有代理行統計,2月份共錄約273宗工商鋪成交,宗數創下6個月以來新高。

金額72.55億按月升77%

該行代理表示,根據資料,2月共錄約273宗工商鋪買賣,按月升約26%,為過去半年以來單月新高;惟與第五波疫情前相比,仍有改善空間,按年減約28%,金額錄約72.55億,較上月急升約77%,主因月內錄多宗大額成交,商鋪最突出,月內錄共9宗逾億成交中,商鋪佔逾60%。

市場錄9宗逾億元買賣

代理續稱,上月錄約86宗備商鋪買賣,總金額約37.89億,分別按月升約50%及約77%,核心消費區鋪位連錄成交,旺角亞皆老街16至16B號旺角商業大廈地下E鋪及1樓至4樓,總面積約1.7萬方呎,市傳以約3.5億易手,曾獲火鍋店作旗艦店,高峰期月租逾90萬,2016年遷出後分拆出租,現獲3間食肆租用。

代理指,寫字樓價量齊升,2月份宗數約42宗,按月微升約5%;金額錄約23.74億,按月攀升約1.6倍。觀塘鴻圖道73至75號 KOHO 全幢,以約17億易手,呎價約8340元。工廈錄約145宗成交,按月回升約22%,金額約10.83億,與1月約10.42億相若。

(星島日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

灣仔商業地 入場門檻低吸引競投

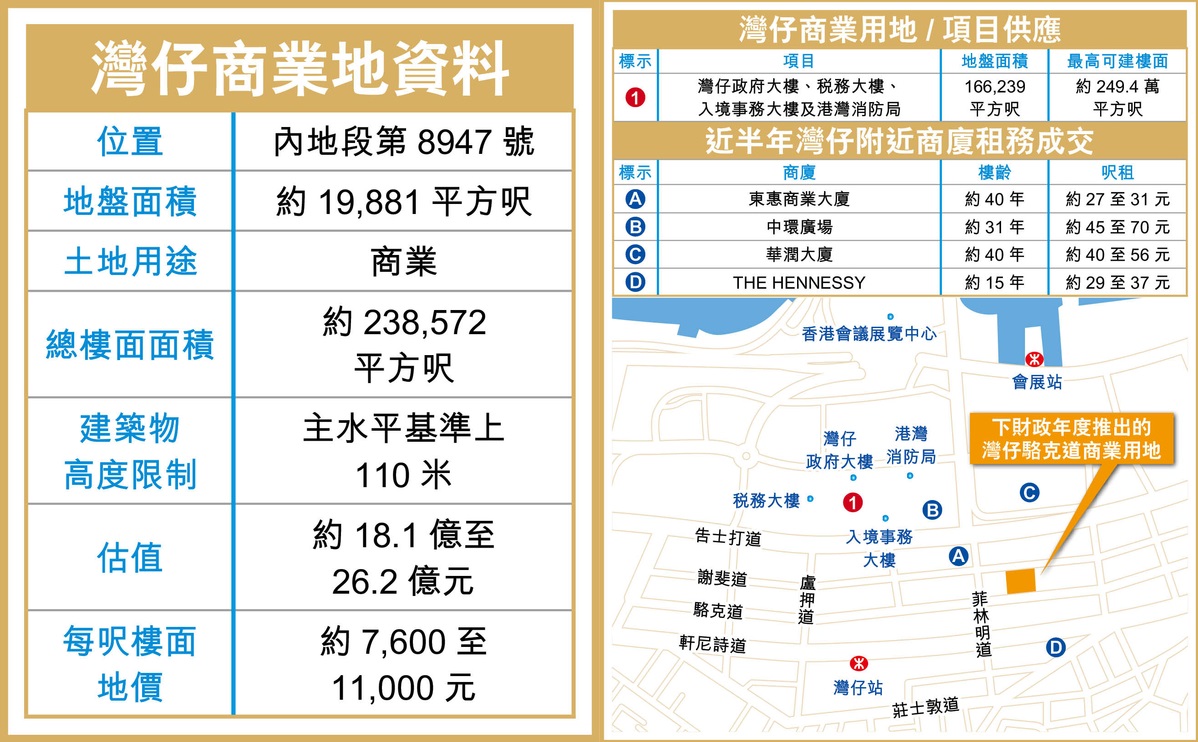

下財政年度 (2023至2024年) 將會推出3幅商業地,其中兩幅位於傳統核心商業地段,包括多年前已經計劃推出的前灣仔警察已婚宿舍用地。該地屬多年來區內罕有的商業用地供應,而且規模是3幅中最細,入場門檻相對低,估計將吸引不少發展商競投,尤其是中型發展商。

