The first commercial site in the

West Kowloon Cultural District - the Artist Square Towers Project - was

awarded to Sun Hung Kai Properties (0016), the only bidder.

The

project comprises three commercial buildings with a total gross floor

area of approximately 65,000 square meters, including 62,435 sq m for

office use and 2,500 sq m for retail/dining/entertainment uses.

SHKP

has the right to develop and operate the project for about 47 years

under a build-operate-transfer arrangement and will be responsible for

the project's design, construction, financing, marketing, leasing,

management, operation, and maintenance, the West Kowloon Cultural

District Authority said in a statement yesterday.

The

price was not disclosed but the authority believes it is "commensurate

with the market level" having considered the average valuation provided

by three independent valuers.

Betty

Fung Ching Suk-yee, chief executive of WKCDA, said the project is a key

component of the development model of the district and the authority

looks forward to working with SHKP to make the development a success.

SHKP

chairman Raymond Kwok Ping-luen said he was very pleased to have won

the site and expects it to create synergy with the developer's two

nearby projects - the International Commerce Centre

and the High-Speed Rail West Kowloon Terminus Development, further

boosting the area's status as a unique commercial, cultural, arts,

retail, entertainment, and transportation hub in Hong Kong and the

Greater Bay Area.

The

developer bought the site atop the high-speed rail for HK$42.2 billion

in 2019 and later sold more than half of the interest in the office part

- a 25 percent stake to the Kwok's family for HK$9.4 billion and a 30

percent stake to an arm of Ping An Insurance (Group) (2318) for HK$11.3

billion.

The first

tender of the AST project was canceled earlier this year and the

retender kicked off in September after the authority extended the

construction and operation period for the project by 14 years to 2070

and lengthened the period for parking spaces by 38 years to the same

year.

Meanwhile, SHKP

plans to invest about HK$10 million - 25 percent more than last year -

in promotion for its apm mall in Kwun Tong through Christmas, including

setting up three giant TVs for customers to watch the World Cup and

promotions for celebrating the Christian festival.

It expects sales in the mall for the rest of the year to rise by 20 percent from last year.

(The Standard)

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

Wan Chai project offers a discount

Swire Properties (1972) is offering a 3 percent discount on four homes at its completed project Eight Star Street.

Swire Properties director Adrian To said the areas of the one and two-bedroom units range between 431 to 555 square feet.

The

Wan Chai project, launched in March last year, has sold eight units

worth a total of HK$628 million. The average price per sq ft was

HK$38,888, while the most expensive one sold at HK$53,122 a sq ft.

To

said there would be a tender for the project's unit A on the 21st

floor, which has an area of 913 sq ft and three rooms, at a reference

price of HK$48.8 million, or HK$53,450 per square foot.

It

is normal that the local property market fluctuates due to negative

factors such as interest rate increases, To said, but there is a massive

demand for property in Hong Kong which is believed to be healthy in the

long run.

(The Standard)

Citibank expects Hong Kong property prices to fall another 10 per cent, bottom out in second quarter of 2023

Property prices to fall another 10 per cent from October to the second quarter of 2023, bank says

Rising interest rates are the ‘biggest negative factor’ affecting market, executive says

Hong Kong property

prices are expected to bottom out in the second quarter of next year at

the earliest, following an estimated drop of 20 per cent from a record

high posted in 2021, Citibank said on Tuesday.

The

bank, the first to make a clear-cut forecast, said property prices will

fall another 10 per cent from October to the second quarter of 2023.

“The interest rates upcycle

is the biggest negative factor affecting the property market,” said

Josephine Lee Kwai-chong, managing director and head of Citibank Hong

Kong’s retail banking. “It increases people’s burden of loan repayments

and the difficulty in passing stress tests.”

Citibank

is not alone in forecasting a decline in property prices. Last month,

Goldman Sachs forecast a 30 per cent decline in overall home prices in

the city over two years, while DBS said it expected a 5 per cent drop in

2023. Morgan Stanley, HSBC and two property agencies have all predicted

lower prices recently.

