧原因,畢竟本港商業氣氛尚未回復,特別甲廈市場,空置率高加上供應多,租金持續受壓,令投資者卻步。相反工廈空置率低,租金有增長,數字甚亮麗,而在加息持續下,投資者定必對回報率更加重視,如今工廈回報率仍高於甲廈及商舖,故令投資者相對安心。

此外,工廈始終具備增值空間,如最近大手成交的工廈,多屬基金購入,改裝成迷你倉,故物業價格同時提升。既有穩定回報,又有增值空間,工廈難怪繼續成投資者首選。

(經濟日報)

工廈錄145宗註冊按月跌16% 代理行:淡市下企業偏向租用

一間代理行綜合土地註冊處資料顯示,10月工廈註冊量只錄145宗,金額12.67億,按月分別跌16.2%及26.9%。工廈買賣減少,令售價按月跌0.4%。

金額12.67億按月跌26.9%

該行最新發表的工廈市場報告指出,10月共有約510宗租務,租金按月升0.5%,連升三個月。矚目租務為,荃灣嘉民國際通訊中心低層2層樓面,分別以月租約101萬和72.3萬租出,面積分別達58569方呎和41909方呎。另外,石門永得利中心高層單位則以月租約58.8萬成交,呎租約10.1元。

貨倉連錄大額租賃

十月份有三區平均呎價按月上升,升幅皆維持1%以內。跌幅最大的分區為荃灣區,最新報4183元,按月跌1.4%。分區呎租方面,升幅最大的分區為九龍灣和沙田 (火炭及石門),10月呎租分別報17.7元及15.1元,按月升3.1%。黃竹坑 (香港仔及/鴨脷洲) 最新呎租為15.8元,按月跌1.5%,為跌幅最大一區。

上月錄4宗逾億成交,以基金投資者為主,他們對貸款依賴較低,無畏加息。10月最大宗億元成交為新加坡基金普洛斯以10.8億購入青衣清甜街8至12號全幢倉庫,黑石基金亦夥同StorHub迷你倉以8.5億向曹光彪家族買入位於長沙灣的永新工業大廈全幢。

該行代理表示,加息減少投資活動,令工廈買賣疏落,為節省成本,企業都會偏向租用物業。

(星島日報)

代理行:上月100宗鋪位註冊升25%

有代理行綜合土地註冊處資料顯示,上月錄100宗鋪位,在工商鋪三個範疇,未及工廈的145宗,惟最矚目成交都集中鋪位。

海悅廣場全幢4.5億矚目

上月錄100宗鋪位成交,按月升25%,矚目包括,銅鑼灣羅素街8號英皇鐘錶珠寶中心19樓全層,九龍城馬頭圍道209號海悅廣場全幢,作價分別1.1億及4.25億,海悅廣場項由老牌家族俊業集團向中國海外買入,計畫翻新為民生商場,項目鄰近土瓜灣及啟德,區內正在變天。

該行指出,截至10月份為止,今年下半年 (7至10月份),工商鋪宗數共錄1357宗,按年跌約39%,料未來2個月註冊量低位徘徊,全年註冊宗數或較該行早前預測的5555宗還要低。雖然預計工商鋪難以在短期內回復至昔日高峰期水平,但本月宗數及金額稍回暖,微升約0.6%及8.4%,各板塊表現個別發展。

工廈註冊量按月降約16.2%,錄145宗,金額按月挫約26.9%至12.67億,唯一錄跌幅板塊。商廈註冊錄68宗,按月升約17.2%,10月份整體金額錄39.28億,按月升約8.4%。

(星島日報)

Secondary home sales rise amid price cuts

Transactions at major housing estates in the secondary market rebounded amid deeper price cuts, with deals at Taikoo Shing and Nan Fung Sun Cheun falling to under HK$9 million and HK$6 million respectively.

Data from a property agency showed that 10 major housing estates saw a 175 percent jump in transactions to 11 last weekend, amid the possible slower pace of interest rate hikes by the United States and eased Covid-19 restrictions in mainland China.

