由興盛創建持有的西營盤干諾道西138號THE CONNAUGHT減價放售,由10億減至6億,呎價約1.44萬。

有代理表示,THE CONNAUGHT酒店位處西營盤干諾道西138號,樓高29層,總建築面積約41705方呎,於2019年完成翻新工程,現共提供52個房間,每個房間均可飽覽180度維港景。截標日期為2024年10月23日中午12時正。

2018年購入價7.3億

另一代理表示,儘管環球經濟仍不穩定,酒店投資市場表現不俗。今年2月初,本地共居品牌Dash Living夥拍外資基金保德信PGIM,以3.2億承接上環皇后大道286號奧華酒店,呎價1.23萬。

據了解,業主最初叫價10億放售全幢,現下調目標價至6億,累減4億或40%,呎價約1.44萬,按最新叫價計算,每個房間價值約1154萬。

平均每個房間值1154萬

酒店前身為服務式住宅太極軒138,興勝創建於2018年以7.3億收購並將之翻新為酒店,當時,發展商曾表示,預料每呎翻新費用約1000至2000元,料日後月租收益約290萬。若以酒店總樓面計算,翻新費亦至少逾4170萬。

(星島日報)

航天城11 SKIES 明年第二季起開放

機場及東涌一帶發展加快,其中總樓面達到380萬平方呎的航天城11 SKIES項目陸續落成,零售及娛樂體驗設施部分,將在明年第二季陸續開放。

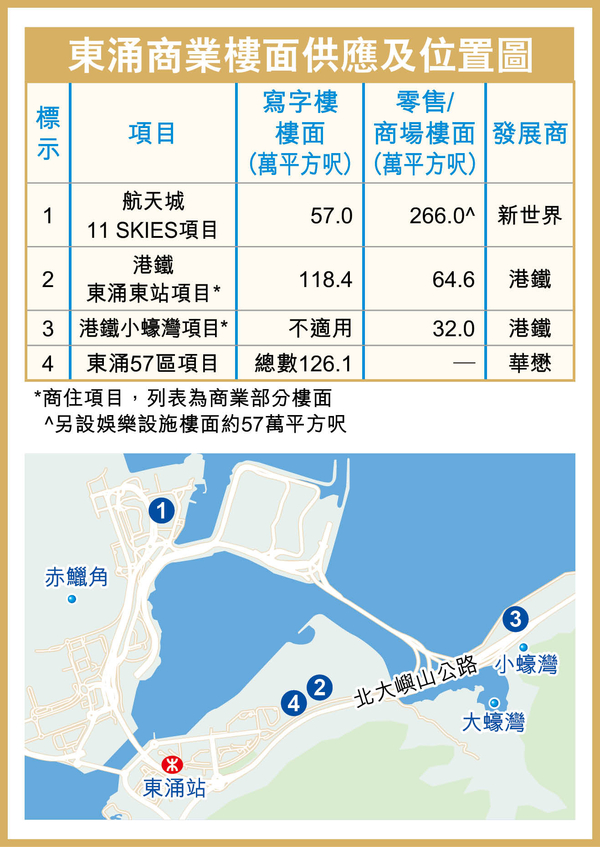

根據資料顯示,連同赤鱲角機場在內,東涌及周邊未來有4個大型商業項目,合共為區內增逾660萬平方呎商業樓面,其實中規模最大屬於航天城11 SKIES,而港鐵 (00066) 則分別在東涌東站、小蠔灣兩個項目上,合共擁有逾220萬平方呎商業樓面。

投資逾200億 備娛樂餐飲零售

航天城11 SKIES位於機場二號客運大樓,跟亞洲博覽館之間,由新世界 (00017) 所發展,屬於大型綜合項目,總樓面達到380萬平方呎,將會提供大型零售、娛樂設施,及3幢合共約57萬平方呎的甲級寫字樓K11 ATELIER 11 SKIES,總投資額高達約200億元。

11 SKIES在零售部分提供約266萬平方呎,包括逾800間商舖,另外設有57萬平方呎的沉浸式體驗娛樂設施。首階段娛樂設施將於明年第二季陸續開放,零售、餐飲等服務則會配合機場與航天城整體項目的發展時間,擬於2025年第4季起逐步投入服務。

至於寫字樓方面,K11 ATELIER 11 SKIES總樓面約57萬平方呎,由3幢甲級商廈組成,早在2022年7月已經陸續入伙,辦公室的單位面積介乎約1,696至33,868平方呎,吸引不少金融機構、健康醫養及初創企業進駐。

