信和Landmark South 招租 呎租逾30

信和集團今年兩寫字樓項目落成,集團現先推出黃竹坑 Landmark South 甲廈招租,呎租約30餘元;而下半年將推出元朗One North項目,兩項目合共提供約80萬呎樓面。集團認為今年市場整體商廈供應多,具特色的商廈仍有需求,而集團整體商廈出租率約9成。

信和集團及帝國合作發展的黃竹坑業勤街39號全新甲廈項目 Landmark South,預計今年第2季落成,樓高31層,總樓面達256,957平方呎,包括16層甲廈、3層零售空間及藝術展覽廳,另提供佔地9,000平方呎空中花園。藝術發展局將於此開設一個約5,000平方呎的多用途藝術展覽,另項目最頂兩層29及30樓,享特高樓底,項目可望今年8月入伙。

黃竹坑甲廈 已錄成交

信和集團資產管理董事蔡碧林表示,Landmark South 現進行招租,單位面積約1,497至1.4萬平方呎,呎租約30餘元。她指因疫情關係,招租工作及睇樓活動最近才開始,暫時反應不俗,已獲室內設計、私募基金等機構視察,並已錄得數宗細單位成交。項目賣點上,她表示項目鄰近港鐵站,而黃竹坑本身與中環僅數站之距,租金差幅大,亦鄰近南區,地點甚理想。

集團對上一次新寫字樓項目落成已為2008年,而今年更有兩幢甲廈推出,位於元朗One North,為集團在2015年以16.9億元投得,鄰近港鐵朗屏站,涉及2座樓高14層商廈,寫字樓面積約44.5萬平方呎,另商場零售面積約11.3萬平方呎,合共總樓面面積55.8萬平方呎。

元朗One North 料第三季招租

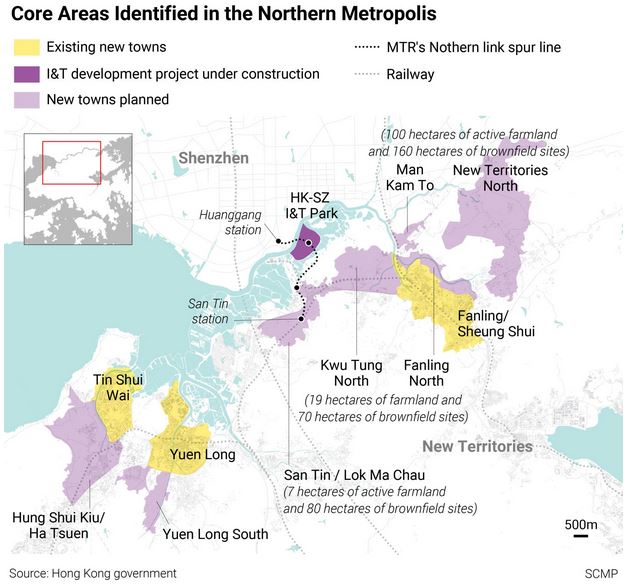

蔡碧林指,該項目位處元朗,有北部都會區概念,可招攬創科等商戶,亦合半零售商戶,預計第三季招租。

信和今年兩項目共有80萬平方呎樓面推出,而今明兩年整體商廈供應量高,蔡碧林認為,無疑市場供應多,惟具特色商廈仍有一定需求,而集團兩項目分布南區及北區,具有獨特性。

市況方面,疫情下不少機構採在家工作策略,租客對商廈需求或有變,她則認為,很多生意仍需面對面傾談,在家工作執行上亦有其他困難,故實體辦公室重要性不減。她指,集團旗下寫字樓整體出租率約9成,與第5波疫情前相若,租客在疫情下無意搬遷,故出租率仍穩定,租金方面,現時租金水平與高峰期比較,仍低約1成以上。

(經濟日報)

更多Landmark South寫字樓出租樓盤資訊請參閱:Landmark South寫字樓出租

更多黃竹坑區甲級寫字樓出租樓盤資訊請參閱:黃竹坑區甲級寫字樓出租

租務市場將轉好 租金企穩

整體商廈租金穩定, 有代理行預計,隨着租務需求上升,租務市場將轉好,租金亦企穩。

據本港一間外資代理行每月商廈租金走勢數據,中環超甲廈呎租約134.6元,按月微升0.2%,而整體中環呎租約114元,按月微跌0.2%,按年則升約0.8%,反映租金相對穩定。另外,其他商業區亦相對平穩,跌幅較大為鰂魚涌,按月跌約2.7%,現呎租約51元。

中環有數幢甲級寫字樓在3月底錄得雙位數空置率,但中環整體空置率維持在7.2%水平,表現較非核心商業區好,邊綫區如金鐘及灣仔區,空置率分別達8.4%及11.2%,

IWG租全幢商廈 港島最大手

租務上,該行指,3月港島租務成交,主要為細單位,面積6,000平方呎以上單位,獲金融及律師行等租用;較大手為金融機構租用中環怡和大廈3.1萬平方呎樓面,另律師樓租用中環花園道3號。

港島區最大手租務,為IWG集團租用灣仔皇后大道東8號全幢 (8QRE),開設Spaces辦公中心,而8QRE Spaces預計於2022年7月開幕。該集團指,該中心將提供超過900個辦公位置及70間私人辦公室,同時預留5層空間作企業專屬套間。除了服務式辦公室,其中兩層更將改造為「商務俱樂部」。業內人士預計,是次成交呎租料約45元,該廈總樓面約8萬平方呎,原由忠利保險租用。據悉,2019年共享空間品牌WeWork亦曾預租該廈全幢,惟最終取消,如今由IWG接手。

另外,中環中心連錄成交,物業中低層全層,面積約2.5萬平方呎,成交呎租僅約40元。新租客為一家英資軟件公司,原租用同廈極高層單位,呎租約75至80元,如今於同廈進行搬遷,主因可節省一半租金。另外,物業高層單位約2,856平方呎,以每呎約70元租出,月租約20萬元,上址舊租金每呎約105元,租金跌約33%。

九龍寫字樓租金 末季將回升

九龍區方面,大手租務為觀塘綠景NEO大廈中層兩層樓面,合共近5萬平方呎,成交呎租約30元。新租客為手機配件連鎖店CASETiFY,該品牌原租用同區工廈天星中心,涉及約1萬平方呎,如今大幅擴充至約5萬平方呎,屬近期罕有擴充個案。

該行指,隨着員工重返辦公室工作,更多租戶重新考慮搬遷等計劃,令3月份的寫字樓租賃活動水平反彈。該行指,由於疫情緩和,預計未來數月租務活動增加,而九龍區方面,該行料寫字樓租金將在未來幾個季度保持觸底反彈的趨勢,並在今年最後一季略有回升,故租金年底將有1至3%的整體增長。

(經濟日報)

更多怡和大廈寫字樓出租樓盤資訊請參閱:怡和大廈寫字樓出租

更多花園道3號寫字樓出租樓盤資訊請參閱:花園道3號寫字樓出租

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多皇后大道東8號寫字樓出租樓盤資訊請參閱:皇后大道東8號寫字樓出租

更多灣仔區甲級寫字樓出租樓盤資訊請參閱:灣仔區甲級寫字樓出租

更多綠景NEO大廈寫字樓出租樓盤資訊請參閱:綠景NEO大廈寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

鰂魚涌海裕街地皮放售 可建40萬呎

「去中環化」下,不少企業搬至港島東,區內商廈項目受重視,現太平協和旗下鰂魚涌海裕街臨海地皮,由接管人委託測量師行進行放售,可重建成40萬平方呎商業樓面。

作酒店和辦公室用途

有外資代理行表示,獲接管人委託,招標出售鰂魚涌海裕街內地段第8590號餘段及內地段第8723號餘段,項目截標日期為2022年7月7日 (星期四) 中午12時正。

項目原由太平協和持有,去年3月獲通過有關原址換地申請,擬換地後的地盤面積或可達91,838平方呎,經補地價後,或可提供建築面積約400,000平方呎樓面,興建5幢34米至41米 (主水平基準以上) 的低矮建築物,作為酒店和辦公室用途,平台設4.1萬平方呎的觀景平台。

據市場人士估計,地皮市值約40億元,每呎樓面地價約1萬元,而日後轉作商廈用途需補地價。

(經濟日報)

九龍灣億京中心 享海景樓面大

九龍灣億京中心位於區內主要商業地段,分層樓面面積大,最大賣點是享有全海景。

億京中心位於九龍灣宏光道,而地段屬區內核心商業地段,附近為企業廣場一期及企業廣場二期、企業廣場五期 Megabox、恩浩國際中心等商廈群,商業氣氛理想。交通方面,由港鐵九龍灣站前往該廈,步行需15分鐘以上,稍為不便,而大廈設有接駁巴士前往港鐵站,另若坐車前往啟德則約5至10分鐘車程。此外,Megabox商場附近亦有多條巴士綫,可前往港島,交通整體來說仍算方便。

飲食配套上,大廈步行數分鐘便到達Megabox商場,有大量餐廳及商店,此外,商場對出為零碳公園,甚為舒適,可供上班人士公餘時散步。

物業於2009年落成,物業規模大,共分A、B兩座。A座每層面積約1.26萬平方呎,另B座較細,每層面積約1.24萬平方呎。若兩座樓面相連下,每層樓面面積,可達2.5萬平方呎,適合大型公司使用。

物業樓高35層,地下大堂甚具氣派,亦設有梳化供商務人士使用。A及B座每層,各設3部客用升降機。

單位四正 間隔靈活

寫字樓層由7樓起。以18樓至21樓間隔為例,A、B座原則每層間有5伙。兩座全層可提供約10個單位,大單位A室分布於每層兩邊,面積可達4,000平方呎,至於其他單位,面積由1,000多平方呎起,故可合中小型公司。

單位間隔相當四正,未見多餘角位,柱位全位於牆身內,增加間隔上靈活性。景觀方面,以A座A室最為好,單位設有3邊落地玻璃窗,較其他單位只有一邊窗,採光度優勝。整體來說,物業大部分單位單邊向海,望啟德海景,亦可望向維港,前方未見大型建築物阻擋,絕對為區內優質海景商廈之一。

買賣方面,物業今年錄得3宗成交,年初B座32樓全層,面積約12,678平方呎,以約1.46億元成交,呎價約11,579元,對上一宗成交為2月中,B座28樓A室,面積約3,939平方呎,以約4,600萬元易手,呎價約11,678元。

(經濟日報)

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多企業廣場寫字樓出租樓盤資訊請參閱:企業廣場寫字樓出租

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

更多億京中心寫字樓出售樓盤資訊請參閱:億京中心寫字樓出售

更多九龍灣區甲級寫字樓出售樓盤資訊請參閱:九龍灣區甲級寫字樓出售

高層多戶招租 呎租約21元起

九龍灣億京中心質素不錯,現物業高層多個單位進行招租,意向呎租約21元起。

面積1788至4492呎

有代理表示, A座28樓多個單位現正放租,涉及該層A至D室,面積由1,788至4,492平方呎,意向呎租約21元起。據了解,該層樓面由一本地廠家持有多年作收租之用,現可因應不同客戶需求,靈活安排把個別單位打通使用。由於屬高層樓面,單位享極開揚海景,非常舒適。

資料顯示,億京中心今年暫錄5宗租務成交,3月份物業A座18樓A室,面積約4,083平方呎,成交呎租約20元,另A座16樓B至C室,面積約3,640平方呎,以每呎約20元租出。4月份大廈亦錄兩宗租務,其中A座33樓A至C室,面積約8,426平方呎,成交呎租約23元。

附近大廈租務上,同屬億京發展的恩浩國際中心,4月錄得兩宗租務,其中27樓C室,面積約1,305平方呎,成交呎租約22元,另中層E室,面積約2,435平方呎,以每呎約21元租出。

(經濟日報)

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多恩浩國際中心寫字樓出租樓盤資訊請參閱:恩浩國際中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

尖沙咀新港中心 中層戶意向呎價1.9萬

尖沙咀新港中心罕有細單位放售及放租,意向呎價約1.9萬元。

意向租金5.2萬 每呎36元

有代理表示,尖沙咀廣東道30號新港中心二座中層單位現正放售,建築面積約1,443平方呎,業主意向售價約2,800萬元,折合每平方呎約19,404元,另單位同時放租,意向租金約52,000元,每平方呎租約36元。

該代理表示,單位屬於罕有細面積單位,間隔四正靈活,雖無附設裝修,但更適合準買家依照企業需求隨意設計。大廈配備8部升降機,並設有停車場。

大廈租務方面,上月新港中心錄得1宗租務成交,涉及1座低層8室,面積約1,424平方呎,成交呎租約32元。

(經濟日報)

更多新港中心寫字樓出售樓盤資訊請參閱:新港中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

4月整體樓宇買賣 代理行估4700宗

有地產代理行統計,4月 (截至27日止) 整體樓宇買賣合約登記 (包括住宅、車位及工商舖物業) 暫錄4,016宗及311.4億元。預計全月錄4,700宗及370億元,將較3月份分別上升22.8%及6.2%。

一手私人住宅方面,4月份暫錄214宗,總值27.7億元。預計全月約有250宗及30億元,將較3月份的161宗及36.1億元,分別上升55.3%及下跌17.0%。金額將創2016年2月的30億元後74個月新低。

二手私人住宅方面,4月份暫錄2,820宗,總值261.7億元。預計全月約有3,200宗及290億元,將較3月份的2,493宗及226.4億元,分別上升28.4%及28.1%。宗數及金額將齊創2021年12月的3,315宗及302.5億元後4個月新高。

(經濟日報)

Property market on the upswing as Covid wanes

Hong Kong's property market has regained its momentum with both primary and secondary markets performing well over the past few days amid the waning fifth Covid wave in the city.

All 388 homes at The Grand Mayfair I in Yuen Long on offer in the first round of sales sold out last Friday, and the remaining 327 units will be put on the market tomorrow, said the developers.

These homes were over 12 times oversubscribed after attracting more than 4,300 checks, they said.

On offer are 103 one-bedroom flats, 173 with two bedrooms, and 51 with three bedrooms, which are priced from HK$6.45 million to HK$14.91 million after discounts.

The 715-flat project is phase 1A of a 2,200-flat mega development that is being jointly developed by Sino Land (0083), K Wah International (0173) and China Overseas Land and Investment (0688).

The prices of phase 1B, which provides 805 flats, will be announced soon after the Wednesday sales, the developers said.

In Tai Kok Tsui, The Quinn Square Mile recorded at least 51 transactions as of Sunday, said the developer Henderson Land Development (0012), which cashed in nearly HK$330 million from the sales.

In Kai Tak, Henderson's project The Henley II kicks off sales of 98 homes today, including 92 on price lists and six by tenders.

The builder said it has collected over 350 checks for the 92 units on the lists, meaning the flats were more than 2.7 times oversubscribed.

Meanwhile, 10 defaulted flats at Sea to Sky, or phase eight of Lohas Park in Tseung Kwan O will be put up for sale again this Friday, said the developers CK Asset (1113) and MTR Corporation (0066).

The completed units, ranging from 468 square feet to 1,054 sq ft, are available for viewing, they said.

