全面通關後,整體商廈買賣氣氛轉好,而核心區甲廈交投亦稍增,個別造價亦理想。

據一間代理行資料顯示,2月份共錄得約273宗工商舖買賣成交,按月上升約26%,亦是近半年以來單月新高。寫字樓市場同樣呈價量齊升之勢。2月份商廈成交宗數約42宗,按月微升約5%;金額則錄得約23.74億元,較上月大幅攀升約1.6倍。當中全幢商廈因投資方向靈活備受追捧,消息指,觀塘鴻圖道73至75號 KOHO 全幢,總面積約203,829平方呎,作價約17億元易手,平均呎價約8,340元。

中環美國銀行中心呎售3.84萬 近年高位

傳統核心區甲廈成交稍增,個別成交造價理想,消息指出,中環美國銀行中心高層03室,面積約1,303平方呎,以約5,000萬元成交,呎價高見約3.84萬元。疫情以來,該廈成交偏低,2020年初該廈1單位成交,呎價更曾低見2.88萬元,按最新成交價計,屬近年該廈呎價新高。

單位原業主於2006年以約1,250萬元購入,持貨17年轉手,獲利約3,750萬元,升值約3倍。

另外,金鐘海富中心一座中高層19室,面積約757平方呎,以約1,460萬元易手,呎價約1.93萬元。原業主於2015年斥資約1,700萬元購入,持貨8年,帳面損手約240萬元,貶值14.1%。

金鐘指標商廈力寶中心錄得成交,資深投資者正八集團主席廖偉麟,購入力寶中心一座37樓4至6室,面積約3,475平方呎,涉資約7,818萬元,成交呎價約2.25萬元,物業市值呎租約60元。原業主早於2003年約1,130萬元購入3個單位。

核心區優質盤供應少 後市看俏

至於甲廈新盤,銷情同樣不錯,黃竹坑甲廈新盤宏基匯連錄多宗成交,其中23樓全層,面積約6,178平方呎,以每呎約1.6萬元易手,涉資約9,885萬元;另物業1105室,面積約801平方呎,以每呎約1.28萬元易手,涉資約1,025萬元。翻查資料,宏基資本於2017年以約14.8億元,購入區內標達中心全幢工廈。宏基匯樓高27層,總樓面約10.7萬平方呎。

分析指,中港全面通關後,整體工商舖買賣亦轉好,其中以商舖市場反應最快,核心區錄得多宗大額買賣成交。至於商廈市場方面,疫情期間甲廈成交偏少,租售價亦明顯調整,主因通關下租務淡靜。如今全面通關,個別機構重新擴充,令甲廈重獲留意,投資者入市興趣亦加快,特別核心區優質單位供應始終少,料交投持續向好。

(經濟日報)

更多KOHO寫字樓出租樓盤資訊請參閱:KOHO 寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

奢侈品迎通關 旗艦店重現核心區

Swatch百萬租皇后大道中4層舖 設Omega展館

中港全面通關,帶動旗艦店重新出現核心區,早前中環皇后大道中54至56號豐樂行4層約8,735呎舖,以100萬元租出。消息指,新租客為Swatch group,料作旗下名錶Omega旗艦店。另外,近日珠寶店有所擴充,業界指通關後奢侈品亦加快租務決定,預計今年租務市況轉旺,舖租有望從低位反彈約1成。

較早前,中環皇后大道中54至56號豐樂行多層舖租出,物業地下至3樓,面積合共約8,735平方呎,以每月約100萬元租出。物業位於皇后大道中的正中段,人流非常暢旺,比鄰Zara複式旗艦店。豐樂行由老牌業主持有,數年前業主進行重建,並於2020年落成。物業樓高28層,總樓面面積3.3萬平方呎,而地下至3樓為商舖部分。

消息指,是次新租客為國際大型連鎮鐘錶集團Swatch Group,該集團擁多個名錶品牌如浪琴、雷達錶等,過往亦活躍租舖,惟疫情期間大幅收縮。消息人士指,是次集團租用,料作旗下歐米茄 (Omega) 之用。

六福珠寶洽租 栢麗大道舖

據了解,該品牌目前亦有租用同區中建大廈地下,是次預租豐樂行,因看中物業樓面大,可打造具氣派的旗艦店。據悉,在4層樓面中,除了銷售名錶外,更會預留部分樓面作展覽館,介紹品牌故事及展示經典款式等,增加體驗成分,以吸引更多客人前來。是次亦屬疫情以來,罕見奢侈品租用多層舖位打造旗艦店。

