Hong Kong's private home price

index dropped to a 13-month low after falling 2.1 percent, or 8.1 points

month-on-month to 382.1 points last month, but rents rebounded, data

from the Rating and Valuation Department shows.

The accumulated drop this year has reached 3 percent and the February home price is also 0.7 percent lower than a year earlier.

Prices of small and medium-sized units fell by 2 percent month-on-month, or 0.5 percent year-on-year last month.

Among

them, prices of flats under 40 square meters fell 2.7 percent

month-on-month to the lowest in nearly two years. Homes above 100 sq m

recorded a 3.5 percent decrease in price in February from January, and

also slid 4.8 percent compared to the same month in 2020.

Property

agent said that the decline reflected the slack market during the

traditional low season of the Chinese New Year when the fifth wave of

the Covid outbreak started to worsen.

The

agent believes that real-estate prices in March will sink further as

the property market and economic activity nearly came to a halt amid

stricter social restrictions to combat the coronavirus outbreak.

The

sluggish market performance is also reflected in the rise in

loss-making deals - at least 60 property transactions booked

depreciation this month, a month-on-month increase of more than 70

percent, and also the most cases since the pandemic began.

While

property agencies see a strong rebound in the next quarter when the

restrictions are lifted, investment bank Goldman Sachs expects the

city's property prices to fall 5 percent each year until 2025 due to a

dull macro-economy and other problems.

The

official rental index, however, snapped the four-month downward trend

last month and inched up by 0.5 percent from January, with small and

medium-sized units rising 0.4 percent and flats of more than 100 sq m up

by 1.3 percent.

The

agent believes that the increase showed the actual housing demand in the

market - Hongkongers are looking for more space to live in amid the

pandemic, resulting in the rise in rents.

In

the secondary market, a 3,982-sq-ft penthouse at 8 Peak Road on The

Peak was sold for HK$498 million, or HK$125,062 per sq ft, the most

expensive flat transaction by average price this year.

(The Standard)

Home prices hit 13-month low, spurred by new Covid wave

Hong

Kong private home prices dropped at a faster pace in February to their

lowest since January 2021, official data showed on Tuesday, as the Asian

financial hub was hit by a new wave of Covid-19 infections.

Prices

declined 2.08 percent last month, according to the data, the biggest

drop since November 2018, and compared to a revised fall of 0.89 percent

in January.

Hong Kong,

a major regional financial hub, this month was again ranked by survey

company as the world’s most unaffordable housing market for the 12th

consecutive year.

Home

prices started consolidating after reaching an all-time high in

September. They have stayed largely resilient during the mass protests

that convulsed the city in 2019 and through the pandemic over the past

two years, supported by robust demand and lower interest rates.

The

pace of price declines accelerated last month as Covid-19 infections

surged and the government rolled out some of the most stringent social

restrictions in the world since January, affecting many businesses and

driving property agents to lower their full-year price forecast.

A

real estate consultancy expected that home transaction volume would

drop nearly 50 percent in the first quarter from a year ago, to the

lowest since 2016, but it would recover in the second half if the

pandemic is brought under control before mid-year.

The firm expected growth in home prices of 0-3 percent for the whole of 2022.

The

government’s move to ease the mortgage ratio last month has helped to

stimulate some home purchase demand as the city is set to gradually open

up, realtors said, with transactions of small to medium sized

apartments picking up in the past couple of weeks.

Hong

Kong reported 7,685 new Covid-19 infections on Monday, the third day in

a row below 10,000 cases, and the government announced last week an

easing of restrictions from April.

(The Standard)

Hong Kong landlords drop rents to tie down quality tenants amid a glut of new flats

Tenants should hunt for bargain rents in areas such as New Territories West, Tseung Kwan O and Kai Tak, industry insiders say

Landlords of lived-in homes might cut rents for tenants they believe to have good backgrounds or jobs

Hong Kong landlords

are slashing rents to attract and retain good tenants, especially in

areas where a flurry of new homes will be delivered in the first half of

this year, as the city’s unemployment rate rises because of the

coronavirus pandemic.

Tenants

should hunt for bargain rents in areas such as New Territories West,

Tseung Kwan O and Kai Tak, where rents were expected to drop further and

the landlords were desperate, industry insiders said. As far as

lived-in homes elsewhere in the city were concerned, landlords might cut

rents for tenants they believe to have good backgrounds or jobs.

