據代理行最新商廈租金統計,中環超甲廈呎租為134元,而傳統甲廈租金約103元,兩項數字按年跌約3.7%,跌幅明顯較去年收窄。其他地區方面,邊緣區跌幅較大,灣仔呎租約53.2元,按年跌1成,而金鐘商廈亦按年跌7.7%。九龍區方面,尖沙咀及東九龍呎租分別為56.9元及30元,按年跌3.3%及5.9%。

該代理行指,中環整體商廈租金回調後,漸吸引租客進駐,令中區空置率連續6個月下跌,至最新的7.4%,而周邊商業區如銅鑼灣及灣仔,空置率亦輕微回調至7.1%及7.6%。

美銀續租長江集團中心7層

區內近期租務活動上,美銀續租長江集團中心37至40樓4層、以及52、53、55樓即合共7層,總樓面約15萬平方呎,該集團於2014年9月起租用,租約期8年,呎租約100餘元。據悉,該集團於上月與業主提早訂立新租約,涉及7層樓面,租約期由2022年9月至2028年,租約期6年,另外有3年續租權。此外,首3年月租約1,677.6萬元、呎租約112元,屬市價水平。

至於今年區內最大手新租個案,為國際金融中心一期兩全層,連同部分單位,合共約5.3萬平方呎,成交呎租料約130元,按國際金融中心一期高峰期,呎租高達180元計,因疫情影響商業活動,租金亦從高峰回落近3成。新租客為中資金融機構中金公司,該機構早於2000年租用物業,最初佔用一層樓面,其後不斷擴充。據悉,機構近月有意擴充,而業主亦把部分樓面整合,包括早前澳洲基金麥格理棄租樓面,合共約5.3萬平方呎,連同集團原租用的7萬平方呎續租,合共涉及約12萬平方呎,成為該廈最大租戶。

7成港企有意增加寫字樓

該行指,外界普遍認為疫情和實行「在家工作」會影響寫字樓的吸納量,但根據該行全球 (Y) our Space「你我空間」報告,約70%的香港企業表示在未來三年考慮增加寫字樓租用面積,可見寫字樓空間對香港企業的重要性並沒有因疫情而發生大改變。

後市方面,該行認為,隨着中環寫字樓租賃需求回升,寫字樓「再中心化」的迹象愈來愈明顯和業主積極填補空置寫字樓的決心,導致中環空置率下跌及租金水平持續上升。中環整體寫字樓租金跌幅放緩,今年首11個月的累積跌幅少於3%。展望明年,港島甲級寫字樓租金有5至10%的升幅,當中以中環、金鐘和灣仔的升幅最顯著。至於新供應,未來兩年港島區將有超過280萬平方呎的新寫字樓面積,供應主要集中在中環和鰂魚涌。

(經濟日報)

更多長江集團中心寫字樓出租樓盤資訊請參閱:長江集團中心寫字樓出租

更多國際金融中心寫字樓出租樓盤資訊請參閱:國際金融中心寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

九龍租務增3成 租金料平穩

九龍商廈租金平穩,有代理行指,今年區內新增租務逾35%,租金已見底,明年料平穩。

該代理行指,2021年九龍區的寫字樓需求錄得輕微回升,新簽訂的寫字樓租賃個案按年大幅增加35.5%,迹象顯示租金已經見底。

積金局洽租觀塘新廈8萬呎

東九龍新供應多,新甲廈獲大手洽租。消息指,新地 (00016) 旗下觀塘巧明街98號寫字樓項目,明年中落成。其中8萬平方呎樓面獲洽租,呎租約30元。項目總樓面115萬平方呎,其中兩幢寫字樓合共約65萬平方呎,而兩幢樓面每層面積,分別約2.2萬及1.3萬平方呎。

據了解,洽租機構為積金局,機構目前有數個辦公點,包括九龍貿易中心A座全層、觀塘創紀之城一期一座,同屬新地旗下寫字樓,另集團亦租用中環南豐大廈樓面。相信是次積金局大手租觀塘新項目,可作整合業務。

