Hong Kong's primary residential

market seems not to have been affected by an expected interest rate

hike, with new projects booking over one hundred transactions over the

weekend.

Another 50 flats at Caine Hill

in Sheung Wan are now being offered by Henderson Land Development

(0012) after the 50 homes in the first batch were sold within three

hours after its launch on Saturday.

The

second batch, is priced at HK$29,630 per sq ft after discounts, about 3

percent higher than the first one, and includes 13 studio flats and 37

one-bedroom flats ranging from 190 sq ft to 285 sq ft.

Henderson said 28 of 50 flats worth over HK$209 million in total will hit the market on Thursday.

In Ngau Tau Kok, The Aperture

saw at least 42 out of 130 flats available in the second round of sales

sold over the weekend with the developer Hang Lung Properties (0101)

raking in HK$358 million.

In Tseung Kwan O, Kowloon Development (0034) has booked nearly HK$2.9 billion in revenue after more than 64 transactions at Manor Hill were recorded on Saturday.

The secondary market was quiet, in contrast.

Only

nine deals in a property agency’s top ten blue chip estates were logged

over the weekend, down by 2 deals or 18.2 percent from last week to a

seven-week low.

Agent

said that the decline was due to first-hand residential projects

snatching a lot of second-hand property customers, coupled with the

recent volatility in the stock market and the negative news about

mainland developers.

With

the new variant of the coronavirus still under control, the agent

expects that property transactions would surge significantly once the

border between the mainland and the city officially reopen.

Separately, two more homes at The Henley III in Kai Tak were sold for HK$6.08 million and HK$5.95 million, respectively.

(The Standard)

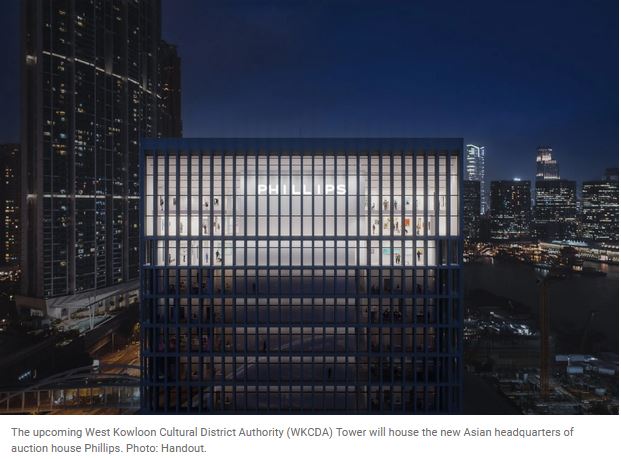

West Kowloon district emerging as new darling of Hong Kong-based multinational tenants

The

area is set to see new office buildings open in the next few years,

including the West Kowloon Cultural District Authority (WKCDA) Tower

Auction house Phillips has signed a deal to rent the main floors of the WKCDA Tower, next to the M+ art museum

The

West Kowloon district is likely to become an important commercial

district in Hong Kong in the coming years, as new office space comes

onto the market, according to analysts.

“The

Kowloon station precinct serves as an extension to the core Tsim Sha

Tsui office submarket but currently has only limited amount of office

space, so it isn’t seen as a stand-alone office submarket for the time

being,” said property agent said.

However,

“the future offices and generous open space to be built within the West

Kowloon Cultural District Authority (WKCDA) Tower will help strengthen

the commercial atmosphere of the area and gradually build up the appeal

of the Kowloon station precinct as a preferred office district”, the

agent said.

The

area is expected to attract financial companies and mainland

enterprises upon the completion of the 16-storey WKCDA Tower, as well as

a planned twin tower development with 2.6 million sq ft of office space

and 603,000 sq ft of retail space atop the Guangzhou-Shenzhen-Hong Kong

Express Rail Link (XRL) terminus, set to open between 2025 and 2026,

the agent said.

The

XRL terminus, the only station in Hong Kong linked to the wider

high-speed railway network in China, as well as the Kowloon station,

which connects to the Hong Kong International Airport via the Airport

Express, are some of West Kowloon’s biggest draws. The XRL’s West

Kowloon station is a seven-minute drive from the Tsim Sha Tsui MTR

station and a 15-minute ride to Shenzhen.

At the moment, however, the ICC

– the tallest building in Hong Kong and home to the outposts of several

major Chinese and multinational financial institutions – is the only

office block in proximity.

One

company that is taking advantage of the rapidly developing area is

Russian-owned auction house Phillips. It has signed on to rent a 48,000

sq ft space occupying the main floors of the WKCDA Tower to house its

new Asian headquarters, which is eight times bigger than its current

space at St. George’s Building, according to Ingrid Hsu, public relations director for Asia at Phillips.

West

Kowloon’s transport links and the opening this month of the M+ museum

of contemporary art and design are some of the reasons behind Phillips’

decision to relocate to the area.

“Being

located at the heart of the West Kowloon Cultural District will allow

Phillips to work alongside M+, the Hong Kong Palace Museum and the wider

district on complementary programming and events, further enhancing the

area as a world-class global destination for arts and culture,” Hsu

said.

Cheaper

rents in the area compared to on Hong Kong Island are also likely to

entice potential tenants. In November, office rents in Tsim Sha Tsui

ranged between HK$41 (US$5.25) and HK$94 per square feet, while those on

Hong Kong Island cost between HK$56 and HK$152 per square feet,

according to another angency.

