上月甲厦录26宗买卖

疫情稍缓和,带动甲厦交投回暖。据代理指出,上月50大甲厦共录26宗买卖,按月上升逾八成,创过去3年单月新高。

代理数据显示,今年4月五十大甲厦共录26宗买卖,较3月的14宗升85.7%,创自2018年3月以来新高、即3年新高纪录;至于成交总楼面涉11.1万方呎,按月挫13.2%,主要是因为3月市场连录多宗全层大手买卖,推高基数所致,总结今年首4个月,五十大甲厦共录62宗买卖,为去年全年76宗的81.6%。

创近三年单月新高

若按区域划分,上月九龙区成交量最多,录得17宗,至于新界及港岛区分别录4宗及5宗。其中,东九龙期内共录8宗买卖,是上月表现最佳的分区,尖沙嘴 (包括尖东) 亦录得6宗交投。若以大厦分类,上月葵涌新都会广场连录4宗买卖,是成交量最多的大厦。而近期有拆售活动进行的中环中心,上月也录得3宗易手。

代理表示,去年底工商铺「撤辣」,加上本地疫情缓和,刺激市场交投气氛,同时,环球游资充裕,股市表现畅旺,部分资金转投写字楼市场,带动交投出现「报復式反弹」,上月买卖宗数亦重返一七、一八年旺市水平。

该代理续指,上月以东九龙交投表现较突出,因为该区甲厦呎价普遍1万餘,属低水,吸引不少新晋投资者入市,带动交投,展望后市,代理认为,政府已经推出「回港易」计画,现时亦与澳门及澳洲、纽西兰等地商讨旅游气泡,相信稍后中港通关也有望实现,故对后市感乐观。

(星岛日报)

更多中环中心写字楼出售楼盘资讯请参阅:中环中心写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

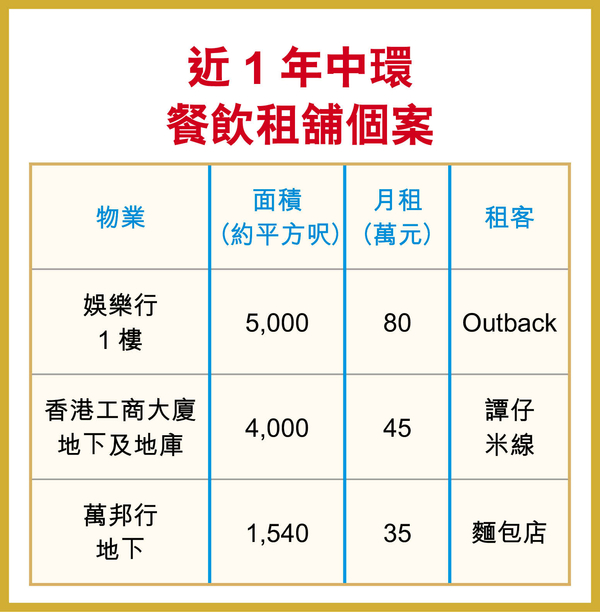

中环巨铺每呎80元租出重返十年前水平

经济环境欠佳情况下,大铺拆细出租司空见惯,惟市场亦有例外,中环皇后大道中地标商厦娱乐行,数个细铺被合併为一个约5000方呎巨铺,由食肆进驻,平均呎租约80元,较旧租金减逾50%,重返十年前水平。

消息人士表示,上址为皇后大道中30号娱乐行部分地下及1楼,前身为时装店、红酒及咖啡店,都是反修例前受捧的行业,惟随着近年经济走下坡,租客离去,铺位亦丢空多个月,最近被合併为一个建筑面积约5000方呎的巨铺,由美式餐厅进驻,售卖汉堡包及沙律等食品,月租40万,较旧租金减少约50%,平均每呎约80元,重返十年前水平。

细铺合併月收租40万

中环核心区近期涌现吉铺,主要由两类型租客「填上」,食肆及口罩店,上述娱乐行对面的华人行,地铺有一家口罩店,拥有口罩制造机,在贵重的闹市「设厂」,向路人展示生产过程,这个铺位面积约1093方呎,上手鐘表店月租高达110万,最新月租30万,下跌约73%。

名店巨铺拆售出租

上述属于中环皇后大道中「皇中之皇」地段,主要港铁站出口皆设于此,由此地段步行2至3分鐘,走至皇后大道中九号基座嘉轩广场,曾是Hermes自用的巨铺,3年前易手后,一直丢空多时,最后巨铺被拆细招租,短租客包括艺术画廊及快闪店,消息人士指,其中地下6号铺及阁楼亦录长租,建筑面积约3000方呎,由食肆进驻,月租20万,平均呎租约67元。不过,现时所见,仍未见有食肆进驻。

中环摆花街与市中心有距离,录得38号地铺及1楼,建筑面积约3200方呎,由人气咖啡品牌承租,月租35万,较旧租客运动品店Under Armour旧租金,足足跌65%。

(星岛日报)

更多娱乐行写字楼出租楼盘资讯请参阅:娱乐行写字楼出租

更多华人行写字楼出租楼盘资讯请参阅:华人行写字楼出租

更多皇后大道中九号写字楼出租楼盘资讯请参阅:皇后大道中九号写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

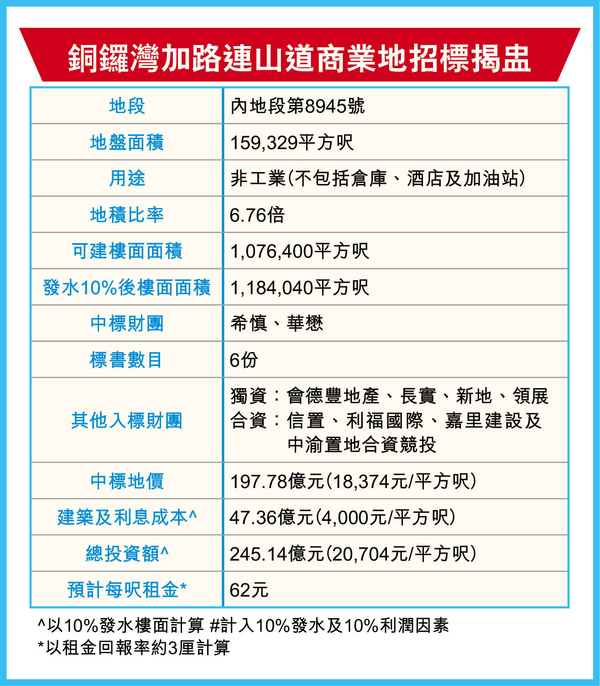

铜锣湾商业地掀财团争夺

儘管疫市下商厦造价持续受压,惟政府推地步伐未见放缓,铜锣湾加路连山道商业地,将于本周五截标,为同区近年罕有大型商业地供应,市场估值约150亿,每呎地价约1.4万,料吸引本地及内地大中型财团争逐;新地及华懋均表示,会研究入标竞投项目。

市场估值150亿

上述项目为铜锣湾加路连山道商业地,地盘面积15.9万方呎,以地积比率约6.76倍计,可建楼面约107.6万方呎。有测量师表示,近期疫情及环球经济下,料对竞投意欲亦将受影响,加上同期中环商业地王亦推出招标,摊分市场焦点,预期市场反应会较审慎,料估值逾150亿,每呎价估值约1.4万。

新地副董事总经理雷霆称,集团正研究入标;此外,华懋集团行政总裁蔡宏兴表示,本港为国际金融中心,商业前景值得看俏,集团正研究入标。

该地皮早于10多年前,由规划署将前机电工程署旧总部、前民安队大楼等组成的大型用地重建发展,直至今个财政年度才放入卖地表,为同区罕有大型供应。

(星岛日报)

楼价年内料升3%至5% 协成行方文雄:购买力稳步释放

近期楼市交投回勇,协成行董事总经理方文雄认为,大湾区发展将成为本港经济发展的主引擎,加上疫情近期稍放缓,在低息环境及供应有限等利好因素支持下,市场购买力稳定释放,料今年楼市表现较去年为佳,预期至年底,在未来约8个月可录3%至5%升幅。

协成行方文雄接受本报访问时指出,儘管疫情持续反覆,惟楼市近期交投气氛已见改善,随着疫苗啟动接种,本港经济可重新起步,配合大湾区发展,楼市前景值得看俏。

料发展商贴市价推盘

他指,「现今楼市正处復甦期,惟近期新盘交投不俗,客源包括年轻上车客及换楼客,证明市场需求殷切,加上低息环境及供不应求等因素支持,预期今年楼市表现较去年为佳,至年底楼价料可录约3%至5%升幅。」

中小型单位主导大市

另外,他称,受疫情等因素影响,市场早前积压不少购买力,随经济环境稍回稳,发展商纷开盘吸客,因市场购买力殷切,他们不怕竞争,造就该购买力得以释放。他亦称,现今市道估计,料发展商以贴市价推盘,採货如轮转的销售策略,以维持稳定的资金流,单位户型则以中小型单位作主导。

对于集团最新推盘大计,方文雄指,集团何文田胜利道单幢项目,料最快今年第3季应市,地盘面积约4890方呎,可建楼面约4.14万方呎,涉约71伙,面积由286方呎至481方呎,主打1房及2房,料于明年第3季竣工,料力吸家庭客及年轻上车客源。

胜利道项目料下季应市

对于政府近期有意重提空置税,他回应指,豪宅物业属市场罕有供应,惟对民生影响不大,该政策对市况有一定影响,并指豪宅物业买卖决策应由发展商决定,发展商都以货如轮转的销售策略为主,故不会囤积单位待售。

另一方面,方文雄亦指出,自疫情于去年初爆发,楼价表现仍然「硬净」,惟他认为本港楼价持续高企,亦有碍经济发展,事实上,现今土地供应呈供不应求,故希望政府积极觅地,以紓缓楼价压力,可行措施包括发展棕地及填海等,若有效增加土地供应,对发展商言,亦属「佳音」。

(星岛日报)

工厦呎价低供应缺 疫后反弹力高

代理:市场热钱多 利投资市场

投资市场转好,代理认为,量化宽鬆下市场热钱多,有利投资市场,而外资基金近期主攻工厦,该代理分析因呎价便宜,贴近成本价,疫后反弹力高。

受疫情影响,去年大手物业市场非常淡静,而随着今年疫情缓和,投资气氛明显有改善,近期相继有逾10亿大手买卖出现。代理分析,资金主导投资市场,在量化宽鬆下,资金流入地产市场,更不担心泡沫,「环球资金多,热钱涌港,美国及其他国家进行量化宽鬆印银纸,至今仍未停止。今次规模不是个别地区而是全世界,当全世界都有泡沫,便不是泡沫,未来资产价格可看高一綫。香港楼价平稳,其他欧美地区,疫情下楼价没有下跌,相信是资金太多。」

地产市场 最坏时间已过

去年环球疫情影响投资气氛,至今未完全解决。该代理相信,香港地产市场最坏时间已过,復甦在即,「疫情令準买家未能来港视察,加上看不清前景,故暂缓入市。去年尾第4波,为本港市场最大忧虑之时,但随着疫情缓和,最坏时间已过。政府控疫措施有效,疫苗出现可望控制疫情。最近与新加坡啟动旅游气泡,港人从内地返港免14日隔离等,这些因素对地产市道更有帮助。」

投资市场略为转旺,正是集合眾多因素,代理料下半年更旺,「亚洲地区特别大中华区控疫上较佳,香港復甦料快,可吸引资金流入。另外,政府去年尾减印花税,买卖物业个案即上升。至于去年多项法例落实,局势较明朗。」该代理认为,外资基金不只投资香港,亦在内地物色投资物业,故未见外资对香港投资兴趣减,「投资无国界,只睇赚钱机会。对外资基金来说,今次可能是难得投资机会,因为价格下挫。最近投资市场转活,相信下半年更加畅旺。」

通关后利甲厦 中资有力填补

近期投资市场出现两大现象,首先工厦交投一枝独秀连录大额成交,另外买家主力为外资基金。市场消息指,荃湾有线电视大楼多层物业,获施罗德鹏里基金以约26亿元承接,涉及56万平方呎楼面,暂为今年最大额工商铺买卖。另外,葵涌、屯门及长沙湾,均录全幢工厦买卖,单计外资承接工厦,今年已录逾60亿元成交。他分析,工厦集多个有利因素,「工厦呎价较低,而新供应亦缺乏,政府即使推工业地皮,新买家多作数据中心,故传统工厦更少。」代理预计,资金追捧低水物业,故只要呎价偏低,便足以吸引资金入市,「不论基金及投资者,投资最重要睇呎价,若价格基数低,接近建筑成本,买家即有兴趣。如荃湾工厦最近成交呎价约4,000餘元,贴近地价,属非常低水。疫情过后,物业价格反弹力度高」」

至于近月表现较弱的商厦市场,该代理认为市况日后会有改善,通关后中资机构将来港开业,有利甲厦市场,「中资机构有力填补,始终很多大型科网企业準备来港上市。」

(经济日报)

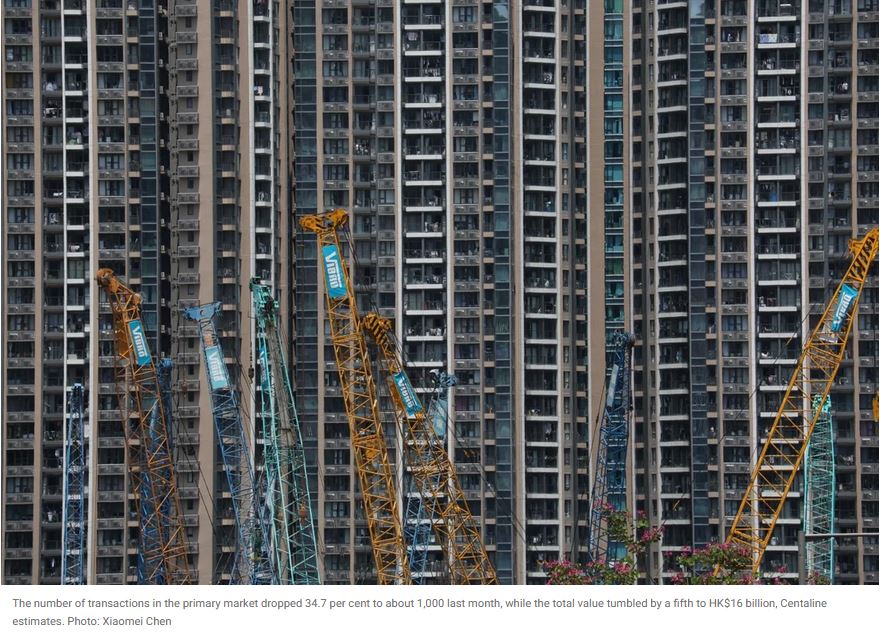

Hong Kong’s total property sales surged to US$10.6 billion in April, highest in 23 months, property agency predicts

Total sales, including homes, shops, industrial units and parking spaces, hit their highest monthly level in almost two years as buyers bet on the local economy bouncing back from recession

Used homes fared much better than new units, with an estimated 5,800 flats changing hands for HK$50 billion

Hong Kong’s total property sales, including homes, shops, industrial units and parking spaces, may have soared to their highest monthly level in almost two years as buyers bet on the local economy bouncing back from recession amid a decline in coronavirus cases.

The number of property transactions in April climbed to 9,100 deals with a total value of HK$82.5 billion (US$10.6 billion), according to an estimate by property agency on Sunday.

Official data from the Land Registry will be released in the next few days.

The property agency’s forecast represents a 0.4 per cent rise in the number of deals from March’s 9,067 deals, and a 5.7 per cent increase in value from HK$78 billion.

“Both sales volume and value will be the highest since May 2019,” agent said. That month saw 10,353 deals with a total transaction value of HK$90.3 billion.

In the residential market, the agent said sales of second-hand homes had outperformed those of new units.

The agent said there was a sharp rebound in demand for used homes last month, with an estimated 5,800 flats changing hands for HK$50 billion. That would be the largest number of transactions in the secondary market since October 2012, when 5,994 deals were closed.

Sales of new homes did not fare as well. The number of transactions dropped 34.7 per cent to about 1,000 last month, while the total value tumbled by a fifth to HK$16 billion, the property agency’s estimated.

Hong Kong will experience “considerable growth” in its economy in the first quarter of the year, but the Covid-19 pandemic will still be a hurdle on the path to recovery, Financial Secretary Paul Chan Mo-po wrote in his official blog on Sunday.

The government is expected to reveal its projection for first-quarter gross domestic product on Monday.

Kingswood Villa in Tin Shui Wai, where flats cost as little as HK$10,000 per square foot, was the most actively traded housing estate with 63 homes changing hands last month, according to the property agency’s estimate. City One in Sha Tin saw 47 transactions completed, making it the second-most popular housing estate, followed by Taikoo Shing with 45.

On the Labour Day holiday weekend, buyers splashed out more than HK$5.4 billion snapping up close to 380 units of the 500 on offer across the city. It was the biggest weekend for property sales in seven months.

To capture the positive sales momentum, developers have raised prices for the next batch of units to hit the market.

