有外資代理行指出,通關後,寫字樓總租賃於上半年增加13.8%,恢復至2019年底疫情前73%水平,期內錄負吸納量32.6萬方呎,整體空置率由去年底12.2%升至12.6%。

商廈空置率12.6%

中環寫字樓租賃需求主要來自資產管理、私人銀行及基金,至於商務中心、金融服務、消費品牌及保險業則活躍於灣仔、銅鑼灣及港島東,九龍東吸引專業服務機構及科技租戶。整體寫字樓租金於上半年回落2.1%,中環寫字樓租金下跌2.6%。尖沙嘴租金微升0.3%。

該行代理表示,未來半年,整合及提升寫字樓質素租賃支持需求,由於租金較2019年高位回落約30%,業主提供租賃條款更具彈性,新供應推高空置率,不過,預期寫字樓租金下半年跌0%至5%。

核心街鋪空置率由去年底的16.6%跌至6月底的13.7%,鋪租去年跌10.6%,今年上半年回升8.2%。短期而言,餐飲業、藥房、大眾時裝及生活品牌,以至體驗性零售,繼續成為市場主導。該行另一代理表示,年底前約400萬方呎新零售樓面落成,預期下半年核心街鋪及大型商場租金升幅將為5%以內。

該行另一代理表示,上半年成交價5000萬以上商用物業,投資總額較去年下半年減1.8%至178億,商鋪佔總額約43.5%。投資者對核心街鋪重拾興趣,價格去年下跌7.6%後回升2.4%。

核心區鋪租升幅料5%以內

該行另一代理表示,樓市最壞情況已過去,但復甦之路漫長,未來受5大因素左右,分別是1加息、人才缺失、政府政策、本地經濟增長及內地經濟復甦步伐。

該行另一代理表示,賣地及補地價收入減少,政府總收入下跌,一些交通基建工程或因而影響竣工。仲量聯行香港主席曾煥平表示,港樓市經歷自2008年以來最長調整期,並尚未見底。

(星島日報)

山頂和福道2幢洋房5.6億易手 前明珠興業黃坤妻子沽貨每呎6.97萬市價水平

傳統豪宅受追捧,前明珠興業主席黃坤的妻子沽售山項豪宅,涉及和福道2幢洋房,合共涉資5.6億,平均呎價逾6.97萬,屬市價水平。據悉,項目放盤短時間易手,彰顯傳統豪宅有價有市。

市場消息透露,山頂和福道11號及13號,每幢面積4016方呎,擁有4房 (包3間套房) 及特大花園,早前以每幢意向價3.8億放售,隨即引起多組實力買家洽購,儘管出價未到業主意向,由於業主有心出售,最終每幢減價接近1億,以逾2.8億易手,合共涉資5.6億。

市場消息指,買家為同一名買家或相關人士,並以本地客呼聲較高,以買賣公司形式易手。

每幢洋房減價約1億售

市場消息指,11號洋房由國健實業有限公司持有,於1993年6月以1700萬購入;至於13號洋房於1994年由輝進投資有限公司購入,作價4450萬,兩家公司董事都包括王綺霞,為前明珠興業主席黃坤的太太。該2洋房購入價合共6150萬,持貨至今約30年獲利可觀,帳面高逾4.38億。

坐擁大花園及泳池

有代理表示,該每幢洋房各自擁有2000方呎花園,內里有泳池,花園設計極具品味,惟由於項目並非望海景,故造價未能突破新高。洋房皆連傢俬出售,內里豪華而且別致。

和福道一向有不少名人業主,包括梁朝偉及劉嘉玲、資深大律師陳志海、名人何添後人何厚鏘、何厚浠兄弟等。於2012年5月,息影國語片女星汪玲沽售和福道7號屋,作價約2億,建築面積4527方呎,同樣擁有4房 (包3間套房) 及特大花園,呎價約4.42萬。

今年以來,山頂不乏大手買賣,最矚目為馬來西亞「錫礦大王」陸佑家族持有逾70年的山頂馬己仙峽道30至38號豪宅,於今年4月以50億易手,造價更創有史以來本港屋地第三高。

(星島日報)

雅居樂底價9.66億奪九龍塘舊樓業權

雅居樂併購的九龍塘龍圃別墅,今年3月獲土地審裁署批出強拍令,項目原定於5月舉行拍賣,惟當時因小業主業權問題而取消;最新於昨日再次舉行拍賣會,底價9.66億,由手持「1號牌」的雅居樂代表,在未有其他競爭無對手下以底價投得,成功統一業權發展。