In the secondary market, a total of 21 deals were recorded in the 10 major housing estates over the weekend, the same as last week, and above the 20-mark for the seventh week in a row, according to property agency.

Property agent said that the secondary transactions did not decline despite the sales of new projects, reflecting that buyers still have strong interests in the property market.

The agent expects that there will be around 1,500 first-hand deals this month and the overall real estate prices will bounce back as well.

(The Standard)

‘The worst is over’ for Hong Kong’s shops segment, with rents and prices to recover on better consumer sentiment

Hong Kong’s shop market can expect a V-shaped rebound in transaction volume and prices in the second half, says Bridgeway CEO Lee

Prime street shop rents have continued to fall since the social unrest in mid-2019, taking the cumulative decline in value to 75 per cent from 2013

Hong Kong’s shop market is likely to see a V-shaped rebound this year as the easing of social distancing measures following the fifth wave of coronavirus outbreak in the city puts consumer spending back on track.

Shop rents could increase by up to 10 per cent in residential areas and by as much as 20 per cent in core areas, said Edwin Lee, founder and CEO of Bridgeway Prime Shop Fund Management.

“The worst for the shop market is over,” said Lee. “I expect that as the pandemic subsides, and with [subsequent] border reopening at home, there will be a V-shaped rebound in the sales volume and transaction prices [of shops] in the second half of the year.”

The prices of shops will increase by 5 to 10 per cent in residential areas and by 10 to 15 per cent in prime areas, he forecasts.

Prime street shop rents weakened 5 per cent in the first quarter this year, adding to a three-year slump. They tumbled by one-third in 2019 in the wake of the social unrest, followed by another 23.4 per cent in 2020 and 4.3 per cent in 2021 amid the Covid-19 pandemic, according to a property agency.

Overall, they have crashed by around 75 per cent since the first quarter of 2013, when the Individual Visit Scheme drew the most number of mainland travellers to the city.

Lee’s optimism is shared by other market insiders.

“Rents in traditional tourist areas will definitely increase by 10 to 20 per cent, as most of the shops in prime areas have seen rents fall by as much as 70 per cent from their highs,” a surveyor said.

On the other hand, the surveyor said that the rent increases in residential neighbourhoods will be sluggish, as unlike core areas where rents slumped during the pandemic, they moved higher in the same time span.

Meanwhile, the city recorded 288 shop transactions in the first three months this year, the lowest since 248 deals in the second quarter of 2020, according to Land Registry data. The value fell to HK$7.58 billion (US$966 million), the least since the first quarter of 2021.

“Even if there is a sixth wave, [prices] will not drop greatly [as] buyers feel they can bet on it, considering the [low] prices now,” a property agent said, adding that selling prices will be largely flat moving forward.

Russell Street, once the world’s most expensive retail strip, has recently seen a few short-term tenancies of face-mask shops. These retailers sometimes land a bargain, paying as little as HK$80,000 per month, which is about 15 to 25 per cent of peak rents seen in 2013.

With consumers unleashing “revenge spending” in the market, Bridgeway last month found a tenant for its street-level shop in Sheung Wan, who paid significantly higher than the previous client, Lee said.

The company signed a five-year lease for the 2,300-sq ft shop, with a fixed monthly rent of HK$130,000 for the first two years versus HK$100,000 previously, he added. The rate will increase to HK$143,000 per month thereafter.

(South China Morning Post)

市建盛德街項目已收逾九成單位

為協助公務員建屋合作社 (下稱合作社) 解決重建難的問題,市區重建局 (下稱市建局) 於2020年5月以試點形式啟動土瓜灣區兩個合作社項目重建計劃,其中盛德街/馬頭涌道重建項目 (下稱盛德街項目) 去年8月開始收購,至今年4月底已有逾九成業主接納收購。市建局亦透露,已就西灣河一帶合作社向業主進行意見調查,絕大部分業主期望其樓宇可作重建。

韋志成:支援散社令收購順利

前述兩個合作社項目,其中盛德街項目涉及約155個業權,預計日後可重建約640個私人住宅單位。市建局行政總監韋志成於網誌中指出,該項目推展進度較順利,地盤內9個合作社中,有8個在市建局開展項目前已經解散;餘下1個涉及12伙的合作社,在市建局顧問團隊支援下,只需約一年完成整個解散合作社 (散社) 和取回業權的程序,較以往社員自行處理散社所需的時間,縮短約18個月。

該項目僅有約9個業權因為業主離世後之繼承手續等較複雜的問題,尚未成功收購;其餘逾140個業權,市建局早前已向業主發放現金補償和特惠津貼。韋志成說,部分業主已陸續在九龍城、沙田、元朗等地區購買單位,另有43名業主選擇市建局提供的重置單位認購方案,有9人於上周一 (4月25日) 成功購入市建局位於九龍東啟德煥然壹居的樓換樓單位,部分則擬購買日後原址興建的新盤內的樓換樓單位,43人中有約一半則擬選購香港房屋協會正於啟德興建的專用安置屋邨內所提供的資助出售房屋。

至於規模較大的土瓜灣靠背壟道項目,現存有約460個單位,市建局預計日後可提供約950個公營房屋單位和逾1500個私人住宅單位。韋志成稱,該項目約四成單位尚未解散相關合作社,令市建局是否在此情況下提交予政府展開收地程序存在一定未知數和難度,市建局將繼續以最大努力協助靠背壟道項目社員散社。

西灣河多數舊樓業主盼重建

此外,韋志成透露,市建局去年底向西灣河一帶的業主進行首個「市區更新需求先導調查」(更新需求調查),了解業主是否希望其樓宇重建或進行復修等,當中涵蓋該區一些合作社項目。初步資料顯示,有近八成已散社和逾九成未散社的合作社社員希望其樓宇可重建。

韋志成表示,由土瓜灣兩個試點項目可見,散社是推展合作社重建項目的關鍵,該局會總結試點項目的經驗,並深入研究西灣河更新需求調查有關合作社樓宇社員意見所得的啟示,以規劃並向政府建議日後處理其他合作社項目的方向。

(信報)

Price-sensitive buyers snap up 51 units at The Quinn Square Mile in Tai Kok Tsui, netting HK$330 million for Henderson

Young buyers snap up 51 units out of 138 on offer at The Quinn Square Mile, Henderson Land says

Sunday’s launch follows an eventful week of new launches as pent up demand resurfaces after Covid restrictions

Henderson Land Development sold 51 units out of 138 on offer at the residential project The Quinn Square Mile in Tai Kok Tsui on Sunday, according to the developer, as price-sensitive buyers snapped up small-sized flats amid a pickup in new project launches from developers over the past week.

Most of the units sold by 6pm were one-bedroom flats and studios, according to property agents, with the majority of buyers being end users younger than 30 years old. Agents expected about 60 per cent of all available units to be sold by the end of the day, the second of the three-day Labour Day weekend.

“Many buyers remain optimistic about the property market outlook, as there is a strong pent up demand from buyers standing on the sidelines in the first quarter and fourth quarter of last year,” property agent said.

The sale of the Henderson Land project followed an eventful week of launches from developers, which saw new orders from buyers every day of the week. This is in sharp contrast to the preceding three-month lull in sales as social distancing measures linked to the city’s fifth wave of Covid-19 caused developers to delay new project launches.

Ahead of the sale, The Quinn Square Mile received 900 registrations from interested buyers, meaning about 7 interested buyers were going after each of the 138 units on offer, according to local media.

The batch released today, which accounts for about a fifth of the total 614 units in the project, also featured two-bedroom flats, with the biggest flat measuring up to 382 sq ft. The first-batch units were earmarked for sale at an average launch price of HK$23,928 per square foot after discounts offered by the developer.

That is about 1 per cent lower than units at Soyo, another tiny flat development in Mong Kok from Chun Wo Development Holdings. The launch price for those units last December was an average of HK$24,179 per square foot.

The Quinn Square Mile sales have so far netted HK$330 million for Henderson Land, according to Mark Hahn, the general manager of sales.

The resurgence in interest has also come ahead of more rate hikes in store for the rest of this year, which could increase buyers’ mortgage repayments down the line.

The US Federal Reserve is widely expected to raise the Fed funds rate by half a percentage point this month, as US inflation rose at the fastest pace in 40 years. The Hong Kong Monetary Authority would likely mirror the hike in its base lending rate due to Hong Kong’s currency peg to the US dollar, adding upwards pressure to mortgage payments linked to interbank rates.

Some potential buyers may be prompted to buy ahead of further rate hikes, which banks typically respond to with higher income requirements for mortgage applicants, agents said. That might have fuelled sales at The Grand Mayfair I in Yuen Long, which was developed by Sino Land, K Wah International and China Overseas Land and Investment. All 388 flats on offer sold out on Friday.

Sales of new homes are likely to hit 1,200 units in April, according to another property agent. That would make it the busiest month since December, when 1,493 units were sold, according to Land Registry data. Sales could rise further to a 10-month high of 2,000 in May, the agent predicted.

(South China Morning Post)國際律師行 租中環約克大廈3層樓面

疫情緩和後,中環甲廈租務略增。置地旗下中環約克大廈3層樓面,獲國際律師行租用作擴充。

同區擴充 呎租約90餘元

國際律師行White & Case租用中環約克大廈3層,總樓面約2.5萬平方呎,新辦公室已於4月底啟用。據悉,該律師行原租用同區中匯大廈,是次搬遷屬擴充業務。市場人士預計,是次呎租約90餘元。

White & Case為國際律師事務所,在全球31個國家共設有45個辦事處;據悉,該公司曾租用置地旗下寫字樓。White & Case香港辦事處管理合夥人文宇軒表示,很高興重返置地中環物業組合,為不斷擴展的團隊及業務提供更大發展空間。置地指,截至去年尾,律師事務所租戶在置地中環物業組合整體租戶基礎中,佔比增至31%,租用面積超過126萬平方呎。現時整個「大中環區」內,近3/4大型律師事務所均為置地中環物業組合的租戶。

九龍區租務方面,有代理表示,九龍灣宏光道1號億京中心A座29樓A室,面積約4,492平方呎,月租約13萬元,呎租約29元。

(經濟日報)

更多約克大廈寫字樓出租樓盤資訊請參閱:約克大廈寫字樓出租

更多中匯大廈寫字樓出租樓盤資訊請參閱:中匯大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

啟德多焦點商業項目 勢成第二CBD

近年啟德區成為新盤供應重鎮,同時有大量商用項目發展,包括寫字樓、商場及酒店等。隨着各項基建及社區設施相繼落成,以及交通基建網絡趨完善,啟德有望成為香港第二個核心商業區。

AIRSIDE 料今年末季開幕

啟德全新地標 AIRSIDE 為一個190萬平方呎混合商業用地,由南豐集團於2017年投得,以逾246億元創下當時土地投標紀錄,項目樓高47層,當中逾30層為甲級寫字樓,面積合共120萬平方呎,坐擁無敵維港海景,更是首個連接啟德港鐵站和地下購物街的大型商場,購物空間達70萬平方呎。

項目總投資金額預計高達320億元,於今年第4季正式開幕。

另外,兩大日式百貨公司,SOGO 啟德旗艦店及 AEON 啟德店,都會先後進駐啟德區。當中 SOGO 崇光百貨將以雙子塔形式呈現,建築工程亦已進入直路,明年將正式落成開幕,區內住客的生活和消閒選擇一應俱全,當區樓價有望再升值。而 AEON 則將於啟德體育園內開設 AEON STYLE 新店,合約期9年,同樣預計於明年開業。

值得留意的是,位於車站廣場下的地下購物街將會連接九龍城、新蒲崗、啟德站及宋皇臺站,預計全長達1,500米,比日本心齋橋地下街長1倍,將成為東九龍又一個新地標。

而交通方面,東鐵綫過海段提早於本月15日通車,由啟德站到達金鐘只需約12分鐘;而連接西九龍及將軍澳的六號幹綫,預計於2026年通車,進一步提升啟德區交通網絡。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE 寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

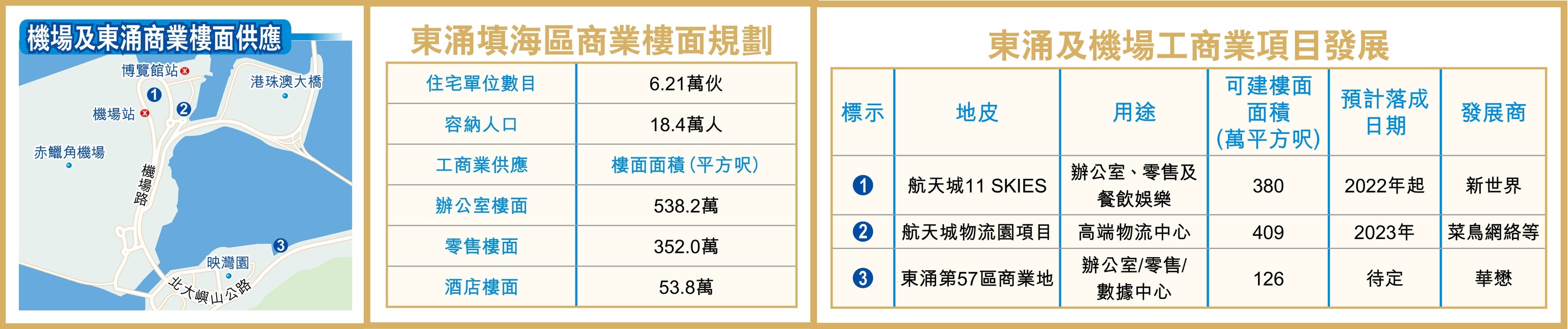

流標重推 華懋奪東涌57區商業地

隨政府積極發展東涌東新填海區,填海區將會新增多達逾940萬平方呎商業樓面供應,當中該帶首幅用地東涌第57區商業地已經重推,並由華懋投得,計劃發展數據中心及辦公室等,涉及多達126萬平方呎商業樓面。

早於2020年首度推出,並曾「流標」的東涌第57區商業地屬於新填海區首幅推出的私人發展用地,位於東涌市地段第45號、迎東邨東面。地皮早在2020年10月招標時,只截收3份標書,但最終因投標金額未達政府底價而「流標」。不過發展局早前已將地皮再納入賣地表,並已於上季推出。值得留意的是,政府重推地皮前已調整招標條款,包括加入容許發展數據中心、調整零售樓面等。

而是次重推後,地皮共接獲5份標書,較首推時多出2份,並最終由華懋以約27.78億元奪得地皮,即每平方呎樓面地價約2,202元,成交價貼近市場估值下限。華懋表示,計劃在該地皮興建商場、辦公室及數據中心。地皮佔地約13.3萬平方呎,規劃為「商業 (1)」用途地帶,以地積比率約9.5倍發展,預計提供逾126萬平方呎商業樓面。

修訂招標條款 增數據中心用途

事實上,地皮於2020年首次招標時,當時賣地章程規定,項目逾9成樓面或114.6萬平方呎須作辦公室用途,餘下約11.5萬平方呎或1成則作商場用途。鑑於疫情打擊商業氣氛,所以其辦公室樓面比例過高被市場視為「流標」的主因之一。而是次修訂賣地條款後,除了可迎合近年數據中心龐大的市場需求,亦讓發展商設計時有更大彈性。