該行分析,很多企業永久地實行在家工作,引發不少租戶重新審視並優化其房地產策略,從而帶動搬遷需求,租賃需求溫和上升,支持租金水平。以上的因素減輕商務環境疲弱帶來的影響,因此九龍區的寫字樓租金下跌幅度相對香港島的跌幅較輕微,預計九龍區的寫字樓市場在2022年將較為平穩且稍稍由租戶主導。業主將繼續爭取市場上高質素的租戶進駐,但預計租戶跟業主的議價空間相比2021年初收窄。

(經濟日報)

更多九龍貿易中心寫字樓出租樓盤資訊請參閱:九龍貿易中心寫字樓出租

更多葵涌區甲級寫字樓出租樓盤資訊請參閱:葵涌區甲級寫字樓出租

更多創紀之城寫字樓出租樓盤資訊請參閱:創紀之城寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多南豐大廈寫字樓出租樓盤資訊請參閱:南豐大廈寫字樓出租

更多上環區甲級寫字樓出租樓盤資訊請參閱:上環區甲級寫字樓出租

代理行:上月商廈錄102宗升26%

本港疫情走勢穩定,為商廈市場釋出正面訊息。據本港一間代理行指出,上月全港商廈市場錄102宗買賣登記,按月回升26%,屬連跌兩個月後錄反彈,惟料本月商廈交投仍備受壓力。

該行代理表示,據統計數據顯示,11月全港共錄102宗商廈買賣登記,較10月81宗升26%,屬連跌2個月後反彈並重上百宗水平。

雖然11月登記量顯著上升,但成交額卻急挫49%,主因是前月曾錄得一宗近12億的大額登記拉高基數所致,故拖累11月商廈買賣登記金額、減至只有約15.31億,創近8個月來的新低。至於11月最矚目的單一登記項目為觀塘觀塘道368號37樓A室連天台,涉及合約金額逾1.56億;其次為同座商廈36樓A室連平台的近1.45億登記。

料本月交投回軟

至於以地區劃分,在該行觀察的11個分區當中,共有5區的登記量按月上升,當中以九龍灣區的2.5倍升幅最高,由前月的4宗大增至上月共有14宗。此外,觀塘區及上環、中環及金鐘區亦分別錄得5宗及15宗登記,分別按月上升1.5倍及1.1倍。

代理指出,早前對12月市況感樂觀,不過,11月下旬先後有美國聯儲局表明收水及預期來年加息,以及突然爆發Omicron變種病毒,加上11月中旬以來的1個月,港股再度急挫近2300點,令原先反彈的商廈市道再受壓;因此相信反映上述期間市況的12月份登記量將再度回軟,料按月下跌一成,跌至約90宗的水平。

(星島日報)

更多觀塘道368號寫字樓出售樓盤資訊請參閱:觀塘道368號寫字樓出售

更多觀塘區甲級寫字樓出售樓盤資訊請參閱:觀塘區甲級寫字樓出售

大手工商鋪交投按年倍升 九龍灣國際展貿中心全幢作價105億最矚目

本港疫情走勢穩定,投資市場氣氛持續改善,帶動買賣價量齊升,今年逾億元工商鋪買賣錄約163宗,按年急升約1.14倍,成交金額亦升1.08倍,外資基金及機構投資者撐起市場,最矚目為億京等合組財團向合和購入九龍灣國際展貿中心,作價約105億。

疫市下工商鋪大手交投回暖,據一間外資代理行統計資料顯示,截至今年12月,逾億元工商鋪大手成交共錄約163宗,較去年全年的76宗,按年急升約1.14倍,成交金額錄約692億,較去年的331.89億按年上升約1.08倍。當中,最矚目為由億京等合組財團向合和購入九龍灣國際展貿中心,作價約105億,以總樓面約177.5萬方呎計,平均呎價5900多元,買家有意重建甲廈或大型住宅。