Among six housing estates which reported at least one deal, City One Shatin topped the list with five deals at an average price of HK$13,200 per square foot, while transactions in Kingswood Villas in Tin Shui Wai doubled to two, despite a 4.5 percent decrease in the average price to HK$9,723 per sq ft.

Taikoo Shing's sole deal came after the owner slashed the asking price by HK$3.5 million or 29 percent to HK$8.5 million, resulting in an average price of HK$14,605 per sq ft for the two-bedroom unit.

The agency added that Taikoo Shing has reported four transactions so far in November, at HK$15,158 per sq ft on average.

Apart from the 10 estates, Nan Fung Sun Cheun in Quarry Bay saw a flat traded for HK$5.78 million or HK$11,202 per sq ft, which might be the first deal below HK$6 million for a three-bedroom unit since 2016.

Elsewhere, a flat with three bedrooms in Festival City Phase 2 in Tai Wai brought a loss of HK$1.38 million to the holder after offering a price cut of 18.4 percent to HK$10.2 million, which led to an average price of HK$13,765 per sq ft, a new estate low in the past 18 months.

Hong Kong Property also attributed the increased deals in the secondary market to the expected slowdown in interest rate hikes as homeowners continue to offer price cuts.

Meanwhile, demand in the primary market remained hot, with small units remaining lucrative to homebuyers.

Vanke Hong Kong said seven flats at Bondlane I in Cheung Sha Wan were sold on Saturday, after the 30 units offered in the first round saw a demand of over seven times the supply, with 250 pledges.

The two-bedroom flats among the released units have sold out.

The developer responded it might consider offering more units with two bedrooms for sale in the short term.

The prices after discount for the 30 units in the first round ranged between HK$4.16 million and HK$7.82 million.

(The Standard)

甲廈上月空置率10.2% 近1年新高

10月份寫字樓市場活躍度持續下滑。布代理行發表商廈市場報告指出,上月商廈售價略為回軟,指標甲廈售價按月挫1%,乙廈價格按月則跌0.7%。不過,甲廈租金及乙廈租金分別按月反彈0.7%及0.3%。

該報告指出,今年下半年 (即7至10月份),50大甲廈買賣成交僅錄14宗,按年跌65%。

上月全月50大甲廈買賣只有3宗,數字徘徊於今年甲廈成交量的低位。同時,整體甲廈空置率連續4個月上升,最新達10.2%,亦為近一年以來新高。

根據政府初步數字,今年第三季本地生產總值按年實質下跌4.5%,營商環境及投資市場負面情緒蔓延,寫字樓成交陷入低谷,月內欠缺大額成交。10月部分矚目成交以細面積及低呎價為主,集中於柴灣、北角及尖沙咀東,成交金額約為1億元以下,主要為分層寫字樓成交,反映投資者及企業態度保守審慎。

灣仔租金按月升5.8%

該行代理表示,雖然近期加息及經濟環境不明朗,令商廈投資需求受壓,但整體租務市場較買賣市場更為暢旺。該行於10月份錄得406宗寫字樓租務成交,按月增加4.6%。在整體甲廈租金方面,其中灣仔區的表現較為突出,按月升5.8%。

該代理指,市場上亦有不少大型租務成交,如瑞銀預租西九高鐵站項目9層樓面,涉總樓面面積約25萬平方呎,並同時續租中環國際金融中心二期共14萬平方呎樓面,市場預料月租約1,820萬元。反映市場憧憬通關在即,金融機構積極部署在港擴充。

該行預計,商廈市場表現仍視乎宏觀經濟情況及本地防疫政策。若在短期內未有重大利好消息,商廈市場表現維持疲弱,但若政府進一步落實「0+0」檢疫措施,甚至全面通關,商廈的投資及租賃需求將會上升。

(經濟日報)

