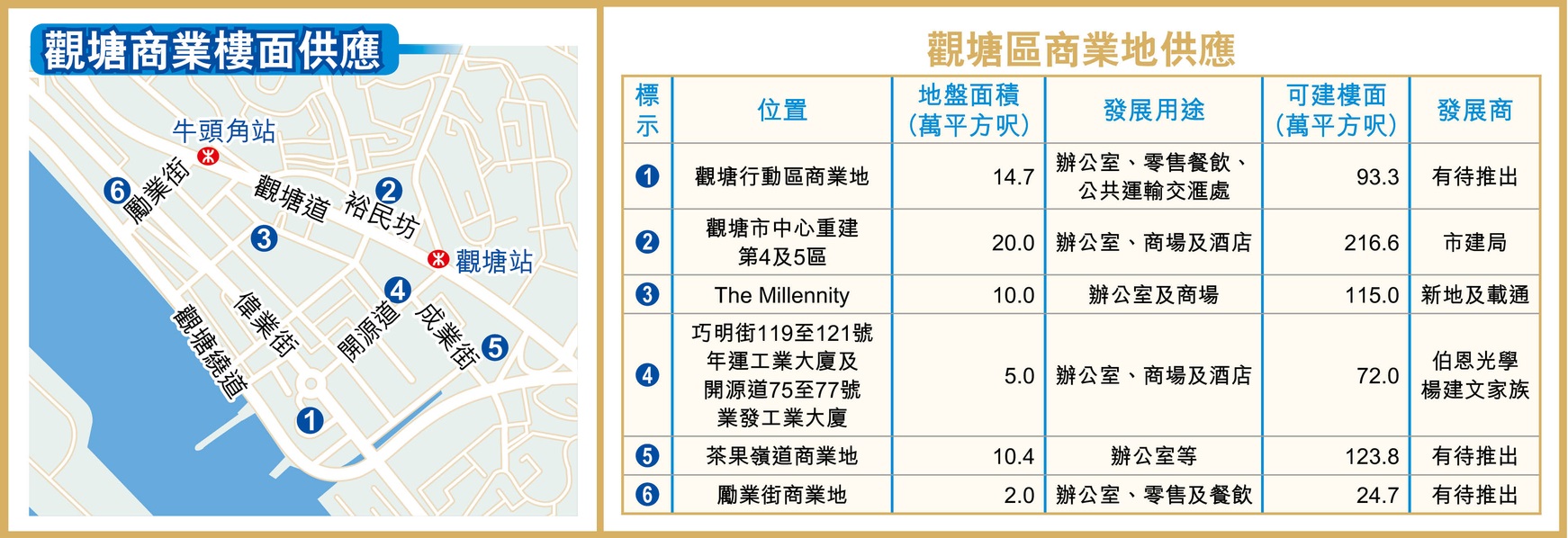

观塘近年发展成新的商业区,未来有不少大型商业项目落成,涉及约650万平方呎楼面,当中新地 (00016) 旗下巧明街综合商业项目「The Millennity」,将会提供约115万平方呎楼面。

The Millennity 率先登场 规模如apm

观塘目前有 The Millennity、市建局观塘市中心第4、5区重建,以及伯恩光学杨建文家族旗下业发工业大厦合共3个规模较大的重建项目,再连同有待政府推出的观塘行动区等3个商业地,未来单是这6个项目已经提供接近650万平方呎商业楼面。

最先登场属于已经落成的 The Millennity,项目由新地与系内载通国际 (00062) 合作发展,由2座大楼组成,各提供20层高甲级写字楼,总楼面约65万平方呎,基座为10层高大型商场,佔地约50万平方呎,规模与apm相若。项目地库4层停车场共设有近400个车位,当中配备电动汽车充电系统。

积金局已预租8万呎楼面

The Millennity 前身为九巴车厂,由九巴于2009年以约9.8亿元将其转售予母公司载通,翌年新地以约4.9亿元购入一半权益,至2016年8月新地再斥约43.05亿元为项目完成补地价,当时每呎补地价约3,743元。项目位置邻近港铁观塘站及牛头角站,亦有行人天桥接驳至创纪之城6期。据指公营机构积金局早前已经预租 The Millennity 约8万平方呎楼面,呎租料约30元。