東涌站第1期 6成為辦公室樓面

東涌是一個以住宅發展為主的新市鎮,而隨東涌東新填海區發展,填海土地將供應多達6.2萬伙公私營房屋,其中港鐵旗下東涌東站第1期項目,比鄰迎東邨,將會以地積比率8.8倍作綜合發展用途,提供住宅、辦公室及零售設施、公共交通交滙處等,料可提供約1,500伙,而該用地已經納入本財年賣地表。

按政府規劃,上述填海區除了提供住宅,還會興建大量商業設施,涉及多達944萬平方呎,計劃建構地區商業中心,當中將以辦公室樓面主導,佔總樓面近6成,涉538.2萬平方呎樓面。同時,新填海區將會供應多達352萬平方呎的零售樓面,及約53.8萬平方呎作為酒店用途。

(經濟日報)

入標價差距大 發展潛力現分歧

雖然政府重推東涌第57區商業地前已調整招標條款,增加發展彈性,避免再度流標,但參考地政總署上周公布的發展商入標價,可見發展商對該地皮的發展前景及潛力存有極大分歧。

地皮3月底共截收5份標書,除中標的華懋外,還有嘉華 (00173) 、建灝,長實 (01113) 及信置 (00083) 入標。據資料顯示,撇除中標價27.78億元,其餘4份標書所出的標價介乎6,300萬至18億元,即每平方呎樓面地價約50至1,427元,可見中標價與次標價18億元已經大幅相差約54%,而最低標價更只錄6,300萬元,呎價僅約50元,屬於極低水平,意味中標價較最低標價足足高出27.15億元或逾43倍。

(經濟日報)

有代理行表示,九龍灣億京中心A座29樓A室,面積約4492方呎,成交呎租約29.5元,月租約13萬元。

該行指出,單位位於大廈單邊,三面均設有落地玻璃,用家可欣賞全海景景致,為億京中心A座及B座的最優越單位;單位配備豪華裝潢及寫字樓家具,租客即租即用。

業主於2009年斥約2214萬元購入單位,一直自用,近期因為公司擴充業務放租,現可享約7厘租金回報。

(信報)

更多億京中心寫字樓出租樓盤資訊請參閱:億京中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

大角嘴宏創方7400萬易手 兩層工廈連18個車位 投資者劉志華承接

疫市下工廈表現「硬淨」,市場再錄大手成交。由宏基資本發展的大角嘴工廈宏創方兩全層連地下停車場,以約7400萬連租約售出,平均呎價6963元,買家為投資者劉志華及相關人士,劉氏亦是佳明執行董事,回報逾三厘水平,料購入作長綫收租用途。

工廈物業再錄大手成交。由宏基資本發展的大角嘴工廈宏創方兩全層及車場,涉及該廈1樓及2樓,以約7400萬售出,買家為佳明執行董事劉志華及相關人士。據悉,上址建築面積約10627方呎、另設平台約1458方呎,平均呎價約6963元,地下車場設有11個私家車位、5個小型貨車位及2個電單車位。

連約回報逾3厘

本報昨日就上述消息向佳明作出查詢,惟集團以上述買賣為劉志華私人投資事務為由,故不作回應;據地產代理指出,上址1樓及2樓樓底高達4.9米,亦因為位處低層,適合各行業進駐,現時以全包形式獲承租,月租收入約17萬,至於每個車位市值租金約4000元,料買家購入作長綫收租用途,享租金回報逾三厘水平。

宏創方由宏基資本發展,項目位處大角嘴必發道128號,早於2018年入伙。

低市價約1成

有代理稱,上址為該項目貨尾項目,成交呎價低市價約一成,同時,地下停車場設18個車位,以每個車位市值約200萬計,合共3600萬,以此計算,上述成交價屬吸引價,全層工廈更是同區罕有供應。

據另一代理行資料顯示,該廈於今年以來頻錄買賣,成交呎價介乎7305元至8700元,最新成交個案為該工廈1室,建築面積約5308方呎,於今年3月以4618萬售出,平均呎價約8700元。

至於租務方面,該廈近期承租個案為低層9室,建築面積293方呎,於上月以8200元租出,呎租約28元;低層10室,建築面積439方呎,亦於同月以1萬元租出,呎租約23元。

(星島日報)

佐敦商住樓6600萬售 料合併毗鄰舊樓重建

疫情走勢持續放緩,帶動工商鋪交投轉活,市場再錄大手買賣。消息指,佐敦廣東道538號全幢商住樓以6600萬易手,市傳買家為新世界,並會與毗鄰早前以1.92億易手的四海玉器中心作合併重建發展。

綜合市場消息指出,佐敦廣東道538號全幢以6600萬成交,市傳為新世界相關人士;就地產代理指出,上述屬迷你全幢,佔地逾500方呎,地鋪建築面積約580方呎,另設入則閣約580方呎,樓上住宅樓面約1740方呎,另設天台約580方呎,項目總樓面約2900方呎,以易手價計,呎價約2.27萬。

市傳買家為新世界

據悉,原業主於1994年12月以2000萬買入,持貨28年帳面獲利約4600萬,物業期間升值約2.3倍。本報昨日就上述消息向新世界作出查詢,惟於截稿前未獲回覆。

事實上,上址毗鄰廣東道530至536號四海玉器中心全幢商廈,剛於上月底以約1.92億售出,現址為4層高商廈,包括地鋪、閣樓及1樓至2樓,地盤面積約2392方呎,總樓面約7759方呎,呎價約2.47萬。

毗鄰商廈早前1.92億易手

原業主為資深投資者李栢景,早於2011年以1.1億購入,持貨11年帳面獲利約8200萬,升幅約74%。據業內人士分析,上述兩項目買家料為同一發展商,購入作合併毗鄰地盤發展。

(星島日報)

New York law firm White & Case opens 3 floors at Hongkong Land’s York House as tenants cherry pick from Central’s office market slump

White & Case opened a 25,000-square foot (2,300 square metres) office across three floors late last month in York House, part of Hongkong Land’s Landmark complex

The lease marked the firm’s return as a Hongkong Land tenant, after spending 15 years down Queens Road Central at Central Development Limited ’s Central Tower

Office tenants are tiptoeing back to Hong Kong’s Central district, picking up choice commercial real estate space in what used to be the world’s costliest urban centre at more affordable prices amid a resurgent Covid-19 pandemic.

White & Case, a New York-headquartered law firm with 45 offices across 31 markets, opened a 25,000-square foot (2,300 square metres) office across three floors late last month in York House, leased for an undisclosed price at Hongkong Land’s Landmark commercial complex in Central.

The lease marked the law firm’s return as a Hongkong Land tenant, after spending 15 years further down Queen’s Road Central at Central Development Limited’s Central Tower. Before moving to Central Tower in 2007, White & Case occupied 17,000 sq ft of space at Gloucester Tower, one of the three office buildings in the Landmark complex.

“We are pleased to return to the Hongkong Land Central portfolio as we make room for our expanding team and future growth, [where] we look forward to continuing our focus on excellence and serving our clients as we deepen our expertise and presence in the market,” said Eugene Man, the executive partner at White & Case’s Hong Kong office. “York House will provide our employees and clients with unparalleled access to corporate and market leaders in one of the world’s leading international financial hubs.”

Office rent has plunged by 27 per cent from its peak in late 2021 in Hong Kong, according to Morgan Stanley’s estimate. Prices are likely to remain soft as 4.6 million sq ft of new grade A office supply are likely to be added to Hong Kong this year, the second-highest annual addition since 6.8 million sq ft were added in 1998.

Central’s office rental charges, still among the highest in the world, dipped by 0.1 per cent in March from February, according to a property agency. Overall office rents across the city fared worse, with a 0.2 per cent drop in the same month.

Still, the return by White & Case as a Landmark tenant was “not a sweetheart deal,” said Hongkong Land’s director Neil Anderson.

“White & Case chose to return to the Hongkong Land Central portfolio to make room for their expanding team and future growth and support their talent retention efforts,” he said. “York House is not a cheaper location. White & Case wanted to improve their workplace environment and saw the move as a flight to quality.”

The vacancy rate in Central dipped to 7.3 per cent in March, compared with 8 per cent in December 2021, according to data provided by the agency. City authorities have begun to gradually relax some of the social-distancing rules that were enforced in January to keep the highly transmissible Omicron variant of Covid-19 in check.

The gradual improvement in the take-up rate of empty offices is sustainable in the coming months as social distancing rules are further relaxed, and more employees return to work from their offices, a property agent said.

“Market momentum and activities are likely to improve in the second half as the government gradually relaxes the social-distancing rules from April 21 onwards,” the agent said. “Transactions will become more active in the second half, given the recovery cycle for the sector has been largely delayed by the Omicron strain of the coronavirus.”

Institutional investors are also likely to be more aggressive as they seek opportunities in Hong Kong, property agent said.

“In fact, 68 per cent of the first-quarter investment transaction [value] in Hong Kong were by institutional investors,” the agent said. “Most of the key investors [who] have their teams and presence in Hong Kong, [they] may have delayed their site inspection or decision-making process, but with the Omicron wave gradually stabilising, the investment market will become active again.”

(South China Morning Post)

For more information of Office for Lease at York House please visit: Office for Lease at York House

For more information of Office for Lease at Central Tower please visit: Office for Lease at Central Tower

For more information of Office for Lease at Gloucester Tower please visit: Office for Lease at Gloucester Tower

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

Chicago-based Heitman joins global funds to tap Hong Kong’s growing demand for cold-storage facilities

Heitman plans to convert a 100,000 sq ft industrial building in Fanling into a cold-storage facility within the next 12 months

Global investment funds have spent HK$2.3 billion to acquire three cold-storage assets in Hong Kong over the past year

Global real estate funds are tapping growing demand for cold-storage facilities in Hong Kong as the tough social distancing rules and work from home arrangements amid the pandemic accelerates online sales of groceries.

Chicago-headquartered Heitman, with over US$50 billion in assets under management, is the latest entrant into the sector, acquiring a 100,000 sq ft industrial building in Fanling for an undisclosed price.

The fund will commence a fit-out of the property to repurpose the asset into a cold-storage facility.

“We expect demand for specialised en-bloc facilities to continue to grow on the back of close to full occupancy of cold-storage space currently across Hong Kong,” said Brad Fu, head of Asia-Pacific acquisitions at Heitman, which has been investing in Hong Kong’s traditional industrial and office properties since it set up an office here in 2012.

The facility is 100 per cent pre-let to end users even before the completion of the renovation work, which is likely to take around 12 months, Fu said. He added that the tenants include high-end fresh and frozen food operators, but declined to name them.

“Demand growth for cold-storage space has remained resilient as the online sale of groceries in the city has multiplied in recent years, while consumption of fresh and frozen foods has also continued to increase,” said Fu.

While imports of frozen food in terms of weight into Hong Kong grew at 11 per cent from 2016 to 2020 annually, cold-storage space by gross floor area saw a mere 4 per cent growth over the same period, according to the latest figures from a property agency.

Cold storage also enjoys a rental premium of about 20 per cent to 25 per cent above traditional warehouses, which rent for between HK$10 and HK$16 per square foot per month.

In recent years, cold storage has emerged as a sought-after subsector in Hong Kong’s industrial market, with investment funds typically showing huge interest, according to a report by the agency. International funds have bought three cold-storage assets since last year for a total of HK$2.3 billion.

New York-headquartered Angelo Gordon paid HK$1.43 billion for the 291,697 sq ft Kai Bo Group Centre in March last year.

The deal came one month after Australian property group Goodman bought the 103,746 sq ft Seapower Industrial Centre for HK$520 million, and Singapore-headquartered SilkRoad Property Partners paid HK$321 million for Smile Centre, a 97,751 sq ft cold-storage building.

Kwai Chung stands out as one of the most promising sub-markets, accounting for 44 per cent of the licensed cold-storage space that is well connected via the highway network, the agency’s report said.

Total cold-storage investment in Asia-Pacific reached US$2 billion in 2020, growing at an average annual rate of 21 per cent since 2011.

(South China Morning Post)

Sales kick off for The Henley II in Kai Tak

At least 12 of the 98 units on offer at The Henley II in Kai Tak were said to be sold after sales kicked off yesterday.

The developer Henderson Land Development (0012) said it has received 440 cheques for the 92 flats on the price lists, making the batch four times oversubscribed, and had sold four out of the six flats via tender.

The four homes sold by tender had areas of 888 square feet each and buyers forked out between HK$30.2 million and HK$34.5 million - or between HK$34,000 per sq ft and HK$38,851 per sq ft - for the flats.

A property agent said that property prices in Kai Tak will benefit from the opening of the East Rail Line cross-harbor extension, though the effect on The Henley II sales may be limited.

In Yuen Long, The Grand Mayfair I was nearly 22 times oversubscribed with 7,393 checks for the 327 flats on sale today.

On offer are 103 one-bedroom flats, 173 with two bedrooms, and 51 with three bedrooms, which are priced from HK$6.45 million to HK$14.91 million after discounts.

The 715-flat project is being jointly developed by Sino Land (0083), K Wah International (0173), and China Overseas Land and Investment (0688).

Also in the same area, CK Asset (1113) has unveiled a new batch of 23 duplex flats at #Lyos, with prices starting from HK$13.82 million after discounts, or from HK$17,668 per sq ft.

The sales will kick off on Saturday and another eight special units will be sold by tender, said the developer.

All the 290 standard flats on price lists were sold last year and together with the duplex flats sold earlier, CK Asset has cashed in HK$1.85 billion from the project.

As developers speed up the pace of launching new projects, the agent expects the total number of first-hand transactions to be above 2,500 this month, which could be an 18-month high.

The market watcher said that the upcoming interest rate hikes may only have a temporary psychological impact on buyers and that buying properties is still a tool to offset currency depreciation amid inflation pressure.

Meanwhile, real estate consultancy said the high level of expected supply in the primary market will likely prompt developers to take on competitive pricing strategies, which in turn will exert pressure on the secondary market. Combined with the factor of increasing interest rates, housing prices will be under pressure this year, it added.