中港全面通關後,核心區租務加快,初期以藥房租務較多,最近漸見奢侈品重新落戶,如六福珠寶早前承租,銅鑼灣羅素街8號英皇鐘錶珠寶中心地下3及5號舖,面積約3,068平方呎,月租約70萬元,呎租約228元,亦為通關後,核心區首宗珠寶租用核心區舖位。市場消息指,六福近期亦有物色其他核心區舖位,包括正洽租尖沙咀栢麗購物大道舖,可見心態轉為積極。

通關兩月 核心區錄10租務

1月初中港初步通關,至今約兩個月,核心區已先後錄得十多宗商舖租務成交,主要為本地藥房,包括租尖沙咀廣東道、海防道及旺角西洋菜南街,當中如藥房1月以約30萬租廣東道86至98號地下,近日已極速開業迎接旅客。

有外資代理行代理指,通關後普遍零售商對市況感樂觀,深信零售銷售業務將遠比疫情期間理想。該代理指首階段仍以本地藥房落戶為主,而國際奢侈品牌,則因需時觀察,並需要獲總部批准增分店,落實時間不及本地商戶快,但近期亦轉正面,加快查詢及洽商。代理指出,疫情3年多,核心區舖租累跌4成,對零售商來說,租舖成本降低,故感一定興趣,預計計今年舖位租金可從低位反彈約1成。

(經濟日報)

更多豐樂行寫字樓出租樓盤資訊請參閱:豐樂行寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

更多英皇鐘錶珠寶中心寫字樓出租樓盤資訊請參閱:英皇鐘錶珠寶中心寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

名店核心區有選擇 租金難大升

市況復常,商舖租務市場同樣復甦,惟核心區空置舖位仍多,消化需時,相信舖位租金仍處於較低水平。

近兩個月旅客重返香港,特別過往支撑本港旅遊業及零售業的內地客逐步訪港,帶旺本地市況。人數上,據入境處數字顯示,前日 (3月8日),訪港內地客數字達50,889人,較通關初期約2萬餘人明顯增多,而上星期六 (3月4日),內地訪港人數更高見86,811人。

訪港人數大增,與封關期間零旅客,完全兩個世界。旅遊業正在穩步復甦,加上本港撤銷口罩令等,相信可帶動消費市場進一步轉好。

大量吉舖 等待長租客吸納

近期漸見零售商重新租舖,相信個案會持續增加。不過,租金方面則預計難大幅反彈,主因核心區吉舖仍甚多。據統計數字顯示,去年尾4大核心區,包括中環、銅鑼灣、旺角及尖沙咀,空置率分別為8%、14.5%、17.1%及20.3%,即使近期租務增加,本港主要街道如彌敦道、西洋菜南街,仍有大量吉舖、短租舖,正在等待長租客吸納,要消化仍然需時。

至於租金方面,按近期多宗核心區舖位租務成交,涉及月租普遍在30萬元起,至百萬元以下,涉及銀碼不算大。

此外,從成交租金計,即使比起疫情期間的短租有一定升幅,若與零售高峰期相比,仍跌約6至7成以上,反映目前吉舖數量偏高,租客選擇亦較多,業主亦不敢大幅提價,故相信租務增加同時,租金仍會處於偏低水平。

(經濟日報)

翠華重返中環 35萬租荊威廣場舖

租務氣氛向好,不同商戶亦趁機擴充。消息指,翠華茶餐廳以每月35萬元,重新落戶中環威靈頓街。

市場消息指,中環威靈頓街1號荊威廣場高層地下舖位,面積約5,089平方呎,以每月約35萬元租出。據了解,新租客為本港知名茶餐廳品牌翠華,該集團近年放棄多間分店,消息稱是次集團租用中環店,將以全新餐飲概念配合,帶來新意。

租金回落 餐飲租二綫舖增

翻查資料,翠華自1998年,租用中環威靈頓街華商會所大廈3層,涉及約8,160平方呎,打造集團旗艦店,由於該舖位處蘭桂坊,鄰近夜店,生意非常理想。該舖高峰期月租達230萬元,及後受疫情衝擊,翠率於2020年不續租。2021年譚仔三哥米綫以45萬元租用該舖,同年開業至今。如今翠華以35萬租荊威廣場舖,重返中環。

荊威廣場地下、地庫、1至2樓,面積合共約2萬平方呎,曾由渣打銀行租用多年,而一家內地財團,於2019年以310萬元租用舖位,開設夜店,惟僅經營一段短時間便結業。期間物業一直交吉,現業主決定把樓層分拆招租,以吸引更多租客。

整體商舖空置率仍高,在租金回落後,近年核心區二綫地段,餐飲租舖的個案有所增加,如最近尖沙咀加連威老道愛賓商業大廈地庫舖位,面積逾3,000平方呎,近日獲日式人氣餐廳壽司郎租用,現正進行裝修。

(經濟日報)