The Millennity 过往被视为新地观塘商业王国「创纪之城 (Millennium City)」的第8期,新地早在上世纪80、90年代开始,已经在观塘将商厦、车厂打造成商厦群,最早完成的观塘道388号创纪之城1期,前身亦为九巴车厂,早在1998年已经落成,由2幢30层高商厦组成,总楼面约123万平方呎。

及后,由2000年开始陆续有创纪之城2期至第7期落成 (不设第4期),当中规模最大为比邻港铁观塘站的创纪之城5期,总楼面面积约134万平方呎,包括约74万平方呎的商厦及基座60万平方呎商场组成,商场部分命名为「apm」。

(经济日报)

更多The Millennity写字楼出租楼盘资讯请参阅:The Millennity写字楼出租

更多创纪之城写字楼出租楼盘资讯请参阅:创纪之城写字楼出租

更多观塘区甲级写字楼出租楼盘资讯请参阅:观塘区甲级写字楼出租

观塘市中心第4及5区 下月截标

市建局将于下月中就观塘市中心第4及5发展区项目截标,项目规模达216.6万平方呎,市场预测总投资额达200亿元以上,故此市建局在招标门槛及支付地价方便提供弹性。

用途地价具弹性

观塘市中心第4及5区最高可建楼面约216.6万平方呎,採用「浮动规划参数安排」,容许发展商弹性分配商业、办公室、酒店设施楼面面积,酒店最多34.44万平方呎、不设下限,而商场楼面不少于约70万平方呎。

据了解,招标条款只要求发展商建议「前期费用」,亦即是竞投地价决胜负,未见有分红要求,模式跟2017年10月上环嘉咸街C地盘商业项目相同,并规定发展商建成后须保留约11万平方呎楼面,以及50个办公室车位予市建局。

值得留意的是,市建局规定入标财团除了有合资格的发展经验外,资产净值或市值亦不能低于251亿元,而合资财团的话,则需要每个成员按照各自出资比例计算的市值不低于要求。

同时,市建局亦容许发展商分4期共约2年时间支付标价金额。签约时即付首期5,000万元,第2期,在签约21日后支付共标价40%;在签约12个月及24个月后各付30%。

(经济日报)

卖地收益869亿急跌52% 政府全年售出13幅土地

卖地收益是政府主要收入来源之一,今年本港受疫情及加息因素影响,楼价持续回软,连带地价收益随市况回落。今年政府先后售出13幅卖地表地皮,惟年内并未有百亿地王出现,连同「一铁一局」及私人项目补地价等收入,估计为库房进帐约869.89亿,较去年急跌约52%。

今年政府先后成功售出13幅土地,包括8幅住宅地、3幅商业地,以及工业地及物流地各1幅,对比去年全年售出11幅地皮,多出2幅。单计卖地表住宅、商业及工业等地皮,卖地收入已达287.05亿,若连同「一铁一局」项目及补地价等收入,估计政府全年土地收入约869.89亿,对比去年全年约1830亿,劲减960.11亿,跌幅高达52.5%。

未有「百亿地王」诞生

回顾年内虽然未有「百亿地王」诞生,但出现本港卖地表地呎价最高纪录,今年2月由爪哇夺标的浅水湾南湾道豪宅地,中标价逾11.88亿,每方呎楼面地价达62352元,呎价打破本港卖地史纪录,一举登上呎价最贵地王宝座,爪哇早前宣布引入汉国置业共同发展。

浅水湾地每呎6.2万破顶

今年最贵价地皮为长实于12月底以87.03亿投得的啟德2A区4号、5 (B) 号及10号合併用地,以可建总楼面约141.8万方呎计,每方呎楼面地价约6138元,呎价重返8年前。「第二贵」地皮为葵涌美青路与货柜码头南路交界的物流地,今年7月以52.56999999亿批出,以可建总楼面约148.54万方呎计,每方呎楼面地价约3539元。

除政府卖地表地皮外,「一铁一局」的发展项目亦成为发展商争夺目标,年内「一铁一局」批出6个项目。今年港铁推出3个项目招标,成功批出2个项目,最瞩目为去年曾流标的港铁东涌牵引配电站物业发展项目,华懋于7月成功夺得项目发展权,该项目补地价金额约35.475亿,即每呎补价约3776元。

