One can afford to buy a home in an urban area in

Hong Kong for less than HK$4 million now, as the city's home prices are

still almost 30 percent lower after peaking three years ago.

The Highline in Kennedy Town has just unveiled its first price list of 50 units, with the cheapest at HK$3.89 million.

The project is developed by Right Honour Investments under the Shanghai Commercial Bank.

The average price after discounts stands at

HK$21,380 per square foot, the lowest in the district in eight years and

about 18 percent lower than the recent average of around HK$26,000 in

the West Island, an agency said.

The 50 units are comprised of 40 studios, six one-bedroom and four two-bedroom units, with sizes ranging from 211 to 524 sq ft.

The Highline plans to offer a total of 173 units

in a 30-story tower, including 90 studios, 50 one-bedroom, 14

two-bedroom and 19 three-bedroom flats.

Its show hall will be open to the public today and subscriptions will start on Friday, an agent said.

In Cheung Sha Wan, The Vim has priced its seven

high-rise flats in its sixth price list at a low of HK$3.41 million

after discounts. The cheapest unit is a 201-sq-ft studio costing

HK$17,003 per sq ft.

The sizes of these seven units vary from 199 to 289 sq ft, with an average price of HK$16,656 per square foot.

The Vim is jointly developed by Carrianna Group (0126) and Choice Holdings.

It comes as the city's private home prices have

lost 28 percent from its peak in September 2021, though it rebounded 2

percent in the past three months after the removal of housing curbs in

late February.

Henderson Land Development (0012) said The Haddon,

its redevelopment project in Hung Hom, has received 272 cheques as of

yesterday for 92 units in its first price list, around twice

oversubscribed.

Henderson plans to start the first round of sales by the end of this week or the middle of next week.

In other news, the value of registered residential

property sales jumped 45 percent year-on-year to HK$53.4 billion

despite a 31 percent fall month-on-month, data from the Land Registry

showed.

The number of contracts amounted to 5,546, 38.5 percent higher than one year ago but 35 percent lower than one month earlier.

(The Standard)

Hong Kong property deals fall by a quarter as exuberance over scrapping of cooling measures fades

Some 7,361 homes, car parks, shops, office and industrial units changed hands in May, down by 25. 5 per cent from April

From a year ago, both the number and value of property transactions in May were still higher by about 40 per cent

Hong Kong’s property

sales fell by a quarter in May, the latest official data shows, as

analysts said the initial exuberance over the lifting of property

cooling measures had started to wear off.

Some 7,361 new and

lived-in homes, car parks, shops, office and industrial units changed

hands in May, down by 25.5 per cent from April, according to Land

Registry data released on Tuesday. The total value of property sales

plunged 25.8 per cent to HK$62.28 billion (US$7.9 billion).

From a year ago, both the number and value of property transactions were still higher by about 40 per cent.

Sales of residential units plummeted 35.1 per cent to 5,546 in May, but were up by 38.54 per cent from a year earlier.

The boost that stemmed from the scrapping of property curbs at the beginning of March appeared to be tapering off.

In March and April,

property deals rose on a monthly basis. In particular, the April sales –

the highest since July 2021 when 9,957 units were sold – were roughly

double the number in March, which marked the first full month of a

restriction-free property market.

The prices of Hong Kong’s

secondary homes have so far largely reflected the new-found optimism,

increasing by an aggregate 2 per cent since February, official data

shows.

“Overall trading has

returned to a more rational state, but it is expected to remain better

than the sluggish market conditions before the withdrawal of the cooling

measures,” another agent said.

“It is expected that the

overall property transaction registration volume in June will only fall

by about 3 per cent month on month, and will maintain the level of 7,000

units.”

With more than 7,000 new

homes sold in the three months since the property restrictions were

relaxed, it was natural for the market to “take a breath”, another agent

said.

In May, fewer units were launched compared to April, the agent added.

“Developers mainly pushed

their old inventory for sale during the month,” the agent said. “With

several new projects in the pipeline awaiting launch, we expect

developers to adjust their pricing strategy as buyers are mainly

attracted by discounts and incentives.”

