本港疫情走勢平穩,為甲廈市場釋出正面訊息,核心區頻錄承租個案,消息指,中環皇后大道中八號高層全層,於交吉約10個後,以每呎約115元租出,較舊租輕微下跌約4%。

交吉10個月始錄承租

據代理指出,中環皇后大道中八號高層全層,面積約3012方呎,以每呎約115元租出,月租約346380元,據悉,上址於今年2月交吉至今,舊租金為每呎120元,故最新租金微跌約4%,屬市價水平。

代理指,隨疫情走勢持續平穩,現今甲廈空置率逐步改善,惟整體租金表現仍備受壓力,隨踏入年尾,部分業主希望於農曆新年前將單位租用,令議價空間逐步擴闊,故近期甲廈租金均見折讓。

卡佛大廈每呎61元租出

據代理行資料顯示,該甲廈近期租賃交投疏落,對上承租個案為該甲廈高層全層,於去年6月以336830元租出,以面積2591方呎計,呎租約130元;另一宗為中層全層,面積約3012方呎,於去年1月以361440元租出,平均呎租約120元。

此外,中環區內商廈亦頻錄承租個案,消息指,卡佛大廈高層07B室,屬醫務層,面積359方呎,以每呎約61元租出,月租約21899元;同區歐陸貿易中心中層03A室,面積約952方呎,以每呎約52元租出,月租約49504元。

(星島日報)

更多皇后大道中八號寫字樓出租樓盤資訊請參閱:皇后大道中八號寫字樓出租

更多卡佛大廈寫字樓出租樓盤資訊請參閱:卡佛大廈寫字樓出租

更多歐陸貿易中心寫字樓出租樓盤資訊請參閱:歐陸貿易中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

上環全幢乙廈7000萬售

新一波疫情來勢洶洶,惟市區全幢物業仍備受追捧。上環皇后大道中全幢乙廈以約7000萬易手,原業主持貨17年帳面獲利約5920萬,物業期間升值約5.48倍。

綜合市場消息指出,上環皇后大道中323號全幢以約7000萬易手,原業主於2004年以約1080萬購入,持貨17年帳面獲利約5920萬,物業期間升值約5.48倍。據業內人士指出,上述地鋪連閣樓為鋪契,至於項目1至5樓則為寫字樓,成交價貼近市場價水平。

17年升值5.48倍

另一方面,代理表示,西營盤德輔道西1號低層全層商廈,單位面積約1616方呎,以意向價約1800萬放售,呎價約1.11萬。黃氏表示,上述單位間隔四正實用,獨立全層配備分體冷氣及內置洗手間,大廈設有兩部客梯,適合各行業進駐設立總部。單位景觀開揚,外向干諾道西天橋,廣告效益盡收眼底。物業地理位置優越,該項目鄰近港鐵上環站,交通配套不俗。

德輔道西商廈意向呎價1.11萬

據代理行資料顯示,該商廈近期頻錄買賣,其中,20樓全層,面積約1088方呎,以今年11月以約938萬易手,呎價約8621元;另一宗為項目高層全層,面積1088方呎,於今年9月以1200萬售出,呎價約11029元。

(星島日報)

市建土瓜灣項目截收31份意向

近年市區大型發展項目供應罕有,市建局土瓜灣第三個以「小區模式」發展的鴻福街、啟明街及榮光街四個重建項目、合併為一個項目發展,挾市區及鐵路沿綫住宅的優勢,昨日截收31份意向書,雖較同區首兩個小區項目的36份意向書數目為少,但市場反應仍算理想。

意向書較同區兩項目少

市建局昨公布,項目截收31份意向書,意向書數目對比該局今年6月及9月、同樣截收36份意向書的同區首兩個以小區發展項目 (庇利街/榮光街、鴻福街/銀漢街項目) 略為減少5份,若以該局住宅項目計,則是自17年3月截收28份意向書的大角嘴福澤街/利得街需求主導重建項目後的逾4年半以來最少。

市建局指,該局董事會設立的遴選小組,將會按照訂定的入圍準則,就發展商及財團的項目發展經驗和財政能力,從收到的意向書中挑選符合資格的發展商及財團;並將根據董事會已批准的主要招標條款,邀請入圍的發展商及財團提交標書。