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

投資者減價吸客 工商舖大手買賣增

個別投資者近日積極沽貨,叫價上亦有一定折讓,吸引財團捧場,令近日大手工商舖買賣稍增。

近期市況稍波動,個別投資者放售物業,其中羅守輝為近期市場上最積極沽貨的投資者之一。消息稱,旺角登打士街43號登打士廣場錄成交,涉及物業1至3樓全層,面積合共約9,072平方呎,以約1.2億元成交,呎價約1.3萬元。旺角登打士街為傳統飲食地段,而該廈亦屬銀座式商廈,租戶主要為餐廳。據悉,項目每月租金收入約54萬元,回報率逾5厘,相當可觀。

該舖原由投資者羅守輝持有,事實上,過去一星期他連環沽貨,舖位方面,他以約9,800萬元,沽出紅磡馬頭圍道巨舖,面積合共23,489平方呎,由護老院租用。另北角和富道96至106號地下1號舖及閣樓,物業地下面積約2,366平方呎,閣樓面積約2,157平方呎,合共約4,523平方呎,舖位以約5,300萬元易手。舖位現由火鍋店以每月16萬元租用,回報率約3.6厘。

旺角凱途發展大廈 兩層蝕310萬

羅守輝持於2017年以5,180萬元購入舖位,其後以約6,280萬元放售,現減價約16%沽貨。羅氏持貨5年沽貨,帳面獲利約120萬元,升幅僅約2.3%,惟扣除使費,僅平手離場。

商廈方面,他亦以約5,146萬元,沽出旺角凱途發展大廈兩層乙廈樓面,每層面積各約3,100平方呎,持貨5年帳面虧損310萬元。連同是次北角舖位,一周內已沽3物業,套現約3億元。

至於資本策略近日亦沽貨,涉及啓發徑8號城點基座,物業地庫、地下及1樓,面積約1.7萬平方呎,舖位以約4.5億元成交,呎價約2.6萬元。

舖位現時租客包括銀行、餐廳及便利店等民生商戶,每月租金收入約140萬元,回報率約3.7厘。該物業原由資本策略持有,早年投得地皮,發展住宅項目,舖位部分一直保留作收租之用。據了解,早年資本策略曾放售物業,現因應市況降價放售物業。事實上,今年舖位成交焦點,多在民生區商舖基座,如土瓜灣馬頭圍道209號海悅豪庭基座商場「海悅廣場」,獲本地財團以4.25億元承接。

AVA 622地舖 4000萬售減800萬

至於中細價舖位,亦錄多宗減價沽貨,如佐敦迷你單幢住宅項目AVA 622地下1號舖,建築面積約1,439平方呎,原以4,800萬元放售,終以4,000萬元成交,呎價約2.78萬元。該舖由點心店以每月11.5萬元租用,租金回報率約3.5厘。

分析指,由於仍處加息周期,工商舖投資氣氛直接受衝擊,個別持重貨的投資者希望減磅,故願降價放售物業,因個別減幅較大,吸引其他財團承接。由於後市仍存不明朗因素,相信個別業主放售物業時,仍願作出較降大降幅,料減價成交個案持續。

(經濟日報)

偉業街161號 活化商廈合樓上舖

觀塘為東九龍核心區地段,而觀塘偉業街161號全幢,已進行活化,現時設備全面升級為標準商廈。

政府已落實將多個政府部門遷至東九龍,加上多家跨國巨企率先進駐同區,東九龍有望轉變為重點商貿核心區。該區的觀塘偉業街161號全幢近年活化成商廈,大廈大堂、電梯及部分樓層已全面翻新。

項目位置位處於偉業街大單邊,乃東九龍區主要街道,人流車流如鰂,而附近酒店亦將改建為共居空間,將可大大增加該地段人流及帶動附近更多元化商貿發展。值得一提,新地 (00016) 觀塘巧明街98號即將落成,項目總樓面115萬平方呎,其中兩幢寫字樓合共約65萬平方呎,而兩幢樓面每層面積,分別約2.2萬及1.3萬平方呎,並提供大型商場,故地段前景甚佳。