以可建總樓面約6.49萬方呎計,每方呎樓面地價約14880元。

長沙灣公務員樓申強拍

另外,土地審裁處接獲今年第4宗申請強拍,由財團併購的長沙灣順寧道308至314號公務員合作社舊樓,新近獲財團申請強拍,以統一業權發展,該財團持有約90%業權,整個項目市場估值約逾1.24億。

(星島日報)

柴灣角7項目 重建商廈數據中心

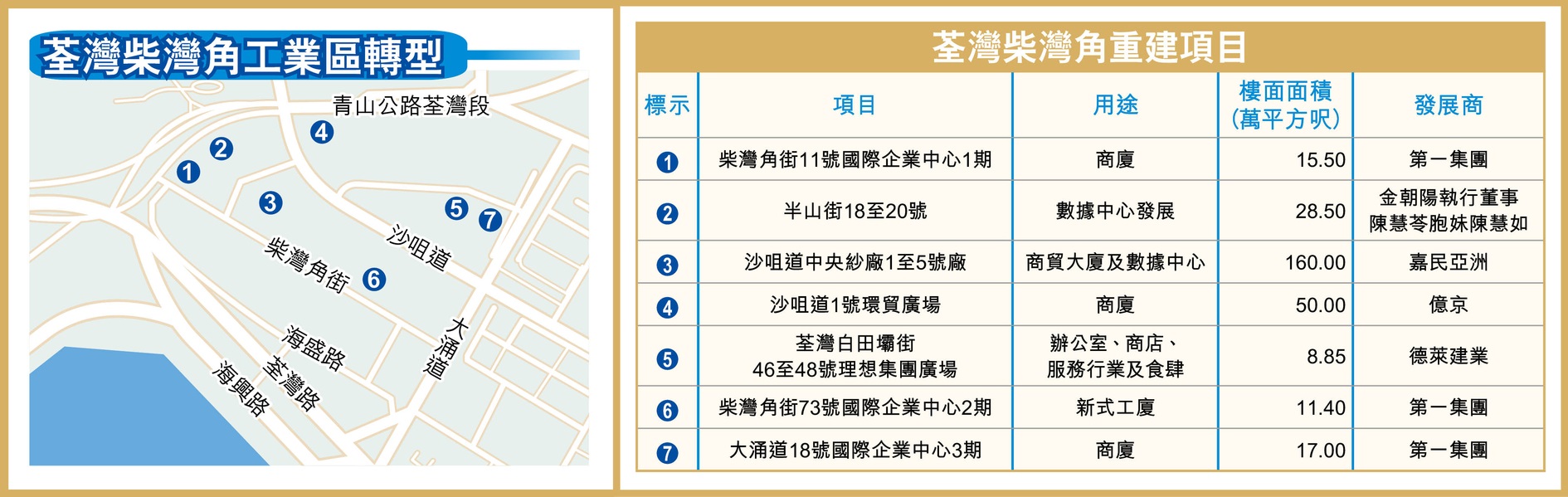

荃灣柴灣角商貿區屬於近年轉型較快的商業區之一,區內近年有多個較大型重建計劃,將提供逾290萬平方呎的工商業樓面,規模最大屬於嘉民亞洲旗下的中央紗廠重建計劃。

柴灣角工業區的範圍,東面至大涌道,西面至荃灣西近麗城花園,北面至青山公路近愉景新城,南面至海盛路海旁,包括青山公路 (荃灣段) 中段及沙咀道前段的工廠大廈。

早在上世紀60、70年代「紗廠」、紡織廠林立,被稱為「小曼徹斯特」,規劃署近年見該區具轉型的潛力,故此將整區改劃成「其他指定用途 (商貿)」。近年區內至少有7個重建計劃正在進行,涉及約291萬平方呎工商業樓面,當中不少計劃重建成商廈或數據中心。

紗廠重建4大樓 項目出租逾8成

當中嘉民於2014年購入中央紗廠第1至5號廠原址展開重建,重建轉型為4座大樓,總面積達160萬平方呎,將會作為數據中心用途,當中丈量約份第355約地段第301號A及餘段地盤在今年3月完成2.65億元補地價,以項目最高可建樓面約145,349平方呎計,每呎樓面地價約1,829元。