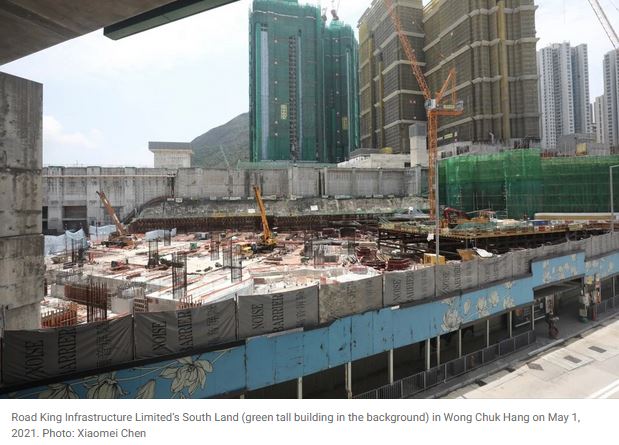

Road King Infrastructure said it raised the prices of the next batch at its South Land project adjoining the Wong Chuk Hang MTR station by 11 per cent on Sunday, after all 240 units sold a day earlier for a total of HK$4.6 billion.

It has released 180 units at an average HK$33,103 per square foot, up 11 per cent from the launch price of HK$29,680 per square foot.

South Land was jointly developed by Road King, Ping An Insurance and the local subway operator MTR Corporation.

Meanwhile, Sino Land said it had raised HK$830 million from the sale of 121 units at its joint venture project, One Soho in Mong Kok, on Saturday. It plans to release another 78 units for sale on Thursday.

(South China Morning Post)

Buyers pile into Hong Kong’s biggest weekend property sales in seven months as they park their investments in fixed assets

Increased investor interest was seen in Saturday’s sales of three newly released projects in Hong Kong

Investors and owner-occupiers snapped up 379 flats, or 76 per cent of the 500 units on offer across the city as of 8.40pm, according to sales agents

Buyers piled into Hong Kong’s biggest weekend property sales in seven months, snapping up new homes on offer at three locations across the city over the Labour Day holiday weekend, as they set aside concerns of a flare-up in coronavirus cases to park their investments in fixed assets.

Investors and owner-occupiers bought 379 flats, or 76 per cent of the 500 units on offer across the city as of 8.40pm, according to sales agents. The total tally excluded 10 luxury units which were sold without price guidance, the results of which will be disclosed next week.

Road King Infrastructure Limited sold all 240 flats at its South Land project at the Wong Chuk Hang subway station. The first apartment project to sit atop a major subway station in about three decades received 5,500 bids, or an average of 22 buyers registering their interest for every available unit, with one family splashing HK$200 million (US$25.8 million) for eight units of South Land’s three-bedroom apartments, agents said without identifying the buyers.

Brisk sales were also reported at Sino Land’s One Soho project in Mong Kok, where 121 of the 168 apartments found buyers. Sun Hung Kai Properties (SHKP), aiming to repeat its 90 per cent sell-out launch from last weekend, sold 18 of the 82 apartments on offer at phase two of its Regency Bay development in Tuen Mun.

The bull run in the residential property market underscores the economic conundrum amid raging coronavirus pandemic: the torrent of cheap money unleashed by global central banks to bolster the world economy finding its way into the stock market and fixed assets, as investors seek higher returns for capital. Hong Kong’s economy is struggling to claw its way out of the worst contraction on record, and the city’s jobless rate is at a multi-year high.

“The sales progress of the three projects can be regarded as hot,” property agent said. “Purchasing power is increasingly being released as people worry that money will depreciate amid low interest rates, and they prefer to invest it in property.”

One in three buyers at One Soho was buying the flat to rent out, the agent said. Regency Bay tends to attract customers who are buying the homes to live in and we are estimating that 80 per cent of buyers were owner-occupiers, the agent said.

Hong Kong’s home prices have been edging upwards in recent months, as the Covid-19 outbreak tapers off while the number of vaccinations rose. The monthly home price index may rise by 4.6 per cent in the second quarter, according to another property agency, forecasting that the gauge could climb to a record in May or June.

An influx of new immigrants, mainly from mainland China, also bolstered home sales. The price index for lived-in homes rose to a 20-month high in March as rich investors and buyers turned bullish about the local market.

South Land was jointly developed by Road King, Ping An Insurance and the local subway operator MTR Corporation. The flats on offer ranged from one-bedroom units to three-bedroom apartments, priced between HK$11.5 million and HK$32.4 million each, or HK$27,005 to HK$38,155 per square foot.

One in two customers at the project was buying for investment, agent said. “The investment potential is huge, with the rental return at around 0.3 per cent,” the agent said.

In contrast, One Soho featured smaller, one-bedroom studios priced between HK$7 million and HK$8.2 million after a 14.5 per cent discount. The price range attracted mostly younger buyers, agents said.

At Regency Bay, 74 units were for first-come-first-served today, with prices between HK$5.7 million and HK$8.7 million, and between HK$17,192 and HK$20,310 per square foot. The other eight were for undisclosed bids without price guidance.

(South China Morning Post)黄竹坑配套渐成熟 工商物业具承接力

近期黄竹坑住宅新盘成市场焦点,事实上,该区配套渐成熟,前景甚佳,近期区内工商物业亦具承接力。

黄竹坑为传统工业区,近年渐有甲厦落成,而出租情况亦不差。据代理统计各商业区商厦空置率方面,黄竹坑在住宅项目晋环销情热烈的协同效应下,令市场对该区关注上升,连带区内甲厦空置率有明显改善,由2月约12.81%减3.04个百分点,3月甲厦空置率录得约9.77%。

One Island South 呎租高见30

同区商厦租务上,上月区内指标甲厦 One Island South 录成交,涉及中层8至11室,面积约4,645平方呎,成交呎租约28元;另同厦低层26至30室,面积约5,335平方呎,呎租高见30元。至于楼龄较新的 W50,项目高层01室,面积约2,267平方呎,成交呎租约28元。

恒云国际中心 呎价约1.37万

工厦方面,区内新工厦项目承接力不俗,代理表示,黄竹坑香叶道44号恒云国际中心高层06室,面积约415平方呎,附有基本装修,刚以呎价约13,775元售出,涉及总额逾571.6万元。

新买家为投资者,看好黄竹坑区商贸气氛渐升温,加上黄竹坑站上盖项目陆续发展,人口将递增,认为该区前景潜力无限,因此决定偷步入市作长綫投资部署。

恒云国际中心近期交投平稳,4月份共沽出约4伙,成交价由约432.82万至870.2万元不等,涉资逾2,648万元。

翻查资料,恒云国际中心于2018开售反应热烈,曾录得多宗大手成交。至早前项目届现楼入伙后,发展商趁势推出曾作保留的精选优质单位,销情亦见理想。

至于同区旧式工厦方面同样录买卖,如金来工业大厦一座低层Q室,面积约671平方呎,以约468万元成交,呎价约6,975元。另得力工业大厦中层A室,面积约1,868平方呎,以约1,398万元易手,呎价约7,484元。

分析指,随着港铁南港岛綫通车,黄竹坑与中区距离大为拉近,商业气氛即提升。近日黄竹坑新盘开售,而住宅项目基座部分提供大型商场,可解决区内餐厅及商店不足的问题,配套更为完善,可吸引更多机构进驻该区,料区内工厦及商厦租售价有力向上。

(经济日报)

更多 One Island South 写字楼出租楼盘资讯请参阅:One Island South 写字楼出租

更多 W50 写字楼出租楼盘资讯请参阅:W50 写字楼出租

更多黄竹坑区甲级写字楼出租楼盘资讯请参阅:黄竹坑区甲级写字楼出租

九龙湾亿京中心 呎价1万放售

九龙湾亿京中心单位,以每呎约1万元放售。代理表示,九龙湾宏光道1号亿京中心A座7楼A室连租约放售,单位面积约4,197平方呎,意向售价约4,406.85万元,每平方呎约10,500元。

连约出售 意向价4407万

代理表示,是次放盘连租约出售,物业现时月租约96,500元,租金回报约2.6厘。

单位间隔四正,楼底高度约4.465米,极具空间感,窗户採用特大玻璃设计,用户可享开扬海景景观。

买卖方面,去年尾物业低层D室,面积约1,906平方呎,以约1,990万元易手,呎价约1.04万元。租务上,4月大厦B座高层C室,面积约1,658平方呎,成交呎租约22元。

(经济日报)

更多亿京中心写字楼出售楼盘资讯请参阅:亿京中心写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

观塘国基集团中心 享地利前景佳

观塘活化项目国基集团中心经大型翻新后,质素提升,而物业最大优势,是位处区内核心地段,相当便利。

国基集团中心位于观塘巧明街,地段为该区核心工商及商业地段,连接开源道,除了传统工厦林立外,亦有大型商厦项目包括地标 Landmark East。此外,新地 (00016) 旗下九巴观塘车厂重建项目为于该地段,前景不俗。

3年前完成活化 提升质素

物业比邻地标商场apm,上班人士由港铁观塘站下车,从apm商场再接驳至港贸中心出口便到达该厦,距离地铁站仅5至10分鐘。观塘道亦有多条巴士綫,可前往港九各地。

饮食配套上,apm商场餐厅较多,而附近工厦内或地厂,近年亦开设了不少新餐厅,故选择不少。

国基集团中心原为工厦,2009年政府推出活化工厦措施,业主即进行申请更改用途。

该物业地盘面积约9,300平方呎,楼高9层,总楼面面积约7.5万平方呎,大厦3年前完成活化,提升质素包括大厦外墙,而1至3楼的商铺部分,更用上黑色框,外形上较为时尚。低层部分属零售用途,业主加装扶手电梯,有效疏导人流。地下大堂铺上云石,甚为光猛。

出租率达8成 包括快餐店

物业楼高9层,两部升降机基本上已足够疏导人流。分层楼面方面,5至9楼为写字楼,每层面积约8,000餘平方呎,分为两个单位,分别望向观塘道及巧明街。景观方面,面前受apm等物业遮挡。

楼底高近3米,柱位不算多,间隔四正。至于1至4楼作零售用途,其中4楼提供平台。

大厦现时出租率达8成,零售部分租客包括有快餐店、潮州菜馆、傢俬店等,楼上则获写字楼客人租用,而最顶半层单位现由业主自用。

(经济日报)

更多城东誌写字楼出租楼盘资讯请参阅:城东誌写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

罗素街铺呎租74元跌60%连锁汉堡包店进驻

受疫情冼礼,铺位市场观望气氛瀰漫,核心区一綫街租金持续下滑。消息指,铜锣湾罗素街8号地铺连1楼,获外资连锁快餐店以50万承租,平均呎租约74.6元,取代连锁化妆品零售商,租金急挫近6成,重返约十五年前水平。

月租50万重返15年前

市场消息指出,上述为罗素街8号地铺连1楼,面积6700方呎,旧租客连锁化妆品零售商莎莎,月租120万,租约至今年10月,惟今年4月迁出,市场消息指,该铺获连锁汉堡包店FIVE GUYS以每月50万承租,呎租约74.6元,较旧租金急挫约58%。

据悉,该铺于06年由另一连锁快餐店以每月68万租用,最新租金较十五年前更平。本报昨日就上述消息向业主英皇查询,惟于截稿前未获回覆。

昔日曾为全球最昂贵租金的罗素街,受疫情等因素冲击,租金暴跌,据戴德梁行报告指出,该街道平均呎租按年急跌约43%,亦被尖沙嘴广东道取代为亚太区最贵主要商业街道。

尖沙嘴康宏广场呎租22元

市场消息指出,尖沙嘴康宏广场低层11室,面积约825方呎,于交吉近半年后,以每呎22.4元租出,月租约18458元,低市价约20%,上址旧租金为每呎42元,故最新租金下跌约46%。

(星岛日报)

更多康宏广场写字楼出租楼盘资讯请参阅:康宏广场写字楼出租

更多尖沙咀区甲级写字楼出租楼盘资讯请参阅:尖沙咀区甲级写字楼出租美国商会斥8588万 入市中环乙厦

香港美国商会继去年放售金鐘美国银行中心一篮子单位后,近日入市中环乙厦。根据土地註册处资料,中环香港钻石会大厦高层全层,上月初以8,588万元成交,据代理提供资料,该层面积2,750平方呎,呎价约3.12万元。

新买家是香港美国商会,本报已向商会查询有关事宜,惟至截稿前仍未收到会方回覆。而原业主于1991年以1,220万元买入上址,持货近30年,是次转手帐面获利7,368万元,物业升值逾6倍。

事实上,早前有指商会因财困而沽出旗下一篮子物业,例如金鐘美国银行中心19楼的04至07室、及13室,单位总面积5,968平方呎,并于去年10月以约1.4亿元沽出,呎价约2.3万元。会方前后「一买一卖」,未扣除印花税、地产代理佣金等杂费,美国商会净套现约5,412万元。

尖沙咀汉威大厦地铺 呎售8万

另外,尖沙咀汉威大厦地下A号铺,面积约1,000平方呎,近日以8,000万元沽出,呎价8万元。资料显示,买家为嘉林国际有限公司,而该公司董事是陈善飞,即嘉林国际物流有限公司的创办人。

而上述单位旁边的B号地铺,面积相同,于本年初以意向价约8,800万元放售,呎价叫8.8万元。

(经济日报)

更多美国银行中心写字楼出售楼盘资讯请参阅:美国银行中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多香港钻石会大厦写字楼出售楼盘资讯请参阅:香港钻石会大厦写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

信和广场巨铺减58%租出丢空近两年平均每呎23元

铜锣湾最新录巨铺承租,信和广场一个巨铺,面积逾1.4万方呎,在丢空接近两年后,最新获日本料理以每月约33万承租,较旧租金大跌约58%,平均每呎23元,重返十年前水平。

位处波斯富街及告士打道交界的信和广场,位置上自成一角,惟该厦基座商场聚集名店及高级食肆,地铺有专卖名牌手袋服饰的ISA Boutique旗舰店,1楼有「阿一鲍鱼」富临饭堂。消息人士透露,毗邻富临饭堂的1楼103号铺,建筑面积约14342方呎,最新由日本料理板神承租,月租约33万,较旧租客誉宴月租约80万,足足下跌58%,最新平均呎租仅23元。

日本料理月租33万进驻

知情人士续说,该铺旧租客早于2019年5月离场,面积巨大,加上业主严选租客,令该铺位丢空接近两年,最新迎来的日本料理,堪称全港面积最巨型的日式食肆,该店只提供100个座位,以巨铺面积计,人均呎数逾140方呎,场地阔落,且是正宗日本食肆,不论午餐或晚餐人均消费1000元,高级食肆此时扩张,正显示租客看好后市。而该名租客在接手铺位后,日夜赶工,目前刚在试业,下月才正式开业。

罗珠雄8500万沽鸿福地厂

事实上,近期区内巨铺频获食肆承租,汉堡饱店进驻罗素街1楼巨铺,旧址化妆品连锁店莎莎;区内谢斐道517号总统戏院,旧址酒家,最新由五粮液国际餐饮承租,铺位装修中。

据代理指,由资深投资者罗珠雄持有的观塘鸿福工业大厦地厂,以8500万易手,面积10850方呎,呎价约7834元,属市价水平,上址由汽车美容以19万租用,料回报约2.6厘。

皇后大道中九号每呎3.45万售

市场消息透露,金鐘力宝中心1座中层10至11室,面积约2440方呎,坐享山景对正电梯,以每呎约60元获金融公司承租,创属近一年呎租次高,月租约14.64万。

消息指,中环皇后大道中九号中层12至13室,面积811方呎,以约2799.9万易手,呎价约34524元。土地註册处资料显示,上址原业主于2000年以425万购入,21年升值约5.5倍。

上月录645宗工商铺买卖

据代理统计,4月份市场录约645宗工商铺买卖,总金额约108.93亿,按月微跌约3.8%及10.5%,对比去年同期劲升2.14倍及1.06倍。代理表示,月内瞩目大额买卖,包括新世界以约13亿售出铜锣湾百德新街22至36号翡翠明珠广场地下及地库,传新买家为恒力投资。

(星岛日报)

更多信和广场写字楼出租楼盘资讯请参阅:信和广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多皇后大道中九号写字楼出售楼盘资讯请参阅:皇后大道中九号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