更多荊威廣場寫字樓出租樓盤資訊請參閱:荊威廣場寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

恒大許家印山頂銀主盤招標市場估值8.8億

恒大創辦人許家印持有的山頂布力徑一幢洋房早前已被銀行接管,淪為銀主盤,最新中原及世邦魏理仕已被委託為聯合獨家代理出售該大宅。目前物業市場估值約8.8億,每呎估價約17.6萬。

接獲數10組買家查詢

一間本地代理行及一間外資代理行表示,是次大宅將按現狀交吉出售,並計畫於3月下旬選定買家。他們表示至今已接獲數十組買家查詢,當中超過6成屬本地老牌家族及超級富豪,約3成為內地客。

外資代理行代理表示,由於內地與香港兩地通關,經濟逐步復常,加上美國加息估計將近見頂,豪宅市場可看高一綫。

本地代理行代理表示,自本港與內地通關後市況回暖,豪宅成交活躍,豪宅買家對後市信心加強,加上新一份財政預算案重啟投資移民,能引進資金、人才和企業,令市場觀望氣氛消散,豪宅交投升溫。是次大宅位於罕有獨立地段,亦為傳統名門望族聚居地,是次放盤備受市場關注。今年首2個月,全港一二手5000萬以上成交錄得約96宗,當中洋房成交佔14宗。

(星島日報)

Stamp duty revenue soars 66pc

Hong Kong's stamp duty revenues soared 66 percent month-on-month to HK$556.2 million in February, according to the data from the Inland Revenue Department.

There were 234 property transactions, 76 more than the number in January, resulting in a 48 percent increase.

Out of the three stamp duties - special stamp duty, buyer's stamp duty, and double stamp duty - the SSD saw the largest surge.

The revenue from SSD soared 93 percent compared to HK$180 million and the number of transactions also jumped by 79 percent to 61 transactions.

In the primary market, Chinachem's In One atop the Ho Man Tin MTR station uploaded its sales brochure yesterday and plan to release its first price list next week.

The developer also plans to unveil the show flats next week. The first batch of units, which consists of no less than 50 one- to three-bedroom units, is expected to go on sale this month.

The project is equipped with three designated lifts, which access the concourse of Ho Man Tin Station directly.

Grand Victoria II in Cheung Sha Wan, co-developed by Sino Land (0083) and others, will put 117 units on the market tomorrow, including 59 on price lists and 58 via tender.

The units offered for sale on price lists cover a range of studio to three-bedroom units, with a discounted price of HK$23,017 to HK$30,943 per sq ft.

Sun Hung Kai Properties (0016) will put 189 flats at phase 2B of Novo Land in Tuen Mun on sale on Sunday, of which around 60 percent are priced under HK$6 million after discounts.

Also in Tuen Mun, Grand Jeté, jointly developed by CK Asset (1113) and SHKP, has released the sales brochure for Phase 2 which has 400 flats.

(The Standard)

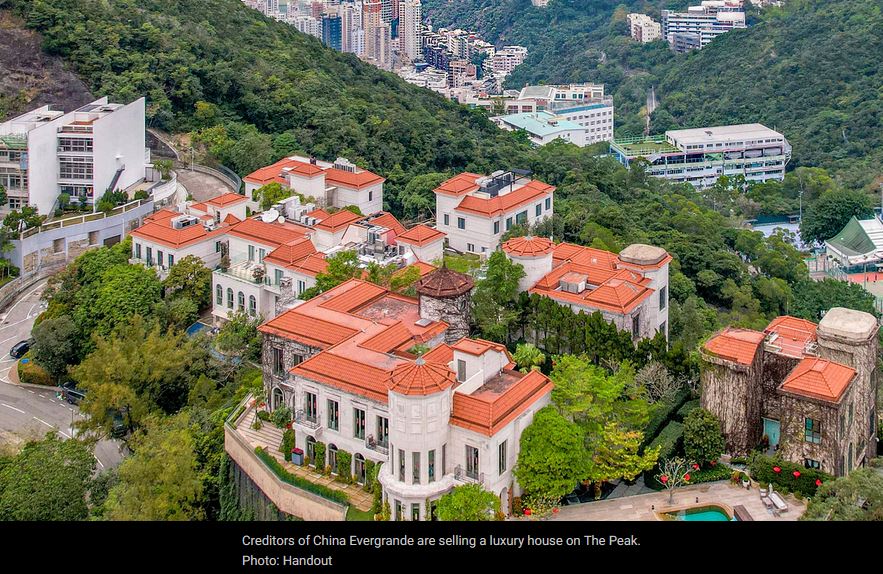

Receivers of a luxury property on The Peak linked to top Evergrande executive put the asset up for sale

Two property agencies have been appointed as sole co-agents to sell the ultra-luxury property on The Peak

The mansion being put on the market is 10B, Black’s Link, which could be valued at over HK$800 million

Receivers of a Hong Kong luxury property owned by a company linked to top China Evergrande executive have put the asset on The Peak up for sale in an attempt to recover unpaid bills.