目前嘉民荃灣西項目首2座落成大樓已全數租出,其餘2座大樓預計於2024年完工,目前整個項目的預租率達87%,租戶均為數據中心及創科企業。

第一集團3地盤 建國際企業中心

除了嘉民亞洲外,另一個活躍區內工廈重建的第一集團,近年購入區內3個重建地盤,打造成國際企業中心1至3期項目。當中從星星地產手上以約9.8億元購入的柴灣角街11號,由第一集團發展成商廈國際企業中心1期,總樓面面積約15.5萬平方呎。

至於柴灣角街73號的國際企業中心2期,則屬於新式工廈項目,樓高20層,涉約11.4萬平方呎樓面,全層樓面則約6,000平方呎。而大涌道18號工業地盤,第一集團補地價逾9億元,並發展成20層高商廈國際企業中心3期,屬於20層高商廈,每個單位建築面積介乎900餘至約1,600平方呎不等。

同時,億京購入前永南貨倉大廈,亦在近3年前補地價約14億元,現時已重建成沙咀道1號商廈環貿廣場,樓高23層,寫字樓單位面積由約500餘至全層約2.7萬平方呎不等。

(經濟日報)

環貿廣場今年暫錄7成交 呎價1萬

荃灣近年有不少新工、商業項目推出,其中億京去年開始拆售的沙咀道1號環貿廣場,今年錄得7宗成交,最高呎價約1.1萬元。

據EPRC經濟地產庫顯示,環貿廣場今年以來共錄得7宗買賣成交,平均呎價約1萬元,涉及以中、小型單位為主,面積介乎約543至2,125平方呎,售價由535至2,141萬元不等,每平方呎造價介乎9,108至10,735元,例如今年3月成交的17樓一個單位,面積約563平方呎,以約604.4萬元沽出,平均呎價約10,735元。

中小型單位受捧

至於同區第一集團發展的大涌道國際企業中心3期,由推出至今平均呎價約10,672元,其中上月沽出的15樓單位,面積約1,210平方呎,售價約1,403.6萬元,平均呎價約11,600元。另外,大家樂 (00341) 首席執行官羅德承等人亦曾經在去年5月斥逾4,200萬元購入中層2個單位。

(經濟日報)

Low valuations to spur bargain hunts among developers

A "large pool of undervalued assets" in Hong Kong's property market may spur more bargain hunting among majority shareholders as valuations hit a 30-year low, according to JPMorgan Chase.

The SAR's cash-rich property tycoons may take advantage of the cheap valuations to buy assets, conduct buybacks or take out minority shareholders at a time when developers and landlords are on average valued at a 63 percent net asset value discount to the aggregate market capitalization, wrote its analysts, including Cusson Leung, in a note.

"We believe the uniqueness of the Hong Kong property and conglomerates sector is that their majority shareholders will not be shy to grab opportunities from the market downturn," the analysts wrote.

The property sector is trading at a combined market cap of HK$1.1 trillion, while their aggregated net asset value amounted to HK$3 trillion, the investment bank said. That represents a large pool of undervalued assets that majority shareholders can choose from, it added.

Some families may be more active than others in taking advantage of the valuation dislocation, such as Li Ka-shing-backed CK Asset Holdings (1113). Others include Wharf Real Estate Investment (1997), Kerry Properties (0683), Swire Pacific, Swire Properties (1972) and Henderson Land Development (0012).

(The Standard)

Flat prices 'to go up on mortgage easing'

Wheelock Properties anticipates developers will increase the sale of mid-priced units due to the relaxation of mortgage loan measures, while overall home prices in Hong Kong are expected to rise 5-7 percent this year. And Wheelock also plans to sell four new projects.

Its vice chairman, Ricky Wong Kwong-yiu, expects mid-price flats in the HK$10 million to HK$15 million range to be highly sought after, projecting a 20-30 percent increase in transactions for such units in the primary market in the second half compared to the first half.

That came as the developer reported total sales of over HK$11.3 billion in the first half from 814 units. And the four projects it is planning to launch in the second half involve over 1,800 units.

On the other hand, a property agency predicted a 10 percent decline in residential property prices in the second half, saying market conditions do not support a lasting recovery in property prices.

It recommends the government consider doing away with cooling measures, particularly stamp duties, and eliminating stress tests.

In other news, benefiting from the upturn in property transactions, stamp duty revenue in the first half saw a 75.9 percent rebound to around HK$4 billion, compared with HK$2.3 billion in the second half last year. The trend is not expected to be sustained amid sluggish sentiment.