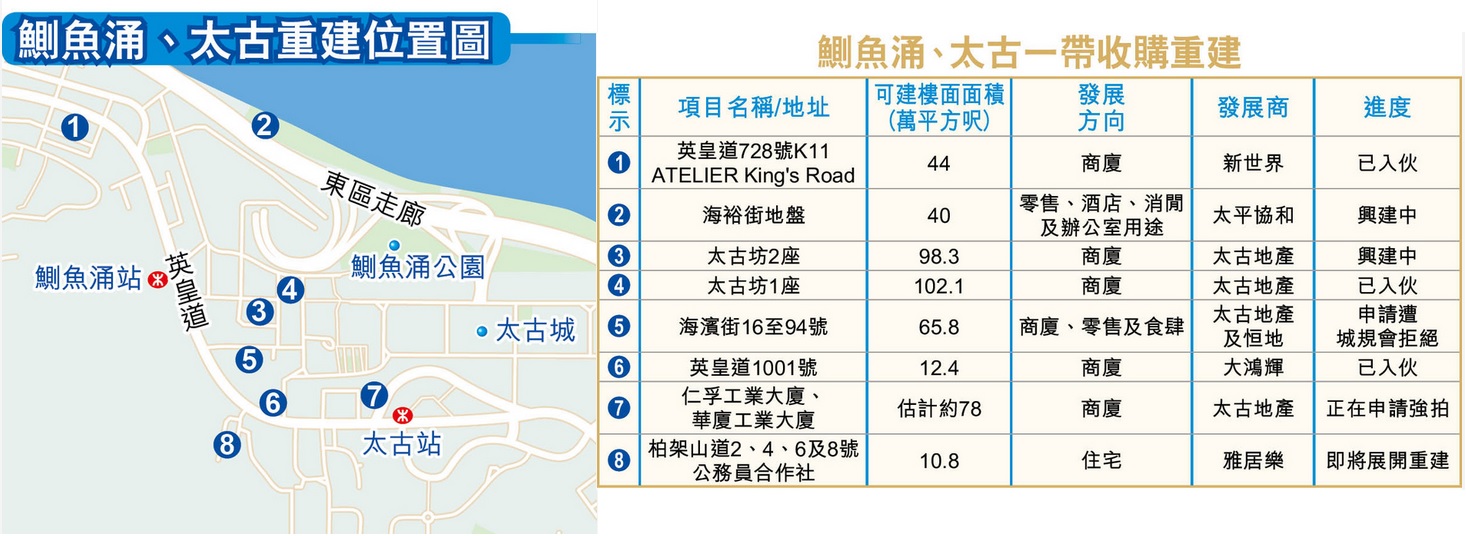

太古持344万呎商业楼面 称霸港岛东

受「去中环化」影响下,港岛东的商业地位与日俱增,其中鰂鱼涌一带现有约8个重建项目,料可为该区供应逾450万平方呎商业楼面,单计大地主太古地产 (01972) 区内手持的项目,已涉逾344万平方呎商业楼面,同时,区内不乏其他发展商,透过收购区内旧楼「插旗」。

早在19世纪已落户于鰂鱼涌的太古,先区内兴建糖厂、船坞及汽水厂,其后于80至90年代逐步发展太古坊商业区及太古一带商厦,令港岛东的商业地位提升。而单计区内持有4个项目,涉及的总楼面面积达344.2万平方呎。

太古坊2座望年内竣工

近年太古地产续积极发展其鰂鱼涌核心商业区太古坊,集团于2016年宣布重建其中3幢工厦,包括康和大厦、常盛大厦及和域大厦,并已经陆续重建成太古坊一座及二座,合共供应逾200万平方呎商业楼面,其中太古坊一座已于2018年落成,其总楼面面积约102.1万平方呎,项目楼高48层,为近年区内规模最大的甲级商厦。另外,太古坊2座将料于2021年竣工,预计可提供约98.3万平方呎商业楼面。

事实上,鰂鱼涌一带近年亦接连录得多宗旧楼收购个案,当中去年太古伙拍恒地 (00012) 就鰂鱼涌滨海街16至94号及英皇道983至987A号旧楼,曾向城规会申请重建为两幢32层高的商厦,惟申请终遭拒绝。

柏架山公务员合作社 拟建住宅

另一个大型发展商新世界 (00017) 近年亦踊跃发展重建项目,除了邻近的北角皇都戏院重建项目上马在即,集团旗下北角甲级商厦 K11 ATELIER King's Road 完成重建,并为该区提供约44万平方呎的商业楼面。

除了商业项目以外,鰂鱼涌亦不乏住宅重建工程,早前由雅居乐收购,位处鰂鱼涌柏架山道2、4、6及8号的公务员合作社物业,已由发展商以底价约4.52亿元夺得,并初步计划兴建3座住宅。值得留意的是,雅居乐于数年前亦已收购比邻的柏架山道10至12号及14至16号公务员合作社物业,可见发展商正积极在区内扩大发展版图。

(经济日报)

更多太古坊一座写字楼出租楼盘资讯请参阅:太古坊一座写字楼出租

更多K11 ATELIER King’s Road写字楼出租楼盘资讯请参阅:K11 ATELIER King’s Road 写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

山顶洋房传8.74亿「卖壳」

由九仓持有、并由会德丰地产负责销售的山顶77/79 PEAK ROAD,市传项目79A号大屋,以公司股权转让形式沽出,作价约8.74亿,呎价达11万,成交价及呎价同创项目新高。

市场消息指,77/79 PEAK ROAD的79A号大屋,传以公司股权转让形式沽出,成交价逾8.74亿,以大屋面积7896方呎计,呎价达11万,成交价及呎价为项目新高。本报昨日就有关消息向会德丰地产作查询,但截稿前尚未获回覆。

仍未上载销售安排

项目共提供8幢大屋,已先后沽出5幢洋房,而是次传沽出的79A号屋,则尚未公布销售安排。是次传沽出的79A号屋,尚未公布销售安排,未能正式推出市场发售,但可透过公司股权转让形式发售。

据土地註册处资料,发展商于18年10月,以4.79亿内部转让79A号屋予DELUXE ACHIEVE LIMITED,目前该公司董事分别为吴天海、徐耀祥及包静国,均为九仓高层。

同系啟德 GRANDE MONACO 昨售出9伙,包括5伙低座单位,面积446至1123方呎,成交价1173.6万至3591.354万元,涉资逾1.68亿。蓝田 KOKO HILLS 再沽1伙,为3座高层H室,520方呎,售价1119.7万,呎价21533元,项目累售107伙,套现逾13.3亿。

(星岛日报)

汉口道铺8000万易手嘉林物流陈善飞承接

尖沙嘴汉口道汉威大厦地铺早前以8000万易手,买家身分曝光,为嘉林国际物流创办人陈善飞。

本报早前率先报道尖沙嘴汉口道44号汉威大厦地下A号铺易手,买家身分终曝光。据土地註册处资料显示,买家以公司名义嘉林国际有限公司登记,註册董事陈善飞,为嘉林国际物流註册董事,原业主早于1968年以28万购入,及后于2012年由陈英鸿及陈英图,以遗产承继人身分承接,物业于53年间升值7972万,升幅约284倍。

豪宅投资者转投铺市

市场消息指,陈善飞由豪宅投资者转投铺市,他近年以约4.95亿购入山顶TWELVE PEAKS双号屋,及以1.22亿购入西半山天汇中层单位。

据嘉林国际物流网页资料显示,该公司1998年成立,从事海运拼箱业务,于本港及内地拥有17家分公司和5个海外办事处;本报向嘉林国际物流查询,惟截稿前未获回覆。业内人士指出,该铺位面积约1000方呎,呎价约8万,交吉易手,于铺市高峰时,澳门鉅记饼家以每月约35万承租。

屯门井财街金铭大厦地下双号铺,建筑面积约500方呎,以1160万售出,呎价约2.32万,原业主于2013年以1250万购入,持货8年帐面蚀让90万,期间贬值约7.2%,现址髮型屋月租3.2万,料回报约3.3厘。

(星岛日报)

US snaps up floor space for $86m

The United States is leveraging on the SAR's property market at a time when the office segment is reeling from pandemic woes.

The American Chamber of Commerce in Hong Kong bought a floor at Hong Kong Diamond Exchange Building in Central for HK$85.8 million after it sold its office space of 5,968 square feet at Bank of America Tower on Harcourt Road for HK$145 million in October.

The 2,750-sq-ft floor at the 26-story Hong Kong Diamond Exchange Building at 8-10 Duddell Street was sold off at HK$31,229 psf. The seller, who bought the floor for HK$12.2 million in 1991, will pick up HK$73.6 million.

The deal went through after the sale of the US government's six-block residential property at Shouson Hill - a thorny issue for potential buyers amid the Sino-US rift. That was not completed until February.

Beijing had stepped in unexpectedly and said its approval was needed in late 2020.

The Land Registry told Hang Lung Properties (0101), which agreed to buy the luxury villas for HK$2.56 billion in September, that if the US consulate general intended to rent, purchase or sell any property in Hong Kong, then the US government must make a written application to China at least 60 days before any deal.

It also stated that the US consulate was not a commercial entity, and nor was the property ordinary real estate.

Washington had put the six blocks occupying a 94,796-sq-ft spread at 37 Shouson Hill Road up for sale amid tensions over Hong Kong. It had held the property since 1948.

The twists raised eyebrows as tycoon Ronnie Chan Chi-chung, the chairman of Hang Lung Properties, has good relations with influential elements in the mainland and the United States.

Beijing's high-profile interference has rarely been seen in other transactions of consulate property in Hong Kong.

Five years ago the Canadian consulate sold a house at 6 Goldsmith Road in Jardine's Lookout to Pansy Ho Chiu-king, daughter of the late Macau casino tycoon Stanley Ho.

And in 2011, the French consulate sold its property at 8 Pollock's Path to Ryoden Development.

(The Standard)

For more information of Office for Sale at Bank of America Tower please visit: Office for Sale at Bank of America Tower

For more information of Grade A Office for Sale in Admiralty please visit: Grade A Office for Sale in Admiralty

For more information of Office for Sale at Hong Kong Diamond Exchange Building please visit: Office for Sale at Hong Kong Diamond Exchange Building

For more information of Grade A Office for Sale in Central please visit: Grade A Office for Sale in Central

Property turnover shoots up

The property sector saw turnover more than double to HK$85.1 billion last month from a year before, data from the Land Registry shows.

That was up 122 percent on a year-on-year basis and 9.1 percent month on month.

By volume, property transactions surged to a two-year high, up 88 percent year on year and 0.9 percent month on month to 9,150.

Residential property deals amounted to 7,325, up 78.6 percent year on year and down 1.6 percent month on month.

Property agent said first-hand private home sales declined in April after months of hot sales. Transactions saw a 33 percent decline month on month.

That came as Henderson Land Development (0012) expects to release about 50 units more in the third price list of The Henley I in Kai Tak.

It plans to open the first round of sales on Sunday to offer at least 146 units, said general manager of sales Thomas Lam Tat Man. At least 10 featured units will open for sales by tender on Saturday.

The company received at least 1,400 checks and was oversubscribed more than eight times.

AquilaSquare Mile in Tai Kok Tsui will open sales of 22 units on Saturday, with prices between HK$23,043 and HK$27,173 per sq ft after discounts.

RK Properties will offer 180 units at South Land, the first phase of The Southside development above Wong Chuk Hang Station, on Saturday. The developer may also launch eight units by tender at the same time.

Mainland developer Sino-Ocean Group (3377) will offer 45 units at Uptify in Mong Kok for sale on Saturday.

The first round of sales includes 17 studio units, 23 one-bedroom units and five one-bedroom with study room units, ranging from 172 square feet to 318 sq ft.

The price is between HK$19,596 and HK$25,055 per sq ft after discounts.

Emerald Bay Phase 2 in Tuen Mun will put 110 units up for sale on Saturday and 27 units up for tender on Monday. The minimum price of a 223-sq-ft flat is HK$3.73 million.

CK Asset (1113) sold a 2,945-sq-ft unit at 21 Borrett Road in the Mid-Levels for HK$232.8 million, or HK$79,000 per sq ft.

In the secondary market, an 863-sq-ft flat at South Horizons in Ap Lei Chau changed hands for HK$18.3 million, or HK$21,205 per sq ft. The seller, who bought the unit for HK$4.43 million in 1993, will see a capital gain of HK$13.87 million.

The one-month Hong Kong interbank offered rate, which is linked to the mortgage rate, fell to 0.08089 percent yesterday.

(The Standard)

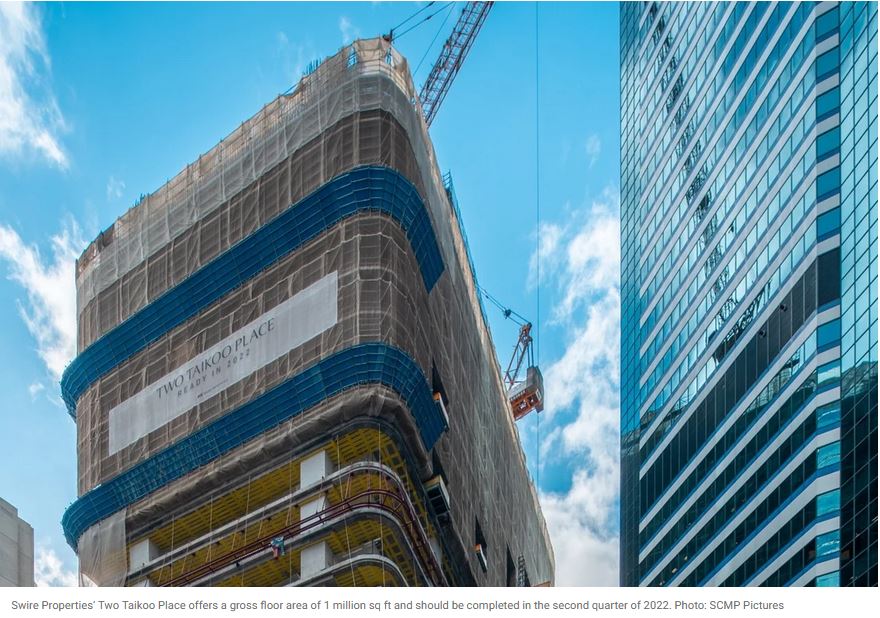

Swiss bank Julius Baer leases office space in Swire’s Two Taikoo Place, Quarry Bay, in biggest ‘decentralisation deal’ since 2018

The bank, currently based in Central, has leased four floors in the 41-storey skyscraper, which property agents described as the largest ‘decentralisation deal’ in Hong Kong since late 2018

Many companies have left Central, the world’s most expensive place to run an office, to take up space in non-core districts such as Causeway Bay, Quarry Bay and Tsim Sha Tsui

Swiss private bank Julius Baer will move into Swire Properties’ new 41-floor skyscraper, Two Taikoo Place in Quarry Bay, which property agents described as the largest “decentralisation deal” in more than two years in Hong Kong.

The bank, currently based in Central, said it has leased four floors of the office building, which is scheduled for completion in the second quarter of 2022.

Swire said it has successfully secured its first anchor tenant, which is from the finance sector and will take up four floors covering 100,000 square feet of the new building, but did not provide further information. The company would not say whether it was referring to Julius Baer.

“We are increasingly attracting a greater proportion of both professional services and those from the banking sector. For most of them, obviously [moving from Central] represents cost saving, but they are also increasingly looking for space where they can design offices that cater to a new workplace strategy,” said Don Taylor, director of office, Swire Properties.

Julius Baer currently has three floors in the International Finance Centre (IFC) with a lease expiring at the end of 2023 and two floors in Exchange Square expiring in March 2023, according to Land Registry documents.

“We will continue to have our presence in Central in the foreseeable future. We continue to hire and this new premises in Quarry Bay will be our significant investment in Hong Kong,” said the bank, which has its headquarters in Zurich. “This will allow us to expand our presence in the next decade [and] to design the future workplace and cater to the growing needs of our clients.”

The average monthly rent in Quarry Bay was about HK$50 (US$6.44) per square foot in the first quarter, just 40 per cent that of Central, according to property agent.

That would mean the Swiss bank could save nearly HK$5 million a month with a wholesale relocation.

“Such a move would save the Swiss bank at least half of what it used to pay,” agent said.

“This is the biggest decentralisation deal since the SFC announced its relocation to Quarry Bay in late 2018.

Decentralisation has become a growing trend as companies have left Central, the world’s most expensive place to run an office, to take up space in non-core districts such as Causeway Bay, Quarry Bay and Tsim Sha Tsui. It has been going on since late 2018, when rents hit a record high in the city.

The Securities and Futures Commission (SFC) moved out of the Cheung Kong Center in August last year, having inked the deal in late 2018.

BNP Paribas was reported to have shed one floor in Two IFC in January this year while Australian investment bank Macquarie Group gave up a major portion of space it leases at One IFC last June.

Recently, some international companies have been moving back to Central, to take advantage of a dramatic decline in rents caused by the Covid-19 pandemic’s blow to the economy. They include rating agency S&P which relocated from ICC to Three Exchange Square.

But market observers believe that amid the city’s worst recession on record, companies are still cautious about spending big on leasing office space.

“Although there are some cases of companies moving back to Central as rents have turned soft there, the greater trend continues to be cost-saving relocations amid uncertainties ahead,” agent said.

Hong Kong’s economy rebounded by 7.8 per cent in the first quarter of 2021, after a sinking to a historic low a year ago amid the coronavirus pandemic.

“Occupiers are focused on cost, workplace health, safety, and we are likely to see an increase in office relocations in the future. There is increased emphasis from landlords to offer greater occupier amenity and experience, from flexible office space, communal meeting and conferencing facilities to pop-up style F&B that adds to the user experience,” another agent said.

To meet the changing requirements, Swire plans to roll out more flexible space in Two Taikoo Place, with on-demand meeting rooms and event spaces as well as informal collaborative spaces.

“There will be winners and losers. The landlords that adapt to the changing requirements of corporate users are clearly going to benefit,” Swire’s Taylor said.

“In order to give their employees the confidence to come to work after Covid-19, to retain and secure talent, occupiers are picking their work locations very carefully. Many are looking at new buildings like Two Taikoo Place that can offer them a blank campus to implement new workplace solutions, for example reducing the density of work stations, and having high ceiling and natural light.”