(The Standard)中環中心每呎80元續租跌15%

受疫情等因素打擊,甲廈租金跌勢未止。消息指,由外號「小巴大王」馬亞木持有的中環中心中層單位,以每呎約80元續租,較舊租金下跌約15%。

「小巴大王」馬亞木持有

據市場知情人士透露,中環中心5106至7室,建築面積約4233方呎,新以每呎約80元續租,月租約338640元,上址於早前由同一商戶以每呎約95元租用,並於近期決定續租,最新租金較舊租金下調15.7%,但已屬貼市水平。

據地產代理指出,上址由資深投資者,外號「小巴大王」馬亞木持有,本報於昨日向馬亞木兒子馬橋生作出查詢,惟未獲回覆。

另一方面,據本港一間代理行綜合土地註冊處資料顯示,工商鋪4月份註冊量錄374宗 (主要反映3月份市況),按月上升約4.5%,註冊金額則錄47.39億,按月升約4.9%。該行認為,隨着第二階段社交距離措施將於5月放寬,第五波疫情的陰霾逐漸消退,預料後市將平穩發展。

該行代理表示,今年以來受疫情影響,隨著第五波疫情放緩,情況稍有改善。第二階段社交距離限制措施將於今起放寬,預料後市交投將會逐步恢復活躍。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

尖區銀座式商廈一籃子貨沽 投資者紀寶5億售出 12年升值1倍

疫情走勢持續放緩,為工商鋪釋出正面訊息,投資老手率先趁勢沽貨。消息指,由資深投資者紀寶持有的尖沙嘴國際商業信貸銀行大廈,屬銀座式商廈一籃子物業,以約5億易手,呎價約1.29萬,物業於12年間升值近一倍,料買家享租金回報逾三厘水平。

市場消息指出,尖沙嘴加拿芬道25至31號國際商業信貸銀行大廈一籃子物業,包括該廈1至2樓、5至6樓、8樓、10樓及15樓,總建築樓面約38514方呎,以買賣公司形式易手,作價5億,平均呎價約12982元。

地產代理指出,該廈屬銀座式商廈,上述易手物業現時由多家食肆及娛樂場所等商戶承租,每月租金收入約132.5萬,料買家享租金回報約3.18厘,屬不俗水平。據悉,上址原業主為資深投資者紀寶,早於2010年以約2.54億購入,持貨12年帳面獲利2.46億,物業期間升值約0.96倍。

買賣公司形式易手

據業內人士分析指,上述位處尖沙嘴區內核心區地段,亦屬市場罕有商廈供應,早於多年前在市場以暗盤形式放售,當時意向價高達6.5億,料買家購入作長綫收租用途。

租金回報逾3厘

據代理行資料顯示,該廈近期成交疏落,對上一宗買賣需追溯至2011年底,為該廈3樓及4樓,總樓面約1.14萬方呎,當時以約1.01億售出,平均呎價約8860元。

至於租務方面,該廈地下8室,建築面積608方呎,於今年1月以8萬元租出,平均呎租約132元,另一個案為地下1A室,建築面積920方呎,另設地庫建築面積7770方呎,於去年6月以30萬租出。

紀明寶又名紀寶,為活躍於工商鋪市場的資深投資者,他於去年底以約8000萬售出土瓜灣北帝街21至25號匯川大廈地下A至J鋪、地庫及一樓全層,總樓面8220方呎,平均呎價約9732元,物業門闊37呎,買家為本地廠家。現址三名租客,地下A鋪及地庫,面積分別500方呎及1800方呎,由紅酒館月租3.5萬,租期至明年9月30日,地下B至J鋪面積2700方呎,超市月租10.5萬,至2024年8月15日,1樓面積3220方呎,由長者日間中心承租,月租5.5萬,月收合共19.5萬,買家料回報約2.9厘。

此外,紀寶亦於2018年底以8650萬向海航集團購入銅鑼灣yoo Residence基座地下及1樓鋪位,面積約7351方呎,同年中,以8850萬沽同區新時代中心頂層全層,面積3454方呎,持貨逾14年,帳面獲利7700萬。

(星島日報)

更多國際商業信貸銀行大廈寫字樓出售樓盤資訊請參閱:國際商業信貸銀行大廈寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

更多新時代中心寫字樓出售樓盤資訊請參閱:新時代中心寫字樓出售

更多灣仔區甲級寫字樓出售樓盤資訊請參閱:灣仔區甲級寫字樓出售

置地暗盤放售薄扶林百合苑 市場估值逾12億 財團「吼到實」

疫情走勢緩和,樓市氣氛持續向好,豪宅物業更頻錄追捧,據知情人士指,由置地持有的薄扶林百合苑,近日以暗盤形式低調放售,項目最高可建樓面約3.22萬方呎,以近期同區洋房成交呎價約每呎3萬至4萬計算,市場估值約10億至12億,據悉,因同區甚少大型豪宅群放售,近日已有財團積極洽商中。

據知情人士透露,由置地持有多年的薄扶林百合苑,日前突然透過一家國際測量師行,以暗盤招標形式放售,據資料顯示,項目地盤面積為44800方呎,最大地積比率約0.75倍,地契限制最高可建樓面約32255方呎,而隨着該物業暗盤放售,近日已獲財團積極洽購。

有同區代理指出,近期薄扶林區的洋房成交呎價,介乎約3萬至4萬,以項目可建樓面32255方呎計,市場估值介乎約10億至12億。

可建樓面逾3.2萬方呎

此外,項目由7幢3層高的洋房組成,其中A1至A3號洋房面積為4440方呎,而B1至B4號洋房面積則為4506方呎,目前該項目所在地皮,為「住宅 (丙類) 1」用途,若買家購入後作重建,樓高最多為三層(包括開敞式停車間),最高建築物高度不得超過10.67米,以及最大覆蓋面積25%。

項目由7幢洋房組成

該樓盤位於薄扶林沙宣道46號,即在同區知名豪宅貝沙灣,以及芝加哥大學香港校園的中間,屬區內一綫地段,項目於1985年落成入伙,位置臨海,由於前方沒有建築物阻擋,可享無阻擋海景。

同時亦有區內代理指,薄扶林區豪宅交投向來稀少,而洋房業主多數為長期用家,放盤極為少有,當中屬同區較具規模的洋房盤趙苑,目前有4個放盤,大屋面積由2094方呎至2753方呎,叫價由4800萬至7350萬不等,呎價在23000至27000元水平。

此外,鄰近百合苑的海日樓,因業主大部分為自用客,成交量更甚為稀少,對上一宗成交須追溯至去年10月,其雙號屋以1億易手,以大屋面積2457方呎計,呎價約41925元。

(星島日報)

興勝創建2.11億售沙田工業中心

工廈物業有價有市,再錄大手成交。由興勝創建持有的沙田工業中心一籃子物業,總樓面約2.8萬方呎,以約2.11億易手。

興勝創建公布,售出沙田工業中心一籃子物業,作價約2.11億,包括該廈A座4樓1至23號工作間及2樓V49及V55號車位,以總樓面約28050方呎計,呎價約7533元,買家為加拿大基金公司Brookfield Asset Management Inc。

該集團通告指,出售上述物業可重新分配資金,有利日後投資用途。上述物業已出租,於2021至2022年財政年度產生318萬及348.5萬租金收入,於完成交易後,集團將失去此物業租金收入。

買家為加拿大基金公司

據代理行資料顯示,該廈近期頻錄買賣,其中,A座低層11至12室,建築面積12680方呎,於今年4月以7608萬售出,呎價約6000元;另一買賣為A座低層4室,建築面積4783方呎,於今年1月以2689萬售出,呎價約5622元;至於租務方面,該工廈近期呎租介乎14元至16元,近期承租個案為B座18室,建築面積1307方呎,於今年3月以20912元租出。

資料顯示,興勝創建於去年9月亦以約1.29億售出觀塘工業中心一籃子物業,涉及樓面約21146方呎。

(星島日報)

新世界沽非核心物業 屯門聯昌低層連地廠2.84億售

疫情持續回穩,帶動整體市場交投向好,發展商亦趁勢沽售旗下非核心物業。市場消息盛傳,由新世界持有的屯門工廈聯昌中心低層多層樓面連地廠,總樓面約7.1萬方呎,以約2.84億易手,平均呎價約4000元。

據市場知情人士透露,由新世界持有的屯門聯昌中心低層多層全層樓面連地廠,早以於市場以暗盤形式放售,於近期突告成交,並以售後租回形式易手,涉約樓面約7.1萬方呎,料買家購入作長綫收租用途,以該廈市值呎價約4000元計,成交價高達2.84億,實屬市場近期矚目「大刁」。

總樓面7.1萬呎

本報昨日就上述消息向新世界作出查詢,惟於截稿前未獲回覆;據美聯工商舖資料顯示,該工廈近期頻錄買賣,其中,中層5室,建築面積2158方呎,於今年3月以630萬售出,呎價約2919元。

事實上,新世界近期頻沽售旗下非核心物業,於今年初以約1.428億售出,長沙灣荔枝角道888號甲廈停車場,平均每個車位售價約168萬。

消息指,紅磡漆咸道北423至433號怡輝大廈地下雙號鋪,建築面積約700方呎,以約1350萬售出,呎價約1.92萬,據悉,原業主於1986年6月以77.8萬買入,持貨36年帳面獲利約1272.2萬,物業期間升值約16.3倍。

(星島日報)

更多荔枝角道888號寫字樓出售樓盤資訊請參閱:荔枝角道888號寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

灣仔商廈Novo Jaffe開售 涉58伙

宏基資本 (02288) 旗下灣仔商廈新盤「Novo Jaffe」新盤即將開售,物業位於灣仔謝斐道218號,樓高27層,3至30樓為寫字樓用途,每層面積約2,243平方呎,據悉部分樓層將分間細單位,面積約469至550平方呎起,項目合共58伙。

定價方面,消息指預計項目呎價約1.8萬元起,預計入場費約800餘萬元起。

(經濟日報)

京瑞廣場商廈中層叫價1905萬

有代理表示,沙田石門安群街1號商廈京瑞廣場二期中層Q室,建築面積約1524方呎,業主放盤叫價約1905萬元,呎價約12500元。資料顯示,業主於2016年以約1295.4萬元購入自用作教會,呎價約8500元。按市況估算,單位市值呎租約28至30元,新買家可享租金回報約2.6厘起。

(信報)

更多京瑞廣場寫字樓出售樓盤資訊請參閱:京瑞廣場寫字樓出售

更多石門區甲級寫字樓出售樓盤資訊請參閱:石門區甲級寫字樓出售

投資者開始放眼零售及酒店物業

有外資代理行回顧本年首季物業投資市場表現時指出,在本港第五波疫情下物業投資市場轉靜,各類物業的交投均有減少;然而,少數重要成交仍反映投資者繼續垂青回報穩健的物業,有望為第二季市況帶來轉機。

受疫情影響,加上其他地緣政治因素、股市波動及加息周期開始等亦對投資市場表現帶來衝擊。

若論整體市場在首季錄得的整幢/持有大部分業權的成交,從成交總額的佔比來看,工業物業成交額佔總金額的50%,零售/商場及酒店亦分佔30%及17%。

投資者方面,私募股權房地產基金在總成交金額的佔比高達56%,本地資金亦佔上44%,兩者成為首季市場的主導者。事實上,私募股權房地產基金自2020年以來在本港物業市場上的投資額達到419億元,其對工業物業更是情有獨鍾,在該類物業的投資佔比自2020年的15%急增至2021年的61%。

該行代理表示,雖然首季投資市場非常沉寂,但投資者最近已逐漸放眼於零售及酒店物業,這從近期機構投資者及基金等開始購入整幢酒店及住宅/地塊的成交可見。就零售物業前景而論,新一期消費券發放,加上疫情趨緩,社交距離措施有所放寬後,有助促進零售區的人流,為舖租帶來重要的支持;假如疫情進一步減退,通關有望,則酒店物業的前景將會更為看好。上述因素促使部分投資者掌握先機,趁物業價格已有較大回調時盡早入市。預期第二季開始隨着市場氣氛改善,市面的盤源將會增加。

該行另一代理指出,近年投資者的工業物業成交趨勢亦出現變化,從以往的成交多為發展商購入地皮興建新式工廈作為自用,到近年基金等投資者大手進行工業買賣,為分層工廈及倉庫的價格帶來支持。工業物業市場去年出現一輪熾熱成交,成交宗數幾乎是2020年的三倍,以致盤源極速被吸納,而本年首季市場遇冷,投資宗數亦按季大跌33%,至570宗,當中僅有兩宗為整幢物業成交。不過,由於疫情下電子商貿的需求有增無減,導致物流物業的需求仍然穩固,未受最近一輪疫情影響,因此投資者仍然繼續積極尋找工業物業投資機會,特別是呎價較小、回報率達3厘或以上的物業最受青睞。

該行另一代理稱,本港豪宅市場在首季開局不俗,頻錄大手成交,包括大潭道45號的5號洋房以4.538億元售出;另一幅位於淺水灣的罕有政府住宅地皮以招標方式售出,以每方呎樓面地價62355元刷新紀錄,成為呎價地王。可惜的是,本港第五波疫情爆發,加上俄烏戰事及加息周期等外圍因素,給樓市的良好勢頭澆了一盤冷水,令市場活動驟減;然而,隨着疫情逐步緩和,近期成交以特色項目為主,價格亦逐漸邁向第五波疫情前的水平,預料來季投資者及基金等對豪宅及地塊的興趣將會持續。

(信報)

鄧成波家族再放售30物業

「舖王」鄧成波離世快將一年,其家族成員繼續積極出售資產。近日市場流傳一張由鄧氏家族成員持有的物業清單,包括住宅、工廈、商舖等物業,清單附有物業的最新叫價及狀况,共30項,綜合計算,整批叫價共逾70億元。本報就上述資料向鄧成波兒子鄧耀昇旗下陞域集團查詢,發言人稱不回應。

叫價共逾70億 蔚盈軒全幢減價一成

據代理消息,該家族部分物業售價略有調整,如九龍城蔚盈軒全幢,去年放售價約20億元,近日減價至約18億元,減幅一成。若以總樓面66,428方呎計,呎價約2.7萬元水平。據悉物業每月租金收入約200萬元,若以最新叫價出售,買家可獲租金回報約1.3厘。

另觀塘開源道50號利寶時中心地下1及2號舖,面積約2076方呎,放售價亦由去年1.2億元下調15%至最新的1.02億元,呎價約4.91萬元。事實上,自鄧成波離世後,該家族接連出售所持物業,如上月就以1150萬元售出尖沙嘴北京道永樂大樓地下1A號舖,該家族早於2008年以1000萬元購入,持貨14年,帳面僅獲利150萬元或15%。

佳明相關人士7400萬購宏創方兩層連車位

另外,近日市場有不少投資者入市工商物業,資料顯示,大角嘴必發道128號新式工廈宏創方地下停車場連1樓及2樓全層,上月初以7400萬元售出,買家以恩柏投資有限公司 (YAN PAK INVESTMENTS LIMITED),董事包括劉志華、劉凱恩等,其中劉志華為佳明 (1271) 執行董事及行政總裁,而恩柏投資註冊地址同為佳明位於尖沙嘴漆咸道南39號鐵路大廈總部。上述物業包括11個私家車位、5個輕型貨車位及兩個電單車位,另1樓及2樓建築面積共約10,627方呎,連1468方呎平台,呎價約6963元。

不過,亦有投資者趁機沽貨,資料顯示,西環卑路乍街139號金堂大廈地下A舖,面積約700方呎,連約400方呎閣樓,總面積約1100方呎,上月以3700萬元售出,呎價約3.36萬元。原業主為環亞拍賣董事總經理區蘊聰等人,2018年透過買殼形式購入,當時有傳購入價約3300萬元,持貨約4年,帳面獲利約400萬元或12%。

(明報)

更多鐵路大廈寫字樓出租樓盤資訊請參閱:鐵路大廈寫字樓出租

更多鐵路大廈寫字樓出售樓盤資訊請參閱:鐵路大廈寫字樓出售

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

Island South Grade-A project launched

Sino Group and Empire Group have commenced leasing their latest Grade-A commercial project in Wong Chuk Hang Landmark South, fetching an average monthly rent of about HK$30 per square foot.