Two property agencies have been appointed as sole co-agents to sell the ultra-luxury property on The Peak, they said in a joint statement on Thursday.

The mansion being put on the market is 10B, Black’s Link, which could be valued at over HK$800 million (US$101.9 million) given comparable properties on The Peak are valued at HK$140,000 to HK$150,000 per square foot, a source familiar with the sale process said.

It is owned by Better Vision, whose director is Tan Haijun, according to a companies search. Tan is also the director of Giant Hill, which owns 10C and 10E, Black’s Link, according to Land Registry data. Hui Ka-yan, Evergrande’s founder and chairman, resigned as a director of Giant Hill on July 30,2021. On the same day, Tan Haijun was appointed as Giant Hill’s director.

Dozens of potential buyers have inquired about the house, of which over 60 per cent are local ultra-rich families and tycoons, and around 30 per cent are from the mainland, the agents said.

A decision on the winning bidder is expected in the second half of March.

“Thanks to the Hong Kong-mainland border’s reopening and the ensuing economic recovery, prospects in the luxury property market are looking good,” an agent said. “Expectation that US interest rates will be peaking around midyear also helps.”

Some 96 residential property transactions worth more than HK$50 million were recorded in the first two months of this year, of which 14 deals were mansions, according to the property agency.

Hui, whose wealth has shrunk from US$9.1 billion to US$3 billion as estimated by Forbes, has put some of his personal assets on sale to repay Evergrande’s debt. The company’s total liabilities are estimated at more than US$300 billion.

Three adjoining mansions of up to 5,400 square feet each at 10 Black’s Lane on The Peak in Hong Kong were remortgaged in late 2021 for HK$1.1 billion.

Hui’s business empire spans a diverse range of businesses including banking, bottled water, real estate, electric cars, wealth management and even a football club.

(South China Morning Post)

Hong Kong property: border reopening not quite the magic bullet hoped for, property agency report suggests

Transactions involving buyers from outside Hong Kong were still dramatically lower in January than in pre-pandemic times, a property agency’s data shows

Interest from Hongkongers looking to buy property in the mainland cities of the bay area has increased markedly since the reopening, however

The reopening of the border with mainland China failed to boost Hong Kong’s beleaguered property market as much as had been anticipated, according to a report released by a property agency on Wednesday.

The report showed that 3,051 homes changed hands in January, almost a fifth lower than the monthly average of 3,755 seen in 2022.

Transactions involving buyers from outside Hong Kong were particularly tepid. Just 34 such transactions – signified by payment of Buyer’s Stamp Duty (BSD) – were recorded in January, below last year’s average of 53 and a far cry from pre-pandemic levels.

“The average monthly transaction volume involving BSD was 294 in 2018 and 178 in 2019, so it’s still significantly below the pre-Covid level,” an agent said.

In 2019, the year before the coronavirus broke out, mainland Chinese buyers accounted for 8.4 per cent of overall home sales in Hong Kong, according to data compiled by another property agency.

But annual transactions involving buyers who were non-permanent residents or non-domiciled companies slumped by about three quarters under the strict travelling restrictions introduced during the pandemic, according to Inland Revenue Department statistics cited by the agency.

The resumption of cross-border travel had been seen by industry watchers as the key to reviving Hong Kong’s weakened property market, which saw residential transactions plummet 39 per cent year on year to 45,050 last year, the lowest level since record-keeping began in 1997.

Hong Kong’s government last month announced it would cut stamp duty for first home buyers to spur demand, the latest in a slew of easing measures aimed at bringing the housing market back to life.

Instead of the anticipated rush of mainlanders across the newly opened border to buy Hong Kong property, the reverse appears to have happened.

Inquiries from Hongkongers looking into property projects in the mainland cities of the Greater Bay Area have shot up. Agents have resumed marketing these developments in Hong Kong, luring buyers to attend home viewing tours in mainland China.

Each tour might draw about 20 to 30 potential buyers from Hong Kong, several agents told the Post.

“We’ve seen enquiries from Hong Kong buyers asking about homes in the Greater Bay Area has surged several-fold from before [the cross-border opening],” an agent said.

“I had expected an improvement in the market with the resumption of cross-border travel and recovery of the economy, no matter whether it’s the Hong Kong market or the mainland market.”

The Greater Bay Area includes Hong Kong, Macau, and nine mainland cities in Guangdong province: Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing.

(South China Morning Post)