(South China Morning Post)

For more information of Office for Lease at International Finance Centre please visit: Office for Lease at International Finance Centre

For more information of Office for Lease at Exchange Square please visit: Office for Lease at Exchange Square

For more information of Office for Lease at Cheung Kong Center please visit: Office for Lease at Cheung Kong Center

For more information of Grade A Office for Lease in Central please visit: Grade A Office for Lease in Central

For more information of Office for Lease at International Commerce Centre please visit: Office for Lease at International Commerce Centre

For more information of Grade A Office for Lease in Tsim Sha Tsui please visit: Grade A Office for Lease in Tsim Sha Tsui

HKR International invests more in Hong Kong’s older buildings as home prices climb amid land shortage

The developer behind Discovery Bay has recently spent HK$677 million (US$87.2 million) on two buildings – one industrial and one residential – for redevelopment

The number of industrial properties changing hands rose 37 per cent in March to the highest level since May 2019, according to data from property agency

HKR International, the home builder behind Discovery Bay, is focusing more on redeveloping older buildings in urban areas as the city’s famous shortage of land forces developers to try new strategies in order to tap rising home prices.

It has spent HK$677 million (US$87.2 million) on two buildings – one industrial and one residential – since December for redevelopment.

“The continuous shortage of land in Hong Kong, especially in prime locations, has caused property developers to turn to alternative means of growing their portfolios,” said executive chairman Victor Cha Mou-zing in an email interview with the Post.

“Acquisition and conversion of old buildings, and transforming low-yield growth assets is gaining popularity among developers.”

Hong Kong’s home prices have been edging upwards in recent months, as the Covid-19 outbreak tapers off and the roll-out of vaccinations has gathered pace.

Cha, formerly deputy chairman and managing director of the company, was named executive chairman of HKR late last year after his older brother Payson Cha Mou-sing, 77, died in early November.

The 71-year-old has more than 40 years of experience in real estate development under his belt.

In December, HKR paid HK$310 million for a 16-storey industrial building, the United Daily News Centre, in Kowloon’s To Kwa Wan area. Then in March it purchased at a 66-year-old residential building on Hollywood Road and Upper Lascar Row in Sheung Wan for HK$367.3 million.

It has filed an application to the Town Planning Board to convert the United Daily News Centre into a 24-storey, 110-unit residential tower. Residential units will take up 45,538 square feet, while 8,708 square feet will be commercial spaces, according to a document released by the planning board last Friday.

The proposed redevelopment would generate a total gross floor area of 54,246 sq ft, according to the submitted plan, and could translate to an average land cost of HK$5,716 per sq ft before the land premium payable to the government.

The acquisition came two weeks after the government announced the removal of double-stamp duty on non-residential properties.

The double taxation – known as Doubled Ad Valorem Stamp Duty (DSD) – was introduced in February 2013 with the aim of tackling speculative activity in the market. It doubled or increased stamp duty rates across the board. The maximum rate has now dropped back from 8.5 per cent to 4.25 per cent, spurring the industrial investment market.

On a monthly basis, the number of industrial properties changing hands rose 37 per cent to 349 in March, the highest level since May 2019, according to data from property agency.

The agency said the total transaction value jumped 24 per cent to HK$2.3 billion in the same period.

“It is a trend for builders to acquire old buildings for redevelopment as small to medium-sized players have been edged out by the fierce competition in government tenders,” a surveyor said.

The diversification away from Discovery Bay – a sprawling community on Lantau Island – could help to reduce risk, the surveyor said.

“With a limited supply of industrial buildings in urban area, the commercial value for the redevelopment of such properties will be attractive to developers,” another agent said.

(South China Morning Post)上月录687宗工商铺买卖 代理:创两年来新高

据代理综合土地註册处资料显示,今年4月工商铺註册录687宗,按年飆升2.2倍,创两年新高,註册金额录90.4亿,亦创一年半新高。总计今年首4个月,工商铺註册量合共录2353宗,已经超逾去年全年的62%,註册金额累积录得289.6亿,为去年全年59%。其中,铺位註册量连升五个月,创近三年新高水平。

工厦录380宗成交

上月註册量最多为工厦,期内共录380宗,铺位市场居次席,录178宗,写字楼则录129宗,其中铺位註册量连升第5个月,并创下接近3年新高纪录。

工厦录最多登记金额,共涉44.6亿,当中包括葵涌佳宝集团中心全幢,登记金额为14.35亿,该宗亦为工商铺4月登记金额最高的个案。

铺位註册量连升五个月

代理表示,去年底工商铺正式「撤辣」,加上市场前景渐明朗,游资四出找机会,去年基数甚低,未来将有多个新盘推出,预计交投持续,该代理调高全年成交量,由早前预期5250宗,调高至全年逾7000宗,原先料按年升约38%,最新为升逾80%,数字相当于未来8个月,每月平均逾580宗水平。

(星岛日报)

铜锣湾商地明截标 估值降3成

市场料113亿至172亿 测量师忧流标

坐落于铜锣湾加路连山道,可建楼面逾百万平方呎,属区内罕有的大型商业地。这幅「百亿地王」将于明日 (7日) 截标,有测量师表示,在目前市道不景气下,项目仍有流标风险,而且零售市道差,发展商有机会调高项目写字楼楼面比例。而市场亦跟随市况,将估值调低平均约3成。

该测量师表示,地皮的优势在于他的体量大,预计日后不难吸引人流,惟地理位置不算理想,因为地点远离铜锣湾最核心位置,并距离港铁铜锣湾约10多分鐘的步程,其方便程度或商业配套不及时代广场那一带。

观乎近期零售市道不太理想,该测量师认为,往后发展商有机会提高写字楼的比例至8成,甚至将其中部分楼面发展为服务式公寓,以充分利用地皮。参考目前铜锣湾时代广场写字楼平均租金逾60元,测量师相信以地皮的规模而言,落成后呎租可达60元的水平。如以租金回报约3.5厘计,即呎售约2.4万元。不过,招标条款指明,项目不可分拆出售。

建地下行人通道 接铜锣湾站

值得留意的是,按照卖地条件,买方需兴建幼儿中心、长者日间护理中心及地区康健中心的社会设施。同时,买方亦需要在地皮兴建行人天桥,以连接利园不同期数,并需兴建地下行人通道接驳港铁铜锣湾站,这意味日后通往区内核心地段会更方便。另外,买方亦要保留地皮原有的树木,而且如工程影响地皮内的古迹,包括砖墙及陶瓷喉管,买方需先向古諮委提交保育方案。

项目的地盘面积约15.9万平方呎,以地积比6.8倍计,可建楼面达107.6万平方呎。受疫情影响,市场已将地皮估值平均下调约3成,至约113亿至172亿元,每平方呎楼面地价介乎1.05万至1.6万元。而过去一年接连有商业地流标,该测量师估计,这幅商业地皮亦存流标风险。「根据差估署2021年2月数字,整体租金较2019年8月数字下跌约16%,加上空置率维持约10%的水平,因此发展商出价会更审慎。」

鑑于铜锣湾大地主之一希慎 (00014) 拥有多个大型项目,加上日后将有天桥连接同系的利园商场,可与地皮产生协同效应,因此该测量师预计,希慎很大机会入标,以巩固区内商业王国的地位。除了本地龙头发展商外,中资亦有机会与本地财团合资竞投,扩大香港的商业版图。

(经济日报)皇后大道中九号每呎3.45万易手

核心区甲厦有价有市,再录大手成交。中环皇后大道中九号中层单位,以2800万易手,每呎造价约3.45万,属贴市价水平。

据土地註册处资料显示,上述为中环皇后大道中九号中层12至13室,于上月22日以2800万售出,买家以公司名义耀保(香港)有限公司 (SURE CHARM (HONG KONG)LIMITED) 登记,註册董事为荣智权 (YUNG LINCOLN CHU KUEN) 及荣吴佩仪 (YUNG NG PUI YEE POLLY),前者为前上海商业银行董事长荣智权,以面积811方呎计,成交呎价约34525元。

中层2800万沽

同时,资料亦显示,原业主于2000年5月以425万买入,持货21年帐面获利2375万,物业期间升值约5.6倍。

事实上,该甲厦近期交投不多,据代理资料显示,该甲厦近期成交为皇后大道中九号30楼6室,于2018年9月以1.635亿售出,以面积2930方呎计,呎价约55802元。

(星岛日报)

更多皇后大道中九号写字楼出售楼盘资讯请参阅:皇后大道中九号写字楼出售

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

力宝中心短炒半年升值18%

疫情重创甲厦交投之际,市场罕现短炒获利个案。金鐘力宝中心1座中层单位,以5900万获投资者承接,每呎造价约2.96万,属市价水平。原业主于去年底以4982万购入,持货仅半年,帐面获利逾900万,半年升值18%。

代理表示,上述买卖为金鐘力宝中心1座中层02室,面积约1993方呎,以交吉形式,作价约5900万售出,呎价约2.96万,属市价水平。

投资者5900万承接

买家为投资者,购入作长綫收租用途。

原业主于去年底以约4982.5万买入,持货仅约半年,帐面获利约917.5万,物业期间升值约18%。

据土地註册处资料显示,上址由YORK FAITH INVESTMENT LIMITED持有,註册董事为李姓及文姓等人士。

料回报约2.2厘

代理续指,单位坐享开扬海景,附设基本装修及来去水位,属该甲厦优质单位,以市值租金每呎55元计,料买家享租金回报约2.2厘,据大型代理行资料显示,该甲厦对上一宗买卖为1座20楼5室,面积约1680方呎,于去年以10月以3920万售出,呎价约23333元。

(星岛日报)

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

外资基金18亿购光辉冻仓邓成波减磅沽货三年升值12%

全幢工厦受捧,葵涌录瞩目成交,外资基金ESR首度进军本港,购入葵涌光辉冻仓全幢,作价18亿,原业主为「铺王」邓成波,是他近年来最大宗沽货个案,物业于三年间升值12%。

市场消息透露,「铺王」邓成波沽出一项重磅货,葵涌永业街11至15号光辉冻仓全幢工厦,由外资基金ESR承接,作价约18亿,平均呎价5445元,ESR属于亚太区领先综合物流地产平台,管理资产总值高达299亿美元,涉及物业总楼面为2010万平方米。

邓成波于3年前以约16亿购入该全幢,帐面获利约2亿,物业升值约12.5%。

ESR首度购本港工厦

本报向邓成波儿子邓耀昇旗下的陞域集团查询,发言人表示对市场消息不作评论。

本报亦向ESR查询,发言人亦表示不回应市场消息。

不过,根据ESR通告指出,该公司于香港首次收购一项物业,位处葵涌全幢工厦,未来打算发展数据中心,香港是发展数据中心好地方,电力低廉,天气相对稳定,令风险大为减低,市场对数据中心需求极之殷切,此项收购令集团发展跨进一大步。

本报向该公司查询该项收购地点及作价,惟发言人强调,公司不作公开披露详情。

平均呎价5445元

有熟悉该宗交易的代理透露,该宗交易洽商时间长达一年,买方对物业重建数据中心,作详细市场调查,更就技术性问题,例如开拓基建及电力供应,与电力公司协商,单是掘路及铺设电力费用涉资逾数千万元,在落实一切可行性后,才拍板购入。

对于将来重建发展筹划需时,因此,相信在未来一段长时间,对冻仓租客不会带来影响。该代理续说,该工厦早于三年前,波叔甫购入时,已多番录準买家洽商,当时波叔由企硬逾23亿,减至20亿,曾有準买家在「握手」后褪軚,重建需要魄力克服困难,ESR做得到,而今番卖方减价5亿或21%,推动买方果断决定。

该名代理续说,近两年,葵涌区先后录数据中心营运商购入工厦,内地财团万国数据,先后以8.8亿及7.7亿,购入葵涌大圆街美罗工业大厦1期全幢,以及蓝田街2至16号地盘,发展数据中心。

持货三年帐面赚二亿

近年贸战、政治事件及疫市接着而来,「铺王」邓成波去年下半年开始大手沽货,套现约20亿,随着该全幢冻仓沽出,市场消息指,令他的财政压力减低。该冻仓属巨无霸项目,楼高13层,地下及低层地下为冷仓及车场,1至13楼为货仓,每层面积约2万至3万平方呎,总楼面293850方呎,供应罕有。

目前,邓成波大手放售的项目,还包括西贡5幢工厦,意向价25亿,以及深井汀兰居服务式住宅,意向价约23亿。

(星岛日报)

铜锣湾商业地王今截标疫市重击商厦市场财团出价审慎

儘管疫市下商厦造价持续受压,惟政府推地步伐未见放缓,铜锣湾加路连山道商业地,将于今日截标,为同区近年罕有大型商业地供应,据业内人士指出,受疫情持续反覆,本港经济前景未明,预期财团出价将相当审慎,并具一定流标风险,市场估值约150亿至172亿,每方呎由1.4万至1.6万。

该幅位于加路连山道商业地,地盘15.9万方呎,以地积比率约6.76倍计,可建约107.6万方呎。有测量师表示,该项目属港岛区罕有大型商业地供应,规模仅次于下个月截标的中环海滨地王,地皮位于礼顿道利园6期的对面,紧贴希慎旗下的商厦王国,惟项目位置远离港铁站,加上项目投资额庞大,而且不可拆售,属长綫投资,料项目将主要用作写字楼,预计项目可收7至8份标书,入标财团以大型发展商为主,料以审慎态度竞投,料每方呎地价介乎1.41万至1.45万。

卖地条款不可拆售

另一测量师指出,该项目不可分拆出售,加上疫情持续反覆,零售市道表现欠佳,料各大发展商「各自计数」、以审慎态度竞投,料每呎地价由1.5万至1.6万。

该测量师指出,上述项目为百亿地王项目,投资金额庞大,对发展商资金流具一定压力,料资金回本期高达20年,若项目最终以流标收场,将对市场构成重大冲击,并会影响于下月截标的中环海滨地王。

料资金回本期达20年

另一测量师又表示,近期疫情及环球经济下,料竞投意欲亦将受影响,加上同期中环商业地王亦推出招标,摊分市场焦点,预期市场反应会较审慎,料估值逾150亿,每方呎估值约1.4万。

新地华懋研入标

新地副董事总经理雷霆称,集团正研究入标;此外,华懋集团行政总裁蔡宏兴表示,本港为国际金融中心,商业前景值得看俏,集团正研究入标。

据卖地章程,发展商必须在项目内兴建幼儿中心、长者日间护理中心及地区康健中心各一所,面积约2.08万方呎,日后政府将以建筑成本回购。发展商亦须负责一部分加路连山道的道路改善工程及铺设一条连接东西两边的道路。项目内亦要提供不少于6,000平方米的休憩用地及一个公眾停车场。该地皮早于10多年前,由规划署将前机电工程署旧总部、前民安队大楼等组成的大型用地重建发展,直至今个财政年度才放入卖地表,为同区罕有大型供应。

(星岛日报)

外资宝盛 租太古坊二座9.2万呎

早前消息指,太古地产 (01972) 旗下太古坊二座多层,获外资银行预租。太地发言人表示,集团同时确认太古坊二座迎来首个主要租户,属私人银行瑞士宝盛,将承租太古坊二座约92,000平方呎楼面,租金水平与太古坊一座及港岛东中心高层相若,呎租介乎60中位至70低位。

集团指,太古坊二座的兴建正全速进行,落成后将为太古坊新增100万平方呎楼面。

(经济日报)

更多太古坊一座写字楼出租楼盘资讯请参阅:太古坊一座写字楼出租

更多港岛东中心写字楼出租楼盘资讯请参阅:港岛东中心写字楼出租

更多鰂鱼涌区甲级写字楼出租楼盘资讯请参阅:鰂鱼涌区甲级写字楼出租

代理表示,九龙湾企业广场三期单位,现以约1亿元放售,呎价约1.1万元。

该代理指,涉及物业25楼01至03及05室连两个车位,属4个相连单位,建筑面积约8,970平方呎,坐拥啟德邮轮码头及开扬维港海景。单位部分交吉及部分连租约出售。

(星岛日报)

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

东九商厦活跃 大手买卖涌现

全球多国近年进行量化宽鬆,市场游资充裕,预计明年底或更后时间,美国都不会加息。而随着本港政府将「回港易」计划扩展至广东省以外内地其他地区,以及预料最快5月重啟与新加坡的「旅游气泡」,加上本港新冠疫苗接种计划逐渐普及,笔者认为下半年中港通关有望,预计会刺激本港工商铺市场。

12宗逾万呎买卖

根据代理最新发表的商厦报告指出,近月受到工商铺撤辣带动,不少投资者相继入市,写字楼市场表现渐见突出,今年首3个月指标甲厦售价累积反弹4.5%。今年东九龙商厦大手买卖市场大旺,根据市场资讯及土地註册处资料,由去年年初至今年4月中,东九龙的商厦共录得12宗涉及逾万呎的买卖成交,总成交面积达230,452平方呎,总成交金额更超过24亿元,其中万泰利广场一个高层海景全层于今年3月成交,面积约12,042平方呎,呎价16,741元,总售价超过2亿元。

东九龙商厦拥有眾多优势,其中低基数效应,加上普遍区内商厦平均呎价为一万餘元,吸引不少独具慧眼的投资者入市,大型企业相继落户。政府一直致力将东九龙打造成第二个核心商业区,正落实多项大型城市发展及交通改善工程,再者,政府在推动「起动东九龙」后,观塘、九龙湾一带的工商物业叫座力大为提升,不少业主放盘意慾大增,商贸气氛日益浓厚。