Boasting a total area of 256,957 square feet, the 30-storey office-cum-retail complex will be officially opened in the third quarter. Bella Chhoa Peck-lim, director of asset management of Sino Group, revealed that some design and architecture firms, as well as galleries have shown keen interest in the project.

Despite the trend of hybrid working mode, Albert Yiu Chi-wai, executive director of Empire Group, expects the rent in the area to be stable unlike Central, which was once hard hit by the pandemic, due to its relatively low rent and the completion of more residential and commercial projects as well as the Fullerton Ocean Park Hotel Hong Kong that will draw more people to the district.

The site was acquired for HK$2.53 billion, or HK$8,872 psf, based on a gross floor area of 284,945 square feet, and the developers are required to accommodate the Hong Kong Arts Development Council in the premises as a part of the government’s Invigorating Island South initiative.

(The Standard)

For more information of Office for Lease at Landmark South please visit: Office for Lease at Island South

For more information of Grade A Office for Lease in Wong Chuk Hang please visit: Grade A Office for Lease in Wong Chuk Hang

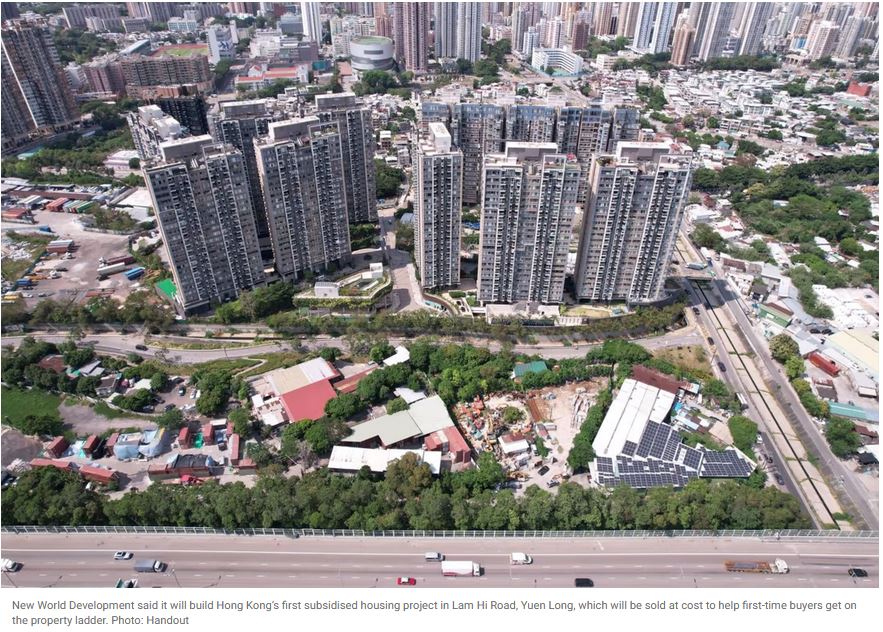

The Grand Mayfair I in Yuen Long is nearly sold out within a week of its launch.

At least 322 of the 327 flats available in the second round of sales launched yesterday were purchased, with developers raking in over HK$3 billion in just one day.

The flats were nearly 22 times oversubscribed before the sales, with prices ranging from HK$6.45 million to HK$14.91 million after discounts.

Together with the sales last Friday, 710 of the 715 homes in the project have been sold over the past six days, with the developers cashing in more than HK$6.6 billion in contracted sales.

The project is phase 1A of a 2,200-flat mega development that is being jointly developed by Sino Land (0083), K Wah International (0173), and China Overseas Land and Investment (0688).

Prices of phase 1B, The Grand Mayfair II with 805 flats, will be announced soon.

In Tai Kok Tsui, 18 more homes at The Quinn Square Mile will be put on the market today, and another five on Saturday, said the Henderson Land Development (0012).

Several special units will also be tendered soon, and it has recorded a contracted sales of HK$368 million from the project after selling 57 flats, Henderson said.

In Ngau Tau Kok, sales of 40 units at The Aperture will be relaunched on Sunday, the developer Hang Lung Properties (0101) said.

(The Standard)

The Grand Mayfair I project in Yuen Long enjoys strong sales as discounts attract first-time buyers

The project, developed by Sino Land, K Wah International and China Overseas Land and Investment, found buyers for 322 of the 327 flats on offer on Wednesday

Analysts predict a surge in supply, as more cut-price projects are launched in the coming months, will suppress house prices

Almost all available units at The Grand Mayfair I in Yuen Long were sold on Wednesday as buyers continue to snap up projects launched after a three-month lull caused by the fifth wave of Covid-19.

The project, developed by Sino Land, K Wah International and China Overseas Land and Investment, found buyers for 322 of the 327 flats on offer, a company spokeswoman said. It was the second round of sales after the project at Kam Sheung Road Station sold all 388 units on offer last Friday.

“The pandemic has subsided significantly, and social distancing measures have been gradually relaxed, which is good for the property market,” a property agent said. “Developers are taking advantage of the situation to push forward developments at full speed.”

Sales are likely to have been boosted by the relatively cheap prices, as developers seek to make up for lost time by shifting as many units as possible.

Prices started at HK$6.45 million (US$821,784) for a 339 square-foot flat.

The average price this time worked out at HK$18,777 per square foot, after a discount of 16 per cent. That was about 1 per cent higher than the first round, but still 12 per cent lower than the prevailing secondary market price of HK$21,400 per sq ft seen at Ocean Pride in Tsuen Wan West, according to data from a property agency.

the agent said that the relatively low prices helped boost sales as “the unit prices are suitable for first-time buyers.”

The project fetched 7,393 registrations of intent, which meant about 23 people competed for each unit.

The first batch of 388 flats sold out in one day last Friday, pushing up the first-hand sales volume in April to about 1,030, which surpassed the total for the first quarter of the year, the agent said.

Another property agency expects the overall number of property transactions in May to climb to a five-month high of some 7,000.

Hong Kong developers have already launched hundreds of flats at knock-down prices in a bid to make up for lost time as the city began to emerge from months of strict social-distancing measures that made house sales all-but impossible.

Analysts predict a surge in supply, as more cut-price projects are launched in the coming months, will suppress house prices.

Another agency expects that this year’s mass home prices to drop by about 5 per cent, a downgrade of its previous forecast of a rise of up to 5 per cent.

“We expect a high concentration of launches in the second half of 2022, with potentially over 20,000 units to be issued with presale consent, similar to the previous peak in 2018,” another agent said. “Combined with increasing interest rates, housing prices will be under pressure.”

The agency said that developers had postponed launches originally slated for the first few months of the year. Four projects consisting of 1,211 units acquired presale consent but were held back during the first quarter as fifth wave of coronavirus struck.

“The high level of expected supply in the primary market is likely to prompt developers to take on competitive pricing strategies, which in turn will exert pressure on the secondary market,” a property agent said.

(South China Morning Post)

Heitman Buys Hong Kong Industrial Asset From New World Heir for Reported $57M

Heitman has acquired an industrial building in Hong Kong’s Fanling area from a grandson of New World founder Cheng Yu-tung for a reported HK$450 million ($57.33 million), with the US fund manager planning to transform the asset into a refrigerated storage facility.

The Chicago-based fund manager announced on Wednesday that it has purchased the New China Laundry building in Fanling, in the eastern New Territories, and will convert the 101,463 square foot (9,426 square metre) property into a cold chain facility within the next 12 months.

“We are pleased to add to our existing industrial and commercial portfolio in Hong Kong by acquiring this strategically located asset from a rare corporate divestiture and look forward to executing our business plan of transforming the property into a best-in-class cold chain logistics center,” Heitman head of acquisitions for Asia Pacific Brad Fu said in the statement.

While Heitman declined to comment on the price paid for the asset or the beneficial owner of the vendor, Hong Kong’s company registry shows that the seller is controlled by William Junior Guilherme Doo, son of New World non-executive vice chairman William Doo, with local media reports putting the sale consideration at HK$450 million.

Chilled Valuation

Fu said that with the laundry business, which primarily services hotels and airlines, having been hit hard by the pandemic Heitman was able to secure the 1990-vintage asset at a discounted price, with the purchase having already been completed.

The reported price tag for the six-storey building translates to around HK$4,435 per square foot of built area, with the building occupying a 22,163 square foot site.

Without specifying current tenants, Fu said the building at 6 Yip Cheong Street is now fully leased, and after its conversion will be used as a last-mile distribution hub primarily for storing wine as well as frozen and chilled food products.

“We expect demand for specialized en-bloc facilities to continue to grow on the back of close to full occupancy of cold-storage space currently across Hong Kong,” Fu said.

Heitman picked up the industrial property on behalf of its $750 million Heitman Global Real Estate Partners II which reached a final closing in July 2021. The fund manager has said that with this fresh cash it will invest around $1.5 billion in mispriced, maturing and defensive assets around the world.

“The Hong Kong logistics asset provides geographic and sector diversification while aligning with the smart diversification theme of our proprietary global portfolio construction process. Further, the acquisition is aligned with our global selection of well-positioned assets for re-use in order to benefit from changing consumer demands,” said Gordon Black, senior managing director and portfolio manager at Heitman.

New Fund on the Block

Heitman’s acquisition of 6 Yip Cheong Street is the latest in a series of Fanling deals by international investors over the last 16 months, and the third on the same block.

In September, Blackstone purchased Yip’s Chemical Building at 13 Yip Cheong Street for HK$283 million, with JP Morgan Asset Management following up one month later with its HK$231 million purchase of the Chung Tai Printing Group building at 11 Yip Cheong street – just a few doors down from Heitman’s latest prize.

Including SilkRoad Property Partners’ HK$321 million purchase of the Smile Centre in Fanling in January of last year, international funds have now spent nearly HK$1.3 billion acquiring logistics assets in Fanling, according to data from a property agency. Also during 2021, China Resources Logistics acquired the Mineron Centre in Fanling for HK$695 million.

In a briefing, the agency noted that en bloc industrial transactions hit a five-year high of HK$19.4 billion in Hong Kong last year, with Fanling accounting for more than a quarter of the buildings traded in the sector since the beginning of 2021.

Of the HK$30 billion in Hong Kong real estate investments by international funds since the beginning of last year, some 70 percent went to industrial assets, according to the agency’s figures.

Chengs on the Move

Local news accounts indicated that the seller of the Fanling asset, Success Ocean Ltd, had owned the property since 1999.

Now 48, Willam Doo Jr, who serves as a director of several businesses including New World’s NWS Holdings infrastructure division, The Bank of East Asia and property management firm FSE Lifestyle Services, has sold the New Territories property just a half year after his father’s purchase of a commercial project in London in November 2021.

The 77-year-old real estate tycoon bought the former House of Fraser department store at 68 King William Street in the City of London for around $175 million, making the 11-storey commercial block his first directly owned property in the city.

The Cheng family is one of the richest clans in Hong Kong with the fortune of Henry Cheng – New World’s chairman and the son of Cheng Yu-tung – combined with his family’s wealth ranking the Chengs third on Forbes’ 2021 rich list for the city.

(Mingtiandi)

力寶中心每呎2.3萬沽低市價10%

疫情持續放緩,帶動甲廈市場頻錄買賣,消息指,金鐘力寶中心二座低層單位以1513萬售出,呎價約2.3萬售出,低市價約10%,原業主持貨11年帳面獲利約475萬,物業升值約45%。

星光行每呎1.04萬售

據市場消息指出,金鐘力寶中心二座低層3室,建築面積約658方呎,新以約1513.4萬售出,呎價約2.3萬。據代理指,上址早前以意向呎價約2.8萬放售,惟受疫情等因素影響,市場問盤洽購淡靜,業主逐步擴闊議幅,最終減價至每呎2.3萬售出,減幅約17.8%;若以該甲廈市值呎價約2.5萬計,上址成交價亦低市價約10%。

上址原業主早於2011年以1038萬購入,故持貨11年帳面獲利約475.4萬,物業期間升值約45.7%。據代理指出,上址現時以每呎約54元租用,料買家享回報約2.8厘。

觀塘工中地廠4500萬成交

甲廈頻錄買賣,尖沙嘴星光行低層31A室,建築面積488方呎,以510萬售出,呎價約10451元;同區其士大廈亦錄買賣,消息指,該廈低層3室,建築面積約844方呎,以1124.9萬售出,呎價約13329元。

消息指,觀塘工業中心1期地廠連一樓單位,總建築樓面4700方呎,以4500萬售出,呎價9574元。

(星島日報)

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多星光行寫字樓出售樓盤資訊請參閱:星光行寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

英基標售環角道豪宅地 市場估值逾18億 可建3.1萬呎

繼置地日前暗盤放售薄扶林豪宅項目後,英基書院持有南區舂坎角環角道30號地皮,於昨日招標放售,項目最高可建樓面約3.15萬方呎,若參考近期淺水灣南灣道豪宅地成交呎價約每呎6.2萬,市場估值約18至20億。

由英基持有的舂坎角環角道30號屋地,距離赤柱著名地標美利樓約11分鐘步程,毗鄰皆為低密度住宅、綠化地帶及海岸保護區,現為32幢2層高住宅別墅連64個車位及保安室,地盤面積為42496方呎,按最高地積比0.75倍計,可建樓面約31565方呎。而英基持有該地皮作員工宿舍之用。

現為英基員工宿舍

而負責是次招標的代理行指,項目屬區內罕有地皮,前臨赤柱灣內灣,享無遮擋海灣、陽光及沙灘景致,規模不俗,可建數幢8000方呎至10000方呎大屋,連數千呎花園,為內地客最鍾情類型,將於本年6月30日截標,料有機會創區內呎價最高紀錄。

如果參考本年2月淺水灣南灣道豪宅地呎價約62352元,是次地皮市場估值約18至20億。而美國加息對於用家、特別是豪客而言影響不大,預料未來豪宅樓價將會平穩發展。

地盤面積4.24萬呎

該行代理表示,舂坎角屬傳統富裕社區,驅車25分鐘可到達中環及金鐘商業區,同時鄰近知名院校,截至去年十月,物業約九成別墅均已租出,租金收入穩定,預期會吸引投資者。

晟林複式招標推

此外,該行獲接管人委託,招標出售喇沙利道晟林18樓至19樓頂層複式A單位,面積3949方呎,連910方呎私家天台,另可配售一至三個車位,招標時間由本月10日至7月8日。

(星島日報)

尖沙嘴漢口道舊樓作價15億 樂風夥外資基金收購 將重建甲廈項目

疫情走勢持續穩定,發展商紛加快收購步伐。樂風集團昨日公布,夥拍外資基金施羅德資本及BentallGreenOak,斥資逾15億收購尖沙嘴漢口道舊樓大部分業權,每呎地價約12953元,項目僅餘一伙住宅未獲收購,將申請強拍統一業權,重建甲廈項目。

樂風集團昨日公布,夥拍外資基金施羅德資本及BentallGreenOak,已完成收購尖沙嘴漢口道31至37號物業的大部分業權,擬重建甲級商廈。樂風集團創辦人及主席周佩賢昨日接受本報訪問時表示,上述項目總投資額約25億,僅餘一伙住宅因未達成共識,故尚未獲收購,是次重建項目坐落於尖沙嘴核心區漢口道,是區內主要街道之一,並毗鄰港鐵站出入口,周邊各項商業配套完善,擬建甲級商廈項目發展。