錄163宗按年倍升

今年以來,各路買家齊出動,領展於11月公布,以31.2億及27億,向本港老牌汽車經銷商仁孚行,收購紅磡及柴灣2座汽車服務大樓,合共斥資58.2億,較整體物業估值60.8億折讓4.3%。兩幢物業均設有汽車服務中心,其中紅磡物業為綜合用途停車場大廈,柴灣物業為一座倉庫大廈,是領展首度將資產組合納入倉庫。根據買賣協議,仁孚行售後將會租回有關物業,並定立5年租約及最多9年續租權,確保每份租約期限內每年租金升幅達4%。

金額692億升1.08倍

另一代理表示,今年工商鋪市場繼續升溫,相關利好措施令整體入市成本降低,相比其他投資產品,回報相對穩健,吸引投資者目光。整體環境而言,疫苗接種人口持續增加,雖然疫情仍有反覆情況,但始終港府致力重振經濟,前景有所好轉。

有代理稱,疫情至今揮之不去,但本港政經環境逐步回穩,為市場釋出正面訊息,香港作為國際金融中心,吸引世界各地投資者伺機入貨,加上亞洲地區疫情較歐美國家為穩定,故本港市場被環球各國投資「吼準」;對於美國聯儲局早前公布逐步減買債,翟聰回應指,現時息口基數仍屬低水平,加上現今市場資金仍然充裕,同時,儘管聯儲局加息,本港銀行亦不一定同步跟隨,加息幅度亦相當有限,故對後市仍感樂觀。

領展60.8億購兩物業

該代理續指出,近期工廈市場交投暢旺,其購買力主要來自外資基金或基構性投資者 (INSTITUTIONALBUYER),受動亂及疫情等影響,令交投轉趨淡靜,去年成交量為過去10多年來新低,市場累積一定購買力,加上期間環球央行持續量化寬鬆,令市場游走資金相當充裕,今年第三季本港M3數字處歷史高位徘徊,外資基金及機構性投資者亦順勢大舉集資,同時亦積極為資金尋找出路。

整體工商鋪交投回暖,當中以工廈物業於今年以來可謂「獨領風騷」,代理行統計資料顯示,工廈市場於今年以來錄56宗逾億大手成交,成交額逾285億,為工商鋪三範疇中金額最旺,較去年全年76億,按年急升約2.75倍,並以領展出手買倉庫最轟動。寫字樓及鋪位分錄46宗及61宗大手成交,成交金額分別為202.7億及203.9億。

另一代理表示,據該行統計資料顯示,今年錄約3894宗工廈買賣成交,總金額約571.71億,較去年比錄價量齊升,宗數升約61%,成交金額增約1.6倍。

代理續指,今年矚目成交首推全幢工廈,本年度錄約24宗全幢工廈成交,為2014年後新高紀錄。除全幢工廈外,一手物業近期亦異軍突起,由麒豐資本及廣興置業集團合作發展新蒲崗東傲銷情理想,項目暫錄得最高成交呎價約1.15萬,創區內新高。

(星島日報)

更多九龍灣國際展貿中心寫字樓出租樓盤資訊請參閱:九龍灣國際展貿中心寫字樓出租

更多九龍灣區甲級寫字樓出租樓盤資訊請參閱:九龍灣區甲級寫字樓出租

「鋪王」鄧成波離世 家族頻大手沽貨

回顧今年,「鋪王」鄧成波今年5月突然離世,該家族頻沽售旗下物業,據本報統計,至今沽約45項物業,合共套現逾110億,涉及工商鋪、住宅、車位及地皮等物業,帶旺整體投資市場,最大宗的為屯門東亞紗廠工業大廈,作價約22.4億。

沽45項物業套現110億

有代理指出,今年第二季,工商鋪買賣氣氛明顯升溫,「鋪王」鄧成波家族大規模沽貨,包括工商鋪、舊樓及車場等各類型物業,為市場掀起千重浪,更吸引部分久未露面的資深投資者尋寶,繼而帶動第二季工商鋪成交量按季跳升近兩成,成交金額亦增逾八成。