據現場所見及綜合市場消息,多家本地大型和中型發展商都有遞交意向書,包括長實、新地、恒基、會德豐地產、信和、南豐、新世界、華懋、英皇國際、遠東發展、帝國集團、泛海國際、中國海外、招商局置地、爪哇控股,另有多家不知名財團等。

英皇國際物業經理蔡宏基表示,該盤屬市區項目,並具地皮發展規模,遞交意向書希望取得標書作詳細研究,他透露綜合所有因素後,集團出價較為進取,傾向以獨資方式入標。

估值逾60億

有測量師指出,雖是次意向書數目對比同區首兩個項目有所減少,唯市場反應仍然理想,是次項目發展規模較大,若連同建築費在內,料發展成本將過百億,不排除部分中小型發展商因而未有遞交意向書,料將來可截獲6至8份標書,傾向為大型發展商為主。

上述重建項目由啟明街分隔兩個相鄰地盤,總地盤面積約5.85萬方呎,預計兩個地盤可建總樓面約52.68萬方呎。成功取得項目的財團,須按發展協議中列明土瓜灣小區發展的「總體設計要求」,作為興建新發展項目藍本,與該局毗鄰重建項目產生協同效應。綜合市場消息指,參考今年9月同區首個批出項目每呎樓面地價約1.14萬作指標,預計該項目估值約60億至66億,每方呎樓面地價約1.14萬至1.3萬。

(星島日報)

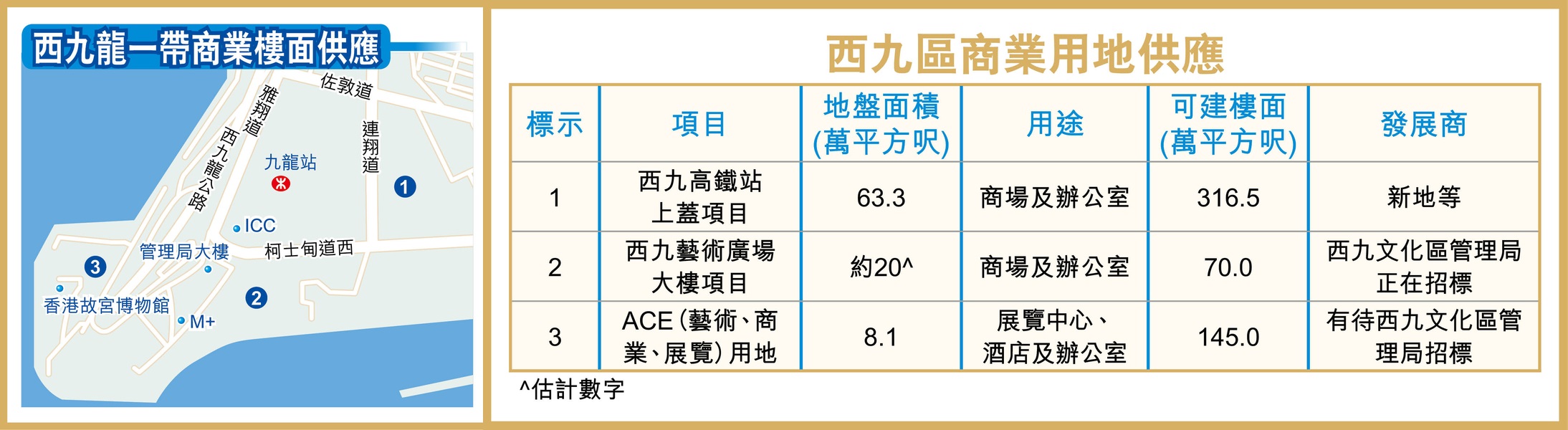

西九區商業見雛形 供應達386萬呎

隨着西九文化區發展逐漸成形,將陸續推出商業用地供應,早前就以BOT模式 (建造、營運及移交) 就區內藝術廣場大樓項目,總樓面面積約70萬平方呎,連同新地 (00016) 西九高鐵站項目等,區內未來幾年商業樓面供應將達386萬平方呎。