4月批出的将军澳百胜角通风楼物业项目,由新世界夺得项目发展权;该项目补地价金额约达11.0137亿,以可建总楼面约29.06万方呎计,每方呎补价约3789元。

尚餘一个为小蠔湾第一期项目,于今年12月接收33份意向书,同月推出招标,明年2月8日截标。据了解,项目不设补地价条款,须支付「一口价」固定金额为12亿;发展商须就分红比例向港铁自行提出建议以决定胜负,而且分红比例并不设限制。值得留意的是,小蠔湾项目可建总楼面约926.24万方呎,包括约889.1万方呎作私宅用途及37.1万方呎作商业用途。该项目上月以86.03亿完成补地价。据港铁公布,项目以市值 (即计入铁路沿綫元素) 须向政府「一笔过」补地价,并扣减建造新的小蠔湾站、重置车厂、物业备置工程等发展成本,据港铁早前公布以截至2020年年底的价格预期费用合共约360亿。

市建局批出4项目发展权

至于市建局方面,年内批出4个项目发展权,金额达107.85亿,当中以「小区模式」发展的土瓜湾项目有2个,包括第三个以「小区模式」发展的土瓜湾鸿福街、啟明街及荣光街四个重建项目的合併发展,由长实于3月以59.96亿夺得,每方呎楼面地价约11382元。

该局第四个以「小区」发展的荣光街/崇安街项目,于10月由信和伙招商局置地以23.88亿投得,每方呎楼面地价约8571元。另外,该局同年8月亦批出西营盘崇庆里/桂香街发展项目,并由远东发展以12.4亿夺得,每方呎楼面地价约13085元。

观塘市中心项目是市建局历来规模最大的单一重建项目,该项目为最后一个发展区域,位于新盘凯滙对出,毗邻港铁观塘站,地盘面积为27.55万方呎,可建总楼面约216.59万方呎。

(星岛日报)

铜锣湾利园区「升级」涉资20亿 希慎兴业吕干威:长远有助资产增值

「铜锣湾大地主」希慎伙拍华懋,去年夺取加路连山道商业地王,希慎兴业首席营运总监吕干威表示,配合新地标落成,集团斥资逾20亿,为整个利园区作升级改造,除了行人通道系统、连接各车场的地下隧道外,更引入大量可持续发展元素,长远有助资产增值。

吕干威表示,随着商业地王兴建,「利园版图」由现时逾383万方呎,拓展至逾493万方呎,增幅达29%,铜锣湾亦随之变天,有盖行人通道连接希慎广场及利园二期,新天桥网络贯通利园三期、利园五期及利园六期,行人可轻易由港铁站直抵加路连山道全新大楼,步程10分鐘以内。

配合地标项目落成

他续说,事实上,早于投地前,集团向政府提议,指任何财团投得土地,皆期望新项目有通道接驳港铁站,故两年前已落实计画。现时,更斥资逾20亿为整个利园区升级改造。「旗下资产净值逾850亿,计画有助长远增值,只要年收入增加1%,便高达8.5亿!」

他形容,百年历史的利园区,佔地广阔,细看顾客足迹,可将之分为「三个区域」,希慎广场顾客乘搭公共交通工具而来,利园一期所在一带,聚集奢侈品店铺,豪客有司机接送,利园六期及周边受中产家庭热捧,驾车到来光顾食肆及家具店。

「三个区域」定位清晰

过往集团多番重建旧厦,连繫整个区域的大规模升级改造,则前所未有,日后,「三个区域」更加清晰吸引,希慎广场将成为「潮流带领者」(The Trendsetter),利园1、2、3、5及6期成为奢侈品旗舰大本营 (Home of Luxury Flagships),加路连山新项目所在地,将发展绿化地带 (The Green Centric),儼如「后花园」。

升级改造始于今年10月,从希慎广场4楼Urban Park入手,面积约7000方呎,当中4000方呎,将成为港岛区首个商场内的滑板公园,下月啟用;希慎广场4楼2家大型食肆将迁走,换上5至6家精緻餐厅,零售楼层引入不同主题及趣味商户。