波叔逝世後,其家族着手重整資產組合,列出物業放售清單,由於資產多元化,當中包括工商鋪物業外,亦有全幢舊樓、地盤及停車場等不同類型項目,當中個別更以價清晰、有票即簽作招徠,吸引投資者目光。

24億售屯門粉嶺兩工廈

該批物業成為追逐對象,亦帶旺整體投資市場,當中較大額成交為以總價約24億售出兩幢全幢工廈,分別為屯門東亞紗廠工業大廈及粉嶺勉勵龍中心,新買家為華潤物流,帳面獲利合共近10億。

根據本報統計,鄧成波家族沽貨的盤源當中,部分獲利豐厚,部分則蝕讓,其中,蝕讓最大宗的為葵涌中央工業大廈全幢,作價9億,物業購入價為10.8億,帳面虧損1.8億。

平均呎價約5211元

鄧成波家族最新一宗買賣為,沽售大角嘴中華漆廠大廈一籃子物業,作價2.88億,獲博富臨置業承接。上址為大角嘴雅蘭街5B號廣東道1163號中華漆廠大廈一籃子物業,包括該廈1樓至9樓及屋頂平台,總樓面約55258方呎,平均呎價約5211元。

同時,物業亦由家族作為旗下生意的大本營,交易完成後,上址除一樓外,將以月租56萬租予賣方,為期兩年。資料顯示,鄧成波家族於2011年以約2.06億購入上址,故持貨10年帳面獲利8200萬,物業期間升值近4成。

(星島日報)

堡獅龍1.84億沽荃灣工廈兩單位 涉4.1萬呎 其士國際承接

工廈物業於疫市下表現「硬淨」,市場再錄大手成交;由堡獅龍國際持有的荃灣長豐工業大廈兩單位,以交吉形式約1.84億售出,錄出售收益約1.73億,買家為其士國際,以總樓面約41051方呎計,呎價約4500元。

堡獅龍國際昨日公布,該公司以約1.847295億、售出荃灣白田壩街23至39號長豐工業大廈兩單位,買方為其士國際全資附屬公司,涉及物業為該工廈高座8樓1室、風櫃房及高座8樓2室,建築面為41051方呎,以易手價計,平均呎價4500元。

錄出售收益1.73億

該公布亦指出,上述物業曾出租,惟租賃協議已完結,故以交易形式售出,集團預期完成出售事項後錄得出售收益約1.73億,並指出售上述物業將改善集團流動資金及財務狀況。

成交呎價4500元

消息人士表示,其士國際購入作新業務用途;據代理行資料顯示,該工廈近期頻錄買賣,其中,該工廈4室單位,面積約10330方呎,於本年11月以4800萬售出,呎價約4647元。

建華20萬租龍豐花園鋪

另一方面,據市場消息指出,上水龍琛路33號龍豐花園地下單號鋪,建築面積658方呎,於交吉近半年後,獲建華集團以約20萬承租,平均呎租約303.9元,該鋪早前由連鎖零售商以約15萬租用,惟於今年4月結業,故該鋪交吉逾半年後,最新租金較舊租上升約33%,屬區內一綫街道罕見的鋪位租金上升個案。

據業內人士指出,受疫情衝擊,拖累上水區內一綫街道鋪位租金應聲而落,區內藥房等商戶結業聲音亦不絕於耳,惟上址位處傳統街市地段,備受民生消費支持,人流亦相當不俗,故吸引建華集團以進取價承租。

另一代理評論指,街市行業屬疫市奇葩,該集團早前亦頻頻入市,上述鋪位屬區內一綫龍頭鋪,同類物業於市場上少有放盤,故吸引建華集團以進取價承租。

事實上,建華集團近期頻頻入市,本報早前獨家報道,由「小巴大王」馬亞木持有的深水埗長發街全幢商住樓以7800萬易手,買家為建華集團相關人士,總樓面約4000方呎,呎價約1.95萬,原業主於2005年以1800萬購入,持貨16年帳面獲利約6000萬,物業期間升值約3.3倍。

