The value of commercial property

transactions in Hong Kong surged by 35 percent month-on-month in January

to HK$4.08 billion as sentiment improved following the reopening of the

border with the mainland, according to a property agency.

This

was even though the number of deals in January fell 6.5 percent to 215,

mainly due to the Chinese New Year holidays at the end of the month.

The

property agent expects the commercial market to further recover, with

Covid PCR test requirements and quotas for cross-border travel scrapped

from today.

Turnover

from commercial buildings soared 62 percent monthly to HK$901 million

from last December, and the number of transactions jumped 66 percent to

40 in January, though both were still below the levels seen a year ago.

The

agency believes prices of commercial buildings are rallying, amid a

surge in business activities following the border reopening.

A new tower, NCB Innovation Centre

in Cheung Sha Wan, for example, sold seven car-parking lots for over

HK$125 million, as well as three flats on the 22nd floor to a

Singaporean firm for HK$63.25 million.

Meanwhile,

shops transactions rose about 50 percent to HK$2.14 billion from a

month ago, despite a 19 percent fall in deals to 57.

Turnover for industrial buildings remained flat while the number of deals fell 15 percent to 118.

(The Standard)

For more information of Office for Sale at NCB Innovation Centre please visit: Office for Sale at NCB Innovation Centre

For more information of Grade A Office for Sale in Cheung Sha Wan please visit: Grade A Office for Sale in Cheung Sha Wan

Kwun Tong center redevelopment will now add residences

The

Urban Renewal Authority plans to introduce residential elements into

its Kwun Tong Town Centre Development Areas 4 & 5 project, whose

tender was canceled last week after the only bid from Sun Hung Kai

Properties (0016) was rejected.

Managing

director Ir Wai Chi-sing said in his blog that in line with the future

development of the Kowloon East central business district, the authority

decided to introduce residential housing into the project to enhance

its attractiveness.

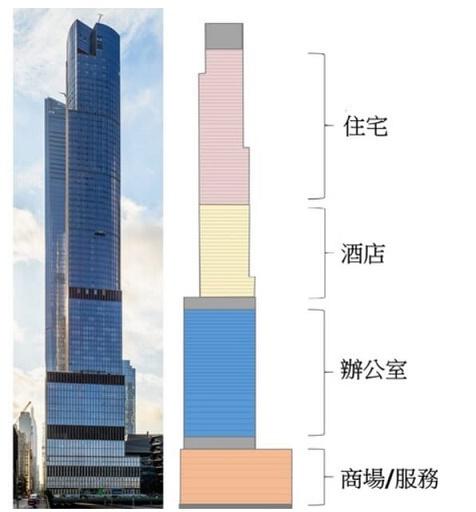

The residential area will be built above the hotel, office and shopping areas.

Wai

said that if the site is granted in a depressed market, the project

will suffer a serious financial loss and hurt the resources for future

urban renewal projects.

Besides,

the project involves the acquisition of more than 400 private homes and

disposing of over 100 unauthorized structures, which was a huge

expenditure.

The site of

Kwun Tong Town Centre is strategically located adjacent to Kwun Tong

MTR Station and Yue Man Square Public Transport Interchange and the URA

said its role as a "town center" in terms of traffic, logistics and

economic activity will not change.

The URA's revenue has been significantly reduced amid the housing market downturn.

Its

To Kwa Wan Road/Wing Kwong Street development scheme was awarded last

October at a price of HK$9,200 per square foot, 33 percent lower

compared to the Hung Fook Street/Ngan Hon Street development project

which was tendered in late 2021 at a price of HK$13,700 per sq ft.

URA

estimates the tender for future projects will be under pressure as the

acquisitions for the sites were done when property prices were high.

(The Standard)

Luxury home sales surge amid reopening

The

number of transactions of new luxury homes costing more than HK$50

million hit a 16-month high last month and weekend transactions in 10

major housing estates reached a three-week high as the border reopening

with the mainland and slowing interest rate hikes fueled the market.