希慎广场设滑板公园

吕干威续说,日后,整个利园区成为特备活动及体验的专属区域,Cartier、Chanel、Dior、Hermes、Louis Vuitton将在区内扩充,开设逾万呎旗舰店。

(星岛日报)

更多希慎广场写字楼出租楼盘资讯请参阅:希慎广场写字楼出租

更多利园写字楼出租楼盘资讯请参阅:利园写字楼出租

更多铜锣湾区甲级写字楼出租楼盘资讯请参阅:铜锣湾区甲级写字楼出租

Festive cheer as home deals hit 12-year high

A total of 32 transactions were recorded in the 10 major housing estates during the four-day Christmas holiday, a record high since 2010, according to a property agency.

The agency also recorded 17 transactions over the weekend in the 10 major housing estates, a 183 percent jump from the previous weekend.

Many buyers have turned positive on the outlook for the local property sector and accelerated their pace entering the market on the hope that China will reopen its border, an agent said.

The agent added that the expected slowdown in interest rate hikes in the US is also boosting market sentiment.

Property prices are expected to bottom out and rebound 15 percent next year after the reopening with the mainland, the agent said.

In the primary market, Henderson Land Development (0012) said The Quinn Square Mile in Tai Kok Tsui will launch the sale of 10 flats on Thursday, with the cheapest one priced at HK$6.12 million after discounts.

The price per square foot after discounts ranges from HK$22,924 to HK$25,501, it said.

This came as another agency said it expected to record a net loss for this year compared with a net profit of HK$100 million in 2021.

The consolidated net loss as of November totaled HK$480 million, it said in a filing yesterday.

The expected loss was mainly due to a significant decline of 40 percent in the transaction volume of residential property sales in Hong Kong, which could be the lowest since 1996, the firm said, citing negative factors including Covid-related restrictions, interest rate hikes, and a slowdown in the launch of new properties on the market.

The firm added that the loss was also caused by limited rental concessions granted by landlords and its Covid-hit business in the mainland.

The agent believes the local property market will remain volatile next year, "but if Hong Kong achieves full reopening with the mainland and sees a peak in the interest rate hike with economic recovery and improved investor sentiment, home prices could see a 5 percent rebound for the whole year. "

(The Standard)

Hysan earmarks US$256 million for ‘Lee Gardens Rejuvenation’ in Causeway Bay, turn it into ‘home of luxury’

The new Caroline Hill Road development will expand Hysan’s office portfolio by 30 per cent in Hong Kong’s Causeway Bay

Top luxury brands like Cartier, Chanel, Dior, Hermes and Louis Vuitton plan to open 10,000 sq ft plus flagship stores in Lee Gardens

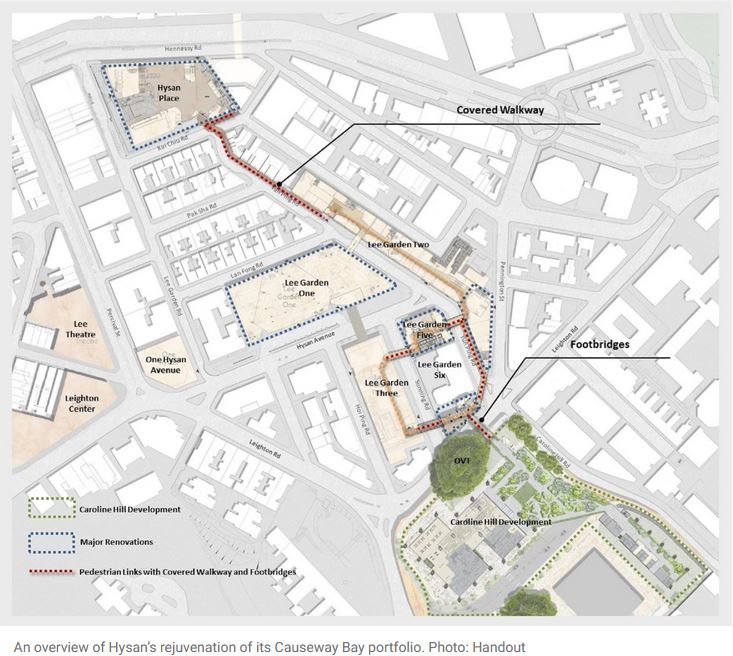

Hysan Development, Causeway Bay’s largest landlord, has set aside HK$2 billion (US$256.2 million) to upgrade its Lee Garden portfolio in the prime Hong Kong shopping district and turn it into a one-stop luxury shopping destination.