另一方面,隨着港鐵東涌東站及小蠔灣站的發展,港鐵在區內兩個大型商住項目亦將陸續推出,住宅外,亦擁有約220萬平方呎的商業樓面,其中183萬平方呎來自東涌東站項目。

港鐵2項目 料年內重新招標

該項目位於東涌第113區,佔地約82萬平方呎,總樓面約678萬平方呎,當中7成屬於住宅樓面,亦設有商業零售及辦公室樓面,分別涉約64.6萬及118.4萬平方呎。

港鐵曾經在去年11月推出東涌東站1期招標,其中包括8.8萬平方呎的商場樓面,惟最終流標收場,港鐵計劃最快今年內重新招標。

至於小蠔灣項目佔地約323萬平方呎,總樓面達到926萬平方呎,其中大部分作住宅發展,涉及約2萬伙,並設有逾32萬平方呎的商場。

大中華首間KidZania 57萬呎娛樂設施

新世界 (00017) 旗下機場航天城11 SKIES設有57萬平方呎的娛樂設施,包括當中大中華區首間KidZania趣志家兒童職業體驗樂園於今年7月底至9月初試營運,樓高3層與近30個國際及本地品牌合作。

11 SKIES設有多項大型娛樂設施,包括香港首間動感飛行影院「飛越天際」、韓國最大沉浸式多媒體藝術博物館ARTE MUSEUM、以柏靈頓熊為主題的室內親子娛樂體驗,以及KidZania趣志家兒童職業體驗樂園。

其中KidZania Hong Kong香港趣志家早前試運,提供近70個逼真職業角色體驗,包括七大「香港獨家」創意體驗如財富管理中心、智慧城市科技工作坊、兒童運動健康的綜合體育館、中式糕點烘焙坊等。

3層高 集職業角色體驗動感影院

至於,動感飛行影院方面,以香港風貌為主題,透過數碼技術、無邊界熒幕等先進科技,將香港日與夜的美景展現於13米球形熒幕上。

(經濟日報)

Owners of Hong Kong’s Connaught hotel slash sale price by 40% amid property downturn

The owners of the 52-room, four-star hotel in Sai Ying Pun have lowered the asking price to HK$600 million from HK$1 billion previously

The worsening slump in Hong Kong’s property market is pushing owners to deepen the discounts of assets already on the market.

The Connaught, a 29-storey hotel in Sai Ying Pun, adjoining the core business zone of Central, is being offered at a 40 per cent discount to its initial asking price.

The owners of the 52-room, four-star hotel with a gross floor area of 41,705 sq ft have dropped the price to HK$600 million (US$77 million) from HK$1 billion previously, according to a statement from two agencies who’s the joint agents for the sale.

The asset is just one of many that have been put for auction by landlords and investors in recent months. It is owned by a joint venture of Hong Kong-based Hanison Construction and New York-based private equity real estate specialist Angelo Gordon, sources said.

On Monday, another agency said that it has been appointed as the sole agent for the sale of five en-bloc industrial buildings in Sai Kung with a gross floor area of 383,579 sq ft. The buildings are valued at HK$950 million. The property “holds significant potential for conversion into a high-end senior living community”, according to the agency.

In the first half of the year, sales of distressed property in Hong Kong surged to about three quarters from the typical 10 per cent of such levels in previous years, according to an estimate by another property agency. With interest rates at a 23-year high, asset owners have found it increasingly difficult to service debt, the property agency said.

“Despite the unstable global economy, the hotel investment market has demonstrated outstanding performance in the past two quarters,” an agent said.

“The revival of the inbound tourism industry, coupled with the Hong Kong government’s effort to promote the Quality Migrant Admission Scheme, will propel the growth of the entire hotel investment market,” the agent added.

In February, co-living brand Dash living and fund manager Prudential Investment Management acquired the Ovolo hotel in Sheung Wan for HK$320 million, or an average price of about HK$12,300 per square foot.

The Connaught enjoys a “strategic location advantage”, as it is a few minutes’ walking distance from the Sai Ying Pun MTR station and the Hong Kong-Macau Ferry Terminal, another agent said.

The hotel can benefit from Hong Kong’s talent scheme aimed at attracting high-quality professionals globally for career development, the agent said.

“The property is well-served as a suitable accommodation for company management,” the agent added. “With only an MTR station away from the University of Hong Kong, it is perfectly positioned to function as a dormitory for senior teaching staff.”

The closing date for the hotel tender is October 23.

(South China Morning Post)

Hong Kong property deals slump to 6-month low as market-boosting measures wear off

Overall real estate transactions in August fell 10 per cent month on month to 4,729 units, while value declined 20 per cent to US$4.4 billion

Hong Kong’s property market lost some of its zip in August, with overall property transactions slumping to the lowest since February when cooling measures were still in place.