A

total of 503 new home sales were recorded last month, which was up by

87 percent from December and the highest in four months, according to a

property agency. Among them, homes priced over HK$50 million saw 41

transactions, up by nearly 2.2 times to a new high in 16 months, the

agency said.

The momentum in the upscale home market is expected to sustain as the economy picks up.

Yesterday,

Kerry Properties (0683) sold a 1,699-square-foot luxury home with a

parking space at Mont Rouge on Beacon Hill in Kowloon Tong for HK$70.3

million, or HK$41,376 per sq ft via tender.

Only

four flats are left for sale and the developer has collected over

HK$6.5 billion from selling 41 homes at an average price of more than

HK$60,000 per sq ft at the project.

In

the mass market, Minmetals Land's (0230) Montego Bay in Yau Tong sold a

517-sq-ft flat with two bedrooms for HK$12.77 million, or HK$24,700 per

sq ft, the highest at the project in more than one year.

In

Fo Tan, Centralcon Properties will launch sales of 389 completed flats

at The Arles, including 306 flats on price lists and 83 homes via tender

on Thursday.

In Cheung Sha Wan, Seaside Sonata

saw 300 groups of home viewers over the weekend after slashing prices

of 10 flats on the last price list by as much as 16 percent to attract

buyers, the developer CK Asset (1113) said.

The remaining 22 flats, including 12 flats to be sold via tender will be put on the market on Friday, it said.

In

the secondary market, A property agency saw a three-week high of 22

home sales in 10 major housing estates over the weekend, up by nine

deals or 69.2 percent from a week ago.

The

market is on track for recovery after the Chinese New Year holiday and

some buyers had to raise their bidding prices to clinch a deal, an agent

said.

The agent expects both the transaction prices and volumes to increase this month.

However,

a luxury apartment with a parking space at Mount Nicholson on the Peak

recently sold for HK$390 million with the vendor suffering a loss of

HK$139 million or 26 percent after buying it for HK$520 million in 2018.

(The Standard)

代理行:市場氣氛回暖 商廈交投按月升66%

中港兩地通關,帶動工商鋪氣氛回暖,有本地代理行資料顯示,商廈買賣顯著向好,上月錄40宗買賣,按月升66%。

金額9.01億按月升62.3%

該行代理表示,上月商廈價量齊升,共錄約40宗買賣,總金額約9.01億,按月升約66.6%及約62.3%,從商廈市況持續改善看來,證明動亂及疫情洗禮,商廈價格觸底回升。通關伴隨龐大商務需求,跨國企業購入指標商廈。長沙灣荔枝角道888號南商金融創新中心,連沽7個單位,總金額逾1.25億;其中22樓3伙獲新加坡公司購入,涉資約6325.1萬元。

鋪位交投金額按月升49%

商鋪買賣則錄57宗,較12月的71宗回落約19.7%,金額錄約21.40億,按月急升約49.7%。工廈較平穩,1月共錄約118宗成交,對比12月減少約接近一成半,成交金額則大致相若。

上月錄215宗工商鋪成交

據該行資料顯示,1月份工商鋪暫錄約215宗成交,對比2022年12月約230宗輕微下跌,今年農曆年假較以往早,減慢買家入市步伐,總成交金額走勢凌厲,1月份總成交金額錄約40.83億,對比去年12月大幅增加約35%,主因月內錄多宗大手成交,反映通關消息刺激市場氣氛回暖,資金隨之流向工商鋪物業,尤其是商廈。

(星島日報)