前宿舍地 逾30年新供應

前灣仔警察已婚宿舍用地位於傳統商業地段駱克道,附近有不少商廈,亦鄰近世紀香港酒店、比鄰前灣仔警署,目前規劃為「商業 (4)」用地,最高地積比率限制為12倍,總樓面約23.9萬平方呎,規模適中,市場估值18.1億至26.2億元,每呎樓面地價約7,600至1.1萬元。

翻查賣地紀錄,不計及2011年推出的酒店用地,灣仔逾30年來未曾有新商業官地供應,因此是次地皮供應罕有,而且地皮的規模適中,屬於下財年推出的3幅商業地中規模最細,投資額相對較細,入場門檻較低,估計除大型發展商外,可吸引更多財團參戰。

有測量師認為,地皮位置不俗,在沙中綫通車後更具優勢,而且沙中綫通車後,區內未有商業地推出,所以地皮成交價具指標作用。參考上周批出的旺角洗衣街商業地已以低價批出 (每呎樓面地價約3,103元),估計灣仔商業地每呎樓面地價只有7,600元左右。考慮整幅地皮規模及近期投標氣氛後,預測可接獲至少6至8份標書。

此外,上述用地早前已經放寬其建築物高度限制,由80米 (主水平基準上,下同) 增加約37.5%至110米,估計日後建成項目最高樓層可達20多至30層。

(經濟日報)

Novo Land sells out with more units to hit market

All 352 homes available at Sun Hung Kai Properties' (0016) phase 2B of Novo Land in Tuen Mun were sold out after the sales launched last Saturday, while the secondary market saw weekly transactions fall.

An additional 171 flats will be put on the market on Wednesday, as part of the 180 units revealed in the fourth price list last Saturday, said the developer. The latest batch of units was priced between HK$4.2 million and HK$9.3 million, or at an average price of HK$14,098 per square foot after discounts.

The project so far has been 29 times oversubscribed with a total of 10,691 checks received last week, cashing in at least HK$2 billion. It is the first new residential development project to receive over 10,000 applications after seven months when phase 1B of Novo Land got 12,887 checks last August.

In Tai Kok Tsui, Henderson Land Development's (0012) The Quinn Square Mile sold seven flats yesterday, raking in HK$41.58 million. The most expensive unit was a two-bedroom 382 sq ft flat, sold at HK$8.88 million. The remaining were studios and one-bedroom units ranging between 209 sq ft and 272 sq ft, with prices between HK$4.6 million to HK$6.5 million.

At least 600 deals were recorded in the primary market this month, a property agent said. The agent expects the figure to triple by the end of March to reach over 2,500.

In the secondary market, 17 secondary transactions were recorded in the ten benchmark housing estates over the weekend -- a decrease of 29 percent from last week's 24 deals, according to a property agency.

Whampoa Garden in Hung Hom notched up the most transactions at five.

Tai Koo Shing in Quarry Bay was the only housing estate that had zero transactions over the weekend, after five deals were made during a frenetic weekend late February.

Meanwhile, the number of transactions in Hong Kong's industrial, commercial properties and shops jumped by 27 percent to 273 last month from January, the agency said, marking the highest record in six months. The total considerations also rocketed 77.5 percent to about HK$7.2 billion, the agency remarked.

