本港疫情走勢平穩,為甲廈市場釋出正面訊息。據一間外資測量師行指出,中環甲廈空置率於上月報7.4%,屬連跌6個月,並預期市況可逐步改善,料明年港島區甲廈租金上升約5%至10%。

連跌六個月

該測量師行昨日發表市場報告指出,中環甲廈空置率於今年11月報7.4%,屬連跌6個月,儘管疫市下居家工作成市場大趨勢,令寫字樓需求萎縮,惟據該行統計資料顯示,約70%以香港為總部的企業,於未來三年間均考慮增加寫字樓租用面積,證明於疫市下寫字樓仍為企業營運的重要元素。

展望來年市況,在「再中心化」的推動下,該行預計明年港島區甲廈租金將上升5%至10%,並以中環區升幅最高;至於九龍區於未來面對較大新供應,故該行預期該區於明年寫字樓租金升幅僅約2%。

至於零售市道方面,據相關統計數字顯示,本港10月零售銷售金額約307億,連升9個月,按年上升約12%,此外,截止今年10月奢侈品銷售金額為318億,較去年同期上升29.2%。

料明年租金升10%

與此同時,本地電子商務市場持續增長,與去年同期相比,今年首10個月的網上銷售金額飆升41.7%,隨着零售市場逐步復甦,該行預計整體零售租金將穩定下來,明年首季零售表現將取決於疫情發展,以及本港與內地免檢疫通關的時間。

(星島日報)

統一中心高層 呎租37跌12%

金鐘金鐘道95號統一中心高層A03室新近獲承租,單位面積約4,382平方呎,以每月16.2萬元租出,呎租37元,較舊租金減約12%,新租客為律師樓。

(經濟日報)

更多統一中心寫字樓出租樓盤資訊請參閱:統一中心寫字樓出租

更多金鐘區甲級寫字樓出租樓盤資訊請參閱:金鐘區甲級寫字樓出租

Siu Ho Wan flats set to get green light

MTR Corporation's (0066) proposal to build 15,000 flats atop Siu Ho Wan Depot in Lantau Island is expected to receive the green light from the Town Planning Board today.

The 300,658-square-meter site will be developed in four phases. Phases one to three comprises of 56 residential buildings with a total gross floor area of 1.04 million sq m, the application showed.

The three phases will provide a total of 10,720 private flats and 4,280 public flats. The remaining site portion, or phase four, will be reserved for future expansion to provide about 6,200 public housing flats, mainly subsidized sale flats.

Also expected to win a nod from the board today is Sun Hung Kai Properties (0016), who proposed to boost the number of flats of its renewal residential project at Sha Tsui Road in Tsuen Wan by 283, or 27 percent, to 1,330.

Meanwhile, in the firsthand property market, Henderson Land Development's (0012) new project in Cheung Sha Wan which offers 337 units was named The Harmonie.

The presale consent of the project was granted recently and the first price list may be released right after January 1 at the earliest, said Thomas Lam Tat-man, a general manager of the sales department.

Caine Hill, Henderson's other project in Sheung Wan, has launched another batch of 18 units after selling 26, or nearly 93 percent of the 28 units offered in the second round of sales.

The latest batch, including three studio homes and 15 one-bedroom homes, are priced from HK$5.91 million to HK$9.06 million after discounts, Henderson said.

Separately, Sino Land (0083) said it sold 1,740 flats this year, of which Grand Victoria contributed 658 flats. The developer expected to launch four new projects next year.

In other news, the vacancies of Central offices have dropped for six months in a row to 7.4 percent in November on growing demand, a report by a real estate consultancy showed.