更多南商金融創新中心寫字樓出售樓盤資訊請參閱:南商金融創新中心寫字樓出售

更多長沙灣區甲級寫字樓出售樓盤資訊請參閱:長沙灣區甲級寫字樓出售

代理行:工商鋪交投料按年升30%

在與內地通關效應下,工商鋪交投活躍,有本地代理行預期,今年全年工商鋪將回升至5800宗,較去年增加約30%。該行代理表示,內地居民赴港澳旅行團,相信優化措施能吸引旅客來港,重振本港零售業及旅遊業,帶動核心區地鋪,代理續指,財政預算案快將出爐,若有進一步政策,將吸引中資及海外企業來港投資及設立據點。

料全年數目達5800宗

該行綜合土地註冊處資料顯示,1月份工商鋪註冊量共錄259宗,較去年12月223宗按月升16.1%,連跌兩個月後首度回升,金額錄32.04億,按月跌約64.3%,1月份註冊個案主要反映12月份市況。

短期內未能回復疫情前水平

1月份工商鋪各板塊註冊宗數全綫上升,工廈及商鋪較佳,註冊量分別按月升約10.4%及29.2%,最新分別錄127及84宗。商廈註冊量按月升約11.6%,錄48宗。市場氣氛逐漸回暖,令註冊量增加,但投資者態度仍趨審慎,交投增長速度未明顯回升,預料整體註冊量及金額未能在短期內回復疫情前水平。

該代理又說,美國聯儲局宣布加息0.25厘,顯示加息幅度放緩,有望改善市場氣氛。代理認為,投資市場逐漸適應後疫情時代,更了解各板塊物業增長潛力及未來價值,部分工商鋪價格已累積一定跌幅,吸引投資者趁低吸納。

(星島日報)

市建局擬為觀塘商業項目增住宅元素 改作混合模式

市建局觀塘市中心第4、5區巨無霸商業項目(總樓面面積逾216.5萬方呎),早前因為只接獲新地 (0016) 一份標書,上周決定收回、即流標收場;市區重建局行政總監韋志成今日在網誌透露,市建局團隊希望為項目加入住宅元素,局方會以新規劃思維,因應市場對房屋、辦公室、酒店和零售等需求,將地標大樓的發展規劃,包括加入住宅元素,應對不斷變化的市場和社會環境,以配合九龍東核心商業區的未來發展,提升項目吸引力。

為衝破上述傳統「甲類」住宅項目的地積比率限制,市建局團隊認為應將第4、5發展區土地,由「商業用途」改變為「其他指定用途 (混合發展)」的發展模式,並結合「一地多用」概念,在地盤獲准發展的地積比率為12倍及「浮動規劃參數」機制維持不變的基礎上,加入住宅發展元素,讓日後的中標發展商可更靈活調撥發展樓面,作住宅、辦公、酒店和零售等不同業務。

市建局研究紐約、倫敦和東京等高密度大城市所提倡的「垂直城市」(Vertical City) 發展理念,由「二維」的橫向規劃,革新至「三維」的垂直規劃,將不同的土地用途,融合在一座高層綜合用途的地標建築物內。韋續指,市建局團隊已就「混合發展」規劃的概念,初步與相關政府部門交流,並得到正面回應;同時,市建局亦就此展開全面技術評估,特別是交通負荷的評估。

(明報)

東九CBD搖搖欲墜

地產市場近日有兩單大新聞備受議論,首先是「簡約公屋」選址風波,引起啟德私樓業主群情洶湧;其次,繼赤柱超級豪宅地皮流標後,市建局旗下觀塘商業項目亦告「收回」。這兩宗新聞有其關聯,背景是本港商業活動暫時復甦乏力,甲級寫字樓空置率頗高,尤其是九龍東接近20%樓面丟空。在供過於求之下,九龍東的所謂CBD

2定位面臨重大挑戰,發展商對於斥資「起新office」難免非常審慎。

自從2019年爆發社會運動及新冠疫情,本港經濟活動嚴重受創,商業地產租賃市場首當其衝。據一間外資代理行研究報告,截至去年12月底,本港甲級寫字樓整體空置率達12.1%,整體租金水平較2019年高峰期下滑接近三成。其中,中環、港島東、九龍東的空置率分別達8.8%、11.1%、19.5%。