Despite

the continued downside potential of local home prices, Lee said she

hoped that the relaxation of current cooling measures might stimulate

new demand and an excessive correction of Hong Kong’s property market

might be avoided.

There

is a chance that the Hong Kong government will relax a 15 per cent ad

valorem stamp duty on the purchase price of a second residential

property in the budget to be announced next year, Citibank said. This

would stimulate demand for home ownership and avoid the emergence of

negative equity, it said.

Hong

Kong’s economy is expected to recover next year, with a slowdown in

inflation and a drop in the unemployment rate, which “will help people

return to the property market”, Lee said.

Sentiment

for Hong Kong property remains weak, with a further softening of a

market index and contraction of transaction volumes, Singapore-based

bank UOB Kay Hian said in a report on Tuesday. “Developers are also

cautious over launching sales of new projects. The rising Hibor [Hong

Kong interbank offered rate] is a key risk,” the report said.

The

index has lost 15.2 per cent since a peak in early August last year. It

fell 1.5 per cent to 162.31, the lowest since November 2017, for the

week ended November 13. It is just 1.4 per cent above the level of 160,

which an agency expected the index would touch by the end of November.

Citibank

also released its Residential Property Ownership Survey on Tuesday. The

survey was conducted in September this year and polled more than 1,000

Hong Kong residents from the ages of 21 to 60.

More

than half of the respondents expected property prices to fall in the

coming 12 months. The third quarter of this year saw a sharp decline in

the proportion of respondents who expressed optimism about home prices.

Only 12 per cent of the respondents expected property prices to rise in

the coming year, compared with 51 per cent who expected otherwise.

“The survey results reflect a wait-and-see attitude

among the public towards the property market in 2022,” said Citibank’s

Lee. “We can expect to see continued impact on future property prices

from the economic situation and rising mortgage interest rates, among

other factors.”

Citibank

Hong Kong has been conducting surveys of the Hong Kong housing market

since 2010 to assess the current state of home ownership in the city,

gauge public intentions towards home ownership, and track public

expectations of future housing price trends.

(South China Morning Post)

中環中心全層每呎70元租出 屬市價水平 金融機構擴規模

疫市下優質甲廈仍受捧,「小巴大王」馬亞木旗下中環中心高層全層,以每呎約70元承租,屬市價水平,月租約175萬,新租客為金融機構,於同廈亦承租半層樓面,今番趁疫市擴張業務。

市場消息透露,中環中心 68樓全層,原本分隔多個細單位,力吸中小型客戶,近則獲單一大租客垂青,以呎租70元承租全層,若以建築面積約25000方呎計算,月租約175萬。

華泰相關人士承租

據了解,新租客為華泰國際相關人士,本身亦承租該廈55樓7至12號,租約至2026年1月到期,市場人士指,租客擴充規模,鍾情該全層位處同廈,望開揚城市景及海景,屬於優質單位。而上述全層原有分間9個單位,面積約1000至2000方呎,之前成交呎租由73至逾90元不等,新租金下調約5至15%。

「小巴大王」馬亞木持有

同為馬亞木持有同區的環球大廈2306室,面積約1162方呎,以每呎51.7元租出,月租約6萬,市場人士形容,該單位望正海景,租金稍高於市價,該宗租賃「屬寒冬中暖流」,馬亞木持有該全層約80%樓面,除了1號單位租予信貸公司,其他單位將之拆細,全新裝修,面積約1000至2000方呎,是疫市下受捧呎碼,租賃情況不俗。

環球大廈單位月租六萬

有代理表示,現時核心區商廈雖然仍有不少空置,不過,景觀佳、有裝修的優質單位仍然「去到貨」,市場上需求較殷切的是1000至2000方呎的單位。

該代理指出,目前來說,全層大樓面單位需求較少,一些持全幢物業的大業主,亦傾向拆細單位招租,不過,他們往往將2萬呎的全層單位,拆細至每個5000至6000方呎,並非「市場消化能力最高」的細單位。

