房託领展 (0823) 宣布业绩,中期派息1.5959元,如能保持,以收巿价70.4元计,股息率约4.5厘,可说相当吸引,而早几日商铺投资者蔡志忠伙拍陈秉志以4.55亿元购入新世界 (0017) 的一批铺位,其租金回报率约3.69厘,相比下,一般小投资者买入领展收入也不错。

领展同时宣布以58.2亿元购入位于香港的两幢停车场 / 汽车服务中心及仓库大厦,收购价较该等物业于2021年10月22日的估值总额60.81 亿元折让4.3%。卖家为Jardine Matheson集团 (怡和) 之成员,两幢物业将全部出租予在香港独家代理平治汽车的汽车经销商仁孚行。

领展将同时与租户就目标物业订立租约,由成交翌日起计为期五年 (就柴湾物业而言,现有租约将于2022年6月30日届满),并附带可由租户行使之三次续租权,以重续连续以三年为期限的租约。根据柴湾物业租约,租金将为每月7,313,854元直至2022年6月30日,自2022年7月1日起则为每月7,935,000元,而根据红磡物业租约,首年租金为每月7,962,000元,惟于每份租约期限内每年递增4%,于成交翌日之每个周年日生效。

粗略计算,领展购入这两幅物业的起始租金回报率约3.15厘,不过每年可加租4%,在复利效应下,租金回报率会持续改善,相较一般小业主买人住宅收租,现租金回报率约2厘左右,还随时要付辣招税呢。

(明报)

代理表示,九龙湾企业广场三期39楼全层,面积约1.6万方呎,业主意向租金约37万元,呎租约23元。

该代理指出,上述物业间隔方正实用,属罕有极高层全层放租,外望全海景观,光猛开扬,用户可承租4468方呎至全层物业,极具弹性。

企业广场三期设有14部载客电梯及1部载货电梯,上落方便。

(信报)

更多企业广场写字楼出租楼盘资讯请参阅:企业广场写字楼出租

更多九龙湾区甲级写字楼出租楼盘资讯请参阅:九龙湾区甲级写字楼出租

鸭脷洲大街铺2.2亿成交 呎价达8.8万 46年升值243倍

疫情持续平稳,带动铺位交投转活,市场再录大手成交。市场消息指,香港仔鸭脷洲大街地铺以2.2亿成交,呎价约8.8万,原业主持货46年,帐面获利2.19亿,期间升值约243倍;据业内人士指出,是次成交不排除发展商购入作重建用途。

市场消息指出,香港仔鸭脷洲大街84号兴富楼地下A至L号铺连阁楼,面积约2500方呎,以约2.2亿易手,呎价约8.8万。据悉,上址原业主于1975年以约90万购入,持货46年帐面获利约2.19亿,升值约243.4倍。

业界:料为发展商收购

盛滙基金创办人李根兴指出,上述成交价较市价为高,料为发展商收购作重建用途,该街道近期有不少新盘落成,推动区内发展迅速,料区内将来势现「大变天」。

地铺连阁楼 面积约2500呎

有代理评论指,上述成交价属进取价,资深投资者亦难以负担,事实上,近期传统核心区亦罕见呎价高见逾8万元,证明上述买家看俏区内发展前景。

据业内人士指出,上述租金属一般水平,惟该铺邻近港铁站,交通配套理想,故发展潜力不俗,料发展商购入作重建用途。

筲箕湾铺2350万售

该街道早前频录大手买卖,其中,由恒基持有的鸭脷洲大街68号倚南一篮子地铺,涉11间铺位,总楼面约5228方呎,获本地投资者以2.25亿承接,平均呎价43037元,以月租33.48万计,料回报率约1.8厘。

另一方面,铺位市场亦频录成交,消息指,筲箕湾道241至249号万康大厦地下单号铺,面积890方呎,附设入则阁约780方呎,总楼面约1670方呎,以2350万售出,呎价约1.4万,原业主于1971年以20万购入,持货50年帐面获利约2330万,物业期间升值约116.5倍。