Some

owners might proactively offer their units at cutthroat prices to speed

up leasing, a property agent said. “There will be a large supply of new

homes. If they leave the properties vacant, apart from the rent

forgone, they will also need to pay high management fees,” the agent

said.

About

8,750 homes are expected to be delivered in the first half of 2022, in

new developments across Hong Kong, according to an estimate by another

property agency. Some may be delayed because of slower progress in

construction and Covid-19 driven delays in deliveries of materials.

But

this surge in supply could coincide with a rise in unemployment. For

instance, Financial Secretary Paul Chan Mo-po on Sunday said that Hong

Kong’s unemployment rate for the three months ending in February had risen to 4.5 per cent, its highest level in nearly five months.

Projects that are expected to hand over keys to owners in April include The Henley in Kai Tak, which has 883 flats in two phases, and the 503-flat Ocean Marini in Lohas Park.

Tuen Mun and nearby Sham Tseng districts will have the most number of

new flats at 2,299 units, while Tin Shui Wai district will account for

about 1,612 units and Tseung Kwan O district will account for about

1,510 units. The Kai Tak, Ho Man Tin and Hung Hom districts in Kowloon

will have a total of about 1,123 new flats.

Together

with flats listed for renting in new developments completed in late

2021 that are yet to be leased out, the total number of new homes

available for renting might exceed 10,000 units in the first half of

this year.

And rents are already falling. For example, a 702 sq ft flat in Sea to Sky

in Lohas Park was leased at HK$20,000 (US$2,554) this month, the lowest

rent for such flats since the development’s delivery in late November

last year, according to another property agency.

Rents

in Tuen Mun mid this year are expected to be up to 10 per cent below

the level seen in early 2022, driven by new supply, another agent said.

Emerald Bay Phase One,

which was delivered last year, had cheap listings for small flats at

HK$6,800 to HK$7,000 a month, she said. Rents were still falling earlier

this year even though leases have been signed continuously since late

2021, because supply was too high, the agent said.

Rents

nearby have been dragged down too. Siu Hong Court in Tuen Mun had a

flat measuring 493 sq ft leased at just HK$8,800 a month last week, the

lowest level in the development this year, for instance.

Of

the 14,552 listings available for rent on a local property agency’s

website, 424, or 2.9 per cent, HK$10,000 or less, as of Monday morning.

Most of them are in New Territories, or are older homes or tiny flats in

Kowloon.

Elsewhere,

the landlords of lived-in homes are also proactively slashing rents to

prevent tenants from leaving upon lease expiry. They want to avoid

paying extra commission for a new tenant and a rent gap, or having their

property go vacant, property agent said.

Last

week, the owner of a flat in Tierra Verde in Tsing Yi agreed to lease

their property at HK$15,000 a month, or 15 per cent below market. “The

landlord agreed to rent out the unit at a low price because he found out

that the new tenant was the management of a large company,” another

agent said. The tenant “was straightforward and was willing to pay one

year’s rent in advance in one go”.

The

market has not found a bottom yet. The rental index which track by a

local property agency in 133 estates, extended a four-month slide in

February and hit a nine-month low of 113.75. The index is expected to

fall to early 2021 levels in the first half of this year.

(South China Morning Post)

Goldman

Sachs forecasts 20 per cent decline in Hong Kong homes prices between

2022 and 2025, as borrowing costs, unemployment rise

US bank lowers forecast to 5 per cent decline in each year between 2022 and 2025

Forecast

comes as Rating and Valuation Department data shows prices of lived-in

homes in February fell the most in more than three years

The

prices of Hong Kong homes are likely to fall by a fifth over a

four-year period, as borrowing costs increase and demand slumps because

of rising unemployment, Goldman Sachs said.

Goldman

lowered its forecast from flat prices this year, followed by 5 per cent

declines in 2023 and 2024 and a return to flat again in 2025, with a 5

per cent decline in each year between 2022 and 2025.

“This

cumulative 20 per cent price fall from year end 2021 levels would be

enough to compensate for the 230 to 240 basis points higher borrowing

costs, as it restores affordability along with an expected pickup in

household income of 10 to 15 per cent by then,” the bank said in a

report published on Monday.