另一代理表示,疫市持續,雖然對證券行有影響,不過,近期則有否極泰來的情況,對於租客來說,現時,他們樂於以較低的租金,承租更大的單位。

由於中環區整體空置率高企,業主亦願意提供優惠予租客。

該代理又說,近期踏入寫字樓租賃旺季,一些公司出動物色新據點,並計畫在聖誕前完成搬遷,皆因聖誕新年,很多老闆都需要出門。

(星島日報)

更多中環中心寫字樓出租樓盤資訊請參閱:中環中心寫字樓出租

更多環球大廈寫字樓出租樓盤資訊請參閱:環球大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

西環甲廈干諾道西118號全層單位放售,意向價1.68億,平均呎價1.26萬。

意向呎價12665元

有代理表示,干諾道西118號一個高層全層海景單位,全層面積約13265方呎,意向價1.68億,平均呎價為12665元。

該代理表示,該物業屬區內罕有大面積放售,坐擁無敵海景,大廈大堂甚具氣派,單位間隔四正實用,該廈距離港鐵西營盤站,僅數分鐘步程,同時鄰近西區海底隧道及中山紀念公園。

該廈近年未見全層單位買賣,今年6月錄1宗細單位成交,20樓6室,面積1474方呎,以1998萬易手,平均呎價13555元。於2018年2月商廈高峰期,該廈30樓2室,面積1296方呎,於以2306.9萬易手,平均呎價高達17800元。

屬罕有大面積

於2018年10月,中國南方航空標售該廈4層樓面,36、37、38及40樓4層海景寫字樓,每層約13,265方呎,連18個有蓋車位,40樓屬頂層樓面,樓底高4.5米,當時市值約10億,呎價約1.9萬起,惟未見易手。

(星島日報)

更多干諾道西118號寫字樓出售樓盤資訊請參閱:干諾道西118號寫字樓出售

更多上環區甲級寫字樓出售樓盤資訊請參閱:上環區甲級寫字樓出售

金鐘名廈遠東金融中心單位放售。有代理表示,遠東金融中心高層01室,面積約2449方呎,意向價約6979萬,平均每方呎約2.85萬,單位交吉,間隔方正無柱,望維港景,大廈毗鄰美國銀行中心、力寶中心及海富中心等多幢甲廈。

該廈呎價不僅向來冠絕金鐘,更曾是香港甲廈指標,2018年29樓全層,以5.68億易手,呎價5.26萬,是本港商廈呎價第二高。近兩年受疫情影響,甲廈造價下跌,去年低層單位成交,呎價約25424元,較同層單位高峰期呎價回落50%。

該廈對上一宗租賃為中層2室,於今年5月錄得,建築面積約2703方呎,呎租約55元,月租約148665元,舊租金每呎74元,租金明顯下滑,但屬貼市價水平。

意向價6979萬

該廈於1982年落成,樓高41層,金色玻璃幕牆外觀,於同區甚突出。電梯大堂設於1樓,可從門口扶手電梯上,大堂樓層接駁至金鐘廊,每層面積約10800方呎,最細單位面積由1000餘方呎起,大廈景觀佳,主要望中環添馬公園,前無遮擋,中高層單位享海景,低層亦甚為開揚。

(星島日報)

更多遠東金融中心寫字樓出售樓盤資訊請參閱:遠東金融中心寫字樓出售

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多美國銀行中心寫字樓出售樓盤資訊請參閱:美國銀行中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售