此外,消息指,深水埗美居中心地下单号铺,面积约200方呎,以约780万售出,呎价约3.9万,据悉,该铺由小食店以约1.327万租用,料买家享租金回报约2厘水平。

(星岛日报)

新蒲岗工厦一篮子货1.27亿沽

工厦于疫市下表现「硬净」,市场再录大手成交。消息指,新蒲岗啟德工厂大厦2期一篮子物业,以约1.27亿售出,呎价约3330元,买家以富临集团呼声最高。

市场消息指出,新蒲岗啟德工厂大厦2期5楼C及D室、6楼C及D室及11至12楼全层,总楼面约38354方呎,以约1.27719亿成交,呎价约3330元。据业内人士指出,成交价属市价水平,并指买家以富临集团呼声最高,该集团早前已持有多层楼面,有机会增购该厦物业统一业权,以作重建用途。

富临集团等购入呼声高

据代理资料显示,该工厦近期频录成交,其中,高层C室,面积约4200方呎,于本月以1399万售出,呎价约3330元;另该工厦高层D室,面积约2720方呎,以906万售出,呎价约3330元。

涉逾3.8万呎 每呎3330元

事实上,富临集团等近期频频入市,资料显示,丰展资产旗下观塘骏业街46号低层全层,建筑面积6371方呎,于今年4月以6380万成交,呎价约10014元,买家为富临集团主席兼执行董事杨维。

此外,工厦市场亦频录承接,消息指,九龙湾南丰商业中心低层10室,面积约1029方呎,以597万售出,呎价约5801元;荃湾皇廷广场高层6室,面积约1105方呎,以510万易手,平均呎价约4615元。

(星岛日报)

更多南丰商业中心写字楼出售楼盘资讯请参阅:南丰商业中心写字楼出售

更多九龙湾区甲级写字楼出售楼盘资讯请参阅:九龙湾区甲级写字楼出售

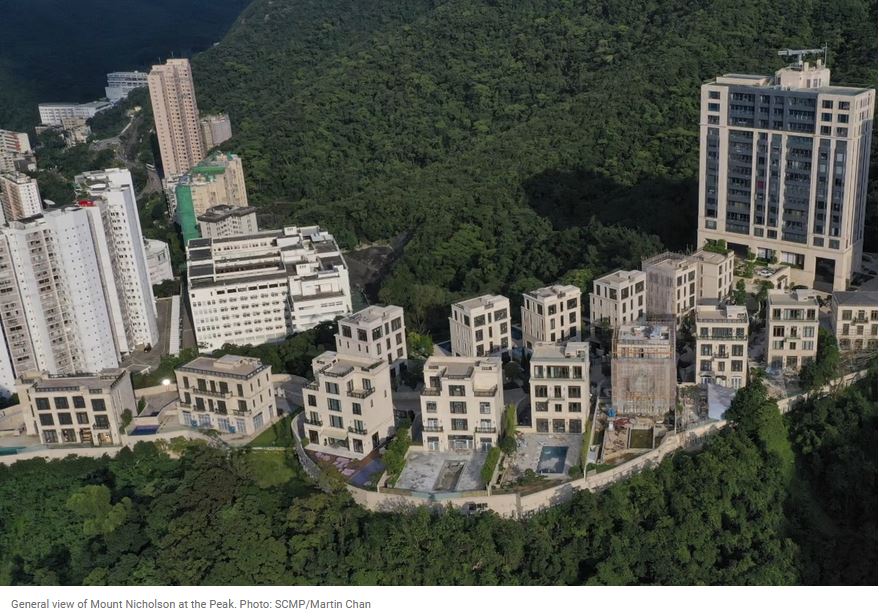

Wheelock property on Mt Nicholson reclaims title for the most expensive flat in Asia in terms of square footage

Flat 16D and three car parking spaces on Mount Nicholson sold for HK$639.796 million, or HK$140,800 per square foot, a record in Asia.

The bumper price came right after news that Hong Kong’s border with mainland China will likely reopen as early as next month.