該幅藝術廣場大樓用地屬於西九文化區第3B區,位於興建中的演藝綜合劇場旁邊,鄰近M+博物館以及西九管理局辦公室大樓,將興建3幢商業大樓組成,總樓面面積合共約70萬平方呎,包括67.2萬平方呎的辦公室樓面,以及2.7萬平方呎作為零售 / 飲食 / 娛樂用途,當中前方的1幢商廈更屬臨海項目,擁有整個維港海景。

文化區建3商業大樓 共70萬呎

今次西九管理局並不是以傳統形式批地,而是採用BOT (建造、營運及移交) 模式出售,中標的發展商負責藝術廣場大樓項目的設計、建造、融資、市場推廣、租賃、管理和維修工作,並獲得34年營運權,期間須在租金上向西九管理局作分紅,而且今次亦要求發展商在簽訂合約後須先分兩期繳交租賃期的部分租金。

現時九龍站甲級商廈環球貿易廣場 (ICC) 租金料約70至80元水平,若果參考這個價錢,西九項目預計每月租金可達4,900萬至5,600萬元,每年租金約5.9億至6.7億元,以30年期計算,總租金收入將達177億至201億元。

除了藝術廣場大樓用地外,西九管理局亦曾經在去年就西隧出口上方的ACE (藝術、商業、展覽) 用地招標,用地佔地約8.1萬平方呎,總樓面約145萬平方呎,計劃在故宮博物館的北面興建一個50萬平方呎的展覽中心,以及在西隧上方興建一個U形的酒店及辦公室,涉及87.3萬平方呎樓面,及7.4萬平方呎的零售及餐飲樓面。

新地高鐵站商地 建兩商廈

項目在去年4月開始招標,於去年底截標,不過西九文化區管理局最後認為招標反應遜於預期,決定暫停ACE項目的招標工作。

另外,新地在2019年以422億元投得的西九高鐵站商業地,地積比率為5倍,在今年初獲批准,由3幢「波浪型」的商廈,改為興建兩幢「鑽石型」商廈,樓高20至30層,總樓面約316萬平方呎,寫字樓部分涉及樓面逾256.18萬平方呎,較已批方案減少約1成樓面。而零售方面,以約0.95倍發展計,可建面積涉逾60.27萬平方呎,則較之前增加約9成。

(經濟日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

Far East Consortium International to sell Kai Tak plot

Developer Far East Consortium International (0035) said it plans to sell the non-industrial portion including the office portion of a land adjacent to the Kai Tak Sports Park to CLP Group (0002) for HK$3.38 billion.

The 32,000-square-meter site, which is under development and undergoing construction includes the 16,621.89-sq-m non-industrial portion with offices and the 15,378.1-sq-m hotel portion.

The hotel portion of the land will be assigned to its subsidiary prior to completion of the transaction, it said in an exchange filing last night.

The non-industrial part of the land was accounted for as an investment property in the financial statements and a fair value gain of approximately HK$438 million was recognized based on the mark-to-market value as of September 30, 2021.

It is expected that further fair value gains of approximately HK$500 million will be recognized before and/or upon completion.

This came after its chairman David Chiu Tat-cheong said he will fully withdraw from the daily operation of i-Cable Communications (1097) but may buy some shares to support the TV company in the future.

Local tycoon Henry Cheng Kar-shun spent HK$208.9 million boosting his stake in the i-Cable last month and he took up the role of chairman while Chiu became vice-chairman this month.

Chiu said he thinks Cheng will be the right person for the job and he is pleased to see that Cheng wants to push i-Cable to the next level.

(The Standard)

To Kwa Wan project draws interest of big guns

The Urban Renewal Authority had received a total of 31 expressions of interest for the combined development of four projects located at Hung Fook Street, Kai Ming Street and Wing Kwong Street in To Kwa Wan, after the invitation for submissions closed yesterday.

New World Development (0017), China Overseas Land & Investment (0688), Nan Fung Group and Wheelock Properties are said to be among the ones that filed the expressions.

A review panel under the URA board will shortlist developers based on their development experience and financial capability and invite them to submit tenders.

The four projects with a total site area of 5,438 square meters covering two adjoining sites, namely Hung Fook Street/Kai Ming Street and Wing Kwong Street/Kai Ming Street, will provide a total gross floor area of 48,942 sq m upon completion.