更多中環區甲級寫字樓出售樓盤資訊請參閱:中環區甲級寫字樓出售

更多遠東金融中心寫字樓出租樓盤資訊請參閱:遠東金融中心寫字樓出租

更多海富中心寫字樓出租樓盤資訊請參閱:海富中心寫字樓出租

更多力寶中心寫字樓出租樓盤資訊請參閱:力寶中心寫字樓出租

更多美國銀行中心寫字樓出租樓盤資訊請參閱:美國銀行中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

新地西九再下一城 奪藝術廣場大樓

與環球貿易廣場高鐵站商地 組668萬呎商業王國

西九藝術廣場大樓項目僅得一份標書,西九文化區管理局公布,批予區內大地主新地 (00016) ,連同環球貿易廣場 (ICC)、西九高鐵站商業地,組成總樓面達668萬平方呎的商業王國。

該藝術廣場大樓商業項目於區內推出的首幅商業地,總樓面約70萬平方呎,在今年初招標時獲4份標書,惟西九管理局均不接納,最終在早前重新招標,但上周一 (14日) 截標時,只得新地一間發展商入標。

最終西九管理局公布,項目由新地全資附屬公司,力享有限公司成功投得。該局指,管理局於截標時收到一份標書,經審視管理局委聘的3位獨立估價師提供的平均估價及其他相關因素後,認為新地的回標價符合市場水平,並決定接納其標書。

西九管理局及發展商方面未有公布中標價,或是總投資額,而市場在截標前,市場估值約28.6億至48.9億元,每呎樓面地價約4,100至7,000元。

根據招標條款,入標者則要提交「一口價」類近地價的固定租金,分兩期繳付,並且由2025年4月起每月繳付「保證租金」或「收入分成」,以價高者為準,初期收入分成比例10%,直至第16年營運期分紅比例提升至20%。

西九管理局行政總裁馮程淑儀稱,項目為香港建構文化樞紐和以藝術為主題的特色商業項目,並帶來長期的收入以支持西九實踐文化使命,期待與新地合作成功發展項目。管理局將繼續釋放西九商業土地的潛在價值。

郭炳聯:對中港前景充滿信心

新地主席兼董事總經理郭炳聯表示,集團繼2019年底投得高鐵西九龍總站上蓋大型商業項目後,另一個在該區地標性項目,集團再次在西九投資發展大型項目,足證集團對香港和國家前景充滿信心。他又指,項目與比鄰的環球貿易廣場 (ICC),以及正在興建的高鐵西九龍總站商業項目發揮聯動效益。

事實上,隨着新地投得今次項目,連同環球貿易廣場及高鐵西九站項目,組成合共668萬平方呎樓面的商業王國,成為控制西九商業區的霸主。

有測量師稱,難以評估最終標價,但認為現時新地奪得西九版圖,對於旗下項目防守性較好,因為擔心若果被其他財團介入,日後在淡市時候或出現競爭,租金進一步下跌。他預期,該項目落成後呎租介乎40至80元。

測量師:存協同效應 助調節租金

另一測量師稱,項目落成後相信會吸引一部分與文藝有關的租戶,例如畫廊或者藝術品拍賣中心,其餘則是一般商業商戶。他同指,新地在區內項目存在協同效應,對於調節租金有幫助。

藝術廣場大樓項目由三幢商業大樓組成,總樓面面積合共約70萬平方呎,包括67.2萬平方呎作辦公室用途和2.7萬平方呎作零售 / 餐飲 / 消閒用途。

(經濟日報)

更多環球貿易廣場寫字樓出租樓盤資訊請參閱:環球貿易廣場寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

