Henderson Land (0012) expects to step up the pace of its sales and raise prices for units at Henley Park in Kai Tak at a time when a survey found 48 percent of Hongkongers still believe home prices will fall in the coming 12 months.

Henderson said it may start a second round of sales for Henley Park next weekend and there is a possibility of increasing prices by up to 5 percent for the upcoming price list.

The developer has received about 5,500 checks for the first batch of 228 flats, indicating an oversubscription rate of 23 times.

The

first batch, ranging from studios to three-bedroom flats, will be

launched tomorrow. They offer practical areas ranging from 250 to 649

square feet, and the discounted average price for them is around

HK$21,463 per square foot.

The

news came as a Hong Kong Property poll, conducted between late May and

early June, found 48.2 percent of 353 respondents expect home prices to

fall, though the ratio is down from 62.8 percent in the third quarter.

Only about 40 percent are considering entering the market, a drop of 8.5 percentage points quarter on quarter.

(The Standard)

Hong Kong government to sell only 2 plots of residential land in second quarter of financial year amid weak market sentiment

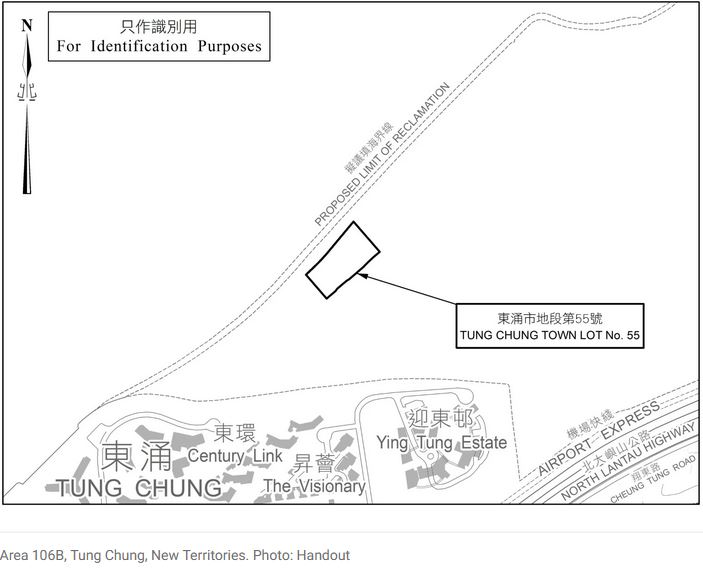

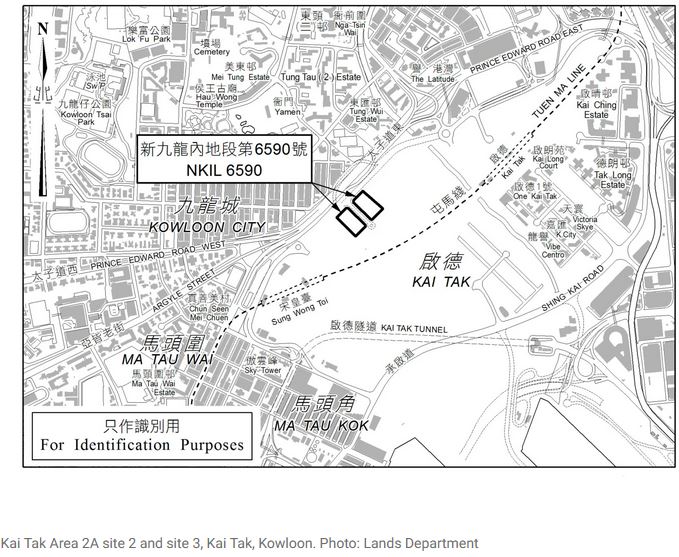

The

parcels in Kai Tak and Tung Chung, providing 1,739 flats in total, will

be put up for tender between July and September, says Secretary for

Development

The

total supply for the first half of the financial year – including

private developments – should support some 8,280 flats, which is about

65 per cent of the annual target

Hong Kong’s government has defied market expectations by announcing it will sell only two plots of residential land in the second quarter of the financial year – about half the number forecast by some analysts.

The

parcels in Kai Tak, the site of Hong Kong’s former international

airport, and Tung Chung on Lantau Island, which will provide 1,739 flats

in total, will be put up for tender between July and September,

Secretary for Development Bernadette Linn Hon-ho said on Thursday.

The provision is smaller than the 2,400 flats from two sites offered in the three months to June, which are in Kennedy Town and Tsuen Wan.

However,

the total supply for the first half of the financial year – including

private developments – is expected to support some 8,280 flats, which is

about 65 per cent of the government’s annual target for housing, Linn

said.

Analysts suggested the surprisingly small offering of land in the

second quarter may reflect the gloomy market conditions, though the

government denied this was a factor in its decision.

A

rapid succession of interest rate increases has cast a long shadow over

a growing property oversupply that is being exacerbated by newly built

flats coming onto the market.

“The

current sentiment in the land market is not particularly good. In fact,

there is a risk of having the tender withdrawn,” a surveyor said.

“Generally

developers would be conservative in bidding for the tender due to the

uncertainty in the economy as well as the interest rate hikes.”

Another surveyor had predicted four or five plots of land would go up for grabs in the second quarter of the financial year.

“The

interest rate remains the main adverse factors,” the surveyor said.

“Developers would not be willing to offer aggressive prices.”

For

the Kai Tak parcel, valuations by five surveyors tracked by the Post

ranged from HK$4,300 (US$549) to HK$6,500 per sq ft, or HK$4.4 billion

to HK$7.08 billion.

For the Tung Chung parcel, valuations ranged from HK$2,840 to HK$3,300 per sq ft, orHK$1.14 billion to HK$1.2 billion.