In the primary market, Manor Hill in Tseung Kwan O unveiled the fourth price list offering 200 units at an average discounted price of HK$22,955 per sq ft, nearly 10 percent higher than the first batch launched more than a month earlier, the developer Kowloon Development (0034) said.

In Ngau Tau Kok, The Aperture, which will launch the first round of sales of 100 flats on Saturday, received at least 1,200 checks, according to the builder Hang Lung Properties (0101).

And in Kai Tak, The Henley III by Henderson Land Development (0012) also launched its latest price list yesterday, providing 41 flats at an average price per sq ft of HK$28,060 after discounts.

In other news, a property consultancy expects Hong Kong property prices to rise by about 3 percent year-on-year next year as more buyers are entering the market in the low-interest-rate environment.

It expects 73,000 home transactions to be recorded this year, with the number will falling to 60,000 to 65,000 next year.

(The Standard)

Property consultancy predicts 3pc hike for home prices

Property consultancy expects Hong Kong property prices to rise by about 3 percent year-on-year next year as more people are entering the market in the low-interest-rate environment.

The projected increase slows down compared to this year, mainly because property prices have reached historic highs, and if the border between Hong Kong and China reopen next year, the prices of luxury homes are expected to rise by 3-5 percent, it said.

the consultancy said that residential rents will increase about 2 percent year-on-year in 2022, underperforming the property prices, and the annual rental returns are expected to remain at a low level of about 2 percent.

It also anticipated that about 73,000 home transactions will be recorded this year, while that of next year will fall back to 60,000 to 65,000.

Government land sale revenue could reach HK$100 billion to HK$110 billion in 2021 driven by large commercial land sold in Central and Causeway Bay and the 2022 revenue is expected to drop to between HK$40 billion and HK$60 billion, it said.

(The Standard)

Offices may decamp to Hong Kong’s Causeway Bay amid rental crash in the world’s costliest retail strip

The monthly net office rent in Causeway Bay averaged HK$60.4 (US$7.74) per square foot, about half the charge in Central, according to property consultancy

Central’s October rent rose 0.5 per cent from a month earlier, while Causeway Bay was unchanged

Causeway Bay looks increasingly more appealing as an office address, amid the rental crash in what was until recently the world’s most expensive retail shopping district.

The monthly net office rent in the district between Hong Kong’s Wan Chai and Quarry Bay averaged HK$60.4 (US$7.74) per square foot, just about half the HK$113.6 per square foot in the city’s Central financial hub, according to property consultancy. Central’s October rent rose 0.5 per cent from a month earlier, while Causeway Bay was unchanged.

“Causeway Bay’s rent is between Central and Quarry Bay,” property consultant said. “Compared with Wan Chai, office buildings in Causeway Bay are newer and of higher quality, which are also reflected in the discrepancy in rents and vacancies.”

The district, particularly the Russell Street thoroughfare, commanded the world’s most expensive retail rents for six consecutive years until 2020, boasting flagships by such luxury designers as Burberry, La Perla and Prada. The Italian designer Prada left Russell Street last year after months of street protests and Covid-19 pandemic, a departure that forced the landlord to slash rents by 44 per cent to fill the vacancy, kicking start a domino effect that weighed on rental charges throughout the district.

One investor betting on Causeway Bay’s potential as a prime office zone is H Development Holdings Limited, which counts the 28-storey retail commercial complex Henry House and the 24-floor Biz Aura office building in its property portfolio. H Development recently completed the redevelopment of a commercial building in Causeway Bay, the 25-storey HDH Centre on Irving Street.

“HDH Centre is our flagship for 2021, a Grade A commercial complex located at the heart of Causeway Bay and primed to become a landmark in the community,” said Eric Ng, H Development’s chairman. “The group is optimistic about the market and potential of Causeway Bay.”

One of HDH Centre’s first tenants is the German home appliance brand Bosch, which will relocate its flagship from Central to occupy the entire first floor. The building’s third to eighth floors will be dedicated to food and beverage outlets, and the rest for office tenants.

“We place great emphasis on the Hong Kong market, hence we are very selective when considering the new location for our Hong Kong flagship store,” a Bosch spokesman said. “HDH Centre is a new completed complex with stylish architectural design. It is conveniently located at the heart of Hong Kong’s commercial and entertainment hub... A mere three-minute walk from Causeway Bay MTR station, convenient transport means a high number of visitors from time to time. Relocating our showroom to Causeway Bay puts us in a better position to reach our targeted premium customers.”