市场普遍看好东九龙写字楼未来发展,相信在多种利好因素推动下,将为区内写字楼需求带来正面影响,预料商厦价量齐升。

(经济日报)

更多万泰利广场写字楼出售楼盘资讯请参阅:万泰利广场写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售铜锣湾商地接6标书 区内地主纷参战

希慎华懋合资竞投 利福伙信置等组财团

铜锣湾加路连山道商业地昨截标,并接获6份标书,参与竞投的以大型发展商为主,当中不乏铜锣湾大地主希慎 (00014) 伙华懋,更有「稀客」领展 (00823) 入标。发展商对本港商业前景有信心。

「百亿地王」铜锣湾加路连山道商业地昨日截标,据地政总署公布,项目合共收6份标书,并吸引多间大型发展商竞投。区内拥多个大型项目的大地主希慎,是次伙拍华懋入标;而信置 (00083) 是次组织「黄金组合」入标,成员包括在区内经营SOGO的利福国际 (01212) 、嘉里建设 (00683) 及中渝置地 (01224) 。另外,会德丰地产、长实 (01113) 、新地 (00016) 、领展均以独资身份竞投。

华懋行政总裁蔡宏兴指,希慎在该区商业及零售物业发展经验丰富,所以很高兴与希慎合作竞投。集团对香港前景富信心,预料办公室需求在经济復甦下将会回升,尤其香港作为国际金融及贸易中心,对写字楼的需求更殷切,会继续物色合适的商业及住宅项目发展。

对前景有信心 领展独资入标

而自数年前开始加入投地市场的领展,是次独资竞投。领展行政总裁王国龙表示,这次独资竞投,反映集团对香港的前景充满信心。另外,他表示集团正寻求合营伙伴;亦相信出价具竞争力。集团未有透露地皮的发展模式。以往领展多以发展民生或公、居屋商场为主,近几年均有参与竞投不同商业地,夺得的项目包括观塘海滨汇及旺角 T.O.P This is Our Place (前工业贸易署大楼)。

有测量师称,由于地皮的规模及投资额较大,是次所收的标书数目相当不俗。在经济前景未明朗下,料发展商出价倾向审慎。

另一测量师指,项目的楼面地价料可高于西九高铁站上盖商业地,而成交价亦对中环商业地的地价具参考价值。

值得留意的是,市场已将地皮估值下调约3成至113亿至172亿元,每平方呎楼面地价介乎1.05万至1.6万元。

项目位于铜锣湾加路连山道,地盘面积约15.9万平方呎,以地积比约6.76倍计,可建楼面达107.6万平方呎。按照卖地章程,中标财团需兴建幼儿中心、长者日间护理中心及地区康健中心。此外,财团亦需兴建行人天桥,接驳希慎旗下的利园商场,而地皮亦不可拆售。

(经济日报)

更多海滨汇写字楼出租楼盘资讯请参阅:海滨汇写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

更多弥敦道700号写字楼出租楼盘资讯请参阅:弥敦道700号写字楼出租

更多旺角区甲级写字楼出租楼盘资讯请参阅:旺角区甲级写字楼出租

更多利园写字楼出租资讯请参阅:利园写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

Link REIT. bids for Causeway Bay site

Link Real Estate Investment Trust (0823) said it has bid for the commercial land on Caroline Hill Road in Causeway Bay.

Chief executive George Hongchoy Kwok-lung said this reflects the confidence in the future of Hong Kong, noting that the city is the base and core market of Link REIT.

Link REIT is prepared to develop the site based on tender conditions and is open to a partnership.

Previously the REIT acquired a retail-cum-office building at HK$5.91 billion, formerly known as Trade and Industry Department Tower at No 700 Nathan Road, Kowloon.

(The Standard)

For more information of Office for Lease at 700 Nathan Road please visit: Office for Lease at 700 Nathan Road

For more information of Grade A Office for Lease in Mong Kok please visit: Grade A Office for Lease in Mong Kok

Hong Kong buyers snap up all 180 of Road King’s South Land flats, as economic growth lifted moods

Road King Infrastructure sold all 180 of its South Land flats at Wong Chuk Hang, repeating its sell-out weekend amid enthusiasm for the first mass property project atop a subway station in decades

In Mong Kok, Sino Ocean sold 27 of the 45 flats on offer at its Uptify project, sales agents said

New homes on offer in Hong Kong over the weekend were greeted with fanfare and enthusiasm, as a stronger-than-expected growth pace in the city’s economy bolstered confidence and brought investors back into the property market.

Road King Infrastructure Limited sold all 180 of its South Land flats at Wong Chuk Hang, repeating its sell-out weekend amid enthusiasm for the first mass property project atop a subway station in decades. In Mong Kok, Sino Ocean sold 27 of the 45 flats on offer at its Uptify project, sales agents said.

“The sales results were not a surprise,” agent said. “A high sales number was expected. Some units priced at more than HK$7 million (US$901,380) at Uptify were unsold because buyers were taking a wait-and-see attitude.”

The strong sales response underscores how the forecast-beating performance by Hong Kong’s economy had lifted sentiments. First-quarter economy expanded 7.8 per cent at the fastest pace in 11 years, beating economists’ forecasts while ending a six-quarter losing streak.

Hong Kong’s home prices have edged upwards in recent months as a rising number of vaccinations helped the city authorities get the Covid-19 pandemic under control.

Prices at South Land’s 180 flats started at HK$11.6 million, going up to HK$66 million (US$8.5 million), or a range of HK$27,005 to HK$54,187 per square foot.

The project’s sales kicked off on May 2, when Road King put the first 240 apartments of South Land on the market. The project sold out, with as many as 22 buyers bidding for every available unit. One family spent HK$200 million to snap up seven of the three-bedroom apartments during the sale, agents said.

Across town in Mong Kok, Uptify was priced between HK$3.98 million and HK$7.34 million, or HK$19,596 to HK$25,055 per square foot. The project was favoured by first-home buyers and younger residents, who made up most of the buyers registering their bids, according to agents.

More than 600 new apartment units had been transacted in May, and the number is likely to break through the 1,000 mark after buoyant sales this weekend. Last weekend, more than 900 flats hit the city’s residential property market, the biggest sale in seven months.

On Sunday, Henderson Land Development will offer 196 units at The Henley, its first project in Kai Tak. Prices of the project are 11 per cent higher than another project on the site of the city’s former airport in February.

(South China Morning Post)铜锣湾勿地臣街作价6380万 祥益汪敦敬连扫两铺

毗邻全港「呎价铺王」、铜锣湾勿地臣街一个地铺以6380万易手,平均呎价约51万,该铺对正时代广场,买家祥益地产主席汪敦敬表示,该地段是兵家必争地,若不是疫市的话,有钱也买不到!他亦新购荃湾一个铺位,作价1800万。

继购入尖沙嘴铺位,祥益地产汪敦敬主席于3个月内,共斥1.656亿买铺,最新为波斯富街77至83号波斯富大厦地下M号铺,位处勿地臣街,面向时代广场,实用面积123方呎,平均呎价高达51万。汪敦敬说,若不是疫市,黄金地段铺位有钱买不到,放盘例必落入前辈手中。「现时市况太悲情,低估了核心区铺位潜力!」

三个月斥逾1.65亿扫货

此铺原业主POON SEE及POON TAI YEE于1984年5月以38万购入,随后1989年3月,增添一名叫POON TEI MAN的人士,三人共同持有,至今逾37年,帐面获利6342万,升值约166倍。

汪敦敬续说,铜锣湾是兵家必争地,即使没有游客,口罩店、银行及食肆林立,生意长做长有,该铺位由妆品店承租,月租6万,今年10月约满将加至7.5万,料当疫市成过去,月租可达20万,回报约3.7厘。「该铺位有来去水,三相电,比汉口道更适宜卖酒,我不排除让儿子自用。」

平均呎价51万

此铺位毗邻为N号铺,是全港最贵「呎价铺王」,实用面积122方呎,由资本策略主席钟楚义伙拍友人于2014年以1.8亿购入,呎价高达147.5万,记录至今未被打破!现址为找换店。

斥1800万购荃湾铺

汪敦敬连环买铺,最新亦刚购入荃湾南丰中心1楼A10号铺,实用面积196方呎,作价1800万,平均呎价9.18万,现址时装店,月租4.3万,回报率2.86厘。他亦持有同地段A12号铺,实用面积160方呎,现址为CSL,月租7.5万。而今年2月初,他购入尖沙嘴汉口道44号汉威大厦地下B号铺,作价8380万,建筑面积1100方呎,让儿子在此经营日式食肆。

(星岛日报)

九龙湾亿京中心中层放售意向每呎1.08万

市场投资气氛转好,工商铺市场近月交投炽热,用家及投资者入市意欲大增。代理表示,有业主连租约放售九龙湾宏光道1号亿京中心B座中层单位,建筑面积约3939方呎,业主意向售价约4254万,折合每方呎约10800元,现租金回报近2.7厘,租约稳健。

租金回报2.7厘

代理表示,单位间隔方正灵活,楼底特高约4.465米,极具空间感,三面单边令採光度大为提升,并可享啟德海景,物业提供24小时冷水供应及三相电,为用户提供更全面的选择。

大厦地下大堂楼底特高,提供6部高速载客电梯及1部载货电梯,并附设多层停车场。物业设有穿梭巴士接驳至港铁九龙湾站,而且邻近企业广场地下有大型巴士总站,可迅速前往各区。代理预计项目洽购反应不俗。

(星岛日报)

更多亿京中心写字楼出售楼盘资讯请参阅:亿京中心写字楼出售

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

陈秉志2680万沽湾仔铺 帐面赚1092万

近期不断沽货套现的资深投资者陈秉志,市场消息指,最新以2,680万元沽出湾仔摩利臣山道8号地铺,帐面赚1,092万元,升值69%,单是今年他已经沽货套现10亿元。

据市场消息指,湾仔摩利臣山道8号地铺,面积600平方呎,原叫价3,000万元,最终减价11%或320万元,以2,680万元交吉沽出,呎价约44,667元。

资料显示,陈秉志在2005年6月以1,588万元购入上述铺位,持货约16年,帐面升值1,092万元或69%。据指,现时租用该铺的租客日式餐厅八摩山,亦是与业主相关人士经营。

陈秉志今年沽货套现10亿

陈秉志放货行动未完,其持有的摩利臣山道10号铺位,叫价2,500万元。

被称为「磁带大王」的陈秉志经营磁带和光碟生产生意,亦是资深物业投资者。

近两年陈秉志不断沽出多项物业,单是今年已经沽出超过10亿元物业,包括1月份以2.4亿元卖出蓝田兴田邨的兴田商场、一篮子地铺及停车场共23个车位,而3月份则以逾1.51亿元,沽出大鸿辉 (荃湾)中心18楼及21楼。

另外,湾仔道87号地下连阁楼,亦即是前裕华国货铺位,最新以3,100万元获时装店老闆购入。据资料显示,原业主在1967年5月以13万元买入铺位,持货54年,升值237倍,帐面大赚3,087万元。

(经济日报)

麒丰资本:物色铺位超豪宅 迎復甦

工厦呎价低水吸投资 将推今年首个项目

投资市场今年转好,麒丰资本认为,在眾多物业范畴中,今年以最低水的工厦呎价走势较佳,而该基金今年将推售首个项目,同时开始物色铺位及超级豪宅,迎接市况全面復甦。

疫下去年投资市场表现淡静,而今年情况大为改善,市场连录多宗大额买卖。麒丰资本创办合伙人暨投资总监洪英伟对物业市场看法正面,「本身供应低,而疫情下全球量化宽鬆,通胀势来临,而市场其他投资产品如债券等,未必能抗通胀,始终物业较稳健,资产价格预计向上。」

不过,他亦认为商业租务市场仍有待復甦,「疫情对租务影响较大,毕竟要完结才有商务活动,空置率续会上升。不过,对投资者来说要早着先机,已开始入市,估计今年下半年整体价格回升,租务则要待明年才畅旺。」

工厦最优秀 连录大手成交

今年暂以工厦市场表现最优秀,连录多宗大手成交,洪英伟分析,工厦价格最低水是关键,「在不同物业类型中,工厦最低水,未来仍会低水,但相信会收窄,未来新式工厦与写字楼价差较细。目前住宅新盘成交呎价已3万元,新式工厦呎价仍维持9,000至1万,低水吸引投资。」除了工厦外,他认为去年第4季商铺市场已略为反弹,最近交投亦颇旺,现已届入市时机。「疫情不会永远存在,投资者不会等復甦才入市,现积极留意铺市。」

最近住宅市场畅旺,新盘热卖,麒丰资本创办合伙人暨行政总监郭浩泉分析,整体住宅市场向好,而超级豪宅更值得留意,「近月豪宅买卖开始转旺,山顶、赤柱、半山地段亦有新高价,但此刻尚未有内地客入市。一直以来,最优质豪宅市场靠内地客推动,只要日后内地客重返,造价会大升,故现亦可以留意。」

麒丰资本过往积极吸纳土地,手上3项目全属工厦地盘,其中两个为工厦项目,一个将补地价发展商厦。

新蒲岗新工厦项目 拟下月底推

基金头炮将为新蒲岗新式工厦项目,该盘原为美华工厂大厦,基金购入全幢后重建,将提供逾200伙,面积约千餘平方呎,合共约30万平方呎,计划下月尾推售,涉投资约25亿元。洪英伟指,项目前景理想,「质素上参考甲厦,设计、外形与甲厦无异,目标为投资客及用家。啟德住宅多,需要商业元素。我们注入新元素,如大厦内设共享空间,甚至健身地方。」

另外,观塘鸿图道32及33号,将发展成商厦及工厦,其中32号补地价作商厦用途。正值政府推出工厦补地价标準金额,郭浩泉认为对发展商来说是好事,并看好观塘前景,「可以较易计算成本,而同地段日后有新地九巴车厂重建,属将来观塘最有规模项目。」他透露,基金两重建项目料明年推出。

(经济日报)

Mother makes daughters' day with $1.7m Henley gift

Henderson Land Development (0012) sold nearly 70 percent of the 196 units on offer at The Henley I in Kai Tak as of 5 pm yesterday.

And as Hong Kong celebrated Mother's Day, a woman forked out HK$1.7 million as down payments for two one-bedroom flats at the project for her two daughters, local media reported.

Meanwhile, RK Properties released 160 units in the fourth price list of SouthLand, the first phase of The Southside development atop Wong Chuk Hang Station, at an average price of HK$33,980 per sq ft after discounts, 14.45 percent higher than the first price list.

The cheapest unit, measuring 290 sq ft, is offered at HK$9.58 million after an 18 percent discount is applied.

The developer has collected about HK$9 billion after selling 426 units at the project.

In the luxury property sector, CK Asset (1113) sold a 2,154-sq-ft unit at 21 Borrett Road in the Mid-Levels for HK$170 million, or HK$78,923 per sq ft.

CK Asset has raked in HK$2.15 billion after selling eight units at the project.

In February, CK Asset sold a 3,378-sq-ft penthouse with a private swimming pool and three parking spaces at the development for HK$459.4 million, or HK$136,000 per sq ft. That per-square-foot price was a new high for a flat in Asia.

In the secondary market, property agency reported 17 secondary transactions at 10 blue-chip housing estates over the past weekend, the same as the previous weekend.

A 518-sq-ft flat at Tai Koo Shing in Quarry Bay changed hands for HK$10.7 million, or HK$20,656 per sq ft.

The seller, who bought the unit for HK$11.35 million in 2018, will make a capital loss of HK$650,000. Another 582-sq-ft flat at the estate fetched HK$12.8 million, or HK$21,993 per sq ft, and the seller will gain HK$7.14 million after holding the property for 11 years.

In Sha Tin, a 327-sq-ft flat at City One Shatin changed hands for HK$6.27 million, or HK$19,174 per sq ft.