(The Standard)

Cheaper land in Hong Kong: what low-price parcel sales mean to buyers, renters, developers and government coffers

Developers are the only players likely to benefit from sales such as one in Mong Kok on March 1 that fetched 35 per cent less than a pessimistic estimate

The low-water mark for the slab of prime commercial real estate could have an adverse impact on government land revenue, analysts say

The recent sale of a parcel of prime commercial land in Mong Kok for 61 per cent less than the HK$12 billion (US$1.53 billion) some thought it might be worth is likely to mean a more handsome margin for Sun Hung Kai Properties (SHKP), rather than any profound change to the city’s real estate fundamentals, according to analysts.

SHKP prevailed over two other bidders to secure the 124,184 sq ft plot on March 1, winning the right to develop and lease the land for 50 years for HK$4.73 billion. That price is 35 per cent below the HK$7.3 million that a property consultancy estimated as the low end of the land’s value, and 61 per cent below the HK$12 billion it cited as the high end of the range.

Market observers were left to wonder whether the lower-than-expected bid indicates that lower rents or selling prices lie ahead in the property market, as well as what the transaction says about future government land sales.

The deal is “very good for SHKP”, said Raymond Cheng, managing director and head of China/Hong Kong research and property at CGS-CIMB Securities.

“The winning bid could be considered surprisingly low,” Cheng said. “It was a reflection of the current state of the market, particularly the office and retail segments. We expect office property prices to drop by 5 to 10 per cent year on year for 2023.”

SHKP plans to construct a 320-metre building with 1.52 million square feet of space on the site, which will be the “largest landmark office cum shopping centre in Mong Kok”, Raymond Kwok Ping-luen, SHKP’s chairman and managing director, said in a statement released on March 1.

Even given some constraints on construction on the site, the effective costs will end up being between HK$4,000 and HK$5,000 per square foot, “which is still quite cheap”, said CGS-CIMB’s Cheng.

“Our conservative estimate of the initial yield of about 5.5 per cent is quite high versus the average of 3 per cent during normal times,” Cheng said.

The property market will likely have recovered by the time SHKP starts pre-leasing the project, a property agent said.

“The commercial property market is expected to be better than the status quo in a few years,” the agent said. “Rental performance will be better after 2025, when the market is gradually moving from a tenant market to a balanced market.”

Now is a fortuitous time for developers to acquire parcels of land for their projects, according to another international property consultant.

“It is the right time for developers with a good balance sheet and strong holding power such as SHKP to enter the market,” an agent said, as the medium-term outlook is strong.

However, buyers and renters should not count on seeing lower costs trickle down to them, analysts said.

“It does not directly translate to cheaper office prices and rents when the buildings are completed,” the agent said. “Developers are conservative in land biddings as the prevailing development costs are high, including the interest-rate environment and construction costs.”

The current environment means higher risks for developers, given the poor uptake of office space at the moment, Au said, adding that they are being more conservative in their bidding as a way to minimise risk.

“SHKP will not only pay $4.7 billion for the site, but will invest a huge amount of capital and effort into developing the second-tallest commercial landmark complex in Kowloon,” said a representative from the developer, which plans to complete the project by 2030.

The tender came in the wake of unsuccessful sales of three other parcels of land – in Lantau Island’s Oyster Bay, Kwun Tong, and Stanley – so far this year, an occurrence that likely convinced the Lands Department to adjust its expectations for the Mong Kok site, a surveyor said.

“Due to lower land costs, [SHKP] may be able to offer a more reasonable rental level to the potential tenants,” the surveyor said. “Their construction costs, including financing costs required for the subject site, are significant. Therefore the developer reflected those in their bidding price.”

The Mong Kok site will be a reference point for other commercial sites to be sold outside the Central business district in 2023/2024, such as a 115,000 sq ft commercial and hotel site in Kai Tak, another agent said. The sale will also factor into land-premium discussions between the government and developers when it comes to converting developers’ sites for commercial use, the agent added.

“As such, this transaction price would cause an adverse impact on government revenue,” the agent said.

The government plans to put 18 more plots – 12 residential, three commercial and three industrial – on the market this year, contributing to a projected HK$85 billion in land premium income, according to Financial Secretary Paul Chan Mo-po.

(South China Morning Post)