In Tower 535 on Jaffe Road also in Causeway Bay, co-working giant IWG has taken over the space vacated by rival WeWork.

On Causeway Bay’s waterfront, the Mandarin Oriental Hotel Group shuttered The Excelsior hotel in 2019 to redevelop the site into a 26-storey office tower at a cost of US$650 million, scheduled for completion in 2025.

Companies, particularly those that do not require marquee addresses to impress customers, have been driven out of the Central district by its record rental charges, decamping to Hong Kong’s outlying districts such as Quarry Bay or Tsim Sha Tsui. Causeway Bay, with its crowded streets, and high-end shopping centres, had not been high on the selection list until now, the consultant said.

Grade-A office rents on Hong Kong Island may increase by between 5 and 10 per cent, especially in Central, Admiralty and Wan Chai, the property consultancy said.

As several companies have recently expanded their footprints or moved back to Central, the office rents in the district are likely to rise faster. This in turn will add appeal to Causeway Bay as a good alternative for corporate offices.

“Given its status, the quality of [the area’s] buildings and other attractions, the office rental market in Central is expected to recover and rise much faster while rents in Causeway Bay are likely to take time to fully recover,” the property consultant said.

(South China Morning Post)

For more information of Office for Lease in HDH Centre please visit: Office for Lease in HDH Centre

For more information of Office for Lease in Tower 535 please visit: Office for Lease in Tower 535

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

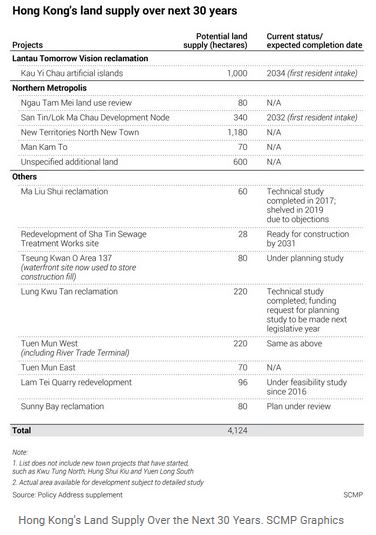

Outlook dims on Kai Tak’s waterfront land as Hong Kong’s Northern Metropolis plan and land conversion add to city’s supply glut

Five plots of housing land at Kai Tak, valued at a combined HK$71.3 billion (US$9.15 billion), may fail to live up to expectations when they go on sale, analysts said

One of the plots was sold last week at a discount of 10.8 per cent from its purchase price in 2018

A distressed sale last week at Hong Kong’s former Kai Tak airport site has clouded the outlook of the city’s property market, as an expected glut of residential land weighs on prices.

Five plots of land at Kai Tak, valued together at up to HK$71.3 billion (US$9.15 billion), may fail to live up to expectations when they go on sale, analysts said. The parcels - yet to be converted from commercial land into residential usage - can yield about 5,800 average-size flats, according to the rezoning proposal in Hong Kong’s 2021-2022 budget announced in February by Financial Secretary Paul Chan Mo-po.

Another factor that puts a cap on prices is the city government’s plan to develop the Northern Metropolis in the New Territories, where at least 900,000 homes may be built over the next 20 years to accommodate 2.5 million people and alleviate Hong Kong’s crowdedness.

“Land prices may soften, rather than be on the rise,” a surveyor said. “The likely supply in Kai Tak and the Northern Metropolis will relieve upwards pressure. The [slump] in the stock market will also make developers more prudent in making their bids.”

Kai Tak, where Hong Kong’s main airport operated from for more than seven decades until 1998, measures 323 hectares (798 acres). It is an important part of the transformation of eastern Kowloon into a central business district to sustain the city’s development, first outlined in 2011 by former Chief Executive Donald Tsang.

Since then, Kai Tak has grown into an upscale residential area, especially on the narrow strip of land protruding into Victoria Harbour where the former airport runway was, as it offers seafront view on three sides. KWG Group Holdings and Longfor Group have launched their Upper Riverbank apartments, where a four-bedroom ground floor flat with a garden sold in October for HK$79 million.

