Flats at the third phase of Koko Hills, named Koko Rosso, are expected to go on sale this month.

The

development by Wheelock Properties is located near Lam Tin MTR station

and Phase 3A will provide 392 one-bedroom and two-bedroom units, most of

them under HK$10 million.

In

the luxury market, Far East Consortium International (0035) will sell

the last 26 duplex flats and four villas at Mount Arcadia in Sha Tin via

tender.

Villa No 2 will open as a show unit to public from today.

The project has sold 36 homes since going on the market, cashing in a total of HK$800 million.

The

developer has appointed a property agency as its sole agent. The agency

said that with the border reopening, mainland investors will come to

Hong Kong to purchase luxury homes.

Meanwhile, two houses on Sassoon Road in the Southern District are up for sale with a reserve price of HK$550 million.

Villa

Ellenbud, a Grade III historic building which includes two houses at No

50 and No 52 Sassoon Road in Pok Fu Lam, was commissioned by the

executor to be put up for tender. The site can be redeveloped into two

mansions with a total floor area of 1,645 square feet.

Elsewhere,

Triplex A at CSI Properties' (0497) Dukes Places at Jardine's Lookout

on Hong Kong Island - a special unit with an area of 4,102 sq ft, a

private garden of 2,817 sq ft and two parking spaces - was sold for

HK$287 million.

And Sino Land (0083) has sold four homes at Grand Central in Kwun Tong, earning more than HK$79 million.

(The Standard)

Hong

Kong developers raise concerns over plan to build 10,700 temporary

public flats in prime urban site, cast doubt on Kai Tak’s ability to

handle new residents

Association

representing real estate developers says it only learned about

government’s plan recently and has received letters from concerned

residents

According to government source, flats ‘will not obstruct’ original vision of turning Kai Tak into business hub

Hong

Kong developers and a lawmaker have raised concerns about the

government’s plan to build 10,700 temporary public flats on a commercial

plot in a prime urban site at Kai Tak, casting doubt on the area’s

ability to cope with an influx of new residents.

An

association representing the city’s real estate developers on Tuesday

said it would accept the government’s plan for “light public housing” as

long as the arrangement was only for a short period.

“Hong

Kong in fact is in need [of more housing], and we think we can

compromise,” said Stewart Leung Chi-kin, the executive committee

chairman of the Real Estate Developers Association. “The most important

thing is to address the traffic problem.”

The group only learned of the project recently from the media and had received letters from concerned residents, he added.

The

5.7 hectare (14 acre) site in Kai Tak, which the government has

earmarked as a new business hub in the long run, is among eight plots

selected by authorities for 30,000 temporary flats.

The

project aims to provide a short-term housing solution for residents who

have been on the waiting list for subsidised homes for at least three

years.

A

government source said building 10,700 temporary homes at the former

airport “would not obstruct” the original vision of turning the area

into a business hub.

Out

of the 30,000 flats, 7,400 homes in four other areas will be available

in 2025, while the remaining 22,600 – including those at the Kai Tak

site – will be completed in 2026. They are expected to remain in place

for at least five years.

Leung

explained that transport links in Kai Tak, particularly ones leading to

existing upscale residential developments and hotels along the former

runway, have been a long-standing concern since the government scrapped

proposal for a monorail in 2020.

He

said developers were worried that the wave of new residents would

overwhelm the Kai Tak MTR station, but he added officials had assured

him that many would take buses and the transport issue would be

resolved.

Leung

said developers were especially concerned about the future of a

community isolation facility for Covid-19 patients located near the

cruise terminal.

With

2,100 units, the Kai Tak facility began operations in August last year

and currently has a mock-up flat for the light public housing scheme.

Chief

Executive John Lee Ka-chiu on Tuesday said the isolation and treatment

centres built for the coronavirus pandemic may be dismantled or

repurposed after a review.

The Housing Bureau earlier said they were open to the idea of turning the centres into light public housing units.

Leung

predicted developers would make “a lot of noise” if the facility in Kai

Tak was repurposed. They feared doing so would clash with the area’s

positioning as an upmarket residential area and undermine its appeal to

land bidders.