(星島日報)

英皇6.88億沽筲箕灣地盤 高帳面值逾30% 老牌家族成員購入

港島市區地皮供應罕有,吸引不少財團出手選購,由英皇國際持有的筲箕灣南安街地盤項目,新近以6.88億易手,成交價較帳面值高逾3成,新買家為信裕行,並由本港老牌家族成員姚帥麟持有,據業界人士,因港島區新盤供應罕有,料項目落成後,單位每呎售價達2.5萬至2.8萬。

英皇國際昨日宣布,以6.88億售出筲箕灣南安街67至77號地盤項目。該項目原為3幢相連舊樓,地盤總面積約5900方呎,有關項目出售所錄得的盈利約為2.141億,出售事項所得款項淨額估計約6.875億,將用作集團的未來業務發展及一般營運資金,是次交易預計於2022年4月29日完成。

英皇國際執行董事張炳強表示,該項目為住宅甲類地盤,集團早年已展開收購,並於今年年中統一業權,現售價比帳面值高逾30%出售,是一個良好時機,並符合集團及股東的整體利益。出售事項的所得款項淨額除了可提升集團的財務狀況,並為未來投資更優質、更具發展潛力的項目提供額外儲備資金。

張炳強︰符合集團及股東利益

翻查資料,上述地皮位距離筲箕灣港鐵站約5分鐘步程,其中,南安街67、69、69A及71號仲齊大廈,現為1幢樓高8層的商住物業,樓齡約57年,地下為3間商鋪,1至7樓共28伙住宅,英皇於今年7月底強拍該項目,並以1.95億成功投得。

南安街67至71號地盤面積約3000方呎,按照項目地積比率約8.4倍計算,料可建樓面約2.52萬方呎。

另外,英皇早年併購毗鄰的南安街73號舊樓、南安街75號合榮大廈,以及南安街77號茂發樓,合共地盤面積約2900方呎,若按住宅8倍地積比計算,可建樓面約2.32萬方呎。

南安街67至77號項目可建樓面合共4.84萬方呎,英皇早前曾計畫合併發展該地盤,預計項目可興建1幢約25至26層高商住物業,提供約168伙。

地盤總面積5900方呎

至於買家方面,據英皇公告所示,上址買家為信裕行,主要從事物業發展,該公司由本港老牌家族成員姚帥麟持有。

姚帥麟鍾情投資具重建價值的物業,曾於2018年初,斥資1.1億購入跑馬地山村臺9號一幢全幢住宅,物業當時樓齡已達68年。

該物業地盤面積約4864方呎,為住宅乙類用地,高度限制不超過4層高。

公司由姚帥麟持有

有測量師指出,預期上述項目可建總樓面約48400方呎,每呎樓面地價約14215元,同時亦認為,港島地皮向來造價不俗,預期是次英皇沽出的筲箕灣南安街67至77號地盤,日後單位每呎可售至少2.5萬至2.8萬元。

目前港島地皮供應罕有,以致區內新盤亦供應匱乏,區內一手住宅呎價一般可達3萬元,因此今次南安街地盤造價較估值高3成屬合理範圍,但對買家而言尚算划算。

英皇近年頻頻併購港島舊樓,集團於今年7月份以2.59億統一西營盤高陞大樓業權,項目地盤面積約2144方呎,以地積比率約9倍計,可建樓面約19296方呎,每呎地價約13422元。

每呎樓面地價約1.4萬

高陞大樓樓齡約55年,位於西營盤皇后大道西78至80號及荷李活道265至267號,對外交通方便,毗鄰荷李活道公園,以及西營盤港鐵站。

同月,英皇又以1.1億購入香港仔舊大街72號舊樓全幢,而毗鄰的74至80號地盤,集團早已統一業權,並已完成清拆,項目佔地為4289方呎,將興建為1幢樓高23層的商住物業,總樓面約3.8萬方呎,提供約110至120伙。