The

American investment bank’s forecast came as Rating and Valuation

Department data revealed on Tuesday that the prices of lived-in homes

had in February fallen the most in more than three years.

Hong

Kong’s economy most likely contracted in the first quarter of this

year, Financial Secretary Paul Chan Mo-po said, as the jobless rate for

the three-month period ending in February rose to 4.5 per cent, the

highest level in nearly five months. The retail and catering industries

were hit particularly hard by the city’s strictest social distancing

curbs since the pandemic began two years ago.

Given

current dynamics for mortgages, including 55 per cent of loan-to-value

ratio and about 27 year tenor, every 25 basis point rate hike would need

a 5 per cent increase in income or a 5 per cent decline in property

prices to maintain affordability at pre-rate hike levels, the bank said.

“We forecast just under 4 per cent peak mortgage rates by 2024, up from

about 1.5 per cent currently,” the report said.

The

decline in the Hong Kong’s lived-in home prices last month came as

owners continued to sell properties at deep discounts and even at a loss

amid the city’s struggle to contain a fifth wave of the Coronavirus

pandemic.

The

Rating and Valuation Department price index for lived-in homes dropped 4

per cent from a peak of 398.1 in September last year, according to the

latest data. On a monthly basis, home prices slipped 2.1 per cent to

382.1 from January’s 390.2.

“This is the largest fall in a single month since December 2018,” a property agent said.

In

recent weeks, sellers have been disposing of homes in Hong Kong at

lower prices. In the upscale neighbourhood of Mid-Levels, mainland

Chinese homeowners have reduced prices by between 10 and 20 per cent,

according to a local property agency.

An

example of this was Sun Hongbing, the younger brother of Sun Hongbin,

the chairman of mainland Chinese developer Sunac China Holdings, who

sold three luxury flats at The Morgan and Arezzo in West Mid-Levels at a

loss of about HK$126 million (US$16.10 million) this year, according to

the Ming Pao newspaper.

Sun

sold a 2,343 sq ft flat with a 460 sq ft rooftop at The Morgan for

HK$138 million, 27 per cent lower than the HK$189 million paid for it in

October 2018. The overall loss added up to HK$109 million, the biggest

loss since the coronavirus outbreak two years ago, if the 30 per cent

stamp duty was taken into account, the newspaper report said.

The

creditors of another Chinese tycoon from Zhejiang province put two

foreclosed duplex flats and two parking spaces at the Marinella in Wong

Chuk Hang for sale at HK$283 million, according to online news portal HK01 on Monday.

“Hong

Kong home prices could tumble by 10 per cent this year,” a mortgage

broker said. The mortgage broker said it would be the first full-year

fall since a 15 per cent drop in 2008.

If

the pandemic is brought under control soon, however, then prices and

transaction volumes were likely to pick up in the coming months, another

property agent said.

(South China Morning Post)

As Hong Kong eases Covid-19 curbs, co-working operators hunt for more acquisitions

The average occupancy rate for flexible office spaces currently stands at a stabilised rate of more than 80 per cent

There is strong demand for flexible work spaces and the sector will perform well in 2022

More

mergers and acquisitions (M&As) were in store for the co-working

sector in Hong Kong amid rising demand for flexible offices, analysts

said.

As

more firms implement a return to offices or hybrid work arrangements,

flexible co-working spaces might prove to be a better option for them

than traditional offices.

“We

have already seen a lot of activity around M&As and investment into

the sector, and expect this to continue,” Property agent said. The

average occupancy rate for flexible office spaces currently stands at a

stabilised rate of more than 80 per cent, he said.

Hong

Kong is easing its strictest Covid-19 restrictions yet on April 1, but

after two years of on-and-off work from home and flexible working

arrangements for staff, firms in the city are expected to rethink their

real estate needs in the world’s most expensive property market.

And

the city’s co-working operators have been busy setting the stage to

benefit from this shift in strategy. Hysan Development and flexible

office giant IWG, for instance, formed a joint venture for the Greater

Bay Area development zone in August last year. Hong Kong-based flexible

workspace provider The Executive Centre was acquired by private-equity

firm KKR and Tiga Investments in June last year.

“As

the sector evolves, we have witnessed more corporate occupiers using

flex spaces in addition to their core office footprint within

traditional offices. We have also seen a couple of new operators looking

to enter the market,” another property agent said.