周佩賢:總投資額25億

她續指出,第五波疫情已步入尾聲,預期商貿活動與日俱增,帶動本港經濟將穩步復甦,若中港兩地可通關,屆時物業市場將迎來「報復式」反彈。

故儘管甲廈現時正處供應高峰期,惟她對後市仍具信心,並指集團將「吼準」於傳統核心商業區及同類供應較短缺的地區收購重建發展。

每呎地價1.29萬

樂風集團投資管理總監梁鎮峰表示,該地盤面積約9650方呎,規劃為『商業 (甲類)』地盤,可建樓面約11.58萬方呎,總收購價逾15億,每呎樓面地價約12953元。

該地盤位於漢口道中段,臨街面闊逾33米,零售鋪位價值高。該地皮的發展將融合各種頂尖技術、優質建築設計、綠色環保及可持續發展概念,以及具前瞻性的科技智能配套等。

尚餘1伙住宅未收購

集團已收購該項目的大部分不可分割業權,目前尚餘一伙未能達成共識的單位,集團已開展強拍程序的預備工作以統一業權。

事實上,作為新晉發展商,樂風集團近年迅速冒起,去年底夥拍博領資產管理及石壁投資牽頭財團,完成收購佐敦南京街11至21號大部分業權,涉資7.5億,共涉及4幢物業,地盤面積約7250方呎,該地段現時劃入商業用途,預計項目總收購價約8.3億,以最高地積比率12倍計算,樓面呎價約9540元。

(星島日報)

首季商廈買賣登記 僅165宗7季新低

疫情衝擊商廈買賣,有代理行指,首季商廈僅錄165宗成交,為7季新低。

該行代理表示,商廈買賣登記上月失守半百宗,而首季合共亦只錄得165宗登記,除按季大挫38%外,更創自2020年第3季以來的7季新低。根據土地註冊處數據,2022年3月份全港共錄49宗商廈買賣登記 (數字主要反映2至4星期前商廈市場實際市況),較2月份的50宗減少1宗,連跌4個月兼創近19個月低位,惟跌勢已見喘穩。

3月份登記量處低位橫行,而成交金額則跌達35%,主因是個別大額登記減少而導致3月份商廈買賣登記金額跌至只有約7.5億元,連跌3個月,創近20個月以來最少。至於,3月份最矚目的單一登記項目為灣仔富通大廈6樓連2個車位,涉及合約金額1.45億元;其次為尖沙咀東海商業中心12樓1202室連2個車位的7,500萬元登記。

按物業價格劃分,在7個價格組別的登記量當中,錄得3跌4升。在跌幅者中,以200萬元至500萬元以內組別的58%跌幅最急劇,月內登記量由2月的19宗大減至3月的8宗;而1億元或以上的大碼組別亦跌50%,只錄得1宗登記。至於登記量最活躍的是介乎500萬至1,000萬元以內組別,月內錄得15宗,按月上升50%;而逆市錄得最大升幅者為銀碼在200萬元以內的超細價組別,登記量按月大增1.5倍,錄得5宗買賣登記。

11分區 3區零成交

以地區劃分,在該行觀察的11個分區當中,共有5區的登記量按月下跌;當中更有3區跌至「零成交」的淡況,包括北角/炮台山區、西營盤/堅尼地城區及九龍灣區。至於長沙灣區買賣登記量亦按月挫50%至只有2宗,而上環/中環/金鐘區也減少20%,3月份錄12宗買賣登記,但已晉身成為該月登記量最活躍的觀察區。至於逆市錄得最顯著升幅的是旺角/油麻地區,由2月份的5宗增加至3月份的9宗,升幅達80%。

代理指出,商廈市道自去年底起連跌4個月,其間經歷第5波疫情,令交投陷入谷底,但相信最壞時刻已過。隨着本港疫情明顯好轉,社交距離措施逐步放寬,商機重現下令市場氣氛回暖;4月份截至27日為止,商廈買賣登記量已追平3月份全月,料4月份最終可達55宗,按月將反彈逾1成。隨着疫情持續改善,預期次季商廈交投將回升至195宗的水平,料較首季的165宗反彈18%。

(經濟日報)

更多東海商業中心寫字樓出售樓盤資訊請參閱:東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

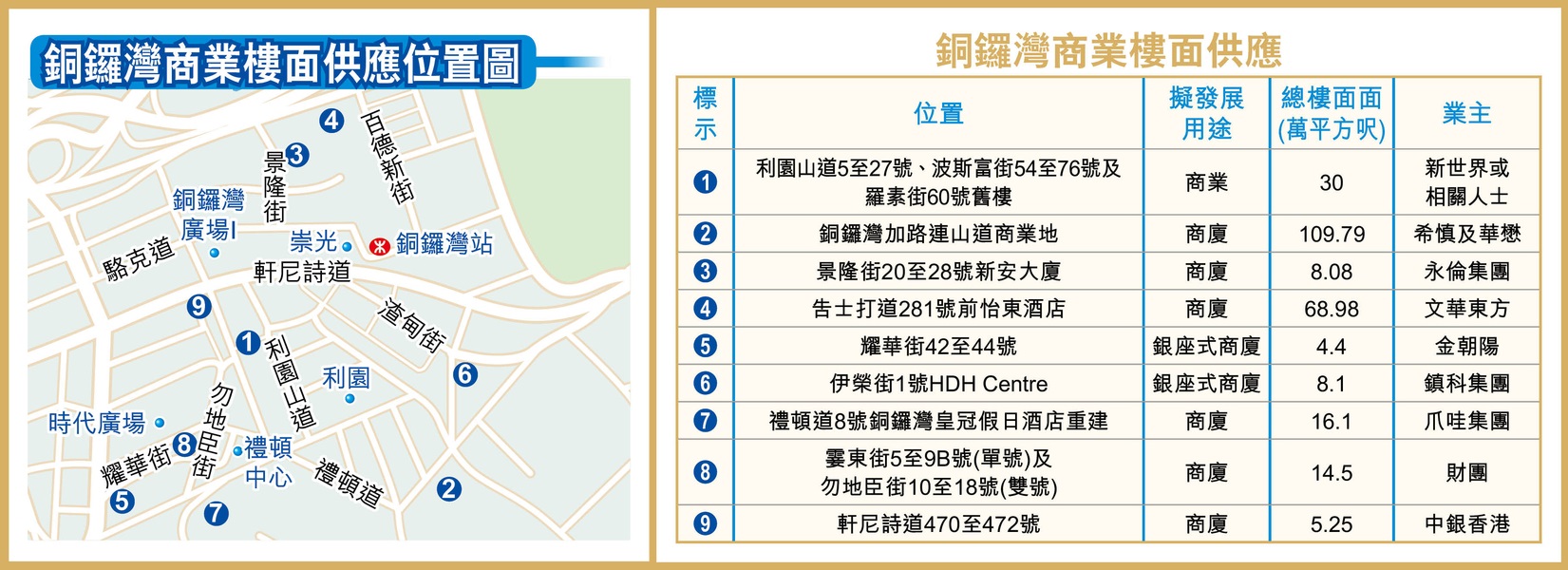

銅鑼灣商地申寬樓面 新增樓面料作文化設施

去年由希慎興業 (00014) 及華懋奪得的銅鑼灣加路連山道百億商業地王,近期向城規會提交發展藍圖,及申請放寬約2%總樓面至約109.8萬平方呎,以發展3座商廈,將提供商業、社會福利設施、演藝及文化場地等。

規劃署表示不反對,料該申請方案今日可獲城規會通過。

規劃署不反對 城規料批出

地皮前身為機電工程署總部等設施,對面是希慎旗下利園六期,佔地約15.93萬平方呎。申請人早前向會方申請,將分區計劃大綱圖內的總樓面面積限制由約107.6萬平方呎,輕微增加2%至約109.8萬平方呎,新增的2.2萬平方呎樓面將作為演藝及文化設施。地皮計劃以地積比率約6.89倍,發展3座16至24層高 (另設5層地庫) 的商廈,預計2029年第三季落成。

文件顯示,第1及2座的地庫1層至5樓將作為商業用途,5樓部分將用作演藝及文化設施,2樓將設有城市公園及橫跨地盤內擬議道路的景觀天橋,及延伸至利園六期的擬議行人天橋。

(經濟日報)

更多利園寫字樓出租樓盤資訊請參閱:利園寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

用途靈活 酒店獲財團熱捧

第2季投資市場開始轉活,其中市場連錄酒店大手買賣及洽購,由於酒店格價回落,加上可更改用途,故成財團熱捧對象。

受疫情影響下,本年首季投資市場淡靜,市場罕有錄得大手買賣。即使交投不及去年活躍,酒店卻成功跑出,首季已錄得數宗酒店成交,包括莊士機構國際 (00367) 持有的紅磡逸.酒店 (Hotel sáv),以16.5億元售出,物業佔地面積約1.02萬平方呎,總樓面面積合共約12.21萬平方呎,設有388間客房,買家為外資基金AEW。

九龍珀麗酒店13.75億易手

踏入第2季,多個酒店項目獲財團洽購,部分更正式易手,較大手交為九龍珀麗酒店以13.75億元成交。物業位於大角咀道86號,於2011年落成及開業,地盤面積約9,090平方呎,總樓面約11萬平方呎。項目樓高27層,提供435間房,天台則為酒吧。以13.75億元成交價計,每間房價值約316萬元。買家為共居品牌weave LIVING,該集團指與環球房地產資產公司落實收購大角咀九龍珀麗酒店,成為集團旗下迄今規模最大的物業。weave LIVING將進行全面翻新,包括為部分房間重新布局,將物業打造成時尚、配套完備、靈活租期的現代住宿空間。

weave LIVING近年積極在港擴充,去年已先後兩度入市,包括以2.95億元收購西半山醫院道6至8號全幢住宅物業,涉48間房。

西環華麗都會酒店9.5億洽至尾聲

另外,西環華麗都會酒店全幢,亦獲9.5億元洽購,物業於2015年落成,地盤面積約4,928平方呎。樓高32層,地下為大堂,1樓為停車場,7至32樓為酒店房間,提供214間房,總樓面面積約6萬平方呎。據了解,酒店暫作隔離檢疫用途,現時每晚房價約600元。消息稱,物業正獲財團出價洽購,涉約9.5億元,按洽購價計,每間房價值約444萬元,樓面呎價約1.58萬元。

物業由華大集團持有,該集團一直營運酒店,較早前以約14.5億元,向鄧成波家族購入荃灣汀蘭居全幢酒店,涉及435間房,平均每個房間作價333萬元,如今或進行換貨,放售西環項目。另外,該業主持有的北角華美達盛景酒店,消息指亦獲積極洽購,涉資約11億元,以該酒店涉317間房間計,每個房間涉資347萬元。

分析指,疫情下不少酒店入住率偏低,特別涉及旅客生意的3星、4星酒店,整體價格回落,開始吸引財團留意。由於共居概念興起,個別財團看好市區優質地段酒店,可改作共居用途,因此趁低價入市。由於本地住屋需求強勁,租金穩定,故共居概念仍有一定前景,料財團續吸納酒店。

(經濟日報)

太極軒放售3服務住宅 市值21億

近期全幢項目受捧,太極軒 (CHI Residences) 放售3項服務式住宅,市值約21億元。

有外資代理行表示,太極軒現正放售灣仔、西環及佐敦服務式住宅。其中,最貴重為太極軒138 (CHI138),物業位於莊士敦道138號,提供107個住宅單位,面積介乎於290至2,400平方呎,單位類型包括開放式單位、1房及2房單位、3房複式單位以及頂層全層特色單位。據悉,項目市值約13億元。

佐敦CHI314 涉59伙

另太極軒120 (CHI120) 坐落於西營盤干諾道西120號,鄰近港鐵西營盤站,屬1梯1伙設計,提供19個住宅單位,每個單位面積約1,050平方呎並設有私人露台,市場估值約4億元。至於至於太極軒314 (CHI314) 位於佐敦彌敦道314至316號,提供59個單位,面積介乎於410至1,400平方呎,估值約4億元,3項物業合共涉值約21億元。

(經濟日報)

Layout revealed for Tai Po flats

Sun Hung Kai Properties (0016) has unveiled the layout of Phase 1 of Silicon Hill in Tai Po, which will provide 576 flats.

Around 70 percent of the flats in the project have two or fewer bedrooms, and studio units with areas of around 230 square feet account for only a "very small proportion," the developer said.

The sales brochure is under preparation and the sales could be launched this month, it added.

In Ho Man Tin, Kerry Properties (0683) has unveiled the first price list for 10 LaSalle, involving 30 one-bedroom flats at an average price per square foot of HK$23,300 after discounts.

The batch, which comprises flats from 319 sq ft to 409 sq ft, is priced from HK$7.38 million to HK$9.33 million after discounts, or from HK$20,989 per sq ft to HK$25,559 per sq ft, the developer said.

The completed project provides 73 homes in total and 11 of them have been sold via tender with the developer raking in over HK$450 million.

Sales will take place next week at the earliest and the future batches may cost more, it said, adding that six flats on the 12th floor are open for viewing.

In Kowloon City, Country Garden (2007) has released the sales brochure of Allegro, which offers 190 homes from 213 to 414 sq ft.

In Chung Hom Kok, a 42,496-sq-ft site which could be turned into a luxury residential development is seeking a sale by tender with a valuation of around HK$2 billion, according to a real estate firm.

In the commercial market, Lofter Group said it plans to acquire the majority portion of a HK$1.5 billion property in Tsim Sha Tsui with partners for a Grade-A commercial redevelopment.

Meanwhile, Hysan Development (0014) and Chinachem have applied for a 2 percent increase in buildable area for the HK$19.78 billion commercial site on Caroline Hill Road in Causeway Bay they secured last May.