七月以逾三億購港島兩舊樓

英皇本月向土地審裁處申請強拍上環皇后大道西70至76號舊樓,以統一業權發展,目前該財團平均持有85.714%業權,市場對整個項目估值逾2.7613億,預期將與毗鄰的皇后大道西78至80號及荷李活道265至267號高陞大樓地盤合併發展,屆時總地盤面積擴展至約5505方呎,涉及可建總樓面約49545方呎。

(星島日報)

Emperor gains $214m in Shau Kei Wan sale

Emperor International (0163) said it expected to record a gain of HK$214 million from the disposal of a site in Shau Kei Wan at a consideration of HK$688 million.

The 5,900-square-feet site at 67-77 Nam On Street was originally occupied by three adjoining old buildings which it started to acquire earlier and unified their ownership in the middle of this year.

The proceeds will be used for business development and as general working capital and the transaction is expected to be completed on April 29, 2022.

Also announcing asset disposals yesterday was clothing company Bossini International (0592), which sold two adjacent units in an industrial building to property developer Chevalier International (0025) for HK$184.7 million.

The two rooms in Cheung Fung Industrial Building in Tsuen Wan with a total gross floor area of 41,051 sq ft are expected to bring a profit of HK$173 million to Bossini upon completion of the deal, it said in an exchange filing.

Meanwhile, in the primary market, the second round of sales of the Yoho Hub atop Yuen Long MTR Station will take place on Sunday, said the developer Sun Hung Kai Properties (0016). A total of 209 units including 204 units in price lists and five via tenders will be available on the day.

(The Standard)

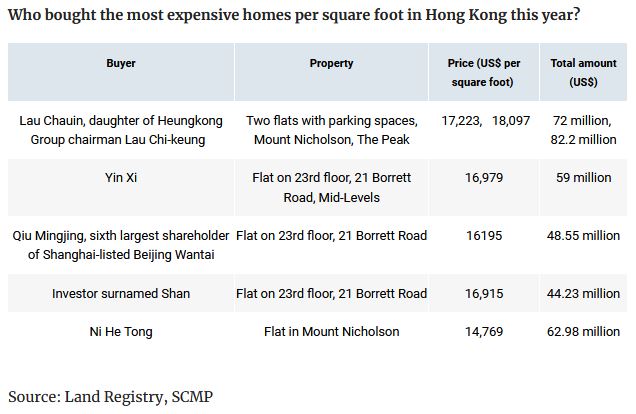

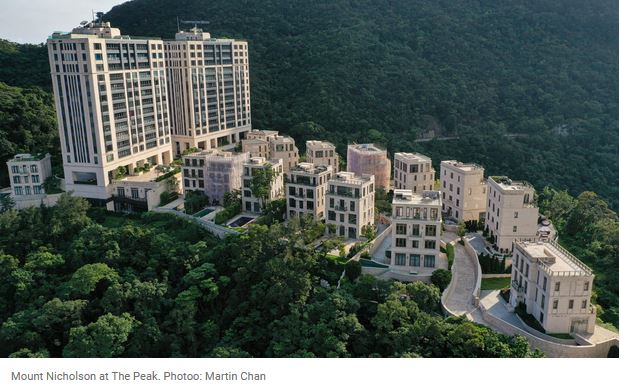

Lifestyles of the ultra wealthy: 2 Hong Kong addresses had the city’s 5 priciest homes in 2021

Most transactions this year concentrated in Mount Nicholson on The Peak and 21 Borrett Road in Mid-Levels

‘New Hongkongers’, or recent permanent residents, comprised 60 per cent of the owners at these two developments

Hong Kong saw the record for per square foot prices of luxury homes being set a couple of times in 2021.

Most of these transactions were concentrated in two areas: Mount Nicholson on The Peak and 21 Borrett Road in Mid-Levels.