The agent expects property deals to decline further in June.

Another property agency which sells luxury lived-in homes, demand had picked up in recent weeks.

“Most of the demand is

coming from Hong Kong and mainland Chinese buyers,” another agent said.

“I think this is because sellers are becoming more realistic and are

willing to cut about 15 per cent from their original asking price.”

Although interest rates

remain at a near 23-year high in Hong Kong, many potential buyers

believe a rate cut is likely to come in the first half of 2025.

“The vendors are

recognising that there is not likely to be a significant increase in

prices because both the mainland China and Hong Kong economies are still

sluggish,” the agent said.

(South China Morning Post)

個別外資機構於中環擴充寫字樓,中環置地廣場-公爵大廈單位,獲新加坡基金公司租用作擴充。

外電報道指,新加坡對冲基金公司Dymon Asia Capital,租用中環置地廣場-公爵大廈單位,將可容納超過70名員工,是目前公司在盈置大廈辦公室可容納人數的兩倍。

涉8833呎樓面 呎租約90

翻查資料,該基金原租用中環盈置大廈17樓一個單位,而預計新近租置地廣場-公爵大廈高層1及05至10室,面積約8,833平方呎,估計呎租約90元。公爵大廈位處中環最核心位置,故是次屬升級及擴充。

有代理表示,有業主放售灣仔摩理臣山道70至74號凱利商業大廈19樓全層,面積約3,014平方呎,另連約300平方呎的空中花園。業主原叫價每呎約12,616元,現以呎價約7,962元放售,意向價約2,400萬元。該代理指,單位享馬場景。

該單位由資深投資者羅守輝持有,他於2017年以2,428萬元購入單位,持貨7年,現以蝕讓價放售物業。

(經濟日報)