Earlier

this month, IWG acquired the digital assets of The Instant Group, which

provides virtual office solutions. This week, the flexible office firm

said that it was leasing all 18 floors of Swire Properties’

newly-refurbished 8QRE

in Admiralty for a new Spaces co-working centre. Spanning 64,800 sq ft,

the new centre will comprise more than 900 workstations and 70 private

offices. Five floors will be dedicated to enterprise suites.

The

current restrictions in Hong Kong and mainland China were proving to be

a challenge for The Instant Group, but there were also some signs of

recovery.

“Across

Hong Kong, The Instant Group saw demand increase by 22.5 per cent last

year compared to … pre-pandemic levels, a sure sign that the demand

growth we are seeing in other global markets will also become apparent

in Hong Kong and Mainland China,” said Bobby Sodeiri, the firm’s

director.

“In

major cities across China, we are already starting to see this play out

this year, with enquiries via The Instant Group online platform

increasing in Shanghai by 16 per cent in the first month of this year

compared to last January,” he added.

TheDesk

said this month that it had acquired Jumpstart Business Centre, which

operates serviced offices in Tsim Sha Tsui, Kwun Tong and three

locations in Shanghai.

M&As

would be the main avenue for growth at theDesk, a company spokesman

said, even as occupancy rate in its mature locations improved to 78 per

cent last year from 67 per cent in 2020. The retention rate of existing

members or tenants was at 86 per cent in 2020 and 2021.

“Acquisitions

are an important extension of our existing business community. Aside

from serviced offices, it brings a number of product and service

extensions, which have the capacity to be cross-promoted across the

portfolio, and are in line with theDesk’s ‘beyond space’ community

philosophy,” he said. After acquiring Jumpstart, theDesk now operates in

13 locations, with seven co-working spaces, five serviced offices and

one space with a network partner.

“There’s

huge potential to bring together the strengths of each business with a

view to providing additional services and opportunities to our members,”

the spokesman said.

One

company that has opted for a flexible working space is Armor Capital,

which employs 10 staff in Hong Kong and overseas. The financial services

company moved to one of theDesk’ locations from an office in Wan Chai,

according to the co-working operator. Armor is likely to save between 15

and 25 per cent in office rents in three years.

“There

is strong demand from occupiers for flexible work spaces, and therefore

we believe the sector will perform well in terms of occupancy in 2022.

We will see deeper partnerships between asset owners and operators to

satisfy demand, and we will also see asset owners position their

buildings with meaningful and integrated amenities to elevate tenant

experience,” a property agent said.

(South China Morning Post)

For more information of Office for Lease in 8 Queen’s Road East please visit: Office for Lease in 8 Queen’s Road East

For more information of Grade A Office for Lease in Wan Chai please visit: Grade A Office for Lease in Wan Chai

新港中心高層呎租30元跌20%

受疫情重擊,商廈市場淪為「重災區」,租金持續下滑。消息指,尖沙嘴新港中心高層於交吉半年後,以每呎約30元租出,較舊租金下跌兩成,低市價15%,並創該商廈一年以來呎租新低。

交吉半年始租出

據市場消息指出,尖沙嘴新港中心2座高層4至6室,建築面積約5842方呎,早前以每呎約36元放租,惟受疫情等因素影響,市場問盤洽租情況淡靜,經多番議價後,業主叫價取態逐步軟化,以每呎約30元租出,減幅約16%,月租約175260元。據地產代理指出,上址上一手租金為每呎約38元,惟租戶於去年9月遷出,故上址於交吉約半年後再租出,租金下跌約兩成。

創一年呎租新低

代理亦指出,上址位處該廈高層,坐享開揚致景,市值租金每呎35元,故最新租金低價約15%。據代理行資料顯示,該廈近期頻錄承租個案,成交呎租介乎34元至45元,其中,該廈2座中層4室,建築面積1424方呎,於上月以48416元租出,呎租約34元;另一宗為該廈中層12A室,建築面積1000方呎,於去年11月以每呎約45元租出,月租約4.5萬。

若該廈租金低見30元水平,需追溯至去年2月,當時高層2至3室,建築面積約2893方呎,以每呎30元租出,月租約86790元。

(星島日報)