Nan Fung Development and The Wharf (Holdings) paid HK$10.4 billion (US$1.33 billion) for the Mount Nicholson site in an auction in July 2010. At HK$32,014 per square foot, it was the third-highest land price in the city’s history at the time. Analysts had expected it to sell for between HK$8.7 billion and HK$11.4 billion. The 2.33-hectare site was the location of government staff quarters that had sat empty for years.

The site at 21 Borrett Road was sold to the then Cheung Kong (Holdings) in June 2011 for HK$11.65 billion in an auction. Analysts had expected the site to fetch between HK$12 billion and HK$15 billion. The price paid was the second highest at that time, just behind the HK$11.82 billion paid in 1997 for the Island Resort site in Siu Sai Wan. At HK$26,763 per square foot, it was also the third-highest at that time.

“New Hongkongers”, or those who have recently acquired permanent residency in the city and do not have to pay the extra 30 per cent stamp duty levied on non-permanent residents for property purchases, comprised 60 per cent of the owners at these two developments, according to land title searches conducted by the South China Morning Post in June.

Such buyers preferred the large flats of these two projects to houses as they tended to divide time between Hong Kong and mainland China, and these flats required less maintenance, a property agent said. Many bought two neighbouring flats for larger spaces as well.

More record-breaking deals are expected in 2022, as developers tend to sell new luxury homes slowly to generate the highest price possible, the agent said. Moreover, with the border with mainland China expected to open in the new year, mainland buyers are expected to return to the Hong Kong housing market and drive up sales.

Here are this year’s top five buyers of the most expensive new flats in Hong Kong on a per square foot basis.

Lau Chauin

Lau, the daughter of Lau Chi-keung, the chairman of Heungkong Group, which has interests ranging from logistics and finance to health care and property development on the mainland, bought flats 16C and 16D in phase three of Mount Nicholson for a combined HK$1.2 billion last month.

The 4,544 sq ft Flat 16D, which comes with three parking spaces, sold for HK$639.8 million, or HK$140,800 per square foot, making it Asia’s most expensive flat on a per square foot basis. It broke the record held by a flat in CK Asset Holding’s 21 Borrett Road project. That flat, which also comes with three parking spaces, sold for HK$459.4 million, or HK$136,000 per square foot, in February.

The 4,186 sq ft Flat 16C sold for HK$560.92 million, or HK$134,000 per square foot.

Yin Xi

Yin, about whom little is known and whose name is identical to the director of five closely held companies, according to the Companies Registry, bought Flat 1 on the 23rd floor of 21 Borrett Road in February, according to Land Registry documents.

The five-bedroom flat in the project’s phase one sold for HK$459.4 million through tender and held the record before Lau’s purchase of flats 16C and 16D in Mount Nicholson.

The 3,378 sq ft flat in Hong Kong’s Mid-Levels, at HK$136,000 per square foot, broke a record held by flats 12C and 12D at Mount Nicholson. These flats sold for HK$1.17 billion, or about HK$132,100 per square foot, in November 2017.

The buyer is a Hong Kong permanent resident, as documents showed that they only paid a basic stamp duty of 4.25 per cent for the Borrett Road property, or about HK$19.52 million.

Yan Hongyan

Yan reportedly bought Flat 6 on the 23rd floor of 21 Borrett Road for HK$377.37 million in March, and then transferred the title to Qiu Mingjing in June. At 2,995 sq ft, the flat’s price translates to HK$126,000 per square foot.

Qiu is a big investor in Hong Kong property. She was the sixth-largest shareholder of Shanghai-listed Beijing Wantai with 4.8 million shares, or a 1.1 per cent stake, according to the firm’s 2020 annual report

Shan

An investor with the surname Shan, whose first name is not known, reportedly bought Flat 3 on the 23rd floor of 21 Borrett Road for HK$344.1 million in April. At 2,731 sq ft, the price translates to HK$126,000 per square foot. Shan is said to have paid an extra 15 per cent in stamp duty, or HK$51.6 million, as it was not their first property.