作為比較,在2019年風風雨雨刮起前,本港甲級寫字樓整體空置率長期低於4%,尤其是中環寫字樓極之搶手,影響到一些大企業擴張受限制,部分公司遂把總部或個別部門辦公室搬到港島東,隨後又進一步遷徙到九龍東。正因如此,港府才在大約十年前提出CBD

2大計,擬把啟德新區至觀塘重建區一帶打造成本港第二核心商業區,為經濟活動提供更多空間。

全面通關 甲廈未必即受惠

這3年多香港發生巨變,如今連中環寫字樓也「十室一空」,地標商廈大業主需要大幅減租留住客戶,部分企業更趁機由港島東「回流」到中環,作為「核心外圍之外圍」的九龍東商廈,面臨更大挑戰。

本港與內地今日起全面通關,初期料將帶挈商舖、商場等零售物業回暖;反觀甲級寫字樓主要用於企業營運,暫時未必立竿見影受惠。對於香港作為「亞太營運總部」之前景,其中一個參考指標是外籍人員派駐香港數量。資料顯示,入境處去年根據一般就業政策批出13495個工作簽證,較2019年勁減63%,創逾20年新低。有國際獵頭公司指出,看不到外籍僱員「大量回流」跡象,因為「這幾年離開香港的外派員,大部分已在其他地區開展生活,料不會回港」。

同時值得留意,近年WFH (居家工作)、遙距辦公等模式興起,全世界商廈需求都有機會受到一定影響;但有別於紐約、倫敦等其他商業中心,香港還面對傳統定位備受動搖、企業及人才流失等因素困擾,堪稱多重打擊,商廈前景難以樂觀。

短期而言,「核心中核心」的中環CBD料仍可保持繁榮,九龍東則尚欠利好因素。基於寫字樓供應明顯供過於求,無從說服眉精眼企的發展商斥資興建「純商廈」項目,潛在回報與風險不容易「計得掂數」。所以港府早前已把啟德5幅商業地皮改劃為住宅用途,該區仍有大量空地用於商業規劃,料將繼續「曬太陽」一段時間。既然如此,當局擬順手借其中一幅空地發展「簡約公屋」,提供逾萬伙單位,並承諾7年後「還地於區」,背後邏輯可以理解。

此外,市建局旗下觀塘市中心第四及第五重建區商業項目去年邀請19家發展商入標,市場估值約87億至130億元,結果只收到「一千零一份」標書,來自區內「大地主」新地 (00016);其餘18家發展商「連入標都慳返」,反映業界整體上興趣缺缺。但市建局上周宣布,在全面考慮入標價格及市場數據等因素之後,決定不接納唯一一份標書,即是流標收場。

觀塘項目混合發展增吸引力

市建局行政總監韋志成昨日透露,將會收回觀塘項目,用「新思維」重新規劃,革新發展模式,包括把項目定位由「商業用途」改變為「其他指定用途 (混合發展)」,「加入住宅元素,應對不斷變化的市場和社會環境」,以提升項目吸引力。由此可見,觀塘市中心純商業項目再沒多少吸引力,不得不像啟德般,把部分樓面改劃作住宅用途。

總的而言,九龍東CBD

2亦可說是本港經濟之縮影,假若企業及人才流失趨勢未能逆轉,「亞太營運總部」定位失色,不但啟德、觀塘的甲級寫字樓陸續丟空,本港整體經濟亦難奢望重拾當年勇。繼推出「Hello香港」吸引遊客大計後,特首李家超馬不停蹄,現正出訪沙地阿拉伯,努力「說好香港故事」。且看特首能否說服一批中東企業來港投資或上市,不妨考慮選址九龍東設立營運總部,讓啟德有機會變身「遠東杜拜」,啟德業主們相信會歡迎酋長和油王做鄰居。

(信報)