更多新港中心寫字樓出租樓盤資訊請參閱:新港中心寫字樓出租

更多尖沙咀區甲級寫字樓出租樓盤資訊請參閱:尖沙咀區甲級寫字樓出租

資策等4.98億沽山頂道8號頂層 採股份形式轉讓 每呎12.5萬創項目新高

疫市下傳統豪宅區錄得大額買賣成交,新近錄得山頂道8號頂層複式單位,以4.98億高價沽出,呎價達12.5萬元。項目早前方以每月75萬租出一個複式單位,呎租達211元,打破全港分層呎租紀錄新高。

市場消息透露,由資本策略及豐泰持有的山頂道8號,新近錄得一宗大額成交,為項目A1座頂層9樓至10樓Penthouse

B室,面積3982方呎,另附1456方呎天台、以及374方呎平台,採4房間隔,望全維港海景,透過俗稱「賣殼」的公司股份轉讓形式易手,成交價高達4.98億,呎價125063元,料為今年呎價次高的分層住宅成交。

區內大碼豪宅業主企硬

有代理指,山頂南區於疫市下錄得豪宅高價成交,主要由於豪客見區內樓價調整幅度有限,遂急不及待出手,購入罕有物業。該代理指,區內大銀碼豪宅業主企硬,善價而沽,並不急於放售;而自第五波疫情緩和以來,近周睇樓客已較前周增加5成,絕大部分為用家,集中物色區內1億元左右洋房,以自用為主要目的,反而億元以下物業因業主不肯減價,加上投資者審慎,睇樓及成交都較少。

另一代理表示,是次成交的山頂道8號單位,擁全維港海景,屬區內罕有,故能以高價成交。現時區內買家態度積極進取,部分買家還價達15%至20%,惟業主一般僅提供3%至5%議價空間。

MOUNTNICHOLSON今季最高價物業

山頂南區今年首季暫錄得30宗買賣成交,涉資約42.2293億,較去年第四季的40宗成交、涉資約63.8962億,成交量及金額分別按季跌25%及33.9%。今季區內錄得10宗過億元成交,其中最矚目為山頂MOUNT

NICHOLSON第3期15樓C室,面積4230方呎,1月份成交價5.8319億,呎價137870元,為首季成交金額及呎價最高物業。至於山頂道56號洋房,面積2928方呎,亦同樣以3.8億易手,呎價129781元。是次成交的山頂道8號,呎價逾12.5萬元,為22年至今成交呎價次高的分層單位。

日前創分層呎租新高

事實上,山頂道8號日前錄得大額租賃成交,為A2座頂層複式戶,面積3555方呎,連1375方呎天台及325方呎平台,附有兩個車位,望全維港海景,以月租75萬獲承租,呎租211元,創全港分層呎租新高。資本策略夥拍豐泰地產於15年斥資18.25億購入山頂道8號貨尾,繼而再斥3億至4億元翻新,現時仍持有項目5伙分層複式單位、1伙分層標準單位、以及1伙洋房,有待部署。

豪宅特色戶繼續獲市場承接,代理指,西貢清水灣麗莎灣別墅天台特色戶,面積1575方呎,採3房套房間隔,連車位以1650萬沽出,呎價10476元。另一代理指,九龍塘又一居3座地下連花園特色戶,面積568方呎,採3房套房間隔,擁452呎花園,加價14.8萬至1262.8萬易手,呎價22232元。

(星島日報)

晉美工廈申建11層高商廈

近期新界西北成市場焦點,元朗東頭工業區內項目亦密密申請改劃發展,未來有潛力發展成新一個商住社區;最新晉美工業大廈,向城規會申請放寬兩成地積比率,以重建一幢樓高11層的新式商廈,涉及可建總樓面約8.8萬方呎。

可建總樓面8.8萬呎

晉美工業大廈位於元朗東頭工業區宏業東街8號,地盤面積約14736方呎,申請放寬地積比率兩成發展,由5倍增加至6倍發展,作為「寫字樓、商店及服務行業」用途,其中1至10樓為寫字樓,地下為商店及機房,整個項目可建總樓面約8.8萬方呎。

申請人指,擬議發展合乎規劃意向及地區轉型,並加入一些園景特色,以改善行人的舒適度及視覺通透感。發展項目將不會改變地盤邊界,而主入口和起卸區車路入口將安排在地下,主要經過宏業東街進入。