Rising

construction costs are likely to be another factor that would deter

developers from investing in land at the moment, according to another

surveyor.

Also,

the reopening of Hong Kong’s international borders did not generate the

expected surge of Chinese buyers back to the city’s property market,

the surveyor added.

“Developers’

bidding offers will be conservative,” a property agent said. “There has

likely not been much profit generated by home sales from construction

sites bought in recent years.

“I

believe they want a good price when bidding for land now. You would not

buy at the price of two or three years ago, nobody wants to do

loss-making business.

“In the past, new projects would be sold in one go … but now possibly only half or one-third is sold after launch.”

The

land sales plan comes after prices of lived-in homes in Hong Kong fell

in May for the first time this year, as looming interest rate increases

dampen demand.

Linn denied that land sale decisions are affected by market sentiment.

“For

government land sales, we must primarily cater to our economic and

housing land needs,” she said. “We cannot only sell land when the market

is very good. We do not purely refer to market estimates.”

Hong

Kong’s private home market will be flooded with new supply in the next

couple of years, according to the latest forecast from the Our Hong Kong

Foundation cited by Bloomberg Intelligence.

An

annual average of about 20,200 private residential units will be

completed this year and next, rising to 20,900 units in 2025, the think

tank said.

(South China Morning Post)

港島甲廈租金首五月挫2.5%

受到供應增加及空置率上升影響,港島甲級商廈租金持續偏軟。有外資代理行發布最新香港物業市場報告指出,5月港島區整體甲廈租金按月回落0.6%,每月呎租僅67.8元;今年頭5個月港島區整體甲廈租金累跌2.5%,期內中環區甲廈租金下挫4.1%最慘情。萊坊預期港島甲廈租金跌勢未止,全年料挫3%至5%。

該行稱,隨着寫字樓租金向下,刺激睇樓活動轉趨活躍,企業繼續在核心區尋找租金吸引的優質寫字樓作擴充及升級。

由於到2025年市場約有183萬方呎的新增甲廈供應,主要集中在中環及灣仔,令港島區甲廈空置率上升,供應充裕使甲廈業主除為租戶提供租金優惠外,部分業主更可能為租戶提供其他資助,例如靈活租賃計劃和裝修,以留住和吸引租戶。

九龍區甲廈租務市道仍疲弱,大部分寫字樓租賃交易主要屬面積3000方呎樓面以下,以及呎租22元或以下。租賃活動以續租為主,即租戶傾向以優惠租金續租,而非選擇搬遷。

代理行料舖租全年升5%

不過,該行認為,因部分企業正在尋求整合和擴張的機會,預計第三季市場氣氛會改善,將錄得更多交投,預計九龍區整體甲廈租金在今年餘下時間將上升4%至6%。

商舖市道方面,該行指市場氣氛已改善,零售租賃市場在6月重拾上升勢頭,特別是核心一線區街舖,月內更錄得多宗大額租賃個案,該行預計今年舖租將溫和上升5%。

(信報)

有本港代理行表示,尖沙咀東海商業中心5樓04至05室,面積約1672方呎,意向呎價約1.28萬元,涉資約2140萬元,單位以交吉形式出售。

上述單位配備基本寫字樓裝修,間隔方正實用,物業面向百周年紀念花園,可享噴水池景觀,更可同時遠眺維港海景。

(信報)

更多東海商業中心寫字樓出售樓盤資訊請參閱:東海商業中心寫字樓出售

更多尖沙咀區甲級寫字樓出售樓盤資訊請參閱:尖沙咀區甲級寫字樓出售

馬亞木6480萬沽西環地鋪 佳寶有關人士承接 料作超市自用

近期,不少資深投資者沽貨止賺,亦有實力用家購物業自用,西環德輔道西一籃子鋪以6480萬易手,買家為佳寶超市創辦人林曉毅女兒,市場消息指,物業作為自用,原業主為「小巴大王」馬亞木,持貨逾20年獲利可觀。

西環德輔道西426至428號B號、山道4至16號業昌大廈地下9、10、11、12C、12D、12E、12J、12K及12M鋪,建築面積約5000方呎,以6480萬易手,平均呎價12960元,租客包括家品店,食品雜貨,洗衣及足浴店。新買家為久未出手的佳寶超市相關人士,由該超市創辦人林曉毅女兒林凱欣,透過廣軒貿易有限公司購入,市場消息透露,該物業將作為佳寶超市自用。

平均呎價12960元

佳寶超市林曉毅近年來不斷沽貨減磅,過去3至4年未見出手,市場人士以為他已淡出投資市場,今番他女兒入市,市場矚目;本報昨日聯絡林曉毅,惟直至截稿時仍未聯絡得上。

馬亞木於2002年12月以1380萬買入該地段一籃子鋪位,早前先後沽售,套現4280萬,連同上述鋪位,合共套現1.076億,以2002年購入價1380萬計算,持貨21年,帳面獲利9380萬,物業升值約6.8倍。

持貨21年升值約6.8倍

盛滙商舖基金創辦人李根興評論道,該地鋪向山道,屬於民生旺段,適合開設超市,該鋪位售價廉宜。

市場消息指,近期,鋪位買家不乏用家,包括上述早前易手的12F及8號鋪,以1880萬易手,建築面積1600方呎,買家為五金店,購入鋪位自用。至於12及12B號鋪,建築面積約1700方呎,現址為日本城,馬亞木早前以2400萬沽出,平均呎價14118元。

逾3年未出手的佳寶超市有關人士,購入西環業昌大廈一籃子地鋪,建築面積約5000方呎,該地段屬民生旺段,市場消息指,佳寶超市將自用。

(星島日報)