A number of Chinese developers – exemplified by the voracious asset buyer HNA Group before it went bust in January – snapped up Kai Tak’s plots at record prices in late 2016 and early 2017, driving land prices to between HK$15,000 and HK$18,000 per square foot.

The former airport’s transformation puts the impetus on Kowloon Bay and Kwun Tong nearby to drive the area’s development as a central business district, said Leo Cheung, adjunct associate professor at the University of Hong Kong.

“If proper provisions of infrastructure have not been sufficiently provided, pressure on land prices is expected,” he said.

Prices have corrected since those heady days. Kaisa Group, one of the Chinese developers now buckling under debt, last week sold a plot of Kai Tak land for HK$7.9 billion (US$1 billion) in cash and assumed debt, a discount of 10.8 per cent to the price that a distressed rival paid in 2018.

Kaisa’s Area 4B Site 4 was bought by a venture backed by New World Development and Far East Consortium International. Next to it, Area 4C Site 4 is valued at HK$14.5 billion, while Area 4C Site 5 may be worth HK$11.8 billion, according to another surveyor.

Two of the five rezoned housing land face the Victoria Harbour at the end of the former runway, with the most breathtaking view among all other residential parcels in Kai Tak.

“Land prices could be very volatile [in Kai Tak], depending on changes in market condition and sentiment,” and could “easily vary by more than 10 per cent,” the surveyor said.

(South China Morning Post)

Blackstone, SilkRoad turn Hong Kong’s industrial property into a hotspot with 54 per cent jump in investment

Global real estate funds accounted HK$17.3 billion or 61 per cent of industrial property transactions so far this year, up from 21 per cent share in all of 2020

Hong Kong’s industry revitalisation programme could boost supply and test market resolve on investment returns over the next two years

Global institutional funds have stepped up their purchases of industrial property in Hong Kong this year by 54 per cent, as Covid-19 continues to support bullish demand for data-centre and cold-storage facilities.

They spent HK$17.3 billion (US$2.2 billion) or 61 per cent of total transactions of such assets so far this year, according to a property agency based on deals valued above US$10 million threshold. The funds invested HK$11.2 billion or just over one-fifth of the total in all of 2020.

“New industrial-related businesses such as data centres, cold storage and self-storage are in keen demand, which encourages some value-add potential of old warehouse buildings,” an agent said.

Covid-19 cases have continued to spread as new and more infectious variants emerged, underpinning consumption patterns that fuel demand for logistics assets in the city. As a result, growing e-commerce has fuelled aggressive buying by global real-estate funds, industry consultants said.

Among recent notable transactions, US private equity giant Blackstone acquired an industrial building named Elegance Printing Centre in Shau Kei Wan on Hong Kong Island for HK$500 million.

Industrial assets in Tuen Mun in New Territories have also become a key target for global funds with at least three major deals recorded in the third quarter.

CR Logistics paid HK$2.24 billion for the first phase of East Asia Industrial Building and HK$695.4 million for Mineron Centre, according to data published by another agency. Silkroad Property Partners paid HK$1.1 billion for several units and floors in Block C of Hang Wai Industrial Centre, its fifth acquisition in its Hong Kong portfolio.

Investors, however, are facing one drawback as the surge in investment has shrunk returns. The sector will also need to contend with rising supply as old buildings are redeveloped.

“Robust investment sentiment for warehouse assets so far this year has already pushed prices up by 6.8 per cent and yields down to 3.3 per cent, an all-time low, indicating diminishing investment returns,” property agent said.

The Hong Kong government has approved 57 applications to demolish old industrial buildings over the past three years under its revitalisation programme, adding 12.7 million sq ft of space into the market. Given the success, the policy is being extended to October 2024.

A total of 7 million sq ft of new warehouse space is expected to come on stream over the next two years, the agent said. With little pre-commitment so far, this is expected to test market resolve when the new supply enters the market, the agent added.

In the immediate term, however, demand for logistics assets appears to be sustainable as the local and global supply chains continue to recover. That makes the industrial property sector more appealing, given the downward pressure in rents for office and retail properties in the city.

“It is a global trend and it will support the rental for data centres and warehouses,” another agent said. “The low entry ticket prices have turned industrial buildings into a hotspot among global funds.”

(South China Morning Post)