(The Standard)50大甲厦4月26买卖3年高

商厦买卖加快,报告指,4月份50大甲厦录26宗买卖,创3年新高。

去年底工商铺「撤辣」,加上本地疫情缓和,并已经展开疫苗接种计划,中港通关现曙光,写字楼交投终录「报復式反弹」。代理数据显示,4月份50大指标甲厦共录得26宗买卖,按月大增逾86%,更创下自2018年3月份以后,即3年来新高纪录。

代理数据显示,4月份50大甲厦共录得26宗买卖,较3月份的14宗升85.7%,成交面积共录11.1万平方呎,按月挫13.2%,主要是因为3月份市场连录多宗全层大手买卖,推高基数所致。

首4月录62买卖 达去年82%

总计今年首4个月,50大甲厦合共录得62宗买卖,已经达到去年全年的76宗的81.6%。

若按区域划分,上月九龙区成交量佔最多,期内录得17宗,至于新界及港岛区分别录得4宗及5宗。其中,东九龙期内共录得8宗买卖,是上月表现最佳的分区,尖沙咀 (包括尖东) 亦录得6宗交投。

另外,上月共有35座大厦录零成交,数字是2018年4月份以后单月最低。

代理表示,去年底工商铺「撤辣」,加上本地疫情缓和,刺激市场交投气氛。另一方面,环球游资充裕,股市已经上升近一年,部分资金因而转投写字楼市场,带动交投出现「报復式反弹」,上月买卖宗数亦重回2017、18年旺市的水平。

该代理续指,上月以东九龙交投表现较突出,因为该区甲厦呎价普遍1万餘元,属低水之算,吸引不少新晋投资者入市吸纳,因而带动交投。展望后市,代理认为政府已经推出「回港易」计划,现时亦与澳门及澳洲、新西兰等地商讨旅游气泡,相信稍后中港通关也有望实现,因此对于今年的写字楼成交量感到乐观。

(经济日报)

湾仔海港中心中层 呎价2.9万

湾仔海港中心中层海景单位,获用家以呎价约2.9万元承接,涉及总成交价约1.034亿元。

代理表示,湾仔海港中心中层04至05室刚售出,单位面积约3,567平方呎,成交呎价约2.9万元,涉及总金额约1.034亿元,以交吉形式交易。

原业主早于2007年购入物业,当时作价每平方呎约8,800元,多年来一直作长綫收租用途,持货14年转手,帐面获利约7,205万元,物业期间升值约2.3倍。

另外,投资者早前购入葵涌海暉中心一篮子工商单位,现分拆出售,售价由约434万元起。

葵涌海暉中心拆售 434万入场

代理表示,葵涌梨木道73号海暉中心项目现正公开发售,今次共提供40个单位,面积由约1,278平方呎至全层约8,152平方呎,售价由约434万元起;同时以配售形式推出车位出售,叫价约180万元。何氏指,今次推售的项目以现状形式交易,当中部分单位连租约。

(经济日报)

更多海港中心写字楼出售楼盘资讯请参阅:海港中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

代理表示,九龙湾企业广场三期单位,现以约1亿元放售,呎价约1.1万元。

享邮轮码头维港景

代理指,涉及物业25楼01至03及05室连两个车位,属4个相连单位,建筑面积约8,970平方呎,坐拥啟德邮轮码头及开扬维港海景。单位部分交吉及部分连租约出售。

成交方面,该厦本年录得一宗大额买卖。涉及该厦多层楼面,涉及7.28万平方呎,以约7.9亿元成交,呎价约1.08万元。单按呎价计,已较去年该厦成交呎价约1.2万至1.3万元,低约2成。

据悉,涉及楼层为41、43、45、47、49楼全层,为项目最高楼层,并连16个车位及3个广告招牌位等。由于属极高楼层,可享优质啟德海景。

原业主为内地企业福晟国际 (00627) ,3年前以13.3亿元购入,如今帐面蚀5.4亿元离场。

(经济日报)

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

工商铺4月买卖平稳向好 铺较佳

疫情缓和下,工商铺买卖平稳向好,金额亦上升。代理行统计显示,4月份工商铺买卖平稳,特别以铺位交投较佳,预期本月持续理想。

近两个月工商铺买卖稳定,代理资料显示,4月份市场录约645宗工商铺买卖成交个案,比3月轻微下跌约3.9%,但较2020年4月则大幅增加2.1倍,4月份按月整体工商铺宗数递减主要是受復活节及清明长假期影响,而按年增幅则充分反映市场已逐渐适应新经济环境,买家对入市工商铺信心回升;成交金额方面,走势与宗数相若,4月份涉及总金额约108.93亿元,较上月有约一成跌幅,按年上升约1.07倍。

铺位表现进取 量价齐升

按三个范畴分析的话,铺位市场表现进取,是唯一成交宗数及金额按月上升的类别,由3月约153宗升至最新约167宗;至于金额亦比3月增加约10%,至4月约31.91亿元。

至于代理综合土地註册处资料显示,4月份工商铺註册共录得687宗,按年升2.2倍,并创下两年新高纪录;註册金额录90.4亿元,亦创一年半新高。总计今年首4个月,工商铺註册量合共录2,353宗,相当于去年全年的62%,註册金额累积录得289.6亿元,也接近去年全年59%。

4月份註册量最多的为工厦,期内共380宗,其次为178宗的铺位,写字楼录129宗,其中铺位连升5个月,并创下接近三年新高纪录。註册金额方面,工厦物业录得最多登记金额,共涉44.6亿元,当中包括葵涌佳宝集团中心全幢,登记金额为14.35亿元,该宗亦为工商铺4月份登记金额最高的个案。

回顾上月买卖,铺位交投成焦点,核心区连录大额买卖,包括新世界以约13亿元售出铜锣湾百德新街22至36号翡翠明珠广场地下1、2号铺及地库,总面积约22,654平方呎,新买家为料为中资集团恒力投资陈长伟或有关人士。此外,同区兰芳道7号地铺及1号楼铺位,以8,000万元易手。

代理预测 工商铺全年逾7千宗

后市方面,代理认为,疫苗接种组别渐扩阔,防疫措施逐步放宽,为零售及餐饮市道带来曙光,利好工商铺市场,而即使本月买卖交投量有所放缓,惟成交宗数仍突破600宗水平。相信在眾多正面因素支持下,工商铺买卖成交量会继续稳步上扬。另一代理表示,去年底工商铺正式「撤辣」,加上市场前景逐渐明朗化,游资四出物色投资机会。今年市况,该代理认为将有多个全新盘推出应市,预计工商铺交投将会继续上升,并把今年全年工商铺成交量的预测,由早前的5,250宗调高至全年的逾7,000宗。

(经济日报)

甲厦售价月挫1.5%

甲级商厦租售价背驰,有代理最新发表的商厦报告指出,今年4月整体甲厦售价按月下挫1.5%,结束连续4个月升势,而同期整体甲厦平均建筑呎租则按月涨2%。

东九拖累 四连升断缆

该行报告指出,4月整体甲厦售价下跌,主要受到九龙东低价成交拖累,该区甲厦售价按月挫2.2%,跌幅属全港各商业区最大,最新建筑面积平均呎价约10927元;而上月该区买卖个案,包括浸信会医院以约1.62亿元售出九龙湾企业广场一期单位,建筑面积呎价约5734元。

代理认为,近期甲厦市场买卖集中于九龙东,上月该区录8宗交投,并以低价为主,普遍较2019年社会运动前的高位低20%至30%,拖累整体甲厦售价由升转跌,预料短期内商厦售价将会维持窄幅整固。不过,整体甲厦售价今年以来仍录得2.8%升幅。

至于4月乙级商厦售价按月跌0.1%,今年累积仍升1.7%。相对于售价,甲级及乙级商厦租金表现有所好转,按月同告上扬,其中甲厦租金按月升2%,乙厦租金则涨1.3%。

(信报)

更多企业广场写字楼出售楼盘资讯请参阅:企业广场写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

啟德指标商厦举行平顶仪式

由南丰发展的啟德大型商业项目AIRSIDE,于日前举行平顶仪式,项目楼面达120万方呎,当中包括楼高逾30层甲厦,及高达70万方呎的多层购物商场,总投资金额高达320亿,预计于明年第四季揭幕,势成本港新地标。

南丰集团董事总经理张添琳称,集团一直致力发展顶尖国际建筑项目,AIRSIDE将于生活和工作之间建立新的凝聚力,为每一个人或每位置身于社区中的一员拓展广阔视野。

(星岛日报)

邓成波25亿放售九龙城物业

受疫情等因素打击,「铺王」邓成波近期连环减磅沽货,新近以招标形式放售九龙城联合道一篮子物业,市场估值约25亿。

代理指,由邓成波持有的九龙城联合道2至4号部分、联合道6至8号全幢及联合道10至16号部分,以及联合道18号全幢,目前推出标售,整个项目涉及共8个地段,地盘面积约20218方呎,买家可选择购买全部物业或部分,当中联合道18号佔地约10167方呎,总楼面积约84366方呎,而整批物业市场估值达25亿,并将于6月23日截标。

总楼面8.43万呎

资料显示,联合道18号为服务式住宅蔚盈轩,邓成波家族于2017年以约13亿向丰泰地产购入。

事实上,在疫情持续下,邓成波近期频频沽货,早前更以18亿沽出葵涌光辉冻仓全幢,作价18亿,该冻仓属巨无霸项目,总楼面293850方呎。

(星岛日报)

乐风2.8亿购佐敦旧楼业权

市区靚地买少见少,财团纷积极收购作重建用途,乐风集团购入佐敦南京街15至17号逾8成业权,将与毗邻地盘作合併发展。消息人士指,作价约2.8亿。

周佩贤:购逾八成业权

乐风集团创办人及主席周佩贤表示,集团购入佐敦南京街15至17号逾8成业权,该项目为两个独立地段,涉及两幢7层高物业,该地段已画入「商业」用途,地盘面积2796方呎,以地积比12倍发展,可建楼面约33552方呎。消息人士指出,上述收购涉资约2.8亿。

与毗邻地盘合併发展

周佩贤续指,随集团已购入项目逾8成业权,达至强拍的门槛,目前餘下尚未收购的单位,若交易条款不合理,集团有意向土地审裁处入稟申请强拍出售,同时,项目将会与早前已收购的毗邻11至13号地盘作合併发展。

(星岛日报)

罗素街地铺每呎178元租出 租金重返15年前 时装店取代鐘表行

受疫情冼礼,铺位市场观望气氛瀰漫,核心区一綫街租金持续下滑。消息指,铜锣湾罗素街8号地铺,于交吉近8个月后,获外资时装品牌以60万承租,平均呎租约178.2元,取代连锁鐘表行进驻,租金较高位回落逾8成,重返约十五年前水平。

市场消息指出,上述为铜锣湾罗素街8号地铺地下1号及2号地铺,面积约3367方呎,新获意大利时装品牌BRANDY MELVILLE以60万承租,平均呎租约178.2元,该铺旧租户为劳力士鐘表行,于去年9年撤出交吉至今。

月租60万高位回落八成

本报昨日就上述消息向该铺业主英皇集团作出查询,惟于截稿前未获回覆。据业内人士指出,上述铺位于高峰期,月租高达350万,故最新租金较高位回落约83%,亦重回约15年前水平,反映市况疲弱。

Brandy Melville为意大利时装品牌,品牌大部分衣服只有细码及极少量中码,于2018年首度进驻本港,首间店铺设于中环国际金融中心商场。

昔日曾为全球最昂贵租金的罗素街,受疫情等因素冲击,租金暴跌,据代理的报告指出,该街道平均呎租按年急跌约43%,亦被尖沙嘴广东道取代为亚太区最贵主要商业街道。

元朗铺850万沽

事实上,该街道现今吉铺处处,并频录短租,该街道早前亦录大幅减租个案,资料显示,罗素街8号地铺连1楼,面积6700方呎,旧租客连锁化妆品零售商莎莎,月租120万,租约至今年10月,惟今年4月迁出,新获外资连锁汉堡包店FIVE GUYS以每月50万承租,呎租约74.6元,较旧租金急挫约58%。

另一方面,盛滙商铺基金创办人李根兴指出,该基金新以850万购入元朗洪水桥青山公路4至6号德兴楼地下1号铺,为单边铺,面积530方呎,呎价约1.6万,该铺分别由香烛店及便利店以2万元承租,料租金回报约2.8厘。原业主于1985年以34万买入,持货36年帐面获利约816万,物业期间升值约24倍。

(星岛日报)

$80m Repulse Bay flat sale sets new record

A 1,659-square-foot flat at 3 Repulse Bay Road, Repulse Bay changed hands for HK$80 million, or HK$48,222 per sq ft, with the per sq ft price hitting a new high at the estate.

The seller, who bought the unit for HK$63 million in 2011, will make a capital gain of HK$17 million. In comparison, a 1,715-sq-ft flat at the project fetched HK$80 million, or HK$46,647 per sq ft last year.

Bank of East Asia (0023) executive chairman David Li Kwok-po had purchased a flat at the project for HK$51.6 million in 1997, the year that it was completed.

Sun Hung Kai Properties (0016) released the sales brochure of the project last month and local media reported that the developer plans to launch the unsold units for sale.

Hong Kong's luxury property market is thriving despite growing concerns of mutant coronavirus strains and its worst recession in years.

In the primary market, Yau Lee (0406) released 37 units in the third price list of L ‧ LIVING 23 in Tai Kok Tsui at an average price of HK$22,431 per sq ft after a maximum 16.5 percent discount was applied, 18.94 percent higher than the first price list.

The cheapest flat, measuring 283 sq ft, is offered at HK$5.93 million, or HK$20,979 per sq ft, after the 16.5 percent discount.

Separately, Tang Shing-Bor, known in Hong Kong as the "Shop King," will sell a series of properties at 2-18 Junction Road in Kowloon City by tender at a target price of HK$2.5 billion.

(The Standard)长沙湾9重建项目 增逾293万呎商贸楼面

长沙湾重建步伐加快,区内目前至少有9个工、商厦项目正在重建,带来逾293万平方呎楼面新供应,而今年初凯龙瑞基金亦申请将恆发工业大厦重建,将提供逾22.8万平方呎楼面。

过往以轻工业、制衣厂为主的长沙湾工业区,属于近年转型最快的地区之一,由长沙湾道两旁至琼林街一带以分层工厦为主的部分,近年逐步变成为商贸区,目前区内有至少9个重建项目,涉及293万平方呎楼面。

第一集团3工厦改建

当中第一集团近两年连扫区内三幢工厦作重建,亦分别位于大南西街及长沙湾道,均向城规会申请放宽地积比率,将会兴建成新式工厦,涉及逾51万平方呎楼面。例如长沙湾道916至922号工厦,佔地约9,600平方呎,将重建1幢27层高全新工厦,总楼面约12.92万平方呎,而长沙湾道924至926号工厦,地盘面积约1.2万平方呎,亦将重建为27层高工厦,总楼面约17.2万平方呎。

青山道550至556号 发展新式工厦

有基金亦趁市况回落收购工厦重建,其中凯龙瑞基金以约11亿元购入的长沙湾青山道550至556号恆发工业大厦,亦申请重建。该项目地盘面积约15,837平方呎,申请放宽地积比率至14.4倍,涉及总楼面面积约22.8万平方呎,并计划兴建1幢27层 (包括2层地库及1层防火层) 新式工厦,当中设有一层作庇护层及空中花园。

永义亦积极在区内重建,同系高山企业 (00616) 除了收购琼林街121号项目进行重建外,在两年前亦在内部转让大南西街609号的永义广场,有望连同比邻的丰华工业大厦一併重建,可组成逾1.5万平方呎地盘作重建。

另外,近年以近148亿元连夺区内3幅商业及商贸地皮的新世界 (00017) ,兴建4幢甲级商厦,合共涉约190.8万平方呎楼面,打造成庞大的商业王国。其中,于荔枝角道888号的项目,近年正在推售楼花,计划打造为单幢甲级写字楼,预计日后部分高层单位可望海景,另部分楼面要保留作兴建社福中心及公眾停车场。而位于琼林街的商贸地规模最大,可建楼面约99.8万平方呎,属区内逾10年的最大规模商业地。

(经济日报)

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

更多长沙湾区甲级写字楼出租楼盘资讯请参阅:长沙湾区甲级写字楼出租

上月三大辣税交投345宗 按月下跌11% 双倍印花税跌幅最急

整体楼市交投不俗,惟涉辣税交投及税款金额却录下跌,据税务局最新资料显示,上月三大辣税交投录约345宗,按月下跌约11%,涉及税款仅录8.66亿,按月下滑约12.9%。

据税务局资料显示,上月三大辣税包括额外印花税 (SSD)、买家印花税 (BSD) 及双倍印花税 (DSD),合共录约345宗交投,较今年3月的388宗,按月下跌约11%,随着疫情反覆,市场观望气氛挥之不去,拖累交投量下跌,税项收益亦同步下滑,上月三大辣税涉及税项收益约8.66亿,较3月的9.94亿按月下跌约12.9%。

税款按月跌约12.9%

若以各项辣税细分,双倍印花税于上月录240宗交投,较3月的292宗,按月下跌约17.8%,涉及税款亦录下跌,该税项于上月录6.56亿,较3月的7.07亿按月下跌约7.2%。

另外,涉及非住宅的双倍印花税,于上月仅录得1宗成交,与今年3月相若,反映出工商铺交投仍处低位徘徊,市况依然等待復甦。

至于涉及住宅的双倍印花税于上月录239宗,较今年3月的291宗按月下跌约18%。

工商铺交投仍处低迷

至于反映公司客及境外人士入市状况的买家印花税,于上月录62宗交投,属按月横行,惟涉及税款于上月仅录得约1.86亿,较3月的2.68亿,按月下跌约三成。

另外,额外印花税于上月录43宗交投,较3月的34宗,按月上升约26.5%,税款金额涉2400万,较3月的1900万,按月上升约24%。

SSD交投按月升26.5%

代理指出,近期新盘及二手市场交投均不俗,惟辣税交投及税款金额亦录得下跌,代表市场客源以首置客作主导,若以各项辣税细分的话,额外印花税交投及税款均录得上升,反映出二手市场交投不俗。

另外,反映公司客及境外人士入市状况的买家印花税,因为受到疫情影响,以致中港两地至今仍未通关,拖累交投备受压力,成交量因而明显处于低位徘徊。

(星岛日报)

The Henley flaunts robot-backed lifestyle as $1.7b deals pour in

Henderson Land Development (0012) raked in HK$1.7 billion through deals for 138 flats in the first round of sales at the robot-busy The Henley I in Kai Tak.