(The Standard)

2022 property outlook: Super-size mansions, nano flats, and home offices round out the most important trends in Hong Kong’s housing market

Mansions which cost at least HK$100 million each will become even larger in the new year, as developers aim to catch the eyes of the ultra rich from mainland China

Micro-apartments will shrink even further in Hong Kong as these diminutive abodes are the first rung of the property ladder for many first-home buyers

Hong Kong’s transactions of new residential property may rise 15 per cent next year as buyers continue their demand in every segment of the market from 138-square foot micro-apartments to 4,500-sq ft mansions on The Peak, according to one of the city’s largest real estate agencies.

Up to HK$280 billion (US$36 billion) of new homes may find buyers in 2022, marking the second year that annual transactions have risen, amid the bull run in the residential property market, according to a property agency.

With only a few days left in 2021, home seekers are eagerly looking ahead to the housing market in the Year of the Tiger.

Here are five noteworthy trends for both buyers and sellers in 2022:

1) Mansions will go supersize to attract ultra-wealthy mainland Chinese buyers

A record 129 large, luxury apartments each costing more than HK$100 million were sold in 2021 for a combined HK$31.6 billion. Developers are building even more large homes to appeal to the ultra wealthy, especially those from mainland China, with the rapid development of the Greater Bay Area.

Kerry Properties has taken the lead with supersize homes in Kowloon. The luxury builder controlled by the Kuok family of the Shangri-La Group, will release three Mount Verra mansions each measuring more than 11,000 square feet (1,021 square metres) at Beacon Hill in Kowloon Tong, according to its latest plan, without disclosing the price of the homes.

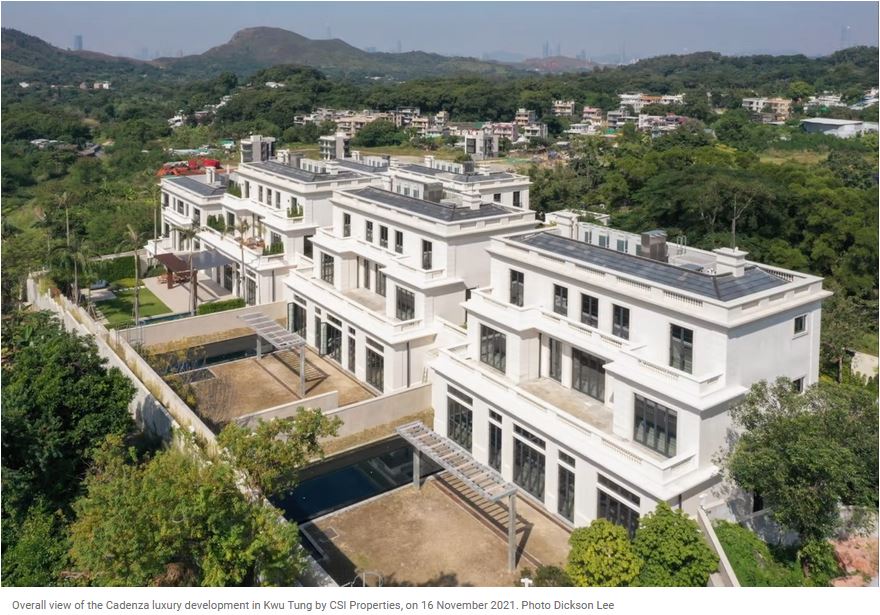

In the New Territories, five 7,000-sq ft villas are on offer at the Cadenza project in Kwu Tung by CSI Properties.

Not to be outdone, K. Wah International Holdings and Chuang’s Consortium are planning to build an eight-storey villa at 28 Po Shan Road at The Mid-Levels, with 44,388 s ft of space over eight floors, complete with a garden measuring 4,446 sq ft and another 2,197 sq ft on its roof terrace.

“The richest Chinese measure their wealth by the size of their residences in terms of mu,” where each unit of the Chinese measurement for land size is equivalent to 7,176 square feet, property consultant said. “Houses of that size will appeal to the richest on the mainland.”

The most over-the-top plan, on paper at least, may be the proposal by China Evergrande Group to build a cluster of 248 luxury villas at Wo Shang Wai near the Mai Po Wetlands in the New Territories.