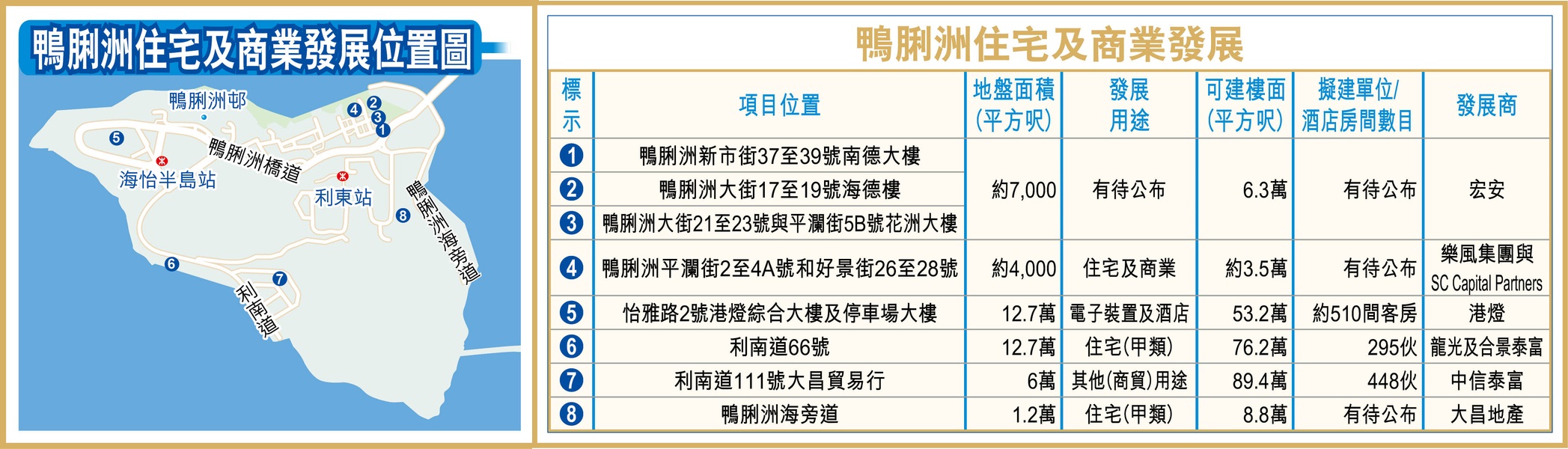

宏安積極申強拍鴨脷州舊樓 待重建

隨着港鐵南港島綫通車,鴨脷洲的交通變得更為便利,近年相繼吸引中小型發展商在區內插旗發展住宅項目,當中又以宏安最為積極,接連為區內舊樓申請強拍。

3項目 重建樓面6.3萬呎

在南港島綫落成後,鴨脷洲的發展潛力增加,吸引不少發展商積極在該區收購舊樓,當中以宏安 (01222) 最為積極,於年初接連為鴨脷洲大街的舊樓申請強拍,包括位於鴨脷洲大街17至19號海德樓、鴨脷洲大街21至23號與平瀾街5B號花洲大樓;及鴨脷洲新市街37至39號南德大樓。

發展商已持有3項目介乎83.33%至94.74%業權。發展商曾經透露,上述3項目將會一併重建,合共組成面積近7,000平方呎地盤,以地積比率9倍計,其可重建樓面約6.3萬平方呎。

樂風擬建高端住宅

另一積極收購的樂風集團亦於今年年中,就鴨脷洲平瀾街2號,以及好景街26至28號項目申請強拍,項目現況市值逾1.45億元。項目的地盤面積約2,400平方呎,如以地積比率9倍重建發展,其可發展樓面約2.16萬平方呎。發展商當時透露,集團傾向計劃就上述項目發展單幢式的高端住宅。

值得留意的是,集團於年初已經公布,已與總部位於新加坡的房地產私募股權投資公司SC Capital Partners,以約4.18億元完成收購上述項目 (連同平瀾街4A號) 的大部分不可分割業權作住宅項目重建。

而龍頭發展商恒地 (00012) 多年前亦已看中區內潛力,收購鴨脷洲大街的舊樓,現已發展為倚南及逸南。

另外,港燈 (02638) 現時在海怡半島仍擁有綜合大樓及停車場項目。項目位於怡雅路2號,亦即位處整個海怡半島的中央,比鄰海怡寶血小學及海怡西商場。事實上,項目於2018年2月以約6.6億元完成補地價,將與長實 (01113) 合作發展酒店項目,涉及可建樓面約38.1萬平方呎,料提供約510個酒店客房,而綜合大樓部分則會保留,總項目樓面共約53.2萬平方呎。

(經濟日報)