The developer has invested more than HK$70 million in innovative technologies and smart living systems at The Henley, including robots that provide services such as deliveries, including carrying heavy stuff.

The delivery robots and luggage-toting robots are also programmed to take lifts and go to a resident's door.

Robots also take on cleaning and sterilizing jobs, and they can check body temperatures.

The Henley has 1,184 homes in three phases. The first phase provides 479 flats from 186 square feet to 1,350 sq ft.

Henderson expects to release a fifth price list soon and to launch a second round of sales next week.

The developer has also released a sales brochure for The Upper South at Ap Lei Chau.

On The Peak, Yeoh Saw Kheng, the wife of Robert Ng Chee-siong, the chairman of Sino Land (0083), bought a 2,448-sq-ft flat at Carolina Garden for HK$103.8 million, or HK$42,402 per sq ft.

Meanwhile, stamp duty collected from property transactions plunged by 12.8 percent month-on-month to about HK$866.8 million in April, data from the Inland Revenue Department shows.

Buyers' stamp duties collected dived by 30.6 percent month-on-month to HK$186 million, and the amount of double stamp duty applied to residential property transactions dropped by 7.5 percent month-on-month to HK$654.5 million in April.

In the commercial property market, the Hongkong and Shanghai Banking Corp renewed the lease on a floor measuring about 7,500 sq ft at Causeway Bay Plaza 2 for HK$247,500 per month from November to September 2024. That is a 25-percent discount on the previous lease.

(The Standard)

For more information of Office for Lease at Causeway Bay Plaza 2 please visit: Office for Lease at Causeway Bay Plaza 2

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay希慎华懋198亿夺铜锣湾地王 超预期 高估值上限15% 每呎楼面地价逾1.8万

位处铜锣湾加路连山道的百亿商业地王中标财团揭盅,由区内大地主希慎兴业(00014) 伙华懋,以197.78亿元夺得,每呎楼面地价逾1.8万元,高于市场估值上限约15%,反映发展商无惧疫情对商厦市场的冲击。

疫情打击商业市道,近1年政府推出的多幅商业地均流标收场,而是次推出的铜锣湾加路连山道商业地王终顺利售出。地政总署昨日公布,地皮由大热门希慎伙拍华懋,以197.78亿元投得,每呎楼面地价约18,374元,较市场估值上限高约15%,可见是次中标发展商出价不算保守,且胜于市场预期。

希慎出资6成 华懋占4成

以中标金额计,该地皮属本港历来第4贵的商业地,最贵的商业地王,属于西九高铁站商业地,地价约422.3亿元,其次是启德第1F区2号商业地皮,成交价246亿元,紧随其后则为中环美利道商业地,当时中标价232.8亿元。

希慎属铜锣湾大地主之一,近百年前已扎根铜锣湾,并集中发展商业项目。目前该集团在区内拥有多个商业项目,包括利舞台广场、利园一至六期及希慎广场等。按照卖地章程,中标财团需要兴建行人天桥,接驳同系利园商场,相信可再大大增加项目之间的协同效应。

根据希慎最新发出的通告,集团将会出资118.67亿元,并将会持有合资公司的60%,亦即是华懋占有其余40%,而合营伙伴应按其各自于投标公司的股权比例出资。

希慎兴业主席利蕴莲称,项目是一项战略性的长期投资,将有助于提升集团的资产组合,并指可在核心地段发展大型商业项目的机会难得。同时,项目将为利园区的未来发展及营运产生协同效应,及可为集团增加稳定的租金收益。

无惧疫情冲击 呎租料达62元

华懋集团执行董事兼行政总裁蔡宏兴表示,除了提供商店及写字楼楼面,项目更附设社区设施及公众休憩空间,可为社会创造共享价值,贯彻集团宗旨。

据卖地章程,项目不能拆售。而铜锣湾一带有不少商厦,惟其租金差异颇大,综合市场资料,去年初至今,区内商厦呎租维持于28至100元水平。假设项目落成后的租金回报率约3厘,初步估计项目日后呎租可达约62元,租金颇为理想。

代理预计,是次卖地结果反映「面粉价贵过面包价」。若计入建筑费及利息开支等,项目的总发展成本高达约260至280亿元,每呎约2.4万至2.6万元,甚至高于金钟甲厦,并料项目落成后呎租逾70元。

代理称,是次中标价反映发展商对后市信心十足,又指成交价对6月截标的中环海滨商业地的地价具参考价值。

▲ 位处铜锣湾加路连山道的百亿商业地王,由区内大地主希慎兴业伙华懋以197.78亿元夺得。 (资料图片)

(经济日报)

更多利园写字楼出租楼盘资讯请参阅:利园写字楼出租

更多希慎广场写字楼出租楼盘资讯请参阅:希慎广场写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

前翠华中环旗舰店 谭仔45万租2层疫市扩充涉4千呎 租金平约4成

餐饮续租铺,翠华位于中环威灵顿街旗舰店交吉一年后,其中两层获谭仔米线以约45万元租用,较旧租低约4成。

中环威灵顿街17至19号香港工商大厦地下及地库,面积约4,000平方呎,以每月约45万元租出。该铺邻近兰柱坊,属餐饮集中地段。

消息称,新租客为谭仔云南米线,该品牌在疫情期间扩充不断,去年亦于中环开店,租用中环华商会所大厦3层,涉及约8,514平方呎,其中用餐区占2层,可提供逾200餐座,亦是现时谭仔所有分店中最大一间分店。如今见租金回调,即于同区扩充。

8160呎铺 高峰期月租达230万

翻查资料,该铺曾由翠华茶餐厅租用,翠华在1998年9月底起租用威灵顿街铺,其后更扩大铺位至地库、地下、阁楼及1楼的旗舰店,整个铺位建筑面积合共8,160平方呎,是翠华在香港最大的分店。

租金方面,高峰期该铺月租曾高见230万元,其后租金随大市回落,4年前翠华以约130万元续租,已经较高峰期少近一半,并在2019年短暂续租,但疫情影响下旅客绝迹,生意未如理想,而翠华去年中决定不续租并迁出,结束22年历史。如今业主重新招租,并把其中两层租出,新租金较旧租平约4成。

疫情下租金明显回落,零售商相对保守,而餐饮则趁机扩充。过去一年,中区不少铺位获餐饮品牌进驻,如中环万邦行地下铺位面积约1,540平方呎,去年获面包店以每月约35万元租用,租金较高峰期跌约7成。同地段的H QUEEN'S地下,近日亦获本地甜品及饼店预租,即将开业。

▲ 翠华去年中决定不续租中环威灵顿街旗舰店铺位并迁出,业主把其中两层租予谭仔米线。 (资料图片)

(经济日报)

更多万邦行写字楼出租楼盘资讯请参阅:万邦行写字楼出租

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

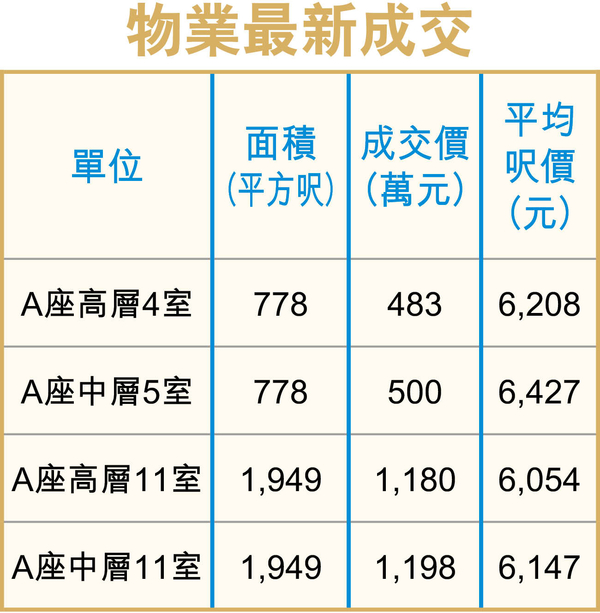

观塘开联工中逾万呎地厂 开价1.38亿

起动九龙东以来,观塘区商易发展乘势加快,而疫情渐趋平稳下,工商铺市场交投亦重回正轨,大额成交纷见,同时吸引业主伺机割爱换货,而现放售的观塘开联工业中心地厂单位,业主以约1.38亿元连租约放盘。

食堂承租回报逾3.6厘

代理指,观塘开源道55号开联工业中心A座地下6C至6D室,面积约11,000平方呎,现以意向价约1.38亿元放售,平均呎价约12,545元,单位业主为资深投资者罗珠雄,见近期市况转旺,将单位叫价由原本约1亿元,提价放售。

放售为地厂单位,现由食堂承租,月租约30万元,按意向价计,新买家可享约2.6厘租金回报,利润吸引,极其适合购入作长线收租投资之用。而物业坐落于区内核心地段——开源道之上,为观塘区主要工商厦地段,人流旺盛,为物业确保稳定客源,加上地厂本身供应有限,而且地厂处于人流必经之地,更为项目增值不少。

罕有大单位 处核心地段

据资料显示,仅仅开源道两旁的工厦,过去一年以来已录得逾30宗成交,而开联工业中心A座占15宗,反映出该厦的受欢迎程度,惟成交的单位以分层户,并以面积于2,000平方呎以下的细单位居多,平均呎价约5,800余元,市场最新录得中层5室,面积仅778平方呎,成交价约500万元,平均呎价6,427元,另高层11室,面积约1,949平方呎,以每平方呎约6,054元易手,造价约1,180万元。

代理指,观塘作为香港第二核心商业区,区内物业投资价值备受肯定,而地厂单位碍于其数量有限,而面积逾万平方呎的大型地厂更为罕有,因而成为投资上佳之选。而据资料显示,观塘区对上一宗逾万平方呎地厂买卖成交,已需追溯至2019年9月,为鸿图道33号王氏大厦地下单位,面积约11,000平方呎,当时以约1.8亿元沽出,平均呎价约1.64万元,相比现正放售的开联工业大厦A座地厂,面积与王子大厦相若,惟单位可即享合理的租金回报,料可获投资者踊跃洽购。

▲ 开联工业中心A座地厂每呎售1.25万(代理提供)

(经济日报)

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

Hysan,

Chinachem’s HK$19.8 billion bid wins first plot of land in Causeway Bay

to be auctioned by Hong Kong government since 1997

The

price is much higher than expected and shows developers’ confidence in

the outlook for Hong Kong’s office market, analysts said

A

joint venture set up by the two developers won the plot on Caroline

Hill Road for HK$18,400 per square foot, the Lands Department said on

Wednesday

A joint bid by Hysan

Development and Chinachem Group has won the first commercial site to be

offered by the government in Causeway Bay for 24 years, for HK$19.778

billion (US$2.55 billion).

The price is much higher

than expected, analysts said, showing developers’ confidence in the

outlook for Hong Kong’s office market as the city tries to get back on

track from a deep recession.

Patchway Holdings (HK), a

joint venture set up by Hysan and Chinachem’s Chime Corporation won the

plot on Caroline Hill Road for about HK$18,400 per square foot, the

Lands Department said on Wednesday. Hysan already owns the Lee Gardens luxury shopping centre in Causeway Bay.

The price tag for the new

parcel of land is 15 per cent above market estimates that ranged

between HK$11 billion and HK$17.2 billion.

“The project significantly expands the scale of the Lee Gardens portfolio

and reinforces Hysan’s leading position in Causeway Bay ... The company

believes Hong Kong will remain a major international city and benefit

from China’s strong economic momentum,” said Irene Lee Yun-lien, who

chairs Hysan Development, in a filing to the Hong Kong stock exchange on

Wednesday evening.

Hysan Development, the

biggest landlord in the city’s famous Causeway Bay shopping district,

holds a 60 per cent stake in the joint venture and will pay HK$11.867

billion for the land, while Chime Corporation controls the remaining 40

per cent. The winning bid was enough to see off competition that

included Hong Kong’s two biggest developers, Sun Hung Kai Properties and

CK Asset Holdings.

“Such a high winning

price shows that the developers are strongly confident in the commercial

property market in the area,” surveyor said.

Hong Kong’s economy

rebounded with stronger than expected growth of 7.8 per cent in the

first quarter of 2021, the fastest in 11 year after a historic low a

year ago when coronavirus pandemic took hold, according to data from the

Census and Statistics Department.

The site, opposite the iconic Lee Garden Three, can yield a million square feet of gross floor area.

It

is the first commercial plot to be tendered by the government in

Causeway Bay since 1997, according to the surveyor expects that the

total investment for the office and retail project could reach HK$28

billion.

“This is a rare

large-scale commercial project in the heart of the city. We are excited

to have this opportunity to partner with Hysan, the most experienced

developer in the district, to develop this project,” said Chinachem

Group’s chief executive Donald Choi. “The project will have synergy with

Hysan’s other Lee Gardens developments and the long-term prospects are encouraging.”

The potential value of

the project will be enhanced by a proposed system of covered walkways

joining it to Causeway Bay MTR station, Hysan said in the filing.

Currently, Hysan

Development’s portfolio of retail, office and residential investment

properties covers a total gross floor area of 4.5 million square feet,

including Lee Gardens, which hosts Hermes and Chanel as well as Goldman Sachs as its office tenant.

The company said the

project will boost the area of its commercial projects by 27 per cent

and is expected to be completed by the end of 2026 or beginning of 2027.

Hong Kong’s office and

retail property segments remain hobbled by an uncertain global economic

outlook amid the coronavirus pandemic that could hurt demand as

companies surrender office space and introduce flexible work

arrangements to cut costs.

The Wan Chai-Causeway Bay

area saw office rents tumble 25 per cent in April from a peak in June

2019, while in Central they fell 30 per cent in the same period,

according to property agent.

The retail property

segment in the city also slumped in 2020, with rental values of prime

shopping streets in Causeway Bay falling between 40 per cent and 50 per

cent, according to property agency.

Sino Land bid for the

parcel on Caroline Hill Road as part of a consortium that included

Lifestyle International Holdings, Kerry Properties and CC Land Holdings.

Offers also came from Sun

Hung Kai Properties (SHKP), CK Asset Holdings, Wheelock Properties and

Link Reit, Asia’s largest real estate investment trust.

(South China Morning Post)

For more information of Office for Lease at Lee Garden please visit: Office for Lease at Lee Garden

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay

亿京拟120亿洽购九展 料快落实

疫情缓和,大型商业项目获财团注视。合和暗盘放售九龙湾国际展贸中心 (九展) 多时,最近获亿京为首财团积极洽购,涉资约120亿元,料快将易手。估计新买家作重建发展,势成东九龙最大型商业重建项目。

合和放盘两年 势成东九最大商业重建项目

由合和持有的九展,为区内大型项目,一直作收租用途。消息指,业主早于两年前已暗盘放售物业,意向价约150亿元。据知情人士指,当时已获财团出价洽购,惟未达业主意向价。

市场消息指,随着疫情今年缓和,加上商用物业租售价回调,吸引财团再度洽购,据悉,最新出价达120亿元,并贴近业主意向价,料快将易手,价钱较高峰期回落两成。

多番发展东九 亿京不作回应

市场人士透露,是次洽购为亿京为首财团,本报就有关消息向亿京查询,集团不作回应。事实上,亿京过去10年多番发展东九龙,多次购入工厦并进行重建,涉及10多个项目,包括亿京中心、恩浩国际中心等,而是次九展项目庞大,估计将联同其他财团合作。过往亿京亦曾与信置 (00083)、资本策略 (00497) 投九龙湾地皮,发展成富临中心商厦。

位于九龙湾展贸径1号九龙湾国际展贸中心,项目地盘面积约23.98万平方呎,楼高14层,总楼面面积约177.5万平方呎,为集结会议、展览、商场、写字楼的综合式物业。写字楼方面,该厦写字楼全层可达10万平方呎,由于项目略偏离核心商厦地段,租金向来略低于同区,现呎租约20元以下,主要租客包括有医管局、香港宽频等,出租率高见95%。

项目最多可建 288万呎楼面

另外,项目设有商铺部分,早年曾租予免税店等,吸引不少内地旅客到访,现时商场由餐厅、零售及戏院租用。项目一大特色,是设有展览场地,包括E-Max佔90万平方呎,不时举行大型会议及演唱会。

若按现时项目总楼面约177.5万平方呎,洽购价约120亿元计,呎价约6,760元。另值得一提,项目未用尽地积比,最高能以地积比12倍发展,可建总楼面增至287.76万平方呎。事实上,同区总楼面达200万平方呎的项目,仅有南丰即将落成的啟德AIRSIDE,涉及约190万平方呎,故新买家料作重建,将成为东九龙未来最大型商业重建项目。

(经济日报)

更多九龙湾国际展贸中心写字楼出租楼盘资讯请参阅:九龙湾国际展贸中心写字楼出租

更多亿京中心写字楼出租楼盘资讯请参阅:亿京中心写字楼出租

更多恩浩国际中心写字楼出租楼盘资讯请参阅:恩浩国际中心写字楼出租

更多富临中心写字楼出租楼盘资讯请参阅:富临中心写字楼出租

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

力宝中心高层5800万售正八廖伟麟承接

正八集团主席廖伟麟今年连环入市,最新以5800万购入金鐘力宝中心单位,平均呎价2.55万,即买即提价37%放售,意向每呎3.5万。

市场消息透露,上址为力宝中心二座24楼10B及11室,建筑面积2270方呎,以5800万易手,平均呎价25551元,买家为正八集团主席廖伟麟。廖氏回应本报指,该单位早一星期购入,最新将上述单位放售,意向呎价3.5万,较购入价提高37%。