(The Standard)中環商廈打造共享工作空間 華懋蔡宏興:入場月租3000元

共享工作空間近年大行其道,發展商紛紛加快發展步伐。華懋集團執行董事兼行政總裁蔡宏興表示,集團旗下全新品牌CCG Commons夥拍營運商the Hive,於中環華懋大廈打造全新共享工作空間,命名為the Hive Central X CCG Commons,合共有四層,總樓面約17027方呎,入場租金由每月3000元起,項目於本月底開業,洽租情況理想,目前出租率約15%。

蔡宏興接本報訪問時指出,該集團成立全新品牌「CCG Commons」,涵蓋三大方向,包括同創、連繫及成長,該品牌首個發展項目,為夥拍共享辦公室品牌the Hive於中環干諾道中34至37號華懋大廈,打造全新共享工作空間,名為the Hive Central X CCG Commons,分布於該廈3樓、6樓、13樓及21樓,總樓面約17027方呎,合共提供270流動辦公桌及38間私人辦公室。

租戶包括科技及專業服務

蔡氏續指出,該項目位處傳統核心商業區,各項配套完善,由華懋集團擁有,項目現正進行試業並招租,於本月底會正式開業,現今收到逾百宗租務查詢,目前出租率達15%,比預期為高,租戶包括科技、專業服務、新經濟行業等,月租由3000元起,租期由一個月起,靈活程度甚高,並強調新落成且具質素的寫字樓於市場上具優勢。

看好疫下後市發展

至於the Hive為業內跨國營運商,於2012年成立,在亞太區多個國家擁有21個據點,當中本港有10個據點。

對於疫市下寫字樓租務最新市況,蔡宏興分析指,受第五波疫情打擊,市場近兩個月租務交投稍放緩,惟甲廈市場近期已見改善,加上疫情加劇市場對靈活辦公室的需求,故預期更多企業會採用同類辦公室,後市值得看俏。

擬推獨立智能工作艙

另一方面,他又指出,集團將會推出獨立智能工作艙,於旗下各大商場作流動會議室、辦公空間、學習室等。此外,集團將推出旗下首個共居空間項目,選址位於荃灣如心廣場,約有兩至三層,料於明年首季推出,主攻年輕專業人士客源。

(星島日報)

更多華懋大廈寫字樓出租樓盤資訊請參閱:華懋大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多如心廣場寫字樓出租樓盤資訊請參閱:如心廣場寫字樓出租

更多荃灣區甲級寫字樓出租樓盤資訊請參閱:荃灣區甲級寫字樓出租

上月錄約357宗工商鋪買賣 代理行:表現「量跌價升」

第五波疫情持續減退,部分社交距離措施提早放寬,加上第一期消費券派發,以及東鐵綫過海段即將通車等利好因素推動下,整體工商鋪市場氣氛回暖。有代理行資料統計,4月份市場共錄約357宗成交,較3月份微升約0.85%。該代理行預測,市況繼續向好發展,4月份出現逾10宗大額買賣,令金額較3月份提升近30%,預料未來一至兩個月大額買賣活躍。

共錄約13宗逾億成交

該行代理表示,根據該行資料,4月份市場共錄約357宗工商鋪買賣成交,按月微升約0.85%,對比去年4月同期則跌約49.07%,總金額呈增長趨勢,4月份共錄約91.93億,較3月份升約29.81%,按年遞減約29.15%,反映4月份大額成交較多。4月份共錄約13宗逾億成交,工廈佔大比數,最大額成交為葵涌貨櫃碼頭路43號集運中心全幢,成交價約28億。

寫字樓表現突出

按類別分析,寫字樓表現突出,成交宗數錄約53宗,按月升約60.61%,帶動總金額急升至約7.64億,對比3月份倍增約76.5%;鋪位買賣宗數同樣攀升約19.10%,共錄約106宗,總金額約27.48億,較3月份下跌約27.34%。工廈出現量跌價升情況,買賣宗數回落至不足200宗,僅錄約198宗,按月減約14.6%,金額則因有3宗逾億元成交而推動至56.81億。

該代理分析,相信在大額交投帶動下,工商鋪於5月及6月持續上揚。

(星島日報)

市建局西營盤項目今截意向

近年港島區住宅地供應罕有,多年來未有土地推出招標,市建局相隔逾5年再有新供應,為西營盤崇慶里/桂香街發展項目,將於今日截收意向書,料將成為各路發展商搶奪對象;綜合市場估值,上述地皮估值介乎約14.7億至16.1億,每方呎樓面地價約15500至17000元。

市場估值達16億

西營盤一帶多年來未有土地供應,上述項目位於崇慶里1至7號、桂香街12至16號及德輔道西216至218號,鄰近私樓薈,距離港鐵西營盤站其中一個出口僅2分鐘步程。

地盤面積約11596方呎,可建總樓面約94766方呎,當中包括約4306方呎的商業樓面面積,住宅部分可興建約165伙。據市建局構思,透過該項目的規劃及設計,提升崇慶里兒童遊樂場的可達性,並改善從德輔道西和桂香街通往該項目的現有行人網絡。

地盤鄰近西營盤站

另外,中標發展商,須按發展協議中列明的標準與品質、可持續發展和智能系統的要求,興建新發展項目,以提供一個可持續發展的生活環境。

資料顯示,上述項目是該局於2017年7月展開,並於2018年5月以每方呎面積23568元向小業主提出收購價建議,為該局首次提出破2萬的收購價,當時創新高紀錄,其後2019年8月被中西區皇后大道西/賢居里每方呎收購價24051元打破。

有測量師認為,上述項目是難得的港島地盤,由於發展規模適中,相信可以吸引各類型的發展商遞交意向書;另外,項目交通及生活配套齊全,毗鄰港鐵站、附近亦有其他交通工具往各地,鄰近亦有街市和各類餐廳。綜合市場估值,上述地皮估值介乎約14.7億至16.1億,每方呎樓面地價約15500至17000元。

(星島日報)

外資基金看好工廈 屢錄大手成交

疫情緩和,投資氣氛好轉,而工廈市場率先反彈,不論分層及全幢均錄大手成交,買家多為外資基金,看好本港市場前景。

近日工商舖大額買賣增加,當中以工廈市場表現較佳,連錄多宗逾億元買賣,包括全幢工廈買賣。其中粉嶺業暢街6號新中國洗衣集團大廈全幢以4.5億元易手,物業地盤面積約22,163平方呎,總面積約101,463平方呎,以4.5億元成交價計,呎價約4,435元。項目於1990年落成,近年由業主自用。翻查資料,原業主於1999年以3,868.8萬元購入,持貨23年轉手,獲利約4.11億,物業升值約10.6倍。

據悉,買家為Heitman,該財團屬美資房地產基金,於澳洲、韓國等均設有辦事處。該基金去年成功集資,將投資逾百億元物業,而是次屬首度於香港入市。消息指,是次購入該工廈項目,將轉作凍倉用途,作長綫收租。事實上,該區全幢工廈去年亦獲基金承接,包括葉氏化工集團,以約2.826億元沽出業暢街13號葉氏化工大廈,成交呎價約4,424元;買家為外資黑石基金,料購入轉作迷你倉用途。

另外,興勝創建 (00896) 以逾2.11億元,沽出沙田工業中心一籃子物業,涉及物業A座4樓的1至23號工作間及位於該廈2樓的兩個車位。總樓面約28,050平方呎,呎價約7,522元。沙田工業中心旁邊為九巴沙田車廠,並鄰近港鐵第一城站、帝逸酒店、住宅欣廷軒等。據了解,是次新買家為加拿大基金Brookfield Asset Management。據了解,新買家計劃購入上述物業作迷你倉業務。

柴灣工廈3層樓面 1.8億售

分層工廈成基金追捧對象,柴灣沙咀道68至76號大成大廈23、24及25樓3層全層,以合共1.8億元售出,每層面積15,818平方呎,合共總面積約47,454平方呎,呎價約3,793元。原業主早於30多年前購入,沽貨賺逾1.64億元,升值10.5倍。據了解,新買家為外資基金SilkRoad,該基金近一年多次購工廈,包括斥11.6億元購入屯門恒威工業中心一籃子物業,以及以3.21億元購入粉嶺安全街堅達中心全幢。

分析指,不少基金近一兩年均成功集資,並有興趣投資本港市場。在工商舖市場中,工廈呎價低,用途廣泛包括物流中心、迷你倉及數據中心等,均提供穩定租金回報,正合基金投資方向。事實上,去年工廈為大額物業投資市場焦點,料今年情況持續。

(經濟日報)

大角咀利.晴坊23 商舖1.2億招標

民生區基座商場具投資價值,現大角咀利.晴坊23商舖部分,以1.2億元標售。

包括5舖平台 連車位

發展商續拆售非核心物業,有代理指,有利集團及市建局合作發展的新盤大角咀利.晴坊23,最新放售商場平台連車位、廣告位業權,市值約1.2億元。以商場樓面計算,平均呎價1.12萬元。截標日期為5月13日。

項目包括5個商舖 (地下1至3號舖、地下4號舖連1樓、地下5號舖連1樓),商場平台建築面積約10,701平方呎,另有5個商用車位及5個廣告位置。由於商舖已分契,若果投資者購入可以將舖位「即買即拆售」

住宅新盤商舖獲投資者留意,如3月份佐敦德成街2號本木商舖部分,以2.1億元成交。涉及地舖及1樓,總樓面約1萬平方呎,平均呎價約2.1萬元。現時舖位部分樓面由咖啡店租用。本木樓高23層,於2021年4月入伙,合共提供172個單位,發展商於2020年尾開售。

(經濟日報)

甲廈連續6個月 錄淨吸納量

甲廈租務有改善,仲量聯行報告指,甲廈連續6個月錄淨吸納量,中環租金按月微跌。

有外資代理行最新發表的市場報告指出,盡管持續的社交距離措施令3月寫字樓租賃市場淡靜,整體甲級寫字樓租賃市場仍連續6個月錄得淨吸納量。

第5波疫情下,現行社交距離措施延長,導致3月租賃交投活動淡靜。不過,由於租戶需求持續增長,整體甲級寫字樓市場仍錄得56,200平方呎淨吸納量。

中環空置率回落 租金跌0.1%

該行代理表示,靈活辦公空間毋須企業作長期承諾便可使用設備齊全的辦公室,這在業務增長或市況未明的情況下尤其重要,因此,愈來愈多企業把靈活辦公空間列入其地產組合內,帶動靈活空間擴充。

該行另一代理表示,隨着新供應落成,3月底整體市場的空置率升至9.4%,較2月份9.1%,升0.3個百分點。中環空置率進一步回落,由2月底7.4%,跌至7.3%,至於港島東,空置率為7.9%,按月升0.2個百點,九龍東空置率持續偏高,最新為12.5%,仍然為各主要分區市場中最高。

上月整體甲級寫字樓租金按月下跌0.2%。主要分區市場中,中環租金月內微跌0.1%,而港島東錄得最大租金跌幅。

(經濟日報)

佐敦香港體檢中心位於區內心臟地段,交通配套甚佳,並以醫生樓作主題,非常適合各類型醫務所使用。

香港體檢中心位於佐敦彌敦道及佐敦道交界,項目處於佐敦最繁忙地段的十字路口,對面為地標裕華國貨,故物業可謂處於區內心臟地段。交通上,從港鐵佐敦站步行至該廈,需時僅數分鐘。值得一提,由該廈步行至柯士甸站及西九龍高鐵站僅約10分鐘,故日後通關,亦適合內地人前往該廈睇醫生及進行體檢。另外,物業附近的彌敦道、佐敦道均有多條巴士綫,絕對四通八達。

其他配套上,物業地下設有商舖,附近佐敦道及彌敦道食店林立,而佐敦亦有不少酒店,設有餐廳,整體配套理想。

物業樓高16層,設有兩部升降機,由於大廈以醫療為主題,出入不乏傷健人士,業主於入口提供設備,方便傷健人士等上落。

樓上各層面積約4,100平方呎,除全層用戶外,個別樓層可分間成4單位,單位面積由921平方呎起,可讓較小型的醫務所使用。景觀方面,大廈單位主要向望佐敦道樓景。

香港體檢租10層 獲命名權

大廈前身為金峰大廈,於1960年落成,地盤面積約5,000平方呎,總樓面約60,798平方呎。2018年,資本策略 (00497) 斥資約21億元購入物業,平均呎價3.4萬元。物業對面的嘉賓商業大廈為傳統「醫生樓」,故資本策略購入,斥資數千萬元進行大翻新,現時大廈地下大堂甚新淨,外形亦較以前理想。大廈去年完成翻新工程,業主把物業打造成以醫務為主題商廈。

物業完成翻新前,已錄大手租務,由香港體檢及醫學診斷中心租用2至11樓共10層,當中2至3樓每層建築面積5,866平方呎,其餘各層建築面積4,153平方呎,總建築面積約44,956平方呎,月租202.3萬元,呎租約45元。是次租期由明年3月初至2025年2月底,為期4年,並有5年續租權,同時獲大廈命名權。

(經濟日報)

更多香港體檢中心寫字樓出租樓盤資訊請參閱:香港體檢中心寫字樓出租

更多佐敦區甲級寫字樓出租樓盤資訊請參閱:佐敦區甲級寫字樓出租

3層樓面招租 意向呎租約48

疫情下醫務所需求大,現佐敦彌敦道241至243號香港體檢中心3層推出市場放租,意向呎租約48元起。

每層面積約4153呎

有代理表示,由資本策略 (00497) 發展的佐敦彌敦道241至243號香港體檢中心,租務交投不俗,目前僅餘13至15樓共3層樓面推出市場招租,每層面積約4,153平方呎,意向呎租約48元起。

該代理稱,單位設基本天花、地台及牆身裝修,可為租客節省部分開支。香港體檢中心以健康生活為主題的商廈,已獲不少體檢中心、物理治療中心、醫學美容等行業青睞。據資料顯示,同幢最新一宗租務成交為低層全層,面積約4,153平方呎,於去年7月以每平方呎約45元租出。

醫務相關行業在疫情下明顯擴充,本年2月,盈健醫療 (01419) 公布,租用尖沙咀星光行地下9、9A及10A舖,以及1樓A至C舖,租約由2022年5月1日起至2028年4月30日止,為期6年,物業將作為大型醫務中心,提供一站式的醫療服務及健康科技相關服務。據了解,該物業面積約3.8萬平方呎,6年租期涉及9,523萬元,按此計算月租約132萬元,呎租約35元。

(經濟日報)

更多香港體檢中心寫字樓出租樓盤資訊請參閱:香港體檢中心寫字樓出租

更多佐敦區甲級寫字樓出租樓盤資訊請參閱:佐敦區甲級寫字樓出租

更多星光行寫字樓出租樓盤資訊請參閱:星光行寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

New launches, rate fears hit secondary market

Secondary home sales at 10 major housing estates declined over the weekend, amid ample primary market supplies and imminent interest rate hikes, according to a property agency.

Only 11 deals were recorded, which was four less than a week ago, the agency said. The number slightly rose to 13 during the three-day holiday if the Monday figure is included.

A property agent said that the ample supply of homes in new projects, anticipated interest rate hikes, and a decline in home viewing appointments on Mother's Day led to the fall in the number of deals.

It may take some time for buyers to digest the news of US interest rate increases, the agent said, adding that they now prefer to wait and see the trend of property prices after the hikes kick in.

Meanwhile, Henderson Land Development (0012) sold at least seven flats over the long weekend and cashed in over HK$67 million, said Mark Hahn Ka-fai, a general manager of the sales department.

The Holborn in Quarry Bay recorded three deals after kicking off sales of 20 flats yesterday.

The developer released the third price list last week, offering 45 units at an average price per sq ft of HK$24,355 after discounts.

Two Artlane in Sai Ying Pun also saw one transaction, and the developer has raked in nearly HK$2 billion from the sales of this project, Hahn said.

In Ho Man Tin, Sun Hung Kai Properties (0016) said the showrooms at Prince Central will open to the public today.

Located at 195 Prince Edward Road West, the completed project provides 101 flats ranging from 251 square feet to 1,351 sq ft.

The developer said the price will be unveiled soon and sales may take place within the week.

One-bedroom and studio units account for over 70 percent of the total number of flats in the project and the SHKP previously released the first price list of 50 units last year but the sales were later scrapped.