A flat in Wheelock’s ultra luxury residential property Mount Nicholson at The Peak has sold at a new record price per square foot in Asia, with analysts saying an expected reopening of Hong Kong’s border with mainland China will likely boost the city’s real estate market.

The developer sold flats 16C and 16D at phase three of Mount Nicholson for a combined HK$1.2 billion (US$154 million) to the same buyers, Wheelock said in a statement on Tuesday, without disclosing the identity of the buyers.

Flat 16D and three car parking spaces at Mount Nicholson were sold for HK$639.796 million, or HK$140,800 per square foot, breaking the record held by a flat in CK Asset Holding’s 21 Borrett Road luxury resident project, which also came with three parking spaces and was sold for HK$459.4 million – or HK$136,000 per square foot – in February.

The price for flat 16C stood at HK$560.92 million, or HK$134,000 per square foot, which was only slightly lower than the previous record at Borrett Road.

The bumper price indicates Hong Kong’s luxury properties remain extremely sought-after by buyers even though the overall economy has not recovered from the impact of the pandemic last year and months of social unrest since mid-2019.

“The record-breaking price came right after the news report that Hong Kong’s border could reopen as early as next month. This has given hope to wealthy mainlanders from the Greater Bay Area to come across the border and buy luxury homes in the city,” a mortgage broker said.

Hong Kong’s land border with the mainland will reopen fully to quarantine-free travel by June at the latest, official sources told the South China Morning Post this week.

The scheme will entail a small pilot programme involving daily quotas in Guangdong province in December, followed by an expansion in February to allow “mass events”, a source said, reaffirming what Chief Executive Carrie Lam Cheng Yuet-ngor had suggested last week. A full border reopening will happen in June, or earlier, if all goes smoothly.

“In addition, interest rates remain at their lowest levels on record while inflation pressure is looming. This has led those who can afford to pay the price to buy properties now, particularly luxury ones as supply remain limited. The outlook for the luxury market remains bullish,” the broker said.

Mount Nicholson was developed by Wharf Holdings along with Nan Fung Development and comprises 19 detached houses and 48 flats in three phases. It has some of Asia’s most expensive homes in terms of square footage. Its location, reputation for build quality and celebrity buyers, has made it a much sought-after address for Hong Kong’s wealthy set.

In May, Mount Nicholson broke another world record by selling a single parking space for HK$11.9 million, the highest price ever seen worldwide.

(South China Morning Post)

Link distributable income rises 14pc to $3.3b

Link Real Estate Investment Trust (0823) said its total distributable amount increased 14.2 percent year-on-year to HK$3.34 billion in the six months before September 30, and the interim distribution per unit for the period increased by 12.7 percent to HK$1.6 billion.

Link also said that it has acquired 100 percent interest in two institutional-grade car park and car service centers in Hong Kong for HK$5.82 billion combined, after buying 50 percent stakes in three retail properties in Sydney for AUD$538.2 million (HK$3.1 billion) on Sunday.

Chief executive George Hongchoy Kwok-lung said in an online conference that the vendors will lease these two properties for long-term use after the sales, and that Link views the deals as long-term investments.

The gearing ratio stands at a "comfortable" level after the acquisitions, he emphasized in the meeting. The ratio of debt to total assets increased to 23.6 percent from 21.6 percent.

Upon completion of the deals, Link will become the owner of the two properties.

One property is located at No. 60 Ka Yip Street in Chai Wan, and is a 9-story godown building with a gross floor area of approximately 438,351 square feet which has been repurposed into a full-service building hosting an automotive showroom, car servicing and repair workshops, godowns and ancillary offices.

The Hung Hom one at No. 50 Po Loi Street is a 13-story mixed-use car park building with a GFA of approximately 421,401 sq ft.

It has also been repurposed to a full-service building hosting an automotive showroom, car servicing and repair workshops, as well as a car park with 932 private and public parking spaces.

It also said it acquired 75 percent interest in two recently-developed modern logistics assets in Dongguan and Foshan for 754 million yuan (HK$918.72 million) on October 27.

(The Standard)