“Repurposing

that facility will ruin the entire Kai Tak area,” he said. “The

government must stick to the plan it had previously envisioned.”

Legislator

Kitson Yang Wing-kit, a Kowloon City district councillor, said he

planned to stage a rally on February 11 to oppose the Kai Tak proposal.

He predicted the project would cast a shadow over the area’s positioning

as a new core business district.

The

government source said community leaders would be consulted, adding the

Kai Tak site did not adjoin any private residential developments and

that neighbours would benefit from the amenities provided on the ground

floor of the light public housing blocks.

The

source on Tuesday confirmed it would cost HK$2.5 billion (US$319

million) to operate and maintain the scheme’s 30,000 units for five

years. The amount is in addition to the HK$26.4 billion construction

cost announced earlier.

The source said operations would be outsourced to non-governmental organisations and property management companies.

The

government will make a HK$14.9 billion funding request at a meeting of

the Public Works Subcommittee on February 8. A second funding request is

expected to be made for the scheme before the second quarter of 2024.

(South China Morning Post)

港島寫字樓租金按年跌8%

有外資代理行發布最新的香港物業市場報告指,去年12月,港島區寫字樓整體租金維持於約每呎69.5元,去年全年港島租金按年下跌8.2%。

而九龍區的寫字樓整體租金趨勢與港島區相若,但12月份,寫字樓租賃交易按月下跌40%,跟往年同期的租金變化模式相似。

自通關以來,中小型寫字樓的需求不斷增加,令共享工作空間經營商有機會受惠,大多數的寫字樓租賃查詢都來自內地企業。

展望未來,該行預期今年首季九龍區的寫字樓租賃市場將保持穩定。雖然有些企業將繼續搬遷以節省租金成本或改善營運,但相信內地通關對租戶的需求,及市場趨勢都會帶來正面的作用。

零售物業租金 料繼續受壓

另外,2022年首11個月,零售總銷貨額按年下跌1.1%,但在市場逐步復甦下,零售物業的租賃市場在今年1月逐漸恢復動力。

隨着社交距離限制的進一步放寬和入境限制的取消,該行相信零售銷貨額將在今年回升,並預計隨着內地客回歸,零售市場將出現穩定的復甦趨勢。但是,整體而言零售物業的租金將繼續受壓,下跌0至5%。

(經濟日報)

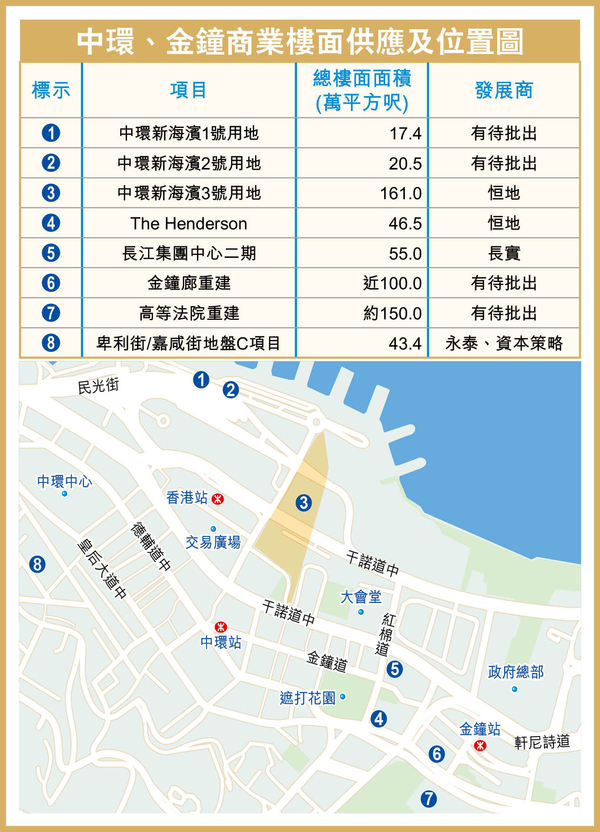

中環逾百萬呎商業樓面 料今年落成

中環新落成的甲廈項目供應罕有,而區內2個甲廈重建項目預計陸續於今年落成,單計該2項目,料提供於逾100萬平方呎樓面,環顧該區未來商廈供應,恒地 (00012) 所佔的樓面最多,涉逾200萬平方呎。