On the luxury front, Sino Land (0083) and CLP (0002) sold a 2,140-square-foot home at St. George's Mansion in Ho Man Tin for HK$105 million, or HK$49,065 per sq ft, via tender.

(The Standard)

Home rents along Hong Kong’s East Rail Line expected to rebound quickly after opening of new cross-harbour extension

More families from Hong Kong Island East are looking for bigger flats in northeastern New Territories, property agent said

Rents in Tai Wai, Sha Tin and Ma On Shan could increase by about 5 to 15 per cent in coming months

Rents at housing developments along Hong Kong’s East Rail Line are expected to rebound first, following the opening of the line’s cross-harbour extension on Sunday, May 15, agents said.

The extension will cut travel times between Tai Wai and Sha Tin in New Territories and Admiralty on Hong Kong Island to about 17 to 21 minutes from 28 to 32 minutes previously, making these areas more attractive to renters, they said, adding that some homeowners in Tai Wai and Sha Tin were already refusing to cut rents. Commuters from these two areas will be able to travel directly to Admiralty from Sunday, instead of changing lines in Kowloon Tong and Mong Kok currently.

“Mainland Chinese students were the major source of demand in these two areas previously, as they are close to Chinese University of Hong Kong and City University of Hong Kong. But we have seen more families from Hong Kong Island East look for bigger flats here,” property agent said.

The 16-station East Rail Line will connect northeastern New Territories directly with central Kowloon and Hong Kong Island. Commuters will be able to reach the commercial and financial hubs in the Wan Chai North and Admiralty areas without changing lines. Admiralty station will become a mega interchange for four railway lines – East Rail Line, Tsuen Wan line, Island line and South Island line.

Families are looking for 1,400 to 1,600 sq ft, three to four-bedroom flats in Tai Wai and even in Ma On Shan, where rents are more affordable than Hong Kong Island, Tsang said. He recently helped a family lease a 1,602 sq ft four-bedroom flat at the two-year-old The Entrance development near Wu Kai Sha station for HK$65,000 (US$8,280) per month. “The project is new, and comes with a sea view,” the agent said.

In Wu Kai Sha, more renters are looking for large units in Altissimo and St Berths since late April, the agent added. Buying activity, however, remains stagnant as demand has been dampened by a potential interest rate hike and uncertainties about the mainland border reopening, the agent said.

Rents in Tai Wai, Sha Tin and Ma On Shan would have greater upside potential in coming months, increasing by about 5 to 15 per cent, the agent said. Viewing appointments had increased by 20 to 30 per cent over the last weekend from the previous weekend, the agent added.

Rents of lived-in homes have fallen 11 per cent after reaching a peak in August 2019, according to the latest Rating and Valuation Department data.

“Home rents dropped most in the first quarter, when the city’s Covid-19 pandemic was worsening, as most owners refused to open their flats for viewing,” another agent said.

Rents in Tai Wai, however, may come under pressure once again, when the phase one of New World Development’s 700-unit Pavilia Farm comes due for occupation in September. “By that time, more new flats will come on the market for leasing and offer more choices to renters,” the agent said.

But the leasing market in Sheung Shui, the second last stop before Lo Wu on the East Rail Line, appears to not have attracted many takers following the news of the new cross-harbour extension.

“We have not seen more purchasers or renters visiting Sheung Shui. But the positive news will bring the area back to buyers or renters’ radar again later,” another agent said.

(South China Morning Post)東莞銀行傳80萬租中環3層巨舖

疫情持續令本港商舖空置率上升,租金大跌,傳統商業區中環亦有不少巨型舖位待租。市場消息指出,鄰近中環中心的中銀集團人壽保險大廈3層複式、總面積近1.4萬方呎的巨舖,獲一家中資銀行以每月80萬元承租,租金較高位下跌約29%。據知情人士透露,新租戶極有機會為去年才進軍本港市場的東莞銀行,擬開設首間零售銀行分行。

據了解,位於德輔道中134至136號中銀集團人壽保險大廈地庫、地下及1樓3層舖位,地庫建築面積約4639方呎,地下建築面積約4586方呎,1樓建築面積約4622方呎,總建築面積約13847方呎,原以每月120萬元放租約一年,至近期獲洽租,終以約80萬元租出,呎租約58元,成交租金較叫租低33.3%。

較舊約平三成 每呎58元

資料顯示,中銀集團人壽保險大廈全幢原由中銀保險持有,於2008年以8億元售予賭王四太梁安琪旗下尚嘉控股,該3層舖位一直租予中銀香港 (02388) 作為分行。舖位對上一份租約為2018至2021年,月租為112.5萬元,租約去年4月屆滿。

中銀香港去年未有續租,舖位過去一年曾短租予散貨場數月,相隔逾一年後才再以長租形式租出,最新租金較舊約下跌28.9%,每月少收32.5萬元。該舖2012年月租曾達96萬元,即最新租金較10年前還要低16萬元或16.7%。

知情人士表示,上述舖位的新租戶為銀行,以東莞銀行的呼聲最高。東莞銀行為大灣區內的城商行之一,去年3月獲金管局授予銀行牌照,並租用中環國際金融中心二期寫字樓單位設立香港分行,是該行目前唯一境外分行。東莞銀行近期再向金管局申請在港設子行的牌照 (本港註冊持牌銀行),新公司命名「莞銀國際」,將染指本地零售銀行市場,估計新承租的舖位將用作首間零售銀行分行。

上址對面的德輔道中141號中保集團大廈地下B舖,建築面積約3805方呎,原由花旗銀行承租多年,惟本月租約期滿並已遷出,舖位現以每月60萬元放租,呎租約158元。花旗銀行的舊租金為66.4萬元,即最新叫租相對回落9.6%。

(信報)

更多中銀集團人壽保險大廈寫字樓出租樓盤資訊請參閱:中銀集團人壽保險大廈寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多中保集團大廈寫字樓出租樓盤資訊請參閱:中保集團大廈寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

美資基金4.5億入市 購粉嶺全幢工廈

基金再度吸納本港工廈,粉嶺業暢街全幢工廈,獲美資基金以4.5億元承接,呎價約4,435元,基金購入將作凍倉用途收租。

呎價約4435 將作凍倉

本年初,粉嶺業暢街6號新中國洗衣集團大廈全幢獲財團洽購,涉資約4.5億元。據了解,該項目近日正式易手。物業地盤面積約22,163平方呎,總面積約101,463平方呎,以4.5億元成交價計,呎價約4,435元,物業附設1部貨運升降機及2部客運升降機,另設11貨車位私家車位。項目於1990年落成,近年由業主自用。

原業主於1999年以3,868.8萬元購入,持貨23年轉手,獲利約4.11億元,物業升值約10.6倍。事實上,去年至今粉嶺已錄多宗全幢工廈成交。

據悉,買家為外資基金Heitman,該財團屬美資房地產基金,於澳洲、韓國等均設有辦事處。該基金去年成功集資,將投資逾百億元物業,而是次屬首度於香港入市。消息指,是次購入該工廈項目將轉作凍倉用途,作長綫收租。

投資市場稍轉好,而工廈成交明顯反彈,並多由外資基金承接,如日前興勝創建 (00896) 以逾2.11億元沽出沙田工業中心一籃子物業,新買家為加拿大基金Brookfield,將發展迷你倉。

(經濟日報)

Brookfield Buys Hong Kong Storage Space From Hanison for $27M After Acquiring RedBox

Brookfield has agreed to acquire industrial assets in Hong Kong’s New Territories from Hanison Construction for HK$211.3 million ($26.9 million), following closely behind the Canadian asset management giant’s under-the-radar purchase of local self-storage operator RedBox.

The assets comprise workshops 1 to 23 on the fourth floor of Block A at Shatin Industrial Centre and car parking spaces V49 and V55 on the second floor of the building, Hanison said Tuesday in a filing with the Hong Kong stock exchange.

Market sources tell Mingtiandi that Brookfield plans to convert the Shatin industrial units into a self-storage facility under the RedBox portfolio, tapping a hot sector that has also seen a series of conversion-led acquisitions by rival investor Blackstone. RedBox executives declined to comment.

Toronto-based Brookfield quietly bought RedBox Storage from InfraRed NF in a deal that closed in March, sources said. InfraRed NF is a joint venture of Hong Kong developer Nan Fung Group and British investment firm InfraRed Capital Partners, which is exiting the real estate business to focus strictly on infrastructure. Brookfield representatives also declined to comment on the Shatin acquisition or on the takeover of RedBox.

Struggling for Sheds

Situated at 5-7 Yuen Shun Circuit near the City One residential precinct, the partly leased Shatin property generated an annual rental income of HK$3,180,000 and HK$3,485,000 in the financial years ended 31 March 2021 and 31 March 2022, Hanison said. The developer, controlled by the Cha family of Hong Kong Resorts International, expects to book a gain on the disposal of HK$66.2 million.

Upon completion of the transaction, Brookfield will take possession of the 34,525 square foot (3,207 square metre) industrial space, paying roughly HK$6,120 ($780) per square foot for the conversion opportunity.

The limited supply of industrial stock for sale in the market means that investors buying into strata-titled floors can still enjoy a decent return from the assets, a property agent said.

“The mini-storage business seems to be quite active in the last year, and in particular Blackstone and Storefriendly have been buying en-bloc properties to convert into mini-storage,” the agent told Mingtiandi. “This sector will continue to grow despite the fact that there are quite a number of players and operators in the market which offer the similar service and product, hence the growth should be slower depending on the locations.”

Blackstone’s trio of acquisitions in 2021 included the Elegance Printing Centre, a Shau Kei Wan property picked up from the family of late “Shop King” Tang Shing-bor for HK$500 million. That November deal followed the US private equity giant’s HK$282.6 million September purchase of Yip’s Chemical Building in the Fanling area and the HK$508 million April buy of the New Media Tower in Kwun Tong, the latter property having already opened as a Storefriendly location through a joint venture with the local self-storage operator.

Self-Storage Heats Up

InfraRed NF acquired a 90 percent stake in RedBox in 2018, on the heels of a 2017 investment of $28 million in China Mini Storage, a mainland-based self-storage provider.

RedBox was founded in 2014 by E3 Capital Partners, a property investment firm led by Simon Tyrrell, and now owns and operates five self-storage facilities in Shatin, Chai Wan, Yau Tong, Tuen Mun and Tsuen Wan, spanning more than 400,000 square feet of space.

Tyrrell stepped down as RedBox CEO in early 2021 to become a board member and executive chairman, focusing on the company’s strategic initiatives. His successor, Tim Alpe, previously served as chief operating officer of the Ovolo boutique hotel group in Hong Kong and Indonesia.

The New Territories contains the lion’s share of Hong Kong’s 690 self-storage locations with 39 percent, according to data compiled by another property agency, followed by Hong Kong Island with 32 percent and Kowloon with 29 percent. Of the total, 249 buildings are considered old, with 88 percent of them having been built in 1987 or earlier, presenting a potential flight-to-quality opportunity, the property agency said.

(Mingtiandi)

灣仔秀華坊18號申強拍 值5751萬

有財團就灣仔秀華坊18號舊樓申請強拍,項目的現況市值約5,751萬元。

秀華坊18號舊樓比鄰嘉諾撒聖方濟各學校,鄰近有住宅星域軒、興建中的Eight Star Street。該舊樓早於1963年落成,現為1座6層高的住宅,而該財團目前已集合83.33%的業權。

是次申請強拍的用地佔地約3,357.5平方呎,劃為「住宅 (丙類)」及顯示為「道路」的用途,而據灣仔分區計劃大綱圖,「住宅 (丙類)」用地的任何新發展的最高地積比率為5倍,而建築物高度最高可建12層,或不可超過現有建築物的地積比率及高度,兩者中以數目較大者為準。

(經濟日報)

Sun Hung Kai plans to build 9,940 flats at Yuen Long’s Tam Mei wetlands in one of Hong Kong’s biggest mass housing projects

Sun Hung Kai Properties (SHKP) plans to build 9,940 flats at Tam Mei in Yuen Long, according to applications filed with Hong Kong’s Town Planning Board

The project comprises 36 residential towers of between 10 and 29 floors each, translating to about 400 square feet (37 square metres) for each unit on average

A mass housing project is taking shape near the wetlands in Hong Kong’s New Territories, with the potential to accommodate 25,850 residents when it is completed in 2026, a major step towards easing the acute shortage in one of the world’s most expensive cities.

Sun Hung Kai Properties (SHKP) plans to build 9,940 flats at Tam Mei in Yuen Long, according to applications filed with Hong Kong’s Town Planning Board.

The project comprises 36 residential towers of between 10 and 29 floors each, translating to about 400 square feet (37 square metres) for each unit on average, according to the plan.

The number of flats being planned, equivalent to Hong Kong’s total home sales in the first seven months of 2021, is about the size of Whampoa Garden in Hung Hom, making it one of the city’s largest residential communities.

The push to develop the area – currently on loan to the city government as a community isolation facility for Covid-19 patients – follows the extension of a transport network to promote Chief Executive Carrie Lam Cheng Yuet-ngor’s Northern Metropolis project.

The project is near the planned Au Tau subway station of the Northern Link, about 800 meters away from the station. It takes 10 minutes to reach the “Hong Kong Silicon Valley” San Tin Technopole, which aims to create 148,000 IT-related jobs.

“Now that the Northern Link construction has been revealed, the land should yield residential development to solve Hong Kong’s housing problem, which is better,” said SHKP’s project director Spencer Lu.

SHKP plans to include nearly three hectares of wetlands within the Tam Mei project to balance conservation with its property development. The project includes land that has been earmarked for a primary school, and elderly care homes and amenities.

The northern part of the project, currently being used as Hong Kong’s community isolation facility – has been permitted for transformation into a large-scale retail outlet in the early years, according to the plan.

The southern part has received permission for the construction of a hotel, and is currently mainly a brownfield site for large open-air warehouses. The Koon Chun Sauce Factory sits in the middle of the site. SHKP said it reached an agreement with Koon Chun to relocate its factory to the southern region of the site.

With a plot ratio of 2.2 to 2.5 times for the residential part, that will account for 4 million sq ft in gross floor area. The non-residential part, with a plot ratio of less than 0.1 time, will yield 150,158 sq ft.

The development site will measure 2.11 million sq ft, including housing development that spans 1.75 million sq ft, the relocated sauce factory and a school.

SHKP claims to be the most active developer in converting farmland to residential use. SHKP is experienced in balancing conservation and development, including the construction and rapid sales of Wetland Seasons Park and Wetland Seasons Bay next to the Hong Kong Wetland Park.

The applications will be subject to three weeks of consultation, and is expected to be discussed in a Planning Board meeting in mid-July, when it may be approved or rejected, according to the Board’s website.

The developer wants the approval process to be fast and completed this year, and aims to complete the first phase of the project by 2026 and 2027, said Rebecca Wong, planning director of project planning and development department of the developer.

The ownership of agricultural land in the New Territories is extremely fragmented, said the developer. It called on the government to adopt a more flexible approach in the future to facilitate more land planning adjustment projects and make better use of land resources.

(South China Morning Post)

Hongkong Land Leases 3 Central Office Floors to White & Case