The proposed “Lee Gardens Rejuvenation” includes the development of the Caroline Hill Road land parcel, Hysan executives said in a briefing last Thursday.

The revamp will turn Lee Gardens into the “home of luxury”, said Ricky Lui, executive director and chief operating officer at Hysan. A number of top international brands such as Cartier, Chanel, Dior, Hermes and Louis Vuitton plan to expand in Lee Gardens, with flagship stores in excess of 10,000 sq ft.

The new Caroline Hill Road development will expand Hysan’s Lee Gardens portfolio by 30 per cent, the company said. The plan includes new covered walkways and footbridges, offering pedestrians a weatherproof walk to and from Causeway Bay MTR station and the Lee Gardens area comprising Hysan Place, Lee Garden One, Two, Three, Five, Six as well as the Caroline Hill Road project.

“People nowadays will only go to the biggest shop, with the best experience and the one with the most variety when prices of the goods are the same in different shops,” Lui said.

He said a unique experience is important to attract and create the motivation for visitors to come as the tourism landscape has changed, adding that for tourists coming from the mainland, big brands and food are no longer enough as the same experience is available in cities like Shanghai and Shenzhen.

“[Tourists] need a deeper level of travel rather than a superficial one.”

A planned underpass linking the car parks in all phases of Lee Gardens will further improve the traffic flow in the area, according to Hysan. The whole revamp will divide the Lee Garden area into three zones catering to high spenders with drivers, young families with cars, visitors and general shoppers, according to the company.

Hysan plans to complete the upgrade to its HK$90 billion commercial portfolio in phases by 2026, with the revamp starting in October. The first project – a 7,000 sq ft urban park on the fourth floor of Hysan Place – will open in January. It includes a 4,000 sq ft dedicated skateboard park, the first on Hong Kong Island.

Hysan reported slightly lower profit and sales for the first half, as the city’s toughest Covid-19 restrictions during the height of the fifth wave of the pandemic slammed the retail segment.

Despite a sharp decline in tourists because of the coronavirus pandemic, Lee Gardens has seen strong local consumption as big brands in the area were doing well, Lui said.

“We’ve seen how Lee Gardens is strongly connected to Hong Kong’s market,” Lui said, adding that these brands wanted to further strengthen ties between local consumption and their businesses.

After nearly three years of Covid-19 curbs casting a shadow on Hong Kong’s economy, things are beginning to look up. Retail sales in October rose 3.9 per cent year on year in value terms to HK$31.9 billion. And with the government practically dismantling Covid restrictions, the city’s economy is set to receive a boost from the anticipated influx of tourists. Rising inflation globally and tightening interest rates, however, still pose a threat to domestic consumption.

Hysan has 4.5 million sq ft of office, retail and residential tenants space mainly in Causeway Bay’s Lee Gardens area, according to its website.

When the Caroline Hill project is ready, Hysan’s office portfolio will be about one-third larger than its retail space, Lui said.

He added the pandemic has altered the office landscape, leading to changes in office use and requirements amid the work-from-home trend and companies cutting down on costs.

In August 2021, Hysan formed a joint venture with the Swiss flexible office giant IWG to exclusively operate all IWG brands in Hong Kong and throughout the Greater Bay Area, including the group’s flagship Hysan Place and Lee Garden Three under the “Spaces” and “Signature” brands.

“Nowadays, flex has become a feature of offices,” Lui said. “If you don’t have a very strong co-working element today, it’s like a shopping mall without restaurants.”

Co-working spaces in Lee Gardens accounted for more than 10 per cent of the overall office tenants, he said, adding that it reflects the changing work environment.

(South China Morning Post)

For more information of Office for Lease in Hysan Place please visit: Office for Lease in Hysan Place

For more information of Office for Lease in Lee Garden please visit: Office for Lease in Lee Garden

For more information of Grade A Office for Lease in Causeway Bay please visit: Grade A Office for Lease in Causeway Bay