Ni He Tong

Ni bought flat 8C in phase three of Mount Nicholson for HK$490 million in January, according to media reports citing Land Registry records. At 4,266 sq ft, the price translates to HK$114,906 per square foot. Ni was said to be a first-time buyer, having paid only 4.25 per cent in stamp duty, or HK$20.83 million.

(South China Morning Post)

Why Hong Kong home renters will pay more next year

Home rents have already rebounded, rising by 3 per cent in 2021

Supply is limited, but there is a lot of demand, analyst said

Hong Kong home rents will rise next year by as much as 5 per cent, with small to medium and nano flats near universities and MTR stations gaining the most, analysts said.

Small to medium gain the most, with rents of homes near universities and MTR stations also rising, said analysts from two property agencies.

Rents in the private residential sector have already rebounded in 2021, rising by 5 per cent, after being battered for two years by the city’s social unrest and the pandemic, according to a property agent. “Average rents increased by about 2.3 per cent [this year] up to November,” the agent said. “It’s the first increase after the past two years’ drop.”

The city’s revised rental index dipped for two consecutive months, falling 1 per cent in October and November, after rising for seven straight months as of September, according to the latest data from the Rating and Valuation Department. By comparison, the city’s average monthly rents in 2020 fell 6.9 per cent from the previous year.

Overall, for 2021, home rents went up 3 per cent from January to November. Rents in Taikoo Shing rebounded to HK$34 per square foot this month, from as low as HK$29 per square foot in October, according to one of the agencies, for instance.

The agent attributed the improvement in the market to the pandemic having been brought under control. This had helped the Hong Kong economy pick up pace and, subsequently, the city’s unemployment rate dropped to a record low – 4.1 per cent from September to November – since February 2020, according to the latest data from the Census and Statistics Department.

Against the backdrop, the agent said that they expected an increase of 5 per cent in home rents across the city. “Most important of all is the fact that supply is limited,” the agent said. “There is a lot of demand in the market.”

The Hong Kong government planned to complete the construction of around 18,230 private residential units this year, but as of October only 11,330, or 62 per cent, had been completed, the agent said. This meant that “there is a high possibility of delays in completion this year to next year, which we believe would lower the supply of new rental units” in 2022, the agent added.

With the city set to reopen its border with mainland China soon, more mainland students will come back to the city, which will also help improve the rental market, the agent said. “One of the reasons that rents have increased this year is the return of mainland Chinese students, and we believe this trend will continue next year,” the agent said.

The agent said that they expected small to medium sized flats would be the most sought-after. Rents for such units in Sha Tin and Tin Shui Wai had registered a 5 per cent increase this year, for example. Rents at City One Shatin stood at HK$39 per square foot and at HK$24 per square foot at Kingswood Villa in Tin Shui Wai.

Homes near universities and MTR stations would also see rent rises. The agent said rents in Tseung Kwan O and Sha Tin would perform better thanks to their proximity to universities that attract mainland students. The new Tsuen Wan line and Sha Tin-Central link would support rents in Tsuen Wan West and Kai Tak.

Another property agent held a more cautious view toward the home rents, but also indicated a best-case scenario where rents would rise 5 per cent.

“Next year will not be rosy [for the rental market], because workers won’t get sharp pay rises quickly,” the agent said. The agent also said that they doubted there would be strong demand.

Smaller flats would outperform other types in the rental market, with a 7-8 per cent rent increase in 2022. “The smaller, the better,” the agent said. “Nano flats – those less than 200 sq ft – will see the most rent increases next year.”

The agent added that the New Territories will witness higher increases – slightly above 5 per cent – in rents, thanks to its low rental base, improved infrastructure and more convenient transport options. In contrast, Hong Kong Island will see only a 1-2 per cent increase, largely because of a decline in the number of overseas employees amid the pandemic.

(South China Morning Post)