他续说,有见铜锣湾地王高价沽售,目前正是出货时机,尤其去年以来,他低水购入商厦及铺位,目前将会伺机出货,同时继续物色低市价项目,年内打算再以12亿至15亿入市,目标包括乙厦、甲厦、铺位等一篮子物业。

一周前每呎2.55万「低捞」

今番最新购入的力宝单位,他说,望全海景,对正电梯,属于优质单位,成交价低市价约20%至25%,租客为知名航运公司,月租12.5万,租期至2023年,连约回报约2.35厘,今次为买物业,需求支付相等于楼价4.25%的釐印费,涉资约246.5万。

即买即提价37%放售

他又认为,现时中港两地虽尚未能通关,商厦本地用家追捧,乙厦则较甲厦优胜,甲厦则有赖内地客追捧,料在未能通关时,价格升幅不及乙厦,不过,当中港通关后,届时甲厦价格势必跑赢乙厦,料甲厦售价有力再升15%,乙厦升幅约10%。

(星岛日报)

更多力宝中心写字楼出售楼盘资讯请参阅:力宝中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

气氛转好 甲厦交投轻微反弹

4月份疫情缓和,整体市场气氛稍好,甲厦买卖市场略为反弹。业内人士指,即使现阶段未算转旺,投资者渐愿出价洽购物业,料交投气氛向好。

据代理的十大指标商厦买卖统计显示,4月份共录6宗成交,仍属偏低水平。较注目的指标商厦买卖为中环皇后大道中九号,涉及中层12至13室,面积约811平方呎,属「𨋢槽位」即无窗户,质素较次,仍以约2,800万元成交,呎价约3.45万元,属颇理想水平。

湾仔海港中心录逾亿买卖

整体商厦买卖气氛转好,其中湾仔港湾道25号海港中心中层04至05室售出,单位面积约3,567平方呎,成交呎价约2.9万元,涉及总金额约1.034亿元,以交吉形式交易。据了解,新买家为用家,看好单位属单边,拥有全海景景致,价格又比高峰期时有所回落,故随即与业主洽购。

原业主早于2007年购入物业,当时作价每平方呎约8,800元,多年来一直作长綫收租用途,至早前租客迁出后,现善价而沽,持货14年帐面获利约7,200万元,物业期间升值约2.3倍。

力宝中心租务理想

至于租务方面,整体租务成交宗数亦有所增加,如金鐘指标商厦力宝中心连录多宗租务成交,其中2座中高层10至11室,面积约1,754平方呎,成交呎租约58元。另1座中层02室,面积约1,993平方呎,成交呎租约55元。至于中环皇后大道中九号中层03至05室,面积约5,851平方呎,以每月约34万元租出,呎租约58元。

代理指,商厦市场自3月起从谷底略为反弹,4月份走势向好。该代理分析,整体疫情缓和,即使尚未通关,投资气氛已胜去年,而投资者亦憧憬下半年商厦市场明显反弹,故现阶段已物色靚盘。该代理指,最近买家出价洽购物业情况明显增加,而业主减价幅度亦已收窄,相信下半年买卖会转好。租务方面,最近商厦租务个案亦上升,料空置率可轻微回落。

(经济日报)

更多皇后大道中九号写字楼出售楼盘资讯请参阅:皇后大道中九号写字楼出售

更多皇后大道中九号写字楼出租楼盘资讯请参阅:皇后大道中九号写字楼出租

更多中环区甲级写字楼出售楼盘资讯请参阅:中环区甲级写字楼出售

更多中环区甲级写字楼出租楼盘资讯请参阅:中环区甲级写字楼出租

更多海港中心写字楼出售楼盘资讯请参阅:海港中心写字楼出售

更多湾仔区甲级写字楼出售楼盘资讯请参阅:湾仔区甲级写字楼出售

更多力宝中心写字楼出租楼盘资讯请参阅:力宝中心写字楼出租

更多金鐘区甲级写字楼出租楼盘资讯请参阅:金鐘区甲级写字楼出租

北水涌商厦市场 投资者套股换楼

新冠疫情虽为本港经济添上不稳定及不明朗因素,但工商铺市场成交表现逐渐回稳。根据代理资料综合土地註册处资料显示,2021年第一季商厦成交宗数按年大升。截至3月24日,今年首季商厦註册宗数录300宗,较去年整个首季的104宗,大增188%;而今年首季商厦註册金额约40亿元,去年同期为约11亿元,按年升幅264%。惟首两个月商厦租售价表现个别发展,甲厦及乙厦售价分别升2.6%及0.7%,甲厦及乙厦租金则跌1.9%及1.6%。

至于首季商厦亿元成交个案频现,根据市场资讯,长沙湾荔枝角道888号全层单位,以约3.4亿元成交,平均呎价约1.39万元。金鐘统一中心高层B室,成交价逾2亿元,平均呎价约2.2万元。观塘区亦出现多宗商厦亿元成交,如万泰利广场高层全层,以及丝宝国际大厦低层全层连车位,分别以约2.07亿及1.68亿元成交。

调查:65%受访者有意入市

该代理行早前以电话访问、电邮及网上问卷形式进行调查,当中约65%受访者指出,今年或有意入市,而调查更有近7成受访者认为,中港疫情发展或恢復通关,是影响他们入市决定的重要因素。笔者认为,由于现时银行普遍推行低存款利息及低按揭利息,令现时资金氾滥,钞票购买力下降,不少客户倾向将资金转移至购买物业。若中港恢復通关,预料北水继续流入股市及楼市,部分投资者或会套股换楼。

事实上,笔者留意到,不少投资者正蠢蠢欲动,密切留意工商铺市场,静待合适入市时机,惟部分人未找到合适笋盘,笔者相信随着更多优质商厦推出市场,投资者入市意慾将大增,包括本地投资者、基金及发展商等均有意购入物业。笔者预料,若「通关」成功,商厦市场气氛将持续转好,进一步刺激交投,商厦收租回报可高达2.5至3厘,价量均有机会齐升。

(经济日报)

更多荔枝角道888号写字楼出售楼盘资讯请参阅:荔枝角道888号写字楼出售

更多长沙湾区甲级写字楼出售楼盘资讯请参阅:长沙湾区甲级写字楼出售

更多统一中心写字楼出售楼盘资讯请参阅:统一中心写字楼出售

更多金鐘区甲级写字楼出售楼盘资讯请参阅:金鐘区甲级写字楼出售

更多万泰利广场写字楼出售楼盘资讯请参阅:万泰利广场写字楼出售

更多丝宝国际大厦写字楼出售楼盘资讯请参阅:丝宝国际大厦写字楼出售

更多观塘区甲级写字楼出售楼盘资讯请参阅:观塘区甲级写字楼出售

旺角弥敦道铺2780万摸售持货一个月升值39%

近期铺市升温,市场更录短炒个案,旺角太子弥敦道联合广场地下一个地铺,以2780万易手,平均呎价3.7万,原业主持货仅一个月,帐面获利780万,物业升值39%。

土地註册处资料显示,太子弥敦道760号联合广场地下6号铺,于上月13日以2780万易手,买家以个人名义购入物业,叫HUANG SHAO JUAN,由于名字为普通话拼音,市场人士料由内地人承接,原业主欣佳 (香港) 有限公司,于3月25日以2000万购入,持货不足一个月,帐面获利780万,物业升值39%,欣佳(香港)董事则为龙瑞安。

呎价3.7万 料回报2.3厘

据了解,该铺位建筑面积约757呎,铺面向弥敦道,以交吉形式易手,平均呎价3.7万。盛滙商铺基金创办人李根兴表示,该铺位被巴士站挡住门面,预期铺位月租5万至6万,新买家料回报约2.3厘。

市场消息指出,荃湾川龙街地铺,面积约250方呎,以2050万售出,呎价8.2万,现址上海陆氏瓜子世家以4万承租,料回报约2.3厘。原业主早于1977年以15万购入,持货44年帐面获利2035万,期间升值约136倍。

万科旗下西环西边街15号Western Street,其地下及一楼商铺,由一名投资者以逾7000万承接,地铺及1楼面积,分别为725方呎及396方呎,平均呎价近3.2万。

中环威灵顿街于交吉逾一年后,获谭仔国际承租,取代翠华餐厅进驻,为「谭仔三哥米线」首度进驻中环。

川龙街地铺44年升136倍

谭仔国际发言人表示,该集团承租中环威灵顿街17至19号香港工商大厦地铺及地库,面积约4000方呎,计画开设中环区首间谭仔三哥米线,新店预计于第二季投入市场,惟上述铺位租金则不便透露。

谭仔三哥米线首进驻中环

市场消息盛传,上述租金约45万,平均呎租约112.5元,租约期约3年,并提供数月免租期,资料显示,该巨铺早前翠华餐厅以130万承租,惟于去年3月起结业,结业前4层楼面月租约130万,故最新租金录明显跌幅。该巨铺由4层组成,总楼面约8160方呎,市传业主以「一拆三」,月租叫价由19万至50万不等。

(星岛日报)

华懋礼苑大厦今强拍底价7.7亿

华懋集团收购的佐敦德兴街7至8号礼苑大厦,今年3月底获土地审裁处批出强拍令,底价为7.74亿元,今天 (14日)举行公开拍卖会。

礼苑大厦邻近港铁佐敦站,步行前往约2分鐘,极具重建价值。现址为一幢楼高10层的商住物业,地下为商铺,楼上为住宅用途,早于1964年落成入伙,楼龄约57年。

上址地盘面积约为11089方呎,如果重建为商住项目,以地积比9倍计算,可建总楼面约99801方呎。

(信报)

Noodle chain rents a street shop in Central for $450,000

Rice noodle chain operator Tam Jai International rented a 4,000-square-foot street shop premise on Wellington Street in Central for HK$450,000 per month, or about HK$113 per sq ft, nearly 60 percent lower than the peak of the previous lease.

The former lessee is casual dining chain Tsui Wah (1314) shop, which once leased the premise for as much as HK$282 per sq ft.

This came as Tam Jai is seeking a listing on the main board in Hong Kong.

In the primary market, Henderson Land Development (0012) released 73 units in the fifth price list of The Henley I in Kai Tak at an average price of HK$30,632 per sq ft after discounts. The units are priced at HK$7.59 million to HK$30.66 million, or HK$24,611 per sq ft to HK$34,801 per sq ft after discounts.

(The Standard)希慎拟260亿 建铜锣湾新地标商厦

铜锣湾大地主希慎(00014) 伙拍华懋,于早前成功投得区内加路连山道商业地,希慎透露,预计整体投资额达到260亿元,将会打造成一幢集绿化、可持续发展元素的商厦新地标。

加路连山道项目 呎租估达60至70元

希慎伙拍华懋,早前成功投得加路连山道的商业地,亦是两家财团首度合作,地价达到197.78亿元,其中希慎属大股东,股权占6成,华懋占余下4成,地盘面积15.93万平方呎,可建楼面达到107.6万平方呎,项目亦设有多项限制,包括不得拆售,中标财团亦需要兴建3所政府物业等。

希慎首席营运总监吕干威称,近年的建筑成本变化相对较稳定,加上过去一年疫情影响下,建筑成本没太大升幅,初步估算项目的建筑成本约每平方呎5,000元,总投资额达到260亿元,若以项目可建楼面计算,每呎地价约2.4万元。商厦预计28至30层高,基座的B1层至2楼将会是零售楼面,现先作规划设计,预计半年后会入纸向城规会申请,大约一年半后正式动工。

将与华懋商融资事宜

而希慎首席财务总监贺树人就指,集团跟华懋都是财务稳健,有相当现金流的公司,稍后会视乎银行的利率变化,再跟合作伙伴商讨就项目融资事宜。

吕干威表示,集团对于能够在铜锣湾再下一城夺得如此大规模的项目作发展,感到相当兴奋,认为是集团新一个里程碑继续往前走。

他又指铜锣湾与其他纯商业区与别不同,区内有更多生活化的元素。他指,当项目日后落成后,整个铜锣湾的商业组合能够提供更多不同类型的单位,有利租金向上,希望可以略为收窄跟中区租金的差距。

现时铜锣湾的甲级商厦的每呎租金水平约60至70元,个别能够望到海景的单位呎租将更高。

吕干威预料,日后加路连山道的商业项目,呎租虽未必能跟海景单位直接比较,但相信会在60至70元的上限水平,但最终仍要视乎日后落成后商厦的市况。至于零售市道,最近见零售气氛有所改善,租金已有慢慢从低位回升。

(经济日报)

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

市建大角嘴项目掀财团争夺

希慎拟260亿 建铜锣湾新地标商厦

政府积极推住宅地增供应,市建局大角嘴橡树街/埃华街于周四截标;据业内人士指出,近期楼市交投气氛不俗,加上市区地皮属市场罕有供应,料项目将吸引中大型财团争逐,市场估值约5.8亿至8.39亿,每呎地价由9700元至1.4万。

市建局旗下大角嘴橡树街/埃华街项目于上月截收41份意向书,为历来市建局项目次高,该项目将于本周四截标。有利集团执行董事黄慧敏表示,对项目感兴趣,有意入标竞投。

可建楼面5.99万呎

代理指出,近期楼市交投不俗,将增加发展商投地信心,市区地皮近年买少见少,故料项目将吸引中大型发展商竞投,预计项目可截收20份标书,料每呎地价约1.2万至1.4万,市场估值约7.19亿至8.39亿。

华坊咨询评估资深董事梁沛泓称,近期住宅及商业地均获高价承接,为市场释出正面讯息,是次推出的市建局项目规模较小,料吸引中小型发展商竞投,预计录约20家财团入标,楼面呎价9700元至10200元,市场估值约5.8亿至6.1亿。

项目位于大角嘴橡树街及埃华街交界,地盘面积6663方呎,可建楼面59966方呎,包括住宅楼面约5万方呎。招标条款列明,项目日后卖楼收益达12.5亿就须向市建局分红,即每方呎卖价20845元以上便要分红。而达标后首3000万,须分红两成,其后按比例增至最多五成。项目单位面积不可少于300方呎,另至少一半单位面积不可大于480方呎。

(星岛日报)

Secondary deals pick up across blue-chip estates

Property

agency reported 28 secondary deals at 10 blue-chip housing estates over

the past weekend, up by 65 percent from a week before.

Only Laguna City in Kwun Tong saw no transactions, according to the agency.

A

652-sq-ft flat at Mei Foo Sun Chuen in Lai Chi Kok changed hands for

HK$8.58 million, or HK$13,160 per sq ft. The seller, who bought the unit

for HK$2.6 million in 2006, will gain HK$5.98 million.

In

Quarry Bay, a 580-sq-ft flat at Tai Koo Shing fetched HK$12.68 million,

or HK$21,862 per sq ft. The seller will gain HK$10.2 million after

holding the property for 20 years.

In

Sha Tin, a 504-sq-ft flat at City One Shatin was sold for HK$8.31

million, or HK$16,498 per sq ft. The seller will earn a capital gain of

HK$5.59 million after holding the flat for 12 years.

Property agent expects that the primary market to record 2,500 deals this month.

In

the primary market, Yau Lee (0406) has raked in about HK$700 million

after selling 108 out of 117 flats on offer at L. Living 23 in Tai Kok

Tsui. The developer previously released 37 flats in the third price list

of the project at an average price of HK$22,431 per sq ft after

discounts, 18.9 percent higher than the first price list.

The 37 flats are offered at HK$5.93 million to HK$12.62 million, or HK$20,139 per sq ft to HK$27,426 per sq ft after discounts.

(The Standard)

邓成波家族逾百亿物业 市场放售

「铺王」邓成波突离世,而近年他活跃于投资市场,斥资逾300亿元入市。近一年该家族积极沽货,已套现40亿元,而目前仍于市场放售逾百亿物业,料成投资市场焦点。

九龙城联合道2万呎地盘 估值约25亿

一直于投资市场活跃的邓成波,上周突离世,享年88岁。事实上,2015年起邓氏家族开始大举进军楼市,3年间先后购入多个酒店、铺位,涉资约300亿元。近一年多受疫情影响,整体工商铺市道欠佳,该家族亦开始沽货减磅,包括近期以约18亿元沽出葵涌光辉冻仓、4亿售出西贡铺位,近一年已累沽约40亿元物业。

目前邓成波家族仍于市场放售大批商铺、住宅地盘等,涉及逾百亿元。近期该家族放售九龙城联合道地盘部分业权,地盘面积涉约2万平方呎,市值约25亿元。另外,早前盛传他以5.5亿沽湾仔尚翘峰商场,惟最终未有售出,仍于市场放售中。

窝打老道银行铺 9800万易手

另外,商铺买卖持续向好,消息指,旺角窝打老道银行铺位,以约9,800万元易手。

市场消息指,旺角窝打老道61至63号铺位易手,涉及物业地铺入口,面积约200平方呎,以及1至2楼,每层面积约5,800平方呎,合共约1.18万平方呎,以约9,800万元易手,市传新买家为资深投资者杨万勤或有关人士。据悉,该铺由渣打银行租用多年,月租约34.6万元租出,回报率约4.2厘。