(South China Morning Post)

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

For more information of Office for Lease at St. George’s Building please visit: Office for Lease at St. George’s Building

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

靈活辦公室疫後市場需求增

疫情期間不少公司採靈活辦公策略,跨國共享空間營運商IWG集團認為,疫情後靈活辦公空間更見普遍,機構亦開始採納混合模式,市場尚有很大增長空間,並指在家工作不會取代傳統辦公室。

IWG集團旗下的靈活辦公室,包括Spaces、Regus及Signature,主要為共享空間,除了提供流動辦公桌外,亦有獨立房間,辦公桌月租由數千元起。

疫情持續2年,商廈需求受封關衝擊,整體甲廈空置率上升。不過,IWG集團香港區域經理Paul MacAndrew指,靈活辦公空間需求卻有上升,如集團旗下出租率,也有明顯增長。他分析,「其實在疫情前,靈活辦公概念已漸流行。疫情出現後,即明顯加速相關的需求。」

在家工作難取代傳統辦公室

在去年疫情高峰期,不少公司採在家工作政策,或靈活辦公的做法,例如把公司員工分成兩隊,一半在家工作,另一半返回辦公室。今年疫情緩和,Paul指出,機構續使用靈活辦公,「疫情後,靈活辦公的概念更加流行,例如一間公司,不是所有員工需在總部辦公室工作,亦非每星期5日均返公司,准許在家工作。」他認為這是大勢所趨,「機構不得不考慮作出變革,因為員工亦喜歡這種模式。」

事實上,早前IWG英國研究指出絕大部分的英國員工(72%),均傾向選擇長期靈活工作,多於加薪1成但需長駐辦公室,反映疫情為員工對辦公室的取態,帶來結構轉變。此外,三分之二的員工更不會應徵沒有提供混合工作模式的職位。

Paul強調,在家工作未能如此代替傳統辦公室,特別香港背景較為困難,「香港不像外國,家居面積大又有花園,香港居住環境細,難以完全在家工作。相信傳統寫字樓絕不會被取代,機構始終需要總部,接見客人。不過,租用面積可能會縮細。」

在IWG共享空間內,會員可租用辦公桌(Hot Desk),另外亦有獨立房間計劃等,而所有會員均可享辦公室內的設施包括茶水間、會議室等。他指,共享空間正是勝在靈活,「租約可以較短,可節省很多裝修費。」

海濱匯佔地逾5萬呎 650辦公位

IWG集團近兩年積極擴充,更於東九龍設首個辦公點。集團租用觀塘海濱匯樓面,旗下Signature佔地超過50,000平方呎,提供超過650個辦公位置及供1至150人使用的私人辦公室,開業已數月。Paul指,東九龍前景不錯,「東九龍為第二核心商業區,現時交通、餐飲配套等理想,甚有吸引力。」他透露,現時旗下東九龍租用的行業涉及IT、時裝、人力資源等,甚為廣泛。

至於傳統的商業區方面,集團早在去年租用銅鑼灣希慎廣場,以及尖沙咀港威中心,今年續活躍擴充,於尖沙沮港威大廈為Signature增添1層樓面,新設商務休息廳及多個私人辦公室。該中心現佔地3層,提供共75,000呎樓面,為本港最大的Signature空間。另外,集團續強攻銅鑼灣區,數月前接手WeWork,租用銅鑼灣 Tower 535 的11及12樓,開設Spaces在港的第6個中心,新址總面積達23,400平方呎,計劃於下月開業,屆時可提供超過300多個辦公位置及供1至60人使用的私人辦公室。

(經濟日報)

更多海濱匯寫字樓出租樓盤資訊請參閱:海濱匯寫字樓出租

更多觀塘區甲級寫字樓出租樓盤資訊請參閱:觀塘區甲級寫字樓出租

更多希慎廣場寫字樓出租樓盤資訊請參閱:希慎廣場寫字樓出租

更多Tower 535寫字樓出租樓盤資訊請參閱:Tower 535寫字樓出租

更多銅鑼灣區甲級寫字樓出租樓盤資訊請參閱:銅鑼灣區甲級寫字樓出租

更多港威大廈寫字樓出租樓盤資訊請參閱:港威大廈寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

看好經濟前景 「甲廈需求總會回來」

疫情衝擊甲廈需求,呂幹威相信,營商人士對本港及內地經濟前景有信心,故甲廈需求總會回來。

疫情期間甲廈需求轉弱,租金下跌及空置率上升,希慎為銅鑼灣大地主,持有大批甲級商廈。呂幹威指,集團旗下商廈整體出租率仍理想,疫情期間波幅不算高。後市上,他認為壓力仍有,「畢竟環球經濟存不確定因素,機構會採保守態度。不過,我認為大型機構對中國經濟長遠有信心,故寫字樓租務需求總會回來,只是暫時抑制。」供應方面,未來兩年踏入甲廈供應高峰,他表示核心商業區供應不多,壓力較細。

集團對商業後市甚看好,今年夥華懋以197.8億奪銅鑼灣利園山道商業地王。呂幹威指出,「地皮規模大,在銅鑼灣商業成熟的地區,能夠擴大3成業務,是非常難得,故值得購入。」

迎潮流 與共享空間機構合作

傳統寫字樓面對另一挑戰,就是近年靈活辦公室出現。他指,「情況有如當年網購出現,對傳統購物商店造成衝犛。現考驗各大業主如何調整寫字樓這項產品,去適應新需求。」事實上,希慎早前亦與共享空間機構合作,開拓靈活辦公市場,正是迎合新潮流,「辦公生態改變,不一定要留在公司工作,或有固定辦公地方,年輕一代亦喜歡舒適而自由度較高的工作環境,故我們把靈活辦公室結合現有寫字樓,可增強物業的吸引力。」

(經濟日報)