分餐飲零售寫字樓樓層

交通方面,物業距離港鐵牛頭角僅6至7分鐘路程,距離港鐵觀塘站約10至15分鐘,附近亦有巴士及小巴站,直達港九新界,交通四通八達。

另外,物業設有超過60多個室內停車位,可作時租或月租,屬區內罕有,方便駕車人士出入。

飲食方面,物業附近有不少茶餐廳可供選擇,亦有麵包店及24小時便利店,適合趕時間的上班族。若時間充裕,亦可選擇步行15至20分鐘到較大型商場apm創紀之城5期,內有不少餐廳選擇。

觀塘偉業街161號樓高23層,總樓面面積約122,000平方呎,可作樓上舖或辦公室之用,迎合各類型企業。物業分為餐飲、零售及寫字樓樓層,地下至6樓為餐飲零售樓層,面積由438至全層5,032平方呎不等;而6樓以上則為寫字樓樓層,單位面積由798至全層5,832平方呎。

物業另一大特點為單位享有極開揚景觀,當中17樓至26樓更可坐擁維港及鯉魚門海景,郵輪碼頭及煙花景盡入眼簾,適合各行各業如健身瑜伽中心、教育機構、金融財務、資訊科技及專業顧問等行業進駐。

(經濟日報)

寫字樓樓層招租 每呎14元起

觀塘偉業街161號經活化後,質素全面提升,現業主進行招租,寫字樓呎租約14元起。

零售樓層意向呎租20元起

有代理表示,觀塘偉業街161號全幢正進行招租,寫字樓樓層意向呎租由14元起,而零售樓層意向呎租則由20元起。

他指,大廈活化完成後推出市場反應熱烈,已有瑜伽中心、教育及資訊科技等行業率先承租,另有多組客人包括餐飲、零售、金融財務、教會及Play House正積極洽商中,估計可於短期內落實。

觀塘區活化商廈一向受市場歡迎,其中,泓富廣場高層8室,實用面積901平方呎,新近以20,800元租出,呎租23元。另威登中心中層9室,實用面積774平方呎,新近以12,230元租出,呎租15.8元。其次,柏秀中心低層C室,實用面積625平方呎,新近以14,062元租出,呎租22.5元。

(經濟日報)

更多威登中心寫字樓出租樓盤資訊請參閱:威登中心寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

尖沙嘴全幢服務式住宅獲洽 廠家出價近9億 平均呎價2.8萬

儘管疫市揮之不去,惟今年以來,酒店及服務式住宅受捧程度遠超往年,由基金持有的尖沙嘴彌敦道一幢服務式住宅全幢,獲本地廠家洽購,出價近9億,平均呎價約2.8萬。

市場消息指,由基金持有的尖沙嘴彌敦道176號The Nate,物業為全幢服務式住宅,擁有71房間,經營共用空間,基座為5層高鋪位,總面積約3.2萬方呎,儘管在疫市下租金收入減,仍然獲準買家垂青,出價近9億洽購,準買家為廠家,有意在疫市下吸納大型項目,並預期隨着疫市過去,該類型物業價值會得到發揮。業主為一家基金,出售物業需經過程序,有意透過大型測量師行將物業招標,就售價作最後定案。該家基金早年購入全幢商住大廈,斥資1億將物業改裝服務式住宅,工程歷時2年,及後一直持有收租至今。

疫市下酒店連錄買賣

今年酒店買賣罕見地暢旺,至今暫錄8宗全幢買賣,涉資由2.2億至24.7億,其中,觀塘悅品海景酒店作價為24.7億,為今年以來暫錄最大宗買賣,其次為紅磡「逸.酒店」涉資16.46億。除了宗數之多,金額涉資龐大,更是多年來罕見,多逾93億,比較去年同期只有9.2億,大升9倍。酒店與服務式住宅屬於同一範疇的物業,在疫市下受追捧。

其中,亞洲住宅租務品牌Weave living最積極,參與其中的4宗,涉資約54.75億。業內人士表示,現時酒店易手價格,並非創新高,而是「撈底價」,亦只有在疫市下,才有更多酒店盤源供應。

準買家擬「低撈」