The Henderson 36層甲廈 外型破格

中環、金鐘一帶為傳統商業核心區,區內的新商業用地供應極度罕有,有價有市,故每當有地皮推出,吸引大型發展商競投,其中恒地早於2017年以約232.8億元奪得 (每平方呎樓面地價逾5萬元) 的前美利道停車場大廈項目,已發展為 The Henderson。項目為1幢36層高 (另設5層地庫) 的甲級商廈,總樓面面積約46.5萬平方呎,料於2023年落成。

項目由世界知名扎哈·哈迪德建築師事務所 (Zaha Hadid Architects) 設計,引入曲面玻璃幕牆,建築外形破格新穎,在該帶的商業建築群中相當突出。

長江集團中心二期較舊址增高18層

另外,前身為和記大廈的長實 (01113) 夏愨道和記大廈重建項目,去年亦已經正式命名為長江集團中心二期 (Cheung Kong Center II),預計同樣於今年落成。早在1974年落成的和記大廈當年樓高23層,重建後物業樓高將增至41層,提供約185個車位,總樓面面積約55萬平方呎。換言之,兩個料於今年落成的中環全新商廈項目,將為區內新增約101.5萬平方呎的商業樓面。

值得留意的是,恒地近年密密擴展區內勢力,約於5年內已經連奪2幅中環地王。繼上述投得美利道商業地王後,恒地於2021年再以約508億元 (每平方呎樓面地價約3.1萬元) 投得中環新海濱3號用地,成交總價創下全港歷來最貴重地皮紀錄。據發展商早前透露,項目將會分2期發展,第1期將於2027年落成,包括約27萬平方呎辦公室樓面、約34萬平方呎零售、餐飲和娛樂空間;第2期涉約39萬平方呎,辦公室樓面及約60萬平方呎零售空間,將於2032年落成。

至於中環、金鐘未來潛在的大型商業地供應要數到金鐘高等法院及金鐘廊重建項目,前者總樓面高達約150萬平方呎,後者則涉近100萬平方呎。兩者除規模龐大,亦鄰近港鐵站,交通方便。此外,中環新海濱1號及2號用地亦有待批出,總樓面分別涉約17.4萬平方呎及20.5萬平方呎。

(經濟日報)

更多The Henderson寫字樓出租樓盤資訊請參閱:The Henderson 寫字樓出租

更多長江集團中心二期寫字樓出租樓盤資訊請參閱:長江集團中心二期寫字樓出租

更多中環區甲級寫字樓出租樓盤資訊請參閱:中環區甲級寫字樓出租

大額成交增 海富中心1.88億沽

中港兩地已經展開首階段通關,市場憧憬商業市道會進一步好轉,最近金鐘一帶亦錄得大額商廈成交。據資料顯示,金鐘指標商廈海富中心二座 15樓全層近日以約1.88億元沽出,按該層面積約10,627平方呎計,呎價約1.77萬元成交,屬低於市價成交。據了解,新買家為內企信義玻璃。

6年貶值4成

資料顯示,上述樓面原業主為上市公司,該公司於2017年以約3.18億元買入物業作為總部,不過該公司早前被停牌,並於去年3月初遭清盤,其後淪為銀主盤。若以1.88億元成交價計,該單位於6年間帳面貶值約1.3億元,虧損約41%。

另外,有業主亦看準市場好轉的趨勢而放售旗下商廈,有業主最新委託特約代理放售金鐘力寶中心一座低層單位,面積約1,495平方呎,意向價約4,000萬元,平均呎價約2.68萬元。

事實上,有物業顧問最新預計,內地通關將為香港經濟帶來正面影響,相信來自內地的企業將在港擴充或開設辦公室,料對寫字樓市場具利好作用,於今年下半年將更顯著。

(經濟日報)

更多海富中心寫字樓出售樓盤資訊請參閱:海富中心寫字樓出售

更多力寶中心寫字樓出售樓盤資訊請參閱:力寶中心寫字樓出售

更多金鐘區甲級寫字樓出售樓盤資訊請參閱:金鐘區甲級寫字樓出售