Wang On Properties (1243) has submitted an application to the Town Planning Board, seeking a 20 percent relaxation in the plot ratio for the redevelopment of Yau Tong Industrial Building tower four, with the aim of building 676 residential units.

Another property agency said yesterday Dragon Court in Kowloon, the subject of a compulsory sale order, was acquired by Agile Group (3383) for HK$966 million.

The Lands Tribunal has also got a fourth application for a compulsory sale this year, the latest being 308-314 Shun Ning Road, Cheung Sha Wan at a valuation set at nearly HK$125 million.

A second price list for 45 units at La Montagne in Wong Chuk Hang was launched at prices starting from HK$9.8 million, or HK$24,309 per sellable square foot, after discounts. Kerry Properties (0683), Sino Land (0083), Swire Properties (1972) and MTR Corp (0066) said together with those launched in the first price list, 115 units will be put up for sale on Saturday.

(The Standard)

Hong Kong’s home prices to decline further amid high mortgage rates, glut of new units, lack of mainland buyers a property agency said

The company’s latest forecasts says prices will drop 5 to 10 per cent in the second half, resulting in a total drop of 5 to 8 per cent in 2023

Housing market is having ‘the longest price adjustment since 2008’ and ‘has not found a bottom’, the property agency said

Hong Kong’s floundering residential property market has not yet bottomed out, and the road to recovery will be long and difficult given headwinds including high interest rates, a glut of unsold new units and a lack of buying power from mainland China, according to a property agency.

Factors including a volatile stock market, a challenging external economic environment and a decrease in new births and marriages are also affecting housing demand, the real estate company said in its midyear property market report, released on Tuesday.

“Hong Kong’s housing market is now having the longest price adjustment since 2008, and the market has not found a bottom,” a property agent said.

Home prices fell by 1.2 per cent quarter-on-quarter in the second quarter of 2023, after rebounding by 4 per cent in the first quarter, and have plunged 15.9 per cent from a peak 20 months ago, the agency said.

The company now expects prices to drop 5 to 10 per cent in the second half, resulting in a total drop of 5 to 8 per cent in 2023.

The number of unsold units in completed projects is the highest since 2007, the report added. There are 83,000 housing units available in Hong Kong, with 18,000 in completed projects and the rest under construction. In addition, about 25,000 more units are expected to hit the market in 2023, according to the agency.

“Based on observations from previous cycles, current conditions do not warrant a sustainable home price recovery,” the agent said, adding that given the headwinds surrounding the sector, the current down cycle will be longer than previous troughs.

The world economy is not expected to recover significantly in the next one to two years, Tsang said, nor would China’s relationship with Europe and US improve significantly in the near future.

Hong Kong’s economy grew by 2.7 per cent in the first quarter over a year earlier, ending four consecutive quarters of contraction. The government’s full-year forecast for growth is between 3.5 and 5 per cent.

A recovery in the property market will only begin with a downward trend in interest rates, the agent said.

The Hong Kong Monetary Authority (HKMA) in June paused its rate hikes for the first time since March 2022, keeping the city’s base rate at 5.5 per cent after the Federal Reserve’s move to stagger potential further increases after 10 consecutive hikes.

But the mortgage rate has more than doubled to 3.5 per cent from 1.5 per cent before the rate hike cycle. This means the monthly mortgage payment for a HK$6 million (US$766,640) flat with a 90 per cent loan-to-value ratio spread over 30 years has surged 30.1 per cent to HK$25,461, according to another property agency.

The HKMA on Friday evening eased mortgage rules for the first time since 2009 to make borrowing easier for first-time homebuyers and those who want to upgrade to bigger flats. The move has piqued the interest of potential homebuyers and current owners, but will not make a big difference for the overall property-market outlook, according to brokers and bankers.

The first agency’s home-price forecast echoes those of other analysts. Another agency has predicted a drop of up to 5 per cent in lived-in home prices for the whole year, while Citi expects prices to end the year flat compared with 2022.

In contrast to the for-sale market, the agent said the residential leasing market will gain support from a population inflow from mainland China and the arrival of people recruited under the Top Talent Pass Scheme.

“These [people] may not buy a house immediately, but they will definitely rent one, and this will benefit the leasing market,” the agent said.

Hong Kong has received more than 100,000 applications to various talent schemes so far this year and approved over 60 per cent of them, nearly double the number targeted.

Luxury rental prices will increase up to 5 per cent in the second half, according to the first agency. This aligns with another agency forecast that said the rental price index will increase by around 5 to 8 per cent in 2023.

(South China Morning Post)