Real estate deals, comprising new and lived-in homes, office units, car parking slots, shops and industrial spaces, fell 10 per cent month on month to 4,729 units, and declined by 33 per cent from six months ago, according to the Land Registry data released on Tuesday.

Overall deal value fell about 20 per cent month on month to HK$34.3 billion (US$4.4 billion), but was up by more than 50 per cent compared with February, the data showed.

On an year-on-year basis, the volume in August was 1.5 per cent higher, while the value was 1.6 per cent lower.

Home sales slipped for the fourth consecutive month to 3,654 units, a 1.9 per cent decrease from July and a six-month low since 2,375 were sold in February. The value amounted to HK$28.47 billion, a 20 per cent slump from HK$35.7 billion in July.

“Home sales transactions fluctuate with the market sentiment regarding interest rates, resulting in periods of both activity and inactivity,” an agent said.

Property registrations will continue to remain at low levels until the interest rate cuts are implemented, the agent added.

Starting in March, the Hong Kong government scrapped all property cooling measures such as the Special Stamp Duty, which was levied on homebuyers who flipped their property within two years of purchasing it. This led to a surge in transactions, with sales in April rising to their highest since July 2021.

The exuberance was short-lived, with deals falling back to the 5,000 level since June.

The market is widely anticipating that the US Federal Reserve will start easing rates later this month, a development that could quadruple home sales this month compared with August, according to a local property agency.

With the local currency pegged to the US dollar, Hong Kong’s monetary authorities are expected to follow any easing by the Fed. Hong Kong’s interest rates currently stand at a 23-year high.

A cut in interest rates could see developers launching at least six new projects with a total of 2,800 flats, according to another local property agency.

The high borrowing costs have weighed on home prices, with developers extending discounts to levels seen several years ago. Wang On Properties launched 60 units at Finnie in Quarry Bay in the last week of August at prices ranging from HK$17,502 to HK$23,470 per square foot, about 30 per cent lower than the initial launch of Henderson Land’s The Holborn, in the same area, in 2021.

Secondary home prices, meanwhile, fell to a near eight-year low in July, according to the latest reading of the Rating and Valuation Department.

“It is anticipated that the overall property transactions in September may see a slight increase with a month-on-month rise of nearly 4 per cent, testing the 4,930 mark,” the agent said.

(South China Morning Post)

Mega projects gear up for launch

Twin Victoria and Cullinan Sky in Kai Tak are among at least four new mega projects planning to put homes up for sale this month, hoping to ride the wave of an expected boost in sales from the imminent US Federal Reserve's interest rate cut.

Twin Victoria, developed by China Overseas Land & Development (0688), is expected to be launched this week with at least 141 flats in the first batch.

The project opened three show flats yesterday, of which one is being decorated and redesigned from a two-bedroom to a one-bedroom unit.

It will offer a total of 702 flats measuring between 244 and 1,770 square feet, spanning studio to three-bedroom homes as well as some special units.

Sun Hung Kai Properties's (0016) Cullinan Sky will release its sales brochure as early as next week and put flats on the market this month.

The project is divided into four areas. The first batch will be mainly from its Elite Zone, with the smallest unit measuring around 250 sq ft.

Elsewhere in the primary market, Great Eagle (0041) will have 133 units at Onmantin Phase IIA in Ho Man Tin up for sale on Friday.

The project sold some of its three- and four-bedroom units in tender earlier, then released its first price list last week, offering 84 flats at an average HK$20,772 per sq ft after discounts. Buyers can purchase up to four units.

The Parkland in Yuen Long, developed by Lai Sun Development Company (0488), uploaded its prospectus yesterday, set to be launched in the short term.

The finished project offers 112 units, comprising one- and two-bedroom flats ranging from 265 to 494 sq ft.

CK Asset's (1113) The Coast Line in Yau Tong launched Mid-Autumn Festival offers amid keen competition.

Homebuyers who buy a studio or two-bedroom unit in The Coast Line II can get a gold gift coupon worth around HK$39,800, and the buyer of the last three-bedroom home in The Coast Line I could gain a gold dragon with the value around HK$99,800.

The rental market shares the upbeat momentum. Henderson Land Development (0012) put 23 of the remaining units at One Innovale in Fanling up for rent, with the monthly rent for a studio starting at HK$9,500.

It also offers eight one-bedroom flats leasing between HK$11,100 and HK$12,600, 10 two-bedroom units ranging from HK$15,800 to HK$16,600, and four three-bedroom flats with monthly rent up to HK$24,800.

Rentals for four-bedroom flats remain up for discussion with tenants.

(The Standard)