大鴻輝西營盤項目三幢改二幢

另外,大鴻輝興業持有的西營盤干諾道西92號至103A號、德輔道西91號、德輔道西99號及101號3個地盤,向城規會提交優化方案,並修訂項目布局發展,主要削減德輔道西1幢建築物,改為綠化行人通道,整個發展由去年初擬建3幢建築物,改為2幢建築物發展,可建總樓面維持30.33萬方呎不變。

是次修訂主要為德輔道西91號地盤、德輔道西99及101號地盤,兩地盤中間被德輔道西93至97號的聯威商業大廈分隔,由舊方案擬建兩幢樓高2層的物業,主要作為商廈的出入口,最新則削減位於德輔道西99及101號的一幢建築物,改為綠化行人通道或休憩處。而干諾道西地盤的發展則由一幢樓高26層商廈、增加2層28層高的新式商廈,而建築物高度則增加3.6%,由主水平基準上約136米增加至140.9米。

(星島日報)

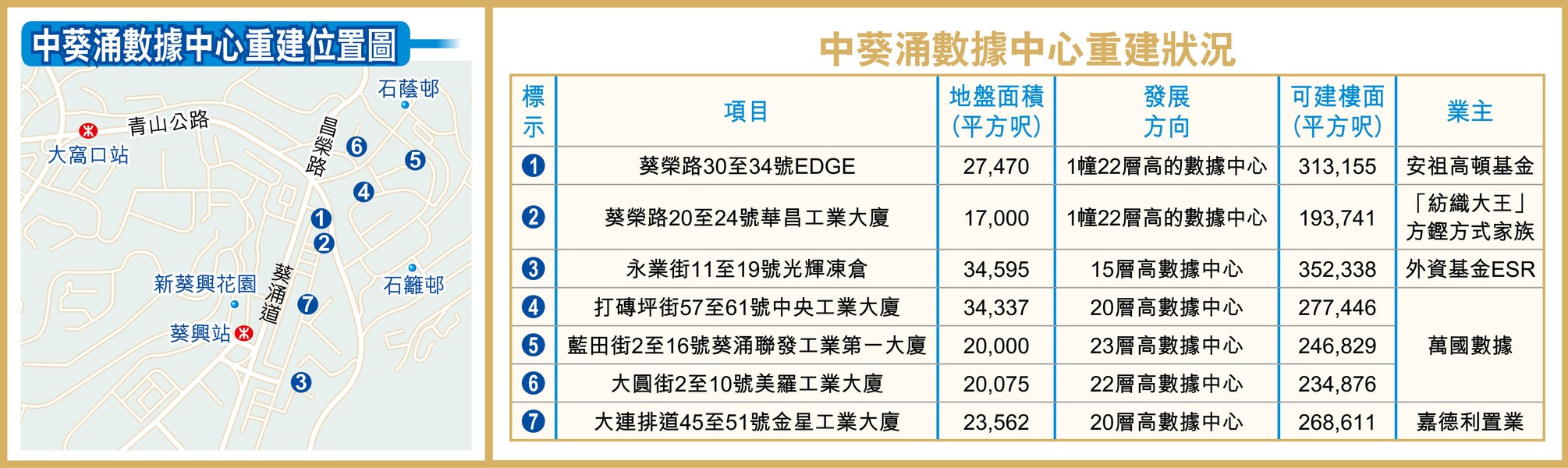

工廈活化加快 中葵涌變身數據之城

政府積極推動工廈活化,傳統工業區的重建或改裝步伐加快,其中,中葵涌有至少14個相關的申請,總樓面面積高達約372萬平方呎,當中至少一半屬於重建為數據中心的相關個案,葵涌勢進化為「數據之城」。

早在約1960年代,政府大力在新界區發展新市鎮,葵涌屬於60、70年代的荃灣新市鎮發展規劃的一部分,其後於80年代與青衣組成葵青區。按照分區大綱圖,該區的市中心為葵興、葵芳一帶的住宅及工業區、和宜合道一帶屬於工業區,西南部則為葵涌貨櫃碼頭。

7項目逾189萬呎 改劃數據中心

而葵涌道以東的工業區,近年相繼有不少工廈重建或者改裝申請,隨着踏入5G年代,市場對數據中心的需求大增,單計中葵涌一帶,目前已錄至少7宗的相關重建或改建申請,涉約189萬平方呎樓面。而區內最新有外資基金將旗下工廈的重建計劃「轉陣」,撤回新式工廈重建方案,改為作數據中心。