更多置地廣場寫字樓出租樓盤資訊請參閱:置地廣場寫字樓出租

更多盈置大廈寫字樓出租樓盤資訊請參閱:盈置大廈寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

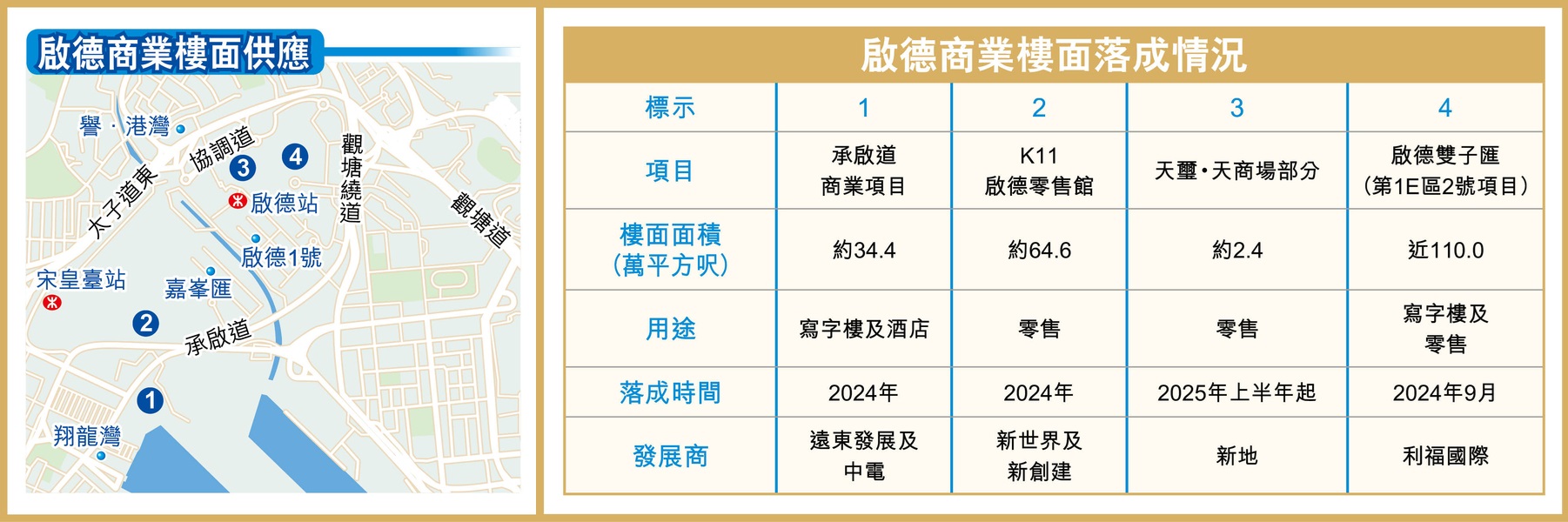

3商業項目 年內進駐啟德

啟德配套日漸成熟,陸續有商業項目落成,繼南豐旗下大型商業項目AIRSIDE於去年落成後,預計今年再有3個商業項目落成,共涉近210萬平方呎樓面。

啟德第二個核心商業區 (CBD 2)

為定位,區內商業樓面供應多達逾2,000萬平方呎,當中去年及今年屬於商業項目落成高峰期,接近約400萬平方呎商業樓面落成,估計今年再有3個商業項目落成,共涉近210萬平方呎樓面,當中以啟德雙子匯項目的規模最大,亦將有知名大型日式百貨進駐。

雙子匯投資額145億 料9月落成

啟德雙子匯前身為第1E區2號用地,於2016年由利福國際擊敗其餘7間財團,以約74億元 (每呎樓面地價約6,733元) 投得,將會發展為2幢樓高18至19層高的雙子塔式商廈,預計於今年9月落成,總樓面約110萬平方呎,總投資額高達145億元。

項目分2幢發展,其中利福旗下日式百貨公司崇光SOGO進駐Tower I,而Tower II擬提供國際奢侈品、美粧、時尚服飾以至生活消閒等商品及服務。

K11啟德零售館 設逾200間商舖

另外,作為啟德重要基建之一的啟德體育園之主要設施,亦預計今年年底落成。園內的K11啟德零售館亦會推出,由新世界 (00017) 營運,主建築共3座,每座最多有5層,佔地約70萬平方呎,涉逾200間商店,提供零售及餐飲服務。

而由遠東發展 (00035)

投得的啟德承啟道商業項目亦預料在今年落成,項目將發展為1幢辦公室及1幢酒店,總樓面約34.4萬平方呎,當中約17.4萬平方呎的寫字樓部分已在2021年12月售予中電

(00002) ,作價約33.8億元,每呎約19,400餘元,將成為中電的新總部。

新地 (00016) 旗下新盤「天璽‧天」的基座還將設有一個零售商場,面積約2.4萬平方呎,預計在2025年起分階段落成。

縱觀啟德區尚有不少商業地待推,涉及商業樓面近980萬平方呎。

值得一提是,政府早前曾提出將啟德5幅商業地改劃為住宅地,但最終只有3幅獲成功改劃,其餘兩幅位於跑道區的商業地 (4C區4號及4C區5號地盤) 則會保留作商業用途,當中4C區4號用地已納入今個財政年度的賣地表中,總樓面約86萬平方呎。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租

去年落成的啟德商廈AIRSIDE接連錄得租務成交,屬於近期市場租務表現較理想的甲級商廈項目。

友邦保險租18萬呎樓面

據市場消息透露,友邦保險 (01299) 最新租用啟德AIRSIDE 5層樓面,共涉約18萬平方呎,呎租約30元,如以租用面積計算,屬於今年最大手租務成交。

事實上,近期AIRSIDE接連錄租務交投,月前其29及30樓全層,共約7.6萬平方呎樓面,獲新加坡華僑銀行承租,預計呎租約35元。而德國超市集團及保誠保險亦承租其寫字樓樓面。

根據一間本港代理行發表的最新商廈市場報告,4月東九龍指標甲廈的平均呎租約22元,按月下跌0.3%,至於售價方面,平均呎價約9,325元,按月亦微跌1.3%。該區空置率在該月達到17.6%水平,為各區最高。

(經濟日報)

更多AIRSIDE寫字樓出租樓盤資訊請參閱:AIRSIDE寫字樓出租

更多啟德區甲級寫字樓出租樓盤資訊請參閱:啟德區甲級寫字樓出租