The centrepiece of the project is a HK$4 billion mansion with eight bedrooms, four private lifts, gardens, a swimming pool and water displays, according to draft plans. At 240,000 sq ft, it will be as big as 180 of the biggest flats in Taikoo Shing, Hong Kong’s most popular mass-market residential project, put together. Compared with the average living space of less than 200 sq ft for every resident in Hong Kong, the size of this single mansion is unprecedented.

Evergrande paid HK$4.2 billion (US$541 million) to convert the farmland into residential use. The company, which defaulted on an offshore bond while it grapples with more than US$300 billion of liabilities, was not available to say whether the Wo Shang Wai project would proceed.

2) Flats will become smaller to help local buyers get on the property ladder

With home prices hovering near records, young Hong Kong families, fresh graduates and first-time buyers have no choice but to opt for the smallest flats that require the smallest down payments to get on the property ladder.

“Flats in urban areas will be tiny, especially those redevelopment residential projects in the city centre,” property agency said.

Known variously as micro-apartments, nano flats, or shoebox homes, tiny abodes have been all the rage in Hong Kong ever since CK Asset Holdings set the trend in motion in 2014 when its Mont Vert project in Fanling sold out in a massive success. The smallest unit, at 165 sq ft, was available for HK$1.29 million after a 15 per cent discount.

Several projects have since followed, the most recent being Chun Wo Development’s Soyo nano flats in Mong Kok, which measure between 152 sq ft and 228 sq ft, priced from HK$3.38 million to HK$5.95 million for an average of HK$24,179 per square foot. The developer had a taste of success in March when a 128-sq ft nano flat at its TPlus project in Tuen Mun sold for HK$2.35 million in the secondary market, a 52 per cent appreciation from its purchase price in 2019.

3) Covid-19 keeps people working from home, driving them further from office locations

Sino Land, one of the biggest developers in Hong Kong, said property buyers have become more tolerant of distances between their homes and the major office hubs ever since Covid-19 broke out in early 2020.

“We have clients who moved from Hong Kong Island to [Sino Land’s new project] Silversands in Wu Kai Sha near Ma On Shan as they would like to live closer to nature,” said the developer’s associate director Victor Tin. “The trend will continue in 2022 as more companies adopt work-from-home arrangements, which alter the way people live. They don’t mind moving further out for better air quality.”

4) Builders add business centres to amenities to let customers work from home

The clubhouse at Sun Hung Kai Properties’ St Martin development in Tai Po features stylish co-working space. The Townplace Soho serviced apartments on Caine Road by the same developer has what it calls “duo social space” indoor and outdoor communal areas that are designed to be work-friendly, featuring soundproof rooms for meetings and video conferences.

The recreational club at Sino Land’s Grand Central development in Kwun Tong has private rooms for residents to hold team meetings.

“We have organised more health related activities for our residents and most of them drew a good response,” said Tin.

5) Narrowing price gap between New Territories and Kowloon

The suburban nature of the New Territories, close to mainland China’s border with Hong Kong, has no longer a drawback for homebuyers, as new subway lines and stations in the area slash the commuting time with the major urban areas of Hong Kong Island and Kowloon, a property consultancy said.

“New townships in the New Territories have enhanced the appeal of the region, most notably in retail offerings. Yoho Mall in Yuen Long is home to a number of international brands including American Eagle, Agnès b. and Aigle,” property consultant said.

Last week, Sun Hung Kai Properties released the first 206 units of The Yoho Hub residential project above the Yuen Long subway station at an average price of HK$19,899 per sq ft, about 18 per cent less than Soyo development in Mong Kok.

The price gap was 23 per cent last January when Hong Kong Ferry offered the first 112 units at Skypoint Royale in Tuen Mun for HK$15,020 per sq ft, compared Vanke released The Campton in Cheung Sha Wan for HK$19,511 per sq ft in the same month.

(South China Morning Post)