位於葵榮路30至34號的「EDGE」,早於2015年由外資基金安祖高頓以約7.8億元購入後,已活化為商廈。基金於去年9月曾向城規會申請重建成新式工廈,但是集團近日撤回該方案,並向會方轉為申請作資訊科技及電訊業發展。

EDGE轉用途 料樓面增逾半

「EDGE」佔地約2.75萬平方呎,目前規劃為「其他指定 (商貿)」用途,最新方案擬以地積比率11.4倍,發展1幢22層高的數據中心。最新方案與去年提出所興建22層高新式工廈的方案接近,總樓面面積亦維持約31.3萬平方呎,若與現有的「EDGE」相比,總樓面則多出56%。

另外,外資基金ESR於去年5月以約18億元向已故「舖王」鄧成波購入永業街11至19號光輝凍倉 (二倉) 後,去年向城規會申請將全幢工廈,改裝為15層高的數據中心,涉及總樓面約35.23萬平方呎。

值得留意的是,在區內重建數據中心個案中,擁中資背景的萬國數據最為積極,共佔3個相關重建項目。上述涉及的3個地點包括打磚坪街57至61號中央工業大廈、藍田街2至16號葵涌聯發工業第一大廈,及大圓街2至10號美羅工業大廈,共涉約75.9萬平方呎總樓面。

(經濟日報)

DONKI月租120萬進駐黃埔時尚坊

本港疫情爆發第五波後,零售市況持續低迷,但超級市場此類民生商戶生意不受影響,甚至繼續積極擴充。日本大型連鎖雜貨店驚安之殿堂 (DON DON DONKI) 繼今年1月進駐九龍灣淘大商場後,亦落實承租紅磡黃埔天地時尚坊約2.5萬方呎舖位,估計月租約120萬元。

早前市場已傳聞DON

DON DONKI將進駐黃埔天地,據了解,DON DON

DONKI落實承租紅磡船景街9號黃埔花園2期商場黃埔天地時尚坊,舖位包括地下入口連MTR層共14個舖位,分別為B1至B8及B27至B32號舖,總面積約2.5萬方呎,市場估計月租約120萬元,呎租約48元。

是次DON DON DONKI簽約5年,租期至2027年,吸引業主將多個舖位打通予單一租戶承租。

簽約5年 每呎48元

資料顯示,上述舖位早年亦是由單一租戶租用,原為全港最後一間以美心大酒樓品牌開業的酒樓,但於2014年1月結業。其後商場把巨型舖位分拆出租,引入多個時裝品牌進駐,包括瑞典快速時裝品牌H&M、日本服裝品牌UNIQLO、女士內衣品牌6IXTY8IGHT等。不過,近年零售業持續低迷,H&M所承租的舖位早於2020年中結業,UNIQLO分店亦在去年12月租約期滿,業主把鄰近數間原由時裝店租用的舖位一併打通,引入近年深受市民歡迎的DON

DON DONKI。

據悉,黃埔天地各期商場舖位的呎租由60至100元,不過是次DON DON DONKI所租用的舖位,則沒有地舖部分,全部零售樓面俱在地下對落一層的MTR層,故呎租相對較低。不過,該MTR層連接港鐵黃埔站出入口,有望為商場帶來不俗人流。

2022首家落實承租新店

DON

DON DONKI在2019年正式打入香港市場,售賣新鮮食品、酒類、美容、家居及生活百貨等日本商品為主,由於港人已有兩年無法外遊,令DON

DON

DONKI深受「哈日族」歡迎,全港至今有9間分店。最新一間分店為去年9月承租的九龍灣淘大商場3期1樓F188至F204號舖,總面積約2.59萬方呎,租期同為5年,剛於今年1月開張。據DON

DON DONKI日本母公司早年公布,計劃全港在2024年6月增至24間分店,黃埔天地時尚坊的舖位為今年首家落實承租的分店。

在近兩年的疫情下,超級市場成為承租能力較強的租戶,本地超級市場大生生活超市本月以每月約25萬元租用旺角亞皆老街73至81號宏安大廈地下部分連1樓全層,總建築面積約6000方呎,呎租約42元。

(信報)